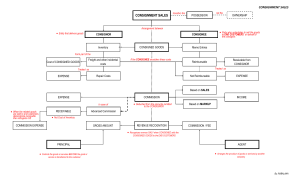

Unit II Revenue Recognition This module account for Revenue on Instalment Sales, Consignment Sales. Revenue from Construction Contracts and Revenue from Franchising. Module 5 Revenue Recognition: Instalment Sales and Consignment Sales The module present the accounting procedure under instalment sales, wherein gross profit is initially deferred and periodically recognized as the instalment payments are received. Included in the module is consignment sales, which is applicable to Consignment arrangement. The consignor recognizes revenue only when the consignee sells the consigned goods to end users. A. Instalment Sales: Learning objectives: The student should be able to a. Explain the applicability of the “instalment sales method” of recognizing revenue. b. Apply the method of instalment B. Consignment Sales Learning objectives; The student should be able to a. Define the consignment arrangement. b. Apply the PFRS 15 in recognizing revenue from a consignment arrangement. SAQ # 1 1. Paral Company began operations on January 2, 20x4, and appropriately used the installment sales method of accounting. The following data are available for 20x4 and 20x5: 20x4 20x5 Installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . P P3,600,000 ... 3,000,000 Gross profit on sales . . . . . . . . . . . . . . . . . . . . . . . . 30% 40% .... Cash collections from: 20x4 sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . P1,200,000 .... P1,000,000 20x5 sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . -- P1,400,000 .... The realized gross profit for 20x5 is: 2. Daily, Inc. appropriately used the installment method of accounting to recognize income in its financial statement. Some pertinent data relating to this method of accounting include: 20x4 20x5 Installment sales P750,000 P900,000 Cost of sales 450,000 630,000 Gross profit P300,000 P270,000 Collections during year: On 20x4 sales 250,000 250,000 On 20x5 sales 300,000 What amount to be realized gross profit should be reported on Daily’s income statement for 20x5? 3. Assume the Randall Corporation sold P30,000 worth of merchandise on the installment basis. The cost of the merchandise was P24,000, and collectability of the receivable is uncertain. Collection in the current year on the account is P8,000. How much gross profit should be reported as realized? Use the following information for questions 4 to 6: Kamus Medical Center uses the cost recovery method in accounting revenue. The following information is available: 20x5 20x6 Sales .................................... P 45,000 P 60,000 Gross profit percentage… 37% 41% Cash collections: 20x5 .................................. P 24,000 P 19,000 20x6 ................................ 40,000 20x7 .................................. for recognizing 20x7 P 85,000 40% P 2,000 17,000 53,000 4. Determine the amount of gross profit to be recognized for 20x5. 5. Determine the amount of gross profit to be recognized for 20x6. 6. Determine the amount of gross profit to be recognized for 20x7. 7. Leno Distribution, which began operating on January 1, appropriately uses the installment method of accounting. The following information pertains to Leno's operations for the first year: Installment sales . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . .P1,000,000 . Cost of installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 General and administrative expenses . . . . . . . . . . . . . . . . . . . . . . . . 100,000 Collections on installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200,000 The balance in the deferred gross profit account at December 31 should be: 8. Piper Co. began operations on January 1, 20x4 and appropriately uses the installment method of accounting. The following information pertains to Piper's operations for 20x4: Installment sales…………………………………………………..P1,800,000 Cost of installment sales……………………………………………1,080,000 General and administrative expenses…..…………………………..180,000 Collections on installment sales……..……………………………….825,000 The balance in the deferred gross profit account at December 31, 20x4 should be: 9. The Cindy, Inc. began operating at the beginning of the calendar year 20x4 and, using the installment method of accounting, presented the following data for the first year: Installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . P 400,000 Gross margin based on cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66-2/3% .. Inventory, Dec. 31, 20x4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,000 . General and administrative expenses . . . . . . . . . . . . . . . . . . . . . . 