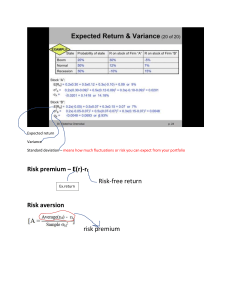

Eric Brisker 645: Investment Analysis Course Notes Risk and Return: Past and Prologue Investments, 10th Edition Bodie, Kane, Marcus Rates of Return Holding-Period Return (HPR) Rate of return over a given investment period 𝑯𝑷𝑹 = 𝑷𝟏 − 𝑷𝟎 + 𝑪𝑭 𝑷𝟏 + 𝑪𝑭 = −𝟏 𝑷𝟎 𝑷𝟎 𝑷𝟎 = 𝑩𝒖𝒚 𝑷𝒓𝒊𝒄𝒆 𝒂𝒕 𝒕𝒊𝒎𝒆 𝒑𝒆𝒓𝒊𝒐𝒅 𝒁𝒆𝒓𝒐 (𝒊. 𝒆. , 𝑩𝒆𝒈𝒊𝒏𝒏𝒊𝒏𝒈) 𝑷𝟏 = 𝑺𝒂𝒍𝒆 𝑷𝒓𝒊𝒄𝒆 𝒂𝒕 𝒕𝒊𝒎𝒆 𝒑𝒆𝒓𝒊𝒐𝒅 𝑶𝒏𝒆 (𝒊. 𝒆. , 𝑬𝒏𝒅) 𝑪𝑭 = 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘 (𝒊. 𝒆. , 𝑪𝒂𝒔𝒉 𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅) What is the HPR for a share of stock that was purchased for $25, sold for $27 and distributed $1.25 in dividends? 𝑯𝑷𝑹 = $𝟐𝟕 + $𝟏. 𝟐𝟓 − 𝟏 = 𝟏𝟑% $𝟐𝟓 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝑮𝒂𝒊𝒏𝒔 𝒀𝒊𝒆𝒍𝒅 = 𝑷𝟏 $𝟐𝟕 −𝟏= − 𝟏 = 𝟖% 𝑷𝟎 $𝟐𝟓 𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒀𝒊𝒆𝒍𝒅 = 𝑪𝑭 = 𝟓% 𝑷𝟎 1) Arithmetic Average Return (aka, Expected Return) 𝑴 𝑺𝒖𝒎 𝒐𝒇 𝒓𝒆𝒕𝒖𝒓𝒏𝒔 𝒊𝒏 𝒆𝒂𝒄𝒉 𝒑𝒆𝒓𝒊𝒐𝒅 𝟏 = ∑ 𝒓𝒊,𝒕 𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒑𝒆𝒓𝒊𝒐𝒅𝒔 𝑴 𝒕=𝟏 𝑴 = 𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝑷𝒆𝒓𝒊𝒐𝒅𝒔; 𝑷𝒆𝒓𝒊𝒐𝒅𝒔 (𝒕) 𝒈𝒐 𝒇𝒓𝒐𝒎 𝟏 𝒕𝒐 𝑴 𝒓𝒊,𝒕 = 𝑷𝒆𝒓𝒊𝒐𝒅 𝑹𝒆𝒕𝒖𝒓𝒏 𝒇𝒐𝒓 𝒂𝒔𝒔𝒆𝒕 𝒊 𝒂𝒕 𝒕𝒊𝒎𝒆 𝒑𝒆𝒓𝒊𝒐𝒅 𝒕; 𝒕 𝒈𝒐𝒆𝒔 𝒇𝒓𝒐𝒎 𝟏 𝒕𝒐 𝑴 What is the average monthly HPR return for Microsoft’s (MSFT) stock over the last five months? In this case, monthly HPR measures the % change in MSFT stock price over the past month for each month indicated. January, 2017 February, 2017 March, 2017 April, 2017 May, 2017 𝑀 5 𝑡=1 𝑡=1 i = MSFT i = MSFT i = MSFT i = MSFT i = MSFT t=1 t=2 t=3 t=4 t=5 HPR = 2% HPR = -3% HPR = 4% HPR = 3% HPR = -2% 1 + HPR = 102% 1 + HPR = 97% 1 + HPR = 104% 1 + HPR = 103% 1 + HPR = 98% 1 1 1 ∑ 𝑟𝑖,𝑡 = ∑ 𝑟𝑀𝑆𝐹𝑇,𝑡 = ( ) × 2% + (−3%) + 4% + 3% + (−2%) = 0.80% 𝑀 5 5 Excel: =Average (select HPR column in table) = 0.80% We could also say that MSFT expected return, E(r), for the next month is 0.80%, or for the next year is (12 x 0.80%) = 9.6% 𝑴 𝟏 𝑬(𝒓) 𝒖𝒔𝒊𝒏𝒈 𝒉𝒊𝒔𝒕𝒐𝒓𝒊𝒄𝒂𝒍 𝒓𝒆𝒕𝒖𝒓𝒏𝒔 = ∑ 𝒓𝒊,𝒕 𝑴 𝒕=𝟏 2) Geometric Average Return Single per-period return; gives same cumulative performance as sequence of actual returns Compound period-by-period returns; find per-period rate that compounds to same final value 𝑴 𝟏 𝑴 𝑴 (∏(𝟏 + 𝒓𝒊,𝒕 )) − 𝟏 = √(𝟏 + 𝒓𝒊,𝟏 ) × (𝟏 + 𝒓𝒊,𝟐 ) ×. .× (𝟏 + 𝒓𝒊,𝑴 ) − 𝟏 𝒕=𝟏 What is the geometric average monthly HPR return for Microsoft’s (MSFT) stock over the past five months? 