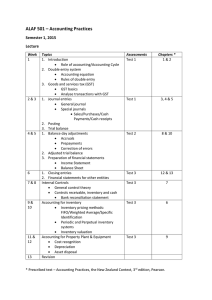

Chapter 2 → The Accounting Equation Assets A present economic resource controlled by an entity as a result of past events. An economic resource Liabilities A present obligation of an entity to transfer an economic resource as a result of past events Owner’s Equity The residual interests in the assets of an entity after the deduction of its liabilities Revenue Inflows of economic benefits in the form of increases in Assets, or savings in outflows in the form of decreases in liabilities that result in an increase in owner’s equity other than capital contributions Expenses Outflows of economic benefits in the form of a decrease in assets or increase in liabilities that result in a decrease of owner’s equity other than capital contributions Current An economic resource that will be used in the next 12 months Non Current An economic resource that will be used beyond the next 12 months Entity Assumption The assumption that the records of assets, liabilities and business activities are kept separate to those of the owner and other entities Going Concern Assumption The assumption that the business will continue to operate into the future and the records are kept on that basis Period Assumption The assumption that reports are prepared for a particular period of time, to obtain comparability of results Accrual Basis Assumption The assumption that revenues are recognised when earned and expense are recognised when incurred. This allows profit to be calculated accurately Relevance Qualitative Characteristic Relevance states that financial information must be capable of making a difference to decisions made by statement users. Relevant informations allows users to make decisions that affect the business’s financial position. Faithful Representation Qualitative Characteristic Faithful Representation states that financial information must be an accurate representation of real world economic events. The report should be neutral and free from error Comparability Qualitative Characteristic Comparability states that users must be able to identify and understand similarities and differences between financial reports from different periods Verifiability Qualitative Characteristic Verifiability states that all transactions must be supported by evidence to check its accuracy. Source documents must be retained Timeliness Qualitative Characteristic Timeliness states that information must be available to uses in time to make decisions Understandability Qualitative Characteristic Understandability states that financial information must be presented in a clear and concise manner so that users can understand the content The Accounting Equation The Balance Sheet This details the firm’s assets, liabilities and owner’s equity at a particular point in time and allows the owner to assess the firm’s current financial position. It is a visual breakdown of The Accounting Equation Double Entry Accounting A system that records at least two effects on The Accounting Equation on each transaction 1. Every transaction will affect at least two items in The Accounting Equation 2. The Accounting Equation must always balance Mark Up Markup % = 𝑠𝑒𝑙𝑙𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 − 𝑐𝑜𝑠𝑡 𝑝𝑟𝑖𝑐𝑒 𝑐𝑜𝑠𝑡 𝑝𝑟𝑖𝑐𝑒 x 100 Selling Price = Cost Price + (Markup % x Cost Price) Chapter 3 → The General Ledger The General Ledger This is part of the recording stage in The Accounting Process. Each item has its own ledger where transactions are recorded using Double Entry Accounting Liabilities + Owner’s Equity + Revenue Expenses + Assets Balancing the Ledger Trial Balance This is part of the recording stage in The Accounting Process. It lists each ledger account and its final debt or credit balance on balance day. This allows for a check of accuracy Errors Not Revealed by Trial Balance - Reversal of Debit and Credit - Incorrect value recorded in Debit and Credit - Omission of transaction - Correct values recorded in incorrect ledger - Duplication of transaction Errors Revealed by Trial Balance - Two Debit and Credit Entries - Inconsistent Values on Debit and Credit sides of ledger Chapter 4 → Cash Transactions: Documents, GST and The General Journal GST A 10% tax charged by the ATO on most goods and services. Businesses collect GST on behalf of the ATO which creates a liability account, owed to the ATO. GST has no effect on the Income Statement GST Liability and Settlement As businesses have a motive to make profit and mark up their products, the selling price is usually greater than the cost price. This results in a GST settlement The General Journal This is part of the recording stage in The Accounting Process. It is used to record and analyse each transaction before posting it to The General Ledger Source Documents Source Documents provide evidence that a transaction occurred and the details of the transaction. By ensuring that transactions are verifiable, source documents ensure that data is supported by evidence and can be checked to ensure the Accounting Report is providing a Faithful Representation of the firm’s transactions Chapter 5 → Accounts Payable: Documents, GST and The General Journal Credit Purchases Advantages: - Enhances Liquidity Position - Eliminates the need to make frequent purchases Disadvantages: - Ensure cash is available when payment is due - Records to Accounts Payable must be maintained Accounts Payable A supplier from whom goods and services have been purchases on credit, but have not yet been paid for Purchase Returns When the business returns an item to a credit