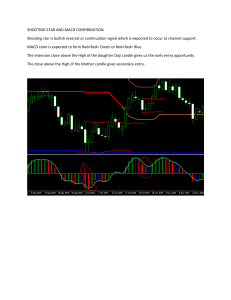

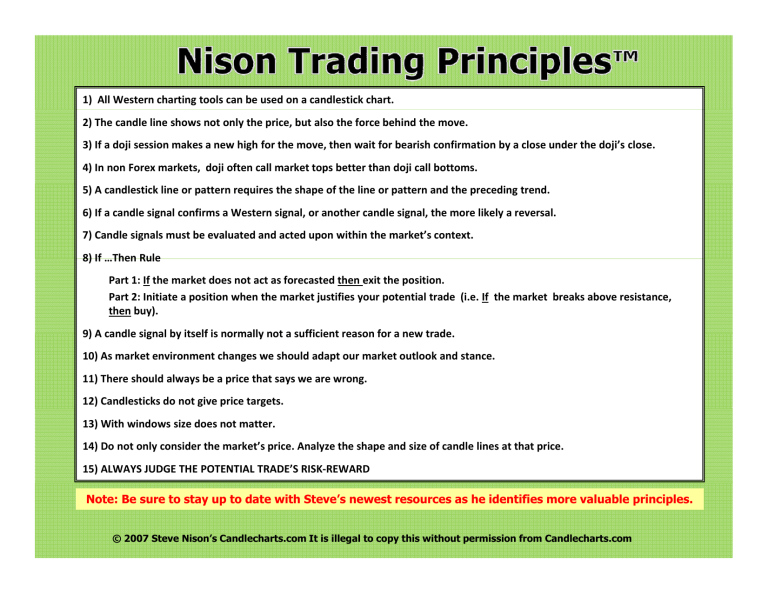

1) All Western charting tools can be used on a candlestick chart. 2) The candle line shows not only the price, but also the force behind the move. 3) If a doji session makes a new high for the move, then wait for bearish confirmation by a close under the doji’s close. 4) In non Forex markets, doji often call market tops better than doji call bottoms. 5) A candlestick line or pattern requires the shape of the line or pattern and the preceding trend. 6) If a candle signal confirms a Western signal, or another candle signal, the more likely a reversal. 7) Candle signals must be evaluated and acted upon within the market’s context. 8) If …Then Then Rule Part 1: If the market does not act as forecasted then exit the position. Part 2: Initiate a position when the market justifies your potential trade (i.e. If the market breaks above resistance, then buy). 9) A candle signal by itself is normally not a sufficient reason for a new trade. trade 10) As market environment changes we should adapt our market outlook and stance. 11) There should always be a price that says we are wrong. 12) Candlesticks do not give price targets. 13) With windows size does not matter. 14) Do not only consider the market’s price. Analyze the shape and size of candle lines at that price. 15) ALWAYS JUDGE THE POTENTIAL TRADE’S RISK‐REWARD Note: Be sure to stay up to date with Steve’s newest resources as he identifies more valuable principles. © 2007 Steve Nison’s Candlecharts.com It is illegal to copy this without permission from Candlecharts.com