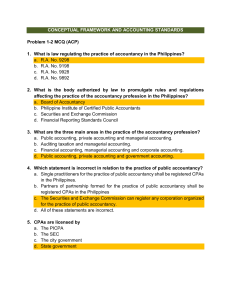

lOMoARcPSD|24544717 CFAS-Problem-1 - CFAS answers for problem 1.2-1.2. Accountancy (University of Northern Philippines) Studocu is not sponsored or endorsed by any college or university Downloaded by Ali Kenessy (21laylk@gmail.com) lOMoARcPSD|24544717 Problem 1-1 Multiple choice (ACP) 1. Accounting is a service activity and the function is to provide quantitative information, primarily financial in nature, about economic entities, that is intended to be useful in making economic decision. This accounting definition is given by a. Accounting Standards Council b. AICPA Committee on Accounting Terminology c. American Accounting Association d. Board of Accountancy 2. All of the following describe accounting, except a. A service activity b. An information system c. A universal language of business d. An exact science rather than an art 3. The important points made in the definition of accounting include all of the following, except a. Accounting information is quantitative. b. Accounting information is both quantitative and qualitative. c. Accounting information is financial in nature. d. Accounting information is useful in decision making. 4. This accounting process is the recognition or nonrecognition of business activities as accountable events. Downloaded by Ali Kenessy (21laylk@gmail.com) lOMoARcPSD|24544717 a. Identifying b. Measuring c. Communicating d. Reporting 5. What are the events that affect the entity and in which other entities participate? a. Internal events b. External events c. Current events d. Obligating events 6. Which is incorrect in relation to an accountable event? a. An event is accountable when it has an effect on asset, liability or equity. b. The subject matter of accounting is the measurement of economic resources and obligations. c. Only economic activities are emphasized and recognized in accounting. d. Sociological and psychological matters are quantifiable. 7. What is the measuring component in the definition of accounting? a. The recognition or nonrecognition of business activities as accountable events. b. The assigning of peso amounts to the accountable events. c. The preparation and distribution of accounting reports to users of accounting information. d. The preparation of audit report by CPAs. Downloaded by Ali Kenessy (21laylk@gmail.com) lOMoARcPSD|24544717 8. The most common financial attribute used in measuring financial information is a. Historical cost b. Current cost c. Fair value d. Value in use 9. The communicating process of accounting includes all of the following, except a. Recording b. Classifying c. Summarizing d. Interpreting 10. What is the overall objective of accounting? a. To provide the information that the managers of an economic entity need to control the operations. b. To provide information that the creditors can use in deciding whether to grant loans to an entity. c. To measure the periodic income of the economic entity. d. To provide quantitative financial information about an entity that is useful in making economic decision. Downloaded by Ali Kenessy (21laylk@gmail.com) lOMoARcPSD|24544717 Problem 1-2 Multiple choice (ACP) 1. What is the law regulating the practice of accountancy in the Philippines? a. R.A. No. 9298 b. R.A. No. 9198. C. R.A. No. 9928 d. R.A. No. 9892 2. What is the body authorized by law to promulgate rules and regulations affecting the practice of the accountancy profession in the Philippines?" a. Board of Accountancy b. Philippine Institute of Certified Public Accountants c. Securities and Exchange Commission d. Financial Reporting Standards Council 3. What are the three main areas in the practice of the accountancy profession? a. Public accounting, private accounting and managerial accounting b. Auditing, taxation and managerial accounting. c. Financial accounting, managerial accounting and corporate accounting. d. Public accounting, private accounting and government accounting. 4. Which statement is incorrect in relation to the practice of public accountancy? a. Single practitioners for the practice of public accountancy shall be registered CPAs in the Philippines. Downloaded by Ali Kenessy (21laylk@gmail.com) lOMoARcPSD|24544717 b. Partners of partnerships formed for the practice of public accountancy shall be registered CPAs in the Philippines. c. The Securities and Exchange Commission can register any corporation organized for the practice of public accountancy. d. All of these statements are incorrect. 5. CPAs are licensed by a. The PICPA b. The SEC c. The city government d. State government Downloaded by Ali Kenessy (21laylk@gmail.com)