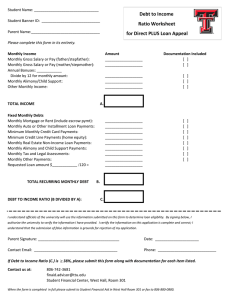

PERSONAL FINANCE THE 5 C'S OF CREDIT 1. Character - Summarizes a borrower's overall trustworthiness, personality and credibility 2. Capacity - Indicates a borrower's ability to repay a loan based on their available cash flow 3. Capital - Demonstrates the borrower's level of commitment 4. Conditions - The overall health of the economy and specifics of the loan 5. Collateral - A valuable asset a borrower pledges to secure a lender's interests in the loan balance CREDITWORTHINESS is a lender's willingness to trust you to pay your debts a borrower deemed creditworthy is one a lender considers willing, able and responsible enough to make loan payments as agreed until a loan is repaid FACTORS TO DETERMINE CREDITWORTHINESS 1. INCOME AND DEBT 2. CREDIT SCORES 3. CREDIT REPORTS 4. COLLATERAL 5. DOWNPAYMENT SIZE 6. CO-SIGNERS / COBORROWERS / GUARANTORS Lesson 6: Creditworthiness FACTORS TO DETERMINE CREDITWORTHINESS INCOME AND DEBT In order to repay your debt, you’ll need enough money to make your monthly payments on top of your living expenses. Lenders use your income and debt to calculate your Debt-to-Income (DTI) Ratio DTI measures the percentage of your monthly income that’s claimed by your debt obligations; the lower your DTI, the more creditworthy you appear DEBT-TO-INCOME (DTI) RATIO To calculate DTI, figure out how much you pay each month toward debt payments and divide that figure by your total gross monthly income For example, if each month you pay P10,000 for your mortgage, P4,000 for your student loan payment, P1,000 for credit card bills, and P5,000 for other miscellaneous debt payments. Total Monthly Debt Obligation P20,000. Then imagine your annual salary before tax is P600,000. Divide P600,000 by 12 to find your gross monthly income, in this case P50,000 Total Monthly Debt Obligation P20,000 Total gross monthly income P50,000 Finally, divide your total monthly debt obligation (P20,000) by your gross monthly income (P50,000) and then multiply the resulting figure by 100 to convert it to a percentage. DTI = P20,000 / P50,000 = 0.4 x 100 = 40% DTI shows that 40% of gross monthly income is going toward debt payments each month, and 60% is left over for other monthly costs Gross or Net? A lot of people ask why DTI uses gross income instead of net income (the amount you actually take home). Lenders use the gross because it's both com- parable and stable: people may have different payroll deductions, and those are more likely to change during the year than salary. For a truer picture of your DTI, use your net income in the calculation. CREDIT SCORES one of the most important factors lenders use to determine your creditworthiness. a higher your credit score represents responsible debt management skills and the likeliness to meet your payment obligations; lower scores pose a risk to lenders. 5 METHODS TO RAISE YOUR CREDIT SCORE FAST 1. Start paying off your debts. - Your score is affected by the percentage of your total available credit that you're actually using the higher your debts, the more you're using of your total, and that's not good for your credit. 2. Keep your old credit card accounts open. - The average age of your accounts is important factor used in calculating your score. Pay off the debt on those cards and don't use them anymore. 3. If you don't have a credit card, go get one. - Having a variety of different types of credit is good for your credit score, meaning that it's beneficial to have at least one credit card. 4. Dispute incorrect items on your credit report. - A vast majority of credit reports on file contains some errors, and those errors rarely "self-correct" over time. Having such items removed from your credit report will raise your credit score. 