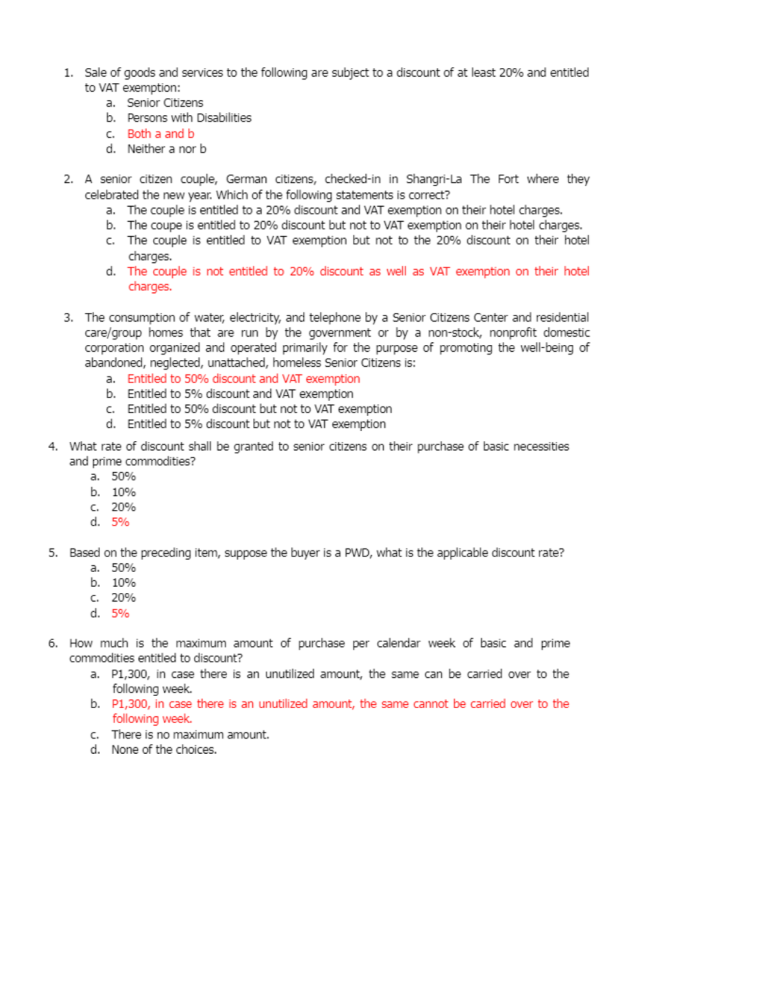

1. The BOC shall exercise the following duties and functions, except: a. Exercise of exclusive jurisdiction over forfeiture cases under the under the tariff andcustoms laws. b. Supervision and control over the imposition of excise taxes over imported goods. c. Supervision and control over the handling of foreign mails arriving in the Philippinesfor the purpose of collecting revenues and preventing the entry of contraband. d. Supervision and control on all import and export cargos, landed or stored in piers,airports, terminal facilities including containers. 2. Statement I: Tariff duties and custom duties are synonymous. Statement II: Tariffs or customs duties are classified as regular tariffs or customs dutiesand special tariffs and customs duties. a. Only Statement I is correct. b. Only Statement II I correct. c. Both Statements are correct. d. Both Statements are incorrect. 3. Which of the following is a regular customs duty? a. Ad Valorem customs duties b. Specific customs duties c. Mixed or compound customs duties. d. All of the above 4. Which of the following statements about regular customs duties are correct? a. These are taxes that are imposed or assessed upon merchandise from or exported to a foreign country for the purpose of raising revenues. b. They may also be imposed to serve as protective barriers which would prevent the entry of merchandise that would compete with locally manufactured items. Thus, they are also referred to as tariff barriers or protective tariffs. c. A high tariff on exports may also serve to discourage the exportation of certain articles, usually materials, to promote their manufacture into finished products. d. All of the above. 5. Which of the following is a special custom duty? I. Anti-dumping Duty II. Countervailing Duty III. Marking Duty IV. Discriminatory Duty a. I and II only b. II and IV only c. I, II, and III only d. I, II, III, and IV 6. Consider the following statements: I. The purpose of the regular customs duty is to raise revenues to meet the needs ofthe government. II. The imposition of customs duties also assists in economic development. III. Customs duties are sometimes imposed to protect local customers. IV. Compound customs duties are computed only on the basis of units of measuresuch as weight measurement, quantity, etc. a. b. c. d. All the above statements are correct. Only statements I, III, and IV are correct. Only Statements I, II, and IV are correct. Only Statements I, II, and III are correct. 7. It is special duty charged whenever any product, commodity or article of commerce is granted directly or indirectly by the government in the country of origin or exportation, any kind or form of specific subsidy upon the production, manufacture or exportation of such product, commodity or article, and importation of such subsidized product, commodity or article has cause or threatens to cause material injury to a domestic industry or has materially retarded the growth or prevents the establishment of a domestic industry. a. Anti-Dumping Duty b. Countervailing Duty c. Marking Duty d. Discriminatory Duty 8. It is a special duty imposed in the event that a specific kind or class of foreign article is being imported into, sold or is likely to be sold in the Philippines, at an export price less that its normal value in the ordinary cost of trade for a like product, commodity or article destined for consumption in the exporting country which is causing or threatening to cause material injury to a domestic industry, or materially retarding the establishment of adomestic industry producing similar products. a. Anti-Dumping Duty b. Countervailing Duty c. Marking Duty d. Discriminatory Duty 9. Which of the following statements is correct regarding Marking Duty? a. The marking of articles (or its containers) is a prerequisite for every article or container of foreign origin which is imported into the Philippines in accordance with Section 303 of the TCCP. b. The marking shall be done in any official language of the Philippines and in a conspicuous place legibly, indelibly permanently as the nature of the article (orcontainer) may permit to indicate to an ultimate purchaser in the Philippines the country of origin of the article. c. In case of failure to mark an article or its container at the time of importation, unless