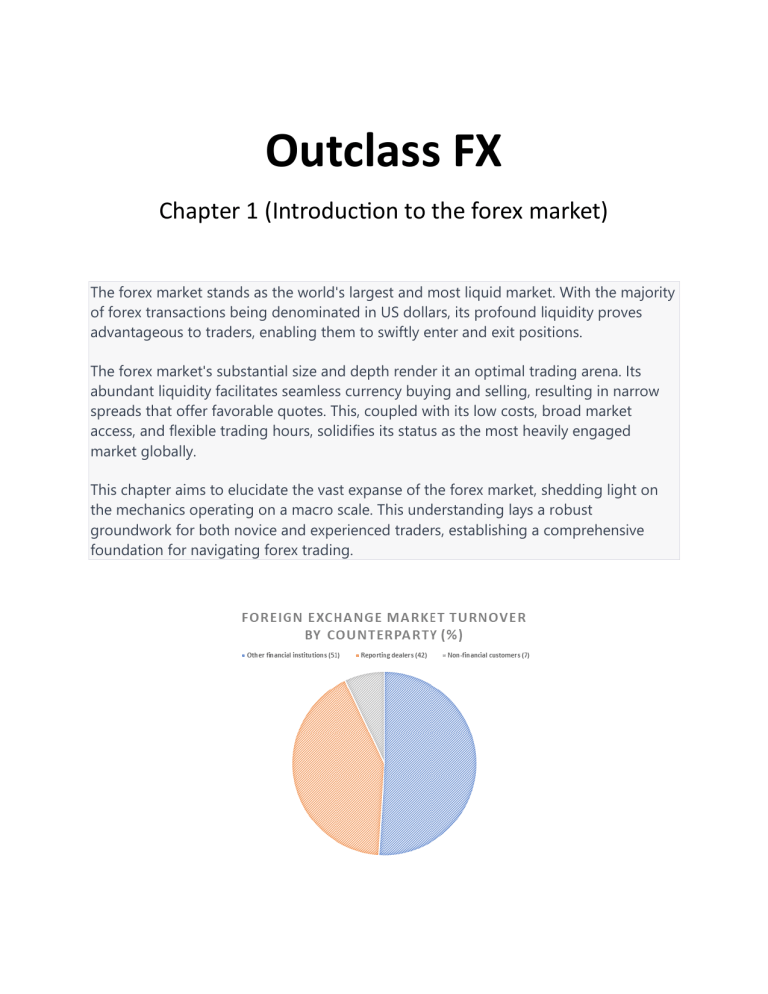

Outclass FX Chapter 1 (Introduction to the forex market) The forex market stands as the world's largest and most liquid market. With the majority of forex transactions being denominated in US dollars, its profound liquidity proves advantageous to traders, enabling them to swiftly enter and exit positions. The forex market's substantial size and depth render it an optimal trading arena. Its abundant liquidity facilitates seamless currency buying and selling, resulting in narrow spreads that offer favorable quotes. This, coupled with its low costs, broad market access, and flexible trading hours, solidifies its status as the most heavily engaged market globally. This chapter aims to elucidate the vast expanse of the forex market, shedding light on the mechanics operating on a macro scale. This understanding lays a robust groundwork for both novice and experienced traders, establishing a comprehensive foundation for navigating forex trading. HOW BIG IS THE FOREX MARKET AND HOW MUCH IS IT WORTH? According to the Bank for International Settlements triennial report of 2016, the foreign exchange market cap averaged $5.1 trillion per day. This figure is down from the previous report in 2013 of $5.4 trillion. There are only a few countries that account for the majority of forex trading turnover. The graph below depicts the major global trading desks as a percentage of total average turnover. From a trader’s perspective, large forex market capitalization lends to less volatility as large trades do not have as significant impact on the price of the market. Smaller markets can be influenced by large institutions/traders with relative ease, however within the forex market this impact is comparatively diluted. The forex market is comprised of several key constituents. The most influential being banks. The interbank market encompasses the largest volume of foreign exchange trading within the currency space. This includes trading between banks, trades for clients and facilitated trading by their individual desks. The US banks control the majority share of this market. Central banks, investment managers, hedge funds, corporations and lastly retail traders round off the rest of the market. Roughly 90% of this volume is generated by currency speculators capitalizing on intraday price movements. As retail traders, it is essential to comprehend the enormity of the forex market in to be successful in your trading strategy, as well as how these different components interact with each other on a larger scale. FOREX TRADING VOLUME Traders from other markets are attracted to forex because of its extremely high level of liquidity. Liquidity is most important as it allows traders to get in and out of a position at with ease 24 hours a day, five and a half days a week. It allows large trading volumes to enter and exit the market without the large fluctuations in price that would happen in less liquid market. This means that you will never get in a position because of the lack of a buyer. This liquidity can vary from one Trading session to another and one currency pair to another as well. The US Dollar makes up 85% of forex trading volume. At nearly 40% of trading volume, the Euro is ahead of the third-place Japanese Yen that takes almost 20%. With volume concentrated mainly in the US Dollar, Euro and Yen, forex traders can focus their attention on just a handful of major pairs. In addition, the greater liquidity found in the forex market is conducive to long, well-defined trends that respond well to technical analysis and charting methods. HOW TO TAKE ADVANTAGE OF THE FOREX MARKET To leverage the opportunities presented by the forex market's vast size and trading volume, traders should strategize based on their trading style. It's crucial to understand the fundamental principles of forex trading, which revolve around these key pillars: • Fundamental Analysis: This approach involves analyzing economic indicators and factors that influence supply and demand for currencies. Consider factors like interest rates, economic growth, employment data, inflation rates, and political risks. By understanding how these variables impact currency values, traders can make informed decisions about their trades. • Technical Analysis: Traders often rely on price charts to identify trends and critical price levels for market entry and exit points. Technical analysis involves studying chart patterns, trends, and various technical indicators to predict future price movements. A solid grasp of technical analysis helps traders spot potential trading opportunities based on historical price patterns. • Money Management: Effective risk management is integral to successful forex trading. Traders should determine the potential risks and rewards for each trade and use this information to guide their