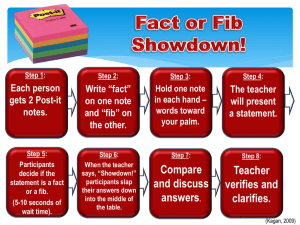

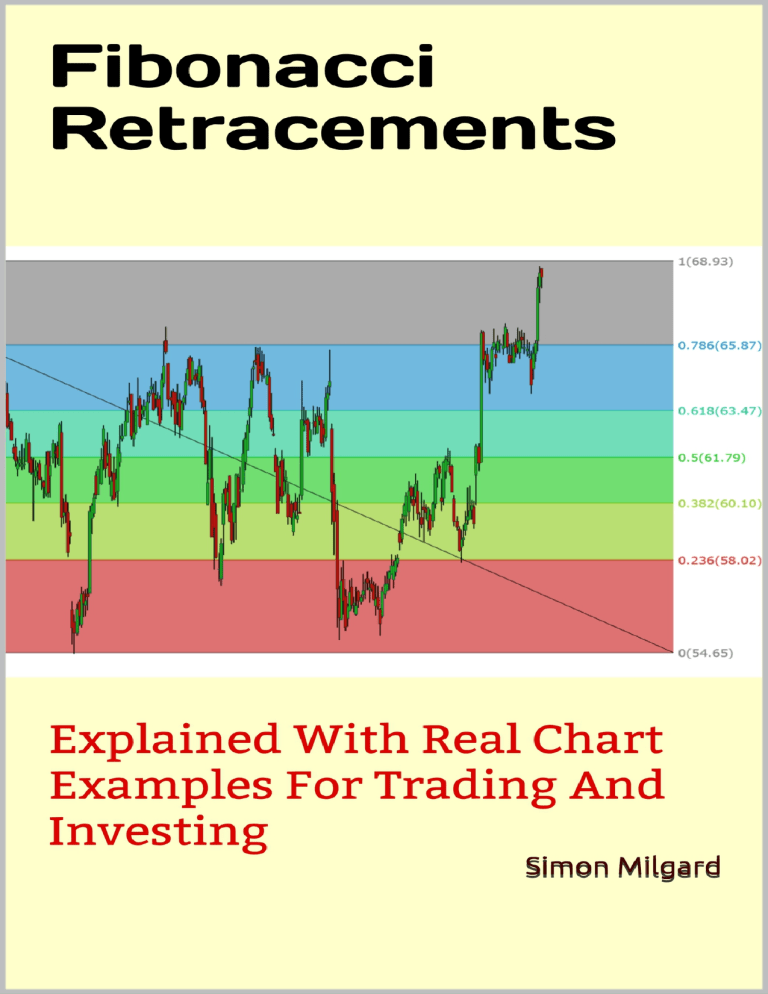

Fibonacci Retracements Explained With Real Chart Examples For Trading And Investing By Simon Milgard Disclaimer All examples and explanations are strictly for demonstrative purposes only. They are not recommendations to buy or sell certain securities. Please do the appropriate research and consult a certified financial professional if necessary before you trade and invest. Some methods discussed in the book may not be suitable for everybody depending on individual ability and/or risk tolerance. Copyright © 2018 Table Of Contents Preface Introduction Chapter 1 How To Draw A Fibonacci Retracement Properly Effective Time Range Large Fibonacci Retracements Flat Price Action: Price Stalls And Price Congestions Price Breakouts Through Fibonacci Retracement Levels Fibonacci Retracements In The Intra-day Timeframe Fibonacci Retracements And Low Dollar(Penny Stocks) Chapter 2. Strategies To Increase Success With Fibonacci Retracements Combining Fibonacci Retracements From Multiple Timeframes Combining Fibonacci Retracements From Inter-day And Intraday Timeframes Practice Combining Fibonacci Retracements With Technical Analysis And Fundamental Analysis Combining Fibonacci Retracements With Chart Patterns Combining Fibonacci Retracements With Technical Indicators Combining Fibonacci Retracements With Fundamental Analysis Chapter 3. The Limitations Of Fibonacci Retracements Chapter 4. How To Trade Using Fibonacci Retracements Trading Reversals Risk Management And Exit Strategies For Reversal Trades Trading Continuations Trading Breakouts Chapter 5. How To Make Long Term Investments Using Fibonacci Retracements Using Fibonacci Retracements For Growth Investing Using Fibonacci Retracements For Dividend Investing Chapter 6. Conclusion Preface After extensive experience, and study of Fibonacci Retracements I decided to make a guide to teach people how to use them properly and effectively. I intend to share helpful knowledge that I just wish I knew when I was learning about Fibonacci Retracements. I will explain certain characteristics of Fibonacci Retracements that are very helpful, but are often not well known or applied properly. Visit www.ascencore.com for more trading and investing related content. Introduction This book will explain how to use Fibonacci Retracements with greater reliability and success for short term trading and long term investing. This will be done by explaining concepts, features, and price behaviour. Dozens of examples of real charts will be used following explanations to demonstrate realistic market scenarios. A quick but important note, for the sake of abbreviation Fibonacci Retracement will often be shortened to "fib" in the book and "fibs" for the plural form Fibonacci Retracements. The specific fib numbers covered will be... 0, .236, .382, .5, .618, .786, and 1. These are the most commonly used and reliable fib numbers. The book will not cover other fib numbers, Fibonacci Extensions, or other Fibonacci based instruments and techniques. All example will use fibs that look like the one below. Furthermore basic knowledge about fibs that can be found from a quick internet search is already expected. Basic background information such as the origin of fibs is so abundant and easy to find it will not be included here. This book is intended for those who already have some knowledge of fibs. Additional knowledge of charting, technical analysis of price charts, and basic fundamental analysis are not entirely necessary. However such knowledge would be helpful and enhance certain examples found later in the book. In case you are well versed with fibs it is still recommended you at least skim through the first two chapters. Lastly please keep in mind this book was written during the summer of 2018. As a result most examples are from the 2010s and 2000s. The main focus will be on stock charts however there will also be examples of other types of charts listed below. The fib concepts in the book apply to all types of charts, but they often work best with charts from the stock market that have high trading volume. As well most examples are of American securities because a large portion of global finance is still US. based or connected. However keep in mind these concepts also apply to other markets around the world. Stock Indices Exchange Traded Funds (ETFs) Forex or FX (foreign exchange) Commodities (mainly gold and oil) Cryptocurrencies (namely Bitcoin) Chapter 1 How To Draw Fibonacci Retracements Properly In this section I will outline the step by step process of drawing a fib properly. As well I will point out key characteristics to improve the reliability of the fibs you draw. The process is straightforward and generally quick once you get some practice. Even if you have plenty of prior experience there will be a high chance you will learn something new here. Now let's go right through the process with explanations and diagrams illustrating the process with real chart examples. Step 1: Find a clearly defined swing low and swing high. These are points where price reversed direction in the past. figure 1 Step 2: Draw your fib by connecting the 2 points. In most all charting programs you click and hold the first point, here it is the swing high at 286.63. Then drag your mouse down to line up the fib with the other swing/reversal point, here it is the swing low at 252.92. When It is an uptrend start from the low and draw towards the high. When it is a downtrend draw from the high towards the low. In this example it is a down trend so we draw from the highs at 286 down to the 252 lows. It is always preferable to use the absolute lowest/highest price in the area where price reverses. That is why the 252.92 intraday low is used here as opposed to the opening or closing price at the swing low reversal area. figure 1.1 After that you are basically done, simple as that you have your fib drawn. Of course that's not the end just yet. Next I will go beyond these initial steps few people learn and even fewer apply, because most learning resources don't go into great depth. That is why step 3 adds some lesser known aspects of drawing a proper fib. These relatively basic concepts will be built upon in further detail in chapter 2 Step 3: Confirm/validate your fib by using what I call a confirmation/validation triangle. A confirmation or validation triangle is a triangle you can draw within your fib to confirm its validity and determine how far into future it will remain reliable. Below I outline the 2 part process of drawing a validation triangle. First confirm your fib levels are valid by seeing if they line up with support and resistance levels that have already been proven in the past. That means you see price reversing direction or stalling at those price levels marked by the fib. When price moves past these levels they will often do so on higher volume and/or larger than normal price movements. If you are looking at currency or commodity charts with no volume look for larger moves in price action that break past fib levels. Second draw a diagonal line commonly called a trend line starting from the first point you began drawing your fib from. Most charting programs have this diagonal line appear in the fib by default. In this case it is the high at 286.63. Line up this trend line with at least one swing point between the swing high and swing low. Here you can see the trend line can contact two reversal points between the swing low and swing high the fib starts and ends at. Finally line up the end of that trend line with the level where your fib ended(in this example it is the swing low reversal at 252.92). This forms a triangle where you can see past resistance and support that confirm and validate your fib to be useful in the future. I added this grey triangle for illustrative purposes most charting programs only have the diagonal line and do not shade or colour this triangle. In any case the triangle is easily visible with or without being marked in shades or colours. The trend line just needs to contact the general areas where reversals occurred between the swing high and swing low the fib started and ended at. figure 1.12 Keep in mind the purpose of a fib is to identify significant price levels that will present support and resistance in the future. You can then use these levels to better guide your entry and exit strategies. Here we see support and resistance levels were accurately identified well in advance of future price movements. figure 1.13 The trend line is not absolutely necessary, but I have found it greatly enhances the reliability of fibs for several reasons. The trend line can by itself present and identify future areas of support and resistance as well as the approximate time they will occur. In this first example you cannot see this because future price did not make contact with the trend line. Don't worry about that there will be examples ahead where the trend line of the confirmation triangle supports and resists price. Effective Time Range The other reason trend lines are useful in fibs is the added context. The term I use for this context is the effective time range of the fib. I define effective time range as the period of time a fib is most reliable based on the trend line drawn within the fib. This period of time the fib is most reliable is determined by how far ahead in time the trend line extends until it lines up with the second swing low/high that completes the fib. In the example above you can see the trend line extends to approximately mid August. After mid August the fib begins to lose reliability since it is at the end of the effective time range. In later examples you can see fibs begin to lose reliability after price moves past their effective range. For extra clarity let's go over one more example of the step by step process of drawing and validating a fib. This time it will be a fib from an uptrend. Pay particular attention to the trend line and the effective time range. Step 1: Find a clearly defined swing low and swing high. These are points where price reversed direction in the past. In this example we could use the downtrend that began at the 32 dollar range, but here I will demonstrate an example with an uptrend. f Figure 1.14 Step 2: Draw your fib clicking the swing low at 22.73. Then drag your mouse to line up with the other swing/reversal point, here it is the swing high 29.46. Notice here 29.46 is a valid swing point because it is a reversal point(a swing high). Even though it is not as established as other points like at 26.09 or 26.89 it is still a point where price clearly changed direction in the uptrend that started from the reversal swing low at 22.73. Figure 1.15 Step 3: Confirm/validate by drawing a confirmation triangle Do the fib levels line up with areas where price reversed, stalled, or broke out with large price movements and/or high volume? Yes you can see it here. Draw a diagonal or trend line whichever name you prefer. Start from the first point you began drawing your fib with, in this case the swing low at 22.73. Then line up the trend line to contact at least 1 reversal point between the start and end points of the fib. Here we have 3. Lastly line up the end of the trend line with the second point that ends your fib range, in this case it is the reversal high of the uptrend at 29.46. Now you have a valid fib that has been confirmed with multiple methods of validation. Unlike the previous example where the chart was reaching new highs, this chart has more price action to reference from the past. To confirm your fib levels for extra validity with these past prices before the fib started, simply extend the lines of your fib to the left. This means you draw lines to past prices on the left side. Check to see if your charting has an option to extend fib levels to the left so you don't have to manually draw lines to the left. For more on trading, investing, charting analysis, and helpful information on the stock markets, currencies, and commodity markets. visit https://www.ascencore.com/ figure 1.16 In addition to the confirmation triangle we can see fib levels also line up with prior resistance and support areas before the confirmation triangle. This process is not necessary, but it gives an extra layer of reliability to the fib. figure 1.17 Lastly we see the end result of reliable identification of key price levels almost 1 whole year in advance. The reversals at the .236 and .786 fib levels in 2011 are especially notable here with large price reversals occurring at these levels. figure 1.18 in the case of this example the fib would lose reliability as price moved outside the price range of the fib. Here it would be if price moved above 29.46 or below 22.79. The other scenario this fib would lose reliability would be after the effective time range was passed and no new confirmation triangles could be drawn to reach new price levels within the price range of this fib. That is to say the confirmation triangle could not be extended by contacting a newer reversal point between the swing low and swing high. Figure 1.19 demonstrate in this case a new confirmation triangle can be drawn within the fib price range from 29.46 to 22.79. This triangle and its trend line extend the effective time range further for a few more months, since the trend line can contact a newer reversal point in later 2011 between 29.46 and 22.79. Figure 1.2 illustrates how reliability begins to decrease as price moves out of the fib price range (in this case price moves above 29.46 in February 2012). figure 1.19 figure 1.2 As you can see the fib levels still identify the approximate areas where price reverses, even after price has moved out of the fib price range and the effective time range of the trend line. However levels are not as accurate as before when they were in the effective time range, and price had not yet moved outside the fib price range. It is a decrease in reliability and accuracy. Reversals do occur around these levels but price often drifts around and doesn't reverse off the levels as cleanly as before February 2012. Now that you are familiar with how to properly draw a reliable fib let's practice by looking