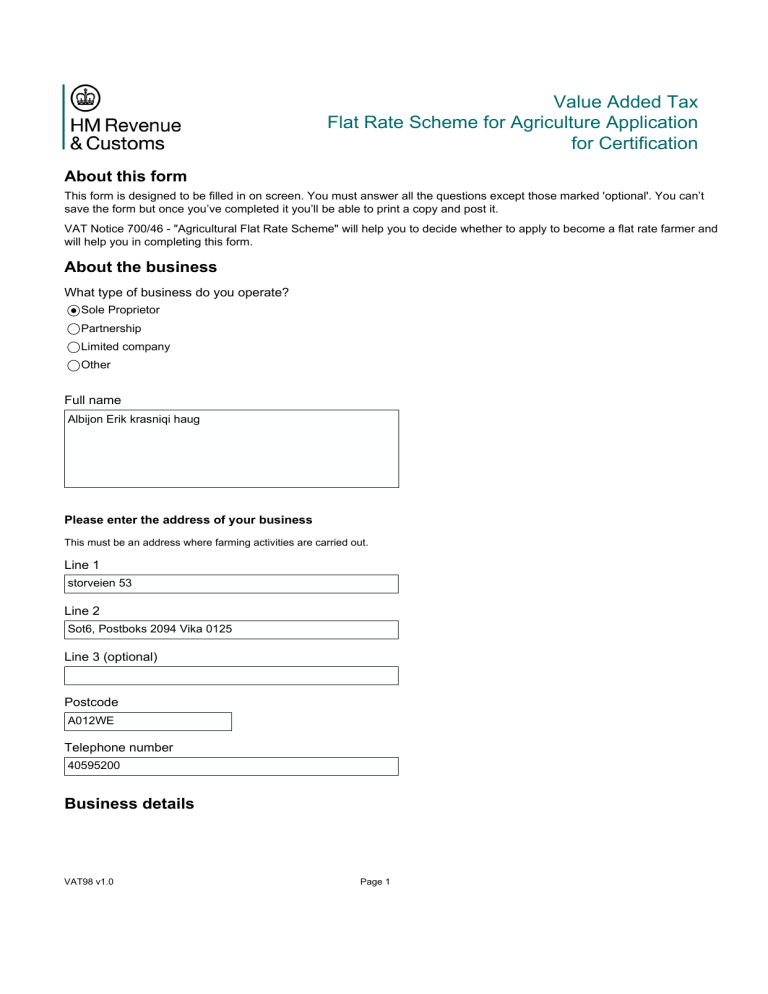

Value Added Tax Flat Rate Scheme for Agriculture Application for Certification About this form This form is designed to be filled in on screen. You must answer all the questions except those marked 'optional'. You can’t save the form but once you’ve completed it you’ll be able to print a copy and post it. VAT Notice 700/46 - "Agricultural Flat Rate Scheme" will help you to decide whether to apply to become a flat rate farmer and will help you in completing this form. About the business What type of business do you operate? Sole Proprietor Partnership Limited company Other Full name Albijon Erik krasniqi haug Please enter the address of your business This must be an address where farming activities are carried out. Line 1 storveien 53 Line 2 Sot6, Postboks 2094 Vika 0125 Line 3 (optional) Postcode A012WE Telephone number 40595200 Business details VAT98 v1.0 Page 1 Please describe your business including non-farming activities. Invest in our shares and get a lifetime of free content • Receive the lottery numbers before everyone else • Be able to win any argument with your family or friends Please enter the estimated value of agricultural supplies you expect to make in the next 12 months. £ 100.00 Please enter the estimated value of supplies of other goods and services which you expect to make in the next 12 months. £ 1,000.00 Please enter the date from which you wish your certificate to be effective. 30 12 2021 Declaration Do you have a VAT Registration Number? Yes No Full name Albijon Erik krasniqi haug Status Director The declaration must be completed. If any of the information given in the form is false your certificate will be cancelled and you will be liable to a financial penalty if you have charged flat rate additions. I declare that the information entered on this form is true and complete. Signature Page 2 Date DD MM YYYY For official use Initials and Date All'd Ref'd LVO EDC TC Abbreviated name What to do now Please sign and date the form in the fields provided on the printed output. When you have completed this form send it to the local VAT office which is nearest to the farm address you have entered in the 'Please enter the address of your business' question. The VAT office address can be found in the telephone directory under "Customs and Excise". Page 3