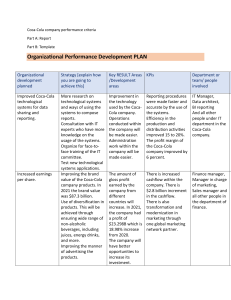

Report on Financial Statement Analysis COURSE: FIN440 SECTION: 10 SUBMITTED TO: Mohammad Sarwar Rekabder (MRE) SUBMITTED BY: MOSTAFA IFTIKHAR TANVIR MD SHAHARIAR HOSSAIN SHANTO MIR SANJIDUL ISLAM TASHNIA RAHMAN IFTI EFTA MEHJABIN RIA 1912931630 2013632030 2011080630 2012545030 2014216630 DATE OF SUBMISSION: January 3, 2023 COMPANY NAME: Letter of Transmittal January 3, 2023 Mohammad Sarwar Rekabder (MRE) Senior Lecturer, Department of accounting and finance North South University Subject: Submission of the financial report on PepsiCo and Coca-Cola. Dear Sir, We are glad to inform you that our group project on the financial report on PepsiCo and Coca-Cola has been completed successfully. It has been a real pleasure for us to present this report to you. Using both primary and secondary sources, we have gathered vital information for preparations. While assembling this review, we gained some useful knowledge about the primary thoughts of the financial position of the company. It was a troublesome encounter for us to assemble a planned report in light of our work and the examination that consolidated academic and practical information. Using your suggestions and advice, we made every effort to make this report as informative as possible. We would like to express our sincere gratitude to you for giving us the opportunity to finish this report. We made an effort to complete this task with as much accuracy and significance as we could. Sincerely yours, Mostafa Iftikhar Tanvir MD Shahariar Hossain Shanto Mir Sanjidul Islam Tasnia Rahman Ifti Efta Mehjabin Riya Acknowledgement Firstly, we would like to express our gratitude to Almighty Allah, for the blessings He has bestowed on us throughout our work and enabled us to successfully complete my Report on the financial report on PepsiCo and Coca-Cola. We also would like to express our sincere gratitude to everyone who allowed us to finish this report. We are especially indebted to our lecturer, Mohammad Sarwar Rekabder sir, who assisted us in coordinating our project, particularly in writing this report, by providing us with valuable suggestions, guidance, and encouragement. Last but not least, we would like to express our gratitude to everyone who contributed to the success of this project in some way, shape, or form. Sincerely, Mostafa Iftikhar Tanvir MD Shahariar Hossain Shanto Mir Sanjidul Islam Tasnia Rahman Ifti Efta Mehjabin Riya CONTRIBUTION TABLE: MOSTAFA IFTIKHAR TANVIR 1912931630 18 MAJOR RATIOS MD SHAHARIAR HOSSAIN SHANTO VALUATION 2013632030 MIR SANJIDUL ISLAM 2011080630 CAPITAL STUCTURE TASHNIA RAHMAN IFTI 2012545030 DIVIDEND POLICY EFTA MEHJABIN RIA 2014216630 DIVIDEND POLICY Contents Introduction ................................................................................................................................................... 1 RatioAnalysis ................................................................................................................................................ 1 Company valuation of Coca-Cola Vs. PepsiCo .......................................................................................... 23 Capital structure .......................................................................................................................................... 25 Capital structure of PepsiCo ....................................................................................................................... 25 Dividend policy of Coca-Cola .................................................................................................................... 28 Dissecting the Coca-Cola's Dividend.......................................................................................................... 28 Payout ratios................................................................................................................................................ 28 Dividend Volatility ..................................................................................................................................... 29 Dividend Growth Potential ......................................................................................................................... 30 INTRODUCTION Coca-Cola, also known as Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. In the latter part of the 19th century, John Stith Pemberton made it in Atlanta, Georgia, with the intention of patenting it as a medicine. At first, it was marketed as a drink for temperance. Pepsi, on the other hand, is a carbonated soft drink manufactured by PepsiCo. In 1893, Caleb Bradham created and released Brad's Drink for the first time. It was renamed Pepsi-Cola in 1898, and the name was changed to Pepsi in 1961. RATIO ANALYSIS LIQUIDITY RATIOS Liquidity ratios are used to assess a company's capacity to meet its financial obligations and its degree of financial security. These ratios measure the number of current assets available to cover upcoming debt payments, providing an indication of whether a company has the necessary resources to meet its liabilities. ➢ CURRENT RATIO: The Current Ratio is a measure of a company's liquidity that is calculated by dividing its current assets by its current liabilities. It shows investors and analysts the company's ability to fulfill its short-term obligations and demonstrates the solvency of its overall financial statements. It is also an indication of how efficiently the company is utilizing its assets to cover its debts and other payables. Current ratio = Current assets /Current liabilities Company name 2019 2020 2021 PepsiCo 0.86 0.98 0.83 Coca-Cola 0.76 1.32 1.13 1|Page 1.4 1.32 1.13 1.2 1 0.98 0.86 0.83 0.76 0.8 0.6 0.4 0.2 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: Current Ratio 0.86 implies that to pay each $1 of current liability PepsiCo has $.86 of current assets. Current Ratio 0.76 implies that to pay each $1 of current liability Coca-Cola has $.76 of current assets. In PepsiCo, we can see that the current ratios are so fluctuating. Over the 3 consecutive years, from 2019 to 2021 the company has maintained current ratios below 1; which is considered, as the company is in an