trade size and decision-making. Establishing proper risk-reward ratios and setting stop-loss and take-profit levels are essential to preserving capital and managing losses. Forex traders typically combine these pillars in ways that suit their preferences and risk tolerance. After achieving a balance among these foundational aspects, traders can then specialize and further refine their skills. Staying informed about political events, monetary and fiscal policies, and global economic developments is crucial for making well-informed trading decisions.For instance, a technical trader might employ various technical indicators and drawing tools to identify potential trade setups based on technical signals. Additionally, monitoring client sentiment can offer insights into potential market reversals, entry and exit points, and overall market sentiment. Ultimately, becoming a successful forex trader involves continuous learning, adaptability, and the ability to tailor your trading strategy to changing market conditions. FOREX VS STOCKS (WHAT IS THE MAIN DIFFERENCE?) Traders often compare forex vs stocks to determine which market is better to trade. Despite being interconnected, the forex and stock market are vastly different. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity, and volume. TOP 5 DIFFERENCES BETWEEN FOREX AND STOCKS The table below summarizes a few key differences between the forex market and the stock market: Let's delve deeper into the detailed comparisons between the forex market and the equities (stocks) market: Volume: The forex market's remarkable distinction from the equities market lies in its vast trading volume. The forex market's daily trading volume is estimated to be around $5 trillion. This immense trading activity predominantly revolves around a select number of major currency pairs such as EUR/USD, USD/JPY, GBP/USD, and AUD/USD. In stark contrast, the combined daily dollar volume of all global stock markets amounts to approximately $200 billion. The substantial trading volume in the forex market offers traders several advantages. With high volume, executing orders becomes smoother and more likely to match desired prices. Although market gaps can occur in any market, the extensive liquidity present in the forex market enhances traders' ability to initiate and conclude trades. Liquidity: Markets with substantial trading volume tend to exhibit high liquidity. Liquidity leads to narrower spreads and reduced transaction costs. Major forex pairs typically feature significantly lower spreads and transaction expenses compared to stocks. This serves as a pivotal advantage for forex trading over stock trading. The increased liquidity and resultant tight spreads provide traders with more favorable conditions for executing trades. The superior liquidity in the forex market fosters an environment conducive to seamless trading. 24-Hour Markets: Unlike traditional stock exchanges, the forex market operates over-the-counter (OTC) through the interbank network. This decentralized structure permits trading across the globe during various countries' business hours and trading sessions. Consequently, forex traders have the advantage of near-continuous trading availability, spanning 24 hours a day for five days a week. On the contrary, major stock indices adhere to varying trading schedules influenced by distinct time zones and diverse market variables. The 24-hour accessibility of the forex market grants traders increased flexibility in managing their trading activities, whereas stock indices follow specific trading hours dictated by their respective exchanges. The disparities highlighted between the forex and equities markets underscore the unique attributes that distinguish each market. The forex market's colossal trading volume, high liquidity, and 24-hour trading capabilities provide traders with advantageous conditions to engage in efficient and dynamic trading activities. SHOULD YOU TRADE FOREX OR STOCKS? Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. FOREX QUOTES This chapter covers the most important aspects of a forex quote that all traders must know – including top tips on how to read a currency pair: • • • • • Forex quote basics Bid and ask price The spread Direct vs indirect quotes Top tips to understand and interpret a forex quote Forex quotes reflect the price of different currencies at any point in time. Since a trader’s profit or loss is determined by movements in price (the quote), it is essential to develop a sound understanding of how to read currency pairs. WHAT ARE FOREX QUOTES? A forex quote is the price of one currency in terms of another currency. These quotes always involve currency pairs because you are buying one currency by selling another. For example, the price of one Euro may cost $1.1404 when viewing the EUR/USD currency pair. Brokers will