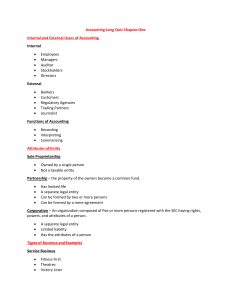

Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 Objectives 1. Introduction to Accounting • Define accounting. • Describe the nature and purpose of accounting. • Give examples of branches of accounting. • State the function of accounting in a business. • Differentiate between external and internal users of accounting information. • Narrate the history/origin of accounting. • State the forms of business organization. • State the types of business according to their activities. THREE IMPORTANT ACTIVITIES 1. Identifying 2. Measuring 3. Communicating IDENTIFYING ● INTRODUCTION TO ACCOUNTING 🏛️ 💰 DEFINITION By the Accounting Standards Council, Accounting is a service activity. The accounting function is to provide quantitative information, primarily financial in nature, about economic entities, that is intended to be useful in making economic decision. ● By the American Institute of Certified Public Accountants (AICPA) Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are in part at least of a financial character and interpreting the results thereof. By the American Accounting Association (AAA) Accounting is the process of identifying, measuring and communicating economic information to permit informed judgment and decision by users of the information Identifying ○ The process of analyzing events and transactions to determine whether or not they will be recognized. Only accountable events are recognized. In general, accountable events and transactions should be: ■ Related to the business, ■ measurable in terms of money, ■ and documented or supported by evidence. Types of Events ○ External events - events that involve an external party. ■ Exchange (reciprocal transfer) reciprocal giving and receiving ■ Non-reciprocal transfer - "one wav" transaction ■ External event other than transfer - an event that involves changes in the economic resources or obligations of an entity caused by an external party or external source but does not involve transfers of resources or obligations. ○ Internal events - events that do not involve an external party. ■ Production - the process by which resources are transformed into finished goods. ■ Casualty - an unanticipated loss from disasters or other similar events. Recognition ○ identifying something from previous encounter or knowledge as well as acknowledgment existence of validity ● 📝 1 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 MEASURING ● ● Measuring ○ Involves assigning numbers, normally in monetary terms, to the economic transactions and events. The several measurement bases used in accounting include, but not limited to, the following: ■ historical cost, ■ fair value, ■ present value, ■ realizable value, ■ current cost, ■ and sometimes inflation-adjusted cost ○ The most commonly used is historical cost. This is usually combined with the other measurement bases. Accordingly, financial statements are said to be prepared using a mixture of costs and values. Valuation by fact or opinion ○ When measurement is affected by estimates, the items measured are said to be valued by opinion. ○ When measurement is unaffected by estimates, the items measured are said to be valued by fact. COMMUNICATING ● Communicating ○ The process of transforming economic data into useful accounting information, such as financial statements and other accounting reports, for dissemination to users. Types of accounting information classified as to users' needs 1. General purpose accounting information a. designed to meet the common needs of most statement users. b. This information is governed by the Philippine Financial Reporting Standards (PFRSs). 2. Special purpose accounting information a. designed to meet the specific needs of particular statement users. b. This information is provided by other types of accounting, e.g., managerial accounting, tax basis accounting, etc. Users of Accounting Information & Products of Accounting Users of Accounting Information are classified as: ● Internal users ○ those who are directly involved in managing the business ○ Examples: ■ Business owners who are directly involved in managing the business, ■ Board of directors ■ Managerial personnel 2 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 ● External users ○ those who are not directly involved in managing the business. ○ Examples: ■ existing and potential investors (e.g., stockholders who are not directly involved in managing the business) ■ Lenders (e.g., banks) and Creditors (e.g., suppliers) ■ Non-managerial employees ■ Public Products of accounting are: ● Financial statements ○ The structured representation of an entity's financial position and results of its operations. ○ They are the end product of the accounting process and the means by which information gathered and processed are periodically communicated to users. ● Accounting reports ○ includes the financial statements plus other information provided outside the financial statements that assists in the interpretation of a complete set of financial statements or improves users' ability to make efficient economic decisions. Financial statements Accounting Reports 1. Statement of financial position 2. Statement of profit or loss and other comprehensive income 3. Statement of changes in equity 4. Statement of cash flows 5. Notes 6. Additional statement of financial position 1. Statement of financial position 2. Statement of profit or loss and other comprehensive income 3. Statement of changes in equity 4. Statement of cash flows 5. Notes 6. Additional statement of financial position 7. Other