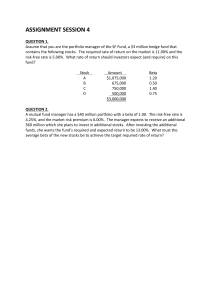

1. Assume that you manage a $10.00 million mutual fund that has a beta of 1.05 and a 12.00% required return. The risk-free rate is 4.75%. You now receive another $10.00 million, which you invest in stocks with an average beta of 0.65. What is the required rate of return on the new $20.00 million portfolio? a. 10.02% b. 10.54% Expected return of fund = Risk free rate + Beta of mutual fund (Market risk premium) c. 10.61% 12 = 4.75 + 1.05 (Market risk premium); Market risk premium = 6.9048 d. 11.31% New stocks’ average beta = 0.65 e. 12.62% New portfolio beta = Weight of mutual fund x Beta of mutual fund + Weight of stocks x average Beta of stocks New portfolio beta = (10/20)(1.05) + (10/20)(0.65) =0.85 New portfolio return = 4.75 + 0.85 (6.9048) =10.61 2. Suppose you hold a diversified portfolio consisting of a $10,000 invested equally in each of 10 different common stocks. The portfolio’s beta is 1.120. Now suppose you decided to sell one of your stocks that has a beta of 1.000 and to use the proceeds to buy a replacement stock with a beta of 1.750. What would the portfolio’s new beta be? a. 0.982 b. 1.017 c. 1.195 d. 1.246 e. 1.519 𝐈𝐟 𝐭𝐡𝐞 𝐬𝐭𝐨𝐜𝐤𝐬 𝐚𝐫𝐞 𝐞𝐪𝐮𝐚𝐥𝐥𝐲 𝐰𝐞𝐢𝐠𝐡𝐭𝐞𝐝, 𝐭𝐡𝐞𝐧 𝐞𝐚𝐜𝐡 𝐰𝐞𝐢𝐠𝐡𝐭 𝐨𝐟 𝐬𝐭𝐨𝐜𝐤 𝐬𝐡𝐨𝐮𝐥𝐝 𝐛𝐞 𝟏 𝐧 𝟏𝟎 𝟏 𝛃𝐏 = ∑ 𝛃𝐢 ; 𝐧 𝐢=𝟏 𝟏𝟎 𝟏 𝟏. 𝟏𝟐 = ∑ 𝛃𝐢 𝟏𝟎 𝐢=𝟏 𝟏𝟎 ∑ 𝛃𝐢 = 𝟏𝟏. 𝟐 𝐢=𝟏 If one of the stocks that has beta of 1 is sold, and replaced with stock with a beta of 1.750, then the sum of beta of 10 stock will now be: Sum of beta of 10 stocks = 11.2 – 1 +1.75 =11.95 New Beta of Portfolio, 𝛃𝐏 = 11.95/10 = 1.195 3. Assume that you are the portfolio manager of the Delaware Fund, a $4 million mutual fund that contains the following stocks: Stock Amount Beta A $400,000 1.50 B $600,000 0.50 C $1,000,000 1.25 D $2,000,000 0.75 The required rate of return in the market is 14.00% and the risk-free rate is 6.00%. What rate of return should investors expect (and require) on their investment in this fund? a. 10.90% b. 11.50% c. 12.10% d. 12.70% e. 13.30% 𝐰𝐀 = 𝟒𝟎𝟎 𝟔𝟎𝟎 𝟏, 𝟎𝟎𝟎 𝟐, 𝟎𝟎𝟎 = 𝟎. 𝟏𝟎; 𝐰𝐁 = = 𝟎. 𝟏𝟓; 𝐰𝐂 = = 𝟎. 𝟐𝟓; 𝐰𝐃 = = 𝟎. 𝟓; 𝟒, 𝟎𝟎𝟎 𝟒, 𝟎𝟎𝟎 𝟒, 𝟎𝟎𝟎 𝟒, 𝟎𝟎𝟎 𝛃𝐏 = 𝐰𝐀 𝛃𝐀 + 𝐰𝐁 𝛃𝐁 + 𝐰𝐂 𝛃𝐂 + 𝐰𝐃 𝛃𝐃 𝛃𝐏 = 𝟎. 𝟏𝟎(𝟏. 𝟓) + 𝟎. 𝟏𝟓(𝟎. 𝟓) + 𝟎. 𝟐𝟓(𝟏. 𝟐𝟓) + 𝟎. 𝟓(𝟎. 𝟕𝟓) = 𝟎. 𝟗𝟏𝟐𝟓 𝐄(𝐑 𝐏 ) = 𝟔 + 𝟎. 𝟗𝟏𝟐𝟓(𝟏𝟒 − 𝟔) = 𝟏𝟑. 𝟑𝟎% 4. An analyst believes that economic conditions during the next year will be either Strong, Normal, or Weak, and she thinks that the Corrigan Company's returns will have the following probability distribution. What's the standard deviation of Corrigan's returns as estimated by this analyst? a. 12.34% b. 13.41% Conditions Probability Return Strong 30% 30% Normal 40 15 Weak 30 -10 Display c. 14.87% You enter Press 2nd 7 , 2nd CLK WORK d. 15.68% e. 16.94% X01 30 enter Y01 30 enter X02 15 enter Y02 40 enter X03 -10 enter Y03 30 enter Press 2nd 8 1–V N=100 ̅ = 𝟏𝟐 𝑿 𝝈𝑿 = 𝟏𝟓. 𝟔𝟖 5. 1 A mutual fund manager has a $20.0 million portfolio with a beta of 1.50. The risk-free rate is 4.50%, and the market risk premium is 5.50%. The manager expects to receive an additional $5.0 million which she plans to invest in a number of stocks. After investing the additional funds, she wants the fund’s required return to be 13.00%. What must the average beta of the new stocks added to the portfolio be to achieve the desired required rate of return? a. 1.12 b. 1.26 First step: Find the required beta of the new portfolio with expected return of 13%. c. 1.37 13= 4.5 + 𝛃𝐏 (5.5); 𝛃𝐧𝐞𝐰 𝐩𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 = 𝟏. 𝟓𝟒𝟓𝟓 d. 1.59 Second step: Using the new portfolio beta, find the average beta of the new stocks added to the portfolio to achieve required rate of return of 13% e. 1.73 Weight of existing portfolio, 𝐖𝐞𝐱𝐢𝐬𝐭𝐢𝐧𝐠 𝐏𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 = (𝟐𝟎/𝟐𝟓); Beta of existing portfolio is 1.5 Weight of stocks, 𝐖𝐬𝐭𝐨𝐜𝐤𝐬 = 𝟓/𝟐𝟓; Let the average beta of stocks be 𝛃𝐒𝐭𝐨𝐜𝐤𝐬 𝛃𝐧𝐞𝐰 𝐩𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 = 𝐖𝐞𝐱𝐢𝐬𝐭𝐢𝐧𝐠 𝐏𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 𝛃𝐞𝐱𝐢𝐬𝐭𝐢𝐧𝐠 𝐩𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 + 𝐖𝐬𝐭𝐨𝐜𝐤𝐬 𝛃𝐬𝐭𝐨𝐜𝐤𝐬 1.5455 = (20/25)(1.5) + (5/25) 𝛃𝐬𝐭𝐨𝐜𝐤𝐬 𝛃𝐬𝐭𝐨𝐜𝐤𝐬 = 𝟏. 