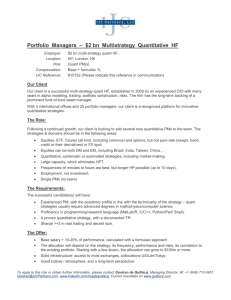

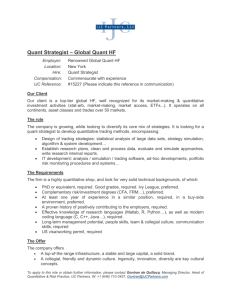

THE CQF CAREERS GUIDE TO QUANTITATIVE FINANCE MAY 2023 Awarded By Delivered By CQF CAREERS GUIDE | CONTENTS | 2 THANK YOU TO OUR RECRUITMENT PARTNERS CONTENTS We would like to express our thanks to the companies across the finance sector that have collaborated with the CQF to promote job opportunities to our alumni. Here is a selection of the companies we work with: 03 Introduction 04 The Increasing Demand for Quant Professionals 08 Quantitative Finance Career Paths 34 Succeeding in Your Job Search 37 Career Opportunities 43 Conclusion We also want to extend our gratitude to the recruitment companies that have contributed their expertise and time to The CQF Careers Guide to Quantitative Finance 2023. CQF CAREERS GUIDE | INTRODUCTION | 3 INTRODUCTION Produced by the CQF Institute, The CQF Careers Guide to Quantitative Finance 2023 is designed for people who are seeking insights on the current state of the industry, career opportunities, and skills needed in the field of quant finance. The CQF Careers Guide examines the quant landscape through the lens of recruiters, CQF Institute members, and CQF alumni, who offer their comments, stories, and survey responses to develop the picture for quants today. THE GUIDE COVERS SIX CAREER PATHS IN QUANT FINANCE: • Portfolio Management • Risk Management • Quant Strategies and Research • Data Science and Machine Learning • Technology • Quant Trading In each of these areas, this Guide will present a brief description of the skills needed, typical roles and responsibilities, and general salary ranges based on research from multiple sources including job websites, recruiter interviews, and industry publications. We look towards the future as well, with spotlights on growing areas of career opportunity in machine learning and quantum computing. This Guide provides a perspective on some of the best ways to prepare for the job opportunities and industry changes that lie ahead. This CQF Careers Guide also offers commentary on the value of further education. In a highly competitive environment, financial organizations are always seeking ways to apply innovative models and methods to generate returns and manage risk effectively. This requires skilled professionals with an understanding of finance, mathematics, and programming. Delivered by Fitch Learning, the Certificate in Quantitative Finance (CQF) is designed to meet this need as a versatile professional designation, where delegates enhance their knowledge and capabilities in each of these areas. In creating this Guide, we spoke to a number of quant recruiters and they all reported that 2022 was a year of increased demand for quants across the industry. Looking ahead, we expect to see continued demand for professionals with a strong quant skillset across many functions within financial services. Those with strong programming skills, expertise in machine learning, and an interest in the ever-changing global financial landscape will be well-positioned for job opportunities around the world. As we celebrate the 20th anniversary of the CQF program, we are delighted to present The CQF Careers Guide to Quantitative Finance 2023 to support your journey through the world of quant finance, with real-world alumni stories to showcase the various roles within the field and guidance on how you can gain the skills you need for a successful future career. Dr. Randeep Gug, Managing Director, CQF and CQF Institute CQF CAREERS GUIDE | INCREASING DEMAND | 4 THE INCREASING DEMAND FOR QUANT PROFESSIONALS CQF CAREERS GUIDE | INCREASING DEMAND | 5 THE INCREASING DEMAND FOR QUANT PROFESSIONALS The past few years have been turbulent times for financial markets. Challenges include the COVID-19 pandemic, the war in Ukraine, pressure on energy supplies in Europe, and rising inflation, which has driven some central banks, including the Federal Reserve in the US, to raise interest rates dramatically. Throughout this period, quants have played an important role in shaping investing and hedging strategies to meet investors’ needs. WHERE QUANTS WORK Quantitative finance is a branch of investment management that employs mathematical and statistical methods to analyze investment opportunities across a range of asset classes. Practitioners in quantitative finance work in equities, fixed income, structured products, commodities, foreign exchange, and derivatives. Specific areas include asset pricing, trading, hedging, portfolio analysis and optimization, risk management, and regulatory compliance. Quants are also increasingly involved in the world of artificial intelligence and machine learning, where the employment opportunities for data scientists have been growing dramatically. The financial industry encompasses a wide range of organizations, including investment banks, asset managers, hedge funds, prop trading firms, insurance companies, technology firms, and consultancies. For these types of employers, a key aspect for job candidates to consider is the division between the “buy side” and the “sell side” – a distinction that places emphasis on similar quantitative skillsets, but with different objectives. Essentially, the buy side is comprised of mutual funds, pension funds, foundations, endowments, and hedge funds (institutional investors), as well as high-net-worth individuals. These entities are focused on investing in securities and managing very large funds or substantial individual or family resources, including those overseen by private wealth managers and family offices. In contrast, the sell side is comprised of investment banks, market makers, and individuals who develop the products and services that the buy side is seeking. This entails the creation, promotion, and sale of stocks, bonds, currencies, commodities, derivatives, structured products, and other financial instruments to the buy side and through the public markets. Outside of the investment banks and large asset managers, quants can find roles in proprietary (“prop”) trading firms, where roles in research and trading are prominent. At insurance companies, quants are involved in portfolio and risk management, and within hightech firms and consultancies, roles lie in technology development, data science research, and regulatory compliance. The emergence of fintech has also created opportunities for quants, including roles related to high-frequency trading, machine learning, and cryptocurrencies, all of which require a strong quant skillset. Read more for additional insights on these facets of the financial services industry. Industry Insights In a poll conducted at the CQF Institute’s Quant Insights Conference in November 2022, over 50% of all respondents noted that one big challenge facing quantitative finance firms in 2023 would be geopolitical instability. CQF CAREERS GUIDE | INCREASING DEMAND | 6 THE INCREASING DEMAND FOR QUANT PROFESSIONALS ESSENTIAL SKILLS IN QUANTITATIVE FINANCE Quants work in different areas of finance and the domain knowledge varies for each specialization, but the essential skills for all quants draw on the same foundations. Core expertise for quants encompasses a solid grasp of mathematics and modeling techniques, knowledge of probability and statistics, and intermediate programming skills at a minimum. Quants are expected to learn on the job, but having a general understanding of the financial markets and demonstrating an interest in developing specific domain expertise are important during the interview process. Most of the people that we see usually have a bachelor’s degree in a quantitative subject and may have continued for a master’s degree as well. Some have gone all the way through to a PhD. They may be good at programming in Python, C++, or R, depending on their role and what type of business they are in. They are often enrolled in or alumni of the CQF, which we actively promote to our candidates since they can continue working full-time while completing the program. Patrick Flanagan, Clarence George In brief, the essential knowledge domains for quant finance can be described as follows: Mathematical Skills – Quants draw on a variety of mathematical methods, with a focus on probability, statistics, linear algebra, calculus, and differential equations, including PDEs and SDEs, for pricing assets from equities and bonds to structured products and derivatives. Programming Skills – Programming skills have become essential for quants. Traditional programming languages such as C and C++ have been popular for quants historically, and Python has become prominent, especially for data science, in recent years. Financial Skills – Even entry level quants should possess an understanding about the various asset classes and financial instruments available in the markets. Depending on their role within a financial firm, a quant will need to develop detailed knowledge of asset pricing techniques, trading methods, investment strategies, portfolio management, or risk management practices. Since each of these fields is quite complex, many people feel a need to continue their education beyond a bachelor’s degree, or equivalent undergraduate degree, and will often undertake programs in higher education and professional qualifications to bridge the gap. From a technical programming perspective, Python is pretty much everywhere at this point in time. I’ve heard it referred as the second-best language for everything, which I think is really testament to the versatility of the language. James Jarvis, Head of Research and Chair of the Investment Committee, Trium Capital CQF CAREERS GUIDE | INCREASING DEMAND | 7 THE INCREASING DEMAND FOR QUANT PROFESSIONALS EMPLOYMENT TRENDS IN QUANTITATIVE FINANCE For many financial industry participants, the first half of 2022 was quite active, with substantial hiring across banks, hedge funds, and tech vendors. As the markets entered