information Brief History of Accounting ● ● ● ● ● Accounting can be traced as far back as the prehistoric times, perhaps more than 10,000 ears ago. Archaeologists have found clay tokens as old as 8500 B.C. in Mesopotamia which were usually cones, disks, spheres and pellets. These tokens correspond to commodities like sheep, clothing or bread. They were used in the Middle West in keeping records. After some time, the tokens were replaced by wet clay tablets. During such time, experts concluded this to be the start of the art of writing. (Source: http://EzineArticles.com/456988) Double entry records first came out during 1340 A. D. in Genoa. In 1494, the first systematic record keeping dealing with the "double entry recording system" was formulated by Fra Luca Pacioli, a Franciscan monk and mathematician. The "double entry recording system" was included in Pacioli's book titled "Summa di Arithmetica Geometria Proportioni and Proportionista," published on November 10, 1494 in Venice. The concept of "double entry recording" is being used to this day. Thus, Fra Luca Pacioli is considered as the father of modern accounting. PURPOSE OF ACCOUNTING OVERALL OBJECTIVE OF ACCOUNTING ● ● To provide quantitative financial information about a business that is useful to statement users, in making economic decisions. The essence of accounting: ○ DECISION - USEFULNESS 3 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 COMMON BRANCHES OF ACCOUNTING ● ● ● ● ● ● Financial accounting ○ focuses on general purpose financial statements. Management accounting ○ focuses on special purpose financial reports for use by an entity's management. Cost accounting ○ the systematic recording and analysis of the costs of materials, labor, and overhead incident to production. Auditing ○ the process of evaluating the correspondence of certain assertions with established criteria and expressing an opinion thereon. Tax accounting ○ the preparation of tax returns and rendering of tax advice, such as the determination of tax consequences of certain proposed business endeavors. Government accounting ○ refers to the accounting for the government and its instrumentalities, placing emphasis on the custody of public funds, the purposes for which those funds are committed, and the responsibility and accountability of the individuals entrusted with those funds. Forms of Business Organization 4 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 Advantages and Disadvantages of the Different Forms of Business Organization 5 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 Types of Business According to Activities ● ● ● Service Business ○ A service business is one that offers services as its main product rather than physical goods. A service business may offer professional skills, expertise, advice, lending service, and similar services. ○ Examples: ■ Schools ■ Professionals (accounting firm, law firm, electrician, etc.) ■ Hospitals and clinics ■ Banks and other financial institutions ■ Hotels and restaurants ■ Transportation and travel (taxi operator, travel agency, etc.) ■ Entertainment and event planners (wedding planners, concert promoters, etc.) Merchandising Business ○ A merchandising business (or trading business) is one that buys and sells goods without changing their physical form. ○ Examples of merchandising businesses include: ■ General merchandise resellers (grocery stores, department stores, hardware stores, pharmacies, online stores, sari-sari stores, etc.) ■ Distributors and dealers (rice wholesalers, vegetable dealers, 2nd-hand cars dealers, etc.) Manufacturing business ○ A manufacturing business is one that buys raw materials and processes them into final products. Unlike a merchandising business, a manufacturing business changes the physical form of the goods it has purchased in a production process. ○ For example, a business that buys and sells eggs is a merchandising business. On the other hand, a business that buys eggs and uses ● ● the eggs as ingredient in making cakes for sale is a manufacturing business. ○ Examples of manufacturing businesses include: ■ Car manufacturers (Toyota, Isuzu, Volkswagen, etc.) ■ Technology companies (Apple, Samsung, Sony, etc.) ■ Food processing companies (San Miguel Pure Foods, Silver Swan, etc.) ■ Factories (clothing factories, animal feeds factories, plastic wares factories, etc.)] Some businesses, called hybrid businesses, engage in more than one type of activity. For example, a restaurant uses ingredients to cook a meal (manufacturing), sells Coca-Cola drinks (merchandising), and serves food to customers (service). Nevertheless, a hybrid business is classified into one of the major types based on the activity that is most in line with the business purpose. Restaurants are expected to fill-in customer orders and provide dining services, thus, they are more of a service-type business. 