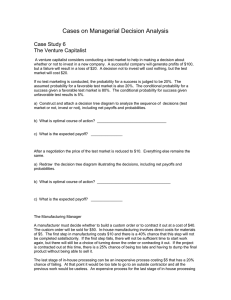

FINANCE 2 BLOCK 3 2023 INSTRUCTOR: E. Smailbegovic smajlbegovic@ese.eur.nl LECTURE 1 WHAT IS A DERIVATIVE? Derivative is a financial instrument that has a value determined by the price of something else (underlying offer of a derivative) Example: An agreement where you pay $1 if the price of corn is greater than $3 and receive $1 if the price of corn is less than $1 is a derivative - This contract can be used to speculate on the price of corn or it can be used to reduce risk. It is not the contract itself, but how it is used, and who uses it that determines whether or not it is risk-reducing. Interested are the people who are speculators If the farmer enters an agreement like this, he can reduce the risk of reduction of the price of corn. This can happen if the price of corn reduces, so the farmer earns less, and because he is in this agreement, he will receive $1 for the reduction of the price of corn. This way this agreement compensates the reduction of income of the farmer. HISTORICAL EXAMPLES 1 - Thales of Milet (6th century a.d.) expected a rich olive harvest and agreed with the owners of olive mills to rent their mills long term, fixing their (low) rent today. During the harvesting season he sub-rented those mills and made a fortune - During the tulip-mania in the 17th century in the Netherlands, there was an active derivatives market for tulip bulbs - The Dojima Rice Exchange was the first organized futures exchange (est. 1697) DERIVATIVES MARKETS The introduction of derivatives in a market often coincides with an increase in price risk in that market. - - Currencies were permitted to float in 1971 when the gold standard was officially abandoned. The modern market in financial derivatives began in 1972, when the Chicago Mercantile Exchange started trading futures contracts on seven currencies OPEC’s 1973 reduction in the supply of oil was followed by high and variable oil prices US interest rates became more volatile following inflation and recessions in the 1970s The market for natural gas has been deregulated gradually since 1978, resulting in a volatile market in recent years The deregulation of electricity behan during the 1990s THE USES OF DERIVATIVES 1. Risk Management: Derivatives are a tool for companies and other users to reduce risk 2. Speculation: Derivatives can serve as investment vehicles 3. Reduce transaction costs: Sometimes derivatives provide a lower cost way to undertake a particular financial transaction 4. Regulatory arbitrage: It is sometimes possible to circumvent regulatory restrictions, taxes and accounting rules by trading derivatives EXAMPLES OF DERIVATIVES APPLICATIONS - Transnational companies buy FX-derivatives to hedge their currency exposure Airlines enter futures contracts in order to be less vulnerable to oil price changes A goldmine can use derivatives to lock in the current gold price Bank can use derivatives to manage interest rate and default risks AND THOSE THAT WENT WRONG… - 2 Barings Bank (1995): Nick Leeson engages in arbitrage business using derivatives. To recover his losses, he bets on a quick recovery of the Asian economy after the Kobe earthquake by investing in futures. - - LTCM (1998): Nobel prize winner advised fund speculates using OTC derivatives. During the Russian crises the counterparties of hedges default. LTCM cannot settle its positions due to illiquidity Societe Generale (2008): Jerome Kerviel nearly brings down the bank by massive fraudulent speculation in equity index futures USA (2007-2009): Role of derivatives in financial crises is debated PERSPECTIVES ON DERIVATIVES AND THE TRADING PROCESS End Users: - Corporations Investment managers Investors Intermediaries: - Market-makers Traders Economic observers: - Regulators Researchers EXCHANGE-TRADED DERIVATIVES MARKETS - Much trading of financial claims takes place on organized exchanges. In the past, the exchange was solely a physical location where traders would buy and sell. Such in-person venues have largely been replaced by electronic networks that provide a virtual trading venue. After a trade has taken place, a clearinghouse matches the buyers and sellers, keeping track of their obligations and payments. To facilitate these payments and to help manage credit risk, a derivatives clearinghouse typically imposes itself in the transaction, becoming the buyer to all sellers and the seller to all buyers. OVER-THE-COUNTER MARKET It is possible for large traders to trade many financial claims directly with a dealer bypassing organized exchanges. Such trading is said to occur in the over-the-counter (OTC) market Exchange activity is public and highly regulated Over-the-counter trading is not easy to observe or measure and is generally less regulated 3 For many categories of financial claims, the value of OTC trading is greater than the value traded on exchanges INTRODUCTION TO FORWARDS, FUTURES AND OPTIONS Basic derivatives contracts: - Forward contracts Call options Put options Types of positions: - Long position Short position Graphical representation: - Payoff diagrams Profit diagrams FORWARD CONTRACTS Forward contract is a binding agreement (obligation) to buy/sell an underlying asset in the future at a price set today Futures contracts are the same as forwards in principle except for some institutional and pricing differences A forward contract specifies: - The features and quantity of the asset to be delivered The delivery logistics, such as time, date and place The price the buyer will pay at the time of delivery READING PRICE QUOTES Index future price listings: 4 Expiration either June or September Open: the open price - High/low: lifetime high or low Settle: Settlement price Chg: daily change THE PAYOFF ON A FORWARD CONTRACT Payoff for a contract is its value at expiration Payoff for: - Long forward = spot price at expiration - forward price Short forward = forward price - spot price at expiration Example: Today S&R 500 index: spot price = $1,000, 6-month forward price = $1,020 In six months at contract expiration: spot price = $1,050 - Long position payoff: $1,050 - $1,020 = $30 Short position payoff: $1,020 - $1,050 = -$30 PAYOFF DIAGRAM FOR FORWARDS Long and short forward positions on the S&R 500 index: ADDITIONAL CONSIDERATIONS Type of settlement: - Cash settlement: less costly and more practical Physical delivery: often avoided due to significant costs Credit risk of the counterparty: - 5 Major issue for over-the-counter contracts - - Credit check, collateral, bank letter of credit Less severe for exchange-traded contracts - Exchange guarantees