a period of volatility, the demand for quants with expertise in credit, fixed income, and equity markets has remained strong. uring the previous years of the pandemic, there D was a big push for commodities quants. Now we are seeing a demand for credit and fixed income quants. Within the last six months, for investment banks and hedge funds, the credit risk space was the buzzword for obvious reasons – across the global markets, interest rates have a massive effect on credit and credit risk. James Holland, Quant Capital Reflecting on recent hiring trends, recruiters reported that in recent years, there had been a significant demand for commodities quants. Now they are seeing an increase in hiring of credit and fixed income quants. In particular, credit risk has become a topic of interest for large banks and hedge funds, as interest rate increases have a significant effect on credit and credit risk throughout the global markets. A second hiring theme expressed by many recruiters entails advanced programming skills, with high demand for quant candidates who have both a strong mathematical background and software development experience. These trends are likely to continue, with an emphasis on practical applications of the quant skillset. Industry Insights According to a poll conducted by the CQF Institute at the Quant Insights Conference in November 2022, nearly 53% of respondents felt that the biggest opportunity for quantitative finance firms in 2023 will be in market volatility. CQF CAREERS GUIDE | CAREER PATHS | 8 QUANTITATIVE FINANCE CAREER PATHS CQF CAREERS GUIDE | CAREER PATHS | 9 QUANTITATIVE FINANCE CAREER PATHS This section of The CQF Careers Guide will outline six different career paths in quantitative finance: PORTFOLIO MANAGEMENT QUANT STRATEGIES AND RESEARCH RISK MANAGEMENT DATA SCIENCE AND MACHINE LEARNING Each career path will present a brief description of the typical roles and responsibilities, with specific examples by job title. The job hierarchy is split into entry level, mid-level, and senior roles. Although job hierarchies and related job titles vary from firm to firm, in general, entry level is a designation for someone coming out of university or with 0 to 5 years professional experience. A mid-level employee would have 5 to 10 years of experience, and a senior level person would have more than 10 years of work experience. In addition, a member of the CQF alumni community working in each quant finance career path outlines what a typical working day looks like for them in terms of the tasks they complete and the skills required for their roles. We will now look at the six categories, describing the general attributes, required skills, and typical compensation ranges for each role. TECHNOLOGY QUANT TRADING Industry Insights A Quant Insights Conference poll conducted by the CQF Institute in November 2022 asked, “Which quantitative finance career path will see the most growth in job opportunities in 2023?” The majority of respondents (over 54%) replied that Data Science and Machine Learning were the most promising in terms of growth. Quant Strategies and Research came in second at about 18%, with Risk Management (12%), and Technology (11%) close for third. CQF CAREERS GUIDE | CAREER PATHS | 10 PORTFOLIO MANAGEMENT CQF CAREERS GUIDE | CAREER PATHS | 11 PORTFOLIO MANAGEMENT Professionals working in portfolio management are responsible for asset allocation and portfolio construction. They initiate trades and monitor portfolios and their exposures carefully. SKILLS FOR PORTFOLIO MANAGEMENT Quants in portfolio management will have strong quantitative and mathematical modeling, coding, and analytical thinking skills. They have a deep understanding of the various asset classes and a strong, clear communication style. They also tend to have good people skills, as their role may entail direct interactions with clients, which includes handling requests, observing pre-trade client guideline compliance, and addressing tax and other management issues. They must possess extensive knowledge of the firm’s investment products as well as products that are available in the broader financial market. Many people on this path begin their careers as portfolio analysts, and some will progress to managing teams of analysts and researchers. Industry Insights During a CQF Institute talk entitled, “A Day in the Life of a Quantitative Portfolio Manager,” by CQF alumnus Michael Althof (May 2022), respondents strongly agreed that the portfolio manager of the future will require more technical skills than he or she needs today (over 68%). CQF CAREERS GUIDE | CAREER PATHS | 12 PORTFOLIO MANAGEMENT TYPICAL JOB AREAS PORTFOLIO ANALYST Portfolio analysts conduct in-depth portfolio analysis, encompassing asset class and industry knowledge, insights on historic trends in the markets, and an understanding of financial metrics and regulatory and legal restrictions that may affect the portfolio. Portfolio analysts communicate with portfolio managers, as well as trading, risk, and compliance teams. They may also make presentations to clients. QUANTITATIVE ANALYST Quantitative analysts use a range of techniques to price assets, manage risk, and identify investment opportunities. Quant analysts will work in the front or middle offices at an investment firm, asset manager, or hedge fund, with the front office being closer to the clients and trading, and the middle office working on risk management and model validation. COMPENSATION (IN USD) PORTFOLIO MANAGEMENT INVESTMENT BANK North America Europe Asia Base Total Comp Base Total Comp Base Total Comp Portfolio Analyst Associate $175,000 $200,000 $220,000 $253,000 $90,000 $140,000 $100,000 $175,000 $95,000 $130,000 $135,000 $160,000 Portfolio Manager VP $200,000 $230,000 $275,000 $295,000 $140,000 $215,000 $160,000 $300,000 $130,000 $190,000 $225,000 $300,000 Portfolio Manager $230,000 Senior VP / Director $300,000 $550,000 $700,000 $215,000 $300,000 $285,000 $530,000 $190,000 $250,000 $350,000 $450,000 QUANT PORTFOLIO MANAGER CQF Corner Quant portfolio managers focus on the use of quantitative investment strategies to manage portfolios for institutional and retail investors. They develop statistical and mathematical models to analyze empirical data, searching for patterns and insights to inform the investment decision-making process. The CQF program gives delegates a strong understanding of asset allocation and portfolio construction, covering everything from modern portfolio theory and the capital asset pricing model to advanced portfolio management techniques. CQF CAREERS GUIDE | CAREER PATHS | 13 A DAY IN THE LIFE OF A PORTFOLIO MANAGER Michael Althof, CQF alumnus, Portfolio Manager and Head of ETF Capital Markets Team, Royalton Partners 8:00 AM - 9:00 AM I arrive at the office, prior to market open. Overnight news is priced into the most liquid instruments first before being priced into securities off those core instruments. Only urgent trades will be undertaken prior to market settling. 9:00 AM - 12:00 PM Most of the adjustment trades have been done and a renewed Portfolio Composition File (PCF) is sent to the ETF dealing community. Insights from markets and policy makers are discussed in morning briefings. Resulting adjustment trades are calculated for the required portfolios. The only constant is the ongoing reevaluation of active portfolio positions. This counts all the more for absolute return mandates with leveraged positions, but even passive portfolios tracking a benchmark will need adjustments from time to time. Trade flow optimization will be discussed. 12:00 PM - 13:00 PM The dealer community in ETFs is informed by a refreshed PCF. The portfolio manager’s task is to verify the correct screen pricing of shares in the fund in secondary markets and to alert the market makers on deviations. 13:00 PM - 14:00 PM This is usually when the US markets wake up. Coordination of positioning into the macro data prints will be discussed. On the follow, market action is analyzed and again the loop of market pricing levels and portfolio composition is discussed. 14:00 PM - 16:00 PM Time for portfolio committee meetings. Resulting new portfolio compositions are taken back to the teams for adjustment trades to be enacted over a given time period and with given market price limits. 16:00 PM - 17:00 PM We are nearing the cutoff for the daily net asset value per unit or share calculation. This is the primary market activity in a fund including ETFs. In the case of the latter, authorized participants will come in with orders to create or redeem shares, versus in-specie (basket of securities), or cash. The pricing of the basket versus the number of shares is estimated into market close and the final prices set at the security valuation going into the NAV calculation. This needs close monitoring. 