supplier Effect on Accounting Equation A: Inventory↓ 360 L: Accounts Payable↓ 396 GST Clearing↓ 36 OE: Nil Discount Revenue The difference between the amount charged for a credit purchase and the amount paid. It is earned when an Account Payable is paid within the credit terms Accounts Payable Turnover An assessment of the businesses payments to credit suppliers. It measures the average time taken (in days) to pay Accounts Payable 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑃𝑎𝑦𝑎𝑏𝑙𝑒 APTO = 𝑁𝑒𝑡 𝐶𝑟𝑒𝑑𝑖𝑡 𝑃𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑠 x 365 Average Accounts Payable = 𝐴𝑐𝑐 𝑃𝑎𝑦 @ 𝑆𝑡𝑎𝑟𝑡 + 𝐴𝑐𝑐 𝑃𝑎𝑦 @ 𝐸𝑛𝑑 2 Need to speak about APTO with faster and slower Chapter 6 → Accounts Receivable: Documents, GST and The General Journal Credit Sales A transaction where foods or services are provided/sold but paid for at a later date Advantages of Credit Sales - Can increase sales as customer may be attracted to a delayed payment, increasing profit and revenue Disadvantages of Credit Sales - Possible liquidity problems can arise - Time and costs in maintaining Accounts Receivables - Possibility of bad debt Sales Returns The return of inventory by a credit customer Discount Expense A price reduction offered to customers in return for quicker payment of Accounts Receivables. Discount Expense results in a decrease in assets and a decrease in owner’s equity Accounts Receivable Turnover ARTO measures the speed at which Accounts Receivables are being converted into cash. ARTO should be compared to credit terms and past periods Managing Accounts Receivable - Screening of credit customers - Invoicing Accounts Receivables - Employing AR Clerk - Issuing monthly Statement of Account - Legal action Chapter 7 → Other Transactions: Documents, GST and The General Journal Memo An internal source document verifying that a transaction not involving cash happened - Non cash contributions by owner - Non cash withdrawals by owner - Establishment of double entry system - Inventory gain/loss - Balance Day Adjustments - Inventory write-downs - Correcting entries Commencement of Double Entry Chapter 8 → Recording and Reporting for Inventory Trading Firm A business that buys inventory for the purpose of resale at a profit Inventory Goods purchased by a trading business for the purpose of resale at a profit Perpetual Inventory A system of recording movements of inventory items on a continuous basis as cost price Inventory Card A record used to identify each individual transaction involving the movement of inventory in and out of the business at cost price (GST excluded) Identified Cost A method of valuing inventory by physically marking (in code) each item with its actual cost price FIFO (First In First Out) A method of recording inventory based on the assumption that the first items that come into the business will be the first to leave the business FIFO Sales Returns To determine the cost price of a sales return, use the last price in the OUT column FIFO Inventory Gain To determine the cost price of an inventory gain, use the last price in the IN column FIFO Inventory Loss To determine the cost price of an inventory loss, use the first price shown in the BALANCE column Chapter 9 → Valuing and Managing Inventory Product Costing The purchase price of inventory plus any costs incurred in getting the inventory into a location and state ready for sale. These costs have to be able to be logically allocated to each item of inventory Period Costing A cost incurred in getting inventory into a location and state ready for sale that can not be logically allocated to each item of inventory Higher Net Profit? Period Product Inventory Higher Cost of Sales Higher COGS Higher NP Higher Net Realisable Value Inventory is recorded at cost price unless NRV falls below its cost price. NRV is the estimated selling price less any costs incurred in selling, marketing or distributing inventory. Inventory Write-down An expense incurred in the application of lower of cost and NRV. There is a reduction in inflows of economic benefit which is due to the valuation of inventory being reduced from cost price to NRV Inventory Turnover A financial indicator that determines how quickly a business can convert its average inventory into sales Cash Cycle ITO + ARTO It represents the number of days it takes for a business to purchase inventory, sell it and collect the cash from Accounts Receivables Chapter 10 → Reporting for Profit Closing the Ledger This is a balance day procedure that resets all revenue and expense accounts to zero in preparation for the next reporting period. The balances are transferred to the P/L Summary Account. The process ensures that only the relevant revenues and expenses to that period are included in the determination of profit/loss P/L Summary Account This is a temporary General Ledger Account that records all summarised totals for revenues and expenses in that period which enable the determination of profit/loss The Income Statement This is an accounting report prepared on balance day that details the revenues earned and expenses incurred in the same period. The outcome of the Income Statement is Gross and Net Profit/Loss Cost of Goods Sold This is a section in the Income Statement that includes all expenses incurred in getting the inventory into a location and state ready for sale Profitability The ability of a business to earn a profit Net Profit Margin (NPM) Measures the proportion of Net Sales Revenue that is retained as Net Profit Gross Profit Margin (GPM) Measures the proportion of Net Sales Revenue that is