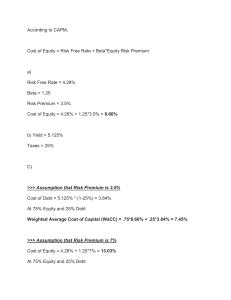

European company practice of estimating the equity risk premium in the CEEC Abstract E Enngglliisshh The strong FDI flows into the central Eastern European countries (CEEC) in recent years faced companies with problem of appreciating the involved country risk in their financial evaluations. The estimation of the equity risk premium, the variable reflecting the systematic risk, is in these countries not straight forward due to high volatility and insufficient stock market data. The existing literature abounds with alternative methods for its estimation in emerging markets, leaving the choice to the companies. This paper investigates which methods companies used to estimate the equity risk premium when evaluating investments in the CEEC during the past decade in the light of the particular situation of the future EU enlargement. The analysis of the underlying reasons and motivations for their choices exhibit the limitations of financial theory: the unrealistically strong assumptions about financial markets and the dynamics of companies’ social networks and decision making processes. Résumé FFrraannççaaiiss Ces dernières années ont été marquées par de forts flux d’investissements directs à l’étranger vers les pays d’Europe centrale; ce phénomène a confronté les entreprises à la nécessité d’intégrer le risque pays dans leurs évaluations financières. L’estimation de la prime de risque de marché, i.e. la variable reflétant le risque systémique, n’est pas un processus simple et précis en raison du manque de données historiques sur les marchés d’actions et leur grande volatilité. La littérature existante propose une pléthore de méthodes alternatives pour déterminer cette variable et laisse le monde des affaires face à un choix difficile. Cette étude explore les méthodes utilisées par les entreprises pour évaluer la prime de risque lors de leurs investissements dans les pays d’Europe Centrale pendant la décennie particulière qui a précédé leur intégration dans l’Union Européenne. L’analyse des raisons qui ont motivé leurs choix démontrent les limites de la théorie financière: des hypothèses très rigoureuses sur le fonctionnement des marchés financiers et l’absence de prise en compte des implications sociales des processus de décision au sein de l’entreprise. 17 May 2004 -1- Patrick Horend European company practice of estimating the equity risk premium in the CEEC Resumen EEssppaaññooll Le flujo de capital a los países central europeos en los últimos años creó el desafío para las empresas de como apreciar el riesgo país en los valoraciones financieros. La medición del riesgo del mercado, la variable reflejando el riesgo sistemático, sufre en estos países de la alta volatilidad y datos insuficientes. La literatura ofrece una multitud de métodos alternativos para medirla en los países en desarrollo. Este papel investiga cuales son las métodos usados en la practica empresaria para calcular la prima del mercado en el contexto de evaluar inversiones en dichos países en la década pasada teniendo en cuenta el entorno particular relacionada con la ampliación esperada de la Unión Europea. La análisis de los razones y motivaciones subyacentes que guiaron las métodos seleccionados son muestras de los limites de la teoría financiera: los hipótesis fuertes sobre el mercado financiero y las dinámicas de los redes sociales y de los procesos de la toma de decisiones en una empresa. I would like to thank Peter Elwin, Juan Cruces, Ingo Weber, Laetitia Blanc, Oswaldo Henriquez as well as the examiner Paul Stonham and the external examiner Grant Hatch for their strong support, helpful comments and the most precious: their time. 17 May 2004 -2- Patrick Horend European company practice of estimating the equity risk premium in the CEEC Table of contents 1. OBJECTIVES AND RELEVANCE ............................................................................6 1.1. 1.1.1. EU enlargement offered and will offer more opportunities...............................7 1.1.2. Why is the 2004 enlargement special? .............................................................8 1.1.3. Strong FDI flows to CEEC ..............................................................................8 1.2. 2. EASTERN EUROPEAN ENLARGEMENT CREATED BUSINESS OPPORTUNITIES..................6 EQUITY RISK PREMIUM IN EMERGING MARKETS ....................................................... 10 1.2.1. ERP in modern financial theory.....................................................................10 1.2.2. ERP in emerging markets .............................................................................. 11 1.2.3. CEEC country risk......................................................................................... 12 1.3. AIMS OF THE RESEARCH ......................................................................................... 14 1.4. METHODOLOGY AND STRUCTURE OF THE DOCUMENT .............................................. 15 ESTIMATING THE ERP IN EMERGING MARKETS .......................................... 17 2.1. HISTORIC RISK PREMIUM ........................................................................................ 17 2.1.1. 2.2. IMPLIED EQUITY PREMIUMS .................................................................................... 19 2.3. THE ERB-HARVEY-VISKANTA MODEL....................................................................21 2.4. MODIFIED HISTORICAL RISK PREMIUM ....................................................................21 2.4.1. Sovereign bond spread or Goldman model .................................................... 22 2.4.2. Public available country ratings ....................................................................23 2.4.3. Relative equity market standard deviations .................................................... 24 2.4.4. CSFB model ..................................................................................................25 2.4.5. Default spreads and relative standard deviations .......................................... 25 2.5. ESTIMATING ASSET EXPOSURE TO COUNTRY RISK PREMIUMS ...................................26 2.5.1. Everything equal ........................................................................................... 27 2.5.2. Beta approach ............................................................................................... 27 2.5.3. Differentiated approach ................................................................................ 27 2.5.4. Which adjustment method? ............................................................................ 31 2.6. 3. Historic risk premium in Eastern emerging markets ...................................... 18 WHICH METHOD TO CHOOSE IN THE PRACTICAL APPLICATION? ................................ 32 TERM STRUCTURE OF THE DISCOUNT RATE ................................................. 35 3.1. WHAT IS THE TERM STRUCTURE? ............................................................................ 35 17 May 2004 -3- Patrick Horend European company practice of estimating the equity risk premium in the CEEC 3.1.1. 4. 5. Theoretic explanations of the yield curve ....................................................... 36 3.2. REASONS TO EXPECT A DECREASING CEEC COUNTRY RISK PREMIUM ...................... 37 3.3. CONVERGENCE TO THE PURE DEFAULT SPREAD ....................................................... 39 3.4. ANTICIPATING RATING IMPROVEMENTS ..................................................................40 3.5. IMPLIED SPREAD ON FUTURE MARKETS ...................................................................43 3.6. LOOKING AT THE HISTORIC CASES PORTUGAL AND GREECE.....................................43 3.7. POTENTIAL EMU JOINING BY THE NEW EU MEMBERS ............................................. 44 3.8. CAN THE TERM STRUCTURE OF THE COUNTRY RISK PREMIUM BE ANTICIPATED ? ....... 44 METHODOLOGY OF THE RESEARCH ................................................................ 45 4.1. FACTORS RESTRICTING DATA ACCESS .....................................................................45 4.2. CHOICE OF APPROACH ............................................................................................ 45 4.3. STRUCTURE OF THE SAMPLE USED .......................................................................... 46 4.4. THE INTERVIEW QUESTIONS .................................................................................... 47 4.5. LIMITATIONS OF THE PRESENTED ANALYSIS ............................................................ 48 FINDINGS AND ANALYSIS OF COMPANY PRACTICE ....................................49 5.1. MOST IMPORTANT FACTORS FOR FDI DECISIONS IN CEEC ...................................... 50 5.2. CHOICE OF METHODS AND ALTERNATIVE APPROACHES............................................ 51 5.2.1. Equity risk premium ...................................................................................... 51 5.2.2. Country risk premium .................................................................................... 52 5.2.3. Consideration of EU enlargement in the discount rate...................................53 5.2.4. Findings particular to industrial sector ......................................................... 54 5.3. ANALYSIS OF THE FACTORS AND MOTIVATIONS FOR COMPANIES’ PAST PRACTICE .....56 5.3.1. Efficient market and information transparency .............................................. 57 5.3.2. Factors undermining value of NPV method in emerging markets ................... 58 5.3.3. Vast existing literature for estimation of developing country ERP.................. 59 5.3.4. High statistical noise in financial market data ............................................... 59 5.3.5. Companies are social networks .....................................................................59 5.3.6. Behaviour consistent with microeconomic theory .......................................... 61 6. CONCLUSION ........................................................................................................... 62 7. BIBLIOGRAPHY ....................................................................................................... 65 17 May 2004 -4- Patrick Horend European company practice of estimating the equity risk premium in the CEEC Directory of Tables Table 1: Elements of country risk ......................................................................................... 13 Table 2: Summary of ERP estimation methods .....................................................................33 Table 3: Example calculation of anticipating country risk reduction for Slovenia. ................. 42 Directory of illustrations Graphic 1: FDI inflows and their share in gross fixed capital formation, 1990-2002 ...............9 Graphic 2: Transmission channel of the ERP to the NPV ...................................................... 11 Graphic 3: Country credit rating CEEC, 1986 – 2004 ........................................................... 13 Graphic 4: Evaluation matrix for adjustment methods of the country risk premium .............. 32 Graphic 5: Historic country ratings of Greece, Portugal, Slovenia and Czech Republic ......... 41 Graphic 6: Principal–Agent problematic between FM and his superior .................................60 17 May 2004 -5- Patrick Horend European company practice of estimating the equity risk premium in the CEEC 1. Objectives and Relevance The equity risk premium (ERP) is a crucial element for any business evaluation. In the case of emerging markets, the high volatility and insufficient sample periods render the historic ERP approach of little value. Current literature, hence, abounds with alternative techniques aimed at the ERP estimation in these markets. This, however, has created a confusing diversity of advocated methods and as Harvey (2001) notes a “widespread disagreement, particularly among practitioners of finance, as to how to approach this problem”. Comparably few studies investigated how companies actually calculate the ERP reflect this diversity in literature. Bruner (1998), Pereiro (2000) and McLaney (2004) demonstrated that finance professionals applied widely differing methods and parameters to estimate the cost of capital. These surveys in the US, Argentina and the UK, respectively explored comprehensively the existing differences and showed as McLaney (2004) concludes that “firms tend not to make all of the adjustments to the overall figure which academics might expect, only making simple adjustments for risk ...” The presented research will follow their line of investigation and focus the analysis on European companies and their past practices to estimate the ERP in the context of financial valuations of FDI in central Eastern European countries (CEEC) in the decade prior to the EU enlargement. Furthermore, it investigates whether companies took into account the by macroeconomic theory expected CEEC country risk reduction due to the EU enlargement and its complex economic and political effects. The analysis of the main factors that influence the choice of the finance professionals show that companies’ disbelief of some fundamental assumptions of financial theory alone do not explain companies non-application of, the by theory, advocated tools to estimate the ERP for financial valuations for FDI decisions in the CEEC. This paper gives a good example of the limitations of modern financial theory in a real business environment. 1.1. Eastern European Enlargement created business opportunities The entry of the 10 candidates in the European Union, May 1 st, 2004, is expected to further decrease the new member’s perceived country risk as indicated by their past credit ratings 17 May 2004 -6- Patrick Horend European company practice of estimating the equity risk premium in the CEEC improvement. Occidental companies invested heavily in these countries during the decade prior to the EU enlargement. This study investigates, therefore, how companies, in the course of financial evaluations for FDI in the CEEC, estimated the ERP, which methods and parameters were used given the existing methods for emerging markets and what were companies motivations to use one or another estimation method. 1.1.1. EU enlargement offered and will offer more opportunities The accession of the 10 countries in 2004 was in fact the latest in a succession of treaties which created the EU of the 15. The Treaties of Paris (1951) established the European Coal and Steel Community (ECSC) by which than lead to the Treaty of Rome (1957) creating the European Economic Community (EEC) and EURATOM. Since then, the EU gates opened four times to welcome new member countries. The Treaty of Maastricht (1992) laid the grounds for free movement of goods, services, money and people in the EU internal market. In 2004, in an expansion towards Eastern Europe, ten countries 1 joined the EU. Other countries, like Bulgaria and Romania are already in concrete accession negotiations for the next wave of EU enlargement, whilst some of the recent joiner countries aspire already to join the EMU in the medium-term future2. Historically, countries entering the EU benefited from the access to the EU internal market and regional aid. Economists3 expect for many of the joiner countries in 2004 and the still waiting aspirants an economic convergence process facilitated as well by access to the internal market and regional aid, but as well by the increased legal security due to the adoption of the Acquis Communautaire. (Source!!!!!) Concluding, the further expansion of the EU will continue to offer investment opportunities in countries in an economic transition similar to the new EU joining countries’ past development with the perspective of joining eventually the EU. Investigating the past practice of appreciating the country risk in the CEEC in the financial valuations will allow the The following countries joined the EU the 1st May, 2004: Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovak Republic, Slovenia 1 Hungary expects to meet the Maastricht criteria by 2008 and to join the Eurozone by 2010, FT (May, 13, 2004, “Hungary economy: Hungary sets new euro entry target” 2 See section 3.2. for a brief summary of macroeconomic literature on the effects EU enlargement on the EU and the joining CEEC 3 17 May 2004 -7- Patrick Horend European company practice of estimating the equity risk premium in the CEEC identification of potential areas for improvement in both current business practice or currently available financial methods and tools. 1.1.2. Why is the 2004 enlargement special? The fact that renders the enlargement of 2004 special is the fact that a club of rich countries like the EU integrates a group of ten countries at once, which were still considered to be developing countries 45 . Investments in these countries, as macroeconomic theory implies, bear an additional risk, the so called country risk. To compensate for this additional risk, investors demand a higher return, which is commonly referred to as the country risk premium. The macroeconomic effects in terms of trade, GDP growth or inflation of the EU enlargement have been well studied in economic literature. However, there have been rather few studies investigating the potential effects of the EU enlargement in particular on the magnitude, the behaviour over time or other characteristics of the ERP from a financial perspective, offering opportunities for further research in this area. 1.1.3. Strong FDI flows to CEEC In 2002, the 10 new EU member candidates saw their capital inflows from FDI increase by 15% to reach a total of slightly more than US$ 21bn6. Given that global FDI flows decreased by 20%, the World Investment Report sees the attractiveness of the CEEC partly in the anticipated EU accession of these countries Other factors were the geographical proximity to end-user markets in the EU and the still favourable level of labour costs in these countries. However due to the perceived country risks in the past, investments in high-tech operations have been very limited.7 The world investment report 2003 divides the world in developing countries, CEEC and developed countries, though in macroeconomic literature they are often referred to as transition economies. 