at many examples with varying time frames and charts of different assets in addition cryptocurrencies, and commodities. to stocks, such as currencies, Before misunderstanding fibs to be perfect tools for predicting future price reversal areas, let's take a look at figures 1.21 & 1.22. Here we can see even with good plotting of a fib with a valid confirmation triangle, future price won't always hit all fib levels with pin point accuracy. figure 1.21 shows strong validation and some of the possible extensions of the effective time range. Figure 1.22 shows perfect contact with fib levels in yellow circles and near contact/misses in blue squares. Keep in mind fib levels are just approximations and not always guaranteed reversal points. Rather they are more appropriately described as marking approximate areas or zones where reversals could occur figure 1.21 Figure 1.22 In the next example with the chart of PepsiCo stock, we see again how there are multiple possible trend lines that can be drawn within the fib price range to extend the effective time range, Pay special attention to the 0(87.06) fib level in late 2013 when price comes close, but doesn't touch the exact fib level where price reversed off a previous high earlier in the year. Situations like this often occur, where the previous swing point had high volume which can slightly lower the area of resistance below the exact fib level. A more accurate line to mark resistance near this fib level is 86.50 because the volume at the previous swing point is higher(more resistance force) and it lines up closer with most of the closing prices of that prior swing point. Later contact occurs and breaks above the exact 0 fib level at 87.06 because the effect of the lowered resistance force dissipated over a long period of time almost a year later. figure 1.23 figure 1.24 In figure 1.25 the Dow also demonstrates the phenomenon described above except this is the reverse. Supporting force is slightly above a fib level that marks a probable support level. I use the an example of the Dow because it shows famous reversals that many stocks markets around the world followed in August 2015, and early 2016. figure 1.25 Unlike the previous charts I just mark the longest and most recent trend line that is relevant for confirming the effective time range of the fib. By now you should be able to clearly see the possible points you could draw the trend line through to extend the effective time range, there were many during 2016. Just like the previous PepsiCo example a major price reversal occurs slightly before a the exact fib level (in this case the 0 level at 15370). The very large price movement and more importantly high volume are enough to create a situation where supporting force is slightly above the exact fib level. Actually during the reversal in early 2016 many were watching the .236 level at around 16000. The best and most realistic way to have used the fib here would be to think of the larger zone between the 0 -.236 fib levels as a support zone. An exact entry in the 15300s would be too idealistic. Although the 0 level is the absolute low, the .236 level was the site of more price action having acted as support and had major price congestion. While the 0 level was only the tip of an intraday low. Lastly you can see price began to congest towards the end of 2016. The first time price went past the 1 level the fib began to lose reliability, incidentally at the same time while price began to congest and the fundamental forces of the stock market were indecisive ahead of the 2016 US presidential election. The 1 level thus still did resist, support, and congest price, but it was losing reliability as a reversal point right at the tail end of the effective time range. Eventually price absolutely rocketed up after the election was over and uncertainty had subsided. This left the fib level irrelevant just as the effective time range and price range of the fib were passed. Large Fibonacci Retracements Continuing on with a related topic to the major stock market reversal in early 2016, we can use an example of oil prices to demonstrate characteristics specific to larger fibs. Larger fibs are just fibs that cover a larger price range and period of time. When compared to previous charts this major reversal of oil prices in early 2016 is a giant in terms of the timeframe and price range covered by the fib. From one of the earliest possible trend lines in 2016 the effective time was extended for over 2 years. figure 1.26 Before we talk about characteristics specific to large fibs I must first reiterate the 2 general characteristics for fibs of any size. These 2 general characteristics are related to decreased fib reliability moving out of the fib's price range and the end of the effective time range. Just like the previous example fib reliability decreases as price moves past the price range of the fib or when price is reaching the tail end of the effective time range. When both these factors occur simultaneously as they do here, fib reliability drastically decreases. The drop in reliability is also magnified with large fibs since they cover larger price and time ranges. As for the characteristics specific to large fibs. Fibs only have a limited number of lines, 7 lines to be exact. That means as they are extended over a larger price range they can't cover every possible reversal area that can be more easily achieved when the fib is smaller and has less of a price range to cover. Usually larger fibs mark price levels where larger reversals occur and often miss small swings. Levels on larger fibs are also less precise and often see price drift above and below a fib level rather than cleanly reversing direction right away. Decreased precision is also due to the longer time frame. Price action in the confirmation triangle shapes the context of price action later in the fib. As time moves on the influence and context of price action in the confirmation triangle often shifts or decreases. This makes more sense by going back to an explanation with charts. In figure 1.26 we see the price action on the .382, .5, and .618, levels in particular are quite reliable and relatively precise for a large fib. Price often reverses directly on these fib levels or reversals happen after some minor price drifts above and below the fib levels. This is because the context is more recent and relevant. The relevant levels predicted by the fib turn out to be more reliable because they are closer in time to the influencing price action from the confirmation triangle. When using the confirmation triangle we can see even though price is still in the effective time range, reliability gradually decreases due to the longer passage of time. The .786 and 1 levels demonstrate this very well as reversals don't occur exactly on these fib levels, or reversals simply don't occur on those levels at all. Lastly the 1 level spans 3 years from the single reversal area in early 2015 at the very unreliable 62.58 price level. In late 2017 as price climbed to the high 50s this level would indicate resistance was in the low 60s. However this was over 3 years from the last confirmation point and nearing the end of the effective time range. Thus the 1(62.58) level would just be a rough indication of a resistance area in the low 60s and you would not rely on it as a highly certain resistance area. Eventually this low reliability was confirmed as oil prices returned well above the low 60s in 2018 figure 1.27 Flat Price Action: Price Stalls And Price Congestions The next 4 charts demonstrate the features of price stalls and congestions at fib levels. Reversals are not always quick, they don't always resemble shapes like the letters V,W,M, or N. Instead they sometimes look more like the letters U,L, or J. When price enters prolonged sideways action this indicates indecision. Price stalls and congestions at fib levels can be used as further confirmation that those fib levels can present support and resistance in the future. Flat movement may also occur before a breakout or continuation of price above/below a resistance/support level. figure 1.28 figure 1.29 figure 1.3 figure 1.31 It doesn't matter if price is before or after a confirmation triangle. The point of these 4 charts is to show price sometimes stalls at fib levels before reversing or breaking past a resistance/support. Instead of just sharply and quickly reversing direction. These features commonly commonly appear due to indecision before or after a major event such as an earnings report or economic announcement. When there is no major news event it may also happen when price is approaching new all time highs or lows and the market is not sure if price will continue in its current direction. Price Breakouts Through Fibonacci Retracement Levels The next 2 charts show another phenomenon found at fib levels before or after a confirmation triangle. This is the presence of price breakouts, price breakthroughs and gaps through fib levels. All this just means price rapidly moves through a fib level with higher volume and a larger price move. The vast majority of the time this is the case, but nothing is a complete guaranteed and there are exceptions. The small areas marked in yellow demonstrate this. These are areas where price passes a fib level without a significant increase in price movement or volume. This is less common but it happens occasionally. figure 1.32 figure 1.33 In the case of charts without volume such as commodities or currencies you can still observe the phenomenon. However volume will of course not be present, only large price moves through fib levels will be visible. The next to charts demonstrate this. figure 1.34 figure 1.35 The following 2 charts show price breaking through a critical level (here it is around 21-22) that can be identified by different fibs. You can draw your fib from any point as long as it meets the confirmation triangle criteria. We can also see the characteristics of price breaking through fib levels discussed earlier. Price movement through the .236 fib level doesn't increase significantly, but there are volume spikes. figure 1.36 figure 1.37 Fibonacci Retracements In The intra-day Timeframe The following 5 charts demonstrate fibs used in the intraday time frame with each candle representing 15 minutes. Basically the characteristics of the inter-day charts seen up to this point can apply to the intraday timeframe too. However fibs are a little bit less reliable in the intraday because this shorter timeframe is often more volatile. These fibs are useful for day trading and even narrowing down an entry point for a longer term trade or investment. figure 1.38 figure 1.39 figure 1.4 figure 1.41 figure 1.42 Fibonacci Retracements And Low Dollar(Penny Stocks) The next charts show the fib principles also apply to low dollar stocks under $20 (penny stocks) with low and high volume in short(intraday) and long(inter-day) timeframes. Again fibs are less reliable here because penny stocks are more volatile. figure 1.43 figure 1.44 figure 1.45 figure 1.46 figure 1.47 For more on trading, investing, charting analysis, and helpful information on the stock markets, currencies, and commodity markets. visit https://www.ascencore.com/ Chapter 2 Strategies To Increase Success With Fibonacci Retracements This chapter will cover increasing success with fibs. In the previous chapter we already went over the procedure of drawing a reliable fib, along with the situations and factors that decrease and increase reliability. Now we will build on those basic concepts concerning reliability and how they can be enhanced to achieve greater success with fibs. Success here means identifying the most relevant and desirable entry and exit prices. Rather than simply identifying areas where price will likely reverse or stall. The key to greater success comes from understanding the context of where price is moving to in the fib. Certain areas in a fib can become more significant than others depending on the current position of price in relation to past price movements and fib levels. Keep in mind each method of enhancing success is optional they are not necessary or practical in all cases. In addition you can choose to use one or a combination of all of them with concepts covered in chapter 1. No one method is better than the others. In some cases some of the following methods will not be possible on certain charts. Combining Fibonacci Retracements From Multiple Timeframes In particular combining 2 fibs, one large and one small. I suggest combining no more than 2 fibs because it can become redundant and/or confusing as the chart gets more cluttered. figure 2 figure 2.1 figure 2.11 The example above of Fedex stock demonstrates several features of a combined large and small fib that increase success. Focus special attention to the reversal in the 220s occurring from June and July. The support zone in the mid 220s was identified as a major area of significance since at least late April. This area emerged as the most critical support zone where a major reversal was likely to occur due to several factors. First let's begin by explaining the formation of this key support zone. Near the end of 2017 the broad area in the low 230s to low 220s acted as a strong resistance with several small reversals. Eventually this area was passed to reach new highs on higher than normal volume and price movements. Even before drawing a fib the large amount of significant price action and volume presented were early indications of an important zone. The second major indication emerged when Fedex and all global stock markets had a sharp downtrend in late January 2018 to early February 2018. The reversal of this significant downtrend would be very important even if it was isolated to Fedex alone. However since the sharp downtrend was also seen across stock markets around the world this added extra importance to the downtrend and subsequent reversal back up later in February 2018. Regardless of what fundamental influences created the price action above, the chart displayed enough price information to draw both fibs by mid February to early March. The key reversal points to reference here are the high in early 2018 at the 270s