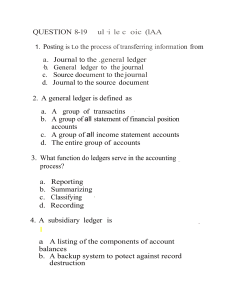

Books of Accounts Objectives 1. Identify the uses of the two books of accounts (journal and ledger) to record business transactions. 2. Explain the use of general and special journals to record business transactions. 3. Discuss the use of general and subsidiary ledgers to record business transactions. Accounting “Accounting is the process of IDENTIFYING, RECORDING, and COMMUNICATING economic events of an organization to interested users.” (Weygandt et.al.) Questions 1. Where do we record the transactions that we have been identified? 2. What are the tools we use to document these transactions? 3. How important are these records in accounting? Books of accounts 1. Journal 2. Ledger Journal A journal functions as a financial diary. It is used to record chronologically as the transactions occur. It is commonly referred to as the book of original entries. Uses of Journal 1. It provides a systematic and chronological record of transactions. 2. It simplifies the ledger as some details in the journal need not be written in the ledger. Uses of Journal 3. It provides an adequate explanation of each entry and presents necessary information about the transactions such as accounts debited and credited. 4. It ensures that the double-entry bookkeeping system is observed when recording transactions. Uses of Journal 5. It helps in solving misunderstanding in business because it serves as proof and legal evidence of transactions. Types of Journal The General Journal The Special Journal General Journal Illustration • On September 1, 2015, Mr. Ben Mabait invested PhP500,000 in a restaurant business by opening an account with SuperBank. • On September 5, 2015, purchased kitchen appliances for his business amounting to PHP100,000 by issuing a check. • On September 6, 2015, started his operations and made sales for that day amounting to PHP20,000. Compound Entry On September 7, 2015, Mr. Mabait purchased a motorcycle costing PHP80,000. He pays PHP30,000 cash and agrees to pay the remaining PHP50,000 on account (to be paid later). Special Journals Some businesses encounter voluminous quantities of similar and recurring transactions which may create congestion if these transactions are recorded repeatedly in a single day or a month in the general journal. Special Journals are used to record recurring transactions. Special Journals Cash Receipts Journal – used to record all cash that has been received Cash Disbursements Journal – used to record all transactions involving cash payments Special Journals Sales Journal – used to record all sales on credit Purchase Journal – used to record all purchases of inventory on credit Special Journals Special Journals Special Journals Special Journals Ledger The ledger refers to the accounting book in which the accounts and their related amounts as recorded in the journal are posted periodically. The ledger is also called the book of final entries because all the balances in the ledger are used in the preparation of financial statements. This is also referred to as the T-Account because the basic form of a ledger is like the letter T. Uses of Ledger 1. It provides detailed information about the assets, liabilities, and owner’s equity of the business. 2. It provides detailed information about revenues and expenses in one place, hence the result of the business can be easily determined. Uses of ledger 3. It assists management in monitoring business performance through information in individual ledger accounts. 4. It serves as a tool for auditors to track the flow of business transactions for a given period of time. Types of Ledger The General Ledger The Subsidiary Ledger General Ledger The general ledger is a grouping of all accounts used in the preparation of financial statements. The GL is a controlling account because it summarizes all the activities that have taken place as recorded in its subsidiary ledger. Subsidiary Ledger A subsidiary ledger is a group of like accounts that contains the independent data of a specific general ledger. A subsidiary ledger is created or maintained if individualized data is needed for a specific general ledger account. An example of a subsidiary ledger is the individual record of various payables to suppliers. The total amount of these subsidiary ledgers should equal the balance in the Accounts Payable general ledger.