1 𝑀 𝑀 𝟏 𝟓 𝟓 (∏(1 + 𝑟𝑖,𝑡 )) − 1 = (∏(𝟏 + 𝒓𝑴𝑺𝑭𝑻,𝒕 )) − 𝟏 = 𝑡=1 𝒕=𝟏 1 [(1 + 2%) × (1 + (−3%)) × (1 + 4%) × (1 + 3%) × (1 + (−2%))]5 − 1 = 0.76% Excel: =Geomean (select (1 + HPR) column in table) – 1 = 0.76% 3) Dollar-Weighted average return Internal rate of return on investment Remember that IRR is the discount rate that sets NPV = 0 Note: Arithmetic Average Returns and Geometric Average Returns are “time-weighted” return calculations 𝑴 𝑵𝑷𝑽 = 𝟎 = ∑ 𝒕=𝟎 𝑪𝑭𝒕 (𝟏 + 𝑰𝑹𝑹)𝒕 𝑪𝑭𝒕 = 𝑪𝒂𝒔𝒉 𝒇𝒍𝒐𝒘 𝒊𝒏 𝒑𝒆𝒓𝒊𝒐𝒅 𝒕 𝑴 = 𝑻𝒐𝒕𝒂𝒍 𝒏𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒑𝒆𝒓𝒊𝒐𝒅𝒔 𝑰𝑹𝑹 = 𝑰𝒏𝒕𝒆𝒓𝒏𝒂𝒍 𝑹𝒂𝒕𝒆 𝒐𝒇 𝑹𝒆𝒕𝒖𝒓𝒏 Given the following cash flows from buying a stock, what is the DollarWeighted average return? Buy 1 share of stock today: Receive Dividend end of year 1: Buy 2nd share of stock end of year 1: Receive Dividend end of year 2: Sell both shares of stock end of year 2: 𝑁𝑃𝑉 = 0 = P0 = $50 Div1 = $2 P1 = $53 Div2 = $2 P2 = $54 CF = -$50 CF = $2 CF = -$53 CF =$2x2 = $4 CF =$54x2=$108 −$50 $2 + (−$53) $4 + $108 + + (1 + 𝐼𝑅𝑅)0 (1 + 𝐼𝑅𝑅)1 (1 + 𝐼𝑅𝑅)2 Must solve for IRR using Excel or Financial Calculator: Excel: =IRR (select CF column) = 7.12% avg. annual dollar-weighted return Inflation and the “Real” Rates of Interest Nominal vs Real Interest 𝟏+𝒓= 𝟏+𝑹 𝟏+𝒊 𝑟 = 𝑅𝑒𝑎𝑙 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑅𝑎𝑡𝑒 𝑅 = 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑅𝑎𝑡𝑒 𝑖 = 𝐼𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 Example: What is the real return on an investment that earns a nominal 10% return during a period of 5% inflation? 1+𝑟 = 1+𝑅 1+𝑖 →𝑟= 1+𝑅 1+𝑖 −1→𝑟 = 1+10% 1+5% − 1 = 4.8% Quick, but not precise, estimate could be calculated as: 𝑟 = 𝑅 − 𝑖 = 10% − 5% = 5% Equilibrium Nominal Rate of Interest 𝐹𝑖𝑠ℎ𝑒𝑟 𝐸𝑞𝑢𝑎𝑡𝑖𝑜𝑛: 𝑅 = 𝑟 + 𝐸(𝑖) where E(i) = Current Expected Inflation Rate U.S. History of Interest Rates, Inflation, and Real Interest Rates, 1926 - 2015 20 15 10 Percent 5 0 -5 T-bills -10 Inflation -15 Real T-bills -20 1925 1935 1945 1955 1965 1975 1985 1995 2005 2015 Since 1950’s, nominal rates have increased roughly in tandem with inflation 1930s/1940s: Volatile inflation affects real rates of return (what was going on during this period?) Risk and Risk Premiums Historical Data Analysis Before we were basing our analysis of returns (i.e., Avg., Geometric, Dollarweighted) on historical returns or cash flows that were known Expected return: Average (aka, Mean) of past distribution of HPRs over some time-horizon (6 months, 1 year, 5 years, etc.) Variance: Sum of value of squared deviations from mean Standard deviation: Square root of variance, and the main measure of assetspecific risk using historical returns The Normal Distribution Central to the theory and practice of investments Distribution