4 The average GDP per head reached in 2003 only about 46% in percent of the EU average of the existing EU-15. FT (2004) 5 6 World investment report 2003, analysis of Central and Eastern Europe, p. 53 - 7 Barry (2002) 17 May 2004 -8- Patrick Horend European company practice of estimating the equity risk premium in the CEEC Graphic 1: FDI inflows and their share in gross fixed capital formation, 1990-20028 In the context of this paper, FDI is defined using the definition by the UNCTAD 9 which comprises cross border M+A transactions as well as the setting up of operations. Baniak et al (2002) conclude that FDI flows depend highly on the following broad characteristics of a host country: legal stability and transparency macroeconomic stability fiscal and business regulations others (size of the market, infrastructure, bureaucracy) However, the expected rise in labour costs as part of the economic convergence process and the harmonisation of the CEEC’s FDI regimes in order to conform with EU regulations will slowly but gradually erode part of the financial attractiveness of FDI in the CEEC10. In order 8 Graphic taken from World investment report (2003) The UNCTAD definition found on its webpage under the statistics part is the following: “Foreign direct investment (FDI) is defined as an investment involving a long-term relationship and reflecting a lasting interest and control by a resident entity in one economy (foreign direct investor or parent enterprise) in an enterprise resident in an economy other than that of the foreign direct investor (FDI enterprise or affiliate enterprise or foreign affiliate). ... FDI has three components: equity capital, reinvested earnings and intra-company loans.” 9 Some CEEC have taken drastic measures to compensate for the change in their non-EU conform FDI regimes by for example general tax reductions like in the case in Hungary. 10 17 May 2004 -9- Patrick Horend European company practice of estimating the equity risk premium in the CEEC to still spot beneficial investment opportunities in the future, financial valuations of CEEC investments will require financial valuations to reflect more accurately the involved risks. 1.2. Equity risk premium in emerging markets The equity risk premium (ERP) is one of the most important variables in modern finance. Despite the continuous discussion about its magnitude and the correct estimation method, notably in emerging markets, it is paramount for allocation decisions of investors and companies. 1.2.1. ERP in modern financial theory The ERP forms an irreplaceable ingredient of modern finance theory. It is defined as “the additional [future] return an investor expects to receive, to compensate for additional risk associated with investing in equities as opposed to risk-free assets”. It is a building block of modern financial market theory such as the capital asset pricing model (CAPM) by Sharpe (1964) and Lintner (1965) or the APT model by Ross (1976). These models are frequently applied to estimate the firm’s cost of capital for a discounting cash flow evaluation11. As a detailed discussion of these financial concepts are not the scope of this paper, the influence of the ERP on the final outcome of a net present value (NPV)12 calculation is presented in the simplified graphic below. Bruner (1998) finds that 80% of the companies use the CAPM model whilst Pereiro (2000) finds that 68% of Argentinean companies use the CAPM and 6% the APT model. CFt 12 Net present value t t (1 r) 11 17 May 2004 - 10 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Graphic 2: Transmission channel of the ERP to the NPV ERP / Country risk Company beta CAPM Cost of equity Cost of debt WACC to derive at discount rate Estimation of CFs NPV Basis for decision making source: Patrick Horend A NPV greater than zero indicates that given the opportunity costs of capital, i.e. the discount rate, the project is beneficial to the firm and vice versa. The application of this concept is paramount to business decision making, for instance when deciding on acquisitions, FDI or capital budgeting. It is important to note that the NPV is very sensitive to minor changes in the used discount rate. This explains the intensive debate on the magnitude and characteristics of the ERP by literature and professionals. 1.2.2. ERP in emerging markets Extensive research has been published on the ERP in emerging markets, notably on Latin America. These mainly econometric studies depart either from a financial market or macroeconomic theory perspective. Generally accepted is the notion that the ERP in emerging markets is on average higher than in established markets 13 reflecting the higher risk and returns of economic activity in these countries. However, the high standard error of emerging markets ERPs due to higher volatility in returns and smaller available samples undermine their explanatory power. A often used approach is therefore the decomposition of the ERP which assumes three main components, somehow similar to the APT approach. Equity risk premium = risk free rate + mature market premium + country risk premium 13 Salomon et al (2004) 17 May 2004 - 11 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC It departs from the assumption that emerging market ERPs should comprehend the risk free rate, the return that investors normally require from equity shareholdings and a premium which is the reward for the extra risk linked to political, commercial and legal uncertainties in a particular country, i.e. the country risk. Many authors like Damodaran (2003) assume that the country risk premium should at least be equal or greater than the sovereign default spread on long term sovereign debt. This assumes implicitly that bondholders’ risks correspond to equity risks, which as well is contested 14. The sovereign default spread is often defined as: Sovereign default spread = yield on sovereign long term debt - yield on US treasury bonds = country risk premium As the government is assumed to be of higher credit worthiness than any company in the particular country, it is seen as the minimum level of default risk which a company, or project in that country incurs. This topic will be further developed in section 2.2. of this paper. 1.2.3. CEEC country risk The central Eastern European countries (CEEC) entered capitalism starting with the Hungarian border opening in September 1989 and the fall of the Berlin wall the November 9th, 1989. The following transition period from a command to a market economy caused severe macroeconomic and political turbulences, which were mirrored by increased default risks on the bond markets15. In the following economic recovery, the countries’ endeavour to comply with the EU membership criteria in a context of global emerging market spread tightening provided the grounds for a continuous decrease in their sovereign bond spreads, i.e. country risk premia, mirrored by improving credit ratings. Harvey (2001) in response to the Goldman model sees it problematic to “assume,.., that the credit spread on a company's rated debt is the risk premium on the equity.” 14 15 Lavigne (1999) 17 May 2004 - 12 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Graphic 3: Country credit rating CEEC, 1986 – 2004 source: Institutional Investor magazine Country risk is a concept borrowed from macroeconomic theory. It encompasses generally the following categories of risk particular to developing countries: Table 1: Elements of country risk Political or sovereign risks Sovereign risk government actions Transfer risk capital controls, risk of repatriation of capital, etc. Risk of catastrophes and other extraordinary contingencies natural and political catastrophes, economic crisis The extra political risks are linked to the location of the investment as well as to the country’s specific laws and customs. Regulatory decisions, the prevalent culture and the political system influence directly the commercial possibilities of a there located company. Commercial and counter-party risks Contractual risks non execution in time, place and form Debtor risk non-payment risk Credit risk non-repayment risk of the debts Rescission risk unilateral rescission These risks are directly related to the ordinary operations of a company involved in international trade. In this case, the perception of risk increases due to the missing knowledge of the foreign country’s customs, missing historical experience or less juridical protection in the case of potential conflicts. Financial risks 17 May 2004 - 13 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Exchange risk volatility of foreign currencies exchange rates Interest rate risk volatility of interest rates. Foreign exchange rates as well as interest rates of the destination / domestic country can lead to a destruction of value of the investment envisaged. source: Echevarria (1999) The adoption of the whole of EU law will augment legal transparency and security, a important element of country risk. Furthermore, a potential, if not likely (at least in the midterm) EMU membership of the new joiner countries would lead to an entire convergence of sovereign spreads compared to German Bunds. The reasons are: the elimination of exchange risk, the loss of their monetary sovereignty and the fact that the ECB and the other EMU members would be the lender of last resort in the case of financial distress. However, in this case, market participants are likely to distinguish between default risk and the risk of owning fixed assets.16 1.3. Aims of the research Literature offers a confusing abundance of methods for the estimation of the ERP in emerging markets, which would apply as well to the CEEC. Few studies have investigated actual company practice in regard to the crucial estimation of the ERP. Bruner (1998), Pereiro (2000) and McLaney (2004) asking American, Argentinean and British companies about the technical details of their cost of capital, concluded that a great variety of different variables and estimation methods are used in professional application. McLaney concludes that firms “tend not to make all of the adjustments to the overall figure which academics might expect, only making simple adjustments for risk ...” Given the particular situations of the CEEC and the EU enlargement, the presented paper investigates: the technical details of how occidental companies estimated the ERP in the financial valuations undertaken in the context of FDI in the CEEC in the decade prior to the 2004 EU enlargement. (i.e. methods, input variables) In this case, two interviewee showed concerns about using the sovereign spread as a good estimate of the actual country risk. 16 17 May 2004 - 14 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC whether companies appreciated in their financial models the potential effects of the EU enlargement on the country risk in the CEEC the factors and motivations that influence company professionals in their choice of estimation method The findings in this paper of actual company practices will contribute to the scarce knowledge in this field of best practice on applied financial theory. The paper aims to explain and analyse the findings in the context of economic theory. The revealed limitations to the application of financial theory in the real business context leads to several recommendations to improve professional practice or to point out potential dangers of current practices for the future. Furthermore, the presented paper aims to stimulate a broader discussion in scientific and company circles about how to reflect the special circumstances of the EU and EMU enlargement in business financial evaluations and capital budgeting planning. 1.4. Methodology and structure of the document In section two, the paper explores the main existing concepts and techniques to estimate the ERP in emerging markets 17 and the eventually necessary adjustments for a particular company. Section 3 treats the in literature less established idea of anticipating the country risk premium over time. It introduces briefly the concept of the term structure of interest rates followed by a more extensive part on the reasons why to expect a future reduction in the country risk premium. Then it presents the few existing methods for its anticipation as well as new possible method. The methodology of the data collection and analysis is detailed in section 4. The paper’s findings and analysis of actual company practice of the existing concepts is presented in section 5. The analysis of company behaviour in regard to the previously presented approaches for the estimation and adjustment of the ERP in CEEC will be undertaken using primary data from semi-structured interviews with experienced finance managers in project evaluations and acquisitions in CEEC. The companies interviewed belong to the industrial, banking sector and financial advisory sector. The interviews focused on the theoretically elaborated theory in section 2 and 3 attempting to analyse the historic company practice in financial evaluations 17 May 2004 - 15 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC undertaken for FDI in the CEEC. Open end questions were aimed at identifying the reasons and motivations for the choice of certain approaches and the potential areas of improvement. In order to avoid a skewed or single-sided analysis, secondary data as well as the studies by Bruner (1998), Pereiro (2000) and McLaney (2004) will be used to complement and enrich the information gained in the interviews. Section 4 discusses the applied methodology in more detail. The extensive literature on this topic prevents a thorough discussion of all existing models. See Damodaran (2003) and Harvey (2001) for more details. 17 17 May 2004 - 16 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 2. Estimating the ERP in emerging markets The common models of modern finance assume that the ERP captures the systemic risk caused by for instance the economic sector or the country risk. Emerging markets’ particular estimation problems due to high volatility and insufficient availability of data are met by extensive literature and studies from scientific and professional sources 18 that advocate alternative methods for its estimation. In a result, Harvey (2001) sees “widespread disagreement, particularly among practitioners of finance, as to how to approach this [estimation] problem.“. The most important concepts of current literature of how to estimate the ERP in emerging markets are discussed in this section. 2.1. Historic risk premium The common way to estimate the future equity risk premium for long established markets is to look at past stock returns assuming that the future will not vastly differ from the past. Despite the inherent flaw that history never repeats itself in exactly the same manner, this approach is commonly used by professional services like Ibbotson Associates or scientific research like Dimson et al (2001). The ERP is calculated as the average excess returns earned on equity investments over investments in risk free government bonds. In order to exclude the effects of exceptional random years and to minimise the standard error the calculation should be based the largest possible sample period.19 There exist two ways to calculate the historic risk premium. Either it is computed using the arithmetic or the geometric mean of the excess returns. The geometric return represents the annualised rate of return over a certain period of time. It is the nth root the of the product of all annual returns minus 1. It is only appealing when past performance is analysed. n Geometric average return on equity n-1 years annual return on equity 1 1 18 “Stocks, Bonds, Bills and Inflation” (SBBI) Yearbook by Ibbotson Associates 19 The study by Dimson et al (2001) used a sample of 100 years for seven major stock markets 17 May 2004 - 17 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC As investment decisions are usually forward looking, however, the arithmetic mean should be utilised, as Dimson et al (2001) argue “it represents the mean of all the returns that may possibly occur over the investment holding period.” Average annual return of equity annual returns on equity plus dividends number of years of sample period The arithmetic mean is calculated as the sum of all n returns, divided by n. The choice of the averaging method presents one of the few areas of general unanimity in application identified by Bruner (1998) and Pereiro (2000). The risk free return is typically measured either using treasury bills or long-term government bonds as the risk-free rate reference. Only treasury bills can really be regarded as risk-free given their insensitivity to inflation, despite investors still running risks in hyperinflationary times. Long-term bonds are riskier due to their sensitivity to inflation expectations and hence real interest rates. Nevertheless, long-term bond prices represent not only the current shortterm interest rates, but as well expected interest rates in the future. Hence for the purpose of valuing cash flows forecasted many years in the future, the return on long-term bonds are better suited as they incorporate the expected returns on treasury bills until maturity of the bond as well. The disadvantage, though, is that its price also reflects a maturity risk premium, which is difficult to measure. (Dimson et al 2001, Ibbotson 1998) The historical ERP methodology is not very well suited for emerging markets as pointed out for instance by Damodaran (2003) due to the high volatilities and small available sample sizes. Practitioners and researchers have therefore developed an armada of concepts to solve these problems. 