𝟕𝟑 6. Which of the following statements is CORRECT? a. If the returns on two stocks are perfectly positively correlated (i.e., the correlation coefficient is +1) and the stocks have equal standard deviations, an equally weighted portfolio of the two stocks will have a standard deviation that is less than that of the individual stocks. b. If a stock has a negative beta, its expected return must be negative. c. According to the CAPM, stocks with higher standard deviations of returns will have higher expected returns. d. A portfolio with a large number of randomly selected stocks would have more market risk than a single stock that has a beta of 0.5. e. If investors became more risk averse, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks. Statement a is false because if the returns of 2 stocks were perfectly positively correlated the portfolio’s variance would equal the variance of each of the stocks. Statement b is false. A stock can have a negative beta and still have a positive return because rs = rRF + (rM – rRF)b. Statement c is false. According to the CAPM, stocks with higher betas have higher expected returns. Statement d is correct. Betas are a measure of market risk, while standard deviation is a measure of stand-alone risk--but not a good measure. The portfolio’s beta (the measure of market risk) will be dependent on the beta of each of the randomly selected stocks in the portfolio. However, the portfolio’s beta would probably approach bM = 1, which would indicate higher market risk than a stock with a beta equal to 0.5. Statement e is false. When the slope of SML increases, the rate of return on low-beta stocks would increase by less than the required return on high-beta stocks 7. Assume that the risk-free rate, rRF, increases but the market risk premium, (rM – rRF) declines, with a net effect that the overall required return on the market, rM, remains constant. Which of the following statements is CORRECT? a. The required return will decline for stocks that have a beta less than 1.0 but will increase for stocks that have a beta greater than 1.0. b. The required return of all stocks will increase by the amount of the increase in the risk-free rate. c. The required return of all stocks will fall by the amount of the decline in the market risk premium. d. The required return will increase for stocks that have a beta less than 1.0 but will decline for stocks that have a beta greater than 1.0. e. Since the overall return on the market stays constant, the required return on all stocks will remain the same. 8. Which of the following statements is CORRECT? a. If the stock return is expected to be higher than the required return calculated using CAPM, it means that the market is in equilibrium. b. A graph of the SML as applied to individual stocks would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis. 9. c. If two “normal” or “typical” stocks were combined to form a 2-stock portfolio, the portfolio’s expected return would be a weighted average of the stocks’ expected returns, but the portfolio’s standard deviation would probably be greater than the average of the stocks’ standard deviations. d. If investors became more risk averse, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks. e. An increase in expected inflation could be expected to increase the required return on a risk-free asset and on an average stock by the same amount, other things held constant. Other things held constant, if the expected inflation rate decreases and investors also become more risk averse, the Security Market Line would shift a. Down and have a less steep slope. b. Up and have a less steep slope. c. Up and keep the same slope. d. Down and keep the same slope. e. Down and have a steeper slope. 