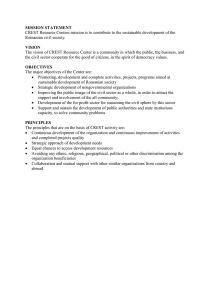

Exam Number: F11079 Word Count: 1500 CRANFIELD SCHOOL OF MANAGEMENT Full Time MBA Programme 2011/12 Term: 1 Part: 1 Financial Management WAC This assessment/report is all my own work and conforms to the University’s regulations on plagiarism An identical copy of this document has been submitted to the Turnitin system Dairy Crest’s Financial Performance Contents 1. Executive Summary 1 2. Introduction 2 3. Discussion of Financial Ratios 2 3.1 Profitability Ratios 2 3.2 Efficiency Ratios 3 3.3 Liquidity Ratios 3 3.4 Financial Gearing Ratios 4 3.5 Investment Ratios 5 4. Conclusion 5 5. Appendices 7 i Dairy Crest’s Financial Performance 1. Executive Summary The report analyses the position and performance of Dairy Crest Plc using financial ratios derived from their 2011 published accounts. Financial strengths and weaknesses of the business are highlighted by comparing the 2010 and 2011 results. Key ratios are also compared with two industry peers in order to benchmark Dairy Crest’s financial performance. 2011 saw a better profitability performance in terms of return on capital employed and operating margin compared to its 2010 results. However, return on ordinary shareholders’ funds of Dairy Crest declined by 13% from 2010 figures. In comparison to its peers, its 2011 return on capital employed and operating margin were the least. 2011 liquidity ratios were a bit of a concern compared to 2010 figures as well as to the liquidity ratios of Dairy Crest’s peers. As liquidity is a signal of the capacity of a business to survive, the decline in the company’s ability to meet its current maturing obligations may worry creditors of the business who may react by recalling credit facilities early or by refusing to offer further credit. Although ratios provide a simple and useful method of analysing business performance, they have a number of limitations. One of such limitations is the quality of the financial statements - ratios will inherit the limitations of the financial statements on which they are based. Other limitations include the effects of inflation on financial information, the restricted vision of ratios, difficulty in finding a suitable benchmark company due to differences between businesses and the snapshot nature of the balance sheet which could lead to misrepresentation of the financial position of the business. 1 Dairy Crest’s Financial Performance 2. Introduction This report analyses the position and performance of Dairy Crest Plc using financial ratios derived from their 2011 published accounts (see Appendix I-III). The company’s performance in 2010 is compared to that of 2011 using profitability, efficiency, liquidity, gearing and investment ratios in order to highlight financial strengths and weaknesses. Dairy Crest’s 2011 performance is then compared to two of its peers, Cranswick Plc1 and Devro Plc2, from the Food Products sector of the Financial Times, in order to benchmark performance. 3. Discussion of Financial Ratios The financial ratios used to analyse the performance of Dairy Crest are presented in Appendix V – VI. The discussion of the analyses and interpretation of the ratios are discussed under the following headings: 3.1 Profitability Ratios The 2011 published accounts show a significant dip in the return on shareholders’ funds by 13.2% from 2010 figures. Although profit for 2011 rose by 9.5% to £57.5 million, total shareholders’ equity increased by a larger percentage of 24.8%, due to an increase in retained earnings, thus cancelling any effects of the higher 2011 profits. Return on capital employed (ROCE) and operating margin rose slightly by 4.1% and 4.8% respectively from 2010 figures. Gross profit margin remained unchanged despite the improvement in operating margin as the proportion of cost of goods sold to group revenue stayed constant. Compared to the 2011 performance of the benchmarks, the ROCE of Dairy Crest was 22.7% and 73.1% lower than that of Cranswick and Devro respectively. Despite having 1 Cranswick Plc is engaged in the production and supply of food products in the UK and is listed as a peer to Dairy Crest on FT. 2 Devro Plc is a supplier of collagen casings for food in the UK and is listed as a peer to Dairy Crest on FT. 2 Dairy Crest’s Financial Performance a much higher operating profit, Dairy Crest was less effective in generating operating profits compared to the average long-term capital invested in the business.3 The 2011 operating margin of Dairy Crest is similar to that of Cranswick. However, the operating margin of Devro is about 200% more than those of the other two peers. Despite a huge group revenue, Dairy Crest incurred equally huge operating expenses both in 2010 and in 2011 compared to the two peers. Thus for every £1 of sales revenue in 2011, an average of 6.21p was left as operating profit, after paying the cost of goods sold and other operating expenses. 