6 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 Chapter 1 Summary ● ● ● ● ● ● ● ● ● ● ● Accounting is a process of identifying, measuring and communicating economic information that is useful in making economic decisions. Only "accountable events" are recorded in the books of accounts. Accountable events are those that affect the assets, liabilities, equity, income or expenses of a business. The information processed in an accounting system is communicated to interested users through accounting reports (e.g., financial statements). Accounting is considered the "language of business" because it is essential in the communication of financial information. Accounting provides information that is useful in making economic decisions. The common branches of accounting include the following: (1) Financial accounting, (2) Management accounting, (3) Government accounting, (4) Auditing, (5) Tax accounting, (6) Cost accounting, (7) Accounting education, and (8) Accounting research. Financial accounting focuses on the information needs of external users, while management accounting focuses on the information needs of internal users. External users are those who are not directly involved in managing the business. Internal users are those who are directly involved in managing the business. Accounting information may be either (a) general purpose or (b) special purpose. General purpose accounting information is provided by financial accounting and is prepared primarily for external users. Special purpose accounting information is provided by management accounting or other branches of accounting and is prepared primarily for internal users. The different forms of business organization are: (1) Sole proprietorship, (2) Partnership, (3) Corporation, and (4) Cooperative. The types of business according to activities are: (1) Service business, (2) Merchandising business, and (3) Manufacturing business. 7 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 Objectives ASSUMPTIONS 2. Accounting Concepts and Principles ● Give examples of accounting concepts and principles. ● Apply the concepts in the solving of accounting problems. ASSUMPTIONS MNEMONICS ● ● ● ● ACCOUNTING CONCEPTS AND PRINCIPLES DEFINITION ● Accounting Concepts and Principles these refere to the principles of which the process of accounting is based. This is sometimes referred ito accounting assumptions, accounting postulates, or accounting theory. Generally Accepted Accounting Principles (GAAP) these represent the rules, procedures, practices, and standards followed in the preparation and presentation of financial statements. These are like laws that must be followed in financial reporting. ● ● Seperate Entity Monetary Unit Time Period Going Concern SMTG Seperate Entity Concept ○ This is also known as accounting entity concept, business concept, or entity concept. ○ Entity concept this means that the entity or the business itself is viewed separately from its owner just like iron man when he has his alter ego tony stark so they are considered separate entities business transactions are recorded in the business records but personal transactions of the owner's are not recorded in the business records so that is what separate entity concept is Monetary Unit Assumption ○ This is also known as stable monetary unit assumption or unit of measure concept. ○ This means that of financial information are stated in terms of a common unit of measure which is in the philippines it is the Philippine peso that would mean that assets, liabilities, equity, income, and expenses should be stated in a common denominator. If there are foreign currency denominated transactions this should be translated into pesos so if the report is also in the US then all financial informations are to be reported in the US dollar currency. Time Period Assumption ○ This is also known as periodicity or accounting period assumption. ○ This means that the life of the entity is divided into series of reporting . 8 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 ● this is usually 12 months or one calendar year or one fiscal year. This can also be divided further into quarterly or monthly show the life of a business entity should be subdivided into a series of reporting periods. Going Concern Assumption ○ There a need to divide the life of the entity into a series of reporting periods that is also because there is what you call a going concern assumption ○ This assumption means that the entity is assumed to carry on its operations for an indefinite period of time and since because the assumption is the life of the entity is infinite so it should be subdivided into reporting period so that financial information can be prepared any smaller chunks of time rather than waiting for the end of the entity's life. ● ● PRINCIPLES ● PRINCIPLES MNEMONICS ● ● ● ● ● ● ● Dual Aspect Accrual Basis Matching Historical Cost Full Disclosure HDFAM Dual Aspect Concept ○ States that every business transaction requires to be recorded into different accounts this concept is the basis of double entry accounting which is when there is a debit there should also be a credit the double entry. Accounting is required by all accounting frameworks in order to produce reliable financial statement Accrual Basis of Accounting ○ it means that the effects of transactions and other events are recognized when they occur and they are recorded in the accounting records and reported in the financial statements of the period to which they relate. This means that income is recognized when earned instead of when payment is received and that expenses are recognized when incurred rather than when the business has made payment. Matching Concept ○ This is also known as the association of cause and effect ○ This means that costs are recognized as expenses when the related revenue is recognized meaning the expenses are matched against the revenues. Historical Cost Concept ○ They generate historical cost concept or cost principle states that the value of an asset is determined on the basis of acquisition cost this concept is not always maintained or applied because this is just generally applied which is why it's called a generally accepted accounting principle Full Disclosure Principle ○ This is also known as adequate disclosure