5. Pay all your bills on time. Late payments are very bad for your credit score, and the more late payments you have within a short period of time, the worse that is for your score. Uayan, 2023 PERSONAL FINANCE LESSON 6: Creditworthiness CREDIT SCORES Landlords, who often run credit checks when deciding whether to rent you an apartment and how large a security deposit you must put down Auto insurers, which may check your credit score when setting your premiums Utility companies, which often perform credit checks before letting you open an account or borrow equipment Prospective employers, which may check your credit as part of a pre-hiring background check HOW TO INCREASE YOUR INCOME AND LOWER YOUR DEBT? CRUSHING DEBT: SNOWBALL METHOD AVALANCHE METHOD List your debts in List your debts in order from the the order from highest interest lowest balance to rate to the lowest. largest. Don't pay Don't pay attention to the attention to the interest rates here. balance. Maximize Maximize payments payments to the debt with the on the smallest debt. But do make highest interest rate (while the minimum payments on your making minimum payments on the other debts! others). When you've paid When you've paid it it off, move on to off, move on to the the next-highest next smallest until interest debt until you've worked you've worked through your list. through your list. TWO METHODS FOR TACKLING DEBT There are 2 common ways to approach tackling debt: SNOWBALL (focuses on total debt size as a priority) AVALANCHE (focuses on highest interest as a a priority) Make minimum payments on each debt monthly Make minimum payments on each debt monthly Make extra payments on the smallest loan Make extra payments on the highest interest rate loan When paid off, move to the next highest loan debt When paid off, move to the next debt with the highest interest rate Lenders often use credit scores to help decide the interest rates they charge. On average, it costs lenders more to manage missed payments and unpaid loans among borrowers with lower credit scores than it does to manage accounts for less risky borrowers with high scores. Lenders, therefore, typically charge higher interest rates to borrowers with lower credit scores and offer better borrowing terms to those with higher scores. CREDIT REPORTS Your credit score is a number, but to calculate that number, the data comes from your credit report. Credit Bureaus generates a credit report with historical data about your current and past debt obligations. Lenders look at your credit report to review specific details about your debts COLLATERAL Lenders may consider savings, real estate holdings, investments and other financial assets that show you have resources you can draw from to repay a loan. Some lenders require collateral—something of value, like your car, or house that secures the loan—to reduce the risk of default after lending you money. If you get a loan that requires collateral and you fall behind on your payments, the lender can repossess the item you pledged Taking out a loan with collateral can sometimes increase your creditworthiness. DOWNPAYMENT SIZE A down payment is an up-front partial payment for a large purchase, like a house or car. The bigger the down payment you make on a loan, the more skin you have in the game and the smaller the amount you’ll need to borrow. Lenders may also reward large down payments with lower interest rates. RCO-SIGNERS / CO-BORROWERS / GUARANTORS Co-signers help make the loan less risky for the lender because co-signers agree to repay the loan if you stop making payments. The lender will also evaluate their creditworthiness, which can help you receive more favorable terms. If you choose to use a co-signer, it’s vital that you repay your debt obligations on time. Any late payments you make will hurt both you and your co-signer’s credit. HOW TO ESTABLISH CREDIT 1. You need a credit history to get credit, and you can't get credit without a credit history. If no one will give you credit, how should you develop a history of responsibly paying your debts? THE TRICK TO ESTABLISHING GOOD CREDIT IS TO MAKE SURE YOU PAY EVERY BILL AND MAKE EVERY PAYMENT ON TIME. TIPS: Don't go into debt to build your credit. An "excellent" credit rating takes up to seven years to build. An "average" or "good" rating can be built in one or two years. A credit report details the past. A credit score predicts your future credit behavior. Uayan, 2023 PERSONAL FINANCE MAKING AUTOMOBILE DECISIONS Evaluate automobile needs and determine what is affordable and not Implement a plan to research and select a new or used automobile Decide between automobile financing alternatives Decide whether to buy or lease a car Be an informed automobile consumer WHY BUY AUTOMOBILE? CONVENIENCE HAVE YOUR OWN FREEDOM CAN TAKE ROAD TRIPS SAVES TIME GREAT FOR FAMILIES SHOWS RESPONSIBILITY BUYING AN AUTOMOBILE ASSESS YOUR NEEDS SET YOUR BUDGET RESEARCH THOROUGHLY