17:00 PM - 18:00 PM Pricing is behind us and follow-on adjustments are enacted as long as market liquidity can be found. Tickets traded during the day are checked if passed through post-trade compliance, settlement issues are solved, and market conformity checks are done. 18:00 PM - LATER Time for reading, preparing presentations to teams, clients, newspapers, and blog posts. The trade floor is calm now, and there’s space for deep thinking. Read more about a day in the life of a portfolio manager. Portfolio managers start early, as overnight risk reports will have run and positions need to be checked. There are two viewpoints, granularly by security level and individual risk measures, and as a composition of a portfolio, including the interdependencies across the portfolio. Since values change with market moves, they need to be watched, adjusted, and checked constantly. Michael Althof, CQF alumnus, Portfolio Manager and Head of ETF Capital Markets Team, Royalton Partners CQF CAREERS GUIDE | CAREER PATHS | 14 RISK MANAGEMENT CQF CAREERS GUIDE | CAREER PATHS | 15 RISK MANAGEMENT Professionals working in the risk management path support the investment decision-making process through risk analysis and the creation of risk model frameworks for specific assets and asset classes. SKILLS FOR RISK MANAGEMENT Quants working in risk management possess strong quantitative and financial modeling skills and have proficiency with programming in Python, for example. They have knowledge of various methods including “Value-at-Risk” (VaR and its variants), statistical models, and simulations to evaluate the risk exposure for an asset or across an entire portfolio of assets. They require knowledge of stochastic calculus, Monte Carlo, PDEs, and other numerical techniques. They need to have familiarity with financial markets, including the most recent regulatory developments. Over the past decade or so, there has been a strong emphasis on regulatory compliance and stress testing and risk managers are often engaged in model testing and validation. Quants in risk management tend to have good communication skills and maintain focus on details and compliance. Post-financial crisis, there is a lot of work in risk management to be done with models and LIBOR transition and handling the regulatory aspects of the business, doing testing and model validation, and writing reports. The risk roles are quite different from those on the trading floor or in the front office, but there are interesting challenges and problems to be solved in this space as well. John Meadowcroft, Anson McCade Industry Insights According to the CQF Institute’s Quant Finance Careers Survey, for people in Risk Management, over half of daily tasks (55%) involve modeling, data analysis, and coding. An additional 20% of their time is spent on research and team management. The remaining 25% of their time is spent on tasks such as client interaction, market monitoring, and strategic planning. CQF CAREERS GUIDE | CAREER PATHS | 16 RISK MANAGEMENT TYPICAL JOB AREAS RISK ANALYST A risk analyst evaluates individual assets, portfolios, and external industry and economic conditions to help firms make risk-aware investment decisions. COMPENSATION (IN USD) RISK MANAGEMENT INVESTMENT BANK North America MARKET, LIQUIDITY, OR CREDIT RISK MANAGER Risk managers use data analytics and mathematical models to evaluate the risk profiles of financial instruments and portfolios, measuring the changes to those profiles over time. They are responsible for risk reporting internally to senior management and externally to regulators. MODEL VALIDATION QUANT Model validators work with models and methods developed by front office quants to assess their validity and mitigate the existence of model risk. Since the Global Financial Crisis, regulators often interact directly with quants in the middle office, including model validators. This area of quant finance has grown significantly in recent years. Europe Asia Base Total Comp Base Total Comp Base Total Comp Risk Analyst Associate $70,000 $90,000 $77,000 $99,000 $65,000 $80,000 $71,000 $88,000 $45,000 $60,000 $55,000 $66,000 Risk Manager VP $90,000 $150,000 $99,000 $165,000 $80,000 $130,000 $88,000 $143,000 $60,000 $125,000 $66,000 $132,000 $165,000 $243,000 $130,000 $160,000 $143,000 $176,000 $125,000 $150,000 $132,000 $165,000 Risk Manager $150,000 Senior VP / Director $230,000 CQF Corner The CQF program helps delegates build knowledge of risk models and analytical practices and covers a range of methods such as VaR and its variants, Monte Carlo simulation, time series analysis, stress testing, and statistical models. CQF CAREERS GUIDE | CAREER PATHS | 17 A DAY IN THE LIFE OF A RISK MANAGER Bilardo De La Victoria, CQF alumnus, Market and Liquidity Risk Manager, Superintendencia de Bancos de Panama 8:00 AM - 9:00 AM I start my day logging into Bloomberg and Refinitiv to catch up with the most important market news in Panama and the rest of the world, especially news related to the banking industry and its regulators. I also look for a summary of the behavior of the main market indicators such as stock indexes and interest rates. 9:00 AM - 11:00 AM At this time, I usually meet with my team members individually to discuss ongoing projects. These projects may be of a diverse nature, from bank inspections and evaluations, to the development of regulatory requirements and standards, to the implementation of risk metrics or models and their automation. 11:00 AM - 13:00 PM I usually spend about two hours a day reviewing the work done by the department’s risk analysts and inspectors. This work is generally reflected in bank inspection reports, which contain a comprehensive analysis of the bank’s models and practices to assess its risks and value its investments, as well as the findings of the inspection. 14:00 PM - 16:00 PM During this time, I often work on automation projects that aim to implement indicators and models to monitor risks across all banks. For this task I use SQL to query information from the databases. I also use Python to process and transform the data, as well as to build risk monitoring dashboards in a web-based application. It is also very common to have meetings with the risk and treasury departments of banks at this time. During these meetings, my team and I have technical discussions about the methodologies that the bank uses to measure its risks and value its investments and derivatives positions. Other issues related to risk management are addressed as well. 16:00 PM - 17:00 PM I catch up with my supervisor on any matter of relevance to the department and to find out if there is anything that needs to be addressed. I brief the analyst team on the highest priority issues and invite them to discuss any improvement initiatives or recommendations they may have developed. I also take advantage of this time in the day to study any technical topics that I need to face new challenges at work. 17:00 PM - 18:00 PM My working day usually ends by this time. Before I leave the office, I go through my emails and to-dos and make note of the most important things for the next day. Read more about a day in the life of a risk manager. I am responsible for the team that evaluates all banks in the Panamanian Banking System in relation to their practices for measurement and management of market risk, liquidity risk, and interest rate risk in the banking book. In this role, I have participated in the development and implementation of rules for the banking sector, such as capital requirements for market risk, investment management, financial derivatives, liquidity risk management, and the liquidity coverage ratio. Bilardo De La Victoria, CQF alumnus, Market and Liquidity Risk Manager, Superintendencia de Bancos de Panama CQF CAREERS GUIDE | CAREER PATHS | 18 QUANT STRATEGIES AND RESEARCH CQF CAREERS GUIDE | CAREER PATHS | 19 QUANT STRATEGIES AND RESEARCH Professionals working in quant strategies and research often use quantitative and statistical methods to analyze the markets, and then generate and test ideas for investment strategies. These quants focus on mathematical models, with the potential to generate alpha, while also managing risk effectively. SKILLS FOR QUANT STRATEGIES AND RESEARCH Quants working in strategies and research will have a detailed knowledge of mathematical and statistical models used in quant finance. They also require knowledge of financial mathematics and stochastic calculus. They will have good programming skills in Python or C++, for example, and may have skills in R, MATLAB, or SAS as well. Knowledge of machine learning and natural language processing techniques is increasingly in demand for quant research and analysis. Over the past two years we’ve seen a significant uptick in quant macro – systematic macro strategies, and portfolio managers or trading teams that are looking at cross-asset futures, FX, commodities – any products that are driven by global macroeconomic events and situations. Even the more traditional equity players are starting to diversify and grow their teams in the macro space. Tyler Robinson, Selby Jennings CQF CAREERS GUIDE | CAREER PATHS | 20 QUANT STRATEGIES AND RESEARCH TYPICAL JOB AREAS QUANT RESEARCHER / QUANT ADVISOR Quant researchers or quant advisors develop and implement pricing models and trading strategies and analyze existing strategies to identify potential improvements. They also create tools to automate research tasks and visualize the information found in complex data sets. Responsibilities may include working on strategy research, backtesting models, execution, latency strategy research, machine learning research, econometrics research, and market microstructure research. QUANT STRATEGIST Quant strategists research and implement trading strategies, using pricing and trading models. They also develop risk models to manage portfolio risks and analyze current strategies to identify issues and make improvements. Quant strategists often work with traders, quant analysts, software engineers, and quant developers. Responsibilities include analyzing trading and asset allocation opportunities and working with a comprehensive set of risk reporting and pricing tools. DERIVATIVES ANALYST Derivatives analysts apply mathematical formulas and computer algorithms to evaluate financial data, detect investment trends, and recommend asset allocation strategies. They may also evaluate transactions from risk management and legal standpoints to ensure compliance with regulatory requirements. COMPENSATION (IN USD) QUANT STRATEGIES AND RESEARCH BUY SIDE North America Europe Asia Base Total Comp Base Total Comp Base Total Comp Quant Researcher Associate $145,000 $165,000 $250,000 $300,000 $100,000 $130,000 $175,000 $300,000 $95,000 $125,000 $165,000 $185,000 Quant Researcher VP $165,000 $190,000 $300,000 $500,000 $130,000 $180,000 $300,000 $500,000 $125,000 $180,000 $185,000 $275,000 Quant Researcher $190,000 Senior VP / Director $300,000 $500,000 $700,000 $180,000 $250,000 $500,000 $650,000 $180,000 $250,000 $275,000 $450,000 CQF Corner The CQF program gives delegates a strong understanding of the mathematical and statistical models, and machine learning techniques needed to work in quant strategies and research. CQF CAREERS GUIDE | CAREER PATHS | 21 A DAY IN THE LIFE OF A QUANT ADVISOR Karolina Hartzell, CQF delegate, Quant Advisor, Pexapark 8:00 AM - 9:00 AM Usually, I tend to start work around 8:00am and I begin by replying to any remaining messages that I may not have managed to answer the previous day. 9:00 AM - 13:30 PM I start my day by prioritizing tasks. I tend to focus first on any type of assignment, which has been requested directly by the client. A recent example of such an analysis involved running a Monte Carlo simulation of the main risks affecting an offshore wind investment in Germany and reviewing how different types of contract structures (hedging instrument) can help to offset the risks and at what cost. I use our simulation engine to obtain thousands of scenarios of realizations of the risks and use self-designed code to calculate payoffs for any given complex structure or strategy. Once the analysis part is done, my task is also to help interpret the results and create a clear and easy to understand message for my clients. I usually work with our Advisory team who are market experts and keep close contact with the client to manage the delivery of the results. 