transactions, requires collateral CALL OPTIONS Call Option is a non-binding agreement (right but not an obligation) to buy an asset in the future, at a price set today Preserves the upside potential, while at the same time eliminating the unpleasant downside (for the buyer) The seller of a call option is obligated to deliver if asked Why would anyone agree to be on the seller side? The seller receives an insurance, an option premium DEFINITION AND TERMINOLOGY A call option gives the owner the right but not the obligation to buy the underlying asset at a predetermined price during a predetermined time period Strike (or exercise) price: the amount paid by the option buyer for the asset if he/she decides to exercise Exercise: the act of paying the strike price to buy the asset Expiration: the date by which the option must be exercised or becomes worthless Exercise style: specifies when the option can be exercised - European style: can be exercised only at expiration date American style: can be exercised at any time before expiration Bermudan style: can be exercised during specified periods (used for speculative purposes) PAYOFF/PROFIT OF A PURCHASED OPTION Payoff = max [0, spot price at expiration - strike price] Profit = payoff - future value of option premium 6 Example: S&R index 6-month call option - Strike price = $1,000, premium = $93.81, 6-month risk-free rate = 2% - If index value in six months = $1,100 - Payoff = max [0,$1,100 - $1,000] = $100 - Profit = $100 - ($93.81 x 1,02) = $4.32 - If index value in six months = $900 - Payoff = max [0, $900 - $1000] = 0 - Profit = $0 -($93.81 x 1,02) = - $95.68 DIAGRAM FOR PURCHASED CALL Payoff at expiration: With blue: payoff of the buyer of the option With red: payoff of the seller of the option With pink: profit of the buyer of the option (lower by the premium) Profit at expiration: PAYOFF/PROFIT OF A WRITTEN CALL 7 Payoff = - max [0, spot price at expiration - strike price] Profit = payoff + future value of option premium Example: S&R index 6-month call option - Strike price = $1,000, premium = $93.81, 6-month risk-free rate = 2% - If index value in six months = $1,100 - Payoff = - max [0,$1,100 - $1,000] = -$100 - Profit = - $100 + ($93.81 x 1.02) = -$4.32 - If index value in six months = $900 - Payoff = - max [0, $900 - $1,000] = $0 - Profit = - $0 + ($93.81 x 1.02) = $95.68 PUT OPTION Put option gives the owner the right but not the obligation to sell the underlying asset at a predetermined price during a predetermined time period The seller of a put option is obligated to buy if asked Payoff/profit of a purchased (i.e. long) put: - Payoff = max [o, strike price - spot price at expiration] Profit = payoff - future value of option premium Payoff/profit of a written (i.e. short) put: - Payoff = - max [0, strike price - spot price at expiration] Profit = payoff + future value of option premium Example: S&R index 6-month put option - Strike price = $1,000, premium = $74.20, 6-month risk-free rate = 2% - If index value in six months = $1,100 - Payoff = max [0, $1,000 - $1,100] = $0 - Profit = $0 - ($74.20 x 1.02) = - $75.68 - If index value in six months = $900 8 - Payoff = max [0, $1,000 - $900] = $100 - Profit = $100 - ($74.20 x 1.02) = $24.32 PROFIT FOR A LONG PUT POSITION Profit diagram: FEW ITEMS TO NOTE - A call option becomes more profitable when the underlying asset appreciates in value A put option becomes more profitable when the underlying asset depreciates in value Moneyness: - In-the-money option: positive payoff if exercised immediately At-the-money option: zero payoff if exercised immediately Out-of-money option: negative payoff if exercised immediately OPTION AND FORWARD POSITIONS: A SUMMARY 9 MINI CASE: BANK OF AMERICA MITTS Questions: - What does the payoff from an investment in 1,000 MITTS look like? - How can we decompose the product in terms of options? - How could the issuing bank hedge the risk associated with the issuance of the MITTS? - How does the bank make a profit? LECTURE 2 INTEREST RATES AND BOND BASICS NOTATIONS - rt (t1, t2): interest rate from time t1 to t2 prevailing at time t r0 (0,t2): zero rate or spot rate A zero rate (or spot rate), for maturity t2 is the rate of interest earned on today’s investment that provides a payoff only at time t2. Usually expressed in annual terms. - 10 Pt0 (t1, t2): price of a bond quoted at t = t0 to be purchased at t = t1 maturing at t = t2 and a $1 payoff only at time t2 - Yield to maturity/ bond yield: percentage increase in dollars earned from the bond MEASURING INTEREST RATES AND IMPACT OF COMPOUNDING The compounding frequency used for an interest rate is the unit of measurement The difference between quarterly and annual compounding is analogous to the difference between miles and kilometers - When we compound n time per year at an annual rate r(0,1) an amount A grows to A(1+r(0,1)/n)^n in one year. Annual (n=1) => 100 * [(1 +10%)/1]^1 Semiannual (n=2) => 100 * [1+10%)/2]^2 Quarterly (n=4) => 100 * [1+10%/4]^4 CONTINUOUS COMPOUNDING - In the limit as we compound more and more frequently we obtain continuously compounded interest rates: (compounding goes to almost infinity) - $100 grows to $100e^r (0,1)T when invested at a continuously compounded rate r(0,1) for time T $100 received at time T discounts to $100e^−r (0,1)T at time zero when the continuously compounded discount rate is r(0,1) - CONVERSION FORMULAS Define: rc: continuously compounded rate (to compound) 11 rn: same rate with compounding n times per year (discrete interest rate + already compounded) Rates used in option pricing are usually expressed with continuous compounding BOND PRICE Zero-coupon bond price that pays CT at T: - Discrete: - Continuous: - General: Coupon bonds: The price at time of issue of t of a bond maturing at time T that pays n coupons of size c and maturity payment of CT at T: Where ti = t + i (T - t)/n BOND YIELD (Not part of the exam) The bond yield is the discount rate that makes the present value of the cash flows on the bond equal to the market price of the bond The bond yield at t = 0 is given by solving: for the value y (this is the continuous version) EXAMPLE: ZERO CURVE AND BOND YIELD You open the financial section of your daily newspaper and find the following table with different bonds, their main characteristics and prices. 