SELECT BASED ON NEEDS DECIDE IF YOU WANT TO LEASE OR BUY NEGOTIATE PRICE ARRANGE FAVORABLE FINANCING UNDERSTAND TERMS OF SALE BEFORE PURCHASE MAINTAIN AND REPAIR AFTER PURCHASE TEST DRIVE LESSON 6: Creditworthiness ASSESS YOUR NEEDS How many passengers do you need to carry? What type of driving do you do? Is it primarily highway, surface streets, off-road? Do you have a long commute and, because of that, is fuel economy important to you? Do you need all-wheel drive? What are your must-have features? Think backup camera, leather seats, Apple CarPlay, etc. What safety features are important to you? Do you want blind-spot monitoring, lane departure warning and automatic emergency braking, for example? What cargo capacity do you need? Will you be using children's car seats? Will you be doing any towing? How much garage or parking space do you have? RESEARCH THOROUGHLY CHOOSING A CAR AFFORDABILITY OPERATING COSTS GAS, DIESEL, OR HYBRID NEW, USED, OR NEARLY USED WEIGH THE COST OF OWNERSHIP SIZE, BODY STYLE, AND FEATURES TRADING IN OR SELLING PRESENT CAR FUEL ECONOMY SAFETY FEATURES CONSIDER OTHER CARS IN THE CLASS FIND CARS FOR SALE DECIDE IF YOU WANT TO LEASE OR BUY Leasing You can drive a more expensive car for less money. You can drive a new car with the latest technology every few years. Most repairs will be covered under the factory warranty. There are no trade-in hassles at the end of the lease. Lower monthly payments Buying You have more flexibility to sell the car whenever you want. You can modify the car to your tastes. There are no mileage penalties if you drive a lot. Your car expenses will be lower in the long run provided you pay off the car and keep it a while. TEST DRIVE Leasing You can drive a more expensive car for less money. You can drive a new car with the latest technology every few years. Most repairs will be covered under the factory warranty. There are no trade-in hassles at the end of the lease. Lower monthly payments Buying You have more flexibility to sell the car whenever you want. You can modify the car to your tastes. There are no mileage penalties if you drive a lot. Your car expenses will be lower in the long run provided you pay off the car and keep it a while. Uayan, 2023 PERSONAL FINANCE LESSON 6: Creditworthiness MAKING HOUSING DECISIONS Evaluate housing needs and determine what is affordable and not Select a home that meets personal needs and negotiate an acceptable price Choose between financing options and know how to apply for and qualify for a mortgage Decide whether to buy or rent a house Be an informed housing consumer HOUSING AS BASIC HUMAN RIGHT The United Nations identifies adequate housing as a fundamental human right, defining it as “the right to live somewhere in security, peace and dignity.” It further clarifies these rights to include security of tenure, adequate conditions, protection against forced evictions and access to affordable housing, according to the UN's International Covenant on Economic, Social and Cultural Rights Adequate housing is essential for human survival with dignity. Without a right to housing many other basic rights will be compromised including the right to family life and privacy, the right to freedom of movement, the right to assembly and association, the right to health and the right to development RENTING (LEASING) 1. When is the rent due? 2. Is there a grace period for rent payments? (Rent may be due on the 1st with a grace period until the 5th, for example.) 3. How do you pay the rent (online, automatic debits, by check)? 4. What is the fee for late rent payments? 5. How long is the lease? (Most people assume it will be twelve months, but that's not always the case.) 6. What utilities and other services (like pest control or parking spaces) are included in the rent? 7. How often can the rent be raised? 8. Will you be responsible for any routine maintenance (like lawn care)? 9. Who should you call for maintenance issues (like a leaky faucet)? 