otherwise excepted from the government requirements of marking, there shall be levied upon such article a marking duty of 5% Ad Valorem. d. All of the above 10. Choose the correct answer. Smuggling a. Does not extend to the entry of imported or exported articles by means of any false orfraudulent invoice, statement, or practices; the entry of goods at less than the true weight or measure; or the filing of any false or fraudulent entry for the payment of drawback or refund of duties. b. Is limited to the import of contraband or highly dutiable cargo beyond the reach of customs authorities. c. Is committed by any person who shall fraudulently import or bring into the Philippines, or assists in so doing, any article; contrary to law, or shall receive, conceal, buy, sell or any manner facilitate the transportation, concealments, or sale of such article after importation, knowing the same to helping imported contrary to law. d. None of the above 11. Under the Tariff and Customs Code, abandoned imported articles becomes the propertyof the: a. Government, whatever be the circumstances b. Insurance company that covered the shipment c. Shipping company in case the freight was not paid. d. Bank, if the shipment is covered by the letter of credit. 12. Is an article previously exported from the Philippines subject to the payment of customsduties? a. Yes, because all articles that are imported from any foreign country are subject toduty. b. No. because there is no basis for imposing duties on articles previously exported fromthe Philippines. c. Yes. Because exemptions are strictly construed against the importer who is thetaxpayer. d. No, if it is covered by a certificate of identification and has not been improved invalue. 13. A violation of tariff and customs laws is the failure to: a. Pay customs duty and taxes and to comply with the rules on customs procedure. b. Pay the customs duties and taxes or comply with the rules on customs procedure. c. Pay the customs duties and taxes. d. Comply with the rules on customs procedure. 14. Amaretto Inc. imported 100 cases of Marula Wine from South Africa. The shipment was assessed duties and value-added taxes of 300,000 pesos which Amaretto Inc. immediately paid. The Bureau of Customs did not, however, issue the release paper of the shipment yet since the FDA needed to test the suitability of the wine for human consumption. Is theBureau of Customs at fault for refusing to release the shipment just yet? a. Yes, because the importation was already terminated as a result of the payment of thetaxes due. b. Yes, the Bureau of Customs stopped holding the release of shipment afterreceiving the payment. c. No, if the amount paid as duties and value-added taxes due on the importation wasinsufficient. d. No, because the Bureau of Customs has not yet issued the legal permit for withdrawalpending the FDA’s findings. 15. Importation of goods is deemed terminated a. When the customs duties are paid, even if the goods remain within the customspremises. b. When the goods are released or withdrawn from the customs house upon payment ofthe customs duties or legal permit to withdraw. c. When the goods enter the Philippines territory and remain within the customs housewithin 30 days from the date of entry. d. When there is part payment of duties on the 16. The Bureau of Customs shall exercise the following duties and functions, except a. Assessment and collection of customs revenues from imported goods and other dues,fees, charges, fines and penalties under the tariff and customs code. b. Simplification and harmonization of customs procedures to facilitate movement ofgoods in international trade c. Border control to prevent entry of smuggled goods. d. Prosecute persons illegally importing goods. 17. Which of the following statements is NOT a test of a valid ordinance? a. It must be contravene the Constitution or any statute b. It must not be unfair or oppressive c. It must not partial or discriminatory d. It may prohibit or regulate trade 18. Which of the following statements is correct? a. The newly registered Board of Investments enjoys income tax holiday for six years from commercial operations for six years from commercial operations for pioneer firms and four years for non-pioneer firms. b. The income tax holiday may be further extended not to exceed 8 years (maximum ITH) upon meeting certain conditions. c. For PEZA-registered enterprises, the income tax holiday is same with BOI-registered companies in general. d. All of the above. 