BBA Program Student Handbook - Bangladesh Open University

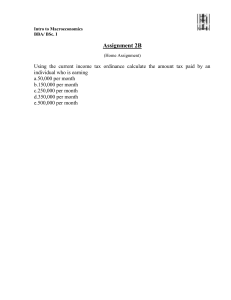

advertisement