retained as Gross Profit Cost of Goods Sold Ratio 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑 x 100 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 Measures the proportion of Net Sales Revenue that is consumed by COGS Chapter 11 → Reporting for Cash Cash Flow Statement An Accounting Report used to show all the inflows and outflows of cash during the reporting period. These inflows and outflows are operating, investing and financing activities. A Cash Flow Statement: - Assesses the firm’s ability to meet its obligations as they fall due - Considers how the firm has generated cash flows and how it may generate future cash flows - Assesses any trends in the way the firm is financing its operations and to evaluate alternative means of obtaining finance Operating Activities Relates to cash flows from the provision and purchase of goods and services, in the day to day operation of the business. Investing Activities Relates to the cash received from the purchase or disposal of non current assets Financing Activities Relates to a change in the financial structure of the business Cash Flow Cover This measures the capacity of the business to meet short term cash commitments in the next 12 months Cash in Cash vs Net Profit Reasons for differences: - Some items only affect P/L - Some items only affect cash - Some items affect both by differing values Revenues that are not receipts: - Credit Sales - Discount Revenues - Inventory Gain Receipts that are not revenues: - GST Collections - ATO refund - Customers - Collections from Accounts Receivables - Cash Capital Contributions - Loans Received Expenses that are not payments: - Cost of Sales - Inventory Loss - Discount Expense - Inventory write-down - Inventory used for advertising Payments that are not expenses: - GST payments - ATO settlement - Suppliers - Cash Purchase of Non Current Asset - Cash Drawings - Payment to Accounts Payable - Loan Repayments - Cash Purchase of All Assets Chapter 12 → Balance Day Adjustments - Prepaid and Accrued Expenses Period and Accrued Expense Accurate Profit and Loss determination for the period is based on the matching of relevant revenues earned against relevant expenses incurred during the period regardless of cash flows because some transactions go across multiple periods, they require balance day adjustments. The Accounting Process on Balance Day Prepaid Expenses These are expenses paid in advance for services or benefits to be provided or consumed in the future within the next 12 months, reported as a current asset Accrued Expenses These are expenses that have been incurred during a period but not yet paid, and thus must be reported as an expense relevant to the period, due to accrual basis. An expense incurred in the current period but has not yet been paid, since it has been consumed it is an expense in the current period thus creating a current liability Effect on Accounting Equation Pre Adjusted Trial Balance This is a list of general ledger accounts with debit and credit balances at the end of a period prior to recording BDA and correcting entries Adjusted/Post Adjusted Trial Balance This is a list of general ledger accounts after corrections and balance day adjustments have been made Chapter 13 → Accounting for Non Current Assets - Part 1 Cost of a Non Current Asset The original purchase price of the NCA and any costs in getting the asset into revenue generating capacity, for use which will provide benefit for the life of the asset Depreciation of NCA - Straight Line Method The straight line method is a constant or equal amount that represents the constant consumption of the NCA in each reporting period. It should be used when the NCA will contribute equally to revenue earning over its useful life Depreciable cost represents that part of the historical value that will provide economic benefit to the business over its useful life Depreciation Expense Residual Value Scrap or salvage value being the expected amount that can be recovered on the disposal of a NCA. It represents an estimate of the remaining economic benefit for future consumption by a different entity Depreciation Expense The allocation of the cost of a NCA as an expense representing its consumption in each year of its useful life Accumulated Depreciation A negative NCA account that represents the total depreciation for the NCA from its purchase day Carrying Value The part of the NCAs historical cost which has not yet been consumed and will provide future economic benefit to the business Chapter 14 → Accounting for Non Current Assets - Part 2 Reducing Balance Method of Depreciation A method of depreciation that is used on NCAs with a diminishing revenue generating pattern. NCAs that have a greater revenue generating capacity in their earlier years and diminish and contribute less to revenue as they age, require the reducing balance depreciation. Carrying Value = Historical Cost less Acc Dep Straight Line vs Reducing Balance Cash Disposal of a NCA Investing Activities - Proceeds on Disposal of NCA + Cash Purchase of NCA Other Expense/Revenue - Profit/Loss on Disposal of NCA Loss on Disposal of NCA Profit on Disposal of NCA Impact on Accounting Equation A: Equipment ↓2000 Bank ↑1100 L: Nil OE: Loss on Disposal of Equipment ↓900 Trade in of Non Current Asset Proceeds from the disposal of a Non Current Asset is in the form of a reduction in the amount payable for the purchase of a new Non Current Asset Impact on Accounting Equation A: Desk↓ 700 Desk↑ 3900 Bank↓ 3990 OVERALL↓ 790 L: GST Clearing↓ 390 OE: Loss on Disposal ↓400 Cash Flow Statement