2.1.1. Historic risk premium in Eastern emerging markets As Damodaran (2001) and other authors point out, emerging markets tend to be more volatile than established ones and secondly, there is a lack of sufficient quality long term data, especially in Eastern Europe due to their communist history. Both effects increase the inherent standard error of any computed ERP. The problem becomes clear, when looking at 17 May 2004 - 18 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC the normal way to express the standard error in the risk premium. It is a function of the annual standard deviation of equity returns and the number of years used for the calculation. Standard error in the risk premium Annualised standard deviation in stock returns Number of years of data in the sample The standard error depends therefore directly on the volatility in a given market and on the number of periods in the sample period. The higher the annual standard deviation, the higher is the resulting standard error. More available periods will reduce the standard error substantially and therefore make the estimated ERP statistically a more reliable estimate for the future. For illustration purpose, the standard error in the historical equity risk premium in the US calculated over 100 years of data amounts to: Standard error in the risk prem ium US 20% 2% 20 100 Even when basing the calculation on 100 years of data, the standard error is around 2% which is about one third of the ERP of 5,8% for US assets. Coming back to Eastern European emerging markets, we might be able to find only 10 years of reliable historical data. Combined with the elevated level of volatility in those markets the standard error surpasses by far any historical premium estimate, rendering the result of the calculation almost meaningless creating the demand for other concepts. 2.2. Implied equity premiums An alternative to the approaches based on historic performances is an implied approach as derived from the Gordon-growth model and its derivatives. Various authors like Madden (1998), Damodaran (1994), Ibbotson (1996), Gordon and Gordon (1997), Pratt (1998) have proposed models either based on a Gordon constant-growth model or a multi-stage dividend discount model. Recently published papers like Madden (1998) used a CFROI-based model and Gebhardt, Lee and Swaminathan (2000) discounted residual income model. For a steady growth case, a simple valuation model would be: 17 May 2004 - 19 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Company value expected dividends in T 1 stock buybacks (required return on equity - expected growth rate) The implied equity premium is obtained by solving for the required return on equity. A calculation which for a multi-stage model becomes a iterative approximation similar to estimating the IRR. The remaining variables can be obtained from the market. The index score of the country’s stock market would be a proxy for the value of the stock. The expected cash yield (dividends plus share buybacks) can be obtained either from financial services like Thomson or Bloomberg using the average consensus forecasts of the individual stocks or topdown consensus estimates for the index as a whole. If the latter are not available, the trailing 12 month cash yield can be used. The long term expected growth rate is the most difficult to estimate, especially given the high sensitivity on the resulting implied ERP. Some analyst use for it the risk-free rate, assuming that real growth is equal to the real interest rate. Damodaran (1994) sees that to be true in the case of mature countries, but for emerging markets it can lead to unsustainable, artificially high growth rates, especially during a general emerging market crisis or if the country is in financial distress. Theoretically, this rate should be equal to what macro-economist call the long term sustainable growth rate, which differs for each country. For the US it is often assumed at to be around 3 to 3.5%21 whilst for northern Europe only at 2.5%. For emerging markets it can safely be assumed to be higher than in mature markets, 4% to 6% are usually adopted. To increase the accuracy of the estimated implied equity risk premium, a multi-stage model is advisable. The usual approach is a two-stage model, but also a three stage model can be justified in particular circumstances. The different stages only differ in their assumption about the expected long term growth rate. The most interesting advantage is clearly the forward looking nature as it uses market’s expectations and the latest market values. On the other hand, it requires market’s expectations 20 Changed example from Damodaran (2003) with data from Dimson et al (2001) 21 See article in The Economist August 9, 2003 “Still in gear?” 17 May 2004 - 20 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC on dividend growth over the medium and long term, which are prone to high uncertainty. In many smaller emerging markets, these can be quite difficult to obtain, if at all. 2.3. The Erb-Harvey-Viskanta Model The model from Erb, Harvey and Viskanta (1996) used the country credit risk survey by Institutional Investor to explain the historic observed ERPs from the country’s historic credit rating. They used data on 47 countries over a period of 15 years to perform a time-series cross-sectional regression to fit the following formula: Ri,t+1 = 0 + 1ln(CCRi,t) +i,t+1 CCR represents the country risk rating of country i and the estimated coefficients were: 0 = 53.71 and 1 = -10.47 in the full sample version in Erb et al (1995),.When testing the model on the US stock market, the model has a R-squared of 30% which is in the range of most multi-factor models. The same approach based also on other country credit risk surveys is commercially available as The International Cost of Capital and Risk Calculator (ICCRC) which delivers companies the cost of equity, WACC and other statistics for any country in the world. The most remarkable fact about this method is that it can be used to estimate the ERP for countries that do not have a stock market as long as they are rated by Institutional Investor magazine. 2.4. Modified historical risk premium A first alternative approach is to use the decomposition concept22 of the ERP and estimate its different components separately : Equity risk premium = risk free rate + mature market premium + country risk premium Called “Build-Up Methodology” by Ibbotson Associates. This approach is accused to lack any theoretical foundation by Harvey (2001) 22 17 May 2004 - 21 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC The risk free rate is usually the yield of US or similar risk free long term government bonds. The mature market premium would usually assumed to be the equity risk premium of the US stock markets23, though slight adaptations are introduced in various methods explored below. Dimson et al (2001) estimated a US ERP of 8.8% in the period between 1900 and 2000, but we could use as well their estimate of the average ERP for 12 major industrial markets of 5.7%. A selection of the most common methods based on the decomposition of the ERP are presented below. The focus is often on the different calculations and adjustments to the estimation of the country risk premium. 2.4.1. Sovereign bond spread or Goldman model24 The sovereign bond spread is a widely advocated and applied proxy for the country risk premium. It is based on the fundamental assumption, that the default risk of emerging market debt corresponds to the country risk for the ownership of fixed assets, which is not necessarily the case. 25 It is normally defined as the difference in yield between a risk free bond and a similar emerging market sovereign bond in US$ or Euro of the same maturity. Sovereign default spread = sovereign bond yield (US$ or €) – risk free rate (US$ or €) Given the high volatility of emerging market sovereign spreads, Damodaran (2003) suggest to use an average spread over a reasonable period of time like two years for the actual computing purposes. This offers a measure which is less dependent on current stock market moods or crises. Cost of equity = Rf + (mature market premium) + sovereign default spread Using the US ERP bears the risk of survivorship, as the US market is undeniable one of the most successful capital markets of the world and might therefore offer a higher reward to investors. See Brown et al (1995) and Brown et al (1999) for a discussion of the phenomenon. 23 24 Various prominent investment banks advocated this model in the 00’s Existence of guaranties by other countries or securitisation methods can distort this phenomena. For details see description of Pereiro (2000) on the differences of Argentinean PAR bonds which are backed by a holding of treasury bonds. 25 17 May 2004 - 22 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC For financial evaluation purposes, the computed rate is usually added to the cost of debt and the cost of equity to derive the required return or the cost of capital (Mariscal and Lee 1993). Some analysts adjust as well the country risk premium itself, here represented by the sovereign default spread, which will be discussed later. 2.4.2. Public available country ratings Country risk measures have been developed during the 20th century by various public and private entities. Easily available are country ratings by the rating agencies (S&P, Moody’s, Fitch) for a country’s outstanding external long term debt. Their ratings measure the credit quality of a security, i.e. they attempt to capture the risk of non-repayment of the debt for the investor. These ratings are designed to measure pure default risk only and not the risk to equity or owning fixed assets in this country. However, they are seen as decent risk proxy and, in fact, encompass all those risks that as well affect equity risk, though not all of them. The country risk premium is obtained by using the current market spread on bonds with the rating of the country or by using the respective historically observed spreads for the rating. Despite the convenience of ratings as a measurement of country risks, using them as the only proxy for country risk bears with it certain limitations. The main problem is that rating agencies usually lag markets in responding to abrupt changes of the country’s situation and hence its default risk. An associated problem is that rating agencies are so powerful in their effect on the market, that their decision, especially in downgrading a country, can become a self-fulfilling prophecy. This in return impedes a totally unbiased timing and allocation of their ratings decisions. Furthermore, the fact that default risk is not equal to equity risk cannot be neglected. There might still exists other risks specific to an economic activity in a particular country, which is not captured by the default risk approach. Apart from the established rating agencies, there exists a number of numerical rating approaches. These are either based on surveys, like the semi-annual country credit rating survey by the journal “Institutional Investor”, or on a more comprehensive set of risk measures. The Eurasia group offers, for instance, a emerging market country rating from 0 to 100, with 100 meaning the highest level of risk. The country risk premium can be obtained by running a regression of the historic country ratings against historically observed sovereign spreads which limits the use of these ratings substantially. However, in the case for the 17 May 2004 - 23 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Institutional Investor country rating exists already a econometrically fitted model by Erb et al (1995) which will be discussed in section 2.4. A final approach to measure country risk consists of using a bottom-up methodology, deriving it from a country’s economic fundamentals. The JPMorgan emerging market method is one example, which uses a weighted combination of economic fundamentals like GDP, current account deficit, etc. over a period of 5 years to evaluate the additional market risk of a particular country. One clear disadvantage is the extent of information and time required for its application compared to the previous approaches. But the real problem here is the translation of the obtained rating in a observed spread. 2.4.3. Relative equity market standard deviations Defining investment risk as the possibility that the real return on an investment deviates from the expected return implies that the a stock market’s volatility measures this risk of deviation. It is usually defined as either the historic standard deviation of a market or as the implicit volatility computed using the future markets. In order to obtain a total risk premium for a nonUS market some analysts use the calculated relative standard deviation as an risk adjustment coefficient and multiply it with the historic equity risk premium for the US stock market. Equity risk premium Country X = equity risk premium US * relative standard deviation Country X Relative standard deviation Country X Standard deviation Country X Standard deviation US Damodaran (2003) points out that a couple of problems can arise when using this method. In emerging stock markets which are illiquid, this approach will for instance underestimate the ERP, as a country’s stock market structure and liquidity wield great influence over the observable standard deviation, possibly delinking market risk and volatility. A second problem is linked to the fact, that when computing the relative standard deviation, the used standard deviations are usually measured in local currencies. Hence this approach is exposed to the often different dynamics in foreign currency markets. An easy remedy would be to calculate the standard deviations in the same currency. 17 May 2004 - 24 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC An bizarre situation might arise when the calculated country risk premium is below the sovereign default spread of the country. From an intuitive point of view, the risk for any economic agent in a certain country should bear at a minimum the sovereign risk of this country. Hence the question whether a company can be seen as more solvent and credit worthy than the government of the particular country. Another version of this more theoretical question is whether a company in an emerging market can have a better rating for its debt than the country itself. Further econometric and theoretical research would be needed to answer this question satisfactorily. 2.4.4. CSFB model The relative equity market standard deviations model is the simplified version of a model proposed by Godfrey and Espinosa (1996) and Hauptman and Natella (1997) which uses the following equation to derive the cost of equity: Ri = RfUS$ sovereign debt + Beta [(RUS – RfUS$ sovereign debt ) * Ai] * Ki The risk free rate is the return of the US$ sovereign external debt, Beta the covariance of stock i with the broad market portfolio, (RUS – RfUS$) a difference of the US ERP and the local risk free rate in US$ terms, Ai is the relative standard deviation of the local and the US equity markets and Ki is an adjustment factor to allow for “the interdependence between the riskfree rate and the equity risk premium” which Natella and Hauptman (1997) propose to be 0.60 according to their econometric calibrations. Critics point out that it lacks any theoretic foundation. Harvey (2001) calls it “a perfect example of the confusion that exists in measuring the cost of capital.” 2.4.5. Default spreads and relative standard deviations The default spread, capturing default risk alone, is not considered to encompass all the risks related to economic activity in a particular country. Damodaran (1999) introduces therefore a coefficient which is supposed to capture the relative higher risk of equity, similar to the relative standard deviation approach seen above. He uses the relative standard deviation of the 17 May 2004 - 25 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC concerned country’s stock market over the standard deviation of the sovereign bond used for the default spread. Country equity premium = sovereign yield spread x ( equity/ bonds) The calculated country risk premium is then added to the mature market ERP. Similar to the pure default spread approach, this premium is susceptible to a change in the country’s sovereign rating or to a change in investors risk perception towards emerging markets, like a temporary emerging market crisis26 and requires as well the existence of US$ denominated long term debt and liquid local stock markets. Problematic is the question whether it is consistent to calculate a coefficient based on standard deviations in two different currencies. It is similar to the problem seen for the relative standard deviation approach. Either one calculates the relative standard deviations quoted in different currencies, thereby including potential distortions due to different market dynamics such as liquidity or regulations, or one eliminates this distortion by converting the local standard deviation to US$ or Euro terms and thereby includes other potential distortions due to the fluctuations of the foreign exchange markets. Neither way is totally satisfactory. All this models based on the decomposition of the ERP are often criticised that they lack a theoretic basis. Harvey (2001) for instance sees little evidence why “the credit spread on a company's rated debt is the risk premium on the equity.” 