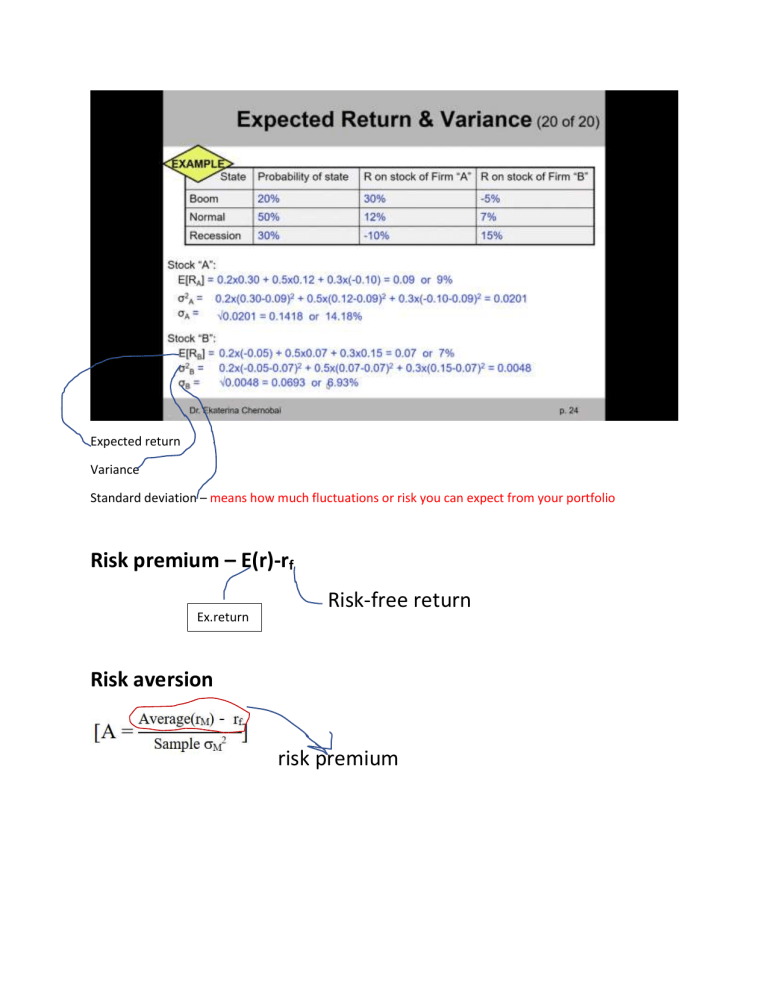

Expected return Variance Standard deviation – means how much fluctuations or risk you can expect from your portfolio Risk premium – E(r)-rf Ex.return Risk-free return Risk aversion risk premium Sharpe ratio – reword to portfolio( the higher Sharpe ratio, the more reword you may receive from the portfolio) 𝑆= 𝑟𝑝 −𝑟𝑓 𝜎 Or residual risk/s.div