typically quote two prices for any currency pair and receive the difference (spread) between the two prices, under normal market conditions. The following sections will expand on the different aspects of a forex quote. The same quote will be used throughout this piece to keep the numbers consistent. This example is presented below: Example of EUR/USD forex quote To interpret forex currency pairs accurately, it's essential to grasp the fundamental components of a forex quote. Here are the key concepts to understand: 1. ISO Code: The International Organization for Standardization (ISO) establishes and publishes international standards, including currency codes. Each country's currency is represented by a three-letter abbreviation. For instance, the Euro is abbreviated as EUR, and the US dollar is denoted as USD. These ISO codes provide a standardized way to refer to currencies in the forex market. 2. Base Currency and Quote Currency: Forex quotes consist of two currencies: the base currency and the quote currency. The base currency is listed first, followed by the quote currency. The value of the base currency is expressed in terms of the quote currency. For example, in the pair EUR/USD, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. This indicates how much one unit of the base currency is worth in terms of the quote currency. 3. Price Representation: The price of the base currency in terms of the quote currency is presented in the forex quote. For instance, in the pair EUR/USD, if the quote is 1.1404, it means that one Euro is equivalent to 1 dollar, 14 cents, and 04 pips. This price representation indicates the relative value of the base currency compared to the quote currency. The presence of pips (percentage in points) signifies the smallest incremental change in price. 4. Fractional Pips: The forex market often deals with fractional pips, which are smaller than whole pips. While physical currency cannot be held in fractions of one cent, fractional pips are a common feature in forex trading. This allows for more precise price movements and more accurate calculations for trading purposes. Understanding these fundamentals of forex quotes is crucial for accurately interpreting and analyzing currency pairs. The ISO codes standardize currency references, the base and quote currencies determine the relationship between the currencies, and the price representation provides insights into their relative values within the pair. The bid (SELL) price is the price that traders can sell currency at, and the ask (BUY) price is the price that traders can buy currency at. This may seem confusing as it is only natural to think of “bid” in terms of buying so just remember the bid/ask terminology is from the broker’s perspective. Traders will always be looking to buy forex when the price is low and sell when the price rises; or sell forex in anticipation that the currency will depreciate and buy it back at a lower price in the future. SPREADS The price to buy a currency will typically be more than the price to sell the currency. This difference is called the spread and is where the broker earns money for executing the trade. Spreads tend to be tighter (less) for major currency pairs due to their high trading volume and liquidity. The EUR/USD is the most widely traded currency pair, so it is no surprise that the spread in this example is 0.6 pips. TOP TIPS TO READ FOREX QUOTES 1. Bid and Ask prices are from the perspective of the broker. Traders buy currency at the ask price and sell at the bid price. 2. The base currency is the first currency in the pair and that the quote currency is the second currency. 3. The spread is the initial hurdle (cost) that traders realize in a trade. HOW AND WHEN TO BUY OR SELL IN FOREX TRADING When it comes to buying and selling forex, traders have unique styles and approaches. This is because the forex market is one of the most liquid and largest in the world and as a result there is no one single way to trade. Knowing when to buy and sell forex depends on many factors, but there tends to be more volume when markets are volatile because of the associated higher risk. This article will explore the concept of buying and selling currencies using practical examples as well as additional resources to boost your forex trading experience. WHAT IT MEANS TO BUY AND SELL FOREX Buying and selling forex pairs involves estimating the appreciation/depreciation in value of one currency against the other. This could involve fundamental or technical analysis as a foundation of the trade. Once a basis has been formed, the trader will look to other technical and fundamental aspects. Key levels of entry and exit will follow, keeping in mind risk management processes. FACTORS WHICH AFFECT CURRENCY PAIRS Political events, economic policies, and technical analysis are key factors that