27 Other developed methods attempt to therefore to approach the ERP problem from other perspectives. 2.5. Estimating asset exposure to country risk premiums Damodaran (2003) argues that the country risk for companies in a particular country is not uniform and requires therefore an adjustment to estimate the actual exposure of an individual assets or company to the previously calculated country risk. 26 Latin America’s history provides many examples like the 1995 Tequila crisis for instanc 27 Harvey (2001), p. 5 17 May 2004 - 26 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 2.5.1. Everything equal Despite the insight of the companies’ different exposures to the country risk, a widely used approach assumes that all companies in a country are equally subject to the same country risk. This is the base case of the Goldman approach, where the mature market equity risk premium risk constitutes an equal additional hurdle for all companies in a certain country. Cost of equity = Rf + (mature market premium) + sovereign default spread The so far calculated cost of equity is in US$- or Euro-terms and to arrive at the local cost of equity a final adjustment is to be made taking account of the different inflation rates. Rescaling the dollar cost of equity using the inflation differential yields then the cost of equity in local terms. 2.5.2. Beta approach Another approach by Damodaran (2003) adjusts for the differing exposure to the country risk using the company’s beta. Assuming it to be a representation of the company’s exposure to the country risk in the same extent as to the overall market risk. Cost of equity = risk free rate + beta (mature market premium + country risk premium) In effect, using this approach, high beta stocks are assumed to have a higher exposure than low beta stocks not only to business risk but as well to country risk. The advantage of this approach, as well as of the first one, is its simplicity and the easy availability of the company betas. However, this hypothesis can lead to a serious distortion of the relative project attractiveness for decision making purposes. The differentiated approach in the next section aims to remedy these disparities. 2.5.3. Differentiated approach Given the limitations of the all-equal and the beta approach, a third more differentiating approach (Damodaran 2003) attempts to account for differing asset exposures to country risk. This method introduces a second coefficient, named lambda (), that measures the company’s 17 May 2004 - 27 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC exposure to the country risk. Its interpretation is similar to the coefficient beta. Centred around one, a lambda of one indicates that a company has an average exposure to country risk, whilst a lambda lower or higher than one indicates, that the company is to a lesser or higher extent exposed to the country risk. This approach yields a two factor equation with the coefficient beta for the company’s exposure to the overall market risk and the coefficient lambda accounting for the company’s exposure to the additional country risk. Expected cost of equity = Rf + (mature market premium) + (country risk premium) Theoretically this approach is very intriguing, it’s practical application though depends on the availability of pertinent data to calculate a practically significant lambda. In the following paragraphs we will look at the a selection of different ways to derive with a reasonable measurement of lambda. Geographic revenue split One way to think about a company’s exposure to country risk is to look at its geographic revenue split. A Polish company that derives 80% of its revenues in Poland is surely more exposed to the Polish country risk than a Polish company selling 80% to export markets. On the other hand the latter company might be exposed to country risks of various other countries, if for example she exports primarily to Russia and other emerging markets. This would imply, if strictly applied, that multinationals like Unilever or L’Oréal can be exposed to substantial country risk due to their substantial revenue generation in emerging markets. 28 Application Converting the revenue dependence on the domestic market into a lambda which is centred around one, requires a conversion factor. The pure percentage of domestic revenue part is not useful as a lambda, as only a company with 100% domestic sales would have a lambda of one. A consistent way is to use the average domestic revenue exposure of a company as a lambda of one and use this to convert the revenue exposure of the evaluated company into a lambda. 17 May 2004 - 28 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Lambda % of domestic revenues for company j % of domestic revenues for average company Whilst the numerator of fraction is usually readily available, estimating the average of domestic revenue generation can pose a serious problem. Either it is computed in a time consuming exercise undertaking a painstaking benchmarking exercise of the quoted companies in the particular market, or alternatively one uses available macroeconomic estimates. The latter solution consists in using data from the World Bank about the part of GDP derived from exports by region of the world and combine it with the data about the percentage of exports of the GDP, which is usually available from the country’s central bank. In order to arrive at a decent estimate of the average domestic revenue exposure in a country, the following formula can be used: Average domestic revenue exposure exports as % of GDP % of GDP from domestic economy Accounting earnings The idea here is, that at least in theory, a company’s earnings from a particular region should increase as country risk decreases and vice versa. A company’s geographic earnings split can be, at least in theory, a proxy for calculating a lambda. The availability of sufficient segmental data can be problematic. In practice, however, using accounting data to measure the exposure to the country risk is problematic due to the combination of three inherent characteristics: 1. Earnings often lag the occurred changes in the fundamentals of a company 2. Practice of earnings smoothing - management can smooth the posted earnings despite a high fluctuation in real activity. In their accounts these companies look safer and less exposed to the actual country risk. 3. Accounting earnings are not measured frequently. The obtained sample is to small, making it difficult to use them for consistent estimation purposes. If the different country risks are uncorrelated, though, diversification eliminates the overall country risk 28 17 May 2004 - 29 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Given the decision to use accounting earnings to estimate lambda, one way is to plot the percentage changes in earnings versus a measurement of country risk, like the sovereign bond spread. For more refined estimates, the application of statistical tools such as regression analysis should be used. The regression coefficient expressing the dependence of the accounting earnings on the changes in country risk would yield an estimate for lambda, Production Facilities Production facilities that are located in the concerned country can lead to a substantial country risk exposure of the owning company. All the country risk factors listed in the introduction can disrupt production or distribution, which affect negatively a company’s present and future financial performance. Trying to evaluate this risk, the crucial issue is whether the company can easily relocate or not its production facilities from this country to another, i.e. be geographically flexible at least on a mid-term perspective. Companies without the option of relocation, imagine a Brazilian iron ore mining company for example, face substantial higher country risks despite their revenues being totally global. Therefore, the more difficult the relocation of production, the higher should be the lambda and vice versa. Company’s risk management capacities If a company can reduce its exposure to certain parts of the country risk by using common risk management tools to protect its activities, a lower lambda is justified. These tools can be traditional methods like buying an insurance to protect against dramatic contingencies or the application of more sophisticated financial market products like futures or currency swaps to protect revenues or even exotic products such as weather derivatives. When in the process of potentially acquiring the company, the lambda should be estimated in dependence of the potential application of risk management tools (by the acquirer) rather than their application by the current management. Using stock market pricing If the company is traded on a stock market, its stock price history can be used as a proxy to estimate its lambda. Two major disadvantages of the accounting revenues and earnings to 17 May 2004 - 30 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC estimate lambda, the lagging nature and the insufficient frequency of publication are of no concern when using stock market prices, as long as the stocks are traded with sufficient liquidity. Despite the inherent flaws of financial markets, stock market prices reflect the investors’ evaluation of the company on a daily basis. One way to compute the lambda departing from the stock price is to set it into relation with the country’s sovereign debt yield, which measures investor’s perceived country risk in form of the default spread. If markets perceive the country risks to be declining, the default spread will lower and the volatility as well.(footnote) The pure application of this approach is equal to the Default spread + relative volatility approach from section 2.2.5. Summarising the differentiated approach The differentiated approach to adjust the country risk is academically highly satisfactory. Its practical application though is not straight-forward. It requires great amounts of good judgement and experience of the financial analyst to make justified assumptions about the final weighting of the different risk factors which lead to the computation of lambda. Arguably, not only one measurement should be used to calculate it. A combination of for instance revenue split, production facility risk and stock market prices can yield a justified final lambda. Problematic remains hence primarily the availability of data, which sometimes is only available to company insiders, for instance when it comes to risk management or geographical accounting data. Secondly, there exists no theoretical consistent framework for the final weighting of the different factors. This results in a highly arbitrarily composition of lambda, depending on each analysts opinion and might therefore differ from company to company29. 2.5.4. Which adjustment method? An adjustment method which requires strong use of usual private or confidential data is less suited for the rapid pace and aim of cost efficiency in a business environment. A method which requires a great amount of personal judgement in the weighting of different factors yields adjustment factors which depend highly on the analyst undertaking the evaluation and can’t therefore be regarded as free from subjectivity. The presented methods will therefore be 17 May 2004 - 31 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC evaluated in the following matrix by the criteria of availability of data and proneness to subjectivity. Graphic 4: Evaluation matrix for adjustment methods of the country risk premium Low subjectivity easy Medium • All equal approach • Beta approach • Differentiated approach difficult Availability of data Best suited for business practice High subjectivity Medium Not suited source: Patrick Horend It needs to be underlined that the from a theoretic point of view highly satisfactory approach seems to be the least suited for business application. The all equal approach and the beta approach are better suited for the cost and time oriented business environment. The latter is from a theoretic point of view more questionable than the all equal approach. 2.6. Which method to choose in the practical application? Investors have to accept the notion that finance has not yet developed a single, theoretical consistent, error-free and easy implementable approach for the calculation of equity risk premia. Any presented method can only lead to an estimate of the ERP, which is due to its inherently unobservable forward looking nature. The great amount existing methods and their confusing variety of approaching the estimation problem are the prove, that the question which represents the “best approach” is still highly debated, among theorists and practitioners. In practical terms, when comparing the various 29 For a more detailed discussion see Damodaran (2003). 17 May 2004 - 32 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC approaches based on the decomposition model, the melded approach of adjusted default spread usually yields the highest ERP, whilst the adjusted mature market risk premium using the relative standard deviation as well as the pure sovereign default spread yield lower ERPs. The implied equity premium method is highly sensitive to the assumed long term growth rate which makes it difficult to make any general judgement about its magnitude. The ErbHarvey-Viskanta model is very simple use and is especially suited for countries without stock markets and for a counter check with ERPs derived with other methods. The table below briefly summarises the advantages and disadvantages of the discussed approaches from theoretic and practical application point of view. Table 2: Summary of ERP estimation methods Estimation method Historical ERP Theoretical considerations Practical considerations Large standard error of calculated Well suited for mature market ERP data widely available, Dimson et al (2001), ERP in emerging markets renders this Ibbotson Associates approach practically useless Unsuited for emerging markets Implied equity Forward looking premium Strongest theoretic foundations Highly sensitive to assumed long Data is hard to obtain Required extent of calculation term growth rates Erb-Harvey- Viskanta model Source data is good representation of Simple and quick application market’s perceived default risk Yields ERP for countries without stock Low R-squared markets Decomposition approaches Lack theoretic foundations Sovereign default Using US ERP possibly to high due spreads / Goldman model Intuitively right Reliable data is easy available Simple application Preferred for SMEs and preliminary to survivor premium Default risk lower that country risk Consistent comparability between valuations ERPs Public available country ratings Comprehensive appreciation of country risk Default risk lower than country risk Reliable data is easy available Information lags actual risk dynamics Relative equity market standard deviations 17 May 2004 Differing market dynamics need to be Data is difficult to obtain Coefficients not readily available considered Coefficient comes from two different - 33 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC markets or includes FX distortions CSFB model Data basis seems highly arbitrarily Data is difficult to obtain Theoretic basis questionable Coefficients not readily available Data are hard to obtain Default spread + Intuitive logic relative volatility Mixes variables from different Coefficients not readily available Preferable for companies concerned about markets downside risk as it yields highest ERP source: Patrick Horend At the time of the writing, there is no consent among theorists about which approach will yield the estimations with the lowest forecasting error and highest consistency. The choice of the applied method is therefore mainly left to companies. It is easily understandable that the confusing variety in theory will not lead to a consistent approach by companies. Research which compares the historic forecasting power or that identifies the best method in dependence of the market maturity could yield promising information to unravel the prevailing chaos. The so far presented methods serve to compute a single magnitude for the ERP. However, it is widely accepted, that cash flows should in theory be discounted with the appropriate discount rate for each time period or at least match the duration of the project. Whilst most companies and practitioners books like the Brealy and Myers use for simplification purposes a static discount rate in valuations, the special situation of the EU enlargement and the CEEC justifies a closer look at what research offers so far in this respect. 