10. Which of the following statements is CORRECT? a. If a company’s beta doubles, then its required rate of return will also double. b. If investors became more risk averse, then the slope of the security market line should decrease. c. If a company’s beta is cut in half, then its required rate of return will also be halved. d. Other things held constant, if investors suddenly became convinced that there would be deflation in the economy, then the required returns on all stocks should decrease. e. If the risk-free rate rises by 0.5% but the market risk premium declines by that same amount, then the required rates of return on stocks with betas less than average will decline while returns on stocks with above average betas will increase. 11. Which of the following statements is CORRECT? a. A large portfolio of randomly selected stocks will always have a standard deviation of returns that is greater than the standard deviation of a 1-stock portfolio if that one stock has a beta less than 1.0. b. A large portfolio of randomly selected stocks will always have a standard deviation of returns that is less than the standard deviation of a portfolio with fewer stocks, regardless of how the stocks in the smaller portfolio are selected. c. Company-specific (or diversifiable) risk can be reduced by forming a large portfolio, but normally even highly diversified portfolios are subject to market (or systematic) risk. d. A large portfolio of stocks whose betas are greater than 1.0 will have less market risk than a single stock with a beta = 0.8. e. If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio. 12. Which one of the following statements is correct concerning a portfolio of 20 securities with multiple states of the economy when both the securities and the economic states have unequal weights? A. Given the unequal weights of both the securities and the economic states, the standard deviation of the portfolio must equal that of the overall market. B. The weights of the individual securities have no effect on the expected return of a portfolio when multiple states of the economy are involved. C. Changing the probabilities of occurrence for the various economic states will not affect the expected standard deviation of the portfolio. D. The standard deviation of the portfolio will be greater than the highest standard deviation of any single security in the portfolio given that the individual securities are well diversified. E. Given both the unequal weights of the securities and the economic states, an investor might be able to create a portfolio that has an expected standard deviation of zero. 13. Which one of the following events would be factored in the expected return on Wolpert stock? A. The chief financial officer of Wolpert unexpectedly resigned. B. The labor union representing Wolpert ' employees unexpectedly called a strike. C. This morning, Wolpert confirmed that its CEO is retiring at the end of the year as was anticipated. D. The price of Wolpert stock suddenly declined in value because researchers accidentally discovered that one of the firm's products can be toxic to household pets. E. The board of directors made an unprecedented decision to give sizeable bonuses to the firm's internal auditors for their efforts in uncovering wasteful spending. 14. Which one of the following statements related to risk is correct? A. The beta of a portfolio must increase when a stock with a high standard deviation is added to the portfolio. B. Every portfolio that contains 25 or more securities is free of unsystematic risk. C. The systematic risk of a portfolio can be effectively lowered by adding T-bills to the portfolio. D. Adding five additional stocks to a diversified portfolio will lower the portfolio's beta. E. Stocks that move in tandem with the overall market have zero betas. 