is fully described by the mean and standard deviation Normality over Time When returns over very short time periods are normally distributed, HPRs up to 1 month can be treated as normal Bottom line, we can use monthly HPRs in most analysis dealing with stock returns, or continuously compounded returns when normality plays crucial role Normal Distribution E(r) = 10% and σ = 20% Risk is the possibility of getting returns different from expected Using Time Series of Return Scenario analysis derived from sample history of returns Variance and standard deviation estimates from time series of returns: 𝑬(𝒓) = 𝒓𝒕 = 𝟏 ∑ 𝒓𝒕 𝒏 𝑽𝒂𝒓(𝒓𝒊 ) = 𝟏 ∑(𝒓𝒕 − 𝒓𝒕 )𝟐 𝒏−𝟏 𝑺𝑫(𝒓𝒊 ) = √𝑽𝒂𝒓(𝒓𝒊 ) Risk Premiums and Risk Aversion Risk-free rate: Rate of return that can be earned with certainty Risk premium: Expected return in excess of that on risk-free securities Excess return: Rate of return in excess of risk-free rate Risk aversion: Reluctance to accept risk Price of risk: Ratio of risk premium to variance The Sharpe (Reward-to-Volatility) Ratio Ratio of portfolio risk premium to standard deviation (higher is better) 𝑺𝒑 = 𝑬(𝒓𝒑 ) − 𝒓𝒇 𝑷𝒐𝒓𝒕𝒇𝒐𝒍𝒊𝒐 𝑹𝒊𝒔𝒌 𝑷𝒓𝒆𝒎𝒊𝒖𝒎 = 𝑺𝒕𝒂𝒏𝒅𝒂𝒓𝒅 𝑫𝒆𝒗𝒊𝒂𝒕𝒊𝒐𝒏 𝒐𝒇 𝑬𝒙𝒄𝒆𝒔𝒔 𝑹𝒆𝒕𝒖𝒓𝒏𝒔 𝝈𝒑 E(rp) = Expected return of the portfolio rf = Risk Free rate of return σp = Standard Deviation of portfolio excess return Mean-Variance Analysis: Rank portfolios by Sharpe Ratios The Historical Record: World Portfolios World large stocks: 24 developed countries, approximately 6000 stocks U.S. large stocks: Standard & Poor’s 500 largest cap U.S. small stocks: Smallest 20% on NYSE, NASDAQ, and Amex World Bonds: Same countries as World Large Stocks U.S. Treasury bonds: Barclay’s Long-Term Treasury Bond Index Asset Allocation across Portfolios Asset Allocation o Portfolio choice among broad investment classes Complete Portfolio o Entire portfolio, including risky and risk-free assets Capital Allocation o Choice between risky and risk-free assets The Risk-Free Asset o Treasury bonds (still affected by inflation, interest rate risk, reinvestment rate risk) o Price-indexed government bonds (try to eliminate inflation risk) o Money market instruments effectively risk-free (very little inflation, interest rate risk, or reinvestment rate risk due to their short-term nature) o Risk of CDs and commercial paper is miniscule compared to most assets Example: Your total wealth is $10,000. You allocate $2,500 of your wealth into risk-free T-bills and the remaining $7,500 in a stock portfolio invested as follows: Stock A: $2,500 Stock B: $3,000 Stock C: $2,000 