10. How much notice will you get before the landlord enters your apartment? OWNING PROS CONS STABILITY Monthly payments on a fixed rate loan never change. REPAIRS & MAINTENANCE You are responsible for the maintenance of your home. EQUITY You benefit from positive moves in the market, not your landlord. LOCATION You may not be able to afford a home in the exact location you prefer. TAXES You may get tax benefits by deducting mortgage interest or property taxes. FLEXIBILITY If you wish to move, it's likely you'll have to sell your home first. PERSONALIZATION You can improve, decorate & modify your home to suit your lifestyle. ADVANTAGE Inflation hedge: Build wealth as home appreciates in value. However, Property values can fall. That happened during the 2008 nationwide housing crisis, and more local conditions can cause this, too. Your building will depreciate over time, especially if you don’t maintain it. Sense of community, stability and security Greater privacy: You own the property so you can renovate it to your liking, a benefit renters don’t enjoy. Home office: The work-at-home phenomenon may not vanish after the pandemic fades, which means more of us will need a home office DISADVANTAGE High upfront costs: Closing costs on a mortgage can run from 2% to 5% of the purchase price, including numerous fees, property taxes, mortgage insurance, home inspection, firstyear homeowner’s insurance premium, title search, title insurance, and points, which are prepaid interest on the mortgage. It can take about five years to recover those costs. Continuing costs: As you try to sell your home, you still have to keep making mortgage payments and maintain it. If you’ve bought another house before selling yours, that means paying for two homes. RENTING PROS CONS REPAIRS & MAINTENANCE The Landlord handles all repairs & maintenance. STABILITY Your rent can increase at the end of every lease cycle. LOCATION You may be able to rent closer to your desired neighborhood. TAXES There is no tax deduction for rental payments. INSURANCE Renter's insurance is less expensive than homeowner's insurance. EQUITY You don't get any of the benefits of an increasing market. FLEXIBILITY You can move at the end of your lease without having to sell your home. ADVANTAGE Rent payments may be lower: This certainly can be true if you’re renting an apartment, and it also may be the case when renting an identical house Low upfront costs: There is no down payment. Except for a security deposit – often the cost of a month’s rent – you don’t have to write a big check or finance the costs required to get a mortgage No HOA dues: Some homes are in developments with homeowner’s associations that require monthly dues on top of all the other expenses, and they aren’t optional. Not so with renting. DISADVANTAGE You can’t change the property: Would you like a deck for entertaining? Would you prefer a fenced yard? Want to paint the bedroom a greyish blue? There’s nothing you can do about any of that in a rental, except complain; see where that gets you. You aren’t building value: When you leave your rental, all you take with you is yourself and the furniture and dishes that belong to you. It’s the property owner’s equity that grows, not yours. No credit score improvement: While paying a mortgage on time improves your creditworthiness, you don’t get the same benefit from rent. Uayan, 2023 PERSONAL FINANCE PERSONAL RISK 1. People are always at risk of contracting a long-term sickness, dying prematurely, or outliving their resources. 2. An individual's assets may lose value or give an inadequate return in accordance to financial demands and objectives. 3. To know the personal risk, one must determine what they consider as their 'assets'. Human Capital Human capital is the net present value of an individual's future projected labor income. Financial Capita Financial capital is conjured up of assets that the individual already owns, which might include a bank account, individual stocks, pooled funds, a retirement account, and a house. PERSONAL RISK MANAGEMENT According to International Risk Management Institute, Inc. (n.d.), Personal Risk Management (PRM) is the practice of adapting risk management principles to meet the demands of individual customers. It is the process of identifying, measuring, and treating personal risk (including, but not limited to, insurance), followed by setting the treatment plan into action and evaluating changes over time. INSURANCE POLICIES Car insurance Life insurance Homeowners / Renter's insurance Health insurance Long-term disability Short-term disability Umbrella policy Misconception about Homeowners Insurance Homeowners insurance is that it is a luxury You can only have insurance if it is your