15. Which of the following are examples of diversifiable risk? I. earthquake damages an entire town II. federal government imposes a $100 fee on all business entities III. employment taxes increase nationally IV. toymakers are required to improve their safety standards A. I and III only B. II and IV only C. II and III only D. I and IV only E. I, III, and IV only 16. Westland Entertainment’s stock is expected to pay a year-end dividend of $3.00 a share. The stock’s dividend is expected to grow at a constant rate of 5% a year. The risk-free rate, rRF, is 6% and the market risk premium, RPM, is 5%. The stock has a beta of 0.8. What is the stock’s expected price five years from now? a. b. c. d. e. $60.00 $76.58 $96.63 $72.11 $68.96 First, find rs = 6% + 5%(0.8) = 10%. Then, find P0 = D1/(rs - g). P0 = $3.00/(0.10 – 0.05) = $60. For constant growth model, g is the capital gain yield. Finally, compound this at the 5% growth rate for 5 years to find 𝐏𝟓 . 𝐏𝟓 = $60(1.05)5 = $76.58. 17. A stock currently sells for $28 a share. Its dividend is growing at a constant rate, and its dividend yield is 5%. The stock’s required return is expected to remain constant at 13%. What is the expected stock price seven years from now? a. $24.62 b. $29.99 c. $39.40 d. $41.83 e. $47.99 Stock required = dividend yield + capital gain yield In constant growth model, g is the capital gain yield The growth rate is the required return minus the dividend yield. g = 0.13 - 0.05 = 0.08. What is D1? 0.05 = D1/$28 D1 = $1.40. What will be the Year 8 dividend? D8 = D1 (1 + g)7 = $1.40 (1.08)7 = $2.399354. The Year 7 price is given by: 𝐏𝟕 = D8/(rs - g) = $2.399354/0.05 = $47.99. Alternatively, P7= $28 (1 + 0.08)7 =47.987 18. Kirkland Motors’ stock is expected to pay a $2.00 year-end dividend. The stock currently sells for $20.00 a share. The required rate of return on the company’s stock is 12% (rs = 0.12). The dividend is expected to grow at some constant rate over time. What is the expected stock price five years from now? a. $21.65 b. $22.08 c. $25.64 d. $35.25 e. $36.78 To find the growth rate: rs = D1/P0 + g Therefore rs - D1/P0 = g 0.12 - $2/$20 = 0.02. To find P5 we can use the following formula: P5= D6/(rs - g). We therefore need D6. D6 = D1(1 + g)5 = $2(1.02)5 = $2.208. 𝐏𝟓 = 𝐃𝟔 𝐫𝐬 −𝐠 = 𝟐.𝟐𝟎𝟖 𝟎.𝟏𝟐−𝟎.𝟎𝟐 =22.08 Alternatively, for constant growth model, g is also the capital gain yield 𝑷𝟓 = $𝟐𝟎(𝟏 + 𝟎. 𝟎𝟐)𝟓 =22.08 19. Osaka Motors has yet to pay a dividend on its common stock, but it expects to pay a $1.00 dividend two years from now. Thereafter, the stock’s dividend is expected to grow at a constant rate of 5% a year. The stock’s beta is 1.4, the risk-free rate is 0.06, and the market risk premium is 0.06. What is the stock’s expected price four years from now? a. b. c. d. e. $10.63 $12.32 $11.87 $13.58 $11.21 Step 1: Step 2: Step 3: 20. Wonder Energy is expected to pay an end-of-year dividend, D1, of $2.00 per share, which is expected to grow at a constant rate over time. The stock has a required return of 14% and a dividend yield, D1/P0, of 5%. What is the expected price of the stock five years from today? a. $77.02 b. $61.54 c. $56.46 d. $40.00 e. $41.23 21. Find the cost of equity: rs = 6% + (6%)1.4 = 14.4%. Find the value of the stock at the end of Year 1: 𝐏𝟐 = D3/(rs - g) = $1.00(1.05)/(0.144 - 0.05) = $11.1702. Find the value of the stock in Year 4: For a constant growth model, g is the capital gain yield 𝐏𝟒 = 𝐏𝟐 (1.05)2 = $11.1702(1.05)2 = $12.3151 $12.32. Step 1: Determine the stock’s capital gains yield, g: rs = D1/P0 + g 14% = 5% + g 9% = g. This is the stock’s growth rate. Step 2: Calculate the stock’s price today: P0 = D1/(rs - g) = $2.00/(0.14 - 0.09) = $40. Step 3: Calculate the stock’s price 5 years from today: P5= $40 (1.09)5 = $61.545 $61.54. Kalson Plastic is expected to pay an end-of-year dividend of $3.00 per share, which is expected to grow at a constant rate over time. The stock has a required return of 14% and the stock price today is $60. What is the expected price of the stock five years from today? a. $77.02 b. $92.32 c. $56.46 d. $40.00 e. $45.00 Determine the stock’s capital gains yield, g: rs = D1/P0 + g 0.14 = 3/60 + g g = 0.09 = 9% Calculate the stock’s price 5 years from today: P5= $60 (1.09)5 = $61.545 $92.32. 