average position; where in the year 2020 it went up to 0.98 which is the highest but in the year 2021, it went down to 0.83 which is the lowest and it portrays that the company is a little bit fall behind from its previous year’s position. The current ratio for Coca-Cola is more than 1 for the years 2020 and 2021, which is good and satisfactory as the company is in a position of meeting its short-term obligations. In 2020, 1.32 was the highest, and 0.76 in 2019 which is the lowest. Activity Ratios Activity ratios measure the speed with which various accounts are converted into sales or cash-inflows or outflows. In a sense, the activity ratio measure how efficiently a firm operates along a variety of dimensions such as inventory management, disbursement, and collection. A number of ratios are available for measuring the activity of the most important current accounts, which include inventory, accounts receivable, and accounts payable. The efficiency with which total assets are used can also be assessed. 2|Page ➢ QUICK RATIO: The Quick Ratio is a measure of a company's liquidity, calculated by subtracting inventory from its current assets and then dividing the resulting figure by its current liabilities. The lower the difference between the current and quick ratios, the better it is for the organization. This ratio takes into consideration only those items that can be quickly converted into cash, thus excluding ending inventory, which is the least liquid asset. Quick ratio: (Current asset - Inventory)/Current liability Company name 2019 2020 2021 PepsiCo 0.70 0.81 0.66 Coca-Cola 0.63 1.09 0.96 1.2 1.09 0.96 1 0.81 0.8 0.7 0.66 0.63 0.6 0.4 0.2 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: Quick Ratio 0.70 implies that to pay each $1 of current liability PepsiCo has $0.70 of current assets excluding inventory. 3|Page Quick Ratio 0.63 implies that to pay each $1 of current liability Coca-Cola has $0.63 of current assets excluding inventory. The ratio of PepsiCo from 2019 to 2021 isn’t considered to be a satisfactory quick ratio; where 0.81 is the highest in 2020, but to be in a satisfactory position the company’s ratio should be 1 or above. And, the fall in ratios to 0.66 in the current year 2021 is the lowest which displays that PepsiCo may not be able to fully pay off its current liabilities in the short-term excluding inventory. The ratio of Coca-Cola from 2020 and 2021 is considered to be a more satisfactory quick ratio than PepsiCo; where 1.09 is the highest in 2020; as it indicates that the company is fully equipped with enough assets to be liquidated to pay off its current liabilities. But, the fall in ratios to 0.96 in 2021 and 0.63 is the lowest in 2019, displaying that Coca-Cola may not be able to fully pay off its current liabilities in the short term. ➢ Inventory turnover: Inventory turnover is a ratio that measures the number of times a company's inventory is sold and replaced over a period of time. It is used to measure how efficiently a company is managing its inventory. A higher inventory turnover ratio generally means that the company is efficiently managing its inventory and selling its products in a timely manner. Inventory turnover= cost of goods sold / inventory Company name 2019 2020 2021 PepsiCo 9.03 7.62 8.53 Coca-Cola 4.33 4.11 4.50 10 9.03 8.53 9 7.62 8 7 6 5 4.33 4.5 4.11 4 3 2 1 0 2019 2020 PepsiCo 4|Page Coca-Cola 2021 Interpretation: Inventory turnover 9.03 means PepsiCo sold and restocked 9.03 times its inventory during 2019. Inventory turnover 4.33 means Coca-Cola sold and restocked 4.33 times its inventory during 2019. Here, PepsiCo is in a comparatively good position than Coca-Cola. The ratio conveys that PepsiCo can sell and restoke its inventory two times faster than Coca-Cola. But it doesn’t mean that Coca-Cola’s inventory turnover is not in a good position. ➢ Average age of inventory The inventory ratio formula is used to measure the amount of inventory a company holds relative to its sales. It is calculated by dividing the average inventory value by the average cost of goods sold (COGS) over a given period of time. This ratio indicates the average number of months that a company will have inventory in stock before it needs to be replenished. It is a useful metric for assessing the liquidity of a company's inventory and can be used to compare the performance of different companies in the same industry. Average age of inventory = 365 / inventory turnover Company name 2019 2020 2021 PepsiCo 40.43 47.89 42.80 Coca-Cola 84.37 88.74 81.14 100 88.74 84.37 90 81.14 80 70 60 50 47.89 42.8 40.43 40 30 20 10 0 2019 2020 PepsiCo 5|Page Coca-Cola 2021 Interpretation: Average age of inventory 40.43 days means on an average PepsiCo needs 40 days to sell out its inventory and restock during 2019. Average age of inventory 84.37 days means on an average Coca-Cola needs 84 days to sell out its inventory and restock during 2019. We can see that in 2019 and 2020 both of the companies faced an upward trend in the days’ sales in inventory which is not a healthy sign for the companies. Hence, they are piling up their assets more than in the previous year. However, in the year 2021, both companies managed to reduce their sale days in inventory, which is a good sign for the companies. If we compare the two companies, PepsiCo is in a better position than Coca-Cola as PepsiCo has always faced a lower number of days. ➢ Receivable turnover The receivables turnover ratio is a financial metric used to measure the average rate at which a company is collecting its accounts receivable on credit sales during a given period of time. This metric is calculated by dividing the total net credit sales of a company by the average accounts receivable balance during the same period. A higher receivables turnover ratio indicates that the company is more efficient at collecting its receivables and is able to generate more sales from its existing credit customers. Receivable turnover = sales/account receivables Company name 2019 2020 2021 PepsiCo 10.42 10.21 11.08 Coca-Cola 9.38 10.50 11.01 11.5 11.08 11.01 11 10.5 10.5 10.42 10.21 10 9.38 9.5 9 8.5 2019 2020 PepsiCo 6|Page Coca-Cola 2021 Interpretation: Receivable turnover