own. Lesson 7: Protecting Household Wealth IDENTIFYING THE RISKS RISKS COMES IN DIFFERENT FACES AND THEY CAN BE CLASSIFIED AS FOLLOWS (YADNYA INVESTMENT ACADEMY, 2022): INCOME RISK Death Disability Health Risk Unemployment Risk Career Risk Aging EXPENSE RISK Living beyond means • Insufficient Income Emergencies • Unforeseeable Circumstances ASSET / INVESTMENT RISK Not saving enough or investing wisely enough to achieve financial objectives • Incorrect investment mix for the goal you want to achieve · Investing money and losing it (principal) Inflation Purchase Risk Investing portfolio that is under or undiversified Return on investment (ROI) that isn't up to par Stolen or destroyed belongings Depreciation · Information Security Risk CREDIT RISK Excessive amount of debt Accumulation of Bad Debt Overspending on debt-related costs • Credit problems TREATING THE RISKS RISK MANAGEMENT METHODS The basic methods for risk managementavoidance, retention, sharing, transferring, and loss prevention and reduction—can apply to all facets of an individual's life and can pay off in the long run (Yu, 2021). Avoidance Avoidance is a method for mitigating risk by not participating in activities that may incur injury, sickness, or death. Retention Retention is the acknowledgment and acceptance of a risk as a given. Accepting risks has the advantage of incurring no expenditures and freeing up your resources for higher priority, more severe threats. Risk Sharing Risk Sharing - also known as "risk distribution," means that the premiums and losses of each member of a group of policyholders are allocated within the group based on a predetermined formula. Reduction The reduction strategy tries to lessen the chances of the danger occurring or to minimize the damage if it does occur. Risk Transfer Risk transfer is a risk management approach that involves transferring risk to a third party. In other words, risk transfer entails one party taking on the obligations of another. HOW INSURANCE WORKS Insurance A contract between oneself, the policyholder, and the insurance company Policy limit the maximum amount that the insurer will pay Insurance policy the contract between the policyholder and the insurance company Deductible the amount the policyholder must pay before the insurance company begins paying towards covered expenses. Insurance premium the actual cost of the insurance plan that is divided monthly Beneficiaries the people policyholders nominate to receive the insurance benefit The insurance company arranges an insurance policy that will protect the holder in case a risk occurs in exchange for a premium. The insurance company pools together the resources of a large number of people who have similar risks to make sure that the few people who experience loss are protected. If their property is accidentally lost, stolen, damaged, or destroyed, and the policyholder has an insurance policy that covers the property for those risks, he can make a claim and draw on that pool of money to help pay for repairs or replacements costs. Insurance companies base their charges on the actuarial calculations of the risk they insure. Consequently, an individual who has a pre- existing sickness or works in a high-risk job may be charged more premium than another individual who's healthy or working a normal job. Uayan, 2023 PERSONAL FINANCE Home Insurance WHAT IS HOME INSURANCE? Home insurance is a type of property protection covering damages and losses to a person's house including the assets inside it. THINGS TO CONSIDER WHEN BUYING HOME INSURANCE Structure of your Home The size of your house and materials used in construction are considerations when choosing your insurance policy. These factors including the land it sits on contribute to the overall rebuild cost which your insurance should cover. Contents of the Home More often than not, the home insurance won't pay for the complete loss of your valuables inside. It would be fair to create a just and realistic estimate of everything inside your house. Coverage The types of coverage in a home insurance policy depend on the package. Legal and Alternative Accommodation Alternative accommodation is temporary shelter provided by the insurer in case your home is uninhabitable or damaged. Location Home insurance is greatly affected by crime rates in your area and proximity to natural hazards. HOW