19. Which of the following is statement is incorrect? a. BOI-registered companies are subject to 5% gross income tax in lieu of national localtaxes. b. After Income Tax Holiday period, BOI-registered companies are treated as ordinary corporations. c. BOI-registered are subject to zero-rated (0%) VAT. d. None of the above 20. Statement I: The EO 226 otherwise known as the Omnibus Investment Code of 1987, is arelatively focused and systematic of incentives based on an Investment Priorities Plan (IPP). Statement II: The IPP is an annual listing of activities/undertakings considered critical tothe attainment of the country’s overall economic growth and development. a. Only statement I is correct. b. Only statement II is correct. c. Both statements are correct. d. Both statements are incorrect 21. Income Tax Holiday (ITH) for BOI registered enterprises presupposes that it shall be exempt from the payment of income taxes reckoned from the scheduled start of commercial operations until the period given by the BOI has lapsed. Which of the following is ITH period is correct? I. Six (6) years for new projects with pioneer status II. Four (4) years for new project with non-pioneer status III. Three (3) years for expansion projects a. b. c. d. I and II only II and III only I and III only I, II and III 22. Statement 1: New registered firms may avail of bonus year. Statement 2: In no case shall the registered pioneer firm have avail of the ITH for a period exceeding eight (8) years. a. only statement 1 is correct b. only statement 2 is correct c. both statements are correct d. both statements are incorrect 23. Statement 1: To attract foreign and domestic investors into the country. The government usually offers various tax incentives, principally through the Board of ‘investment (BOI) pursuant to EO 226, as amended, otherwise known as the Omnibus Investment Code of 1987. Statement 2: The overall declaration of government policy on investment initiatives under EO 226 Includes investment made by foreign and local investors, providing for incentives fiscal and non-fiscal, to preferred areas of investments, pioneer or non-pioneer, export production as well as rehabilitation of expansion of existing operation. Statement 3: Non-fiscal include, among others, employment of foreign nations, simplification of custom procedure, unrestricted use of consigned equipment and multiple entry visa. a. only statements 1 and 2 are correct b. only statements 1 and 3 are correct c. all statements are correct d. all statements are incorrect 24. Which of the following is/are a non-fiscal incentive(s) granted to BOI registered enterprises? I. Employment of foreign nationals II. Simplification of custom procedure III. Unrestricted use of consigned equipment and multiple entry visa a. I only b. I and II only c. II and III only d. I, II, III 25. Which of the following incentives is/are granted to BOI registered enterprises? I. Tax exemption II. Tax credits III. Additional deductions from taxable income a. I only b. I and II onl c. II and III only d. I, II, III 26. Which of the following tax incentives is/are granted to BOI registered enterprises? I. Income Tax Holiday (ITH) II. Exemption from taxes and duties on imported spare parts III. Exemption wharfage dues and export tax, duty, impost and fees IV. Tax exemption breeding stocks and generic materials a. I and II only b. III and IV only c. I, II and III only d. I, II, III and IV 27. Which of the following incentives, in addition to tax exemption is/are granted to BOIregistered enterprises? I. Tax credit on tax duty portion of domestic breeding stocks and generic materials II. Tax credit on raw materials and supplies III. Additional deductions for labor and expense (ADLE) a. I only b. I and II only c. II and III only d. I, II, III 28. Statement 1: BOI registered enterprises are subject to 5% gross income tax in lieu of nationaland local taxes, except real property tax. Statement 2: PEZA registered enterprises are subject to 5% gross income tax in lieu ofnational and local taxes except real property tax. a. only statement 1 is correct b. only statement 2 is correct c. both statements are correct d. both statements are incorrect 29. Which of the following