and the low in early February in the 220s. After drawing the 2 fibs the effective range could be increased as we can see by the many swing points from which trend lines could be drawn after early March. Given this prior price action in the mid 220s and the close proximity of a large and small fib level in this range, a major area of significance was identified by the end of February. The swing lows in late March, with high volume near this level also added greater validity. This 2nd swing low in late March didn't touch the exact fib levels in the mid 220s because the prior swing low in early February was on exceedingly high volume and a large price move. This led to the supporting force being raised slightly above the fib level(s). The lining up of these 2 fib levels with significant reversal areas formed a strong and relatively narrow support zone. An entry price for a buy order is represented here by the line at 226.12. You don't have to be exact, it will be near impossible to get the absolute bottom price. Any price roughly near a zone where a large and small fib converge is sufficient. This price can also be fine tuned by lining up the fib level/zone with one or more major prior reversals. Here you can see both these characteristics making for an excellent entry point at a high probability support price zone. Identifying these 2 characteristics will result in a sufficiently precise entry price that is in between the large and small fib or slightly below or above them. In theory the areas covered by fib levels from both the large and small fib are the most significant price ranges where reversals are more likely to occur. Areas of support/resistance identified by only a single fib are generally less significant. However as we can see this is only partly true in the above chart. Case and point the downward reversal at the single small fib’s .768 level in early June. Placing greater importance on price zones just because they are formed by levels from a large and small fib is not enough. To further increase success we need to determine which fib levels are more relevant. To do this we first look at the areas where fib levels from the large and small fibs are very close together. In this case 3 levels The mid 270s at the 1 level for the small fib and 0 level for the large fib The Mid 240s at the .382 level for the small fib and the and the .236 level for the large fib. The mid 220s at the 0 level for the small fib and .382 level for the large fib. Naturally the combining of levels from both fibs outlines a rough price or price range where reversals are even more likely to occur. Out of the 3 price areas mentioned above the one in the mid 240s can easily be disregarded as a relevant and major reversal zone. Even though it is a zone formed by a large and small fib level, it was never the site of a major reversal for the length of the entire chart. That is not to say it should be ignored completely. Rather it has far lower consideration when compared to the mid 270s and mid 220s where moderate to major reversals can clearly be seen. This builds on concepts of the confirmation triangle to further increase reliability and help to narrow down which price ranges warrant more attention. Specifically this example highlights the importance of referencing to see if the fib levels also line up with past reversal areas. It is not reasonable to emphasize certain price levels just because one or more fibs approximate a certain price range. Using additional methods such as checking to see if past reversals occurred at that level/zone, serves to improve reliability and success with fibs. When looking at reversals that occurred at price levels from only one fib(here it is the small fib) we notice some key features. These reversals line up with price ranges that have had one or more reversals clearly visible. In this example we can see them on the small fib at, .618(256.50) in April .236(238.33) in early May .786(264.48) in June. The first two reversals could have been easily confirmed with greater accuracy because they lined up with past reversals at those fib levels too. The 3rd one at the .786 level is a special case. It would appear there was no reliable additional method to confirm a reversal was more likely to happen at that fib level. However there was a clear reason, that being price was becoming over extended. Generally price can move through two levels on normal volume without stalling or reversing. Once price moves to three fib levels without stopping to stall or reverse, the chances of a reversal increase significantly. If there is a reversal it is also likely to be larger. This is because price cannot normally maintain movement in one direction for more than two fibs without at least a brief increase in volume to sustain the trend. On this chart price continued an uptrend after reversing off the .236 level for four fib levels to the .768 level. Additionally this extended uptrend was also on normal volume with no major increases in volume in the period from May to June. Since volume was normal here price was on a healthy uptrend for at least 2 fib levels, but after that the absence of major increases in volume indicated unsustainable upward movement. Price did begin to stall between the .5 and .618 level. After passing the .618 level, three fib levels had been passed and the uptrend was becoming overextended. Eventually after stalling at the .786 level price regressed back to normal behaviour and the inevitable reversal back down came, due to the absence of no major bullish volume spikes to sustain the uptrend. The downtrend off the .786 level moved down 5 levels to the 0 level in the small fib. At that point the downtrend became over extended and reversed. Price movements in a fib can be thought of like an elastic band. The further price moves or stretches the greater the chances are a rebound will occur, and the chances of that rebound being a large reversal are also greater. Overstretching begins after price has moved through three or more fib levels without an increase in volume to sustain the trend. Lastly a small note about trend lines, specifically using the trend line from the confirmation triangle as a sign of a future reversal area. On this chart that would be the reversal in early May on the small fib's .236 level. Trend lines can be used from the confirmation triangle or drawn separately to indicate the general area and time a reversal could occur on a particular fib level. This is just a minor additional method to enhance fib reliability. Trend lines are useful, but not necessary. They are often misinterpreted and misused on charts because they are easily drawn. All you need is 2 swing points or more to run a line through. 2 points on a chart can easily be manipulated to draw a line that will indicate any area you want to be a likely reversal area. Use trend lines carefully and sparingly in the context of a fib. The next chart demonstrates why it is unnecessary to combine fibs of near equal size. This causes a mess of overlapping fib levels. figure 2.12 The better route to take is to have the larger fib be a minimum of 2 fib levels larger than the small fib to avoid a cluttered chart and redundant price identification. figure 2.13 The chart above is a cleaner chart and identifies the most relevant fib levels more clearly and with higher validity. Having the large fib 2 fib levels larger is just a minimum. I have found generally the best size difference is a large fib 3 levels larger than the small fib. Usually the .5 level of the large fib lines up with the 0 or 1 of the small fib depending on whether the small fib is an up or down trend. This more clearly highlights the areas of greater significance. Normally this means for every large fib level there are 2 small fib levels in between the areas where the fibs overlap. figure 2.14 The levels at the high and low of the small fib are normally easily identified as significant price ranges. Naturally this is the case because these are moderate to major reversals that formed the high and low of the small fib. These are also 2 levels that line up with the large fib. The low/high of the small fib normally lines up with the .5 level of the large fib when the large fib is 3 levels larger. The rest of the fib levels in between are not as easy to identify. As we have seen in this and the previous examples the small fib levels that are close to the .236 and .382 levels of the large fib, don’t always form more significant zones. Remember we have to see if they also line up with past reversal price ranges. In this case the .5 and .618 small fib levels are about equal distance from the large .236 fib level. We must only choose one small fib level to form a zone with the large .236 level. Here the .618 small fib level was chosen because it lined up with more past reversals areas that were more numerous and significant in terms of the length of the reversals. figure 2.15 By revisiting examples from figure 1.36 and figure 1.37 which only used one single fib(in that case a single large fib), we can see the added benefits of combining fibs(in this case a small fib). While at the same time observing characteristics such as combined fib lines referenced with past reversal points to better identify the most relevant price zones. figure 2.16 Note the increased importance of price ranges formed by the small and large fibs that line up with past reversal areas. We can also see there are some reversals just below the 25.71 to 25.20 range because some of the past swing points had large price movements on higher volume which lowered resistance force. The next 2 charts demonstrate the drop off in effectiveness that normally occurs when the large fib is 4 fib levels larger than the small fib. Key areas of greater significance are still revealed at areas where fib levels from both large and small fibs are close, and line up with past reversal areas. However certain areas are missed in the middle levels between the high and the low of the small fib that were identified using a large fib only 3 levels larger. For this reason if it is possible, it is normally best to have the large 3 levels larger when combining fibs. Anything more or less usually leads to mistaken identification of price zones that are more important. figure 2.17 figure 2.18 Unlike figure 2.15 a large fib does not cover the 25300 to 25100 price range where significant levels were identified using a large fib only 3 fib levels larger. Combining Fibonacci Retracements From Interday And Intraday Timeframes For shorter term traders(especially day traders), when combining a large fib from the daily timeframe with a small fib in the intraday timeframe it is best to split the charts into both time frames and have them side by side. This allows for a more clear view of the more significant and relevant price ranges. The same principles from the inter-day timeframe still apply to the intraday timeframe, but as mentioned in chapter 1, fibs are less reliable since this timeframe is more volatile. figure 2.19 a messy way to combine a fib from the inter-day intraday timeframes. figure 2.20 a neater way to combine a fib from the intraday timeframe. The large fib on the left is the daily timeframe, the small fib on the right is the intraday on a 15 minute chart. Next is a detailed example of price development that combines everything we have discussed thus far. The end result is highly accurate identification of the most relevant and significant support and resistance zones marked in advance of major price reversals. Practice figure 2.21 The large fib is at least 2 fib levels larger than the small fib. Also note here unlike the other examples where there was one fib with an up and one with a down trend, this one has both fibs in an uptrend. Both fibs may also be in a downtrend, it doesn't matter. By now you will notice the areas marked in yellow show areas where fib levels from the large and small fib are close together to reveal the approximate price ranges that will present support and resistance, and be likely areas of reversals. In theory this concept of combined fibs reveals the most relevant areas where price is more likely to reverse. On the next chart(figure 2.22) we can see the additional concept of lining up fib levels/zones of a combined large and small fib with past reversal areas. This marks the approximate areas where price is likely to reverse. The remaining areas not highlighted are single fib levels. Normally these would be less relevant and significant compared to areas where combined fib levels encompass past reversal points. However in this example both single fib levels (the small .236 and .5 levels) line up very cleanly with past reversal points. Thus while they don't combine with a large fib level to form a zone, they do have a proven track record reversing price. A combined fib zone is one form of extra validation as is lining up fib level(s) with past reversal areas. When both these elements are combined a reversal is even more likely to occur at that particular price region. figure 2.22 In the next figure we will see exactly how price behaved. We will also see the areas with more confirmation generally became the areas where price reversals occurred and these price reversals were also generally larger. figure 2.23 After a steep downtrend from the triple top reversal in early 2018, price reversed sharply back up at the approximate zone(#1). It went slightly below what was originally drawn, but that's to be expected due to the major downward reversal on exceedingly high volume. Price overshooting is very normal. The next two upward reversals(#2 & #3) were well within their respective zones, note how they didn't have price overshoot. This is because price was not in a sharp downtrend and/or on exceedingly high volume like reversal #1. The downward reversals marked in red also follow a similar pattern and do not over shoot as price movement and volume were normal and not exceedingly high. Next focus on the highlighted zone where reversals did not occur namely the .382(312.54) large fib to .618(308.63) small fib range from June/July (marked with a grey square). Price stalled at this zone for 2 days in a row before resuming back