Weights in the risky portfolio: WA = $2,500 / $7,500 = 0.3333 WB = $3,000 / $7,500 = 0.4000 WC = $2,000 / $7,500 = 0.2667 The complete portfolio includes the risk-free asset and the risky portfolio: WA = ($7,500 / $10,000) x 0.3333 = 0.25 WB = 0.75 x 0.4000 = 0.30 WC = 0.75 x 0.2667 = 0.20 WRf = $2,500 / $10,000 = 0.25 Expected Return & Standard Deviation of the Complete Portfolio 𝑬(𝒓𝑪 ) = 𝒚 × 𝑬(𝒓𝒑 ) + (𝟏 − 𝒚) × 𝒓𝒇 E(rC) = Expected return of the complete portfolio E(rp) = Expected return of the risky portfolio Rf = Return of the risk free asset (such as the 3 mos. TB) y = Percentage weight in the risky portfolio 𝝈𝑪 = 𝒚 × 𝝈𝒑 σC = Standard Deviation of the complete portfolio σp = Standard Deviation of the risky portfolio Note: The risk-free asset as a standard deviation of 0 as it has no risk Example: Assume the risk-free rate of return is 5% with standard deviation of 0 (no risk). The expected return on the risky portfolio is 14% with a standard deviation of 22%. An investor decides to invest a proportion (y) of their total wealth in the risky portfolio and the remainder, 1 – y, into the riskfree T-bill money market funds so that the overall portfolio will have an expected return of 11.75%. What is the proportion y? 𝐸(𝑟𝐶 ) = 𝑦 × 𝐸(𝑟𝑝 ) + (1 − 𝑦) × 𝑟𝑓 11.75% = 𝑦(14%) + (1 − 𝑦)(5%) 11.75% = 𝑦(14%) + 5% + (−𝑦)(5%) 6.75% = 𝑦(9%) 𝑦 = 0.75 = 75% 75% will be invested in the risky portfolio and 25%, 1 – 75%, in the risk-free asset What is the standard deviation of the rate of return on your client’s portfolio? 𝜎𝐶 = 𝑦 × 𝜎𝑝 𝜎𝐶 = 75%(22%) 𝜎𝐶 = 16.5% Now, look at this graphically with the Capital Allocation Line (CAL) Capital Allocation Line (CAL) Plot of risk-return combinations available by varying allocation between risky and risk-free If we invest 100% in the risk-free asset our E(r) is 5% with STD of 0% If we invest 100% in the risky portfolio our E(r) is 14% with STD of 22% If we invested 75% in the risky portfolio and 25% in the risk-free asset (see example above) our E(r) is 11.75% with STD of 16.5% How can we invest greater than 100% in the risky portfolio (i.e., y = 1.5) Borrow at the risk-free rate and invest in the risky portfolio using 50% leverage (i.e., margin) 𝐸(𝑟𝐶 ) = 𝑦 × 𝐸(𝑟𝑝 ) + (1 − 𝑦) × 𝑟𝑓 𝐸(𝑟𝐶 ) = 1.5(14%) + (−50%)(5%) 𝐸(𝑟𝐶 ) = 18.50% 𝜎𝐶 = 𝑦 × 𝜎𝑝 𝜎𝐶 = 150%(22%) 𝜎𝐶 = 33% Risk Aversion and Allocation Greater levels of risk aversion lead investors to choose larger proportions of the risk-free rate Lower levels of risk aversion lead investors to choose larger proportions of the risky portfolio