of 10.42 implies that on average PepsiCo has collected cash from its credit customer and converted it into sales for 10.42 times during 2019. Receivable turnover of 9.38 implies that on average Coca Cola has collected cash from its credit customer and converted it into sales 9.38 times during 2019. Here both companies maintain a quite close timing of collecting cash from the credit customers and converted into cash. PepsiCo’s turnover ratio little bit fluctuated but Coca-Cola’s ratio is upstream. ➢ Average collection period The average collection period ratio is a measure of how quickly a company is able to collect payments from its customers. It is calculated by dividing the number of days in a period (usually a year) by the total accounts receivable for that period, then multiplying it by the average accounts receivable balance for that period. A lower average collection period ratio indicates a company is able to collect payments faster, while a higher ratio indicates slower collection times. Average collection period = 365 / receivable turnover Company name 2019 2020 2021 PepsiCo 35.04 35.75 32.94 Coca-Cola 38.89 34.76 33.16 7|Page 40 38.89 39 38 37 36 35.75 35.04 34.74 35 34 33.16 32.94 33 32 31 30 29 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: PepsiCo collects the average account receivable after 35 days during 2019. Coca-Cola collects the average account receivable after 39 days during 2019. In terms of the average collection period, both companies perform quite similarly, in 2019 Coca-Cola’s collection was bit high but in the following years they were able to match the industrial average and both companies are very much close to the industry average which is good thing. It means both companies display their management and performance in collecting their debts smoothly. ➢ Payable turnover The payable turnover ratio is a measure of a company's ability to manage its accounts payable. It is calculated by dividing the total amount of the company's accounts payable by the average amount of its accounts payable during a certain period. The higher the ratio, the more efficient the company is in managing its payables. A low ratio indicates that the company is taking longer to pay its suppliers, which could lead to difficulty in obtaining credit and a negative impact on the company's cash flow. Payable turnover = purchases/account payables Company name 2019 2020 2021 PepsiCo 3.76 3.59 3.77 Coca-Cola 3.84 3.82 3.34 8|Page 3.9 3.8 3.84 3.82 3.77 3.76 3.7 3.59 3.6 3.5 3.4 3.34 3.3 3.2 3.1 3 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: Payable turnover 3.76 indicates that PepsiCo pays 3.76 times to its creditors over an accounting period so a higher payable turnover ratio is more favorable. Payable turnover 3.84 indicates that Coca-Cola pays 3.84 times to its creditors over an accounting period so a higher payable turnover ratio is more favorable. Both the companies’ payable turnover ratios fluctuated in the 3 consecutive years. But overall, each company has a good condition in accounts payable turnover from 2019 to 2021. ➢ Average payment period The payment period ratio is a measure of a company's ability to pay its bills on time. This ratio is useful for analyzing a company's liquidity and its ability to generate enough cash to pay its creditors. It is also an important indicator of the company's overall financial health. A higher payment period ratio indicates that the company is taking longer to pay its bills, which could be a sign of financial distress. Average payment period= 365 / payable turnover Company name 2019 2020 2021 PepsiCo 97.06 101.62 96.81 9|Page Coca-Cola 94.98 95.56 109.38 115 109.38 110 105 101.62 100 97.06 95.56 94.98 96.81 95 90 85 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: Average payment period is 97.06 days means on an average PepsiCo needs 98 days to pay off it’s account payables during 2019. Average payment period is 94.98 days means on an average Coca-Cola needs 95 days to Pay off its account payables during 2019. The average payment period of both companies is more than 90 days in all 3 years, which is good for the company. It shows that management is efficiently managing its creditors by asking for late payment permission. It benefits the liquidity of the company as the money can be used for other purposes, due to slow cash outflow. Not only that it also indicates that the companies are not pay-off their account payables before collecting cash from their credit customers. ➢ Total assets turnover The asset turnover ratio is a financial measurement used to assess a company's efficiency in using its assets to generate revenue. It is calculated by dividing a company's total sales by its total assets. The ratio measures how efficiently a company's assets are being used to generate sales. A higher asset turnover ratio means that a company is generating more sales from its assets, indicating that it is managing its assets more efficiently and is more profitable. A lower asset turnover ratio can indicate that a company is not using its assets efficiently, which could lead to lower profits. Total assets turnover = sales / total assets 10 | P a g e Company name 2019 2020 2021 PepsiCo 0.86 0.76 0.86 Coca-Cola 0.43 0.38 0.41 1 0.9 0.86 0.86 0.76 0.8 0.7 0.6 0.5 0.43 0.41 0.38 0.4 0.3 0.2 0.1 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: Total asset turnover ratio of 0.86 indicates that PepsiCo had generated 0.86 times revenue from each dollar of the total asset during 2019. Total asset turnover ratio of 0.43 implies that Coca-Cola had generated 0.43 times revenue from each dollar of the total asset during 2019. The total asset turnover ratio of PepsiCo has been the same in 2019 and 2021. In 2020, it decreased to 0.76 which is the lowest. On the other side, the total asset turnover ratio of Coca-Cola decreased from 0.43 to 0.38 from 2019 to 2020. In 2021, it increased to 0.41. The graph shows that PepsiCo has consistently outperformed Coca-Cola in terms of the total asset turnover ratio over the past three years, indicating that PepsiCo is more successful in utilizing its assets to generate sales. This suggests that PepsiCo is more efficient in managing its