statements pertaining to Pioneer enterprises under EO 226 is correct? a. Pioneer enterprises are registered enterprises engaged in the manufacture, processing or production of commodities or raw materials that are not yet being produced in the Philippines on a commercial scale. b. Pioneer enterprises also involves the use of a design, formula, method, process or system of production or transformation of any element, substance or raw material into another raw material or finished goods which is new and untried in the Philippines. c. Pioneer enterprises are also engaged in the pursuit of agricultural, forestry and mining activities and/or services and energy sectors. d. All of the above. e. 30. refers to the most recent list of the thirty (30) poorest provinces of the Philippines at the time of application, as determined by the National Economic Development Authority (NEDA). a. Pioneer enterprises b. Special Economic Zones (SEZ) c. Investment Priorities Plan (IPP) d. Less Developed Areas (LDA) PEZA registered enterprises 31. is a selected area with highly developed enterprises or which have the potential to be developed into agro-industrial, industrial, tourist/recreational, commercial, banking investment and financial centers. a. Pioneer enterprises b. Special Economic Zones (SEZ) c. Investment Priorities Plan (IPP d. Less Developed Areas (LDA) 32. Incentives to enterprises locating in export processing zones a. Foreign merchandise, raw materials, spare parts, etc. brought into the zone shall not besubject to customs and internal revenue laws and regulations nor to local tax ordinances. b. BOI-registered enterprise incentives. c. Exemption from local taxes and licenses except real estate taxes. d. All of the above. 33. Statement 1: The PEZA law specifically provides that the ecozones shall be managed and operated by PEZA (not by any other government entity) as a separate custom territory. Statement 2: in keeping with the status of ecozone as separate custom territory, the PEZA is conferred the power and function to operate, administer, anage and develop the ecozone, and to register, regulate and supervise the enterprises in ecozones. a. only statement 1 is correct b. only statement 2 is correct c. both statements are correct d. both statements are incorrect 34. are enterprises registered enterprises engaged in the manufacture, processing or production of commodities or raw material that are not yet being produced in the Philippineson a commercial scale. a. Pioneer enterprises b. Non-pioneer enterprises c. Multi-national companies d. Export oriented enterprises 35. To encourage investment in desirable areas of activity, EO 226 provides incentives to the following: A B C D enterprises registered with the BOI True True True True enterprises locating in less developed False True True True True True True True False False False True True False True True area (LDA) MNCs establishing their RHQs/ROHQs in the Philippines MNCs establishing their regional wareHouses in the Philippines Enterprises locating in export processing zones 36. Statement 1: RA 7916 or the Special Economic Zone Act of 1995 (February 24, 1995) provides the framework for the transformation, formation and monitoring of certain designated areas in the country called special economic zones (ecozones) where companies and industries establishing their operations therein are given incentives and privileges. Statement 2: Enterprises locating or operating within the ecozones shall register with the Philippine Export Zone Authority (PEZA) and are entitled to similar incentives granted as provided for under PD 66 or those provided under EO 226 (Omnibus Investment Code). a. only statement 1 is correct b. only statement 2 is correct c. both statements are correct d. both statements are incorrect 37. Statement 1: For PEZA purposes, the 5% gross income tax is in lieu of all taxes, excluding local taxes. Statement 2: PEZA registered enterprises paying the 5% tax on gross income are not liable for local business taxes are not liable for local business taxes and other charges normally due to the local government unit. a. only statement 1 is correct b. only statement 2 is correct c. both statements are correct d. both statements are incorrect 38. Statement 1: PEZA income tax holiday incentives imply exemption from income tax. Statement 2: PEZA income tax holiday