3.2 Efficiency Ratios In 2011, Dairy Crest’s average inventories turnover period and average settlement period for trade payables increased by 8.7% and 8% to 53 days and 24 days respectively. Raw materials and consumables as well as finished goods inventories both increased in 2011 while the cost of sales decreased slightly. As inventories are usually expensive to hold, a shorter inventories turnover period is preferred to a long one. Therefore, the company may have pertinent reasons for increasing inventory held perhaps in anticipation of a rise in raw material prices or a possibility of a supply shortage. The increase in the average settlement period for trade payables is desirable in order to free up funds. However, such a policy may result in the loss of goodwill of suppliers if it is taken too far. The sales revenue per capital employed dipped slightly in 2011 due to lower group revenue with the capital employed remaining more or less the same. However, sales revenue per employee increased but only due to a reduction in the number of employees by 708 between 2010 and 2011. 3.3 Liquidity Ratios A food products company such as Dairy Crest would be expected to have a relatively low current ratio as it holds mainly fast moving inventories and a significant part of its 3 Operating profit before exceptional items is used for calculating all ratios. 3 Dairy Crest’s Financial Performance sales would be made for cash. However, all the liquidity ratios deteriorated in 2011 compared to 2010 values showing a general decline in the ability of the business to meet its maturing obligations. This is attributed to an increase in current liabilities mainly as a result of short term borrowing increasing by a massive 29 times and trade and other payables increasing by about 18%. At 1.02, a decrease of 19% from 2010, the current assets are just sufficient to cover the current liabilities of the company. However, as the inventory is excluded from acid test ratio, the value of the ratio (0.56) shows that Dairy Crest is unable to meet its current obligations with its remaining current assets. An even more alarming issue is the decrease by 39% from the 2010 figure for cash generated from operations to maturing obligations to 0.36. It would be expected that the company should be able to generate sufficient cash to cover it maturing obligations considering its relatively fast moving inventory of perishable food products. Compared to its peers Cranswick (0.84) and Devro (1.02), Dairy Crest is performing significantly lower with respect to the acid test ratio. Therefore, this performance is unlikely to be a sector wide phenomenon. However, the apparent liquidity problem may be planned and short term and of no real cause for concern for the business. 3.4 Financial Gearing Ratios4 The gearing ratio for 2011 decreased by 11%, compared to 2010 value, to 50.77% due to a net reduction in total financial liabilities (long term and short term) and an increase in retained earnings. Interest cover improved by 12% to 4.84 showing an improved capacity to meet maturing interest obligations. Therefore, despite the apparent liquidity issues, the operating profit of the business is able to cover interest payments by almost 5 times. Dairy Crest seems quite highly geared compared to Cranswick and Devro at 19.34% and 17.65% respectively. This has the advantage of increasing the return to shareholders but makes the returns more volatile by increasing its sensitivity to changes in operating profits. A gearing ratio of 50.77% compared to an average of 18% for both peers may 4 Long and short term financial obligations have been used in calculating gearing ratios. 