resources and producing a higher quality product with fewer resources than Coca-Cola. Debt ratios The debt position of a firm indicates the amount of other people’s money being used to generate profits. In general, the financial analyst is most concerned with long-term debts this commits the firm to a stream of 11 | P a g e contractual payments over the long run. The more debt a firm has, the greater its risks of being unable to meet its contractual debt payments. ➢ Debt ratio Debt ratio is a financial ratio that measures the extent of a company’s leverage. It is calculated by dividing the total debt of a company by its total assets. This ratio measures the percentage of a company’s assets that are financed by debt. A high debt ratio indicates that the company has a high degree of leverage and may be at increased risk of bankruptcy if its income decreases. A low debt ratio indicates that the company has a low degree of leverage and may be able to better weather economic downturns. Debt ratio = total liabilities / total assets Company name 2019 2020 2021 PepsiCo 81 85 83 Coca-Cola 75.5 75.6 73.6 86 85 83 84 82 81 80 78 75.6 75.5 76 73.6 74 72 70 68 66 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: Debt ratio of 0.81 in 2019 indicates that PepsiCo has $.81 debt for $1 of assets. Debt ratio of 75.5 in 2019 indicates that Coca-Cola has $.75 debt for $1 of assets. 12 | P a g e PepsiCo's debt ratio has increased from 81% in 2019 to 85% in 2020, showing that the company has become increasingly reliant on loans to finance its assets, making it riskier and more indebted. This has led to an increase in interest payments and a decline in profits. In comparison, Coca-Cola's debt ratio has remained relatively stable, decreasing to 73.6% in 2021. This suggests that Coca-Cola is in a more favorable position than PepsiCo. ➢ Time interest earned ratio The time interest earned ratio is a measure of a company's ability to satisfy its short-term obligations from its current income. It is calculated by dividing a company's earnings before interest and taxes (EBIT) by its total interest expenses for the same period. The higher the ratio, the better the company's ability to cover its interest expenses with its current income. It can also be used to compare the level of financial risk between different companies. Time interest earned ratio= EBIT / interest expense Company name 2019 2020 2021 PepsiCo 9.20 9.04 6.27 Coca-Cola 12.40 7.78 8.78 14 12.4 12 10 9.2 9.04 8.78 7.78 8 6.27 6 4 2 0 2019 PepsiCo 2020 Coca-Cola 2021 Interpretation: If PepsiCo and Coca-Cola keep operating the same way, PepsiCo will be able to cover its interest expense with its EBIT of 6.27 times, while Coca-Cola could cover its interest expense with its EBIT of 8.78 times. The time interest earned ratio of above 1, is better for both companies. And both companies have more than 5 times the ability to pay off interests with their EBIT. But the downstream trend indicates that the companies are slowly losing their ability. However, as compared to PepsiCo, Coca-Cola is better off in this position. 13 | P a g e PROFITABILITY RATIOS Profitability ratios measure a company's ability to generate income relative to its revenue, operating costs, balance sheet assets, and shareholders' equity. These ratios are used to measure the relative success of a company in terms of its ability to generate profits. Some of the most commonly used profitability ratios include return on assets (ROA), return on equity (ROE), gross margin ratio, operating margin ratio, and net profit margin. ➢ Gross profit Margin The gross profit margin ratio is a financial metric used to measure a company's profitability and financial health. It measures the percentage of each dollar of revenue that a company keeps after subtracting the costs of goods sold (COGS). It is calculated by dividing gross profit (the difference between revenue and COGS) by total revenue. The higher the gross profit margin ratio, the more profitable a company is, as it is able to keep more of its revenue after accounting for costs. Gross profit margin= gross profit/sales Company name 2019 2020 2021 PepsiCo 55.13% 54.82% 53.35% Coca-Cola 60.77% 59.31% 60.27% 62 60.77 60.27 59.31 60 58 56 55.13 54.82 53.35 54 52 50 48 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: From $100 sales PepsiCo generate a gross profit of $55.13 in 2019, $54.82 in 2020, and $53.35 in 2021. Here, the company faces a downstream trend which indicates the gross profit in sales decreasing. 14 | P a g e On the other hand, from $100 sales Coca-Cola generate a gross profit of $60.77 in 2019, $59.31 in 202and 0, and $60.27 in 2021. So as compared to PepsiCo, Coca-Cola is better off. Overall, both companies should reduce the cost of goods sold to improve their gross profit. ➢ Operating profit margin The operating profit margin ratio is a financial measure that shows the amount of operating profit a company can generate from its total sales. It is expressed as a percentage and is calculated by dividing a company's operating profit by its total revenue. This ratio is used to measure the overall financial health of a company and to compare its profitability to that of similar businesses. It is also used to assess a company's ability to generate profits from its operations. Operating profit margin = EBIT / Sales Company name 2019 2020 2021 PepsiCo 15.56% 14.49% 14.70% Coca-Cola 31.48% 33.88% 36.27% 40 36.27 33.88 35 31.48 30 25 20 15.56 14.7 14.49 15 10 5 0 2019 PepsiCo 15 | P a g e 2020 Coca-Cola 2021 Interpretation: From $100 sales PepsiCo generate an operating profit of $15.56 in 2019, $14.49 in 2020, and $14.70 in 2021. Here, the company faces a downstream trend which indicates the operating profit in sales decreases their operating efficiency declines over the period. On the other hand, from $100 sales Coca-Cola generate a gross profit of $31.48 in 2019, $33.88 in 2020, and $36.27 in 2021 which is upstream. It indicates that the company’s operating efficiency is growing over the period. So as compared to PepsiCo, Coca-Cola is better off of generating operating profit from sales. ➢ Net profit margin Net profit margin ratio is a profitability measure used to evaluate