would mean that an entity entitled to it enjoys exemption from income tax only, unless expressly exempted from other taxes. a. only statement 1 is correct b. only statement 2 is correct c. both statements are correct d. both statements are incorrect 39. A PEZA registered enterprise has a registered and unregistered activity. The MCIT hall applyto: a. Registered activity b. Unregistered activity c. Both activities d. Neither registered or unregistered activity 40. Private entities that employ disabled persons who meet the required skills or qualifications, either as regular employee, apprentice or learner, shall be entitled to an additional deduction from gross income equivalent to: a. 15% of the total amount paid as salaries and wages to PWDs. b. 25% of the total amount paid as salaries and wages to PWDs. c. 50% of the total amount paid as salaries and wages to PWDs. d. 100% of the total amount paid as salaries and wages to PWDs. 41. Which of the following statements is not a requirement in order for private establishments employing senior citizens to be entitled to additional deduction form their gross income equivalent to fifteen percent (15%) of the total account paid as salaries and wages for senior citizens? a. The employment shall have to continue for a period of at least one (1) year. b. The annual taxable income of the senior citizen does not exceed the poverty level asdetermined by NEDA. c. Both statements “a” and “b” d. Neither “a” nor “b” 42. Which of the following statements regarding discounts to PWDs is incorrect? a. In case the seller provides promotional discounts, the PWD will have the option tochoose either the promotional discount or the PWD discount. b. Only the PWD discount is exempted from VAT. c. In cases the PWD shall also be entitled to SC discount in order to maximize the discountsgranted under Magna Carta for PWDs and SCs. d. None of the above. Use the following data for the next three (3) questions: Mabuhay Services Corporation (MSC) provides 20% discount to senior citizens. It recorded thefollowing during the year: CUSTOMERS Receipts Cost of services Other deductible expenses Regular P8,000,000 Senior Citizen P1,000,000 Total P9,000,000 5,000,000 2,000,000 43. The amount of gross receipts to be reported is? a. P1,000,000 b. P1,250,000 c. P9,000,000 d. P9,250,000 44. The regular and special itemized deductions deductible from gross income of MSC is? a. P2,000,000 b. P2,250,000 c. P5,350,000 d. P7,000,000 45. The taxable net income of MSC is? a. P750,000 b. P1,000,000 c. P1, 750,000 d. P2,000,000 Mabisa Drugs Incorporation had the following during the year: Customers Regular Senior Citizen Total Gross Sales P8,000,000` P2,000,000 P10,000,000 Cost of Sales P5,000,000 P1,000,000 P6,000,000 Other deductible expenses P2,000,000 Mabisa adopts a policy of giving senior citizens 25% discount. As a result, it granted P500,000total senior citizens’ discount during the year. 46. The amount of gross sales to be reported is?a. P8,000,000 b. P9,500,000 c. P9,600,000 d. P10,000,000 47. The amount of other deductible expenses to be reported is?a. P400,000 b. P500,000 c. P2,400,000 d. P2,500,000 48. The taxable net income is? a. P1,500,000 b. P1,600,000 c. P1,800,000 d. P2,000,000 49. Bobads Corporation employs both regular and senior citizen employees and paid thefollowing compensation: Regular Employees P800,000 Senior Citizen Employees: With salary above the poverty level P200,000 With salary below the poverty level P1,000,000 The deductible expense is? a. P1,100,000 b. P1,115,000 c. P1,120,000 d. P1,145,000 50. Using the above information except that 20% of the regular employees are persons with disability receiving a total compensation of P160,000 the deductible compensation of the corporation is? a. b. c. d. P1,152,000 P1,155,000 P1,178,000 P1,192,000 51. Statement 1: If a taxpayer, classified as PWD, is unable to make his own return, the return may be made by his duly authorized agent or representative or by the guardian or other person charged with care of the person or property. Statement 2: The principal (PWD) and his representative or guardian shall assume the responsibility of making the return and incurring penalties provided for erroneous, false, fraudulent returns. Statement 3: The privileged of statement 1 and transfer of responsibility in statement 2 islikewise available to a