12 1. Given the bond prices above, please draw the zero curve for the next two years (continuously compounded rate) Bond A: 100 * e^-r*0.25 = 97.5 => r = 10.13% Bond B: 100 * e^-r*0.5 = 94.9 => r = 10.469% Bond C: r(0,1) = 10.536% Bond D: c * e^-r (0,0.5)*0.5 + c * e^-r (0,1)*1 + (100 + c) * e^-r(0,1.5)*1.5 = 96 => 4 * e^-0.10469*0.5 + 4 * e^-0.10536*1 + 104 * e^r(0,1.5) *1.5 = 96 r(0,1.5) = 10.681% Bond E: r(0,2) = 10.808% 2. You are interested in a long-term investment in a safe bond. However, before investing in Bond E, you would like to know its yield to maturity YTM = 6 * e^-y*0.5 + 6 * e^-y*1 + 6 * e^-y*1.5 +106 * e ^-y *2 = 101.6 (Can only be solved with computer) FORWARD RATES The forward rate is the future zero rate implied by today’s term structure of interest rates FORMULA FOR FORWARD RATES 13 Suppose that the zero rates for time periods T1 and T2 are r(0,T1) and r(0,T2) with both rates continuously compounded The continuously compounded forward rate for the period between times T1 and T2 is: This formula is only approximately true when rates are not expressed with continuous compounding The discrete forward rate for the period between T1 and T2 is: UPWARD VS DOWNWARD SLOPING YIELD CURVE - For an upward sloping yield curve: For a downward sloping yield curve: forward rate > zero rate (developing economy) zero rate > forward rate (recessions) FINANCIAL FORWARDS AND FUTURES INTRODUCTION Financial futures and forwards: - On stocks and indexes On currencies On interest rates How are they used? How are they priced? How are they hedged? ALTERNATIVE WAYS TO BUY A STOCK Four different payment and receipt timing combinations: 1) 2) 3) 4) Outright purchase: ordinary transaction Fully leveraged purchase: investor borrows the full amount Prepaid forward contract: pay today, receive the share later Forward contract: agree on price now, pay/receive later Payments, receipts and their timing: 14 Four different ways to buy a share of stock that has price S0 at time 0. At time 0 you agree to a price, which is paid either today or at time T. The shares are received either at 0 or T. The interest rate is r. PRICING PREPAID FORWARDS - If we can price the prepaid forward (FP), then we can calculate the price for a forward contract: F = future value of F Three possible methods to price prepaid forwards: 1. Pricing by analogy 2. Pricing by arbitrage 3. Pricing by discounted present value (not discussed) For now, assume that there are no dividends PRICING BY ANALOGY - In the absence of dividends, the timing of delivery is irrelevant Price of the prepaid forward contract same as current stock price Where the asset is bought at t = 0, delivered at t = T PRICING BY ARBITRAGE - Arbitrage: a situation in which we can generate positive cash flow by simultaneously buying and selling related assets, with no net investment and with no risk => free money If at time t = 0 , the prepaid forward price somehow exceeded the stock price, i.e. , an arbitrageur could do the following: 15 - Since, this sort of arbitrage profits are traded away quickly, and cannot persist, at equilibrium we can expect: PRICING PREPAID FORWARDS WITH DIVIDENDS What if there are dividends? Is - still valid? No, because the holder of the forward will not receive dividends that will be paid to the holder of the stock => - For discrete dividends Dti at times ti = 1,...,n - The prepaid forward price is: - For continuous dividends with an annualized yield δ: - The prepaid forward price is: PRICING PREPAID FORWARDS: TWO EXAMPLES Example 1: XYZ stock costs $100 today and is expected to pay a quarterly dividend of $1.25. If the risk free rate of 10% compounded continuously, how much does a 1-year prepaid forward cost? FP = $100 - (1.25*e^-0.0.25*1 +1.25*e^-0.05*1 +1.25*e^-0.075*1 +1.25*e^-0.1*1 ) = $95.30 Example 2: The index is $125 and the dividend yield is 3% continuously compounded. How much does a 1-year prepaid forward cost? FP = $125 e^-0.03*1 = $121.31 16 PRICING FORWARDS ON STOCK Forward price is the future value of the prepaid forward price - No dividends: - Continuous dividends: Forward premium: The difference between current forward price and stock price Forward premium = F0,T / S0 Annualized forward premium = - Can be used to infer the current stock price from forward price CREATING A SYNTHETIC FORWARD One can offset the risk of a forward by creating a synthetic forward to offset a position in the actual forward contract How can we do this? (Assume continuous dividends at rate δ) 17 - Recall the long forward payoff at expiration: ST - F0,T Borrow and purchase shares as follows: - Note that the total payoff at expiration is the same as forward payoff The idea of creating synthetic forward leads to following: - Forward = stock - zero coupon bond Stock = forward + zero coupon bond Zero coupon bond = stock - forward Cash-and-carry arbitrage: buy the index, short the forward NOTE: Cash-and-carry arbitrage with transaction costs: Trading fees, bid-ask spreads, different borrowing/lending rates, the price effect of trading in large quantities, make arbitrage harder OTHER ISSUES IN FORWARD PRICING Does the forward price predict the future price? - According to the formula, the forward price conveys no additional information beyond what S0, r and δ provides Moreover, the forward price underestimates the future stock price Forward pricing formula and cost of carry: - Forward price = spot price + interest to carry the asset - asset lease rate FUTURES CONTRACTS 18 - Exchange-traded “forward contracts” - Typical features of futures contracts: a. Standardized, with specific delivery dates, locations, procedures b. A clearinghouse i. Matches the buy and sell orders ii. Keeps track of members’ obligations and payments iii. After matching the trades, becomes counterparty - Differences from forward contracts: - Settled daily through the mark-to-market process => low credit risk - Highly liquid => easier to offset an existing position - Highly standardized structure => harder to customize EXAMPLE: S&P 500 FUTURES - Notional value: $250 x index Cash - settled contract Open interest: total number of buy/sell pairs Margin and mark-to-market a. Initial margin b. Maintenance margin (70 - 80% of initial margin) c. Margin call d. Daily mark-to-market Mark-to-market proceeds and margin balance for 8 long futures contracts: Notional value of one contract is 250x $1100 = $275,000 We want to enter 2.2 million / $275,000 = 8 contracts => 8 x 250 x $1100 = 2000 x $1100 =$ 2.2 million r = 6% and margin is 10% 19 Week Multiplier Future Price Price Change Margin Balance 0 2000 $1100 - 1 2000 $1027.99 -72.01 a) 2 2000 $1037.88 9.89 b) 2000 $1011,65 2.2m x 10% = $220,000 … 10 44,990.57 1) Payoff forward: ST=10 - F0,T=10) x multiplier => (1011.65 - 1100) x 2000 = - $176,700 WEEK 1: Price change = - 72.01 MARGIN ACCOUNT) => 2000 x (-72.01) = - $144,020 (DEDUCTED FROM THE a) New margin balance: 