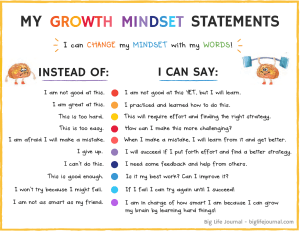

Who do you think is your worst enemy when it comes to getting rich? I’ll tell you the answer: it’s you , and you might not even realize it. This is because if we don’t try to understand our own minds, they will work against us. It can be hard to get rich, and you should use every edge you can to make sure you get a piece of the pie. Mistake #1 – Lifestyle inflation Let’s start with this one since many people just don’t get it. Lifestyle inflation, also called “lifestyle creep” is when a person’s spending goes up at the same rate as their income. When people make more money, they often think they can buy more or live better, which leads to them spending more. This extra spending can come in many forms, like buying a more expensive home , or a high-end car, luxury goods, or even just going out to eat more often. It’s normal to want to improve your standard of living. But the problem with lifestyle inflation is that it can make it hard to save a lot of money. This is because people are spending their extra mone y instead of putting it in the bank . Even though you’re making more money, you may not be getting closer to your long-term financial goals. Let’s say a person gets a $10,000 yearly raise… Instead of saving or spending that extra money, they decide to move to a more expensive apartment that costs $800 more per month. At the end of the year, they’ve spent an extra $9,600, which is almost all of their raise. Their savings have stayed the same. Lifestyle inflation can be troublesome because it can be hard to stop. When you’re used to a certain level of living, it can be hard to try to live on less. It’s important to have a clear budget and financial goals to avoid living inflation . When you get a raise or some other extra money, think about how you can use it to help you reach your financial goals. This doesn’t mean you can’t raise your standard of living, but you should do it in a way that lets you save and spend at the same time. It’s all about finding the right mix and making smart decisions. Remember that even if you had a trillion dollars in your bank account right now, you could look around the Internet and find something to buy with all of them. Think about that for a while. Mistake #2 – Herd Mentality You’ve probably already heard about this one. In life, if the group is moving in a haphazard way in one direction, it’s usually best to go the other way. Here’s how it works: People often use the term “following the herd” to describe a way of thinking in which people make decisions based on what everyone else does instead of using their own judgment or analysis. This is an example of what psychologists call “ herd behavior ” Here’s how this mindset mistake can keep you from becoming wealthy 1) Investing in trends – People often decide to invest in something new because everyone else is doing it. This could be a stock, an industry, or an asset class like Bitcoin, but they might not fully understand the trade or even give a thought to how well it fits with their financial goals. If the trend turns out to be a bubble, like the dot-com bubble in 2000 or the housing bubble in 2008, people who joined the trend late could lose a lot of money. 2) Ignoring fundamentals - When people do what everyone else does, they often forget about basic financial analysis. Instead of looking at a company’s revenue, earnings, debt, and other financial indicators, they make choices based on how well-known it is. This can lead to bad investment results. 3) Lack of Diversification - When people do what everyone else does, they may be drawn to the same types of purchases that are popular at the time. If these products don’t do well, this lack of diversification can make the risk higher. Remember, if you want to build wealth, it’s important to make decisions based on your personal financial goals. Consider how much risk you’re willing to take and thoroughly study. If you follow the crowd without thinking about these things, it can cost you a lot of money, if not all your money. It’s also important to keep in mind that what works for some people might not work for you. This shows how important a personalized investment plan is. Mistake #3 – FOMO (Fear of missing out) Now, this one could have been used as an example in the last point, but I thought it needed a more detailed explanation. If you spend a lot of time on Reddit in places like Wall Street Bets, you have probably already heard about this. “FOMO” which is short for “fear of missing out” is a psychological name for worrying that other people might be doing fun things that you are missing out on. People with this kind of social anxiety are always curious about what other people are doing. FOMO often shows up in the financial world as a fear of missing out on possible gains. This makes people make hasty investment decisions based on what they think other people are getting. This mistake can hurt your efforts to get rich when it comes to money and investing . When investors have FOMO, they often act on a whim. For example, they might buy a crypto that is going up quickly without first doing their research. This can make people buy at the top prices, only to see the price go down afterward. Fear of missing out (FOMO) can also make investors give up on their carefully planned investment strategies. This makes them more likely to be hurt by risk and change. FOMO can also keep people from