MUCH IS COMPREHENSIVE CAR INSURANCE? FACTORS THAT MAY AFFECT YOUR POLICY RATE ARE: Model - the fancier the vehicle, the more expensive the policy • Make - luxury and foreign makes are more expensive to insure Year- older cars are cheaper to insure Usage - how worn out is the car? Accessories - the number of accessories can also increase the rate Safety Features - the safer the car is, the cheaper it is to insure • Fair Market Value - how expensive is your car? · Depreciation - how new/old is your car? Lesson 7: Protecting Household Wealth COMPANIES THAT OFFER HOME INSURANCE IN THE PHILIPPINES MAPFRE MAPFRE offers four types of policies which are the Standard Home Insurance, Standard Home Insurance Additional Benefits, with Comprehensive Home Insurance and Comprehensive Personal Liability. AIG AIG Philippines lets you choose between AllRisk and Property Terrorism. AXA Philippines AXA's property insurance protects you against natural and unexpected disaster. Bank of the Philippine Islands (BPI/MS) BPI Home Care Advantage is a comprehensive insurance package covering the structure of a person's private residence UNDERSTANDING AUTO INSURANCE PROPERTY SUCH AS DAMAGE TO OR THEFT OF YOUR CAR LIABILITY YOUR LEGAL RESPONSIBILITY TO OTHERS FOR BODILY INJURY OR PROPERTY DAMAGE MEDICAL THE COST OF TREATING INJURIES, REHABILITATION AND SOMETIMES LOST WAGES AND FUNERAL EXPENSES DOS GET QUOTES FROM SEVERAL INSURANCE COMPANIES ASK THE INSURANCE COMPANY ABOUT DISCOUNTS ASK IF YOU WILL GET A LOANER CAR SHOULD YOU GET IN AN ACCIDENT • CONSIDER PAYING YOUR POLICY IN FULL • MAKE SURE YOUR CURRENT POLICY REFLECTS YOUR CURRENT NEEDS CTPL INSURANCE Malayan Insurance Malayan's property repayments for damages. WHO IS COVERED BY AUTO INSURANCEAND UNDER WHAT CIRCUMSTANCES? You and other family members on your policy, whether driving your car or someone else's car (with their permission) Provides coverage if someone who is not on your policy is driving your car with your consent Your personal auto policy only covers personal driving, whether you're commuting to work, running errands or taking a trip DONTS FORGET TO REVIEW YOUR DRIVING RECORD BEFORE SHOPPING FOR INSURANCE FORGET TO ASK YOUR EMPLOYER ABOUT DISCOUNTS JUST SIGN UP FOR THE MINIMUM BE AFRAID TO SWITCH TO ANOTHER COMPANY IF YOU FIND A BETTER DEAL LATER ON BUY A LOT OF UNNECESSARY EXTRAS, SUCH AS TOWING INSURANCE COMPREHENSIVE CAR INSURANCE There are two types of auto insurance: Compulsory Third Party Liability (CTPL) and Comprehensive Car Insurance (Compre). It's important to establish right off the bat that both types are equally essential. Unlike comprehensive insurance, CTPL insurance is mandated in the Philippines. Compulsory Third Party Liability Insurance It protects the owner of the vehicle from financial obligations to anyone who is injured or killed by the insured vehicle. The CTPL insurance isn't that expensive, compared to the problems you might face on the road. If you plan to get a one-year coverage, you'll need to pay Php560.00 for private cars and PhP250.00 for motorcycles. If you opt for a three-year coverage, private cars can pay PhP1,610.00 and motorcycles PhP720.00. The CTPL only covers injury or death of a third party. It does not cover the damages of the insured vehicle and the driver, or any damages to the property of the third party. Comprehensive Insurance for Cars in the Philippines It's not mandatory, but it is highly recommended to buy one, especially if you use your vehicle every day. A comprehensive insurance provides financial protection to you and your car by covering car repairs and insuring you against damage, liabilities caused by collision, car theft, floods, and landslides, among many road mishaps. Without a comprehensive insurance, you're basically just gambling with fate. Uayan, 2023 PERSONAL FINANCE How to Get Comprehensive Car Insurance in the Philippines Take the time to compare the rates from different providers to find the best deal possible. Once you've picked out your provider, here are the comprehensive car insurance requirements to prepare: Original vehicle receipt Certificate of Registration of your vehicle Your driver's license Another valid government ID Photocopies of each document Things to Remember When Buying Comprehensive Insurance for Your Vehicle Know your policy schedule Don't skip the fine print Consider