14:15 PM - 16:00 PM I have a few calls with my colleagues, with whom I work on the different assignments. It’s always good to quickly debrief on the progress of any analysis work or any challenges in the way of completion. If the quantification part of the project is already done, we work together on the presentation of the results. 16:00 PM - 17:30 PM If I have completed all my prioritized tasks, I use this time to work on the development projects that aim to expand our software. There are still a lot of interesting things to do when it comes to helping our customers better understand and optimize their investment portfolios containing renewable assets. These projects often involve many stakeholders and require detailed interaction and alignment with our Quant Engineering team. After this, I am usually done for the day. Read more about a day in the life of a quant advisor. I am involved in many different projects across the company, which means I get requests for various types of analysis. A recent example involved running a Monte Carlo simulation of the main risks affecting an offshore wind investment in Germany and reviewing how different types of hedging instruments can help to offset the risks and at what cost. I use our simulation engine to obtain thousands of scenarios of realizations of the risks and use self-designed code to calculate pay-offs for any given complex structure or strategy. Karolina Hartzell, CQF delegate, Quant Advisor, Pexapark CQF CAREERS GUIDE CQF |CAREERS CAREER PATHS GUIDE | 22 DATA SCIENCE AND MACHINE LEARNING CQF CAREERS GUIDE | CAREER PATHS | 23 DATA SCIENCE AND MACHINE LEARNING Professionals working in data science and machine learning are responsible for research, modeling, and testing. They work with data sets to uncover relationships and patterns in empirical data. SKILLS FOR DATA SCIENCE AND MACHINE LEARNING Professionals working in this area need to have a deep understanding of algorithms, machine learning, and specific domains such as natural language or signal processing to help identify and assess patterns in the data. They have strong quantitative analysis skills and a solid understanding of artificial intelligence and machine learning techniques, as well as familiarity with the programming languages commonly used in machine learning, particularly Python. Roles for quants in data science and machine learning require significant knowledge of models and programming. These jobs tend to sit within the research area of an organization. Firms that are active in data science and machine learning include investment banks, asset managers, hedge funds, and technology companies that offer consulting services to the financial industry. There are also opportunities for quants in tech organizations that develop software products for the financial industry. Many firms are hiring people who have great technical skills. Those who can write good code and are truly hands-on with programming are in demand. In terms of languages, Python is now the industry standard for data analysis and machine learning. It’s an important skill to have, along with a good knowledge base in math, statistics, probability, and game theory. Tyler Robinson, Selby Jennings Industry Insights In the November 2022 Quant Insights Conference Polls, attendees reflected on the most important skills for quants working in Data Science and Machine Learning. Data Analysis (about 38%) and Modeling (about 34%) far outpaced Coding (about 19%) and Research (about 9%), as seen by the poll respondents. CQF CAREERS GUIDE | CAREER PATHS | 24 DATA SCIENCE AND MACHINE LEARNING TYPICAL JOB AREAS DATA SCIENTIST Data scientists in quantitative finance apply their analytical skills to extract insights from large datasets, using machine learning algorithms and statistical methods to inform decision-making and drive business strategies. MACHINE LEARNING ENGINEER Machine learning engineers focus on building, training, and deploying machine learning models tailored to the needs of financial institutions, ranging from predictive analytics to natural language processing. DATA ENGINEER Data engineers build systems that collect, manage, validate, and convert raw data into high-quality, usable information for data scientists to study. In quant finance, this data would include information from stock exchanges, the OTC markets, and other market, trading, and business information. DATA ANALYST Data analysts use descriptive statistics to evaluate problems, create data visualizations, and develop insights based on empirical analysis. They may assist with collecting and cleaning data sets and supporting the senior members of the data science team. COMPENSATION (IN USD) DATA SCIENCE AND MACHINE LEARNING INVESTMENT BANK North America Europe Asia Base Total Comp Base Total Comp Base Total Comp Data Analyst Associate $75,000 $150,000 $85,000 $165,000 $70,000 $100,000 $80,000 $110,000 $80,000 $110,000 $90,000 $120,000 Data Scientist VP $150,000 $230,000 $165,000 $250,000 $100,000 $180,000 $110,000 $200,000 $110,000 $130,000 $120,000 $140,000 Data Scientist Senior VP/Director $230,000 $260,000 $250,000 $285,000 $180,000 $250,000 $200,000 $275,000 $130,000 $200,000 $140,000 $220,000 CQF Corner With modules on Data Science and Machine Learning, the CQF program gives delegates the experience of using modeling and machine learning methods to solve real-world problems in finance. Python Labs allow delegates the opportunity to implement the models and techniques studied in lectures. CQF CAREERS GUIDE | CAREER PATHS | 25 A DAY IN THE LIFE OF A LEAD DATA SCIENTIST Victor Acevado, CQF alumnus, Lead Data Scientist, Banco de Credito del Peru 8:30 AM - 9:00 AM I start work with a quick review of my emails and meetings for the day. I also check the sticky notes I have on my desktop with the messages I would like to give the team throughout the day. 9:00 AM - 9:30 AM Time for a daily meeting to coordinate with the team. I usually ask for a quick summary of the previous day’s progress and about any issues that may be holding up the team’s progress to see how I can help. 9:30 AM - 12:30 PM During this time, users will sometimes call me to ask about the models we develop. The analytical solutions that we provide to the business units are wide-ranging. They can go from mitigating the risk in specific sectors of the population to generating relevant offers for a target audience. However, the majority of our work is focused on developing models for the prediction of credit risk. We often discuss with our users the type of algorithm that should be used, the main assumptions, how the solution can be deployed, and the development time. 14:00 PM - 17:30 PM I continue working on the proposed solutions to business problems and then present them to the users. I usually meet with the team at some point in the afternoon in case they need my help. 17:30 PM - 18:00 PM I review my emails one last time and write down list of things to start or continue the next day. Read more about a day in the life of a lead data scientist. As Lead Data Scientist, I am responsible for deploying and implementing analytical solutions for credit risk problems. Most of the time, the solution involves estimating inputs for expected loss, namely probability of default, loss given default, and exposure at default. We also build through the cycle version of these parameters as needed for economic capital requirements. Lately, I have been dedicating much of my time to designing a new workflow for building a loss given default model for my business segment. Victor Acevado, CQF alumnus, Lead Data Scientist, Banco de Credito del Peru CQF CAREERS GUIDE | CAREER PATHS | 26 TECHNOLOGY CQF CAREERS GUIDE | CAREER PATHS | 27 TECHNOLOGY Quant professionals working in technology design, develop, and implement software solutions to support various departments across the firm. SKILLS FOR TECHNOLOGY Quants in technology will have excellent coding skills in Python, C, C++, or C#, for example. They should also have a good understanding of computational mathematics, software engineering, and financial products. They tend to work on projects with a number of teams if they are in a large organization, so having domain expertise combined with good skills in collaboration and communication will be helpful. Candidates who come in with strong computer science backgrounds, including natural language processing can do very well in quant jobs now. If we single out