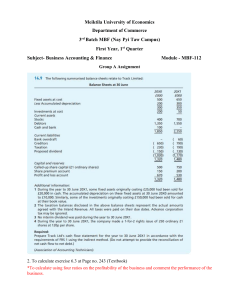

PROFITABILITY RATIOS BY MUHAMMAD AQEEB UR REHMAN VUID IS BC180405347 VIRTUAL UNIVERSITY OF PAKISTAN JUNE 03, 2023 TABLE OF CONTENTS 1.CHAPTER-1------------------------------------------------------------------ PAGE-01 1.1 Introduction ---------------------------------------------------------- PAGE-01 1.2 Background ---------------------------------------------------------- PAGE-02 1.3 Objectives ------------------------------------------------------------ PAGE-03 1.4 Significance ---------------------------------------------------------- PAGE-04 2.CHAPTER-2------------------------------------------------------------------- PAGE-05 2.1 Project Proceeding -------------------------------------------------- PAGE-05 3.CHAPTER-3 --------------------Methodology----------------------------- PAGE-06 3.1 Type of research ----------------------------------------------------- PAGE-06 3.2 Data Collection Source --------------------------------------------- PAGE-07 3.3 Data Collection Tools ----------------------------------------------- PAGE-07 3.4 Subjects --------------------------------------------------------------- PAGE-07 3.5 Data Collection ------------------------------------------------------ PAGE-07 3.6 Conclusion ----------------------------------------------------------- PAGE-08 (CHAPTER-1) (1.1) INTRODUCTION Profitability ratios are used to evaluate a company’s ability to generate profits, efficiency and effectiveness in relation to sales, assets or equities. Profitability ratios are the most important tools for Investors, Creditors and management to evaluate a company’s financial health and its growth. Profitability ratios are used to assess a company’s current performance with its past, or with other companies or used in determining the industry average. This project is all about for an investor, for a businessman and for every single person who is interesting in financing because these ratios give the ability to know that what is current situation of any business or any firm. In accountancy all the calculations and processes proceed to know that how much we gain profit & loss. This research gives us the knowledge of getting some ratios which describe the situation of business in advance. My research proposal is about HM Sons PVT LTD which have a wide network of tiles and sanatory wares in all over Pakistan and recently I’m working here as a junior accountant. I’ve some working of my previous month in which I’ve calculated net profit by the supporting of P&L and balance sheet. I will show all my working below in related section. #01 (1.2) BACKGROUND Background of the research shows the impact and implication of the Profitability Ratios on the environment. Profitability is a critical aspect of corporate financial performance. Profitability ratios are commonly used to measure a company's ability to generate profits relative to its sales, assets, or equity. These ratios help investors, creditors, and management evaluate a company's financial health and performance. However, little research has been conducted to explore the relationship between profitability ratios and corporate financial performance. This study aims to bridge this gap by examining the impact of profitability ratios on corporate financial performance. #02 (1.3) OBJECTIVES To examine the importance of profitability ratios in evaluating financial performance. To identify the most commonly used profitability ratios and their components. To evaluate the relationship between profitability ratios and corporate financial performance. To determine the impact of profitability ratios on small business success. To explore how different industries and sectors affect the relationship between profitability ratios and financial performance. To investigate how profitability ratios are used by companies to make informed financial decisions. To recommend best practices for using profitability ratios to improve financial performance. To contribute to the academic literature on the relationship between profitability ratios and financial performance. Overall, the objective of a research proposal on profitability ratios is to provide insights into the importance of profitability ratios in evaluating financial performance, the factors that affect their relationship with financial performance, and how companies can use these ratios to improve their financial performance. #03 (1.4) SIGNIFICANCE Profitability ratios indicates the problems. Helps out in saving the money. Shows the performance of company. Final measure of profit & loss. EXPECTED OUTCOME The findings of this study will contribute to a better understanding of the relationship between profitability ratios and small business success. The results will identify how small businesses use profitability ratios to measure their financial performance and the impact of these ratios on their success. The study's findings will help small business owners and financial professionals better understand the importance of profitability ratios in managing and improving small business performance. #04 CHAPTER-2 PROJECT PROCEEDING (as sample) All the ratios of profitability are as follows: NET PROFIT MARGIN = NET INCOME / TOTAL SALES GROSS PROFIT MARGIN = REVENUE-COGS/REVENUE RETURN ON ASSETS = NET INCOME / TOTAL ASSETS RETURN ON EQUITY = NET INCOME / TOTAL EQUITY RETURN ON C APITAL INVESTED = EBIT / TOTAL EMPLOYED CAPITAL #05 (CHAPTER-3) METHODOLOGY 3.1 This study will use a qualitative research design to explore the effect of profitability ratios on small business success. Data will be collected through in-depth interviews with small business owners and financial professionals. The participants will be selected from different industries to obtain a diverse perspective on the use of profitability ratios in small businesses. The data collected will be analyzed using thematic analysis to identify themes and patterns. Here, I’ve a sample of my final report in which I’ve conclude net profit in the presence of all expenses as follows: HM SONS P & L FEB 23 Remarks Debit MISC-FARE A/C MISC-UTILITY BILLS MISC-DONATION MISC-CUSTOMER REFERSHMENT MISC-FUEL EXP AUDIT EXP FIX ASSTE A/C SALARY MISC-RENT (GODOWN/SHOWROOM) MISC-GODOWN EXP MISC-LABOUR EXP MISC-OFFICE EXP MISC-BUILTY/FARE EXP (OUTSTATION) MISC-KITCHEN EXP (FOOD) BREAKED TILE LOSS 15 UFONE SIMS TOTAL DAILY M 62,450 71,240 1,987 1,010 4,280 50,000 50,000 464,166 7,750 1,000 210,000 4,500 1744853 -2,649 P/L 1411812 REVALUATION -437,474 NET P/L -107,082 696,000 22,150 71,400 26,920 #06 3.2 NOTE: I’ve got all the above-mentioned info. from related ledgers of our company (HM SONS PVT LTD). H.M SONS PVT LTD. (n.d.). Title Company in Rawalpindi. https://hm-sons-pvt-ltd.business.site/ 3.3 All records are calculated on my own, source tool was our accounts software. I’ve saved a lot of time by using this software it generates all required ledgers in few seconds for me. Instead of the using this software MICROSOFT OFFICE (word, excel etc.) are used for working on this project. 3.4 I’m targeting contractors, dealers, and walking customers for enhancing my profitability. REGIONAL HEAD, BRANCH MANAGERS, SUPERVISORS, EXTERNAL AUDITOR, ACCOUNTS RELATED STAFF AND SALES EXECUTIVE. The focus of my analysis is all about the organization which is a limited company and all the data I’ve collected is from the organization named as HM SONS PVT LTD where I’m recently working. The whole market competitor were in my sight during the research all behavior and stability of market in my area was observed that how the entrepreneurs play tricks for maximizing their profit margins. I’ve analyzed our firm by working on 4P’s of business framework which are Price, Place, Product and Promotion because these are the main factors for running a business. 3.5 Data collected by approaching some persons who were related to our field like accountants of other firms. Due to good social relationship in market, we will assure that all data which is received is not fake by observing their previous records. Practically all the issue will be written down, by the guidelines of the instructor and with the teamwork I will try to solve every issue. #07 CONLUSION Overall, this research proposal aims to explore the effect of profitability ratios on small business success. By conducting this study, we can better understand the significance of profitability ratios in small businesses and their role in improving financial performance. The study's findings will help small business owners and financial professionals make informed decisions to improve profitability and drive business success. For analysis and data entry main supporting software will be EXCEL, POWER POINT etc. will be in use. Every technique, which will relate with our topic will be used according to the availability of time. THANK YOU! #08