220,000 x e^0.06*1/52 - $144,020 = $76,233.32 WEEK 2: Price change = 9.85 => 2000 x (9,85) = $19,780 b) new margin balance: $76,233.32 x e ^0.06*1/52 + $19,780 = $96,102.01 Futures payoff: (-$176,700) $44,990.57 - $220,000xe^0.06*10/52 = -$177,562.60 < Forward payoff Futures prices vs Forward prices: - The differences negligible especially for short-lived contracts Can be significant for long-lived contracts and/or when interest rates are correlated with the price of the underlying assets USES OF INDEX FUTURES Why buy an index futures contract instead of synthesizing it using the stocks in the index? Lower transaction costs - 20 Asset allocation: switching investments among asset classes Example: Invested in the S&P 500 index and wish to temporarily invest in bonds instead of index. What to do? - Alternative 1: Sell all 500 stocks and invest in bonds Alternative 2: Take a short forward position in S&P 500 index CURRENCY CONTRACTS Currency prepaid forward - Widely used to hedge against changes in exchange rates Suppose you want to purchase ұ1 one year from today using $x0 => Where x0 is current ($/ ұ) exchange rate and ry is the yen-denominated interest rat Why? By deferring delivery of the currency one loses interest income from bonds denominated in that currency Currency forward: - r is the $ - denominated domestic interest rate (domestic risk-free rate exceeds foreign risk-free rate) CURRENCY CONTRACTS: PRICING Example 1: Y-denominated interest rate is 2% and current ($/Y) exchange rate is 0.009. To have Y1 in one year one needs to invest today: 0.009*e^-0.02*1 = 0.00882 21 Example 2: Y-denominated interest rate is 2% and $-denominated rate is 6%. The current ($/Y) exchange rate is 0.009. The 1-year forward rate is: 0.009*e^(0.06-0.02)*1= 0.009367 SUMMARY - Understanding the term structure of interest rates is essential for derivatives markets The value of a forward contract (or any other derivative) is based on the non-arbitrage condition The payoff of a forward contract can be replicated using the underlying and a risk-free investment LECTURE 3 FORWARD RATE AGREEMENTS FRAs are over-the-counter contracts that guarantee a borrowing or lending rate on a given notional principal amount - Can be settled at maturity (in arrears) or the initiation of the borrowing or lending transaction Forward price = Implied forward rate - FRA settlement in arrears: (r - rFRA) x Notional principal At the time of borrowing: notional principal x (r - rFRA) / (1 + r) FRAs can be synthetically replicated using zero-coupon bonds INTRODUCTION TO COMMODITY FORWARDS Financial forward prices can be described by the formula: - A commodity forward contract is a “different Three examples of futures contracts: 1) E-mini S&P 500 Futures 3) Copper Futures animal” 2) Corn Futures The set of prices for different expiration dates for a given commodity is called the forward curve (or the forward strip) for that date. If on a given date the forward curve is upward sloping, then the market is in contango. 22 If the forward curve is downward sloping, the market is in backwardation - NOTE: that forward curves can have portions in backwardation and portions in contango EQUILIBRIUM PRICING OF COMMODITY FORWARDS Different commodities have their distinct forward curves, reflecting different properties of: - Storability Storage costs Production Demand Seasonality SHORT-SELLING AND THE LEASE RATE For a commodity owner who lends the commodity, the lease rate is like a dividend - With the stock, the dividend yield, δ, is an observable characteristic of the stock With a commodity, the lease rate, δI, is income earned only if the commodity is loaned The lease rate has to be consistent with the forward price Therefore, when we observe the forward price, we can infer what the lease rate would have to be if a lease market existed The annualized lease rate: NO ARBITRAGE PRICING INCORPORATING STORAGE COSTS The cost of storing a physical item such as corn or copper can be large relative to its value Moreover, some commodities deteriorate over time, which is also a storage cost We can view storage costs as a negative dividend THE CONVENIENCE YIELD Some holders of a commodity receive benefits from physical ownership (e.g. a commercial user). This benefit is called the commodity’s convenience yield. 23 If there is a continuously compounded convenience yield, c, and interest rates, r, and storage costs, λ, are paid continuously and are proportional to the value of the commodity then: A user who buys and stores the commodity will be compensated for interest and physical storage costs less a convenience yield. The commodity lease rate will be: δI = c - λ HEDGING RISK AND THE CASE OF METALLGESELLSCHAFT AG I Futures are very useful in hedging commodity price exposure (e.g. risk of changing prices in the future) However, in many cases futures do not represent exactly, what is being hedged (basis risk) Two common types of basis risk are: 1. Cross hedging: - Airline companies often use crude oil futures to hedge jet fuel price risk - Issues: 1) Estimation error and 2) Hedge ratios may change over time - Time series: 1) Crude Oil Prices (WTI) 2) Kerosene-Type Jet Fuel Prices 2. Stack and roll: - Sometimes hedgers need to hedge distant obligations with near-term futures Example: An oil producer agreed to deliver 100,000 barrels of oil each month at a fixed price for one year. - Natural way to hedge this contract is to enter 12 futures contracts for each of the months (strip hedge) Issue: Distant futures contracts are illiquid or unavailable at that point in time Alternative: Stack hedge and roll A stack hedge entails going long 12x100,000 barrels of oil using the next month’s futures contract At maturity (one month), the hedger re-establishes the stack hedge with the next month’s futures contract (rolling) However, at each maturity date, the hedger makes a profit or loss, depending on the term structure of forward prices 24 Ideally, any potential profits, losses will be offset by the payoff from the fixed price contract at the end Metallgesellschaft AG: Very prominent case of “bad” hedging - MG sold a huge volume of 10-year oil fixed-price supply contracts These contracts were hedged with short-term futures contracts that were rolled forward Issue: At this time period the oil price fell dramatically causing margin calls These additional costs could not be offset by the short term profits from the fixed-price contracts In long-term these losses would have been offset, but the short-term losses were so severe that all contracts were closed with a loss of USD 1.33 billion INTRODUCTION