high-frequency trading firms, their business method is about speed and efficiency and the quants they employ are skilled in using C++ and working with ultra-low latency systems. Python is a very useful and popular language as well. Once you understand one type of coding, it is fairly easy to pick up other languages as needed. John Meadowcroft, Anson McCade CQF CAREERS GUIDE | CAREER PATHS | 28 TECHNOLOGY TYPICAL JOB AREAS QUANT DEVELOPER Quantitative developers, also known as quantitative software engineers, or quantitative engineers, develop, implement, and maintain quantitative models. They are highly skilled programmers, specialized in languages like Python or C, C++, and its variants, and they often work at the intersection between software engineers and quantitative analysts. Typical responsibilities may include developing and maintaining programming libraries, developing high-performance numerical library components, performance tuning of libraries, and consulting on high-performance computing, optimization, and strategy. COMPENSATION (IN USD) TECHNOLOGY North America Europe Asia Base Total Comp Base Total Comp Base Total Comp Quant Developer Associate $130,000 $150,000 $132,000 $154,000 $85,000 $120,000 $94,000 $140,000 $45,000 $60,000 $50,000 $66,000 Quant Developer VP $150,000 $220,000 $154,000 $260,000 $120,000 $155,000 $140,000 $170,000 $60,000 $121,000 $66,000 $133,000 Quant Developer Senior VP/Director $220,000 $260,000 $260,000 $300,000 $155,000 $170,000 $170,000 $187,000 $121,000 $153,000 $133,000 $168,000 CQF Corner With online Python Labs, as well as advanced electives on C++ and Decentralized Finance Technologies, the CQF program helps delegates develop excellent coding skills in Python so that they are able to build, implement, and analyze quantitative models used in technology roles. The CQF program also contains lectures on quantum computing, one of the latest additions to the curriculum. CQF CAREERS GUIDE | CAREER PATHS | 29 A DAY IN THE LIFE OF A LEAD QUANT DEVELOPER Alok Jadhav, CQF alumnus, Quant Developer, y-intercept 9:00 AM - 10:00 AM I attend a daily stand up meeting with my team. During this meeting we review and update the status of work done the previous day and plan the day’s tasks. After the meeting, I review my items for the day and get started. By 9:30am, I am completely focused on the tasks I have at hand. Usually, I have one main task for the day or a few minor tasks. I typically use morning hours to do the development work and post-lunch hours are used for meetings and research. 10:00 AM - 12:15 PM I keep working through my daily tasks. For example, one day I noticed that one of the equity index futures didn’t roll automatically in EMEA. After investigation I discovered that we had an exceptionally large quantity to trade the previous day and the trading couldn’t complete automatically due to constraints. I notified the team about the cause of incompletion and asked the users to roll the remaining quantity manually. With no more pending issues, I then focused my efforts on the Algo Engine development. 12:15 PM - 13:00 PM I continue to work on the Algo Engine development. It’s a big project and still in the early stages. We use a JIRA board for tracking our deliverables. For development, we follow the TDD approach, where you write the test cases before you write the actual code. Currently, I am setting up the Algo Engine in backtesting mode, which will aid in doing further development and enable us to check the execution performance. 13:00 PM - 17:00 PM I research new financial papers that could be useful for the Algo Engine and then continue to work on development - closing those Jira tasks one by one. If there were any issues reported with any of them, I resolve those issues and plan for a release. Some issues are urgent and require an urgent patch and release without waiting, whereas other issues can be aligned in the next release of the application. 17:00 PM - 18:00 PM I catch up with other team members on issues pertaining to my projects and schedule follow-up meetings with other teams. I also use this time to catch up with the data team on any data requests. I then have a status meeting with the management team, where we discuss the longer-term plans for the execution platform. Read more about a day in the life of a quant developer. I am responsible for the execution platform for the trading desk. This platform receives target portfolios from a quantitative trading team that need to be executed over the day. Some orders are meant to be forwarded to broker algos, while others are to be executed internally in a smart way, with the aim of reducing trading costs. Lately, most of my time is spent on a new application called the Algo Engine, which is in the very early stages of development. Alok Jadhav, CQF alumnus, Quant Developer, y-intercept CQF CAREERS GUIDE | CAREER PATHS | 30 QUANT TRADING CQF CAREERS GUIDE | CAREER PATHS | 31 QUANT TRADING Professionals working in quant trading employ mathematical and statistical models to identify potentially profitable trading strategies and to execute trades. They develop strategies and then focus on backtesting, analysis, and optimization. Quant traders may be involved in statistical arbitrage, algorithmic trading, and high-frequency trading. SKILLS FOR QUANT TRADING Quant traders must have deep knowledge of quantitative and statistical analysis, and strong programming skills in Python or C++, for example. They may have experience with machine learning techniques as well. Psychology is very important for quant traders and trading job candidates must demonstrate that they thrive in extremely competitive environments and can handle pressure well. Employers are increasingly interested in people who are not just technically and quantitatively equipped. They must also be knowledgeable and passionate about markets and asset classes. They’re looking for someone who has an interdisciplinary understanding of how different factors affect markets and can apply technical knowledge to their investing activities with intuition. The CQF definitely provides an edge here, covering both the financial acumen and the technical skills to match. Dennis Grady, Spire Search Partners CQF CAREERS GUIDE | CAREER PATHS | 32 QUANT TRADING TYPICAL JOB AREAS QUANT TRADER Quant traders trade a variety of asset classes, including equities, bonds, commodities, currencies, and derivatives using a combination of market knowledge, trading experience, and math and computer skills. Quant traders work at investment firms, hedge funds, and banks. They may also be proprietary (“prop”) traders working in small groups within such organizations, or independently for their own accounts. COMPENSATION (IN USD) TRADING North America Europe Asia Base Total Comp Base Total Comp Base Total Comp Quant Trader Junior Trader $100,000 $150,000 $125,000 $170,000 $100,000 $130,000 $140,000 $205,000 $70,000 $120,000 $120,000 $225,000 Quant Trader Senior Trader $150,000 $200,000 30-50% of PnL $90,000 $145,000 10-40% of PnL $150,000 $170,000 10-40% of PnL Quant Trader Head of Trading $240,000 $300,000 $550,000 $700,000 $210,000 $290,000 $260,000 $525,000 $215,000 $250,000 $325,000 $375,000 CQF Corner The CQF program teaches the mathematical models traders need to price assets, manage risk, predict market movements, implement algo trading strategies, and find arbitrage opportunities. CQF CAREERS GUIDE | CAREER PATHS | 33 A DAY IN THE LIFE OF A LEAD QUANT TRADER Vitor Angrisani, CQF alumnus, Quantitative Equity Trader, RBC Global Asset Management 7:00 AM - 9:30 AM First, I check my live orders from Europe (which are in mid-trading session at this time), then I check overnight fills from APAC and make sure I am up to speed and comfortable with the trading strategy in place, or adjust as needed. Once all overseas orders are under control, I move on to the “pre-North America open” phase of the day. Before the open of the North American market, it is important to go through the news and evaluate any relevant macro or stock-specific events that might impact my trading day. Pre-market preparation includes reading reports, taking calls from brokers, strategizing and implementing trading strategies on the new and multi-day equity orders on my blotter, and sharing the highlights with the Quant Portfolio Managers and my trading peers. 9:30 AM - 12:00 PM At 9:30am, the North America market opens and dominates my attention. As a trader, your primary responsibility is to execute orders while keeping market impact to a minimum. In order to do this, we use a variety of systems and tactics, including algorithmic and block trading. I also analyze and present relevant trade opportunities based on the activity of other market participants to Portfolio Managers, bringing insights from the market to complement the signals from our models. 12:00 PM - 16:00 PM No lunchtime for traders. You can’t afford to be away from the desk if something happens. Your reaction time to any adverse or favorable price action has direct P&L implications and mere seconds can really cause a multi-million loss or gain, so you have to be connected at all times. Every moment away from the desk has to be covered by a backup trader. 