22. An analyst is estimating Burress Inc.’s intrinsic value. The analyst has estimated the company’s free cash flows for the following years: Year Free Cash Flow 1 $3,000 2 4,000 3 5,000 The analyst estimates that after three years, free cash flow will grow at a constant rate of 6% per year. The analyst estimates that the company’s WACC is 10%. The company’s debt and preferred stock has a total market value of $25,000 and there are 1,000 outstanding shares of common stock. What is the (per-share) intrinsic value of the company’s common stock? a. $ 78.31 b. $ 84.34 c. $ 98.55 d. $109.34 e. $112.50 Corporate Valuation model for valuing stock Timeline: 0 | FCFs Continuing Value Total FCFs 0 10% 1 | 3,000 2 | 4,000 3,000 4,000 3 | 5,000 5,000(1 + 0.06) 132,500 = 0.10 – 0.06 137,500 Enter the following data as inputs in the financial calculator: CF0 = 0; CF1 = 3000; CF2 = 4000; CF3 = 137500; I/YR = 10; and then solve for NPV = Total value of firm = $109,338.84. So, the entire company is worth $109,338.84. This, less the market value of debt and preferred stock, which was given in the problem, leaves $109,338.84 - $25,000 = $84,338.84 as the value of the firm’s common equity. The value of its common stock is calculated as $84,338.84/1,000 shares = $84.34/share. 23. Club Auto Parts’ last dividend, D0, was $0.50, and the company expects to experience no growth for the next 2 years. However, Club will grow at an annual rate of 5% in the third and fourth years, and, beginning with the fifth year, it should attain a 10% growth rate that it will sustain thereafter. Club has a required rate of return of 12%. What should be the price per share of Club stock at the end of the second year,P2 ? a. $19.98 b. $25.08 c. $31.21 d. $19.48 e. $27.55 Time line: 0 rs = 12% 1 2 3 4 g1 = 0% g1 = 0% g2 = 5% g2 = 5% gn = 10% | | | | | 0.50 0.50 0.50 0.525 0.55125 P̂2 = ? 0.606375 P̂4 = = 30.319 0.12 − 0.10 CFt 0 0.525 30.87025 Numerical solution: P̂2 = $0.525 $30.87025 + = $25.08. 1.12 (1.12)2 Financial calculator solution: Calculate the PV of the stock’s expected cash flows as of time = 2. Inputs: CF0 = 0; CF1 = 0.525; CF2 = 30.87025; I/YR = 12. Output: NPV = $25.08. P̂2 = $25.08. 5 Years | 0.606375 24. A financial analyst following Fast Start Inc., a new high-growth company, estimates that the current risk-free rate is 6.25%, the market risk premium is 5%, and that Fast Start’s beta is 1.75. The current earnings per share (EPS0) are $2.50, and the company’s payout ratio is 40%. The company’s dividend is expected to grow at a rate of 25% this year, 20% next year, and 15% the following year. After three years the dividend is expected to grow at a constant rate of 7% a year. The company is expected to maintain its current payout ratio. What is the current stock price? a. $16.51 b. $17.33 c. $18.53 d. $19.25 e. $19.89 Use the SML equation to solve for rs: rs = 0.0625 + (0.05)(1.75) = 0.15 = 15%. Calculate dividend per share: D0 = (EPS0)(Payout ratio) = ($2.50)(0.4) = $1.00. Calculate the dividend and price stream (once the stock becomes a constant growth stock): D0 = $1.00; D1 = $1.00 x 1.25 = $1.25; D2 = $1.25 x 1.20 = $1.50; D3 = $1.50 x 1.15 = $1.725; D4 = $1.725 x 1.07 = $1.84575; P̂3 = $1.725(1.07) = $23.071875. 0.15 − 0.07 Put all the cash flows on a time line: Time line: 0 rs = 15% | gs = 25% 1.00 P0 = ? 