17 May 2004 - 34 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 3. Term structure of the discount rate As seen on the great variety of different methods Researchers and practitioners propose to calculate the ERP in emerging markets, there exist no agreement on which is the theoretical correct way of estimation. Whilst some propose to use the decomposition approach (Damodaran 1996), others prefer other methods based for instance on country risk ratings (Harvey 2002). However, both these approaches rely on some kind of measure of country risk, either the sovereign spread, potentially adjusted, or a published country credit rating. In the particular case of the CEEC, many economists expect a gradual reduction of the country risk due to the effects of the EU membership and the expectation of potential EMU accession. The following section will after a short overview of the concept of the term structure of interest rates and the cited reasons for a reduction in country risk present a few theoretic approaches which could be used by companies to consider the term structure effect in financial evaluations of CEEC projects. 3.1. What is the term structure? When valuing a bond, the yield to maturity of a bond or the IRR that matches the expected future payments with its market price is only a average like representation of the interest rate at each period30. In reality, however, bondholders demand different interest rates for holding debt with different maturity, normally referred to as spot rates. For the valuation of a bond therefore, the different interest payments and the repayment of the principal need to be discounted at the respective spot rate: PV bond Coupon Coupon Coupon Principal ... 2 (1 r1) (1 r2) (1 rn) n The spot rates ri are computed by bootstrapping government bonds31 or by looking at the yield to maturity of stripped bonds, which are effectively zero-bonds. This concept is often referred to as the term structure of interest rates or the yield curve, which is technically the graphical representation of the spot rates on the y-axis and the available maturities on the x-axis. When 30 The relationship between spot rates and yield to maturity is discussed in Schaefer (1977) “A process of creating a theoretical spot rate curve using one yield projection as the basis for the yield of the next maturity. “ (Financial glossary www.analystworks.com) 31 17 May 2004 - 35 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC comparing a dividend paying bond to a cash flow generating project, theory argues that the expected future cash flows should be discounted at their respective spot rates reflecting the risks attached to the cash flows expected at different time periods. In practice, though, showed Bruner (1998) that companies only match the duration of the evaluated projects with the input variables used for the cost of capital calculation. 3.1.1. Theoretic explanations of the yield curve A variety of theories have been developed to explain the fact of the term structure. As a thorough presentation of these theories is not the aim of this document, only the most important ones will be briefly presented below.32 Unbiased expectations hypothesis First postulated by Irving Fisher (1896) and then further developed by Friedrich Lutz (1940), supposes the expected future interest rates are equivalent to the forward rates computed from observed bond prices if the term structure to be unbiased. In the absence of transaction costs of rolling over bonds and uncertainty, actual future rates are supposed to be equal to implied forward rates. Liquidity premium in the Term structure Hicks (1946) argued that a liquidity premium exists because a given change in interest rates will have a greater effect on the price of long term bonds than on short term bonds. Hence the risk of loss is greater with holding long term bonds. Fama (1984) investigated statistically the term premium in US bond returns. Despite the finding that expected returns in long term bonds exceeded the returns on one month bills, the premium did not increase continuously to maturity, but rather peaked around eight to nine months. The high variability of longer term bonds did not allow to draw any conclusions about the liquidity premium in bond returns. 32 For an excellent discussion of the term structure, please refer to Van Horne, (2001) 17 May 2004 - 36 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Market Segmentation Hypothesis This theory argues that investors and borrower do not take into consideration all investment opportunities resulting in limited substitution between certain asset classes or maturities. This theory believes market actors to have preferred “habitats” of securities in which they preferably act and which leads hence to imperfect substitution (in their eyes) of the different investment opportunities. 3.2. Reasons to expect a decreasing CEEC country risk premium The macroeconomic effects of the EU enlargement on the CEEC are well discussed in literature. For instance, Baldwin et al (1997) forecasts the growth effects of EU membership on the CEEC economies on exports (+25%) and the economies (real income +1.5%). Various authors developed models on the basis of other theories like neoclassical model for growth economies (Lucas 2000) or endogenous growth models (Aghion and Howitt 1998). Overall, most authors predict a parallel reduction of the CEEC country risk premium due to the EU accession. Notably, the case of a potential joining of the EMU is seen to reduce the sovereign spread to a marginal level similar to the cases of Portugal and Greece33. However, except for rather general guidance towards considering investments in the CEEC, these theories offer little practical implications for the purposes of managerial decision making. Statements of the country risk reductions are missing specific forecasts or methodologies for its estimation which could enhance financial models to capture this notion. Many authors offer only a macro-view of the wealth effect on either GDP or capitalisation of publicly quoted companies leaving out the refining of these implications on the micro- or company level. The aspects elaborated below are cited by economist as reasons why to expect a continuous decrease of the CEEC country risk premium during the years preceding as well as after 2004 EU enlargement. The general idea is that by the implementation of a variety of legal and Joining the EMU would imply a fixed exchange rate regime, hence eliminating the exchange risk, the loss of monetary sovereignty to the ECB and the fact that the ECB would be lender of last resort practically eliminating credit default risk. 33 17 May 2004 - 37 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC political measures as well as strengthened growth and FDI these countries will experience an accelerated development towards industrialised countries34. Implementation of the acquis communautaire: The joining countries are required to adopt the common rules, standards and policies that make up the body of EU law. This provides the basis for higher transparency for all economic agents in the European Union by assuring the legal means to enforce their rights. The accession requirements state that the countries shall exhibit a strong democracy, the respect of human rights and the rule of law. Investors and companies are provided, hence, with the same level of investment and legal security as in the EU or other OCDE countries. For foreign companies, this reduces substantially the political risks and at parts the commercial counter-party risks by providing stronger legal recourses. A functioning market economy: One of the Copenhagen entry criteria for joining the EU is the existence of a functioning market economy. By establishing free competition regulations and the rule of fair trade, the commercial and political risks will be reduced. Stronger economic performance in the future: The adoption of the Common Commercial Policy, or put differently the integration in the EU customs zone and the expected flow of EU regional aid from the regional cohesion funds are likely to aid the economic performance of these countries. Economists expect an economic convergence process of sustained higher GDP growth similar to the example of Spain. Moreover, the economic and politic stability which reigned in the EU for the past decades is expected to bring the necessary transparency in terms of legal, political and regulatory issues for future strong FDI flows. Potential entry to the Eurozone: The new member countries intend and are expected to join the Eurozone in the later future. In this case, the ECB would become the lender of last resort for these countries, effectively eliminating the default risk of their external debt which should result in only a marginal sovereign spread on CEEC debt.35 Furthermore, the compliance of these countries with the Maastricht criteria imposes tight rules on their budgets and limits thereby reckless fiscal politics. Capping the budget deficits and overall indebtness to 3% and There exists no common definition of what constitutes an industrialised country. Most economists cite certain trigger levels for GDP per head, wealth and characteristics of the political and legal system. 34 17 May 2004 - 38 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 60% of GDP respectively would increase the CEEC’s ability to honour its existing external debt36 and fuel the sovereign spread reduction. Historic examples: The successful EU joining of Spain and Ireland which experienced tremendous economic growth and the building of strong democratic systems are indicators of potential benefits of the EU joining to the new members. Nonetheless, the examples of Portugal and Greece have shown that economic convergence doesn’t come automatically. Forward looking nature of financial markets: Expectations about economic performance and perceived risks are the drivers of financial market participants. An expected improvement of the conditions is reflected in securities prices in anticipation, way ahead of the actual realisation of these expectations. These reasons along with the discussed macroeconomic theory lead economists to the assumption that the sovereign spread of the ten countries that joined the EU the 1st May 2004 but as well of the potential future joiners, e.g. Bulgaria and Romania, will decrease. In conclusion, macroeconomic theory would predict a downward sloping yield curve on CEEC sovereign debt. Being out of the scope of this paper, this represents an area of proposed future research. Then, how could the fact that Poland joined the EU the 1st May, 2004 be reflected in the discount rates used in a financial evaluation? Despite the great amount of macroeconomic literature on this topic, only few concrete propositions exist in financial theory literature. The few proposed approaches will be discussed below, before coming to the analysis of the actual approaches used in the past by financial managers. 3.3. Convergence to the pure default spread Damodaran (2003) points out that if using the sovereign spread plus relative standard deviation approach for estimating the ERP (see section 2.2.5) a possible adjustment method Even Portugal and Greece, the former weakest EU economies had only a spread of 14 and 22 Bps respectively to German ten year German Bunds (May, 4 2004, FT) 35 The question which remains to answered though is whether a politic of fiscal tightening will not undermine economic performance and thereby hamper credit quality. 36 17 May 2004 - 39 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC for maturing markets would be to gradually decrease the relative standard deviation coefficient. The argument goes that equity and bond price volatility converges over longer time periods, effectively reducing the effect of the coefficient.37 In practice that means to narrow gradually the differences between the pure sovereign default spread and the country risk premium over time, effectively converging sovereign spread and country risk premium. On the other hand, Reilly et al (2000)38 do not arrive at the same conclusion. 3.4. Anticipating rating improvements When using a country credit rating approach like the Erb-Harvey-Viskanta model to estimate the ERP, I propose to use it in combination with the econometric forecast model of country credit ratings changes by Cruces (2001). A historic comparison with the country credit ratings improvement experienced by Greece and Portugal during the period of their EU accession could be an indicator as well. The country credit survey from the journal “Institutional investor” provides semi-annual data back to March 1979 based on a global survey of 75-100 major investment banks credit risks departments on a semi-annual basis. Comparing for example the development of Slovenia’s credit rating with Greece’s and Portugal’s in the 4 years before and after their joining of the EU could yield an indication of the potential future credit improvement. Jeremy Siegel observed in his book “Stocks for the very long run” that the standard deviations in equity markets tend downward over time, approaching debt market volatility 37 They analysed the changes in volatility of the US bond market from 1950 to 1999 concluding “that the average volatility for bonds is about 33% of the volatility for stocks” and “that the relationship [between both volatilities] is very unstable. Reilly et al (2000), summary and implications 38 17 May 2004 - 40 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Graphic 5: Historic country ratings of Greece, Portugal, Slovenia and Czech Republic source: Institutional Investor magazine Cruces (2001) analysed the changes of country credit ratings (CCR) based on the Institutional Investor country credit survey and developed an econometrically fitted forecast model of the change in a country’s credit ratings based on the two previous changes in CCR. The equation fitted looks as follows: CCRt = a0 + a1CCRt-1 + a2CCRt-2 + This regression model can be used to estimate the future CCR from the two previous CCR. For Eastern Europe, the coefficients found were: a1= .22 and a1=0.07 with the interceptor a0 being irrelevant. The most obvious limitations of this model is that it does not predict a trend reversion of a CCR.. The Erb-Harvey-Viskanta model which used a regression of CCRs on historic observed ERPs in 47 countries, allows to predict a country’s ERP in dependence of its CCR. The following equation was used: Ri,t+1 = 0 + 1ln(CCRi,t) +i,t+1 17 May 2004 - 41 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC In the estimated coefficients the model were: 0 = 53.71 and 1 = -10.47 In combining these two models, an estimate of a country’s ERP for the next 2 to 4 years can be calculated. Longer forecasts are not feasible as the Cruces’ forecasting model behaves like a saturation curve with declining marginal CCRt. Table 3: Example calculation of anticipating country risk reduction for Slovenia. Cruces (2001) model Country Credit rating CCR Mar 2003 CCR Sept 2003 CCR Mar 2004 Forecast period CCR Sept 2004 CCR Mar 2005 CCR Sept 2005 CCR Mar 2006 CCR Sept 2006 Example: Slovenia Delta Country Credit rating 66,4 69,2 70,8 DCCR Sept 2003 DCCR Mar 2004 2,8 1,6 71,35 71,58 71,67 71,71 71,72 DCCR Sept 2004 DCCR Mar 2005 DCCR Sept 2005 DCCR Mar 2006 DCCR Sept 2006 0,548 0,233 0,090 0,036 0,014 Annualisation by simple average CCR 2004 71,1 CCR 2005 71,6 CCR 2006 71,7 Erb-Harvey-Viskanta (1995) model exp. ERP 2004 9,07 % exp. ERP 2005 8,99 % exp. ERP 2006 8,98 % source: Erb et al (1995), Cruces (2001), Patrick Horend The example presents only a preliminary estimation and is thought to inspire the development of more refined modelling approaches. Various criticism must be made, like the chosen annualisation, which poses the question, whether the country ratings should be viewed as characterising the following period or due to the delay between collection and publishing rather as covering a six-month period centred around the publication date. The limitations each of the two models used need to be considered as well. 17 May 2004 - 42 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 3.5. Implied spread on future markets Assuming that markets are efficient, all the available information and expectations by market participants should be reflected in securities prices. The prices of future and forward contracts on CEEC external debt should therefore reflect the expectations of market participants in regard to the effects of the EU enlargement on the country risk premiums. The implied sport rates for each of the future periods can hence be calculated by bondstripping the forward contract. 3.6. Looking at the historic cases Portugal and Greece Looking at recent European history, three countries that joined the EU or former EEC, exhibited approximately similar economic situations as the group of countries that joined the EU May 1 st, 2004. Greece, Ireland and Portugal had, when they joined the EEC in 1973, 1981 and 1986 respectively, comparable levels of GDP per capita in percent of the EU average. 