senior citizen taxpayer. a. b. c. d. Only statement 1 is correct Only Statement 2 is correct Only statement 3 I incorrect None of the above statements is correct 52. Statement 1: While the 20% senior citizen discount and VAT exemption shall not apply to “children’s meals” as these are primarily prepared and intentionally marketed for children, if the PWD is a child will be applicable as long as it is his for personal consumption. Statement: The 20% discount in the purchase of food and drinks, beverages, dessert and other consumable items served by establishments includes value meals and other similar food counters, fast food, cooked food and short order including take outs. a. b. c. d. Statement 1&2 are false Statement 1 is true but Statement 2 is false Statement 1 is false but Statement 2 is true Statements 1&2 are true 53. Statement 1: Any donation, bequest, subsidy or financial aid which may be made to government agencies engaged in the rehabilitation Statement 2: The 20% discount on purchase of food and drinks, beverages, dessert and other consumable items served by establishments includes value meals and other similar food counters, fast food, cooked food and short orders including take outs. a. b. c. d. Statement 1&2 are false Statement 1 is true but Statement 2 is false Statement 1 is false but Statement 2 is true Statement 1&2 are true 54. Taxing power of local government units shall NOT extend to the following taxes except one: a. Income tax on banks and other financial institutions; b. Taxes of any kind on the national government, its agencies ad instrumentalities, and localgovernment units. c. Taxes on agricultural and aquatic products when sold by the marginal farmers orfishermen; d. Excise taxes on articles enumerated under the Internal Revenue Code 55. Real property taxes should not disregard increases in the value of real property occurring over a long period of time. To do otherwise would violate the canon of a sound tax system referred to as: a. b. c. d. Theoretical Justice Fiscal Adequacy Administrative Feasibility Symbolic Relationship 56. A municipality may levy an annual ad valorem tax on real property such as land, building, machinery, and other improvement only if a. b. c. d. The real property is within the Metropolitan Manila Area The real property is located in the municipality The DILG authorizes it to do so The power is delegated to it by the province. 57. Real property owned by the national government is exempt from real property taxation unless the national government: a. b. c. d. Transfers it for the use of local government unit Leases the real property to a business establishment Gratuitously allows its use for educational purposes by a school establish for profit Sells the property to a government-owned non-profit corporation 58. Where the real property tax assessment is erroneous, the remedy of the property owner is: a. To file a claim for refund in the Court of Tax Appeals if he has paid the tax, within thirty (30) days from the date of payment b. To file an appeal with the Provincial Board of Assessment Appeal within thirty (30) daysfrom receipt of the assessment c. To file an appeal with the Provincial Board of Assessment Appeal within sixty (60) daysfrom receipt of the assessment d. To file an appeal with the Provincial Board of Assessment Appeal within thirty (30) daysfrom receipt of the assessment and playing the assessed tax under protest. 59. Which statement on prescriptive period is true? a. The prescriptive periods to assess taxes in the National Internal Revenue Code and localgovernment code are the same; b. Local taxes shall be assessed within five (5) years from the date they become due; c. Action for the collection of local taxes may be instituted after the expiration of the periodto assess and to collect the tax; d. Local taxes may be assessed within ten (10) years from the discovery of underpayment oftax which does not constitute fraud. 60. The appraisal, assessment, levy and collection of real property tax shall be guided by the following principles. Which statement does NOT belong here? a. Real property shall be appraised at its current and fair market value; b. Real property shall be classified for assessment purposes based on its actual use; c. Real property shall be assessed on the basis of a uniform classification within eachlocal political subdivision; d. The appraisal and assessment of real property shall be based on audited financialstatements of the owner. 