the overall financial health of a company. It is calculated by dividing net income (after taxes) by total revenue. This ratio shows the percentage of each dollar of sales that is converted into net income. It is a helpful tool to compare the profitability of a company to its competitors. Net profit margin = net profit/sales Company name 2019 2020 2021 PepsiCo 10.89 10.12 9.59 Coca-Cola 23.94 23.47 25.28 30 25.28 23.94 25 23.47 20 15 10.89 10.12 9.59 10 5 0 2019 2020 PepsiCo 16 | P a g e Coca-Cola 2021 Interpretation: From $100 sales PepsiCo generate a net profit of $10.89 in 2019, $10.12 in 2020, and $9.59 in 2021. Here, the company faces a downstream trend which indicates that the company’s operational expenses are getting higher as a result the net profit is decreasing with each sale. On the other hand, from $100 sales Coca-Cola generate a net profit of $23.94 in 2019, $23.47 in 2020, and $25.28 in 2021 which is upstream. It indicates that the company’s operating manager was able to minimize the operational costs which increase net profit in each sale. So as compared to PepsiCo, Coca-Cola is better off generating net profit from sales. ➢ EPS Earnings Per Share (EPS) is a financial ratio calculated by dividing the net income of a company by the number of its outstanding shares of common stock. It is a measure of profitability that offers investors an indication of how much money a company is making on a per-share basis. EPS is often used to compare companies within the same industry, as well as to compare companies of different sizes, as larger companies may have a higher net income but also more outstanding shares. EPS = net profit / no. of common stocks outstanding Company name 2019 2020 2021 PepsiCo 5.26 5.16 5.51 Coca-Cola 2.09 1.80 2.26 17 | P a g e 6 5.51 5.26 5.16 5 4 3 2.26 2.09 1.8 2 1 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: 5.26 EPS means by owning 1 share of PepsiCo can get 5.26 dollars’ profit. 2.09 EPS means by owning 1 share of Coca-Cola can get 2.09 dollars’ profit. From 2019 to 2020 PepsiCo’s EPS increased. That means they are generating high profits for their shareholders. On the other hand, from 2019 to 2020 Coca-Cola’s EPS increased and in the next year again goes up. So as compared to PepsiCo, Coca-Cola is generating less profit for its shareholders but that doesn’t mean Coca-Cola is not in a good position. ➢ ROA The return on asset ratio (ROA) is a financial metric used to assess the profitability of a business by measuring how efficiently the company can convert its assets into profits. It is calculated by dividing net income (after tax) by total assets. It is expressed as a percentage and is a key indicator of a company's financial performance. The higher the return on assets, the more efficient the company is in generating profits from its total assets. It is also used to compare the profitability of different companies. ROA= net profit / total assets Company name 2019 2020 2021 PepsiCo 9.31 7.66 8.25 Coca-Cola 10.33 8.87 10.36 18 | P a g e Chart Title 12 10 10.36 10.33 9.31 8.87 7.66 8 8.25 6 4 2 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: ROA 9.31% means out of $100 of investment in total assets PepsiCo generates $9.31 of net profit during 2019. ROA 10.33% means out of $100 of investment in total asset Coca-Cola generates $10.33 of net profit. The highest ROA percentage of PepsiCo was 9.31% in 2019, and the lowest ROA rate was 7.66% in 2020. The company is doing fairly better this year in generating income from assets. The highest ROA percentage of Coca-Cola was 10.36% in 2021, and the lowest ROA rate was 8.87% in 2020. The company reached the highest ROA in 2021 than other 2 years which indicates the company is generating more profit from each dollar assets. As compared to PepsiCo, Coca-Cola’s position is much strong in terms of generating profit by properly utilizing its assets. ➢ ROE The return on equity ratio (ROE) is a measure of a company’s profitability that calculates the amount of net income returned as a percentage of shareholders’ equity. It is calculated by dividing a company’s net income by its total shareholders’ equity. ROE is an important indicator for investors because it shows how efficiently a company is utilizing its capital to generate profits. A higher ROE indicates that the company is better able to use its capital to generate returns. A lower ROE may indicate that the company is not efficiently utilizing its resources to generate profits. ROE= net profit / common stocks equity 19 | P a g e Company name 2019 2020 2021 PepsiCo 49.47 52.92 49.48 Coca-Cola 46.99 40.14 42.48 60 50 52.92 49.47 49.48 46.99 42.48 40.14 40 30 20 10 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: ROE 49.47% indicates that for each $100 of the shareholders' investment in PepsiCo, the company generated $49.47 in net profit during 2019. Similarly, ROE 46.99% shows that for each $100 of the shareholders' investment in Coca-Cola, the company generated $46.99 in net profit during 2019. PepsiCo shows an increasing ROE ratio results with a certain drop in 2021. However, Coca-Cola’s ROE results demonstrate the exact opposite trend; a drop in efficiency in converting equity capital into income in 2020, and in 2017 they improve the ROE to 42.48 %. So, in terms of ROE positioning, PepsiCo is better off than Coca-Cola. ➢ P/E ratio The price-to-earnings (P/E) ratio is a ratio for valuing a company that measures its current share price relative to its per-share earnings. It is calculated by taking the current stock price of a company and dividing it by the company's earnings per share (EPS). The P/E ratio can provide investors with an indication of the company's profitability and future prospects, as well as an indication of the market's view of the company's performance. P/E ratio = market price per share of common stock / EPS 20 | P a g e Company name 2019 2020 2021 PepsiCo 22.22 25.43 23.92 Coca-Cola 26.48 30.37 26.20 35 30.37 30 25 26.48 25.43 26.2 23.92 22.22 20 15 10 5 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: The market price for PepsiCo is 22.22 times greater than each dollar of earnings per share, while the market price for Coca-Cola is 26.48 times