down. Eventually price passed this area on the downtrend in June because there was sufficiently higher than normal volume. When price went through this zone on the upside later in July it passed on regular volume. This is normal because in the context of both the large and small fib, price only went back up through 2 fib levels. If price passed this zone on regular volume after passing 3 or more fib levels in the small or large fib, this would be rare. figure 2.24 The .5(319.05) small fib level is highlighted in purple below. It demonstrates the concept of a single fib level being an area where price is less likely to reverse. It also demonstrates that even though it is a less relevant level it should not be outright ignored. Here it exhibits the other characteristics of fib levels, that are not complete price reversals. That is it acts as an area where price is temporarily supported/resisted, meaning up and down trends were temporarily halted. Price is stalled or congested around the fib level before resuming its previous direction. Furthermore price action during these stalls or congestions is very low meaning no major moves in price take place. Volume also typically remains normal or slightly below normal. When price does move out of these stalls it usually does so with larger price action (a larger move in price) and on normal or higher than normal volume. figure 2.25 figure 2.26 Again we see these principles also apply to price charts for other markets outside the stock market. Here we can see all the principles discussed earlier at work. The most relevant resistance and supporting price ranges are identified in advance of future price reversals. The large fib is at least 2 fib levels larger than the small fib. Areas where fib levels from the large and small fib are close to each other and line up with past reversal areas accurately identified future reversal zones. This is especially true for the areas marked in yellow. The price range marked in grey demonstrates the situation where price stalls or congests rather than completely and immediately reversing direction all the time. Moreover price never moved 3 or more small fib levels after reversing to reach the grey zone,. Thus price still moved in a normal and healthy trend through the grey zone in early to mid 2017. It was never over extended by going past 3 or more fib levels. Later(figure 2.27) as fib levels are redrawn to reflect developments in price we can see these same characteristics again at different price zones. The upper range of both fibs now line up in the mid 1300s range. Though the 1270s-1280s still has fib levels from the large and small fibs lining up with past reversals, there is price congestion rather than reversals. It was also broken through by large price movements in early 2018. Conversely the 1240s now act as a reversal area rather than just stalling or congesting price as it had done on the previous chart. figure 2.27 In the next example we see the same principles at work with a currency pair, Euro to British Pound figure 2.28 Several things to note right away. While there are levels from both fibs converging, some levels are closer than others. The zone marked in purple is a range where 2 levels are not as close as the others. Here you can see price congested or stalled rather than completely reversing in 2016. In 2014 the reversals around the .8000 price level do line up with the 1 level of the small fib. Though they are small reversals, they are reversals nonetheless. Later in mid 2016 price returned to the .8000 price range and reversed off resistance again before price finally broke through this level in late June 2016 with a large price move. figure 2.29 Normally when the ranges between the combined large and small fib is closer they will be areas where reversals are more likely to occur, and those reversals are usually larger. We can see this with the reversals in the narrower zones marked in yellow. The wider zone in purple still resisted or supported price, but price was stalled or congested rather than completely reversing like in the narrower yellow zones. We also see with the zone formed by the .618(0.7597) small fib and the .382(0.7640) large fib that a price range marked by 2 combined fibs is still reliable even though it doesn't line up with any major reversal areas. In figure 2.30 on the next chart you can see more clearly in 2015 that a minor reversal and price congestion occurred. These areas are marked in blue. Though minor the small price congestion and minor reversal are enough to add the additional confirmation that this area had demonstrated features of support and resistance in the recent past. From these examples we can see fibs and price action don't always follow theory and concepts down to the smallest detail. Sometimes the combined fib levels form a range that isn't as narrow as we would like. Sometimes price zones don't always line up with major reversals or they only stall price. These charts demonstrate that the concepts outlined at the beginning this chapter and chapter one are general characteristics that increase reliability of success when using fibs. Again nothing is ever a complete guarantee, these methods merely identify areas where support and resistance are likely to occur. As you have seen they usually reveal the areas where reversals will take place, but a minority of the time this isn't always the case. Just one more note to mention concerning the large fib. You can see the characteristic of large fibs not covering all reversals from chapter one. Price does stall and reverse at the large .786 fib level. However the two reversals in the upper .8000s were not identified by any fib levels. The 1(0.8782) level of the large fib is close but those reversals from July to September 2016 don't touch any fib levels. figure 2.30 Combining Fibonacci Retracements With Technical Analysis And Fundamental Analysis Now that we have covered all the basic and advanced concepts of fibs there are still two more methods of increasing success and reliability. These fall into the broad categories of combining fibs with technical analysis and fundamental analysis . This section will be brief because everybody has their own unique preferences and capabilities when it comes to the degree of technical analysis and fundamental analysis they are able to use effectively. Combining fibs with one or both of these categories is a complimentary addition rather than a necessary component of using fibs effectively. For a quick refresher and reminder when using technical analysis with fibs we already discussed the use of resistance and support levels and price ranges. These are mainly past areas where price reversed direction. Along with that were trend lines which roughly indicate the overall direction of price and a general timeframe when a particular price level may offer greater chances of a reversal. As well we saw the effects of low, normal, and high volume mainly applicable only to stock charts. These are among the most basic and essential concepts of technical analysis that are integral to fibs. In addition to these basics one could choose to apply concepts from chart patterns, and seek further confirmation from technical indicators of their choice. In many of the charts presented in this book you can see certain chart patterns coincide with significant price levels identified in the fibs. For example you can see the major triple top reversal with Lockheed Martin stock in figure 2.23. A triple top is a major reversal pattern and in that case it dropped price past the previously strong support at the 330 level, At the same time price also broke below the strong trend line that formed the confirmation triangle. Furthermore that 330 level became a major resistance area when price moved back up. On multiple occasions price often reversed or stalled in the mid to high 320s before even returning to the exact breaking level in the 330s. This highlights a core concept of technical analysis whereby a previous area of support that price breaks through becomes an area of resistance. The opposite is also true when price breaks above an established resistance price range that becomes support when price returns back down to that area. Figure 1.21 demonstrated a similar scenario where the .382(159.01) fib level switched between resistance and support several times. The same can also be seen in the Fedex example in figure 2.1 around the 227 price range. Combining Fibonacci Retracements With Chart Patterns The following series of charts will present examples of fibs combined with technical analysis based on charting patterns. In the chart below price trades within narrow rectangular ranges that are approximated by the .5, .618, and .786 fib levels. Price also breaks through these rectangles to enter or exit them with large price movements, and higher volume. Price moves a total of 4 fib levels in each case. Remember price is stretched and needs extra volume to easily pass through 3 or more fib levels. Also you can see a major gap down in early 2017 through the.236, and .382 levels on very high volume. Coincidentally this was after a decrease in trading activity leading up to a quarterly earnings report. figure 2.31 figure 2.32 A fib was drawn in early 2018 using the first upswing at the .5 level to form a confirmation triangle. This confirmation triangle became an ascending triangle. Price was supported on the trend line at the .5, .382, and .236 fib levels which was often on higher than normal volume. Price also held firm resistance at or very near the 0 level to form the flat top of an ascending triangle. Price eventually finished the ascending triangle pattern by moving past resistance at the 0 level after the 3rd bounce off support. The next chart shows a head and shoulders pattern that lines up with the .236 fib level where the neckline is formed to act first as a major support and later as resistance. figure 2.32A These are just a few examples of chart patterns coinciding with fib levels, the list can go on and on. Significant levels identified by chart patterns often occur near fib levels which are also significant in themselves. If you do not use chart patterns for whatever reason that is absolutely fine. Using fibs without them is perfectly functional. As with the other methods using chart patterns alongside fibs is no different, they are complimentary and optional additions. They are not entirely necessary for the effective use of fibs. To learn more about the Head And Shoulders Chart Pattern the book Realistic Stock Chart Analysis: The Head And Shoulders Pattern Explained Using Real Chart Examples is an excellent resource. Combining Fibonacci Retracements With Technical Indicators As for the use of technical indicators with fibs I personally don't use any unless you count the use of the 20 day average of volume, which I only use to get a rough idea of what is "normal volume." This is mainly because there are 20 trading days in 1 month and it is generally a good indication of the current normal level of volume. Just like with chart patterns, as long as technical indicators are in agreement with concepts of fibs, they can add additional validity to fib levels a majority of the time. That means an indicator identifies a fib level/zone as being a potential area where price is likely to reverse, congest, or stall. figure 2.33 On the above chart you can see the 20 day and 200 day moving averages indicated the approximate levels of some reversals that also occurred on fib levels. The moving averages also marked the same area as the .236 level near the end of 2017, where price stalled instead of reversing. Remember stalled or congested price is another characteristic of price behaviour on a fib level. I just used moving averages as an example because they are among the most common technical indicators if not the most common. Similar to chart patterns you may choose to use some other technical indicators of your choice or you can use none at all. They are complimentary and not necessary. A general rule is to avoid using too many indicators especially ones like the moving average, because they can cause a lot of clutter on already crammed charts. This is especially true when combining two fibs like the Lockheed Martin chart from figure 2.25. As you can see the chart becomes even more cluttered with just 2 indicators added. figure 2.34 Combining Fibonacci Retracements With Fundamental Analysis Fundamental analysis such as information about a the state of a particular business or economic sector can also be used with fibs. This approach is geared more towards long term investors, but can still be used for shorter term trading. Like the use of technical indicators you can choose which type(s) of fundamental analysis to incorporate into your analysis, and in the case of trading you can choose to ignore it all together if you wish. Fibs essentially outline price levels of interest driven by a fundamental event or influence. Earlier we saw such a situation with figure 1.26 which identified key price levels that presented resistance and formed trading ranges during the recovery of oil prices in 2016. Back on figure 2.11 a nice entry point was identified in the high 220s for traders. This major support zone discussed earlier presented an opportunity to profit from an exaggerated negative reaction to the earnings report in June that started the sharp and short-lived downtrend. Chapter 4 will go into greater detail about trading with Fibs, mainly swing trading in a timeframe ranging from a few days to a few months. Chapter 5 will go into further detail about using fibs for long term investing. Chapter 3 The Limitations Of Fibonacci Retracements After having seen plenty of examples of how useful and reliable fibs can be at identifying significant price levels you probably have greater confidence to use them successfully. Fibs are certainly among the best methods of price analysis if not the best. They are simple to draw and are highly reliable when they present sufficiently strong confirmations. However be careful such a perspective can be dangerous and lead to false confidence if the limitations of fibs are not understood. There are certainly limitations to