61. After the province has constructed a barangay road, the Sangguniang Panlalawigan may impose a special levy upon the lands specially benefitted by the road up to the amount not to exceed a. 60% of actual cost of road without giving any portion to barangay b. 100% of actual project cost without giving any portion to barangay c. 100% of actual project cost, keeping 60% for the province and giving 40% to thebarangay d. 60% of actual cost, dividing the same between the provice and the barangay. 62. What is the tax base for the imposition by the province of professional taxes? a. That which Congress determined b. The pertinent provision of the local government code c. The reasonable classification made by the provincial sanggunian d. That which the Dept. of Interior and Local government determined 63. GG Foundation, a stock educational institution organized for profit, decided to lease for commercial use a 1,500 sq. m. portion of its school. The school actually, directly, and exclusively used the rents for maintenance of its school buildings. Is the leased portion subject toreal property tax? a. Yes, since GG Co. is a stock and for profit institution b. No, since the school used the rents for educational purposes c. No, but it may be subject to income tax d. yes, since the leased potion is not actually, directly, and exclusively used foreducational purposes. 64. The head priest, as a corporation sole, rented out a lot registered in its name for a school site of a school organized for profit. The sect used the rentals for the support and upkeep of itspriests. The rented lot is a. not exempt from real property taxes because the user is organized for profit b. exempt from real property taxes since it is used for religious purposes c. not exempt from real property taxes since it is the rents, not the land, that I used forreligious purposes d. exempt from real property taxes since it is actually and exclusively used foreducational purposes. 65. Apparently the law does not provide for the refund of real property taxes that have been collected as a result of erroneous or illegal assessment by the provincial or city assessor. What should be done in such instance to avoid an injustice? a. question the legality of the no-refund rule b enact a new ordinance amending the erroneous or illegal assessment b. subsequent adjustment in tax computation and application of excess payment to futurereal property taxes liabilities c. pass a new ordinance providing for the refund of excess real property taxes paid 66. Prior to the enactment of the Local Cooperative Code, consumer’s cooperatives registered under the CDA enjoyed exemption from all the taxes imposed by a local government. With the local government code’s withdrawal of exemptions, could these cooperatives continue to enjoy such exemption? a. Yes, because the local government code could not amend a special law b. No, congress has not by the majority vote of all its members granted exemption c. No, the exemption has been withdrawn d. Yes, their exemption is specifically mentioned among those not withdrawn by theLocal Government Code 67. The following resident Foreign Corporations are subject to preferential tax rates, except a. Regional Operating Headquarters b. International Carriers c. Regional Area Headquarter d. Offshore Banking Units 68. Which of the following may be subject to Minimum Corporate Income Tax? a. Philippine Carriers b. International carriers c. Regional Operating Headquarters d. Regional or area headquarters 69. A is defined as any business enterprise engaged in production, processing, or manufacturing of products, including agro-processing, as well as trading and services, with total assets of not more than 3 million. a. Ecozones b. RHQs/ROHQs of MNCs c. PEZA entities d. BMBEs 70. Which of the following are the incentives that may be granted to BMBEs? a. Income tax exemption b. Exemption from coverage pf Minimum Wage Law c. Technology transfer and marketing assistance for BMBE beneficiaries d. All of the above 71. The BMBE purposes, the concerned officer shall cancel the registration of a BMBE for thefollowing cause, except a. When the BMBE transfers its place of business to another locality b. When the value of its total assets as