Discounting, NPV, Annuities, and Project Comparison

advertisement

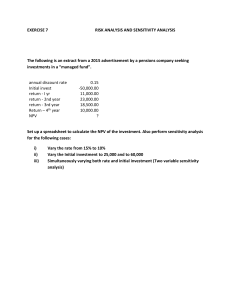

1. Discounting refers to the process of adjusting the value of future benefits and costs to their present value (PV) or future value (FV) equivalents. The formulas for PV and FV are as follows: PV = FV / (1 + r)^n FV = PV * (1 + r)^n Where: PV = Present value FV = Future value r = Discount rate (interest rate) n = Number of time periods To draw a timeline with benefits and costs, you would typically represent time on the horizontal axis and plot the values of benefits and costs at their respective time periods on the vertical axis. Each benefit or cost would be represented by a line segment indicating its magnitude and the time at which it occurs. 2. The timing of costs and benefits can vary. It can be at the beginning or the end of each year, depending on the specific context of the analysis. In the example timeline above, costs are occurring at the beginning of Year 1 and Year 2, while benefits are occurring at the end of each respective year. 3. The NPV (Net Present Value) criterion compares the present value of benefits (NPV(B)) with the present value of costs (NPV(C)). The formula for NPV is: NPV = Σ(PV of benefits) - Σ(PV of costs) In other words, calculate the present value of all benefits and subtract the present value of all costs to obtain the net present value. A positive NPV indicates that the benefits outweigh the costs, making it a favourable investment or decision. 4. The formulas for PV annuities, taking into account the growth of benefits, and PV of perpetuities with constant growth are as follows: PV of Annuity = C * (1 - (1 + r)^(-n)) / r Where: C = Cash flow or annual benefit amount r = Discount rate n = Number of years in the annuity PV of Perpetuity (with constant growth) = C / (r - g) Where: C = Cash flow or annual benefit amount r = Discount rate g = Growth rate of the benefits 1. Comparing projects with different time frames using the Roll-over method and Equivalent Annual Benefit (EAB) method: Roll-over method: This approach involves comparing projects by extending their shorter time frame to match the longer time frame. For example, if Project A has a time frame of 3 years and Project B has a time frame of 5 years, you would calculate the benefits and costs of Project A for 5 years by repeating the benefits and costs of the third year. Then you can compare the projects over the same time frame. Equivalent Annual Benefit (EAB) method: This method converts the benefits and costs of projects with different time frames into an equal annualized amount. By converting the cash flows into an equivalent annual stream, you can compare projects more easily. The EAB can be calculated using the formula: EAB = (Present Value of Benefits - Present Value of Costs) / Annuity Conversion Factor. 2. Converting between Real Values and Nominal Values: Converting from Real to Nominal: To convert a real value (adjusted for inflation) to a nominal value (current-dollar value), you would multiply the real value by the inflation factor. The inflation factor can be calculated as (1 + inflation rate). Converting from Nominal to Real: To convert a nominal value to a real value, you would divide the nominal value by the inflation factor. The inflation factor can be calculated as (1 + inflation rate). (tak sure yang ni dlm slide dr x detail haa huaaa) 3. Formula for real discount rate: The real discount rate is the rate used to discount future cash flows to their present value, taking into account the effects of inflation. It can be calculated using the formula: Real Discount Rate = (1 + Nominal Discount Rate) / (1 + Inflation Rate) 1. 4. Computing Net Present Value (NPV) when there is a horizon value: When there is a horizon value, the NPV calculation includes the present value of cash flows up to the horizon year and the present value of the horizon value itself. The formula for calculating NPV with a horizon value is: NPV = PV of Cash Flows (up to the horizon year) + PV of Horizon Value - Initial Investment. 5. Estimating horizon value: Estimating the horizon value involves projecting the expected value of the project beyond the planning period. Some methods for estimating the horizon value include: Simple projections: This involves projecting the expected cash flows of the project beyond the planning period based on assumptions about growth rates, market conditions, and other relevant factors. Salvage/Liquidation value: If the project involves physical assets that can be sold or liquidated at the end of the planning period, the salvage value or liquidation value can be estimated and included as the horizon value. Depreciated value: For projects with assets that depreciate over time, the estimated depreciated value of the assets at the end of the planning period can be included as the horizon value.