fibs, some of which have already been discussed repeatedly. A refreshing reminder of the limitations discussed thus far is in order. Fibs loose reliability as they approach and eventually pass the end of their effective time range. A significant drop in reliability occurs after price has passed the end of the effective time range marked by the length of the trend line that forms the confirmation triangle. Fib reliability can drop significantly after price moves past the price range of a fib marked between the 0 or 1 levels. Larger fibs are less precise. They tend to miss smaller reversal levels and are less exact with the reversal levels they do identify. This is especially true when fibs cover a timeframe of 2 years or more, and a price range of 30% or more. Generally large fibs are best used to gauge long term trends and identify an approximate area where major reversals are more likely to occur. Large fibs especially when combined with small fibs are best suited for identifying larger reversals and trends rather than small and short term price movements. Fibs are also less reliable in the shorter intraday timeframes mainly due to the higher volatility associated with intraday price movements. As well trading activity and volume(when volume is present on the chart) is not distributed as evenly as it is on the daily time frame. Often the bulk of trading volume and large price movements happen at the open and close in the case of the stock market. Even when none of the characteristics outlined above is present, it is critical to remember fibs are just guides and approximations of price movement. As mentioned many times before nothing is a complete guarantee and fibs are no different. Even under ideal circumstances there is still the possibility fibs can be wrong. If fibs are not wrong there is also the greater chance of misunderstanding and misinterpretation. Though not mentioned earlier you may have already noticed on some charts you could be waiting a very long time for price to form enough reversal points to draw a fib with a confirmation triangle. In some instances appropriate reversals from which to reference and draw a valid fib just takes time to form, lots and lots of time. Further limitations can arise due to the reliance and need to reference past price action in order to draw a valid fib. The name Fibonacci Retracement inherently implies the past. The "re" in retracement in the context of price charts means future price movements will follow a path influenced by past price movements and behaviour. This does not mean price will necessarily copy the exact course of the past and reverse or stall exactly at the fib levels identified. Rather fibs are severely restricted or completely nonviable when price moves into new all time lows or highs. In such situations price literally enters uncharted territory and fibs cannot be used. Since this book specifically focuses on Fibonacci Retracements, and to be more specific fib numbers between 1 and 0, all analysis is limited to charts where price has not reached new historic lows or highs. There are certainly methods of predicting and forecasting price behaviour when a chart enters new all time lows or highs, some of these methods are based on Fibonacci principles. However that is beyond the scope of this book. The focus here is becoming proficient with Fibonacci Retracements using the numbers from 0 to 1. Expanding to other Fibonacci methods or analysis techniques would detract from the focus of this book and decrease the depth of knowledge. For more on trading, investing, charting analysis, and helpful information on the stock markets, currencies, and commodity markets. visit https://www.ascencore.com/ Chapter 4 How Trade Using Fibonacci Retracements For the purposes of this book trading will be specifically defined as a completed transaction in a timeframe usually less than 6 months and definitely no longer than one year. The bulk of examples and explanations will focus on trades lasting from one week to two months. There will be a few intraday examples, but they will not be the focus. In addition to the varying timeframes that can be traded in, many people also prefer certain trading instrument(s) over others. Some only trade stocks, others trade currencies and commodities, others trade them all. Moreover there exists an even greater selection of trading methods and strategies you can choose based on your individual preferences and risk tolerance. That is why it will be extremely difficult to explain how to use fibs for trading in a way that suits everyone's own unique circumstances. Explanations and examples will be divided into several categories concerning the individual factors mentioned above. It is best to read over all of them and decide which combination(s) can best be personalized to suit your style, personality, and preferences, along with your goals and risk tolerance. For trading approach we will look at methods and strategies for 3 broad types of trading. reversals continuations breakouts Explanations and examples will only be from a bullish perspective profiting from upward price movement. Though keep in mind these principles are also applicable and relevant in the reverse for trading with a bearish stance to profit from downward price movement. For planning and making trading decisions we will look at the entry, risk management, and exit elements of a trade. For risk tolerance and profit goals we will look at conservative and aggressive strategies. The following abbreviations will be used to label later examples which illustrate various approaches and strategies that can be taken depending on risk tolerance and objectives. (H) represents high price (L) represents low prices (M) represents medium prices The word "early " will mean a buy or sell order is executed as soon as the chart reaches a predetermined price. The word "late " means a buy or sell order is executed after the chart has passed a certain predetermined price. The first trading approach presented is one that has already been seen extensively in previous chapters. This is of course trading price reversals. Trading Reversals figure 4 figure 4.1 Below are explanations of H, M, and L entries for trading bullish price reversals. The charts above show entry points for bullish reversals for upside profit. An early H entry is an entry price to buy as soon as price drops down to the area slightly above the support level identified by a fib. When a single fib is used these are prices above a single fib level. When combined fibs are used this is the price region above the support zone that is formed by the large and small fib. Early H entries allow for buy orders to almost always be filled because price will nearly always reach these prices slightly above fib support levels and zones. An early entry using a price slightly above the support zone of each reversal shown above would have meant none of those reversals would have been missed due to an order not being filled. Price always reached the areas slightly above fib supports. An early entry increases the exposure to enter reversal trades, but it also increases risk because the average cost is higher. Price can still drop further into the support zone or continue below it. As well if a successful reversal does occur profits will be lower due to a higher entry price. The same is also true when a late H entry is made. This is when a buy order is set at an H entry after price has held and begun to reverse back up from a support level. This carries the same benefits and drawbacks as an early H entry. However the risk of price going below the support zone is slightly less because the reversal has more confirmation from price action holding and coming back up from support. Successful price reversals are more clearly identified when price has held above support and begins moving up. An L entry is any predetermined price to buy at the lower range of a support level/zone or slightly further below a support level/zone. This entry is the most profitable and lowest risk if a reversal occurs. If a reversal doesn't happen and price continues below support, losses will be lower since the purchasing price was lower when compared to purchasing at an H price. This also means profits are greater if a successful reversal occurs at support. Despite these major advantages L entries have one major drawback for trading bullish reversals, and that is missed opportunity. In the case of the last reversals in both figure 4 and figure 4.1 buy orders would not have been filled at L entries, because price never dropped low enough to reach areas in the lower ranges of support. Thus the trades were not even executed. Such scenarios with L entries can be very frustrating and lead to less profits due to missed opportunities. In the event support doesn't hold and price drops down further, L entries only reduce losses due to their lower purchasing price at entry. A failed reversal will still lead to losses albeit lower losses compared to H entries. As you can see in the charts above and many others before, low risk reversals tend to occur quickly. That is to say price reaches a support level/zone and doesn't tend to stay there for a long time before reversing direction back up. Generally if price stalls at a support and drifts slightly above and below it for a long time, a reversal is less likely to occur. This is not always the case but reversals tend to be sharp and quick. Thus if lower risk is desired it is recommended to only make early L entries. You want to have your buy order filled as soon as price reaches the lower areas of support. You set your buy price to enter a trade that is the plan. If a reversal doesn't occur and price continues lower a late entry would be riskier and more stressful. An early L entry means you get the opportunity to be in a successful reversal trade. Since successful reversals tend to happen quickly and less reliable or failed reversals tend to happen after price stalls at support, A late L entry on the other hand means you have the opportunity to enter a reversal trade, but that reversal is less certain since price has already been shown to be indecisive and is drifting around support. The potential for a reversal back up decreases while the potential for support to fail increases. An M entry for a bullish reversal is a price directly on or slightly above/below a support level/line in the case of a single fib, In the case of combined fib this will any price within the zone formed by the large and small fib or slightly above or below the zone. The entry price doesn't have to be exactly halfway between the 2 fib levels/lines. An M entry combines features from both H and L entries. It still allows for greater opportunity exposure and less missed reversals like the H entry. However as seen on the last bullish reversals in both figure 4 and 4.1 there is still a chance albeit a lower chance of not entering the trade if price doesn't go low enough. Profit potential and lower risk from a lower purchasing price are also present but not to the same degree as the L entry. Risk Management And Exit Strategies For Reversal Trades The amount of risk and reward is based on profit target, stop loss, and entry price. Everyone has their own risk tolerances and goals so it will be difficult to demonstrate an exact example for each person's preferences. The next 2 charts show possible entry, and exit price ranges. Depending on how much is deemed an acceptable loss you can place your stop loss price in the lower ranges of support or some distance below support. The stop loss price should also be close to lining up with fib levels and past areas where price exhibited resistance/support by stalling, congesting, and/or reversing. These past price behaviours give a more specific indication of how far price can continue moving down. This reduces the chances of placing a stop loss price that leaves too little room for price to move or too much room that it increases the potential loss if price continues further down. A profit target should be at least 1 fib level/zone above the fib level/zone the entry point was based off. A very conservative approach would take some or all profits here. A more aggressive and bullish outlook would aim to begin taking most profits 2 fib levels/zones above the fib level/zone the entry point was based off of. The majority of profits should be taken off by the time price reaches 3 fib levels above. As mentioned earlier price begins to become overextended and the chances of a reversal are drastically greater after price has moved past 3 fib levels/zones without reversing. The exit price for a profit target can be right at or in the middle of a resistance level/zone. It can also be slightly above or below resistance. Again this all depends on your profit goals and risk tolerance. As well as how close your profit target price is to a fib level and past areas of resistance and support. A more conservative approach will take profits as price nears resistance, in essence an "L" exit. An aggressive approach will take profits slightly above resistance, it could be called an H exit. Finally the M exit would be a mix of the H and L exits benefits and drawbacks since it is placed at or in the middle of a resistance level/zone. The next 2 charts demonstrate these concepts with grey areas marking relevant price ranges that have been drawn based on fib levels and past areas where price exhibited signs of resistance/support(areas where price stalled, congested, or reversed), Purple marks those areas of past resistance/support. Red marks the area where a stop loss could be placed while green areas mark the potential profit areas. Everything is a matter of discretion. The choices you make will determine which prices you enter and exit a trade at. figure 4.11 The first bullish reversal demonstrates a situation where a large stop loss below support was the best option. A normal or tight stop loss within support would have resulted in being stopped out of the trade. A profit target right at the lows of previous support early in 2018 in the low 320s was ideal since this was a major recent reversal area that was clearly visible. This past area of support that was broken became a strong