forex traders consider when making trading decisions. Let's explore these factors in more detail: Political Events: Political developments can significantly impact currency values. Instances of government instability, corruption, or changes in leadership can lead to fluctuations in currency prices. For example, when Donald Trump was elected as President, the value of the US Dollar experienced significant volatility. Traders closely monitor political events and their potential implications on currency movements. Economic Policy: Fundamental analysis involves tracking economic indicators and policies that influence a country's economic health. Forex traders pay attention to indicators such as unemployment rates, Gross Domestic Product (GDP) growth, and various monetary and fiscal policies. These factors provide insights into a country's economic performance and can affect currency values. Economic calendars help traders stay informed about upcoming events that could impact financial markets. Technical Analysis: Technical analysis involves analyzing historical price data, chart patterns, and various technical indicators to forecast future price movements. Traders who use technical analysis often focus on key price levels, such as support and resistance levels, as well as identifying trends and patterns in the market. These technical signals provide guidance for making trading decisions. Overall, successful forex trading often combines both fundamental and technical analysis. Traders need to consider the broader economic context and the potential impact of political events while also utilizing technical tools to identify entry and exit points for their trades. By integrating these factors, traders aim to make informed decisions that maximize their trading outcomes. Case study 1 HOW TO BUY AND SELL EUR/USD Using the EUR/USD currency pair, we will provide an example of how and when to buy or sell forex. Let’s say you want to buy the EUR/USD. If the EUR goes up in value relative to the USD once the trade is sold, you could have made a profit (depending on commission and other fees). A trader in this example would be buying the EUR and selling the USD at the same time. As an example, if the EUR/USD pair was bought at 11300 and the pair moved up to 11504 at the time that the trade was closed/exited, the profit on the trade would have been 204 pips. This is shown in the chart below. In this example the technical perspective was utilized: • • Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal. Exit level – Using key price levels of to set initial take profit level. Similarly, a fundamental trader could trade the USD/JPY currency pair by following political and economic news. For example, if a fundamental trader expected the Fed to hike interest rates, this may attract greater foreign investment into the US, and thus more demand for the home currency (USD). The trader could then look to enter into a long (buy) position in anticipation of the USD to appreciating in value. Of course, this is not absolutely certain as economic principals/theory do not always translate to real world conditions. UNDERSTANDING RISK MANAGEMENT WHEN BUYING AND SELLING FOREX Risk management is essential to longevity in forex trading. This does not simply include a positive risk/reward ratio but understanding the potential swings in volatility as well. Factors affecting forex pairs can have significant impacts at times so preventing adverse effects on your trade can be managed by implementing proper risk management techniques. Buying and selling forex can be complex, therefore understanding the mechanics behind it, such as how to read currency pairs, is essential prior to initiating a trade. Understanding the basics of going long or short in forex is fundamental for all beginner traders. Taking a long or short position comes down to whether a trader thinks a currency will appreciate (go up) or depreciate (go down), relative to another currency. Simply put, when a trader thinks a currency will appreciate they will “Go Long” the underlying currency, and when the trader expects the currency to depreciate they will “Go Short” the underlying currency. Keep reading to find out more about long and short positions in forex trading and when to use them. WHAT IS A POSITION IN FOREX TRADING? A forex position is the amount of a currency which is owned by an individual or entity who then has exposure to the movements of the currency against other currencies. The position can be either short or long. A forex position has three characteristics: 1. The underlying currency pair 2. The direction (long or short) 3. The size Traders can take positions in different currency pairs. If they expect the price of the currency to appreciate, they could go long. The size of the position they take would depend on their account equity and margin