39 Since their entry, these three countries differed widely in their respective economic development. Ireland, often called the Celtic tiger, after a longer starting period, experienced in the 80’s and 90’s a phase of sustained high growth in terms of GDP and GDP per capita. Portugal and Greece, on the contrary, are often portrayed as pessimistic scenarios for the EU joiners in terms of economic performance. Greece effectively remained at the position it was by the time it joined. Its GDP per capita of 70% in 2003 in % of the EU average is virtually unchanged compared to the moment it joined the EEC in 1986. Portugal fared slightly better, but remained still far behind the examples of Spain and Ireland. Its GDP per capita in % improved from roughly 54% by the time it joined to about 70% in 2003. Under the assumption that the future development of the recently joined and the future joiners won’t suffer any extraordinary economic shocks, looking at the past experiences offers a case of average, if not, below average performance in terms of economic development after a EU accession. This could be used to have yardstick to estimate a potential reduction in the sovereign spread. The obvious limitation is, that it first lacks any theoretic evidence, it requires a lot of judgement by the analyst and history is never sure to repeat itself, especially given the volatility in bond markets. 17 May 2004 - 43 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 3.7. Potential EMU joining by the new EU members The intention of the new member states to join the EMU could provide a more practical and accurate method to adjust the ERP in a decomposition approach. The spread convergence seen for Eurozone countries offers much higher visibility and theoretic foundation to anticipate a reduction of CEEC sovereign spreads. In this case, which won’t be considered by stock markets until 3 to 4 years before any anticipated joining, the fact that the ECB will overtake the monetary policy and act as lender of last resort, makes a strong case to assume that rating agencies will further upgrade CEEC’s country ratings which will reduce the yields on CEEC external debt towards the yields of other Eurozone countries. Even Portugal and Greece have seen a strong yield convergence yield on their long term external debt towards the yield of the German or French long term external debt. The doubt which remains though is the question whether in this case the default risk underestimates substantially the risk of holding fixed assets in the particular country. The hypothetical reduction in perceived default risk would be perceived as caused by the default “insurance” from the ECB. 3.8. Can the term structure of the country risk premium be anticipated? After this brief review of existing concepts and theoretic approaches, it can safely be concluded, that the anticipation of the country risk premium is not feasible. Many of the presented approaches are borrowed from mostly debt finance and are not yet tested in practice for other purposes. Given this lack of feasible tools by financial theory, companies cannot be expected to have anticipated the over the last decade decreasing country risk in their financial evaluations of FDI in the CEEC. 39 These GDP numbers in this section are taken from FT (2004) 17 May 2004 - 44 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 4. Methodology of the research This section outlines the research methodology used to gather the data for the findings and the analysis presented in section 4. The primary aim of the research was to know the technical details of the used methods for the estimation of the equity risk premium, comprising the specifics of all input variables and concepts used. Secondary, the research attempted to investigate the different factors which influenced the interviewed professionals as well as companies’ policies as a whole to prefer the methods they applied. These factors included the reasons from a financial perspective as well as social, organisational or psychological. 4.1. Factors restricting data access For the analysis of historic company behaviour regarding the research topic, the primary problem was the lack of quality data. The latter had direct implications for the choice of the research methodology. The following restricting aspects for the collection of information were encountered: Details of valuation, the financial evaluation and terms of an acquisition and FDI are often undisclosed due to confidentiality40 The knowledge of applied methods is highly intangible and rarely recorded in a systematic procedure of knowledge management. Financial models and evaluations evolve continuously as the projects advance, modifying substantially the initial evaluation. Finance manager are the main carrier of the researched knowledge. Specific data is often subject to confidentiality. Every transaction or project has its particular terms making generalisation difficult. 4.2. Choice of approach Generally there exist two types of approaches to design a research – the qualitative or the quantitative. A quantitative approach by surveys or questionnaires would yield findings with a high degree of possible generalisation. For the purpose of this research, the characteristics of World investment report 2003, p.60 cites that especially cross-border M+A deals remain often undisclosed 40 17 May 2004 - 45 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC the data, i.e. the individual structure of each deal and the high use of confidentiality clauses would allow, though, the creation of only very general termed surveys, yielding only top-level information about the choice of methods and the magnitude of the calculated ERPs. More detailed information about the details of the estimations, the motivations and judgements behind the necessary subjective decisions or possible alternative methods of evaluation would be foregone. In order to research actual company practice in comparison to theory, a qualitative approach either by case study or in-depth interviews yields a higher degree of content and valuable information given the research topic. This approach, despite its lower degree of possible generalisation, offers the in particular the chance to explore company or the finance manager’s reasoning for or against one method or the other, the details of the inherent subjective judgements made during the process and the exploration of possible theoretically not considered approaches or alternative methods employed. Given the context of confidentiality and the aim of the study, i.e. to understand the manager’s reasoning for their choice of estimation method, a qualitative approach by in-depth interviews was chosen. This goes in line with Bruner’s (1998) and Pereiro (2000) which given their higher resources used a mixed approach of questionnaires and interviews, where the latter were regarded as extremely important to gain insight into reasons and factors guiding the managers to prefer one method or another. 4.3. Structure of the sample used The in the following sections presented findings are based on primary data which were collected by interviewing experienced finance professionals with extensive exposure to FDI or acquisitions in CEEC. The sample covers three broad sectors: 3 industrial companies, 2 banking & insurance companies and one financial advisor. All the interviewed companies but one have an annual turnover exceeding EUR100m and employing over 1000 people. The limited size of the sample hampering slightly the generalisation power of the analysis is linked to the difficulties of contacting finance managers with access to FDI valuation 17 May 2004 - 46 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC decisions41 as these occupy usually management position with high responsibilities and tight schedules. However, this should be more than compensated by the top-level positions of the interviewed persons which often have direct access to or influence on valuation. 42 Their answers are complemented by the case study of the acquisition of Polish tv-tubemaker Polkolor by the French company Thomson in the mid 90’s. 4.4. The interview questions The interviews were all carried out over the phone and were in two cases completed by additional information enquired by email to clarify and to obtain more details. The interviews started with a short introduction of the purpose of the study followed by the actual question part. In order to obtain unbiased data of actual company practice and to prevent any influence on the answers of the interviewee, no concepts outlined in section 2 were mentioned in the introduction. The order in which the questions were asked intended to go from a top level perspective to the actual technical details, i.e. they started with the issues having the greatest weight in the decision making process for FDI and narrowed later down to the questions of estimation method of cost of capital, ERP and country risk. The last questions are designed to capture out-of-the-box approaches or any other ideas which could be of interest for future investigations. The interviews carried out where of a mix form between structured and unstructured interview. The list of questions, which is provided in the annex, constituted the minimum set of information to obtain, resembling a structured interview. However, in order to get more insights in to reasons and motivations, the interviewer often raised spontaneous follow-up questions attempting to arrive at the underlying reasons for the choice or avoidance of a particular method or theory. After the questions part, most interviewee asked for the theories on the estimation of the CEEC country risk premium and other concepts which are the subject of this paper. The survey of Pereiro (2000) was carried out in collaboration with a executive finance association (Instituto Argentino de Ejecutivos de Finanzas IAEF) facilitating the contact 41 In the case of the financial advisor, the interviewed person was the head of analysis and valuation in Equity research responsible for analyst training and the coherent application of valuation techniques 42 17 May 2004 - 47 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 4.5. Limitations of the presented analysis Given the structure of this research, the following issues need to be pointed out. Firstly, the generalisation power of the study is obviously limited by the small sample size of interviews. Secondly, the results can only be viewed as past company practices in the interviewed industrial, banking and financial advisory companies. The quality and the management positions of some of the interviewees, though, offer insights from the top-level perspective, which partly mitigates these issues. However, the study lacks information from companies belonging to other economic sectors. Thirdly, as all the interviewed managers belonged to occidental companies, any generalisations for company practice in other geographic regions should be taken with care. However, this would represent an interesting aspect of further research, as companies in these companies are directly affected by the additional issues of country risk and potential term structure in their financial valuations. A study in design similar to Pereiro (2000), surveying companies based in the CEEC, should provide a good insight into companies’ practices in regard to the estimation of the ERP in emerging markets and in CEEC in particular. 17 May 2004 - 48 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 5. Findings and analysis of company practice Surprising at fist sight, all companies except for the financial advisor evaluated their FDI projects using their home market ERP without any adjustments of the undoubtedly existing country risk in the CEEC in the ten years prior the EU enlargement. However, these results have to be put into perspective. Companies considered the FDI’s exposure to the country risk in the factors on which they based their investment decisions on in the CEEC. (outlined in section 5.1.) Several factors limited severely the quality of the available financial historic data in the CEEC reducing substantially the value of the financial evaluation for FDI decision making purposes and with it the need to estimate as realistically as possible the ERP. The reader needs to bear the latter in mind, when analysing the in Section 5.2. presented practices of the interviewed companies regarding their chosen methods for: the estimation of the ERP, an eventual estimation of the country risk premium, an eventual consideration of the EU enlargement in the financial models and the particular practices used by one interviewed industrial company to compensate for the limitations of incorporating the risks in the discount rate. The final part of this section analyses the factors and motivations that influenced the interviewed companies to opt for their chosen methods given the importance of the ERP’s magnitude for investment decisions. When analysing the findings, there has to be made a distinction according to the three economic sectors in the interview sample. Each industries’ particularities and historic dynamics need to be born in mind when interpreting the companies’ approaches in the context of this research. The financial advisor43 in his function as financial consultant had exposure to FDI in the CEEC primarily through his clients and not by an explicit investment programme. The applied methods showed the highest degree of sophistication, which was in line with the results found in previous studies. The companies from the banking sector invested primarily as a mean of market expansion, setting up early a strong commercial basis in the CEEC. Their main concern apart from the “standard” issues for FDI was therefore the stability of the banking sector in a particular targeted country. The company names can be found in the annex. No specific names will be mentioned in this section to respect assured confidentiality. 43 17 May 2004 - 49 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC The investments by industrial companies were primarily driven by cost-reduction efforts, i.e. the delocalisation of production facilities to the CEEC to benefit from the enormous cost advantages. Their main problem was the in the CEEC prevailing management culture among industrial companies. This management problem explains partly their venture capital like approach, which is outlined in a separate subsection. 5.1. Most important factors for FDI decisions in CEEC The financial evaluation and hence the estimation of the ERP in the CEEC was by far not the most important criteria companies used when deciding over FDI. Various other issues had more weight in the final investment decisions. One correspondent even referred to the factors listed in standard literature when asked about the considered issues when deciding on FDI within CEEC, though without naming an exact source. The main issues which were considered in the decision process were: (see, for example Lankes and Venables 1996, Baniak et al 2002, and Resmini 2000) Political risks o stability of the political system and government institutions o bureaucracy and regulatory issues o legal issues Overall macroeconomic situation o expected economic growth of the country and the local industry o Inflation, unemployment repatriation risk (possibility to repatriate profits and capital) investment security (technically part of political risks) Using a kind of top-down approach, the above listed criteria served to identified the target country or the group of target countries. The next set of factors leading to the investment decision was the general business situation. This comprised the logic of the business model of the acquisition target, a due diligence and of equal importance several local visits and meetings with the existing management. Especially the industrial countries examined diligently the existing human capital, management capacity and facilities. The historic financial performance as well as the assets in the financial accounts were often regarded with 17 May 2004 - 50 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC suspicion, especially in the case of industrial companies, as most assets were technically outof-date and had to be replaced anyway. 5.2. Choice of methods and alternative approaches 5.2.1. Equity risk premium Brealey & Myers (2003) and other practitioners’ valuation books advocate the use riskadjusted discount rates which correspond to the risks of the evaluated project or company. In the case of the acquisition or FDI in the CEEC this would imply the use of either the ERP of the target country or an adjustment of the discount rate by some means of country risk premium. Surprisingly, all companies but one did not estimate a specific ERP of the FDI target country. Instead, the usual approach was to use the corporate cost of capital. This was equal to using the ERP of the home stock market. Only the financial advisor applied a more sophisticated approach when advising its clients in the past on financial transactions in the CEEC. His is presented in the next section. This result are in line with the findings of Bruner (1998) where 26% of the non-financial firms did not risk-adjust the cost of capital. The follow-up questions on the reasons for not having estimated the ERP of the target country received the following responses: lower confidence in the financial evaluations in developing countries the volatility in the local stock markets makes any calculated ERP subject to the chosen sample period the inherent statistical noise application of the corporate rate because the funding was in US$ or Euro people preferred simple easy understandable methods, even knowing that theoretically these were not correct because of the need to justify the applied discount rate or ERP to a variety of other people, from the direct boss up to the general manager or the board and complex methods would require long explanations 17 May 2004 - 51 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC the usage of the corporate WACC was company policy and not at the discretion of the financial department. Financial advisor approach The estimation approach of the financial advisor exhibited a higher degree of sophistication despite a straightforward simplification circumventing the whole problem of estimating the equity risk premium in developing countries. The company assumed reasonably well integrated global markets which implies that the ERP is the same for any stock market in the world. The actual ERP used for the calculation of the cost of equity was a fixed percentage. This kind of practice is in line with the findings by Bruner (1998) where of the interviewed financial advisors, 10% used a fixed rate of 5.0% and 50% used a fixed rate of 7.0 – 7.4%. These ERPs however were for the US market only. This obvious judgement decision was, according to the company, based on the existing evidence in the literature, notably from the numerous studies on historic ERPs in industrialised and emerging markets. Additional reasons for the simplification were that it is easier to communicate to and understood by its clients. It avoided lengthy discussions, which added little value for its clients, about the magnitude of the ERP and the chosen estimation method. 