TO SWAPS A swap is a contract calling for an exchange of payments, on one or more dates, determined by the difference in two prices. A swap provides a means to hedge a steam of risky payments. A single-payment swap is the same thing as a cash-settled forward contract. AN EXAMPLE OF A COMMODITY SWAP An industrial producer, IP Inc., needs to buy 100,000 barrels of oil 1 year from today and 2 years from today. - The forward prices for delivery in 1 year and 2 years are $110 and $111/barrel The 1- and 2-year zero-coupon bond yields are 6% and 6.5% respectively. IP can guarantee the cost of buying oil for the next 2 years by entering into long forward contracts for 100,000 barrels in each of the next 2 years. The PV of this cost per barrel is: Thus, IP could pay an oil supplier $201.638 and the supplier would commit to delivering one barrel in each of the next two years. A prepaid swap is a single payment today to obtain multiple deliveries in the future. With a prepaid swap, the buyer might worry about the resulting credit risk. 25 Therefore, a more attractive solution is to defer payment until the oil is delivered, while still fixing the total price. Any payments that have a present value of $201.638 are acceptable. Typically, a swap will call for equal payments in each year. - For example, the payment per year per barrel, x, will have to be $110.483 to satisfy the following equation: We then can say that the 2-year swap price is $110.483. PHYSICAL VS FINANCIAL SETTLEMENT Physical settlement of the swap: Financial settlement of the swap: - The oil buyer, IP, pays the swap counterparty the difference between $110.483 and the spot price, and the oil buyer then buys oil at the spot price. If the difference between $110.483 and the spot price is negative, then the swap counterparty pays the buyer Whatever the market price of oil, the net cost to the buyer is the swap price, $110.483: The results for the buyer are the same whether the swap is settled physically or financially. In both cases, the net cost to the oil buyer is $110.483: 26 THE MARKET VALUE OF A SWAP The market value of a swap is zero at interception. Once the swap is struck, its market value will generally no longer be zero because: - The forward prices for oil and interest rates will change over time Even if prices do not change, the market value of swaps can change over time due to the implicit borrowing and lending A buyer wishing to exit the swap could negotiate terms with the original counterparty to eliminate the swap obligation or enter into an offsetting swap with the counterparty offering the best price The market value of the swap is the difference in the PV of payments between the original and new swap rates COMPUTING THE SWAP RATE Notation: - Suppose there are n swap settlements, occurring on dates ti, i = 1, …, n The forward prices on these dates are given by F0, ti The price of a zero-coupon bond maturing on date ti is P (0,ti) The fixed swap rate is R If the buyer at time zero were to enter into forward contracts to purchase one unit on each of the n dates, the present value of payments would be the present value of the forward prices, which equals the price of the prepaid swap: We determine the fixed swap price, R, by requiring that the present value of the swap payments equal the value of the prepaid swap: 27 Above equation can be rewritten as: We can rewrite the above equation to make it easier to interpret: Thus, the fixed swap rate is as a weighted average of the implied forward rates, where zero-coupon bond prices are used to determine the weights GENERAL PRICING EQUATION The swap formulas in different cases all take the same general form Let f0 (ti) denote the forward price for the floating payment in the swap. Then, the fixed swap payment is: The following table summarizes the substitutions to make in the above equation to get various swap formulas: 28 SUMMARY - Commodity forwards slightly more complex in pricing because of the underlyings’ properties Forward rate agreements are essential to protect against increases in the cost of borrowing Swap contract = collection of forward contracts LECTURE 4 OPTION TYPES AND PAYOFFS (RECAP) Payoff and profit for a long call position: - Payoff = max [0, spot price at expiration - strike price] - Profit = payoff - future value of option premium Payoff and profit for a short call position: 29 - Payoff = - max [0, spot price at expiration - strike price] - Profit = payoff + future value of option premium Payoff and profit for a long put position: - Payoff = max [0, strike price - spot price at expiration] - Profit = payoff - future value of option premium Payoff and profit for a short put position: - Payoff = - max [0,strike price - spot price at expiration] - Profit = payoff + future value of option premium PROPERTIES OF STOCK OPTIONS - Which variables affect option prices and how? - Differences in European and American option price - Lower bounds - Put-call parity - Early exercise of American options NOTATION 30 EFFECT OF VARIABLES ON OPTION PRICES The price of an option is determined by the price of the underlying asset, the strike price, time to maturity, the volatility of the underlying asset, dividend payouts/yield and the risk-free rate. EUROPEAN VS AMERICAN OPTIONS Since an American option can be exercised at any time, whereas a European option can only be exercised at expiration, An American option must always be at least as valuable as an otherwise identical European option: LOWER BOUND OF CALL OPTION PRICES 1) Is there an arbitrage opportunity, if we assume: 31 - CEUR= 3 - S0 = 20 - T=1 - r = 10% - K =18 - Div= 0 CEUR >= max [0, PV (Forward price) - PV(Strike Price)] CEUR >= max[ 0, S0, - K*e^(-rT) ] CEUR >= max [0, 20 - 18*e^-0.1*1] CEUR >= max [0, 20 - 16.2871] CEUR >= 3.71 If call price lower than lower bound for a call price => arbitrage exists in this example (3 < 3.71) t=0 t=T S < K (no exercise of the S > K (exercise of the option) option) Buy option -3 0 ST - K Short Stock +20 - ST - ST Invest at r -17 17e^r(0,1)T 17e^r(0,1)T 0 18.788 - ST 18.788 - K > 0 because ST < K > 0 because K =18 TOTAL Zero investment but positive cash flow at T irrespective of value of ST => Arbitrage Alternative strategy to show arbitrage: t=0 t=T S < K (no exercise of the option) S > K (exercise of the option) Buy option -3 0 ST - K Short forward 0 F0,T - ST = S0e^r(0,1)T - ST F0,T - ST = S0e^r(0,1)T - ST Borrow at r +3 TOTAL 0 32 -3e^r(0,1)T -3e^r(0,1)T 18.788 - ST 18.788 - K >0 >0 LOWER BOUND OF PUT OPTION PRICES 2) Is there an arbitrage opportunity, if we assume: - PEUR = 1 - S0 = 37 - T = 0.5 - r = 5% - K = 40 - Div= 0 PEUR >= max [0, PV (Strike Price) - PV (Forward Price)] PEUR >= max [0, K*e^-r(0,T)T - S0] PEUR >= max [0, 40*e^-0.05*0.5 - 37] PEUR >= max [0, 39.01 - 37] PEUR >= 2.01 If put price lower than lower bound for a call price => arbitrage exists in this example (1 < 2.01) t=0 Buy put option Buy stock Borrow at r TOTAL -1 -S0 = -37 +38 0 t=T S < K (exercise of the option) S > K (no exercise of the option) K - ST 0 +ST +ST -38e^0.05*0.5 K - 38.962 ST - 38.962 >0 >0 Investment at t = 0 of zero dollars, but profit of > 0 => Arbitrage 33 -38e^0.05*0.5 Alternative strategy to show arbitrage: t=0 t=T S < K (exercise of the option) S > K (no exercise of the option) Buy put option -1 K - ST 0 Buy forward 0 ST - S0e^rT ST - S0e^rT Borrow at r +1 -1*e^rT -1*e^rT TOTAL 0 K - 38.962 ST - 38.962 >0 >0 PROPERTIES OF OPTION PRICES Maximum and minimum option prices - Call price cannot: 1) Be negative 2) Exceed stock price 3) Be less than the present value of the difference between the forward price and the strike price: - Put price cannot: 1) Be negative 2) Be more than the strike price 3) Be less than the present value of the difference between the strike price and the forward price: 34 PUT-CALL PARITY For European options with the same strike price and time to expiration, the parity relationship is: Call - Put = PV (Forward price - Strike price) Or: Intuition: Buying a call and selling a put with the strike equal to the forward price (F0,T = K) creates a synthetic forward contract and hence must have a zero price PARITY FOR OPTIONS ON STOCKS If underlying asset is a stock and PV0,T (Div) is the present value of the dividends payable over the life of the option, then: Therefore: For index options, Therefore: Equation: helps us to construct synthetic positions in options, stocks or zero-coupon bonds Synthetic security creation using parity: 35 - Synthetic stock: buy call, sell put, lend PV of strike and dividends - Synthetic zero-coupon bond: buy stock, sell call, buy put (conversion) - Synthetic call: buy stock, buy put, borrow PV of strike and dividends - Synthetic put: sell stock, buy call, lend PV of strike and dividends SUMMARY OF PARITY RELATIONSHIPS PROPERTIES OF OPTION PRICES Early exercise for American Options - An American call option on a non-dividend-paying stock should not be exercised early, because: CAMER >= CEUR >= ST - K - That means, one would lose money by exercising early instead of selling the option - If there are dividends, it may be optimal to exercise early, just prior to a dividend - It may be optimal to exercise a non-dividend-paying put option early if the underlying stock price is sufficiently low Example: Call on non-dividend-paying stock: CEUR = S4 + PEUR - Ke^(-r 36 CAMER > S1 - K INTRODUCTION TO BINOMIAL OPTION PRICING The binomial option pricing model enables us to determine the price of an option, given the characteristics of the stock or other underlying asset The binomial option pricing model assumes that the price of the underlying asset follows a binomial distribution - that is, the asset price in each period can move only up or down by a specified amount The binomial model is often referred to as the “Cox–Ross-Rubinstein pricing model” A ONE-PERIOD BINOMIAL TREE Example: Consider a European call option on the stock XYZ, with a $40 strike and 1 year to expiration. - XYZ does not pay dividends and its current price is $41 - The continuously compounded risk-free interest rate is 8% - The following figure depicts possible stock prices over 1 year, i.e. a binomial tree: COMPUTING THE OPTION PRICE Next consider two portfolios: - 37 Portfolio A: buy one call option - Portfolio B: buy ⅔ shares of XYZ and borrow $18.462 at the risk-free rate Costs: - Portfolio A: the call premium, which is unknown - Portfolio B: ⅔ x $41 - $18.462 = $8.871 Payoffs: Portfolios A and B have the same payoff. Therefore: - Portfolios A and B should have the same cost. Since Portfolio B costs $8.871, the price of one option must be $8.871 - There is a way to create the payoff to call by buying shares and borrowing. Portfolio B is a synthetic call - One option has the risk of ⅔ shares. The value ⅔ is the delta (Δ) of the option: the number of shares that replicates the option payoff THE BINOMIAL SOLUTION How do we find a replication portfolio consisting of Δ shares of stock and a dollar amount of B in lending, such that the portfolio imitates the option whether the stock rises or falls? - Suppose that the stock has a continuous dividend yield of δ, which is reinvested in the stock. Thus, if you buy one share at time t, at time t + h you will have e^δh shares 38 - If the length of a period is h, the interest factor per period is e^rh - uS denotes the stock price when the price goes up, and dS denotes the stock price when the price goes down Stock price tree: Corresponding tree for the value of the option: Note that u (d) in the stock price tree is interpreted as one plus the rate of capital gain (loss) on the stock if it goes up (down) The value of the replicating portfolio at time h, with stock price Sh is: At the prices Sh = uS and Sh = dS, a successful replicating portfolio will satisfy: Solving for Δ and B gives: The cost of creating the option is the net cash flow required to buy the shares and bonds. Thus, the cost of the option is ΔS + B: 39 The no-arbitrage condition is: RISK-NEUTRAL PRICING We can interpret the terms as probabilities Let: Then the equation of the cost of the option ΔS + B can then be written as: We call p* the risk-neutral probability of an increase in the stock price CONSTRUCTING u AND d In the absence of uncertainty, a stock must appreciate at the risk-free rate less the dividend yield. Thus, from time t to time t + h, we have: The stock price next period equals the forward price With uncertainty, the stock price evolution is: 40 Where σ is the annualized standard deviation of the continuously compounded return, and is standard deviation over period of length h We can also rewrite the stock price evolution as: We refer to a tree constructed using the above equations as a “forward tree” SUMMARY In order to price an option, we need to know: - Stock price - Strike price - Standard deviation of returns on the stock - Dividend yield - Risk-free rate Using the risk-free rate and σ, we can approximate the future distribution of the stock by creating a binomial tree using equations for the stock price evolution Once we have the binomial tree, it is possible to price the option using the equation of ΔS + B ONE-PERIOD EXAMPLE WITH A FORWARD TREE Consider a European call option on a stock, with a $40 strike and 1 year to expiration. The stock does not pay dividends, and its current price is $41. Suppose the volatility of the stock is 30%. 