determined exceeds 3 million c. When the BMBE surrenders certificate d. When it establishes warehouse outside the locality 72. The of each city shall register BMBE and issue certificate of authority toenable the BMBE to avail of the incentives under BMBE act a. Office of the Mayor b. Office of the Treasurer c. Office of the barangay chairman d. BIR RDO 73. One can register as a BMBE if it is a business entity or enterprise, engaged in, which activities are barangay based and micro-business in nature and scope, except a. Production of products/commodities b. Agro-processing c. Trading and services d. Professional services 74. For BMBE purposes, the Certificate of Authority shall be effective for a period of and renewable for the same period. The concerned officer shall indicate in the certificate the date when the registration of the BMBE commences a. 1 year b. 2 years c. 3 years d. 4 years 75. The following are agents and deputies for collection of National Internal Revenue taxes, except a. The commissioner of customs and subordinates b. The head of appropriate government office c. Banks duly authorized by the commissioner. d. City treasurer with regard to collection of real estate tax 76. The chief officials of the BIR shall be composed of a. 1 commissioner, 4 deputy commissioner b. 1 commissioner, 5 deputy commissioner c. 1 commissioner d. 1 commissioner and 7 deputy commissioner 77. Statement 1: Microfinance NGOs are NGOs with the primary purpose of implementing a microenterprise development strategy. Statement 2: Microfinance NGOs are prohibited from directly engaging in insurance business. a. b. c. d. Only statement 1 is correct S2 is correct All are correct All are incorrect 78. Dr. Albert Rebosa, a VAT registered OB-gyne specialists, owns a maternity lying-in-clinic. The payment received for the month totaling 750,000 pesos are broken down as follows: 350,000 professional fees, 400,000 as payment for use of lying-in-clinic. His output VAT for the month is a. 90,000 b. 48,000 c. 42,000 d. 80,357 79. S1: The office of the treasurer of each city shall register the BMBE and issue a certificate. S2: LGUs shall issue the certificate promptly and free of charge a. b. c. d. S1 is correct S2 is correct Both are correct Both are incorrect 80. S1: Services offered by BMBEs shall exclude those rendered by a licensed professionalS2: Any enterprise can qualify for registration as BMBE a. Both are correct b. S2 is correct c. S1 is correct d. Both are incorrect Answer Key 1. B 21. D 41. A 61. A 2. C 22. C 42. C 62. C 3. D 23. C 43. D 63. D 4. D 24. D 44. B 64. D 5. D 25. D 45. D 65. C 6. D 26. D 46. D 66. D 7. B 27. D 47. D 67. C 8. A 28. B 48. A 68. A 9. D 29. D 49. B 69. D 10. C 30. D 50. B 70. D 11. A 31. B 51. C 71. D 12. D 32. D 52. D 72. D 13. B 33. C 53. D 73. D 14. D 34. A 54. A 74. B 15. B 35. C 55. B 75. D 16. D 36. C 56. A 76. A 17. D 37. D 57. B 77. C 18. D 38. B 58. C 78. C 19. A 39. B 59. B 79. C 20. C 40. B 60. D 80. C Solution 43-45 Solution: RECEIPTS: Regular customers SC (P1M/80%) Total gross receipts Less: Cost of services Other deductible expense (P2M + SC discount of P250,000) Taxable Net Income P8,000,000 1,250,000 9,250,000 (5,000,000) (2,250,000) P2,000,000 The gross sales or receipts to be reported should be the undiscounted amount. The senior citizen /PWD discount shall be reported as part of the operating expense 46-48 Solution: GROSS SALES Regular Customer Senior Citizens (SC) Total gross receipts Less: Cost of Sales-Regular Cost of Sales- SC Other deductible expense (P2M + SC discount of P500,000) Taxable Net Income P8,000,000 2,000,000 10,000,000 (5,000,000) (1,000,000) (2,500,000) P1,500,000 49 Regular employees P800,000 Senior Citizen employees: With salary grade above the poverty level P200,000 With salary grade below the poverty level Additional deductible salary (100,000 x 15%) Total compensation Expense P100,000 P15,000 P1,115,000 Additional compensation of 15% for those salary grades is below poverty level. 50 Solution: Regular employees PWD employees Additional Compensation-PWD@25% Senior Citizen employees: With salary grade above poverty level With salary grade below the poverty level Additional deductible salary (P100,000 x 15%) Total Compensation Expense Additional deductible compensation of 25% for PWD employees. P640, 000 160, 000 40, 000 200, 000 100,000 15, 000 P1, 155, 000