resistance when price returned to the 320s. It is also 2 fib zones above where the reversal started. That is a normal and healthy reversal, which would only be considered overextended if it continued one more fib zone up without any major resistance. The second reversal didn't require as wide a stop. It's upper profit target in the 320s might have been missed if a higher price was set closer to 330. A conservative profit target was more appropriate. In the third reversal a tight stop would of been adequate and a very conservative profit target one fib zone above would of been the safest route. figure 4.12 In both reversals a wide stop would have been unnecessary. However given that no past reversals occurred directly on the .5 level it was best to extend the probable level of support down to the next fib level where clear reversals occurred directly on the .382 level in early 2006. A stop slightly below this level would have been the safest route if a wide stop was acceptable for your trading plan. In addition a late H entry was safest here because the .5 level was not a certain support yet. If you were really risk averse and conservative you could have opted to place a buy order at .382 where support was more certain. This meant the order would not have been filled and you would not have entered a trade with higher uncertainty at the start. In the second reversal this would not be an issue since the .5 level proved to be a recent and relevant area with a clear past reversal. A high profit target was possible 3 fib levels above, but it was safer to exit in part or in whole at the second fib level above at the .786 level. In both cases uncertainty was seen with price stalling and congesting at this level before heading higher. It would be a matter of risk tolerance and profit goal here. The next example will be a case study of a brief profitable trade with Facebook stock. While not necessary for the trade some background information will be provided about the context and state of Facebook stock in this timeframe. Remember from chapter 2 using additional technical and/or fundamental information can increase the effectiveness of fibs. In terms of fundamental forces at the time, Facebook, the public, and the media had begun to forget about a privacy scandal earlier in 2018 involving Facebook sharing user information to third parties. However an quarterly earnings report was scheduled in late July, which brought back some doubt about the long term future of the company. Technically price recovered sharply and broke out to new highs with only minor reversals, and on normal to low volume. It was clearly becoming very over extended. As soon as earnings were reported and price gapped down, fibs could immediately be drawn off the high that price had just fallen from. At this point the market was still indecisive, even after this major drop from earnings. Fundamentally there were still major doubts about privacy issues, and the company was still said to be overvalued. However almost less than a day after earnings many began to realize the above concerns could still be very true, but the record setting price drop was too sharp a move. It was not just the normal healthy price move passing two fib level/zones. Price as you can see below dropped 4 fib level/zones down, very much overextended, especially given that it happened in a very short time. Buying Facebook stock as a long term investment was still debatable. However the case for a short term trade grew stronger. A little profitable bounce in price was becoming more and more probable given the context. figure 4.13 In the next chart we can see preparations for planning the trade. Even just one day after the price drop from earnings, aggressive traders had entered or began planning to buy at prices in the mid 170s especially around the round 175 mark. More conservative traders opted for entry prices at or slightly below the also round 170 mark, which would of placed it in the upper ranges of the next fib zone below. These were the two most popular plans at the time. figure 4.14 figure 4.15 Stop losses would vary depending on the risk tolerance and entry point. The red area covers the most relevant price range where stop losses were being considered. Remember this was expected to be a short term bounce and it was still only a day after the earnings gap down. Modest profit targets in the 180s were popular. They also just so happened to line up with the fib zone in the lower 180s. More unrealistic aggressive targets were set one zone higher in the lower 190s. Now let's see how price actually behaved and where profits were gained or lost. figure 4.16 Above we can see the conservative entry and profit target was the most profitable approach. An early aggressive entry might of resulted in a loss if the stop loss was not wide enough. An alternate route would have been to make a late H entry after price began to hold and begin moving back up into the mid 170s. However the opportunity for this would have been very short. If a very conservative plan placed an entry price lower into the support zone in the mid to low 160s, the trade would have been a missed opportunity. Any profit target in the low 180s targeting the single small.. .5 fib level turned out to be ideal to catch the bulk of this little price bounce. This profit target lines up with the basic criteria of a fib level/zone that also lines up with past areas where price reversals occurred. In addition price also encountered resistance from the trend line of the small fib. As you will remember from chapter 2 the trend line from a fib can add an additional layer of confirmation about the approximate time a fib level/zone will be more relevant in presenting resistance/support. In this case it was right on time presenting resistance at this .5 small fib level in the time period around late July and early August(the area where the trend line intersects with the fib level). It was also fortunate price briefly stalled for 4 days here, allowing for ample time to take profits. If the 190s were a profit target, here was plenty of time to realize this was too optimistic and selling most or all of the position was the safest course of action. The example using the CAD/USD currency pair demonstrate trading when price falls into a tight or narrow trading range. These ranges are typically only one fib level wide. figure 4.17 figure 4.18 The first reversal has a wider support and a wider potential stop loss mainly, due to the last swing point at the start of 2017 lining up slightly lower with the fib at the .618 small fib. Rather than the .5 small fib level. The combined fibs still form a zone centered around the .382 level of the large fib in the upper 0.70s, but it is slightly wider for the reason just mentioned. The next two swings can have narrower stops just below the .382 of the large fib since context has changed, and support has more recently just lined up higher with the small .5 fib level. Stops could have been placed at the .618 of the small fib if you wanted to remain more cautious, but that would be less necessary given that the first swing indicated support moved further up and closer to the .382 large fib and .5 small fib. Profit targets especially for price stuck in a trading range should only be 1-2 fib levels/zones above the reversal point. Here we see price behavior discussed earlier. All the reversals see price reach at least 1 fib level above before reversing back down from the top of the trading range. In the third and last reversal price reached 2 fib levels/zones above the reversal point. It then stalls and eventually reversed back down. In a situation like this it is best to go with a more conservative approach since price trading in a narrow range has less room for price to move up. It is best to take most or all profits at the first fib level/zone above the reversal point. The next example of the FTSE 100 Index demonstrates price behavior from an overreaction to a news catalyst similar to the Facebook stock example, and a situation where price trades in a narrow range before surging higher as seen in the previous CAD/USD example. Support and the stop losses for both trades were placed based on the .236 fib level around the round 5900 mark. This again takes into account the fib level lining up with past reversal areas to form a range of support to plan the trade entry and stop loss around. This example is of the main stock index in the UK that would be heavily influenced by the Brexit vote on June 23rd, 2016. The whole month of June was ripe with speculation and a perfect opportunity to trade based on anticipation and overreaction displayed in price movements. Depending on the risk tolerance, profit targets for the first reversal before the Brexit vote were best placed 1 to 2 fib levels above support. Price activity during this time leading up to the vote would have been moderate to low. The major move driven by the catalyst that was the Brexit vote didn't happen yet. A conservative approach was arguably the safest and only way to go. The second reversal a few days after the sharp yet brief drop following the vote gave reason to extend profit targets up to 3 fib levels for aggressive traders. This could mainly be justified by the rising volume and the firm fast bounce off the .236 fib level. Not to mention like the Facebook trade this sharp price drop was a severe overreaction due to hype and speculation leading up to the vote. Similar to the previous CAD/USD example price also traded in the confines of a price range before surging up. Since this chart has volume unlike the CAD/USD currency chart, we can also see volume for most of 2016 was normal, with very few large spikes in volume. This is common behavior of volume when price trades in ranges or congests at fib levels as can be seen here. Lastly on the second reversal after the vote, we can see that price became overextended after reaching 3 fibs past the initial reversal point. Even with a surge in volume and large price movements, price stalls at the .618 level before resuming higher. As mentioned earlier price almost always becomes overextended after reaching 3 fib levels. The chances of price reversing increases significantly. If price doesn't reverse as seen in this case which is less common, it stalls before continuing higher. Due to these characteristics conservative traders are safer aiming for profits 1-2 levels above a reversal area. Aggressive traders should still take profits into strength at the 1-2 fib level range above where the reversal started. figure 4.19 figure 4.20 Another example of a narrow trading range. This time with UPS(United Parcel Service. stock figure 4.21 figure 4.22 A narrow trading range within one fib level length occurs after a major move(here it is a huge price drop at the start of February). Volume and price action remain normal to low with no major spikes during the trading range. A conservative 1 fib level profit target was always the best approach. A wide stop and M entry were ideal in all cases. The last swing may have stopped you out if the stop was too narrow. Below is an example with larger reversals. figure 4.23 figure 4.24 These trades have profit targets 2 or more fib levels above the reversal point. Volume spikes often occur at the reversal points and decrease as price moves up, and vice versa for when price reverses off a peak at resistance. As with the last example M entries and wider stops were best. We can see the behaviour of price beginning to encounter more resistance at 2 fib levels above the reversal point. There is at least a brief price stall on the second fib above the reversal point before price continues higher. By the third fib up a reversal becomes more and more likely. Profit taking at the first second fib level above the reversal point are still highly recommended. Even in cases such as this where price moves 3 or more fib levels above the reversal point. Trading Continuations Trading Continuations within fibs is essentially trading smaller reversals within an overall larger trend. Entries are planned when price dips within a larger uptrend that is expected to continue. This price dip is usually small, but on occasions they can be large pull backs. The same concepts for trading reversals apply to trading continuations. Planning entries, risk management, and profit targets all transfers over. The only major difference is that continuations are part of an overall trend, while reversals don't necessarily occur within larger up trends. The following is a step by step example of a continuation trade. figure 4.25 As time passes the uptrend becomes more and more clear. It is expected to continue. Shortly after September 2016 we can see the trend begins a small bearish reversal which presents an opportunity to buy the dip. A fib can be drawn from the lows in the 90s up to that area marked by the number "2" where price is starting to reverse back down. This will draw a fib with an upward trend line. A fib with a down trend can also be drawn from the reversal in 2015 marked by the number "1." Draw the fib from that point down to the lows in the 90s. As long as the fib is valid it can be drawn from any points you choose. figure 4.26 figure 4.27 Price makes a minor reversal and continues trending higher. Notice past concepts show up again. Price still moves freely until it reaches a fib level where it will either reverse or stall and congest. A balanced approach would have been to use a slightly narrower stop that lined up with the past reversal in September. Then plan to take some profits at the .5 level and then close out the position at the .618 level which was the area of the last bearish reversal(marked by the number "2". If confidence in the trend was very high the position could be kept open longer. This is the route more aggressive traders take. Like reversals taking profits 1 or 2 fib levels up is the safest route to go in case the uptrend does not continue. The trend did continue more than 3 fib levels from the entry point to pass the .786(123.62) level. Normally this is where a reversal back down would be very likely, price even briefly stalled below this level. However in this case price was able to easily