16:00 PM After all markets close at 16:00pm, I book my trades and catch up with any unread emails before leaving for the day. This is also the time to safely work on any side projects without being interrupted. I usually work on backtesting new strategies. Read more about a day in the life of a quant trader. I started my career in 2008, right before the Great Financial Crisis, and had a chance to experience first-hand its impact in financial markets. Since then, I have worked in different roles and companies, managing and taking risk, in both the sell side and buy side. Once I began trading derivatives, I decided to enroll in the CQF program, as it was the best way to acquire the essential quant skills needed to progress in my career. Vitor Angrisani, CQF alumnus, Quantitative Equity Trader, RBC Global Asset Management CQF CAREERS GUIDE | JOB SEARCH | 34 SUCCEEDING IN YOUR JOB SEARCH CQF CAREERS GUIDE | JOB SEARCH | 35 SUCCEEDING IN YOUR JOB SEARCH As we have seen, in each of the six job categories discussed, there is a strong emphasis on quantitative and analytical skills, technical expertise, and knowledge of specialized areas of finance. Most roles require strong communication skills and entail a significant amount of interaction with internal and external clients. A challenging and satisfying career in quant finance depends on the ability to adapt to changing conditions in the financial markets and the desire to improve on one’s skillset and perspective continuously. The following section addresses additional considerations when seeking a role in quant finance. INTERVIEW PREPARATION Since quant finance is an intellectually demanding field, employers will typically test a candidate’s knowledge and skills quite rigorously throughout the interview process. Financial problems, math brainteasers, and programming samples are often part of the journey. When preparing for an interview, it is good practice to review your knowledge and skills, study the types of questions likely to be posed to you, and research the company carefully. In addition, you may wish to look up the person with whom you will be interviewing on the firm’s website and LinkedIn. The details on their academic background and career progression can provide clues on how they will see the world and what types of knowledge they may explore with you. Ahead of the interview, prepare for various types of conversations. A few good resources for quant interviews include Heard on The Street: Quantitative Questions from Wall Street Job Interviews, by Timothy Falcon Crack, Quant Job Interview Questions and Answers, by Mark S. Joshi, Nick Denson, and Andrew Downes, 150 Most Frequently Asked Questions on Quant Interviews, by Dan Stefanica, Radoš Radoicić, and Tai-Ho Wang, and Frequently Asked Questions in Quantitative Finance, by Paul Wilmott. BUSINESS SKILLS: COMMUNICATION, CURIOSITY, AND COLLABORATION In order to advance through the ranks of either a financial or a technology-focused firm, an employee needs to develop domain expertise and demonstrate consistent high-quality performance. Recruiters also advise that business skills such as communication (both verbal and written), collaboration, and empathy become increasingly important when working on larger teams or moving into managerial roles. A quant can be a strong individual contributor and highly effective at managing projects, which can also lead to career advancement. Those who are able to manage people well may move into senior executive roles. One of the ways to help ensure good career progression is to hone your communication skills – be able to present ideas and explain them clearly to other quants and to colleagues in non-technical roles. For quants, typically you have a great undergraduate degree and perhaps a postgraduate degree, and ideally, you’ve got some professional qualifications such as the CQF. This is maybe 80% along the way to being a great job candidate, but the last 20%, is up to you. For example, when it comes to programming, it’s not necessarily about being the best at a specific skill, it’s about showing progression and aptitude. Richard Booty, Testwood Partners CQF CAREERS GUIDE | JOB SEARCH | 36 SUCCEEDING IN YOUR JOB SEARCH Recruiters also advise that employers value curiosity; they would like to know what you have done outside of your studies. Focus on demonstrating your interest in quantitative subjects, finance, and programming. Many recruiters note that in the job interview process, it’s useful to have completed a significant technical project - something you have developed and can talk about in detail. It’s not necessarily important that the project was completely successful; you can talk about things you have learned from a particular challenge or obstacle. Another good topic for interviews is the books you have been reading lately; be prepared to offer analysis of key points from the readings. It shows that you can assimilate information and put it to use. Recruiters were unanimous on the point that showing a different perspective and curiosity about the world can be a significant factor in job search success. CQF Corner All delegates on the CQF program are required to complete a practical final project before they graduate, pushing them to apply their new skills to a real-world financial scenario. Many alumni state that their final project was directly applicable to their career development and that they often refer to this project during interviews following completion of the program. Finally, it is very helpful to become part of a professional organization that is active in the financial world. Such memberships show commitment to potential employers and provide access to and motivation for additional education on the industry. The CQF Institute offers numerous benefits to its members, including lectures, conferences, and other educational opportunities in quantitative finance. nderstanding the principles of model U development, data structures, and automation is essential for today’s quant jobs. The CQF has modules that are focused on precisely these areas, so it is addressing the current trends in the industry. Lee Horan, Rec Finance THE VALUE OF NETWORKING Beyond developing your professional connections online, many quant finance conferences are held in major financial centers around the world and they offer good networking opportunities as well. The CQF Institute, for example, holds a series of conferences and lectures throughout the year, including the annual Quant Insights Conferences, the Career Insights lecture series, and other industry talks in various locations. In addition to professional certification courses like the CQF, such events are an excellent way to learn about trends in the job market and explore new opportunities for people with a strong quantitative skillset. A final note on career progression entails nurturing your network. Social media including LinkedIn and WhatsApp make it easy to stay in touch with classmates and colleagues. CQF alumni can showcase their CQF designation in several ways on profile pages, from the headline to the education and professional credential sections, so that they are more easily searchable on such platforms. Industry Insights Respondents to the Quant Finance Careers Survey conducted by the CQF Institute concur: 76% felt that a combination of communication, collaboration, and leadership were most important for career progression in finance, as opposed to favoring a single one of those options over the others. Further, 74% stated that networking plays an important or very important role in developing a career in quant finance. CQF CAREERS GUIDE | CAREER OPPORTUNITIES | 37 CAREER OPPORTUNITIES CQF CAREERS GUIDE | CAREER OPPORTUNITIES | 38 CAREER OPPORTUNITIES: GROWTH AREAS Looking across the financial industry, some of the key themes in quant finance remain the same as they have been for decades, while others are evolving in response to technological change. In keeping with the times, there are growing career opportunities in both established and emerging areas for quants, including machine learning, data science, and quantum computing. With regard to the competencies required in these fields, recruiters emphasize the importance of upskilling and the value of a good quant education, no matter what corner of the quant world you are exploring. Industry Insights According to a poll conducted by the CQF Institute at the Quant Insights Conference (November 2022), approximately 62% of respondents indicated that Data Science and Machine Learning would offer the greatest increase in career opportunities in quantitative finance in 2023 and 17% felt that the greatest increase would come from Quantum Computing. The following sections offer a deeper look into the field of machine learning and data science, as an area of particularly high interest for quant professionals, and into the field of quantum computing, where demand for quants is expected to grow in the future. MACHINE LEARNING AND DATA SCIENCE Over the past decade, interest in machine learning has risen rapidly across the financial industry, encompassing all aspects of the industry. For quant finance professionals this provides a range of new career opportunities. How is machine learning used in quantitative finance? Machine learning is a branch of artificial intelligence that draws on techniques from computer science and statistical modeling. Within the world of quantitative finance, machine learning techniques enable quants to discern patterns in large datasets, allowing them to make more accurate predictions of market movements. These techniques also enable the development of more sophisticated trading and risk management strategies, which can result in improved portfolio performance and reduced exposure to market volatility. Quants can also automate complex financial processes with machine learning, which enables faster and more competitive decision-making. As a result of this, traditional investment strategies are beginning to evolve as the markets begin to be shaped more and more by these techniques. Industry Insights According to a series of polls conducted at a CQF Institute talk on Reinforcement Learning by Samit Ahlawat (April 2022), respondents stated that the most common machine learning techniques that their firms had incorporated regularly were Supervised Learning techniques (at about 28%), but an equal percentage responded that their firms had not incorporated any machine learning techniques at all yet. About 16% replied that their firms had adopted Unsupervised Learning techniques, followed by