your budget Compare providers Insurance WHAT IS INSURANCE? According to Jullia Kagan, insurance is a contract in which an entity or an individual receives protection. Insurance is a way to manage your risk. "When you buy insurance, you purchase protection against unexpected financial losses." Insuring Cars and Homes We can not deny that two of the most common assets people buy insurance for are their cars and their houses/residences. These two are possibly the biggest personal assets an individual can own, hence it is only natural that they would want these two to be insured. Buying Auto Insurance There are two types of insurance that can be purchased for your vehicle. These are Comprehensive Car Insurance and Compulsory Third Party Liability Insurance (CPTL). CPTL is the basic insurance that you are required to have before owning a vehicle, while the Comprehensive Car Insurance is optional. CTPL protects you from any possible liability for a third party caused bodily injury and/or death in an accident arising from the use of your motor vehicle. On the other hand, Comprehensive Car Insurance protects you, your vehicle and passengers from unforeseen events or accidents such as floods, theft etc. Lesson 7: Protecting Household Wealth Car Insurance Company MAPFRE Insular 10 years of casa eligibility 366 accredited repair shops PHP 5,000,000 maximum total sum insured Overnight accommodation - Yes, up to PHP 3,000 • Towing - Yes, up to PHP 5,000 Vehicle removal crane services - Yes, up to PHP 10,000 Malayan Insurance 3 years of casa eligibility 58 casa repair shops PHP 7,500,000 maximum total sum insured Overnight accommodation - Yes, up to PHP 1,000 Towing - Yes, up to PHP 4,000 Vehicle removal crane services - Yes, up to PHP 8,000 Insurers also consider your car's depreciation when determining the price of your insurance New India Assurance 10 years of casa eligibility 30 accredited repair shops PHP 3,500,000 maximum total sum insured Overnight accommodation - Yes, up to PHP 1,500 Towing - Yes, up to PHP 4,000 Vehicle removal crane services - Yes, up to PHP 10,000 Prudential Guarantee 10 years of casa eligibility • PHP 3,000,000 maximum total sum insured • Overnight accommodation - Yes, up to PHP 2,000 • Towing - Yes, up to PHP 5,500 • Vehicle removal crane services - Yes, up to PHP 15,000 SGI Philippines 5 years of casa eligibility • 36 accredited repair shops • PHP 5,000,000 maximum total sum insured • Overnight accommodation - Yes, up to PHP 2,000 · Towing amount - Yes, up to PHP 5,000 • Vehicle removal crane services PHP 10,000 Stronghold Insurance 10 years of casa eligibility 167 accredited repair shops PHP 3,000,000 maximum total sum insured The Mercantile Insurance Corporation 10 years of casa eligibility • 77 accredited repair shops • PHP 5,000,000 maximum total sum insured • Overnight accommodation - Yes, up to PHP 2,000 • Towing - Yes, up to PHP 5,000 • Vehicle removal crane services - Yes, up to PHP 10,000 Basic Car Insurance Terms You Need to Know AT FAULT - REFERS TO THE PERSON/S WHO WERE AT FAULT OR RESPONSIBLE FOR THE ACCIDENT DEDUCTIBLE - REFERS TO THE AMOUNT YOU NEED TO PAY FIRST BEFORE THE INSURANCE COMPANY CAN COVER THE REST OF YOUR EXPENSES CLAIM - REFERS TO THE REQUEST FOR YOUR INSURANCE COMPANY TO COVER OR REIMBURSE YOU FROM ANY EXPENSES DUE TO DAMAGES OR LOSS DEPRECIATION - REFERS TO THE GRADUAL DECREASE IN VALUE OF YOUR CAR DUE TO EVERYDAY USE FAIR MARKET VALUE - REFERS TO THE ESTIMATED PRICE OF YOUR CAR ACCORDING TO ITS MODEL AND SERIES PREMIUM - REFERS TO THE PAYMENT FOR YOUR CAR INSURANCE POLICY SCHEDULE - REFERS TO THE FULL DETAILS OF YOUR INSURANCE POLICY (PRICE, COVERAGE, VALIDITY, ETC.) PRIMARY DRIVER - REFERS TO THE PERSON/S WHO ARE COVERED TO DRIVE THE VEHICLE UNDER THE EXISTING INSURANCE POLICY SURCHARGE - REFERS TO THE INCREASE IN YOUR PREMIUM AFTER A VERY EXPENSIVE CLAIM THIRD PARTY - REFERS TO ANY PERSON OUTSIDE AND INSIDE THE CAR INVOLVED IN AN ACCIDENT. NOTE THAT ANYONE RELATED TO YOU WON'T BE CONSIDERED A THIRD PARTY. Uayan, 2023 PERSONAL FINANCE Lesson 7: Protecting Household Wealth FILING AN ACTUAL CLAIM (SUNLIFE) STEP 1: Notify Sun Life about your claim. To file a claim, simply click the Claim Notification Form (see links below) and type the requested information. Claim Notification Form Claim for Free Diagnostic Procedures When all completed, button. fields