5.2.2. Country risk premium None of the interviewed companies reported to have included in the past any extra premium on top of the cost of equity or the ERP for FDI valuations in the CEEC. The only exception to that was the approach of the financial advisor. These findings contradict slightly with the study by Pereiro (2000) in Argentina, hence a developing country, where 26% of the non-financial advisor companies reported to adjust their cost of equity for the Argentinean country risk. However, as seen above, the American companies were as well very reluctant to adjust the used cost of capital for the additional risks of a project. 17 May 2004 - 52 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Financial advisor approach Company policy did not advise any calculation and inclusion of an extra country risk premium. However, the additional country risk in CEEC was taken into account in the cost of equity by using the local risk free rate which was assumed to comprise the local inflation expectation and the difference in country risk. If a local bond market was not available, an international proxy would be used. As most countries have issued external foreign debt, this yield would be converted into local currency using purchasing power parity FX rates in order to adjust for inflation effects. In any case, the instruments used for the estimation of the risk free rate was supposed to match the duration of the valued project, implying usually the usage of 10 year bonds due to the often higher liquidity. A country risk premium was only calculated in the special case valuing a company which is based in an industrialised country but which owns a subsidiary located in a developing country. In this case, the cash flows of the subsidiary would be discounted at the cost of equity adjusted by adding a country risk premium. This premium would normally be estimated to be the sovereign spread, calculated as market yield of the countries external debt less the debt of US treasury bonds or German bunds. However, if due to market movements, the resulting country risk premium was perceived as understating the actual country risk, the company would adjust the premium at its discretion to a level were it perceived the actual risk to be. The company justified this by pointing out that the assumed relation between sovereign spread and actual country risk for fixed assets does not necessarily hold, especially in situations of all-time lows in investment grade debt and a global emerging market spread tightening. On the question whether evaluations for CEEC targets were treated differently then other emerging market countries, the company declined to differentiate the CEEC from other developing countries. 5.2.3. Consideration of EU enlargement in the discount rate None of the interviewed companies took the possible EU enlargement into account when calculating the discount rate for the financial evaluations in the context of FDI decisions in the CEEC. Consequently, despite the fact that most firms acknowledged the probable country 17 May 2004 - 53 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC risk reducing effect of the CEEC’s EU accession, they did not adjust or re-estimate the ERP applied in the financial models. The reasoning was quite similar across the industrial, banking and financial advisory companies, each of them citing most of the three factors: Lack of reliable tools or concepts to measure the effect – The finance interviewed managers regarded the available theoretic concepts or their knowledge of potentially existing ones as insufficient to yield a reliable estimate of how the EU enlargement would affect the country risk premium in the CEEC. EU enlargement was too far in the future with little potential immediate effect – The FDI of the interviewed companies took place in the years before or around 2000. At this point in time, the potential EU enlargement still presented a remote political event which was subject to considerable uncertainty as some of the aspiring entry countries were not expected to pass the EU accession criteria. Furthermore, the potentially effects of an enlargement were too far in the future as to be of immediate concern to companies. A discount rate adjustment could be regarded as number manipulation –The “revolutionary” aspect of a discount rate adjustment was regarded as a potentially opportunistic measure in order to “make the numbers”. The person proposing this method would be exposed to potentially strong criticism by colleagues and superiors. 5.2.4. Findings particular to industrial sector The interviewed managers of industrial companies perceived the risks of a FDI in the CEEC rather on the operational side, i.e. the implementation of efficient procedures, production quality, cost controls. A realistic financial valuation prior to the investment was of less concern. The usually enormous cost advantages due to the low labour costs rendered an investment in the CEEC almost automatically financial viable, if the operational risks were controlled for. Therefore, especially in the case of FDIs, the investment decision depended highly on the availability of infrastructures, e.g. transport, electricity, communication, etc., and the availability of well educated personal. The latter was explicitly addressed in an interview about the Thomson Polkolor case by referring to the management model by Greiner (1972). 17 May 2004 - 54 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC According to the interviewed manager lagged the management culture in the CEEC Western style management by about 20 years. It was based on direct supervision, very low autonomy of the middle management and little loyalty of workers towards their employers. Industrial companies often adopted therefore a venture capital financing based approach to control the attached country risks, as in the particular case of French Thomson in Poland. They divided the total investments in successive phases, applied a tight follow-up for each phase and tried to create a new management culture. These measurements, which are explained in more detail below, reduced the need for an exhaustive financial evaluation prior to the FDI. Division of projects in phases In order to minimise the risks of its FDIs in CEEC, used two of the interviewed industrial companies project management techniques similar to the financing of start-ups by Venture capitalist funds. In these multi-phase approaches, are clear operational and financial objectives, often stretch goals, set for each phase, which have to be reached in the predefined time. Only and only if these objectives are met, the financing for the next phase will be provided. This approach was applied by Thomson for instance during their acquisitions of Polkolor, a Polish tv-tube producer. The division of the financing in phases offered the acquirer’s management increasing visibility on the expected operational performance, commercial viability and associated costs of its subsidiary and especially the possibility stop non-performing investments at an early stage. From a financial perspective, the focus was hence on cost controlling and getting a “feeling” for the financial characteristics of the future full-grown business. In each phase the investing company’s exposure increased gradually with a growing understanding of the business characteristics. This approach relied on manager’s experience that a FDI that failed to show a sufficient performance in the first phases, is likely to fail in the later future. Tight follow-up on each stage Second measure that controlled for the investment risk were sophisticated and exhaustive follow-ups on the results at the end of each project phase. The careful evaluation of obtained 17 May 2004 - 55 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC results in terms of operational, commercial and financial performance was used to improve the business process, hence reducing gradually the potential risk factors. Given the issue of the differing management styles, special notice was laid upon the personal and management performances. Identification and questioning of the results in detail lead to a tracing back of the main causes. The thorough analysis and identification of cause-effect relations in the new operations were highly effective according to the interview partners in expanding the understanding of the behaviour of financial parameters of the foreign operations. The responsible finance managers gained successively more visibility increasing in precision of the financial planning process. The companies undertook deliberately a gradual learning process of how to plan the new operations, envisaging the potential risks of applying standard company planning standards to the new operations. Building management culture As already pointed out, management styles in industrial companies in Western Europe and in the CEEC differed substantially. A first decision was the exchange of the personal of crucial positions in the acquired subsidiaries. Experienced expatriate managers overtook control of the general manager, finance manager and operational manager positions. In addition to controlling the implementation of the procedures and practices from the mother company, they encouraged their Polish colleagues to adopt a more modern management approach. 5.3. Analysis of the factors and motivations for companies’ past practice Given the important effects of a potential EU enlargement with its well discussed effects in macroeconomic literature and the high sophistication of financial theory in areas like option pricing, scenario analysis or real options, it seems surprising that practices applied by companies contrasted so overtly with advocated financial theory. Except for the financial advisory company, was the fact that CEEC belong to the group of developing countries, which demands hence a country risk premium, not reflected in the used ERPs in any with existing literature consistent way. 17 May 2004 - 56 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC In order to understand companies’ choices for a certain method of ERP estimation, it is necessary to look the prevailing opinions among the professionals concerning the fundamental assumptions underlying a great part of the presented theoretic approaches. Economic theories assumption of rational economic agents is only a simplification of real worlds’ complexity, just as any model in sciences. Companies are inherently social structures, where the interaction with other persons influences our personal choices. The decisions on FDI are the result not of a single finance manager but of an often opaque process involving all the elements of social groups, internal hierarchies and contrasting interests. The results of this research need to be interpreted as well in this social context, which is too often ignored in financial theory. The following parts explores the motivations and reasons that influenced the interviewed companies to knowingly not apply theorists’ advocated methods using a variety of “prisms” to gain a better understanding of companies’ decision making in the context of this research. 5.3.1. Efficient market and information transparency The from a financial theory perspective most important aspect is the general disbelieve of the efficient market hypothesis. If managers assume that market prices are not efficient, there remains no obligation to regard market betas, sovereign spreads or volatility as a realistic presentation of economic reality. This in turn justifies the usage of the corporate cost of capital or any other “thought-appropriate” ERP which is based on managerial judgement. A second factor is the lack of information transparency. Firms often acquired non-quoted companies in CEEC for which due to communist mismanagement, the historic financial performances of target companies could only be regarded with great scepticism. Hence, the overall economic situation and the business logic of an acquisition were of paramount importance. Interesting from a theoretic point of view is the argument given by one company that as the funding was in US$ or Euros, the corporate cost of capital and, hence the domestic ERP should be used in the financial evaluation of CEEC target companies. This seems at first sight like a contradiction of the Modligiani-Miller theorem, which states, that a company’s funding decisions should have no influence over its investment decisions. However, this theorem as well relies on the assumption of perfect markets and information transparency. Therefore it 17 May 2004 - 57 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC does not necessarily hold in reality. These results prove in fact that the complexity in business reality is simply not conforming to the theoretical assumptions. 5.3.2. Factors undermining value of NPV method in emerging markets The value of the NPV method relies like any other method on the quality of its inputs. Modern finance theory imposes strong assumptions on the contemplated ways to derive the ERP leading to the cost of equity and the cost of capital. When interviewing companies, there seemed to exist a broader agreement that the fundamental assumptions of rational investors and perfect markets did not resemble business reality. The distrust in market prices, in effect, explains almost all the reasons cited below. By doubting that markets are efficient, they question almost the entire theoretical building of modern finance and justify thereby any practices which are not conform with theory, arguing that it is not a suitable representation of the situation especially in the CEEC. All finance manager (FM) interviewed recognised the limitations of the existing and the personally applied methods to calculate the for the NPV method necessary ERP and discount rate. This implies that in the decision process on a FDI FMs regarded the calculated NPV not as the ultimate truth, but as a rather financial detail, which is of less importance than the business logic and the economic environment in the particular country. Summarising, the following reasons emerged, explicitly or implicitly, during the follow-up questions about the reasons for a particular practice. No believe of efficient market hypothesis Inherent imprecision in the estimation of the ERP and consequently the discount rate Theoretic confusion about estimating emerging market ERPs Very limited visibility on expected future cash flows Data availability and required resource of time, money and people Less developed local stock markets Acquisition targets were often not publicly traded These reasons above diminished the value of the calculation of the discount rate and hence the NPV for decision making. The following issues unique to the situation in the CEEC reduced even further the need for a theoretically highly accurate estimated ERP prior FDI. 17 May 2004 - 58 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Many acquisition targets were bankrupt Acquisition targets were rarely commercially viable due to outdated product portfolios Acquirers needed to inject funds and technology as part of the purchase price Acquisition targets were not informed about Western valuation methods – transactions sometimes neglected goodwill 5.3.3. Vast existing literature for estimation of developing country ERP Another point which should not be neglected is the fact, that even theorists have so far failed to develop a consistent opinion to the question of how the ERP should be estimated in developing countries. The number of presented methods in this paper comprises by far not all approaches which are discussed in the literature and the discussion of which is the theoretically most coherent method is unsolved by time of writing. Therefore, the applied methods in companies reflect partly the situation in the economic literature and partly a conservative behaviour, which could be summarised as “sticking to the proved”. 