requirements. It is important that traders use the appropriate amount of leverage. WHAT DOES IT MEAN TO HAVE A LONG OR SHORT POSITION IN FOREX? Having a long or short position in forex means betting on a currency pair to either go up or go down in value. Going long or short is the most elemental aspect of engaging with the markets. When a trader goes long, he or she will have a positive investment balance in an asset, with the hope the asset will appreciate. When short, he or she will have a negative investment balance, with the hope the asset will depreciate so it can be bought back at a lower price in the future. WHAT IS A LONG POSITION AND WHEN TO TRADE IT? A long position is an executed trade where the trader expects the underlying instrument to appreciate. For example, when a trader executes a buy order, they hold a long position in the underlying instrument they bought i.e. USD/JPY. Here they are expecting the US Dollar to appreciate against the Japanese Yen. For example, a trader who has bought two lots of USD/JPY has a long position of two lots in USD/JPY. The underlying is the USD/JPY, the direction is long, and the size is two lots.Traders look for buy-signals to enter long positions. Indicators are used by traders to look for buy and sell signals to enter the market.An example of a buy signal is when a currency falls to a level of support zone. In the chart below USD/JPY depreciates to 110.274 but is supported at that level multiple times. This level of 110.274 becomes a support level and offers traders a buy-signal for when the price dips to that level. WHAT IS A SHORT POSITION AND WHEN TO TRADE IT? A short position is essentially the opposite of a long position. When traders enter a short position, they expect the price of the underlying currency to depreciate (go down). To short a currency means to sell the underlying currency in the hope that its price will go down in the future, allowing the trader to buy the same currency back at a later date but at a lower price. The difference between the higher selling price and the lower buying price is profit. To provide a practical example, if a trader shorts USD/JPY, they are selling USD to buy JPY. Traders look for sell-signals to enter short positions. A common sell-signal is when the price of the underlying currency reaches for level of resistance. A level of resistance is a price level that the underlying has struggled to break above. In the chart below USD/JPY appreciates to 114.486 and struggles to appreciate further. This level becomes a resistance level and offers traders a sell-signal when the price reaches for 114.486. WHAT ARE PIPS IN FOREX TRADING? A “PIP” – which stands for Point in Percentage - is the unit of measure used by forex traders to define the smallest change in value between two currencies. This is represented by a single digit move in the fourth decimal place in a typical forex quote For example, if the price of EUR/USD moves from 1.1402 to 1.1403 this would be a one pip or ‘point’ movement. HOW TO CALCULATE THE VALUE OF A PIP? The pip value is calculated by multiplying one pip (0.0001) by the specific lot/contract size. For standard lots this entails 100,000 units of the base currency and for mini lots, this is 10,000 units. For example, looking at EUR/USD, a one pip movement in a standard contract is equal to $10 (0.0001 x 100 000). Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. Instead of simply analysing movements in pips, traders can determine how the value of their trading account (equity) will fluctuate as the currency market moves. It’s important to note that the value of one pip will differ for different currency pairs. This is because the value of one pip will always be shown in the currency of the quote/variable currency and this will differ when trading different currency pairs. When trading EUR/USD, the value of one pip will be displayed in USD, when trading GBP/JPY, this will be in JPY. CALCULATING THE VALUE OF ONE PIP - EUR/USD PIPS EXAMPLE As each currency has its own relative value, it’s necessary to calculate the value of a pip for each particular currency pair. Keep in mind that forex trading involves set amounts of currency that you can trade. Most brokers offer a standard and a mini contract with the specifications in the table below: The value of one pip for the EUR/USDstandard contract is calculated as follows: Pip Value = Contract Size x One Pip Pip Value = 100 000 x 0.0001 Pip Value = $10 Every one pip move in your favor translates into a $10 profit and every one pip move that goes against you translates into a $10 loss. By the same logic, a one pip move in a mini contract translates into a $1 profit or loss (10,000 x 0.0001). To help understand pips and pip calculations even further you may want to consider doing some practice calculations on your own. End of CHAPTER 1