Operating GST Paid (390) Income Statement Other Expenses Loss on Disposal of Desk 400 Investing Desk (3600) Loss on Disposal of Non Current Asset Proceeds/Trade In Allowance < Carrying Value Business has under depreciated NCA overstating the carrying value Business has overstated the useful life or residual life Non Current Asset is in worse condition than expected Profit on Disposal of Non Current Asset Proceeds/Trade In Allowance > Carrying Value Business has over depreciated NCA understating the carrying value Business has understated the useful life or residual value Rise in demand for NCA Chapter 15 → Bad and Doubtful Debts Bad Debts A debt that is written off as irrecoverable due to bankruptcy, insolvency or an inability to locate the Accounts Receivable. Bad Debts are expenses as there is a reduction of economic benefit causing assets to decrease leading to a decrease in owner’s equity Action to Decrease Likelihood of Bad Debt - Offering discount for quick settlement - Sending invoices and reminder notices - Threatening legal action Doubtful Debts A debt that is unlikely to be collected in the future but has not yet been written off as there has not been a confirmation that the Account Receivable is unable to pay Faithful Representation Must report as although it is not verifiable, it is still more accurate than reporting Accounts Receivable in full and provide complete information Relevance Information regarding the possibility of bad debts occurring would affect decision making regarding Accounts Receivable Management Doubtful Debts Calculation The income statement approach is where it is estimated as a percentage of net credit sales Allowance for Doubtful Debts A negative asset account based on predictions of future bad debts for amounts outstanding that are unlikely to be collected in the future Impact on Accounting Equation A: Allowance for Doubtful Debts ↓2340 L: Nil OE: Bad Debts Expense ↑2340 Writing off a Bad Debt Impact on Accounting Equation A: Accounts Receivable ↓1650 Allowance for Doubtful Debts ↓1500 L: GST Clearing ↓150 OE: Nil Balance Day Adjustment - Next Period If there is a balance in the Allowance for Doubtful Debts Account, it means last periods bad debts expense was overstated. To compensate the business must understate the bad debt expense in the next period Chapter 16 → Balance Day Adjustments - Revenues Liability Approach A method of accounting where the initial receipt of revenue not yet earned is treated as a current liability, with a subsequent transfer of the amount earned to a revenue account on balance day. A cash inflow has created a present obligation for future economic sacrifice to provide the good/service, a current liability Unearned Revenue A current liability that arises when cash is received in advance for revenue that is yet to be earned GST Collections - Received on unearned services revenue - Received on fully collected unearned sales revenue - Not collected on a deposit on unearned sales revenue Impact on Accounting Equation A: Bank ↑4620 L: Unearned Rent Revenue ↑4200 GST Clearing ↑420 OE: Nil Balance Day Adjustment Revenue recognised involves a decrease in the outflow of economic benefits in the form of a decrease in current liabilities (Unearned Revenue) Unearned Revenue Deposit Sales with a This happens when a new product is released, a customer pays a deposit to secure the item or to guarantee the sale Impact on Accounting Equation A: Bank ↑820 Inventory ↓650 L: Unearned Sales ↓500 GST Clearing ↑120 OE: Sales ↑1200 Cost of Sales ↑650 Accrued Revenue A business has earned revenue in the current period but has not yet been received. The Accrual Basis Assumption requires the recognition of revenue in the period it was earned Term Deposit An amount of cash invested with a bank that is deposited for a set duration of time to generate interest revenue Impact on Accounting Equation A: Bank ↑450 Accrued Interest Revenue ↓375 L: Nil OE: Interest Revenue ↑75 Chapter 17 → Reporting for Cash Budgeting A process of predicting or estimating financial consequences of future events - An advisory report Used for planning and reflection Budgeted Cash Flow Statement Budgeted Income Statement Budgeted Balance Sheet Purpose of Budgeting Assists planning in predicting what is likely to occur in the future and allows owner to prepare to encounter possible problems Aids decision making by providing a benchmark against which actual performance can be compared and allows owner to identify area that are performing unsatisfactorily Sales Budget This is a report that includes the estimated sales for a future period This helps to make decisions about inventory purchase, staffing and advertising Variance % = 𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑉𝑎𝑙𝑢𝑒 x 100 Budgeted Cash Flow Statement This forecasts all future expected inflows and outflows of cash and the start and end cash balance. This can help us to measure liquidity as it will indicate the businesses ability to meet its short term debts. Ideally, cash flows from Operating Activities will be positive but the owner will be warned if it is expected to be negative. Strategies to increase expected cash inflows: - Increasing sales (advertising) - Increasing Receipts from Accounts Receivables (discounts, reminders) - Cash Capital Contribution - Loan Strategies to decrease expected cash outflows: - Slower payments to Accounts Payables - Credit Purchases from suppliers - Decrease Drawings Calculating Cash Flows: - Cash Flows from Sales - Receipts from Accounts Receivables - Payments to Accounts Payables