41 The continuously compounded risk-free interest rate is 8% S = 41, r = 0.08, Div = 0, σ = 0.30 and h = 1 Use these inputs to: - Calculate the final stock prices - Calculate the final option values - Calculate Δ and B - Calculate the option price Calculate the final stock prices: Calculate the final option values Calculate Δ and B Calculate the option price 42 The following figure depicts the possible stock prices and option prices over 1 year, i.e. a binomial tree LECTURE 5 A TWO-PERIOD EUROPEAN CALL We can extend the previous example to price a 2-year option, assuming all inputs are the same as before Note that an up move by the stock followed by a down move (Sud) generates the same stock price as a down move followed by an up move (Sdu). This is called a recombining tree. Otherwise, we would have a non recombining tree Sud = Sdu = u x d x $41 = e^(0.08+0.3) x e^(0.08-0.3) x $41 = $48.114 43 PRICING THE CALL OPTION To price an option with two binomial periods, we work backwards through the tree - Year 2, stock price = $87.669: since we are at expiration, the option value is max(0, S-K) = $47.669 - Year 2, stock price = $48.114: similarly, the option value is $8.114 - Year 2, stock price = $26.405: since the option is out of money, the value is 0 - Year 1, stock price = $59.954: at this node, we compute the option value using the equation C = ΔS + B, where uS is $87.669 and dS is $48.114 - Year 1, stock price = $32.903: again using the equation C = ΔS + B, the option value is $3.187 - Year 0, stock price = $41: similarly the option value is computed to be $10.737 Notice that: - The option price is greater for the 2-year than for the 1-year option - The option was priced by working backwards through the binomial tree - The option’s Δ and B are different at different nodes. At a given point in time, Δ increases to 1 as we go further into the money - Permitting early exercise would make no difference. At every node prior to expiration, the option price is greater than S-K; hence, we would not exercise even if the option had been American MANY BINOMIAL PERIODS Dividing the time to expiration into more periods, allows us to generate a more realistic tree with a larger number of different values at expiration - 44 Consider the previous example of the 1-year European call option - Let there be 3 binomial periods. Since it is a 1-year call, this means that the length of a period is h = ⅓ - Assume that other inputs are the same as before (so, r=0.08 and σ=0.3) The stock price and option price tree for this option Note that since the length of the binomial period is shorter, u and d are smaller than before: u=1.2212 and d=0.8637 (as opposed to 1.46 and 0.803 with h=1) - The second-period nodes are computed as follows: - The remaining nodes are computed similarly Analogous to the procedure for pricing the 2-year option, the price of the three-period option is computed by working backwards using equation C = ΔS + B - The option price is $7.074 PUT OPTIONS 45 We compute put option prices using the same stock price tree and in almost the same way as call option prices The only difference with a European put option occurs at expiration - Instead of computing the price as max(0, S-K, we use max (0, K-S) A binomial tree for a European put option with 1-year to expiration: BINOMIAL PRICING OF AMERICAN OPTIONS The value of the option if it is left “alive” (i.e unexercised) is given by the value of holding it for another period (equation C = ΔS + B) The value of the option if it is exercised is given by max (0, S-K) if it is a call and max(0, K-S) if it is a put For an American call/put option, the value of the option at a node is given by: 46 At each node, we check for early exercise If the value of the option is greater when exercised, we assign that value to the node. Otherwise, we assign the value of the option unexercised We work backward through the tree as usual HOW REALISTIC IS THE CRR OPTION PRICING FRAMEWORK? Assumption of only two possible states is clearly unrealistic But: One period can be split into many periods Nevertheless, we assume: - Volatility is constant - “Large” stock price movements do not occur - Returns are independent over time OPTIONS ON DIFFERENT UNDERLYINGS Pricing options with different underlying assets requires adjusting the risk-neutral probability for the borrowing cost or lease rate of the underlying asset Thus, we can use the formula for pricing an option on a stock with an appropriate substitution for the dividend yield 47 BLACK-SCHOLES FORMULA FOR STOCKS - The Black-Scholes formula is a limiting case of the binomial formula (indefinitely many periods) for the price of a European option - Consider an European call (or put) option written on a stock - Assume that the stock pays dividend at the continuous rate δ Call option price: Put option price: Where: THE N(x) FUNCTION N(x) is the probability that a normally distributed variable with a mean of zero and a standard deviation of 1 is less than x 48 UNDERSTANDING BLACK-SCHOLES Call option price: BLACK-SCHOLES ASSUMPTIONS Assumptions about stock return distribution: - Continuously compounded returns on the stock are normally distributed and independent over time (no “jumps”) - The volatility of continuously compounded returns is known and constant - Future dividends are known, either as dollar amount or as a fixed dividend yield Assumptions about the economic environment: 49 - The risk-free rate is known and constant - There are no transaction costs or taxes - It is possible to short-sell costlessly and to borrow at the risk-free rate APPLYING THE FORMULA TO ALL OTHER ASSETS OPTIONS ON STOCKS WITH DISCRETE DIVIDENDS The prepaid forward price for stock with discrete dividends is: Example: - S = $41, K = $40, σ = 0.3, r = 8%, T =0.25, Div= $3 in one month - PV(Div) = $3 * e^(-0.08*1/12) = $2.98 - Use $41 - $2.98 = $38.02 as the stock price in the Black-Scholes formula Example: Compare to European call on stocks without dividends: $3.399 d1 =[ ln( S/Ke^(-rT)) + 1/2σ^2T ]/ [σ*sqr(T)] = 0.3725 d2 = 0.2229 N(d1) = N(0.3725) = N(0.37) + 0.25 * (N(0.37) - N(0.38)) = 0.6443 + 0.25*(0.6443 - 0.6480) = 0.6434 N(d2) = N(0.2229) = 0.5882 50 C = 41 * 0.6434 - 40* 0.5882 = 3.3553 OPTIONS ON CURRENCIES The prepaid forward price for the currency is: Where x0 is domestic spot rate and rf is foreign interest rate OPTION ON FUTURES The prepaid forward price for a futures contract is the PV of the futures prices Therefore: Where: OPTION