Understanding Strategic Management Textbook

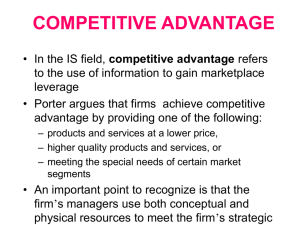

advertisement