pass this extended level due to a gap up in price driven by a surge in volume. Now we see the same setup again but with a fib drawn with the "2" reversal point for a fib with an upward trend. As opposed to the previous example using a downward trend from the reversal marked by "1." figure 4.28 figure 4.29 Since the upper range of this fib is lower compared to the previous example, the maximum profit target is lower. This fib only reaches a price of 118.55, while the last example used a bigger fib and had an upper range at 132.97. Entries and stops are in the same general areas. Lastly the trend line of this fib's confirmation triangle also acts as a trend line that supports price in November. figure 4.30 Above we see a large uptrend and recovery back to previous highs after a sharp decline in 2015. The strong developing uptrend provided opportunities to trade price dips. The first highlighted area was very much like trading a narrow range. Thus a profit target of only 1 fib level was appropriate for a conservative approach. The second area demonstrates a larger pull back and price dip that needed a larger stop. A conservative approach would again take profits 1 fib level above. Perhaps slightly above the .786 level, since the last reversal around this fib level was further up closer to the 90 price range. Each of the two trades could have been held longer, but that decision would come down to individual risk tolerance. figure 4.31 Above is an example of a large price dip/pull back within a strong uptrend. Entry at the round 500 dollar mark near the .5 fib level lining up with a past reversal, and an area where price gapped up. A stop loss was placed at the closing prices of the last major reversal. It was a matter of discretion to use the closing price of the last reversal and not the absolute intra-day low price. This is mainly due to the larger concentration of price at the closing price of the reversal just before September. Rather than at the intra-day low. Later it turned out the stop indeed didn't need to be so wide. A conservative approach takes profits at the .382 and .236 levels. More optimistic/aggressive traders would hold to the 0 level back at previous highs. Trading Breakouts Breakouts are situations where price breaks past a fib level and surges to previous or new highs with large price movements and high volume. These are very risky trades because they are very large and sudden moves compared to reversals. It is also much more difficult to plan entries and profit targets as well as manage risk. For these reasons it is strongly recommended to not trade breakouts in most cases, especially for the less experienced. This section is more of a chance to highlight drastic price behaviour when key fib levels are reached. figure 4.32 Price returns to a previous resistance at the .5 fib level where a recent reversal had occurred. Price begins to stall just below the .5 fib level before breaking out to approach previous highs with a large and steep price movement and a spike in volume. Price breaks through the trend line of the confirmation triangle, in addition to the .5 fib level. figure 4.33 Continuing on with the same chart at a later time, we see the exact same features exhibited. Except this time price breaks out to the previous historic all time high where it stalls and congests before making a smaller breakout to establish new historic high prices. We can also see features discussed previously. For example a trading range below resistance at the .618 fib level. This area could have been traded like a trading range and a continuation trade in the firmly established up trend. Additionally there is a reversal off the .236 level at the start of 2018 after a sharp price drop in a relatively short period of time. This too presented another trading opportunity. figure 4.34 The chart above displays yet another case where price begins to stall or reverse after 2 to 3 fib levels. This occurs even with a strong surge during a breakout. A profit target two fibs above the breakout fib level was once again a safer approach. The chart also demonstrates why it is so risky and difficult to manage risk with an L or M entry. You can see price will break out at or slightly above resistance. Since entry is so close to resistance a stop is very difficult to place, even when referencing past reversal areas near the same fib level/zone. It is easy to look at breakouts in past examples like these. It is much more stressful and uncertain when trades are done live. Imagine you are trading this example, and price moves above the .236 level. Then reverses below a past reversal area from July 2015 before returning above the .236 level where it stalls before surging higher. This would not exactly be the most comfortable experience, having to wait a few days for a trade that has a higher chance of failing. Sometimes it is recommended to make a late L entry after price has cleared resistance. However as you can see in the previous two examples this is still an uncertain and stressful approach, especially if price stalls. If price doesn't stall then even a limit order will likely be too slow to enter when price surges up so fast. It is unlikely your buy order can be filled slightly above resistance, especially for stocks because they can gap up very high overnight. The other alternative to mitigate the issues described above is to trade the aftermath of a breakout and not the breakout itself. This is essentially like a continuation trade. Here a price dip is an entry opportunity in a larger trend that began from the initial breakout at the .236 fib level. On the next chart we see potential entry points when price makes slight pullbacks in this upward trend that is expected to continue. figure 4.35 Trading the aftermath of a breakout is only to be done if it is believed price will continue a larger long term uptrend and price is only expected to pullback with small price dips. This still carries risk as can be seen with the first price dip which needed a much larger stop in order to avoid being stopped out. The next two trades between April and July were more safe after the .618 level began to establish itself as a firm support. While this strategy has less risk than directly trading the point where price breaks through resistance, there are still major drawbacks. After a breakout has occurred a pullback is unlikely to have price drop back down and reverse exactly in the same area where the breakout started. Moreover it can be very difficult to interpret whether price is just making minor dips within a larger uptrend, or if price is ready to make a major reversal back down after an overoptimistic reaction that sent price too steeply upward. Remember a breakout often returns price back to major previous highs, all time historic highs, or new historic all time highs. All three of these situations increase the chance price will have a major reversal rather than a minor price dip. figure 4.36 An example of a breakout where a stock gaps up overnight. Price gaps up and the minor price dips that follow are still at very high prices. They do not even line up nicely with the .786 fib level let alone the point of breakout and gap up levels at the .382 and .618 fib levels. figure 4.37 Figure 4.37 is a similar situation to the last chart in figure 4.36. Except here price gaps up and does pull back to nicely line up with a fib level(here it is the .236 fib level). However price is still very high and doesn't return close to the fib levels where the breakout and gap up occurred(in this case they are the .382 and .5 fib levels). This scenario is far less common than the previous example. Price rarely lines up cleanly with fib levels after a strong break out, especially if it is a stock that gapped up overnight. It is even more rare for price to return to the exact fib levels where price broke out and gapped up. figure 4.38 On the chart above price reaches a previous resistance when returning to all time high prices to form a double top. Instead of reversing the ideal breakout occurs and price rockets to new highs. However trading in the short term like this is not always so safe. This like most breakouts was driven by a news catalyst which in this case was an earnings report. These events can often go either way, basically a coin flip. Below is an example of a situation where price did not break out higher after returning to resistance to form a double top. figure 4.39 Although price eventually continued to reach new highs, this short term trade was an absolute failure. Price fell far below any entry point that would have been near the resistance at the 0 fib level at all time highs. As stated at the beginning of this section, breakouts should be avoided by most people. Even experienced traders will find it difficult to consistently trade breakouts profitably. That being said this section did highlight key price behaviours at fib levels. Once again these are price reversals, price stalls/congestion, and breakouts with large price movements and on high volume. These breakouts as spectacular as they are very difficult to plan for. The chances of entering and exiting one successfully are very low. Price moves too fast to have orders filled according to plan. In the next chapter we will build on previous topics in this and past chapters as they apply to long term investing. For more on trading, investing, charting analysis, and helpful information on the stock markets, currencies, and commodity markets. visit https://www.ascencore.com/ Chapter 5 How To Make Long Term Investments Using Fibonacci Retracements In this chapter we will focus on using fibs for two types of long term investing divided into the two categories of growth investing and dividend investing. Ideally long term investments are to be bought at a low cost, and held for many years while they generate returns from sustained increases in value. Thus these are solid investments that are desirable to own in most cases. Though it is most desirable to enter at a lower cost. This is where fibs come into use. Fibs will function to identify decent or minor opportunities to enter or add to an investment. They also identify major opportunities to buy at heavily discount prices. There is an old phrase in the world of investing that goes something along the lines of "fundamental analysis tells you what to buy and technical analysis tells you when to buy." When applied in the context of fibs for long term investing this means fibs are merely a form of technical analysis that identify opportunities to enter or add to an investment at lower prices. Investment decisions are still primarily based on fundamental analysis that points to sustained long term returns. Using Fibonacci Retracements For Growth Investing The first type of investment covered will be growth investing which will be defined as holding an asset or financial instrument for at least 1 year for the purposes of profiting from the sale of that asset or financial instrument at a much higher price. Generally this increase in price will be at least double digit percentage growth annually. Often the end goal is to be selling at a value a couple hundred or thousand times more than the original purchasing price. Those who profit significantly from these growth investments are the ones who began purchasing at the very early stages when the asset or financial instrument was just being introduced. This will be where fibs show their utility in finding opportune prices to purchase at. After your fundamental analysis has found an investment with great potential for large sustained growth, the next step is to define an acceptable buying price. Generally growth investments continually breakout into new highs on a steady incline. When trending very strongly pull backs are often only a slight dip one or two fib levels deep, because the overall market outlook for the investment remains consistently bullish. For this reason even though most pull backs during strong bull runs are minor, it can still be in your best interest to enter or add to an investment in these situations. A strong investment during a very strong bull run will see price continue to rise. Any opportunity to capture lower prices is an opportunity even if it is only a pull back of one or two fib levels. Price dips that drop for three or more fib levels present even better opportunities to invest at lower prices. Such large pullbacks especially when price falls four fib levels or more are usually due to an overall downturn in the broader market, and not necessarily the particular investment itself. The next few examples demonstrate normal price pull backs of one to two fib levels that presented an opportunity to enter or add to an investment during periods with a very bullish outlook. As you will recall from previous chapters a pullback of one to two fib levels is very normal, and often occurs as a minor price dip in an overall larger up trend that eventually continues to move higher. In some ways planning to enter or add to an investment when price drops one or two fib levels, is essentially like entering a continuation trade. Except in this case the overall trend will last much longer, and the investment will be held much longer figure 5.0 Price continues climbing to new highs following several major drops and a stock split in July 2015. The strong bull run up begins near the end of 2016 after price forms a strong base between the 80 to 100 range. Browse through the next several charts and pay attention to where the fibs are drawn during a strong bull run. An explanation of the charts will follow, along with details about associated price behaviours in these types of scenarios. figure 5.1 figure 5.11 Price continued to rise after breaking to new highs, that was driven by a sustained bullish outlook. Thus a one to two fib level pull back would be realistic. Buying anywhere around the .236 and .382 levels was the best course of action if an entry or addition to an investment was planned during these particular timeframes. figure 5.12 figure 5.13 As a result of price continuing to rise to new highs there were less past reversals points to confirm the fibs. On most of these charts during this extended bull