GREEKS What happens to the option price when one and only one input changes? - Delta (Δ): change in option price when stock price increases by $1 - Gamma: (Γ): change in delta when option price increase by $1 - Vega: change in option price when volatility increases by 1% - Theta (θ): change in option price when time to maturity decreases by 1 day - Rho (ρ): change in option price when interest rate increases by 1% Greek measures for portfolios: - The Greek measure of a portfolio is weighted average of Greeks of individual portfolio components: 51 DELTA - Definition: The number of shares in the portfolio that replicates the option - Stock with continuous dividend yield: - Holding Δ in shares and borrow Ke^(-rT)N(d2) costs Se^(-δT)N(d1) - Ke^(-rT)N(d2) - As Δ changes with the stock price, replicating portfolio changes and must be adjusted dynamically SUMMARY - The binomial option pricing framework is a simple, yet rich approach to value option prices - The Black-Scholes model provides us with the most-widely used formula to calculate the theoretical value of European-style options - Greeks measure the sensitivity of the option prices with respect to a number of determinants 52 LECTURE 6 IMPLIED VOLATILITY - Volatility is unobservable - Option prices, particularly for near-the-money options, can be quite sensitive to volatility - One approach is to compute historical volatility using the history of returns - A problem with historical volatility is that expected future volatility can be different from historical volatility - Alternatively, we can calculate implied volatility, which is the volatility that when put into a pricing formula (typically Black-Scholes), yields the observed option price In practice, we extract the value of σ that fits the observed option price and other determinants in the BS formula Note that implied volatilities of in-, at-, and out-of the money options are generally different - A volatility smile refers to when volatility is symmetric, with volatility lowest for at-the-money options and high for in-the-money and out-of-the-money - A difference in volatilities between in-the-money and out-of-the-money is referred to as a volatility skew CBOE VOLATILITY INDEX, VIX It is a measure of expected volatility of the US stock market, derived from real-time, mid-quote prices of S&P 500 index call and put options It is one of the most recognized measures of volatility - widely reported by financial media and closely followed by a variety of market participants as a daily market indicator 53 PRACTICAL USE OF IMPLIED VOLATILITY Some practical uses of implied volatility include: - Implied volatility serves as an important financial market indicator - Use the implied volatility from an option with an observable price to calculate the price of another option on the same underlying assets - Use implied volatility as a quick way to describe the level of options prices on a given underlying asset: you could quote option prices in terms of volatility, rather than as a dollar price - Checking the uniformity of implied volatilities across various options on the same underlying assets allows one to verify the validity of the pricing model in pricing these options PERPETUAL AMERICAN OPTIONS Because of the possibility of early exercise, it is sensible to define American options with infinite maturity They are called perpetual options or expiration less options Because there are no obstacles produced by the finite horizon (maturity time), the valuation formula is available for these options To price the options, we need to start by establishing the conditions for optimal early exercise: Perpetual American options are optimally exercised when the underlying asset reaches the optimal exercise barrier HC or HP Perpetual American option (options that never expire) are optimally exercised when the underlying asset ever reaches the optimal exercise barrier (HC for a call and HP for a put) For a perpetual call option the optimal exercise barrier and prices are: 54 REAL OPTIONS Real options is the application of derivatives theory to the operation and valuation of real investment projects - A call option is the right to pay a strike price to receive the present value of a stream of future cash flows - An investment project is the right to pay an investment cost to receive the present value of a stream of future cash flows INVESTMENT AND THE NPV RULE NPV rule: - Compute the NPV by discounting expected cash flows at the opportunity cost of capital - Accept a project if and only if its NPV is positive and it exceeds the NPV of all mutually exclusive alternative projects INVESTMENT UNDER CERTAINTY 55 Perpetuity: is a constant stream of identical cash flows until infinity PV = C / (1 + r) + C / (1+r)^2 + … + C/ (1+r)^T = C / r Perpetuity of constant growth: is a constant stream of growing cash flows (growing at g) until infinity PV = C / (1 + r) + C (1+g) / (1+r)^2 + … + C (1+g)/ (1+r)^T = C / (r - g) Example: Invest in a $10 machine, that will produce one widget a year forever at a cost of $0.90 per widget The price of the widget will be $0.55 next year and will increase at 4% per year. The risk-free rate is 5% per year. We can invest, at any time, in one such machine. Should we invest and if so, when? - Static NPV: A natural question that arises from the calculation above: What is the optimal time to wait with the investment? Solution: Treat the project as an option The decision to invest is analogous to the decision to exercise an American option early - Exercise price ~ investment cost - Underlying asset price ~ value of the project Trade-off between 3 factors: 1) Dividends foregone by not exercising: cash flow from selling widgets 2) Interest saved by deferring the payment of exercise price: the value of delaying the marginal widget cost is interest 56 3) Value of the insurance lost by exercising (the implicit put option): since no uncertainty, there is no insurance value Formulas: S = CF / (r-g) K = Investment cost + Marginal cost/ r r = ln (1+r) δ = ln (1+r) - ln (1+g) We are using the Perpetual American options method to calculate the price of the option/Investments (C): Example (continues): Invest when the widget price equals the investment trigger price of $1.472. We reach this price after about 24.32 years SUMMARY 57 - Implied volatility is an important indicator variable in financial economics - Option pricing models help us to extract implied volatility from observed prices - Different assets yield different patterns in implied volatility - Option pricing formulas are also essential for investment decisions of companies