Willingness to accept high levels of risk for high levels of returns would result in leveraged combinations The CAL that employs the market-index portfolio is called the Capital Market Line (CML); (i.e., P = S&P 500 Tracking Index Fund) Passive Investment Strategy Investment policy that avoids security analysis as you simply hold the market-index for the long-term Cost and Benefits of Passive Investing o Passive investing is inexpensive and simple o Expense ratio of active mutual fund averages 1%, but this is starting to fall as active funds are competing more with passive funds o Expense ratio of hedge fund averages 1%-2%, plus 10% to 20% of returns above risk-free rate o Active management offers potential for higher returns (the main selling point of active funds is that they can beat the market-index returns) o Overall, active funds have a horrible record of beating the marketindex returns in the long-run Quantifying Risk Aversion 𝑬(𝒓𝒑 ) − 𝒓𝒇 = (𝑨)(𝝈𝟐𝒑 ) A = Risk Aversion Value (i.e, continuous # such as 1.2, 1.3, …, 2, 2.1, etc.) (𝐴)(𝜎𝑝2 ) = 𝑃𝑟𝑜𝑝𝑜𝑟𝑡𝑖𝑜𝑛𝑎𝑙 𝑟𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 The larger A is, the larger will be the investor’s added return required to bear risk The exact relationship between risk and return in capital markets is not known exactly, but many studies conclude that investors’ risk aversion is likely between 2 to 4. This implies that to accept an increase of 0.01 in portfolio variance, investors would require an increase in the risk premium, E(rp) – rf, of between 2% and 4%. 𝐸(𝑟𝑝 ) − 𝑟𝑓 = (𝐴)(𝜎𝑝2 ) = (2)(0.01) = 2%, 𝑤ℎ𝑒𝑛 𝐴 = 2 Rearranging this equation to solve for A: 𝑨= 𝑬(𝒓𝒑 ) − 𝒓𝒇 (𝝈𝟐𝒑 ) Simply put, all investors require a risk premium to take on risk, but this risk premium differs across investors based on their different risk aversion level. Example: Two portfolios have the following expected returns and standard deviations when the risk-free rate is 5%: Portfolio A: E(r) = 10% with STD = 20% Portfolio B: E(r) = 15% with STD = 27% Risk-Free Rate = 5% Would an investor with a risk aversion of A = 3 find any of these portfolios acceptable on a risk-return basis? 𝐸(𝑟𝑝 ) − 𝑟𝑓 = (𝐴)(𝜎𝑝2 ) 𝐸(𝑟𝑝 ) = 𝑟𝑓 + (𝐴)(𝜎𝑝2 ) 𝐸(𝑟𝐴 ) = 5% + (3)(. 202 ) = 17% > 10%, 𝑁𝑜𝑡 𝐴𝑐𝑐𝑒𝑝𝑡𝑎𝑏𝑙𝑒 𝐸(𝑟𝐵 ) = 5% + (3)(. 272 ) = 26.87% > 15%, 𝑁𝑜𝑡 𝐴𝑐𝑐𝑒𝑝𝑡𝑎𝑏𝑙𝑒 Risk Aversion and Capital Allocation Finding y when A is known: Preferred Capital Allocation 𝑨= 𝑬(𝒓𝒑 ) − 𝒓𝒇 (𝝈𝟐𝒑 ) [𝑬(𝒓𝒑 ) − 𝒓𝒇 ] 𝝈𝟐𝒑 𝑨𝒗𝒂𝒊𝒍𝒂𝒃𝒍𝒆 𝒓𝒊𝒔𝒌 𝒑𝒓𝒆𝒎𝒊𝒖𝒎 𝒕𝒐 𝒗𝒂𝒓𝒊𝒂𝒏𝒄𝒆 𝒓𝒂𝒕𝒊𝒐 𝒚= = 𝑹𝒆𝒒𝒖𝒊𝒓𝒆𝒅 𝒓𝒊𝒔𝒌 𝒑𝒓𝒆𝒎𝒊𝒖𝒎 𝒕𝒐 𝒗𝒂𝒓𝒊𝒂𝒏𝒄𝒆 𝒓𝒂𝒕𝒊𝒐 𝑨 𝒚= [𝑬(𝒓𝒑 ) − 𝒓𝒇 ] 𝑨𝝈𝟐𝒑