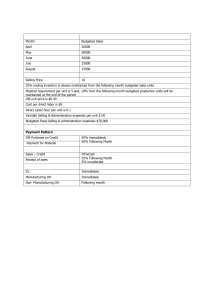

Test 3 Engineering Business Management (EBM307B) Answer on one excel spreadsheet with a sheet for each section. Section 1 50 Marks Time 120 Minutes 20Marks Dealing Company is a merchandiser that provided a balance sheet as of September 30 as shown below: Assets Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Buildings and equipment, net of depreciation . . . . . . Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Liabilities and Stockholders’ Equity Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total liabilities and stockholders’ equity . . . . . . . . . . . . R 59 000 90 000 32 400 214 000 R 395 400 R 73 000 216 000 106 400 R 395 400 The company is in the process of preparing a budget for October and has assembled the following data: 1. Sales are budgeted at R240 000 for October and R250 000 for November. Of these sales, 35% will be for cash; the remainder will be credit sales. Forty percent of a month’s credit sales are collected in the month the sales are made, and the remaining 60% is collected in the following month. All of the September 30 accounts receivable will be collected in October. 2. The budgeted cost of goods sold is always 45% of sales and the ending merchandise inventory is always 30% of the following month’s cost of goods sold. 3. All merchandise purchases are on account. Thirty percent of all purchases are paid for in the month of purchase and 70% are paid for in the following month. All of the September 30 accounts payable to suppliers will be paid during October. 4. Selling and administrative expenses for October are budgeted at R78 000, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at R2 000 for the month. Required: Using the information provided, calculate or prepare the following: 1.1. The budgeted cash collections for October. 1.2. The budgeted merchandise purchases for October. 1.3. The budgeted cash disbursements for merchandise purchases for October. 1.4. The budgeted net operating income for October. [5] [5] [5] [5] Section 2 15Marks Chairbase Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company’s products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Chairbase’s products appears below: Selling price per unit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Variable cost per unit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Upholstery labor-hours per unit . . . . . . . . . . . . . . . . . . . . . . . . . . Recliner R1 400 R 800 8 hours Sofa R1 800 R1 200 10 hours Love Seat R1 500 R1 000 5 hours Required: 2.1 Chairbase is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? [5] 2.2 A small nearby upholstering company has offered to upholster furniture for Chairbase at a price of R45 per hour. The management of Chairbase is confident that this upholstering company’s work is high quality and their craftsmen can work as quickly as Chairbase’s own craftsmen on the simpler upholstering jobs such as the Love Seat. How much additional contribution margin per hour can Chairbase earn if it hires the nearby upholstering company to make Love Seats? [5[ 2.3 Should Chairbase hire the nearby upholstering company? Explain. [5] Test 3 Engineering Business Management (EBM307B) Answer on one excel spreadsheet with a sheet for each section. 50 Marks Time 120 Minutes Section3 15Marks Andrew’s Scrapery Service is investigating the purchase of a new machine for cleaning and unblocking Stormwater pipes in Kwazulu Natal. The machine would cost R137 320, including freight and installation. Andrew’s estimated the new machine would increase the company’s cash inflows, net of expenses, by R40 000 per year. The machine would have a five-year useful life and no salvage value. Required: 3.1. What is the machine’s internal rate of return to the nearest whole percent? 3.2. Using a discount rate of 14%, what is the machine’s net present value? Interpret your results. 3.3 Plot the NPV of the machine for different interest rates on a graph. Show the IRR on the graph. [5] [5] [5]