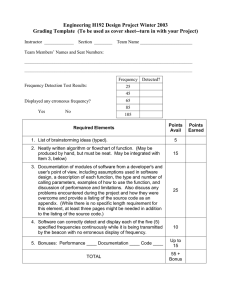

lOMoARcPSD|13931487 Bank Reconciliation problem with solution Accounting (Mindanao State University) Studocu is not sponsored or endorsed by any college or university Downloaded by Samantha Jane Labador (samantha2007schoolemail@gmail.com) lOMoARcPSD|13931487 In your audit of the cash account of Karen Mae Company, you hav ascertained the following data relative to the debits per books and credits per bank: Book Debits in February 400,000 Bank credits in February 360,000 CM for interest earned in January but taken up in the books in February 5,000 CM for interest earned in February but taken up in the books in March 6,000 Check from customer in January amounting to ₱40,000 but was taken up in the books as 4,000 Check from customer in February amounting to ₱20,000 but was taken up in the books as 4,000 Check by company issued to supplier in January amounting to ₱3,000 but was taken up in the books as ₱30,000 Erroneous bank credit- February 2,500 Erroneous bank charge- January 1,000 Deposit in transit- January 31 50,000 How much is the undeposited cash collections at the end of the February? c. ₱15,500 a. ₱47,500 b. ₱31,500 d. ₱46,500 Solution: Deposit in transit, beginning Add: Book debits for the month Less: CM recorded this month Error- check received (Jan) Error- check issued (Jan) Add: Error- check received (Feb) Total Less: Bank debits for this month Less: CM for this month Erroneous bank credit - Feb Erroneous bank charge - Jan Deposit in transit, ending 50,000 400,000 5,000 36,000 27,000 16,000 360,000 6,000 2,500 1,000 Downloaded by Samantha Jane Labador (samantha2007schoolemail@gmail.com) 348,000 398,000 350,500 47,500