greater than each dollar of earnings per share. Both the companies faced a sudden growth in 2020 but in 2021 the growth goes down. compared to PepsiCo, Coca-Cola faced a sudden big decrease in their price earnings ratio which means the price of the stock is a bargain in the market. ➢ Market/Book ratio The book-to-market ratio is a measure of market value of a company relative to its book value. It is calculated by dividing the market value of the company's equity, which is the market capitalization, by the company's book value, which is the amount of assets reported on the balance sheet. The higher the bookto-market ratio, the higher the market value relative to the book value. A low book-to-market ratio indicates that the market values the company's assets higher than the book value. A high book-to-market ratio indicates that the market values the company's assets lower than the book value. Generally, companies with high book-to-market ratios are considered to be undervalued, while those with low book-to-market ratios are considered to be overvalued. Market/Book ratio =market price per common stock/book value per common stock 21 | P a g e Company name 2019 2020 2021 PepsiCo 10.99 13.46 11.36 Coca-Cola 12.48 12.22 11.13 16 14 12 12.48 13.46 12.22 10.99 11.36 11.13 10 8 6 4 2 0 2019 2020 PepsiCo 2021 Coca-Cola Interpretation: The market-to-book ratio of PepsiCo is 10.99, meaning that its market price is on an average 11 times higher than its book value. Similarly, the market-to-book ratio of Coca Cola is 12.48, indicating that its market price is 12.48 times more than its book value. In 2020, PepsiCo’s market-to-book ratio goes up to 13.46% but in 2021 it again goes down to 11.36%.On the other hand, Coca-Cola’s market-to-book ratio is continuously decreasing which indicates that people doesn’t want to buy its share with the same price anymore now they want to pay less. This is not good for a company. 22 | P a g e Company valuation of Coca-Cola Vs. PepsiCo Companies with strong brand values, like Coca-Cola and PepsiCo, profit from having significant pricing power in these times of rising inflation. I'll demonstrate which of the two businesses is now more appealing in terms of risk and profit in this research. PepsiCo's P/E Ratio is now 20.3, while Coca-P/E Cola's (FWD) Ratio is 25.35. Over the past three years, Coca-dividend Cola's growth rate has averaged 3.62%, while PepsiCo's dividend growth rate has been 7.39% on average. To evaluate Coca-Cola and PepsiCo, I utilized the DCF Model to calculate their intrinsic worth. The approach determines a fair value of $222.67 for PepsiCo and $47.91 for Coca-Cola. This translates in a potential downside of 23% for Coca-Cola and a potential upside of 29.6% for PepsiCo at the present stock price. Over the next five years, I project a revenue growth rate and EBIT growth rate for Coca-Cola of 3% and a revenue growth rate and EBIT growth rate for PepsiCo of 5%. owing to PepsiCo's wider range of products (through operating not only in the beverage but also in the snack and food businesses), In the coming years, PepsiCo should have somewhat faster growth than Coca-Cola. The average annual GDP growth rate for the US is around 3%. As a result, I consider Coca-Cola to have a 3% Perpetual Growth Rate. I anticipate PepsiCo will be able to expand somewhat above the GDP Growth Rate in the future because to its wide and diverse product portfolio and strong brand image. As a result, I make PepsiCo's perpetual growth rate an assumption of 4%. I utilized the 7.5% and 6.5% current discount rates for Coca-Cola and PepsiCo, respectively. Furthermore, I use an EV/EBITDA Multiple of 21.5x for Coca-Cola and 17.9x for PepsiCo in my calculations. Both represent the businesses' most recent twelve-month EV/EBITDA. 23 | P a g e Coca-Cola PepsiCo Details Company Ticker KO PEP Revenue Growth Rate for the next 3 years 3% 5% EBIT Growth Rate for the next 3 years 3% 5% Tax Rate 21.2% 20.1% Discount Rate (WACC) 7.5% 6.5% Perpetual Growth Rate 3% 4% EV/EBITDA Multiple 21.5x 17.9x Current Price/Share $62.19 $171.88 Shares Outstanding 4,335 1,380 Debt $42,143 $39,279 Cash $7,681 $5,405 Capex $1,368 24 | P a g e Capital structure The company's capital structure is the collection of securities it issues to investors to raise capital. Firms typically make use of equity and debt securities. Leverage of the business is determined by the amount of debt. A capital structure that maximizes the total value of the issued securities should always be utilized by the business. In order to evaluate the effects of the various ratios on the company, it is necessary to determine the net debt ratio, fixed coverage ratio, interest ratio, long term debt ratio, cash flow ratio, and other ratios in order to determine the firm's capital structure. Comparing and analyzing these ratios with those of other competitors is beneficial. The company can use ratios to determine their position in relation to things like revenues, market value, book value, market capitalization, debt value, and so on. Capital structure of PepsiCo The most essential inquiry of corporate money is the means by which a firm ought to raise capital from financial backers. The kind of security that an organization will offer to investors must be decided. A company's capital structure is the way it finances its assets through equity, debt, or other securities. The company's capital structure can be determined using a variety of theories. Theory of Pecking Order: states that the businesses prefer a particular financing structure; Prior to utilizing any external financing, the factor with the highest preference uses internal financing, such as retained earnings. Debt, convertible securities, preferred stock, and common stock are all forms of external financing. Therefore, the company uses its retained earnings first for operations, investments, or expansions, and then, if necessary, can turn to external financial resources. Theory of Trade-Offs: states that the businesses are funded in part by debt and equity. Due to the tax advantages of debt, this type of financing is preferred. The costs of bankruptcy and non-bankruptcy are also covered by debt financing. Additionally, the