run, fibs often only had one or two past reversals to reference. Additionally most of these past swings were only one or two fib levels in depth. Brief price stalling and congesting can also be seen at fib levels. After price has broken past a fib, a new one needs to be drawn. This can only be done once price begins to peak and reverse off its new high. The next fib is often drawn from a swing low near the site of the last breakout to this new peak where price begins to reverse back down. The next example displays the same features of using fibs to find suitable entry prices during long sustained up trends. It is similar to what was seen in the previous example. figure 5.14 figure 5.15 figure 5.16 figure 5.17 figure 5.18 figure 5.19 As with the previous example of Netflix, this timeframe of Visa stock was a sustained and very strong bullish uptrend. Thus we see the same characteristics. Price reversals usually only have a price dip of about 1 fib level. A fib is often drawn with only one or two minor reversals that are about one fib level deep. Minor price stalling and congestion at fib levels is also seen. Once again after price breaks to new highs a fib can only be drawn once price peaks and begins to fall back down. A fib is then drawn from a swing low near the previous breakout to new highs, to the point where price is beginning to peak. This leads to an opportunity to buy in a price zone around the .236 and .382 fib levels. The past two examples are rare. It is not very common to have price continually break above new highs for more than a few months, and only have a minor pullback of one to two fib levels. It is more common to see pullbacks of three or more fib levels along with minor pullbacks of one to two fib levels. These are even better opportunities to buy long term investments at lower prices. Thus a pullback to the .5 fib level or lower can be considered to be entering bargain territory or heavily discounted price territory. figure 5.20 figure 5.21 The 2 charts above demonstrate the bare minimum threshold of a 3 fib level pullback for price to be considered in bargain territory. In this case price is discounted well below the minimum threshold and drops well past the .5 level. Figure 5.22 For more on trading, investing, charting analysis, and helpful information on the stock markets, currencies, and commodity markets. visit https://www.ascencore.com/ f figure 5.23 figure 5.24 Above is an enormous drop in price offering a fantastic discount on what turned out to be a fantastic long term growth investment. In such a large drop a combined fib was used to identify more desirable areas to enter. Remember a large drop is welcome for long term growth investors. Fibs help identify good deals at or below the .5 level of a small fib. When combined with a large fib the small fib’s .5 and 1 fib levels will normally line up with a level form the large fib as seen above. figure 5.24 figure 5.25 Price continued higher as expected, but this fib marks the end of large pullbacks of three or more small fib levels to the .5 level or below. Price only pulled back to the .382 level, in other words a pull back of only two fib levels. As we saw with the earlier examples of Visa and Netflix, price continually pulls back one or two fib levels when the outlook is very bullish. On the above chart in figure 5.25 Amazon stock exhibits these features as price surges up on a steep incline after the minor two fib level pullback to the .382 level. It's a balancing act as the trend gains strength and steepens, the opportunities for huge discount prices begin to disappear. Conversely when price makes significant drops of three or more fib levels price behaviour often starts to become less stable. Choosing to enter or add to an investment is a matter of choice. If your fundamental analysis tells you growth will be strong and sustained you will opt to buy minor price dips. This will be the zone around the .236 and .382 fib levels. By choosing this route you will miss less opportunities of entering or adding to an investment. However you could miss out on major discounts should price drop below the .382 level. If you plan to buy at large discounts at or below a .5 small fib level, you will naturally have greater chances of buying at lower prices. However if you set your purchase price too low there is a greater chance of missing out on upside moves, especially during a strong uptrend where price doesn't even drop below the .382 level sometimes. The next example of Microsoft demonstrates a situation where fibs identify "rock bottom" prices for investments that had severe price drops, but are expected to recover in the future. Again the reasoning for purchasing an investment will be down to fundamental analysis, which in this case leads you to believe an investment will recover. Fibs merely reveal the price zone where price will likely hit "rock bottom" and begin rising again. The fibs used for the recovery scenario described above are colossal compared to anything seen previously. They will use a weekly or even monthly chart to cover a multiple year timeframe possibly even exceeding a decade. The price range of the fib will also be gigantic, and often cover a price drop of more than 20% from the initial peak price fell from. All previous concepts regarding large fibs from chapter one are especially applicable here. Long term investors are focused on fundamental analysis. There is less emphasis on pin pointing the exact lowest price. A rough price zone marked by a large fib will be adequate. This price zone is often at the 0.618 or 0.786 level, in some cases at the 1 level. In other words a price drop more than 3 large fib levels. figure 5.26 In the above scenario anything below the .618 fib level would be considered a huge bargain. The fib simply reveals tangible numbers that reveal a price range where it is more desirable to enter. The reasoning for buying in this case would still be mainly down to fundamental analysis pointing to Microsoft having great potential to recover. figure 5.27 Again the concept also applies to investments outside the stock market. In this case a price range around the .786 fib level was the end to a steep plunge for oil prices. Using Fibonacci Retracements For Dividend Investing The other type of long term investing is dividend investing, which means examples and explanations will only cover stocks and ETFs that offer dividends. Unlike growth investing the main source of profit will be from dividend payments that are expected to increase over time. These dividend payments will then be reinvested to compound and grow payments even more. Thus increase in the price of the stock is preferable, but not of primary concern. Fibs will be used to determine situations when it is more desirable to buy more shares of stock. Solid dividend investments often have one or a combination of the following traits. high dividend yield high potential for growing dividend yield consistent record of growing dividend payments consistent record of dividend payments being paid out These are often large established companies that are leaders in their respective sectors. These sectors are normally the utilities, consumer staples, and finance sectors. Due to a greater portion of growth coming from dividends, the charts of these stocks usually have lower price appreciation when compared to growth investing stocks. However that is not to say they increase in price very slowly. The trade off for consistent, growing, and/or high dividend yields necessarily means price doesn't rise as fast as growth investments, which almost never pay dividends. In terms of price behaviour, these stocks usually fall into trading ranges or have a few major swing points before moving higher. Sharp inclines are less common on these charts. The goal is to purchase more stock for a lower price, to buy more shares for a lower cost. While at the same time capturing the potential for more price appreciation and dividend growth. Consequently the purchasing price will be much more conservative. As a bare minimum price should at least drop three small fib levels when you consider purchasing a dividend stock. Since their prices often fall into a trading range and have past swing points to reference, a large and small fib can usually be combined to narrow down the suitable price ranges to purchase at. The following examples demonstrate the contrast of using fibs for dividend investing as opposed to growth investing. With dividend investing it is much more plausible to wait for large pullbacks since dividend stock prices don't climb so sharply. Additionally unlike growth investing and short term trading which mainly profit from increases in price, dividend investors can adapt to falling price better. Price appreciation is only secondary to dividend yield, which is the main source of profit. Dividends are also arguably more consistent and reliable contributors to return on investment as opposed to price appreciation alone. Thus the entry price doesn't have to be spot on at a swing low. A general fib level/zone indicating a desirable discount in price can be adequate. Furthermore price ranges and timeframes covered by fibs are normally very large. It is acceptable to use large fibs on a weekly or monthly timeframe in addition to the normal daily timeframe. figure 5.28 Here is a combined large and small fib on a monthly chart. A pullback of three small fibs is the minimum threshold to buy. Zones marked in green are especially attractive since they are formed from combining large and small fib levels that line up with past reversal areas. figure 5.29 Purchasing Verizon stock even at the high price of 33.10 at the minimum .5 small fib level threshold would of been a great discount that captured price appreciation, and more importantly dividend growth. figure 5.30 A weekly chart of fibs drawn on a more bullish chart that is starting to peak and reverse back down. figure 5.31 Price pulls back less than the previous example, but that is expected on a more bullish chart. Other than that the same features are seen. More favourable purchasing prices around the areas where fibs combine to form a zone that lines up with past reversal areas. figure 5.32 A fib drawn on a daily chart that has price continuing to plunge after a gap down. The minimum threshold of price dropping three small fib levels has been met. However price shows more potential to drop given the strong gap down and sharp peak where price had reached all time highs. Waiting to purchase at lower prices is more sensible. figure 5.33 As expected price continues a strong downtrend well past the minimum threshold of three small fib levels. In fact the swing low forms well below the small fib, and finally reverses around the .786(66.51) large fib level. When price is expected to make a large plunge like this the small fib can be disregarded, and focus can be placed at a purchasing price where price drops three large fib levels or more. figure 5.34 Continuing on with the same stock chart a few years later where price has returned to previous historic highs. Here a fib is drawn ahead of another expected big drop in price due to several reasons. First The overall market and Procter & Gamble stock had risen during a prolonged bull market that has shown declining volume, which added to doubts about the longevity of the uptrend. Resistance was expected at the historic highs where price is peaking and reversing. Incidentally this forms a head and shoulders pattern. Remember from chapter two fibs can be enhanced by combining other analysis methods such as chart patterns. The neckline is marked in Gray, if price breaks below this neckline in a head and shoulders pattern a massive correction is expected on a scale similar to the previous example. Thus the minimum fib level considered as an appropriate discount price should use a pullback of three or more large fib levels and not three or more small fib levels. Given the characteristics for a large head and shoulders reversal a buy target four fib levels or more at the .618 and .786 large fib levels would not be too unreasonable. figure 5.35 As expected price plunges and reverses back up after a drop of more than three large fib levels. This allowed for more shares to be bought at lower prices, increasing the potential for more dividend yield and price appreciation. figure 5.36 A closer view shows the assumptions for a large drop and reversal were correct. The neckline of the head and shoulders broke on high volume, sending price down to the .5 and .618 large fib levels where there were minor stalls and bounces back up. However the strong bearish forces continued to break all the way to the .786 large fib level on more high bearish volume and an even a large gap down in price during late April and early May. The reversal back up did have some volume spikes, but overall volume was at normal levels. This is common price behaviour in this type of scenario because price has fallen for so long and on such high bearish volume. A modest bounce back up can easily be achieved on normal bullish volume, because the chart is very oversold and bearish volume has been well expended. figure 5.37 Another example of characteristics seen on charts of dividend investments. There are plenty of trading ranges and past reversals to reference. The minimum pullback of three small fib levels is a very low threshold. As seen here price did stall at that level for a long time in a trading range. Just a little more patience was able to catch far lower prices in the zone formed by the .786 small fib and .618 large fib, which lined up with past bullish reversals in 2014. Chapter 6 Conclusion Fibonacci Retracements are very useful for analyzing price charts for investing and trading. Given the knowledge of f ib features and price behaviour explained and illustrated in dozens of example throughout the book, you can now apply these concepts to real charts. Practice drawing fibs on old charts and see how future price behaves when you draw fibs on live charts. I wish you well with higher returns, and reduced risk now that you have an understanding of the proper use of fibs. Visit www.ascencore.com for more trading and investing related content.