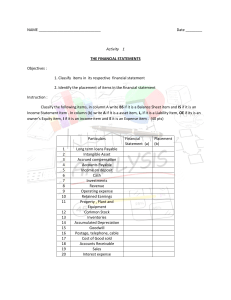

Alessandra Nicole M. Acuzar BSA – A1B Statement Statement of Nature or of Particulars Assets Liabilities Equity Income Expense Financial Characteristic of Financial Performance the Account Position 1. Cash Equivalents X X 2. Insurance Expense 3. Cash X X X 4. Sales Revenue X 5. Owner's Capital 6. Mortgage Payable X X X X X X It is an asset because it is a value owned by the entity. It is an expense because it is an insurance that has expired. Cash is an asset because cash has a value in an entity which can be use in future transactions of the business. Sales revenue is an income because it is the earning that the entity has acquired from selling goods or merchandise. Owner’s Capital is an equity because it is an investment made by the owner thus resulting to owner’s capital. Mortgage payable is a liability because it is an entity’s obligation particularly with Alessandra Nicole M. Acuzar BSA – A1B 7. Prepaid Rent X X 8. Commission Expense 9. Building 10. Accounts Payable X X X X X X regards to mortgage. Prepaid rent is an asset because it is an expense that was paid in advance which means that they have paid some of the future expenses needed to pay by the entity. Commission expense is an expense because it is part of the operating expense of a business as payment for a salesperson in exchange for his/her service. A building is an asset because it is a physical structure owned by the business which can be used for the business’ operation. Accounts payable is a liability because the business has received an obligation that needs to be paid Alessandra Nicole M. Acuzar BSA – A1B 11. Service Vehicle X X 12. Office Equipment X X 13. Salaries Expense X 14. Accrued Expenses 15. Land X X X X X by the business resulting to accounts payable. Service vehicle is an asset because it can be used by the business to provide deliveries to customers which also gives value to the entity. Office equipment is an asset because the business can use it for office purposes. Salaries expense is an expense because it decreases an asset that is used as payment to pay the salaries of the workers. Accrued expenses are liabilities because it is considered as unpaid expenses which the business requires to pay. Land is an asset because it is a space wherein a Alessandra Nicole M. Acuzar BSA – A1B 16. Office Supplies X X 17. Accounts Receivable X X 18. Inventory X X 19. Supplies Expense X X building can be built which means that it can contribute in bringing economic benefits in a business. Office supplies is an asset because these are supplies that are usable for the operations of a business. Accounts receivable is an asset because it is an account that customers owed to the business. Inventory is an asset because these are the items or products that the business aims to sell in the market thus bringing economic benefit to the business. Supplies expense is an expense because these are the expenses that the business requires to pay Alessandra Nicole M. Acuzar BSA – A1B 20. Prepaid Insurance X X 21. Rent Expense X X 22. Utilities Expense X X 23. Service Revenue 24. Owner's Withdrawal X X X X for the supplies used by the business. Prepaid insurance is an asset because it is an advance payment made by the business. Rent expense is an expense because it is an expense that the business requires to pay with regards to the rent. Utilities expense is an expense because it is an expense that the business requires to pay with regards to utilities like usage of electricity, water, and communications. Service revenue is an income because it is the earnings made by the business from the services rendered by the business. Owner’s withdrawal is an equity because it is a deduction Alessandra Nicole M. Acuzar BSA – A1B 25. Loans Payable X X from the owner’s capital which can be used for personal purposes. Loans payable is a liability because it is the business’ obligation.