building wealth over time because it makes them think in the short term. Usually, it takes a long time, smart investment, and a long -term view to get a lot of money. These moonshots where someone claims to have made millions of dollars from a small investment, are no more than a trap for everyone else, and whoever achieve such “insta-wealth” will likely be in bad shape in the not so distant future, as they have 0 financial knowledge and their brain processing is unlikely to be at the required level in order to manage this wealth, and multiply it. Fear of missing out (FOMO) makes investors want to get something right away and forget how powerful steady, long-term buying can be. This can lead to a cycle of buying things quickly, often at the wrong time, which can hurt future earnings and slow the growth of wealth. Because of this, it’s important to make investment choices based on thorough research and good financial planning, not on feelings and the fear of missing out. Mistake #4 – FUD (Fear, Uncertainty, Doubt) In the same way, FUD can be just as bad as FOMO, or even worse. Fear, uncertainty, and doubt are what “FUD” stands for. It’s a term that’s often used in business and investing. It describes a plan to spread bad, vague, or false information about a market in order to hurt or control it. When it comes to investing, FUD can cause people to make decisions based on their feelings instead of facts. This can cause them to sell off their investments too soon or not invest in chances that could give them big returns. This mindset mistake basically means that you don’t know what you’re doing . FUD can be very strong in volatile markets, like cryptocurrenc ies. Here, prices can change a lot in a short amount of time. FUD can be spread by the media, people with a lot of power , or other people in the market, and it can make people sell quickly, or hesitate to spend. People’s emotional responses to FUD can make it hard for them to make smart choices about their investments. This can cause them to miss out on possible gains or lose money. To get past FUD, you need to keep a long-term view, do detailed research, and make well-informed decisions . Forget about reacting on the spot to bad news or market volatility. It’s important to know that markets naturally go up and down and that changes are a normal part of investing. You can lessen the effect of FUD on your path to financial success by staying informed, sticking to a well-thought-out investment plan, and refusing the urge to make decisions based on fear. Short-term thinking Pay extra attention to this one. It has a lot to do with wanting things right away, which may be the hardest mindset mistake to fix. When it comes to money, short-term thinking means putting instant gains ahead of long term success and sustainability (insta-gratification) It means paying more attention to the present and the near future and less attention to the far future. For instance, someone might choose to spend money on things that aren’t necessary right now instead of spending it for growth in the future. Or, when it comes to investments, they might choose choices that pay off quickly instead of ones that pay off more in the long run. Short-term thought can make it hard to build up wealth for a number of reasons . First, you’re more likely to make hasty financial choices. Spending money you don’t need to or making risky investments can drain your money over time. If you’re always looking to make a quick buck, you might miss out. The power of long-term, compound growth, is the key to making a lot of money. Second, thinking in the short term can stop people from saving and investing regularly. Getting rich is usually a slow and steady process that takes patience and focus. When you’re only thinking about the short term, it’s easy to forget about or undervalue these habits. This way of thinking can also make it harder to plan for the future. Setting and sticking to financial goals becomes increasingly difficult. In the end, having a long-term view is a key part of financial planning and building wealth. The Gambler Mindset Ah, yes, that’s the most usual sign that people don’t know enough about money. The worst part is that this way of thin king can be the most addictive because it’s linked to getting things right away. The gambler’s mindset is a way of thinking in which people treat investing like gambling. A lot of faith in luck, making high -risk bets in hopes of getting big returns quickly, and letting their feelings guide their decisions. This way of thinking often makes people act on impulse, like jumping on the latest “hot” investment. People making this mindset mistake are more likely to fall for schemes that offer high returns with little to no work or risk . This way of thinking can keep people from getting rich because it ignores the basic rules of long-term investing. Gamblers tend to think about short-term gains, which in return can cause them to lose a lot of money when high-risk bets don’t pay off. It also makes people more likely to make hasty choices based on short term changes in the market, instead of making plans ahead of time. People who think like gamblers often miss out on the benefits of long term and disciplined spending, like compound interest and steady wealth growth. You don’t believe in your potential Believing in yourself is important for reaching any goal, but especially for getting rich. If you don’t