1 2 3 4 Years | | | | gs = 20% gs = 15% gn = 7% 1.2500 1.5000 1.7250 1.84575 23.071875 = CFt 0 1.2500 1.5000 1.84575 0.15 − 0.07 24.796875 Finally, use the cash flow register to calculate PV: CF0 = 0; CF1 = 1.25; CF2 = 1.50; CF3 = 24.796875; I/YR = 15; and then solve for NPV = $18.53. 25. Mulroney Motors’ stock has a required return of 10% and its stock trades at $50 per share. The year-end dividend, D1, is expected to be $1.00 per share. After this payment, the dividend is expected to grow by 25% per year for the next three years. That is, D4 = $1.00(1.25)3 = $1.953125. After t = 4, the dividend is expected to grow at a constant rate of X% per year forever. What is the stock’s expected constant growth rate after t = 4? In other words, what is X? a. 5.47% b. 6.87% c. 6.98% d. 8.00% e. 8.27% rs = 10%; P0 = $50; D1 = $1.00; g4+ = ? Step 1: Draw the time line: 0 | 1 |g rs = 10% gs = 25% s = 25% 1.00 2 |g s = 25% 1.25 3 | gs = 25% 1.5625 4 | gn = ? 5 | Years 1.953125 P0 = 50 Step 2: Calculate the dividends: g2-4 = 25%. D1 = $1.00. ; D2 = $1 (1.25) = $1.25 ; D3 = $1.25 (1.25) = $1.5625. D4 = $1.5625 (1.25) = $1.953125. Step 3: Calculate the present value of these dividends: CF0=0; C01=1, F01 =1; C02=1.25, F02=1; C03=1.5625, F03=1; C04=1.953125, F04=1. I=10; NPV= 4.45 Step 4: Determine the stock’s price at t = 4: The PV of the stock at t = 4 must be the future value of the difference between today’s price and the PV of the dividends through t = 4. PV (P4) = $50.00 - $4.45 ; = $45.55. 𝐏𝟒 = $45.55(1.10)4 = $66.6898. This is the price at t = 4. Step 5: Determine the constant growth rate: P4 = D5/(rs - g) P4 = [D4(1 + g)]/(rs - g) $66.6898 26. = [$1.953125(1 + g)]/(0.10 – g) $6.66898 – $66.6898g = $1.953125 + $1.953125g $6.66898 – $1.953125 = $68.64288g $4.7158/$68.64288 =g 6.87% = g. Kingston Corporation is planning to issue new 20-year bonds. Initially, the plan was to make the bond non-callable. If the bond were made callable after 5 years with a 5% call premium, how would this affect the bond's required rate of return? a. It is impossible to say without more information. b. Because of the call premium, the required rate of return would decline. c. There is no reason to expect a change in the required rate of return. d. The required rate of return would decline because the bond would then be less risky to a bondholder. e. The required rate of return would increase because the bond would then be more risky to a bondholder. 27, Which of the following statements is CORRECT? a. The shorter the time to maturity, the greater the change in the value of a bond in response to a given change in interest rates. b. The longer the time to maturity, the smaller the change in the value of a bond in response to a given change in interest rates. c. The time to maturity does not affect the change in the value of a bond in response to a given change in interest rates. d. You hold a 10-year, zero coupon, bond and a 10-year bond that has a 6% annual coupon. The same market rate, 6%, applies to both bonds. If the market rate rises from the current level, the zero coupon bond will experience the larger percentage decline. e. You hold a 10-year, zero coupon, bond and a 10-year bond that has a 6% annual coupon. The same market rate, 6%, applies to both bonds. If the market rate rises from the current level, the zero coupon bond will experience the smaller percentage decline. 