Reinforcement Learning (about 14%), and Deep Learning (about 11%). Neural Nets came in last, with about 3% of the vote. With the advent of new AI-powered platforms, such as ChatGPT, at the end of last year, this field is set to change even further. With their natural language processing capabilities, tools such as ChatGPT can help answer complex financial questions, analyze large amounts of financial data, create predictive models, suggest new strategies, and even generate Python code to solve specific problems. Its range of capabilities make it a valuable tool for those in quant finance seeking to improve their performance and enhance their decision-making processes. CQF CAREERS GUIDE | CAREER OPPORTUNITIES | 39 CAREER OPPORTUNITIES: GROWTH AREAS Industry Insights In a poll at the March 2023 CQF Institute Portfolio Management in Quant Finance Conference, 64% agreed that ChatGPT and similar applications will change the nature of quant portfolio management. Skills for machine learning and data science As the markets continue to change with the emergence of new machine learning developments, ambitious quants must ensure they have the skills needed to stay competitive. Essential machine learning quant finance skills include: Mathematics: All quants need a solid understanding of core mathematical concepts, but machine learning quants need this knowledge to create and evaluate sophisticated machine learning models and to understand the vast datasets used by machine learning tools. Programming: Proficiency in a programming language, like Python, is essential for machine learning quants as this facilitates the implementation of machine learning algorithms, data manipulation, and visualization. Machine Learning Techniques: Quants need to understand the different machine learning techniques, including supervised and unsupervised learning, reinforcement learning, and deep learning. Understanding the limitations of each of these methods enables quants to choose the best approach for a given task. Model Selection: This is a vital skill to ensure that a quant’s predictions are robust. Quants need to be able to evaluate the performance of machine learning models using various techniques such as, cross-validation, confusion matrices, and ROC curves, and should understand common pitfalls like overfitting and underfitting. AI/ML Explainability Specialist: As machine learning models become more complex and ubiquitous, explainability is a key concern for many organizations, regulators, and senior executives. Quants in this role develop methods to interpret and communicate the inner workings of AI/ML models to ensure transparency, trust, and regulatory compliance. Data Management: As the volume and variety of financial data continues to grow, quants need to be adept at cleaning data to ensure its quality. Expertise in data management systems, like SQL, is also important as this allows quants to store and manipulate large datasets. Crypto Quant: The rise of cryptocurrencies and blockchain technology has created new opportunities for quants specializing in digital assets. These professionals develop trading strategies, risk models, and valuation methods specifically for the cryptocurrency market. Like all career paths in quant finance, communication skills and domain knowledge are vital to ensure quants can understand the products they are dealing with and be able to communicate complex machine learning concepts to less technical stakeholders. A commitment to continuous learning is also important. As new technologies continue to emerge in the field, quants need to ensure their knowledge stays up to date throughout their careers. These are just a few of the new job titles emerging for quants in the field. For those quants that have the right skills, the opportunities for career development and progression in machine learning and data science could be boundless. New career opportunities in machine learning and data science As machine learning becomes more prolific across the industry, new roles for quants are beginning to emerge in the field. These include: Alternative Data Analyst: With non-traditional data sources (such as social media, satellite images, and web scraping) becoming more important, quants in this role focus on extracting insights from alternative data to inform investment strategies and improve decision-making. CQF Corner As data science has gained traction in the investment world, the CQF curriculum has been updated to provide a strong foundation in the core principles and techniques of machine learning, including supervised, unsupervised, and reinforcement learning, deep learning, neural nets, NLP, and algorithmic trading. CQF CAREERS GUIDE | CAREER OPPORTUNITIES | 40 CAREER OPPORTUNITIES: GROWTH AREAS QUANTUM COMPUTING It’s a similar story for quantum computing. The field of quantitative finance began during an age of classical computers and it was both influenced and limited by the technology available at the time. Since then, computers have become ever more powerful, with greater storage capacity and faster networks. Quantum computing is an emerging form of high-performance computing. It uses the principles of quantum mechanics to perform computations significantly faster than classical computers. For quantitative finance, this creates vast potential for processing complex financial models and algorithms at unprecedented speeds, leading to faster decision-making, portfolio optimization, and risk management. Whilst investment in quantum computing is costly, interest in it is growing and pioneering firms are making investments in quantum technology as part of their corporate strategy. For example, research initiatives are underway at Goldman Sachs and JP Morgan and many start-ups and established firms, like IBM, are working to develop this technology for practical application. Industry Insights Industry Insights In a poll conducted by the CQF Institute at the Quantum Computing in Finance Conference in July 2022, about 47% said that their firms were not currently considering Quantum Computing technology at all. However, about 32% indicated that their firms were researching use cases for Quantum Computing technology, and another 21% replied that their firms were actively investigating Quantum Computing applications. In a poll conducted by the CQF Institute at the Quantum Computing in Finance Conference in July 2022, the highest potential for Quantum Computing was seen to be in Portfolio Optimization (about 42%), followed by Risk Modeling (28%). How is quantum computing used in quantitative finance? The use of quantum computing in quantitative finance is still in its infancy. However, there are promising use cases. For example, within portfolio optimization, quantum computing has been used to process large numbers of assets and their correlations, providing better risk-adjusted returns and identifying optimal asset allocations in investment management. Within trading, it can analyze vast amounts of data and identify hidden patterns, leading to the development of more effective algorithmic trading strategies. For risk management, quantum computing can simulate and analyze complex financial instruments at high speed, which can help companies better understand potential risks, such as credit risk, market risk, and operational risk, enabling them to make better decisions. These are just a few of the areas where quantum computing could start to make a significant difference to the industry. Skills for quantum computing As interest in this emerging field continues to grow, it is important for quants to ensure they have a competitive skillset that could put them at the top of the job candidate list. Important skills for roles in quantum computing include: Quantum Mechanics: More specifically, the principles governing quantum computing, such as superposition, entanglement, and quantum gates, are essential concepts needed for professionals considering entering this field. Programming: Proficiency in languages like Python, is vital for writing and implementing quantum algorithms. Quantum Software Frameworks: Experience with quantum computing platforms and libraries such as Qiskit (IBM) is important as this can help quants facilitate the development and simulation of quantum algorithms. CQF CAREERS GUIDE | CAREER OPPORTUNITIES | 41 CAREER OPPORTUNITIES: GROWTH AREAS Quantum Algorithms: Familiarity with algorithms, such as Grover’s, Shor’s, and quantum machine learning algorithms are necessary for quants to develop and apply quantum computing solutions to financial problems. Statistics: A strong knowledge of linear algebra, probability theory, and statistics is crucial for quants to understand and manipulate quantum states, as well as to model and analyze financial data. Everything in quantum starts with education and education comes in many forms and many flavors. For an organization to achieve a quantum mindset, everyone needs to speak different dialects of quantum – engineering dialects, the scientific dialects, business dialects, but unless there is a common foundation, it would be difficult to develop solutions that create value for society. You need to take responsibility for your education and a good starting point is to take the courses offered by the CQF, attend conferences, and read as much as you can. Esperanza Cuenca-Gómez, Head of Strategy and Outreach, Multiverse Computing As with machine learning and data science, continuous learning will play a vital role for quants working in and on the periphery of this field. As it is still just the beginning of the quantum era, quants will need to watch developments in this space and ensure their skills stay in line with industry requirements. New career opportunities in quantum computing With the continued interest in this field, new career opportunities for quants are beginning to emerge. These include: Quantum Research Scientist: This