concept. ○ This concept requires that the financial statements including the related notes contain all relevant data a stakeholder needs to understand the financial condition and performance of the company non-essential data are excluded to avoid qatar now the sufficient details to be disclosed is also being traded off for sufficient condensation of information to keep the information understandable without having to spend a lot of cost in preparing it. 9 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 CONVENTIONS CONVENTIONS MNEMONICS ● ● ● ● Materiality Cost Benefit Conisistency Conservatism M3Cs ● ● ● ● Materiality concept ○ States that information is material if it's omission or misstatement would influence economic decisions because remember the objective of accounting is to enable the users to make decisions or make the information useful in making decisions and materiality is a matter of professional judgment it is based on the size and nature of the item being judged. A 10 million loss for a large company may not be material versus that of a smaller company materiality thresholds are not set by any standards rather it is based on the professional judgment of the accountant or accountants involved. Cost Benefit ○ This is also known as cost constraint and reasonable assurance. ○ This states that the cost of processing and communicating information should not exceed the benefits to be derived from it meaning when preparing financial statements and accounting reports and in gathering the level of details to be disclosed in the report must not exceed the cost in preparing these details versus that of the benefit that the user will get in making decisions from said information. Consistency Concept ○ States that the financial statements are prepared on the basis of accounting principles that are applied consistently or the same from one to the next if there are changes in the accounting policies. This can only be made when it is required or permitted by the Philippine Financial Reporting Standards (PFRS) or when the change results to more relevant and reliable information changes in accounting policies should be disclosed in the notes to financial statements. Conservatism ○ This is also known as prudence. ○ This is when the use of caution in making estimates under conditions of uncertainty such that assets or income are not overstated and liabilities or expense are not understated meaning when exercising conservatism making estimates should be made based on the least effect on equity meaning. ○ If you have to choose between an estimated income of 100 versus 99 prudence would dictate that you would choose the estimated income of 99 or if there is an estimated expense of 50 versus 49 the 50 is chosen as the estimated expense show prudence means you will try not to get an estimate that will have a bigger effect, so you aim for the estimate that will have the least effect in increasing your equity. 10 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 GENERAL STANDARDS Accounting Standard Setting Bodies and Other Relevant Organizations 11 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 Difference between US GAAP and International GAAP THE ACCOUNTING EQUATION The basic accounting equation: The expanded accounting equation: Definitions ● ASSETS ○ the economic resources you control that have resulted from past events and can provide you with economic benefits. ● LIABILITIES ○ your present obligations that have resulted from past events and can require you to give up economic resources when settling them. ● EQUITY ○ assets minus liabilities. ● INCOME ○ increases in economic benefits during the period in the form of increases in assets, or decreases in liabilities, that result in increases in equity, excluding those relating to investments by the business owner. 12 Financial Accounting and Reporting PRELIM Notes AEC 12 | Ms. Zola Mae D. Caumban | 1ST YR - SEM 1 ● ● EXPENSES ○ are decreases in economic benefits during the period in the form of decreases in assets, or increases in liabilities, that result in decreases in equity, excluding those relating to distributions to the business owner. The difference between income and expenses represents profit or loss. ● THE MAJOR ACCOUNTS ● ● Account ○ The basic storage of nformation in accounting. It is a record of the increases and decreases in a specific item of asset, liability, equity, income or expense. T-Acoounts ● ● ● The Five Major Accounts ○ ASSETS, LIABILITIES, EQUITY INCOME, & EXPENSES Classification of Five Major Accounts BALANCE SHEET ACCOUNTS INCOME STATEMENT ACCOUNTS ASSETS LIABILITIES EQUITY INCOME, EXPENSES CHART ACCOUNTS ● Chart of Accounts ○ a list of all the accounts used by a business. Balance Sheet Accounts ○ Assets ■ Cash ■ Accounts receivable ■ Allowance for bad debts ■ Notes receivable ■ Prepaid supplies ■ Prepaid rent ■ Prepaid insurance ■ Land ■ Building ■ Accumulated depreciation Building ■ Equipment ■ Accumulated depreciation equipment ○ Liabilities ■ Accounts payable ■ Notes payable ■ Interest payable ■ Salaries payable ■ Utilities payable ■ Unearned ○ Equity ■ Owner's capital (or Owner's equity) ■ Owner's drawings Income Statement Accounts ○ Income ■ Service fees ■ Sales ■ Interest income ■ Gains ○ Expenses ■ Cost of sales (or Cost of goods sold) ■ Freight-out ■ Salaries expense ■ Rent expense ■ Utilities expense ■ Supplies expense ■ Bad debt expense ■ Depreciation expense ■ Advertising expense ■ Insurance expense ■ Taxes and licenses ■ Transportation and travel expense ■ Interest expense ■ Miscellaneous expense ■ Losses 13