28. Assume that all interest rates in the economy decline from 10% to 9%. Which of the following bonds will have the largest percentage increase in price? a. b. c. d. e. 29. A 10-year bond with a 10% coupon. A 10-year zero coupon bond. An 8-year bond with a 9% coupon. A 1-year bond with a 15% coupon. A 3-year bond with a 10% coupon. A 12-year bond has an annual coupon rate of 9%. The coupon rate will remain fixed until the bond matures. The bond has a yield to maturity of 7%. Which of the following statements is CORRECT? a. The bond is currently selling at a price below its par value. b. If market interest rates decline, the price of the bond will also decline. c. If market interest rates remain unchanged, the bond’s price one year from now will be lower than it is today. d. If market interest rates remain unchanged, the bond’s price one year from now will be higher than it is today. e. The bond should currently be selling at its par value. 30. A 10-year Treasury bond has an 8% coupon, and an 8-year Treasury bond has a 10% coupon. Both bonds have the same yield to maturity. If the yields to maturity of both bonds increase by the same amount, which of the following statements is CORRECT? a. The prices of both bonds will increase by the same amount. b. The prices of both bonds will decrease by the same amount. c. The prices of the two bonds will remain the same. d. Both bonds will decline in price, but the 10-year bond will have a greater percentage decline in price than the 8-year bond. e. One bonds price will increase, while the other bond’s price decreases. 31. Assume that a 10-year Treasury bond has a 12% annual coupon, while a 15-year T-bond has an 8% annual coupon. The yield curve is flat, and all Treasury securities have a 10% yield to maturity. Which of the following statements is CORRECT? a. The 10-year bond would sell at a discount, while the 15-year bond would sell at a premium. b. The 10-year bond would sell at a premium, while the 15-year bond would sell at par. c. If interest rates decline, the price of both bonds will increase, but the 15-year bond will have a larger percentage increase in price. d. If the yield to maturity on both bonds remains at 10% over the next year, the price of the 10-year bond will increase, but the price of the 15-year bond will fall. e. The 10-year bond would sell at par, while the 15-year bond would sell at a discount 32. A 10-year bond has an annual coupon rate of 9%. The coupon rate will remain fixed until the bond matures. The bond has a yield to maturity of 7%. Which of the following statements is CORRECT? a. The bond is currently selling at a price below its par value. b. If market interest rates decline, the price of the bond will also decline. c. If market interest rates remain unchanged, the bond’s price one year from now will be lower than it is today. d. If market interest rates remain unchanged, the bond’s price one year from now will be higher than it is today. e. The bond should currently be selling at its par value. 33. Which of the following statements is CORRECT? a. Long-term bonds have less interest rate price risk but more reinvestment rate risk than short-term bonds. b. Long-term bonds have less interest rate price risk and also less reinvestment rate risk than short-term bonds. c. Relative to a coupon-bearing bond with the same maturity, a zero coupon bond has more interest rate risk but less reinvestment rate risk. d. If interest rates increase, all bond prices will increase, but the increase will be greater for bonds that have less interest rate risk. e. One advantage of a zero coupon Treasury bond is that no one who owns the bond has to pay any taxes on it until it matures or is sold. 34. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? a. b. c. d. e. 35. The bond’s yield to maturity is 9%. The bond’s current yield is 9%. If the bond’s yield to maturity remains constant, the bond’s price will remain at par. The bond’s current yield exceeds its capital gains yield. The bond’s capital gains yield is positive. A 15-year bond with a face value of $1,000 currently sells for $850. Which of the following statements is CORRECT? a. The bond’s yield to maturity is greater than its coupon rate. b. If the yield to maturity stays constant until the bond matures, the bond’s price will remain at $850. c. The bond’s current yield is equal to its coupon rate. d. The bond’s current yield exceeds its yield to maturity. e. The bond’s coupon rate exceeds its current yield. 