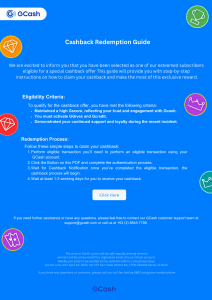

ck h Ba Cas Air M iles What Credit Card to Get? Contents #1: Choosing the Right Card #2: Cashback vs Miles #3: Simplified Analysis s o ing o h C h t g i c r a rd e h t Step 1: Categorise Your Expenses (food, transport, bills etc) Step 2: Decide between Cashback vs Miles Cashback: Cash is King Miles: Fly like a King Step 3: Compare the available Cards! Spend of <$500/mth: Get cards without min. spend Spend of >$500/mth: Get cards with more cashback/miles per $ spent! DID YOU KNOW?? ♥️ If you travelling but can't hit the minimum spend of >$500/mth, certain Miles Cards might be suitable for you! (no min. spend) Cashback Miles Citi Cashback+ Team #Cashback Citi Cashback 1.6%, no min. spend Up to 8%, min. $800 spend SC Smart UOB Absolute Up to 6%, no min. spend 1.7%, no min. spend DBS Altitude Up to 10 miles per $, no min. spend Team #Miles HSBC Revolution 4 miles per $, no min. spend Hybrid for High Earners DBS Vantage Card Click for Higher Bonuses HERE!! contact us! d e i r t C C a E E r d R F A l a n i a c n l y a s n i i s F REFERENCE(S) HTTPS://WWW.MONEYSMART.SG/CREDIT-CARDS *Disclaimer: The information and publication is not intended to be and do not constitute financial advice. For investment advice, please perform your due diligence or seek advice from your financial consultant.