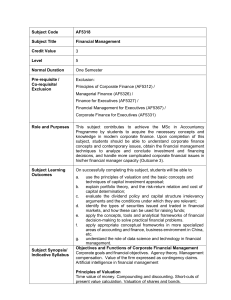

What is value? Lecturer: Gonçalo Faria School of Economics and Finance Week Outline 1. Module introduction 2. Overview of the Valuation topic ● What is Value? <= ● Valuation Exercise: some key ideas ● Valuation: key topic in Finance? What is value? “A lot of executives apparently believe that if they can figure out a way to boost reported earnings, their stock prices will go up even if the higher earnings do not represent any underlying economic change. In other words, the executives think they are smart and the market is dumb....The market is smart. Apparently, the dumb one is the corporate executive caught up in the earnings-per-share mystique.” (WSJ, Editorial October 1st, 1974) “Price is what you pay. Value is what you get.” (Warren Buffet) ● CASH IS KING! What is value? Financial Value vs. Accounting Value ● Cash flow vs. accounting ratios (example: Earnings Per Share) Example: “value destructive” but “accounting constructive” M&A deals ● opportunity cost > return on invested capital: under-remunerated cash should go back to shareholders Relevance of shareholder remuneration policy (dividends + share buyback programs) What is value? Sustainable Value vs. “One-off” events ● Medium / Long term perspective: distinction between fundamentals and circumstantial “drivers” ● Sustainable cash flow generation in the future vs. one-offs Example: Sale of non-core assets as an industrial company selling its real estate What is value? 1st key idea: Valuation Analysis is always focused on cash generated and through an expected sustainable way