click have been the Submit You may also notify us by: contacting your Financial Advisor visiting our nearest Financial Store or Client Service Center calling our Client Care at telephone number (632) 88499888 from Mondays to Fridays, 8:00 am to 7:00 pm, or mailing your notice to: Claims Services STEP 2: Know the requirements. Important Reminders: Submit certified true copies only. Photocopies, except for IDs, are not acceptable. Photocopies of IDs may be submitted provided the original copies are presented for verification. ✓ ✓ Documents submitted to Sun Life Canada (Philippines), Inc (SLOCPI) will not be returned. Always attach a photocopy of the claimant's valid ID (any government-issued ID with photo and signature) with the basic claim requirements. • The parties representing the claimant or beneficiary should submit the following: authorization letter from the claimant/beneficiary, 2 valid government-issued IDs of the claimant/beneficiary and 2 valid government-issued IDs of the representative. • Buying Auto Insurance Applying for insurance is pretty straightforward. You just have to submit the documents to your chosen insurer, pay the premium and wait for the insurance policy to be provided to you. The process is the same for both insurance types. Buying Homeowners Insurance LISTED BELOW ARE THE REQUIRED DOCUMENTS: Original vehicle receipt Certificate of Registration of your vehicle Your driver's license Another valid government ID Photocopies of each document 1. Malicious Damage, Riots, Strikes, Civil Commotion 2. Explosion (i.e. explosion of LPG Tank) 3. Accidental discharge, breakage, leakage or overflow of water tanks, apparatus and/or pipes (more common to condominium unit owners) 4. Robbery 5. Temporary Rental/Accommodation Expense while the insured house/unit is under repair/reconstruction 6. Liability to the Public due to accidents occurring within the insured's premises 7. Personal Accident Insurance for the Family Buying Homeowners Insurance There are many insurers offering to protect your property at varying rates but most of them offer the same level of protection. It all goes down to preference and what specific aspects of your property you want to protect when selecting your insurer. Common insurers for houses or property are Insular Life, BDO Insure, and Prudential Insurance. Buying Renter's Insurance As a side note, the same insurance companies also offer renter's insurance, which is insurance for all of your belongings when you move in or reside within a rented property. Your belongings are not covered by your landlord's insurance when the property is being rented hence the need for renter's insurance arises. Due to modern tech, applying for insurance today is very easy. You just have to visit the online site of your selected insurer, fill out a form and wait for the policies to be emailed to you. You can also contact them via their hotlines directly if you have clarifications. The following benefits are what's included in general for property insurance that most common insurers provide: Insurance Claim An insurance claim is a written request to an insurance company for coverage or reimbursement for a covered loss or policy situation made by a policyholder. The claim is verified by the insurance company (or denies the claim). FILING A HOMEOWNER'S CLAIM Report any crime to the police Phone your insurance professional immediately. • Promptly fill out claim forms • Have the insurance adjuster inspect the damage • • Prepare for the insurance adjuster's visit Prepare a list of lost or damaged articles If you need to relocate, keep your receipts Beneficiaries below age 18 are considered minors and must be represented by their legal guardian. STEP 3: Submit the requirements Sun Life strictly follows the provisions of the Philippine laws involving minors, estates and disqualified beneficiaries. 1. Your Financial Advisor 2. Nearest Financial Store or Client Service Center Once the claim requirements are ready, submit the requirements to the following: For Living Benefits Claims, please check your policy contract for the covered illnesses and their definitions. We may ask for additional documents after reviewing the requirements you submitted. Claims occurring within 2 years from date of policy issue or last reinstatement are contestable and take longer to process. Uayan, 2023