theory asserts that marginal benefits decrease with decreasing debt, while marginal costs of debts rise with increasing debt. Agency cost theory: states that asset substitution, cash flow, and underinvestment are the three distinct agency costs that are associated with a company's capital structure. Substitution of Assets: states that the company has more freedom to invest in new projects as the debt to equity ratio rises, resulting in a decrease in its value and a transfer of wealth from debt holders to shareholders. Underinvestment issues happen when obligation seems, by all accounts, to be more dangerous, in this situation of the firm the profits from the interest in tasks will be coordinated towards the obligation holders 25 | P a g e as opposed to the investors. This might prompt the firm declining to begin any new tasks, and there is a possibility to expand the organizations esteem. Flow of Free Cash: states that if the cash is not returned to the investors, the company's free cash flow will also be a problem. The company's value will be disrupted as a result. Miller-Modigliani Theory: states that the perfect market and the absence of transaction costs and taxes are assumed. Additionally, they stated that a company's equity and debts are added together to determine its value. Capital structure of Coca-Cola Capitalization of Equity: The amount of money that would be returned to a company's stockholders if all of the company's assets were liquidated is referred to as shareholders' equity (or owners' equity for privately held businesses). The amount of equity invested in a business is calculated by subtracting the number of treasury shares from the sum of retained earnings and common stock, which represents the ownership of the company by shareholders. Coca-Cola's total stockholders' equity is $22.81 billion, as stated in its 10-Q for the third quarter. This includes $1.76 billion in par-valued common stock, $18.69 billion in capital surplus, and $70.89 billion in earnings that have been reinvested (retained), less $15.87 billion in accumulated other comprehensive income and $52.67 billion in treasury stock. Coca-Cola had 4,325 billion outstanding shares on December 23, 2022, giving it a market capitalization of approximately $275.5 billion. Capitalization of Debt: The total amount of capital owed to creditors is determined by debt, the other component of the capital structure. First, debt is divided into two categories: liabilities that are due in a year or less and those that mature in more than a year. According to Coca-Cola's 10-Q from October 2022, the company has $26.44 billion in current liabilities. These liabilities include $116.10 billion in accounts payable and accrued expenses, $3.39 billion in loans and notes payable, $729 million in long-term debt with current maturities, and $1.2 billion in accrued income taxes. Together, long-term debt, deferred income taxes, and other liabilities total $46.69 billion. The total liabilities of Coca-Cola amount to $68.04 billion. Leverage: Coca-Cola's ability to pay off its current obligations has actually improved in spite of this debt. The current ratio of Coca-Cola, which is a comparison of a company's current assets to its current liabilities, is 1.12, which is typically regarded as typical for the sector. This indicates that Coca-Cola's liquid assets total $1.12 for each dollar of current debt. 26 | P a g e It has a quick ratio of.97, which measures the ratio of a company's available liquid assets to its current liabilities. Another indication of good financial health is the decrease in Coke's debt-to-equity ratio. This leverage gauge is calculated by dividing the quotient of total liabilities by shareholders' equity. It is used to compare a company's ownership to the amount owed to creditors. Coca-Cola's debt-to-equity ratio decreased from 2.795 in 2021 to 2.78 in Q3 2022. Value to the Company: Investment bankers frequently use the metric known as enterprise value (EV) to determine a company's market value. The EV of a company is determined by adding its market cap and net debt. A company's net debt is calculated by dividing its total cash and cash equivalents by the sum of its liabilities and debt. The current EV for Coca-Cola is $333.77 billion. However, investors should not be alarmed by Coca-Cola's increased EV. When compared to other large corporations like Amazon.com Inc. (AMZN) and Apple Inc. (AAPL), which have seen their EV sales skyrocket by as much as 150 percent at times over the past decade, this is a modest increase. Coca-Cola uses a variety of debt instruments to finance its operations, as shown on its balance sheet. Coca-Cola appears to be managing its finances effectively, as evidenced by its most recent filings. The Generally Accepted Accounting Principles of the United States guide Coca-Cola's accounting practices. Conclusion: Coca-Cola has been in business for more than a century and has experienced some economic turmoil. Despite difficult times, the company continues to perform and makes prudent use of its debt. It also has a substantial amount of cash and equivalents available. Additionally, it has demonstrated its ability to effectively manage its finances by paying dividends to investors for a number of years. 27 | P a g e Dividend policy of Coca-Cola Coca-Cola Corporation is getting attention from institutions. In the current environment, it appears that the category's inflationary resilience and brand strength are proving to be a winning combination. Revenue: $10.0 billion (up 16% from 3Q 2020) Gross profit: $2.47 billion (up 42% from 3Q 2020). Margin of profit: 25%, an increase from 20% in 3Q 2020. Revenue growth was the primary factor in the margin improvement. While earnings per share have increased by 14% on average over the past three years, the company's share price has only increased by 6% annually, indicating that earnings growth is significantly behind. In addition, Coca-Cola increased Q3 volume and improved organic revenue ahead of pre-pandemic levels in 2019. James Quincey, CEO, maintains his optimism regarding long-term growth investments. The company attracted the attention of Credit Suisse, which selected it as its top new