think you can get rich, you might unconsciously put up hurdles that stop you from getting rich. You might be less likely to take calculated risks or make the sacrifices needed to make money, like spending time on school, starting a business, or working hard to move up in your job. By making this mental mistake, you might put things off, miss opportunities, and not use your full ability. Also, not believing in your ability to get rich can affect how and what you do with your money. For example, you might have a “scarcity mindset” in which you think there’s never enough money, which can lead to stress and bad choices about money. Or, you might not bother making a financial plan, a budget, or a way to save money. That happens because you don’t see the point if you don’t think you can get rich. If you don’t handle your money well, you might end up living from paycheck to paycheck, which makes it hard to build wealth over time. The first step toward breaking these habits and getting ahead financially is to believe in yourself. I know it’s difficult, especially if there’s nobody there to help you through it. You are afraid of failure Ever tried? Ever failed? No matter. Try Again. Fail again. Fail better . Because mistakes, are where we learn the most. Fear of failing is one of the biggest mental blocks that can stop you from getting ahead financially. This fear often makes you afraid of taking risks, which makes you avoid chances that have any level of uncertainty or risk. Even though it’s smart to avoid taking unnecessary risks, being too careful can cause you to miss out on investments or business opportunities that could be profitable. Also, this mindset mistake can stop people from coming up with new ideas and being creative . Fear of failure can make it hard for you to get ahead financially. It keeps you from trying new things and getting out of your comfort zone. Fear of failure can also make you think that there isn’t enough to go around. This can lead to making choices based on the fear of losing money instead of the chance to make money. This could cause you to hold on to investments that aren’t making money for too long. Or to not spend at all, meaning you miss out on the benefits of compound interest over time. Also, it might keep you from learning important lessons from mistakes and failures, which are often important steps on the way to success. In the end, getting over your fear of failing is important for your path to wealth. It lets you take advantage of chances, learn from your mistakes, and keep going when things get tough. You don’t execute your ideas If you don’t act on your ideas, you might not be able to make money. That’s because ideas don’t make money, actions do. Ideas are the seeds of possible wealth, but you have to act on them to make that wealth come true. If you have a great idea for a new business, product, or service, you won’t be able to make money from it until you take steps to make it happen, like writing a business plan, making a sample, or looking for investors. By not taking action, you leave money o n the table . Also, putting ideas into action often requires learning new skills and overcoming obstacles, both of which can lead to more ways to make money. By not following through on your ideas, you can develop a bad attitude of inaction and missed chanc es. If you keep letting your thoughts stay just that, you may get into the habit of not following through. This can hurt your personal growth and your ability to make money. Also, things are always changing in the world of busines s. An idea that is new and might make money now might not be so in the future. If you don’t act on your idea right away, you might miss the best chance to make money from it. You never finish anything you start If you don’t finish what you start, it will be much harder to get ahead financially. Consistency and persistence are the keys to making money. Whether it’s starting a business, learning a new skill, or trading in the stock market, starting a project often takes time, effort, and resources. When you always stop projects in the middle, you don’t see the possible returns on your efforts. You also waste the time and money you’ve already spent, which you could have used to do something more useful. This mindset mistake can keep you from getting rich since most projects pay off when they are finished, not at the start . Also, not finishing chores can hurt your reputation and credibility, especially if you do it a lot at work or in business. Reliability and trustworthiness are important if you want to build good relationships, ge t customers, and stay ahead of the competition in business. People may be less likely to invest in your ideas, buy your goods or services, or recommend you to others if they think you don’t follow through. This could make it harder for you to make money and build wealth. Also, every job that isn’t finished is a chance to learn and grow that isn’t taken, which can hurt in the long run because learning and growing are important parts of making money. These are what I consider to be the most common mindset mistakes that prevent people from getting rich. In the case you’re making any of these, don’t waste any time and fix them. It may impact your entire life.

![-----Original Message----- [mailto:] Sent: Saturday, March 19, 2005 12:55 AM](http://s2.studylib.net/store/data/015586592_1-9284065775c2c8448f23d0ece525b0be-300x300.png)