4 Dairy Crest’s Financial Performance increase the perceived risk associated with Dairy Crest thus having an adverse effect on the share price as well as increasing the cost of the next tranches of capital. 3.5 Investment Ratios The dividend cover increased by 5% to 2.19 in 2011 due to a higher profit after tax. At 2.19, the dividend cover is in line with the company’s policy to maintain a level of dividend cover between 2.0 and 2.5 times5. Dividend yield also increased but mainly due to a decrease in the share price year on year while the dividend increased. Earnings per share increased by 6.4% to 43.20p. However cash generated from operations per share decreased by 12% to £96.17 due to a comparatively lower cash position in 2011. Price/earnings ratio reduced by 9% to 8.31 on 31st March 2011 compared to 31st March 2010. This signifies a lower market confidence in the growth of the business compared to 2010 perhaps due to an increased perceived risk as a result of lower liquidity ratios and return on shareholders’ funds. At close of trading today 15th June 2011, price/earnings ratio for Dairy Crest was 8.65 while those of Cranswick and Devro were 9.61 and 12.33 respectively.6 This means that the market expects Dairy Crest to perform less than its peers and hence investors are willing to pay less for the shares of Dairy Crest in relation to its earnings stream compared to its peers. 4. Conclusion 2011 performance of Dairy Crest saw a decline in key financial ratios compared to 2010 values. Return on shareholders’ funds and cash generated from operations per share decreased by 13.2% and 12.3% respectively. Furthermore, the company’s ROCE, operating margin, acid test ratio and price/earnings ratios were all lower than those of its two peers used as benchmarks. 5 6 From page 13 of the 2011 company accounts. Share prices obtained from www.stockopedia.co.uk 5 Dairy Crest’s Financial Performance The liquidity of the company in 2011 is a bit of a concern compared to 2010 figures as well as to the performance of the benchmarks. Creditors may react by recalling credit facilities early or by refusing to offer further credit. However, the lower liquidity may be planned and short term so may not be an issue after all. The underlying causes of these performance issues must to be investigated prior to making any bid for Dairy Crest Plc. 6 Dairy Crest’s Financial Performance 5. Appendices Appendix I7 Excerpts from the company’s published accounts from http://online.hemscottir.com/ir/dcg/download/Dairy-Crest-AR-2011.pdf 7 7 Dairy Crest’s Financial Performance Appendix II8 Excerpts from the company’s published accounts from http://online.hemscottir.com/ir/dcg/download/Dairy-Crest-AR-2011.pdf 8 8 Dairy Crest’s Financial Performance Appendix III9 Excerpts from the company’s published accounts from http://online.hemscottir.com/ir/dcg/download/Dairy-Crest-AR-2011.pdf 9 9 Dairy Crest’s Financial Performance Appendix IV Explanation of the Financial Ratios10 The ratios are grouped into five categories as follows: Profitability Ratios: These express the degree of profit made by the business in relation to other figures in the financial statements or to some business resource. Profitability ratios include: 1. Return On Ordinary Shareholders Funds Ratio (ROSF): 𝑃𝑟𝑜𝑓𝑖𝑡 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟(𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡)𝑙𝑒𝑠𝑠 𝑎𝑛𝑦 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 × 100 𝑂𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑠ℎ𝑎𝑟𝑒 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 + 𝑅𝑒𝑠𝑒𝑟𝑣𝑒𝑠 2. Return On Capital Employed (ROCE): 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 × 100 𝑂𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑠ℎ𝑎𝑟𝑒 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 + 𝑅𝑒𝑠𝑒𝑟𝑣𝑒𝑠 + 𝐷𝑒𝑏𝑡 3. Operating Profit Margin: 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 × 100 𝑆𝑎𝑙𝑒𝑠 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 4. Gross Profit Margin: 𝐺𝑟𝑜𝑠𝑠 𝑝𝑟𝑜𝑓𝑖𝑡 × 100 𝑆𝑎𝑙𝑒𝑠 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 Efficiency Ratios: These ratios measure the efficiency with which particular resources have been used in the business. Efficiency ratios include: 1. Average Inventories Turnover Period: 