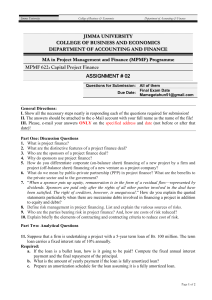

Jimma University College of Business & Economics Department of Accounting & Finance JIMMA UNIVERSITY COLLEGE OF BUSINESS AND ECONOMICS DEPARTMENT OF ACCOUNTING AND FINANCE MA in Project Management and Finance (MPMF) Programme MPMF 622: Capital Project Finance ASSIGNMENT # 01 Questions for Submission: All of them Friday 1st of July 2023 Due Date: abiy_getahun@hotmail.com General Directions: I. Show all the necessary steps neatly in responding each of the questions required for submission! II. The answers should be attached to the e-Mail account with your full name as the name of the file! III. Please, e-mail your answers ONLY on the specified address and date (not before or after that date)! Part One: Discussion Questions 1. What is project finance? 2. What are the distinctive features of a project finance deal? 3. Who are the sponsors of a project finance deal? 4. Why do sponsors use project finance? 5. How do you differentiate corporate (on-balance sheet) financing of a new project by a firm and project (off-balance sheet) financing of a new venture as a project company? 6. What do we mean by public-private partnership (PPP) in project finance? What are the benefits to the private sector and to the government? 7. “When a sponsor puts up equity, remuneration is in the form of a residual flow—represented by dividends. Sponsors are paid only after the rights of all other parties involved in the deal have been satisfied. The right of creditors, however, is unequivocal.” How do you explain the quoted statements particularly when there are mezzanine debts involved in financing a project in addition to equity and debts? 8. Define risk management in project financing. List and explain the various sources of risks. 9. Who are the parties bearing risk in project finance? And, how are costs of risk reduced? 10. Explain briefly the elements of contracting and contracting criteria to reduce cost of risk. Page 1 of 3 Jimma University College of Business & Economics Department of Accounting & Finance Part Two: Analytical Questions 11. Asteroid Company’s management is faced with the problem of financing a new project venture. Assume that management finances already-existing assets and those required for a new project with debts that have a value at maturity of Br. 4,200,000 for each project. Each of the debts is a zero-coupon debt and that the difference between Br. 4,200,000 and the present value of the debt at the start of each project is financed by equity capital. Management can decide to finance existing assets (Project X) and new project assets (Project Y) separately by using a project finance approach, or they could finance the combined projects using a corporate finance approach. Now future cash flows for existing and new project assets will be considered according to the four possible scenarios summarized in the table hereunder: Scenario Hypothesis Debt Project X (assets in place) Debt Project Y (new project) Expected cash flows: Project X Expected cash flows: Project Y A Br. 4,200,000 4,200,000 2,100,000 2,000,000 B Br. 4,200,000 4,200,000 2,500,000 5,450,000 C Br. 4,200,000 4,200,000 5,460,000 2,540,000 D Br. 4,200,000 4,200,000 5,880,000 6,100,000 Required: a. If management decided for corporate financing, i.e., cash flows from Projects X and Y are used jointly to repay the debts contracted for existing and new venture assets, what would be the payoffs to creditors and shareholders of the company under each scenario? b. If management decided for project financing, i.e., cash flows from Project Y are only used to repay the debts for that project, what would be the payoffs to creditors and shareholders of the company under each scenario? c. What are your recommendations for management under each of the foregoing financing alternatives considering contamination risk, conflict of interests, and coinsurance effect? 12. Suppose that a firm is undertaking a project with a 5-year term loan of Br. 100 million. The term loan carries a fixed interest rate of 10% annually. Required: a. If the loan is a bullet loan, how is it going to be paid? Compute the fixed annual interest payment and the final repayment of the principal. b. What is the amount of yearly payment if the loan is fully amortized loan? c. Prepare an amortization schedule for the loan assuming it is a fully amortized loan. Page 2 of 3 Jimma University College of Business & Economics Department of Accounting & Finance 13. A firm wants to acquire a new machine that has an economic life of 5 years and costs Br. 200,000, delivered & installed. However, the firm plans to lease it for only 4 years. The machine’s estimated scrap value is Br. 5,000 after 5 years of use, but its estimated residual value, which is the value at the expiration of the lease, is Br. 20,000. Thus, if the firm buys the machine, it would expect to receive Br. 20,000 before taxes when the machine is sold in 4 years. The firm can borrow the required Br. 200,000 from its bank at a before tax rate of interest of 10%. The firm can lease the machine for 4 years at a rental charge of Br 57,000, payable at the beginning of each year. However, the lessor will own the machine at lease expiration. The lease agreement stipulates that the lessor will maintain the machine at no additional charge to the lessee. However, if the firm borrows and buys the machine, it will have to bear the costs of maintenance, which would be performed by the manufacturer at a fixed contract rate of Br. 2,500 per year, payable at the beginning of each year. The machine’s depreciation per year is Br. 45,000 and the firm’s tax rate is 40%. Required: Should the firm lease or buy the machine? 14. Assume that Canton Industries intends to finance its new project with an IRR of 18.5% through a mixture of capital sources, as shown on below: Capital Source Long Term debt Market Value Br. 1,000,000 Preferred stock 250,000 Retained Earnings 500,000 Common equity 750,000 Total liability and equity Br. 2,500,000 Canton’s cost of capital were, kd = 12%, kp = 15%, kr= 18% & kc = 18.5%. Required: Compute the firm’s WACC and compare it with the project’s IRR. Is the project viable? Page 3 of 3