pick following the positive results. Kaumil Gajrawala, their analyst, praised the achievement of delivering these results in a challenging logistics setting. In the meantime, Body Armor, a manufacturer of sports drinks, is up for sale. The company is valued at US$8 billion after acquiring a 30% stake in 2018 for approximately US$5.6 billion. The sports drink market dominated by their main rival, Gatorade, would be strengthened by this acquisition. PowerAde, Body Armor's brand, is a rising competitor in the market that will undoubtedly benefit from this move. Dissecting the Coca-Cola's Dividend A 3.0% yield is not the highest, but investors probably think the long payment history suggests Coca-Cola has some staying power. When buying stocks for their dividends, you should always run through the checks below to see if the dividend looks sustainable. Payout ratios We must determine whether a company's dividend can be sustained in light of its net profit after taxes. Over the trailing twelve months, Coca-Cola distributed dividends worth 82% of the company's profits. The 28 | P a g e majority of its earnings are being distributed, limiting the amount that can be reinvested in the company. This could point to a commitment to paying a dividend or a limited need for additional capital. Whether the generated free cash flow is sufficient to pay the dividend is another important check. Last year, Coca-Cola distributed 77% of its cash flow. Although this may be able to last, it doesn't leave much room for unforeseen events. This range, on the other hand, is most likely the result of the business entering the buffer zone in order to safeguard the dividend, given that the year 2020 itself was largely unanticipated. Dividend Volatility We want to see if the dividends have been consistent in the past and if the company has a track record of maintaining its dividend before purchasing a stock for its income. We only examine Coca-Cola's dividend payments over the past ten years for the purpose of this article. Excellently, the dividend has remained stable for the past ten years. We believe that this could suggest that the company and its dividends are resilient. The first annual payment over the previous ten years was US$0.9 in 2011, compared to US$1.7 in 2011. Over the course of that time, this amounts to a compound annual growth rate (CAGR) of approximately 6.0 percent per year. If the dividend growth rate can be sustained, companies like these could be valuable in the long run. 29 | P a g e Dividend Growth Potential Over the past few years, dividend payments have been consistent. However, we should always check to see if earnings per share (EPS) are growing, as this will help keep the dividend's purchasing power. Over the past five years, Coca-Cola's earnings per share have increased by 4.1% annually. Limited earnings growth and a high payout ratio can indicate a company's inability to expand, with some exceptions. Companies frequently choose to pay a larger dividend when the rate of return on reinvestment opportunities falls below a certain minimum level. Because of this, many mature businesses frequently have higher dividend yields. In conclusion, shareholders ought to constantly ensure that Coca-Cola's dividends are within their means, that the company's dividend payments are relatively stable, and that the company has reasonable prospects for expanding both its earnings and its dividend. Despite the fact that Coca-Cola distributes dividends for more than half of its earnings, the most recent year was notable for its unusually low annual free cash flow. We appreciate the relatively consistent dividend payments in spite of the limited growth in earnings. We do believe Coca-Cola can be a part of a portfolio that is balanced and focused on yield, even though we are not particularly optimistic about it. Dividend Policy PepsiCo's policy is: Concerning PepsiCo, they have chosen ideal and adaptable profit strategy, set up for north of 40 years at a consistent rate. In terms of the future, Pepsi continues at a steady pace; They have predicted the future dividends of PepsiCo 2013. PepsiCo is ranked the top leading company among other companies because it has given dividends on a consistent basis and at an increased rate for over 40 years. This is due to their increased earnings, new projects, a jubilant of new products within the market, and a yearly total savings of one billion dollars for the year 2012. Pepsi has paid cash dividends quarterly since 1965. Through dividend purchases in 2012, PepsiCo gave its shareholders more than 6.5 billion dollars. Pepsi now has the ability to collect funds from their operations and the US debt markets. PepsiCo, Inc.'s Board of Directors (NASDAQ: PEP) today pronounced a quarterly profit of $1.15 per portion of PepsiCo normal stock, a 7 percent increment versus the practically identical year-sooner period. PepsiCo's announcement of raising its annualized dividend from $4.30 to $4.60 per share, beginning with the June 2022 payment, is in line with today's action. Shareholders who had their shares in hand at the close of business on September 2, 2022, will receive this dividend on September 30, 2022. Since 1965, PepsiCo has paid cash dividends every quarter, and in 2022, the company increased its dividends for the 50th year in a row. More than one billion people worldwide consume PepsiCo products on a daily basis in more than 200 countries and territories. PepsiCo's portfolio of complementary beverages and convenient foods, which includes Lay's, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and SodaStream, 30 | P a g e contributed more than $79 billion in net revenue in 2021. PepsiCo offers a wide range of tasty snacks and beverages, many of which are household names with estimated annual retail sales of more than $1 billion. Our goal for PepsiCo is to win with PepsiCo Positive (pep+) and become the global leader in beverages and convenience foods. pep+ is our essential start to finish change that puts supportability and human resources at the focal point of how we will make worth and development by working inside planetary limits and moving positive change for planet and individuals. 31 | P a g e