role is at the intersection of quantum computing and quantitative finance, researching new applications and algorithmic advancements to solve complex financial problems. Quantum Software Engineer: Like a typical software engineer, these quants design, implement and test software applications for the financial industry; however they work with quantum programming languages and platforms like Qiskit instead. Quantum Financial Analyst: These quants develop and apply quantum algorithms to financial models, evaluate and improve investment strategies, and conduct risk analysis using quantum computing techniques. These roles and others can be found across the industry at companies that are starting to invest in quantum technology in finance. As this technology matures, the demand for the quants with the skills for these roles is expected to grow, which will create even more job opportunities in this exciting field. Industry Insights In a poll conducted by the CQF Institute at the Quantum Computing in Finance Conference in July 2022, most respondents believed that realtime deployment of Quantum Computing in financial services is five to ten years away (49%). About 28% believed that it is less that five years away and another 23% believed that it is more than ten years away. CQF Corner The CQF program contains lectures and an advanced elective on quantum computing. There are also several sources for further information including books, conferences, and quantum computing websites that provide access to quantum computing programming information and developer kits. CQF CAREERS GUIDE | CAREER OPPORTUNITIES | 42 CAREER OPPORTUNITIES: GROWTH AREAS PREPARING FOR THE FUTURE IN QUANTITATIVE FINANCE As fields like machine learning, data science, and quantum computing continue to evolve, it is important for professionals in the industry to sharpen the skills they need to stay competitive. Those who equip themselves with advanced programming, analytical, and mathematical skills will have more varied and interesting career paths to choose from in the future. This is where the value of continuous professional education and development comes into play. This year marks the 20th anniversary of the CQF program. Over the past two decades, we have seen the demand for quant professionals increase dramatically. Keeping abreast of developments in the industry, the CQF curriculum has evolved in compelling If I look around my office at the roles people have in Bloomberg, I see that many are complementing their current skills with programming or data science courses. This is an indication of how the industry had changed and it underscores the demand for professional certifications like the CQF. Natalia Hencsey, Global Head of Sellside Risk Sales, Bloomberg and relevant ways, drawing on the insights and experience of our faculty, dedicated practitioners and academics with relevant industry experience, and our alumni who continue to engage with the CQF program through permanent access to the Lifelong Learning library and the CQF Institute. Two examples of CQF curriculum development include the addition of Data Science and Machine Learning modules in 2017. The CQF was one of the first professional quant finance qualifications to advocate and teach these skills to delegates. These modules are updated regularly to ensure they stay abreast with new developments in the field. In 2021, quantum computing was added to the syllabus as well, giving delegates an opportunity to engage with this emerging professional field. As the industry continues to adapt to new technologies and techniques, the CQF faculty and staff will continue to enhance and update the program content to ensure that all CQF delegates will have a foundation in the most current skills and techniques sought after by employers across the financial industry. The CQF has always been about empowering financial professionals to transform their careers. Our focus on practical skills, combined with a cutting-edge syllabus, has made the program the preferred choice for professionals looking to upskill. The CQF and CQF Institute will always be at the forefront of financial education, delivering the skills and knowledge that quants need to succeed in the 21st century. Dr. Randeep Gug, Managing Director, CQF and CQF Institute CQF CAREERS GUIDE | CONCLUSION | 43 CONCLUSION Opportunities for quants are on the rise, particularly in times of turbulence for the financial markets. By taking time to develop advanced skills in core quant domains, job candidates will demonstrate their value to prospective employers. Candidates should also bear in mind that they need to show curiosity and interests in the field beyond just their university studies, with practical projects and further education being advised by recruiters. For those looking to progress to more senior positions, business skills including communication and collaboration should also be nurtured and developed over time. When preparing for the future in quantitative finance, ongoing professional education is vital to ensure success in a competitive environment. Professional designations, like the globally recognized CQF program, provide a strong foundation for building the essential skills needed to achieve your goals throughout your career. Download a brochure to find out more about how you could achieve your career goals with the CQF. CQF CAREERS GUIDE | ACKNOWLEDGMENTS | 44 ACKNOWLEDGMENTS REFERENCES ABOUT THE CQF A number of people contributed to the development of The CQF Careers Guide to Quantitative Finance 2023. First, we would like to thank Richard Booty of Testwood Partners, Patrick Flanagan of Clarence George, Dennis Grady of Spire Search Partners, James Holland of Quant Capital, Lee Horan of Rec Finance, John Meadowcroft of Anson McCade, and Tyler Robinson of Selby Jennings, who shared insights on the quant job market from the recruiter’s perspective. CQF Institute resources include polling data from the Quant Insights Conference hosted by the CQF Institute (November 2022), the CQF Institute’s Quant Finance Careers Survey (December 2021), and other polls conducted at CQF Institute events, including Reinforcement Learning by Samit Ahlawat (April 2022), A Day in the Life of a Portfolio Manager by Michael Althof (May 2022), the Quantum Computing in Finance Conference (July 2022), the Portfolio Management in Quant Finance Conference (March 2023), and the panel discussion Quantitative Finance: Skills of the Future (February 2023). The Certificate in Quantitative Finance (CQF) is awarded by the CQF Institute and delivered by Fitch Learning. The online program is focused on teaching the essential skills used by quant practitioners in today’s financial markets. The curriculum is updated quarterly in consultation with faculty and senior alumni to ensure that the skills taught in the program are meeting industry demand. Following their graduation, all CQF alumni are given permanent access to the CQF Lifelong Learning library to help them keep their skills competitive throughout their careers. They also have access to the alumni Career Services, which includes regular job posting communications, CV advice, and more. Thank you to the speakers at the Quant Insights Conferences and panel discussion on Quantitative Finance: Skills of the Future for sharing their industry insights. Most notably, we want to thank James Jarvis of Trium Capital, Natalia Hencsey of Bloomberg, and Esperanza Cuenca-Gómez of Multiverse Computing whose quotes have been used in this Guide. Part of the research for The CQF Careers Guide draws on polls that were conducted during some of our conferences and talks throughout 2022 and 2023. The vibrant conversations, on-site polling data, and thoughtful survey responses helped us gain insight into your perspective on quant finance careers. Finally, we gratefully acknowledge the many companies that have supported the CQF program over the years. Ranging from investment banks to hedge funds and recruiters, these firms have actively participated in providing information on new job opportunities through our newsletter. On behalf of the CQF program and our alumni, we thank you very much for your contributions. Salary table sources include Robert Half’s 2023 Salary Guide, Robert Walters’ Salary Benchmarking Tool, and Selby Jennings The Future of Quant: Global Market Report 2022. Additional resources include eFinancial Careers, Glassdoor, Indeed, and the Argyll Scott Technology and Data Analytics Top Skills Report 2022. Where do Quants Work CQF Institute’s Quant Insights Conference on Quantum Finance A Day in the Life of a Lead Data Scientist A Day in the Life of a Portfolio Manager A Day in the Life of a Risk Manager A Day in the Life of a Quant Advisor A Day in the Life of a Quant Developer A Day in the Life of a Quant Trader For further information about the CQF program, visit www.cqf.com. CERTIFICATE IN QUANTITATIVE FINANCE www.cqf.com UNITED STATES, CANADA: SOUTH AND CENTRAL AMERICA: www.cqf.com/linkedin Tim Johnson Pablo Castro www.cqf.com/twitter tim.johnson@fitchlearning.com pablo.castro@fitchlearning.com www.cqf.com/youtube +1 646 943 6210 +1 646 943 6208 ASIA PACIFIC: EUROPE, UNITED KINGDOM: Kay Chng Kevin Brind kay.chng@fitchlearning.com kevin.brind@fitchlearning.com +65 6572 9417 +44 (0)20 7496 8422 DESIGNATED INDIA PARTNER: MIDDLE EAST AND AFRICA: TimesPro Ravinder Panmati cqf@timespro.com ravinder.panmati@fitchlearning.com +91 720 804 0382 www.fitchlearning.com +65 6572 9412 Copyright © 2023 Fitch Learning DESIGNATED CHINA PARTNER: Gaodun Education www.gaodun.com/cqf +86 400 600 8011 55 Mark Lane, London, EC3R 7NE 33 Whitehall Street, 18th Floor, New York, NY 10004 1 Wallich Street, #19-01 Guoco Tower, Singapore 078881 19/F Man Yee Building, 68 Des Voeux Road Central, Hong Kong Dubai International Financial Centre, Al Fattan Currency House, Tower 2, Level 8, Office No. 804, PO Box 482058 DC-10147