5.3.4. High statistical noise in financial market data FMs did not want, by using market data for the estimation of the crucial ERP magnitude, to expose their decisions to current market swings. A financial evaluation that rejects or approves a project only because of a change in market prices over a period of two months cannot be regarded as a good basis for decision making. Moreover, FM’s perceived that the margin of safety in the financial valuations was too low if market swings render the NPV negative by changing the calculated ERP. 5.3.5. Companies are social networks A company’s decisions over a FDI in CEEC were not taken by a single individual or the finance department exclusively. Various groups of people are involved in the decision process in many informal and formal ways. In the course of the decision making process, the finance department or the manager has to justify the in the financial evaluation taken assumptions to fellow colleagues, direct superiors and possibly, depending on the size of the deal, even to the 17 May 2004 - 59 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC board of directors. Given this type of process, a couple of factors favour the application of a less complex estimation method of the used ERP: Less complex and intuitive approaches with which people are familiar require fewer explanations. Time is valuable and having a complex ERP estimation which takes 2 hours for others to understand adds little value. If the superiors don’t understand the assumptions made they are more likely to reject the project (P-A problem, risk averse behaviour) If the approach is too nebulous for the actual decision makers, they could accuse the finance department of championship or manipulation Therefore the choice of a simpler, though less theoretically correct estimation method needs to be interpreted in the context of the companies’ social structures and human behaviour in groups. The latter can comprise the avoidance of conflicts with superiors, the attempt to save time in meetings or a precaution taken to avoid mistrust by superiors. In the case of a potential adjustment for the term structure, the substantial judgement is required by the finance manager. The potential mistrust against his adjustments from superiors, due to the lack of experience with this technique, or other finance managers proposing competing projects can lead to a more risk-adverse behaviour by using a rather simple ERP estimation in spite of better knowledge. This case can as well be interpreted in the perspective of principal-agent situation. Without going into more detail of the P-A theory44, the relationship of the person undertaking the analysis with the person taking the final decision, the existing differences in knowledge and the personal interests at stake affect certainly the choice of the applied estimation method. This could be a field for further research, especially as situations can exist, where the superior has a higher interest in using a rather crude yardstick because he fears a rejection of the project in the case of a more refined method, etc. Graphic 6: Principal–Agent problematic between FM and his superior 44 See Laffont and Martimort (2002) for an comprehensive introduction into the matter. 17 May 2004 - 60 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Agent Financial manager Principal Superior manager Information asymetry Self-interest If Bonus linked to carrying out of the project Finance manager has more knowledge of the evaluation and the underlying theory than the general manager / decision maker. Responsible if project fails. source: Patrick Horend 5.3.6. Behaviour consistent with microeconomic theory Making decisions in the context of the discussed uncertainties, rendered a thorough valuation requiring an investment of considerable time and resources to estimate the appropriate ERP to an exercise which added little value to the decision making process. Seen in this light, the theory contrasting practices show strong business sense for the important aspects adding the highest value. Moreover, when using micro-economic theory, this past practice is conform to the rule that the marginal expected return should equal the marginal costs, i.e. the efforts from the manager or finance department. Translated in the situation of FDI in CEEC, this simply means that the added value of investing more time for a gain in accuracy of the ERP, which given the input variables is highly unreliable, is only pursued to the point where further effort did not justify the potentially added value. The result was a from a financial theory rather crude approach, i.e. using the corporate cost of capital. However, from a manager’s perspective it offered sufficient information content for its use in business decision making. 17 May 2004 - 61 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 6. Conclusion In this study, all the interviewed companies but one did not consider the undoubtedly existing country risks in the CEEC in their financial models, when evaluating FDI in the decade preceding the EU enlargement. Neither the equity risk premium nor the cost of equity were calculated in line with the existing methods in existing financial literature for emerging markets. Instead, these corporations based their financial valuations of FDI on the same equity risk premium they used for their projects in developed countries. Only the interviewed financial advisor used a more refined approach incorporating the country risks of CEEC in the cost of equity. The findings of this paper are therefore in line with previous studies of occidental companies by Bruner (1998) or McLaney et al (2004) who concluded that “firms tend not to make all of the adjustments to the overall figure which academics might expect, only making simple adjustments for risk ...” However this contradicts slightly with the study by Pereiro (2000) in Argentina, hence a developing country, where 26% of the non-financial advisor companies reported to adjust their cost of equity for the Argentinean country risk. Interestingly, all interviewed professionals were without exception aware of the “incorrect” application of suggested financial practice but had their “reasons” to deviate from theorists’ suggested practice. These for theorists, at a fist sight surprising results, are linked to a variety of different factors and motivations which reflect partly a healthy mistrust of market prices, the particular situations in the CEEC prior to the EU enlargement and of equal importance, a company’s social and organisational aspects. The latter seemed to influence the decision taken by finance professionals in regard to the chosen ERP estimation method. This constitutes a result that finds often only marginal attention in financial research. Summarising, the following factors were decisive in explaining practitioners’ deviations from suggested theoretical methodology: Reasons that question fundamental assumptions in modern finance: Markets are not efficient – Practitioners do not believe in the efficient market hypothesis Predictability of cash flows – Historic performance data of companies were highly distorted due to communistic past and different management cultures Markets contain too much statistical noise – which makes the estimated ERP to dependent on the current market moods 17 May 2004 - 62 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Missing consent in literature on the preferable estimation method for the ERP in emerging markets Other reasons of equal importance were: Standard FDI factors had higher priority when deciding on FDI in the CEEC o macroeconomic and political stability o regulatory and bureaucracy issues o a sound business logic of the FDI Companies are social organisms o Managing Directors and not the finance department often decided on the magnitude of the applied ERP o Finance professionals need to justify their choice of ERP to colleagues and superiors. Too complex estimation methods cause unnecessary nuisances. o Principal–Agent situations between superiors and finance professionals can lead to a fixed ERP to maintain confidence in the numbers Different management cultures allowed only for very limited visibility on any cash flow predictions o Application of venture capital financing techniques o Importance of building a corporate culture in the subsidiary In the light of these results, the following recommendations can be made: There is a need of further research which compares the existing estimation methods of the ERP in terms of its explanatory power of ERPs in the past in order to unravel the currently confusing abundance of different methods for the same purpose. Businesses need to revise their lax treatment of the country risk in the CEEC as due to the EU enlargement gradually rising labour costs and less favourable future FDI regimes in the CEEC will require more accurate financial evaluations, besides the standard FDI factors like business logic, etc. Management control over critical financial criteria like the ERP is important to harmonize global company practices, especially in MNEs. However, by imposing the magnitude of the ERP from top management, companies run the risk of establishing an equal financial 17 May 2004 - 63 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC treatment for projects in regions with greatly differing country risk leading to potentially false investment decisions. In the face of global uncertainty, it should be companies’ priority to appreciate more realistically the involved risks of envisaged investments. The increasing sophistication of corporate finance makes FMs the specialists in this field. Top management should endeavour to build their skills and confidence to apply existing methods by giving them more discretion in the estimation of the appropriate discount rates accompagnied by additional training in the recent developments of corporate finance. Concluding, this research showed the limitations of the application of modern financial theory in the day-to-day business practice. The underlying reasons for its non-application are the usual suspects, i.e. the strong hypothesis used like for instance the assumption of efficient financial markets. But as well the social realities of companies, a so far mostly neglected by financial theorists, guide people to rather use simple, easy understandable, yet not 100% theoretically correct concepts in order to be able to communicate and defend their decisions to colleagues and superiors. This shows the need for the development of a broader understanding of financial concepts among senior management, but also a lack of tools that are more oriented on the needs of businesses’ reality. Given the high degree of uncertainty surrounding FDI decisions, it remains to be seen whether recently developed alternative financial concepts for decision taking under uncertainty could provide better financial guidance. Real options theory, already successfully applied to predict FDI flows by Nordal (2001) and Moretto et al (1999), could offer, in the face of substantial political risk in the developing countries, an enhanced appreciation of the involved country risks in financial valuations of FDIs. 17 May 2004 - 64 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC 7. Bibliography Annin, M., Falaschetti, D. (1998), “Equity Risk Premium Article“, Valuation Strategies, January/February, Ibbotson Associates Baldwin, R. E., Francois, J. F., Portes, R. (1997), ” The Costs and Benefits of Eastern Enlargement: The Impact on the EU and Central Europe”, Economic Policy: A European Forum, April, iss. 24, p. 125-70 Baniak, A., Cukrowski, J., Herczynski, J. (2002), “On Determinants of Foreign Direct Investment in Transition Economies“, Central Eastern University Budapest, unpublished working paper Barry, F., Görg, H., McDowell, A. (2003), “Outward FDI and the Investment Development Path of a Late-industrializing Economy: Evidence from Ireland.“, Regional Studies, Jun2003, Vol. 37 Issue 4, p. 341-350 Bofinger, P. (1995), “The Political Economy of the Eastern Enlargement of the EU”, CEPR discussion paper 1234, Centre for Economic Policy Research, London Brealey, R., Myers, S. (2003), Principles of corporate finance, McGraw-Hill/Irwin, 7th ed., Boston Breuss, F. (2002), “Benefits and dangers of EU enlargement“, Empirica, v.29, p. 245-274 Cruces, J. J. (2001), “Statistical Properties of Sovereign Credit Ratings”, unpublished working paper, University of Washington. Copeland, Tom, Tim Koller and Jack Murrin, 2000, Valuation: Measuring and Managing the Value of Companies, 3rd Ed., John Wiley & Sons, New York, NY Damodaran, A. (2003), “Country Risk and Company Exposure: Theory and Practice”, Journal of Applied Finance, Fall/Winter, p. 63-76. Damodaran, A. (1994), Damodaran on Valuation. New York, NY, John Wiley and Sons, Echevarria, J.I., Pastor, P.A. (1999), “Los riesgos en el comercio internacional”, Cámara de comercio, Madrid Gebhardt, W. R., Lee, C. M.C., Swaminathan, B. (2001), “Toward an Implied Cost of Capital”, Journal of Accounting Research; June, Vol. 39 Issue 1, p. 135-177 George Parker, “EU novices hope to roar like Irish ‘Celtic tigers’ rather than star in Greek tragedy”, Financial Times, April 22, 2004 Godfrey, S., Espinoza, R. (1996), “A Practical Approach to Calculating Costs of Equity for Investments in Emerging Markets”, Journal of Applied Corporate Finance, Fall, issue 9, p. 80-89 17 May 2004 - 65 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Gordon, J. R., Gordon, M. J. (1997), "The finite horizon expected return model." Financial Analysts Journal, May/June, p. 52-61 Greiner, L. E. (1972), “Evolution and Revolution as Organizations grow”, Harvard Business Review, Jul/Aug, Vol. 50 Issue 4, p. 37-47 H Grabbe & K Hughes, Enlarging the EU Eastwards, London, RIIA/Cassel, 1998 Haque, M., Hassan, M. K., Varela, O. (2001), “Stability, Volatility, Risk Premiums, and Predictability in Latin American Emerging Stock Markets”, Quarterly Journal of Business and Economics, Summer-Autumn, v. 40, iss. 3-4, p. 23-44 Harvey, C. R. (2001), “The International Cost of Capital and Risk Calculator (ICCRC)” Working Paper, Duke Fuqua School of Business Harvey, Campbell R., (2000), “Drivers of Expected Returns in Emerging Markets”, Emerging Markets Quarterly, Fall, p. 1-17 Ibbotson Associates, Inc., Cost-of-capital Quarterly. Chicago, IL, Yearbook, 1996. Keck, Tom, Eric Levengood, Longfield, A. (1998), “Using Discounted Cash Flow Analysis in an International Setting: A Survey of Issues in Modelling the Cost of Capital”, Journal of Applied Corporate Finance, iss.11, p. 82-99 Laffont, J.-J., Martimort, D. (2002). The Theory of Incentives: The Principal-Agent Model, Princeton University Press, Princeton, NJ. Lankes, H.P., Venables, A.J. (1996), “Foreign Direct Investment in Economic Transition: The Changing Pattern of Investments”, The Economics of Transition, iss. 4(2), p. 331-47 Lavigne, M. (1999), The Economics of Transition, From Socialist Economy to Market Economy, MacMillan Mackie, D., Marrese, M. (2004), “EU enlargement: opportunities grasped by the east, missed by the west“, JPMorgan Research, April 27 Madden, Bartley J. (1998), CFROI Valuation: A Total System Approach to Valuing the Firm. Holt Value Associates, Chicago, IL. McLaney, E. Pointon, J., Thomas, M., Tucker, J. (2004), “Practitioners' perspectives on the UK cost of capital”, European Journal of Finance, April, Vol. 10 Issue 2, p. 123-139 Modigilani, F., Miller, M. (1958), “The Cost of Capital, Corporation Finance and the Theory of Investment”, American Economic Review, June, Vol. 48 Issue 3, p. 261-298 Moretto, M., Valbonesi, P. (1999), “Foreign Direct Investment, Policy Uncertainty and Irreversibility: An Option Pricing Approach” RISEC: International Review of Economics and Business, December, v. 46, iss. 4, pp. 653-75 17 May 2004 - 66 - Patrick Horend European company practice of estimating the equity risk premium in the CEEC Nordal, K. B. (2001), “Country Risk, Country Risk Indices and Valuation of FDI: A Real Options Approach”, Emerging Markets Review, September, v. 2, iss. 3, p. 197-217 Pelkmans, J., Casey J-P. (2003), “EU Enlargement: External Economic Implications”, Intereconomics, Vol. 38 Issue 4, Jul/Aug, p. 196-209 Pereiro, L., María G. (2000), La Determinación del Costo de Capital en la Valuación de Empresas de Capital Cerrado: una Guía Práctica, Working paper, Centro de Investigación en Finanzas, Universidad Torcuato Di Tella. Poole, P., Robertson, C., Ellis, S., Dharan, A. (2000), “EU and convergence“, ING Barings Eastern European Reseach, March 2000 Reilly, F., Wright, D. J., Chan, K. C. (2000), “Bond Market Volatility compared to Stock Market Volatility”, Journal of Portfolio Management, Fall, Vol. 27, Issue 1, p. 82-93 Remsperger, H. (2001), “Enlargement of the European Union and European and Monetary Union: Maastricht meets Copenhagen“, Speech at the annual meeting of ELEC, Frankfurt, 7 December 2001 Resmini, L. (2000), “The determinants of Foreign direct investment in the CEECs. New evidence from sectoral patterns”, Economics of Transition, iss.8 (3), p. 665-689. Salomons, R., Grootveld, H. (2004), “The Equity Risk Premium: Emerging versus Developed Markets“, unpublished working paper, AEGON Asset Management and ROBECO Group Schaefer, S. M. (1977), “The problem with redemption yield”, Financial Analysts Journal, July-August, p. 59-67 Van Horne, J.C. (2001), Financial market rates and flows, Prentice Hall, 6th edition “A May Day milestone”, The Economist, Apr 30th 2004 “Policy in the balance”, The Economist, Apr 29th 2004 “Ever-expanding Union?”, The Economist, Apr 29th 2004 “World Investment report 2003”, United Nations, New York and Geneva, 2003 " Je déclare sur l'honneur que j'ai personnellement réalisé et écrit ce mémoire et que toute 'citation' a été clairement identifiée et rapportée dans la bibliographie." 17 May 2004 - 67 - Patrick Horend