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑖𝑒𝑠 ℎ𝑒𝑙𝑑 × 365 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑠𝑎𝑙𝑒𝑠 10 McLaney, E. and Atrill, P. (2008). Accounting:An Introduction 4ed Essex: Pearson Education Limited 10 Dairy Crest’s Financial Performance 2. Average Settlement Period For Trade Receivables: 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑟𝑎𝑑𝑒 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 × 365 𝐶𝑟𝑒𝑑𝑖𝑡 𝑠𝑎𝑙𝑒𝑠 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 3. Average Settlement For Trade Payables 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑟𝑎𝑑𝑒 𝑝𝑎𝑦𝑎𝑏𝑙𝑒𝑠 × 365 𝐶𝑟𝑒𝑑𝑖𝑡 𝑝𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑠 4. Sales Revenue To Capital Employed ( Net Asset Turnover Ratio): 𝑆𝑎𝑙𝑒𝑠 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 𝑆ℎ𝑎𝑟𝑒 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 + 𝑟𝑒𝑠𝑒𝑟𝑣𝑒𝑟𝑠 + 𝑑𝑒𝑏𝑡 5. Sales Revenue Per Employee: 𝑆𝑎𝑙𝑒𝑠 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠 Liquidity Ratios: These ratios express the relationship between liquid ratios held and amounts due for payment in the near future. Liquidity ratios include: 1. Current Ratio: 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 2. Acid Test Ratio: 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠(𝑒𝑥𝑐𝑙𝑢𝑑𝑖𝑛𝑔 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑖𝑒𝑠) 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 Gearing Ratios: These measure the relationship between the contributions to financing the business made by owners vs. amounts contributed by others in terms of loans. Gearing ratios include: 1. Gearing Ratio: 𝐷𝑒𝑏𝑡 × 100 𝑆ℎ𝑎𝑟𝑒 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 + 𝑅𝑒𝑠𝑒𝑟𝑣𝑒𝑠 + 𝐷𝑒𝑏𝑡 11 Dairy Crest’s Financial Performance 2. Interest Cover Ratio: 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑝𝑎𝑦𝑎𝑏𝑙𝑒 Investment Ratios: These measure the returns and performance of shares from the perspective of the shareholders. Investment ratios include: 1. Dividend Pay-Out Ratio: 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑎𝑛𝑛𝑜𝑢𝑛𝑐𝑒𝑑 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟 × 100 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 2. Dividend Cover Ratio: 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑛𝑛𝑜𝑢𝑛𝑐𝑒𝑑 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟 3. Dividend Yield Ratio: 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 × 100 𝑀𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 4. Earnings Per Share: 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑡𝑜 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑠ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟𝑠 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑠ℎ𝑎𝑟𝑒𝑠 𝑖𝑛 𝑖𝑠𝑠𝑢𝑒 5. Price/Earnings Ratio: 𝑀𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 12 Dairy Crest’s Financial Performance Appendix V Financial Ratios for Dairy Crest Group Plc 2011 2010 % Change Profitability Ratios ● Return on ordinary shareholders’ funds (ROSF). 15.73 18.12 -13.2 ● Return on capital employed (ROCE). 14.79 14.22 4.1 6.21 5.93 4.8 29.45 29.42 0.1 ● Average inventories turnover period. 53.04 48.77 8.7 ● Average settlement period for trade payables.11 24.30 22.50 8.0 ● Sales revenue to capital employed. 2.38 2.40 -0.7 ● Sales revenue per employee. 0.25 0.22 9.1 ● Current ratio. 1.02 1.26 -18.9 ● Acid test ratio. 0.56 0.63 -12.0 ● Cash generated from operations to maturing obligations. 0.36 0.59 -39.3 50.77 57.07 -11.0 4.84 4.31 12.2 ● Dividend cover 2.19 2.09 4.9 ● Dividend yield ratio. 5.49 5.08 8.0 ● Earnings per share. 43.20 40.60 6.4 ● Cash generated from operations per share. 96.17 109.70 -12.3 ● Price/earnings ratio. 8.31 9.16 -9.3 ● Dividend per share 19.70 18.90 4.2 ● Operating profit margin. ● Gross profit margin. Efficiency Ratios Liquidity Ratios Gearing Ratios ● Gearing ratio. ● Interest cover ratio. Investment Ratios 11 Taken directly from page 47 of company accounts 13 Dairy Crest’s Financial Performance Appendix VI Key Financial Ratios for Dairy Crest Group Plc Compared to Cranswick Plc and Devro Plc ● Return on capital employed (ROCE). Dairy Crest 14.79 Cranswick Devro 18.15 25.60 ● Operating profit margin. 6.21 6.46 18.86 ● Acid test ratio. 0.56 0.84 1.05 ● Gearing ratio. 50.77 19.34 17.65 8.65 9.61 12.33 ● Price/earnings ratio on 15 June 2011. 14