36. Four Star Computers has 5.25 percent coupon bonds outstanding with a current market price of $546.19. The yield to maturity is 16.28 percent and the face value is $1,000. Interest is paid semi-annually. How many years is it until these bonds mature? A. 6.64 years B. 7.08 years C. 12.41 years D. 14.16 years E. 28.32 years The number of six-month periods is 14.16. The number of years is 7.08 years. 37. You are purchasing a 25-year, zero-coupon bond. The yield to maturity is 8.68 percent and the face value is $1,000. What is the current market price? A. $106.67 Enter N=25 x2; I/Y=8.68/2; PMT=0; FV=1000; solve for PV=119.52 B. $108.18 C. $119.52 D. $121.50 E. $128.47 38. A 16-year, 4.5 percent coupon bond pays interest annually. The bond has a face value of $1,000. What is the percentage change in the price of this bond if the market yield to maturity rises to 5.7 percent from the current rate of 5.5 percent? A. 2.14 percent decrease B. 1.97 percent decrease C. 0.21 percent increase D. 1.97 percent increase E. 2.14 percent increase Enter N=16; I/Y=5.5; PMT= 45; FV=1000; CPT PV=-895.38 Enter N=16; I/Y=5.7; PMT=45; FV=1000, CPT PV=-876.19 Change in price = $876.19 − $895.38 = −2.14% $895.38 39. Blackwell bonds have a face value of $1,000 and are current price is 980.4. The bonds have a 5 percent coupon rate. What is the current yield on these bonds? A. 4.67 percent B. 4.78 percent C. 5.08 percent D. 5.33 percent E. 5.54 percent 40. Current yield = (0.05 x 1000) /984 = 5.08% The semi-annual, 8-year bonds of Alto Music are selling at par and have an effective annual yield of 8.6285 percent. What is the amount of each interest payment if the face value of the bonds is $1,000? A. $41.50 B. $42.25 C. $43.15 D. $85.00 E. $86.29 We need to find APR compounded semi-annually. 2nd 2, Enter EFF=8.6285; C/Y=2; CPT NOM =8.45 Since the bond is selling at par, the APR (or YTM) and coupon rate are equal. Semi interest payment =( 0.0845 x 1000)/2 = $42.25 41. Northern Warehouses wants to raise $11.4 million to expand its business. To accomplish this, it plans to sell 40-year, $1,000 face value, zero-coupon bonds. The bonds will be priced to yield 8.75 percent. What is the minimum number of bonds it must sell to raise the $11.4 million it needs? A. 210,411 B. 239,800 C. 254,907 D. 326,029 E. 350,448 42. A zero coupon bond with a face value of $1,000 is issued with an initial price of $212.56. The bond matures in 25 years. What is the implicit interest, in dollars, for the first year of the bond's life? A. $12.72 B. $13.58 C. $13.90 D. $15.63 E. $15.89 Implicit interest = $226.14 - $212.56 = $13.58 43. Kaiser Industries has bonds on the market making annual payments, with 14 years to maturity, and selling for $1,382.01. At this price, the bonds yield 7.5 percent. What is the coupon rate? A. 8.00 percent B. 8.50 percent Enter N=14, I/Y= 7.5, PV= - 1,382.01, FV=1000; CPT PMT= 120 C. 9.00 percent Coupon rate = 120/1000 = 12% D. 10.50 percent E. 12.00 percent 44. Dexter Mills issued 20-year bonds a year ago at a coupon rate of 11.4 percent. The bonds make semi-annual payments. The yield-to-maturity on these bonds is 9.2 percent. What is the current bond price? A. $985.55 B. $991.90 C. $1,192.16 D. $1,195.84 E. $1,198.00 45. Technical Sales, Inc. has 6.6 percent coupon bonds on the market with 9 years left to maturity. The bonds make semi-annual payments and currently sell for 88.79 percent of par. What is the effective annual yield? A. 8.34 percent B. 8.40 percent C. 8.52 percent D. 8.58 percent E. 8.60 percent 8.40 is the APR compounded semi-annually Effective annual rate = [1 + (0.0840/2)]2 - 1 = 8.58 percent