40,000 Accounts receivable, Dec. 31, 20x4 . . . . . . . . . . . . . . . . . . . . . . .320,000 . The balance of the deferred gross profit account, end of 20x4 should be: 10. Ft. Myers Co. began business on January 1, 20x3. The company uses the installment method. Additional information follows: 20x4 20x3 Installment sales P160,000 P184,000 Cost of installment sales 136,000 158,240 General and administrative expenses 20,000 8,400 Cash receipts on installment method sales 20x3 sales 40,000 89,600 20x4 sales 36,800 Compute the balance of Deferred Gross Profit at December 31, 20x4. Use the following information for questions 11 to 14: On January 1, 20x4, Panama City Realty sold land for P2,000 that had originally cost P1,600. A 5% down payment was received. Further cash collections were as follows: 20x5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 600 20x6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,200 20x7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100 11. Compute the amount of realized profit for the year 20x5 under the full accrual method. 12 . Compute the amount of realized profit for the year 20x6 under the installment sales method. 13. Compute the amount of realized profit for the year 20x7 under the sunk cost method 14. A corporation sold goods for P10 million during 20x4. Of this amount, P6 million were in cash, and P4 million was on account. However, the company collected P2 million of the sales on account during 20x4. In conformity with the revenue principle, the amount of revenue that should be recognized in 20x4 is: Use the following information for questions 15 and 16: A firm uses the installment method of revenue recognition on an item with a cash selling price of P1,000 and cost of P600. During the year of sale, the firm received P250 from the customer. 15. The net installment account receivable (net of deferred gross profit) at the end of the year of sale? 16. Thereafter, no more cash is received. The firm repossesses the item, worth P500 at that time. The entry to record the repossession includes ASAQ #1 Solutions 1. P920,000 20x4: P1,200,000 x 30% = P 360,000 20x5: P1,400,000 x 40% = 560,000 P920,000 2. P190,000 (P300,000 ÷ P750,000) x P250,000 = P100,000 [(P270,000 ÷ P900,000) x P300,000] + P100,000 = P190,000 3. P1,600– assume the use of installment sales method. It should be noted that if the collectability is highly uncertain or extremely uncertain, the use of cost recovery method is preferable. 4. Zero/Nil When the cost recovery method is used, gross profit is recognized only after all costs have been recovered. 20x5 P45,000 x 63% = P28,350 Cost of sale P28,350 - P24,000 = P4,350 No gross profit is recognized in 20x5. Costs still to be recovered. 5. P19,250 20x6 Relating to 20x5 sales: P19,000 - P4,350 = P14,650 Gross profit recognized Relating to 20x6 sales: P60,000 x 59% = P35,400 P40,000 - P35,400 = Cost of sale 4,600 P19,250 Gross profit recognized Recognized in 20x6 6. P21,000 20x7 Relating to 20x5 sales: Since all costs have been recovered, all cash collected is recognized as gross profit ...... P 2,000 Relating to 20x6 sales: Since all costs have been recovered, all cash collected is recognized as gross profit ...... 17,000 Relating to 20x7 sales: P85,000 x 60% = P51,000 P53,000 - P51,000 = .......... Cost of sale 2,000 Gross profit recognized P21,000 Recognized in 20x7 7. P320,000 [(P1,000,000 – P200,000) x (P1,000,000 – P600,000)/P1,000,000 = P320,000 8. P390,000 P1,800,000 – P1,080,000 = P720,000 (40% gross profit rate) P720,000 – (P825,000 x 40%) = P390,000. 9. P 128,000 Installment Accounts Receivable, end of 20x4 P 320,000 x: Gross profit rate (66 2/3 / 166 2/3) _____40% Deferred Gross Profit, end of 20x4 P 128,000 10. P25,168, determined as follows: Gross profit percentages: 20x3: P136,000/P160,000 = 85%; 100% x 85% = 15% 20x4: P158,240/P184,000 = 86%; 100% x 86% = 14% To deferred gross profit: 20x3: P160,000 x P136,000 = 20x4: P184,000 x P158,240 = Gross profit realized: 0.15 x P40,000 = 0.15 x P89,600 = 0.14 x P36,800 = P24,000 25,760 P49,760 P 6,000 13,440 5,152 P24,592 Balance of Gross Profit Deferred: P49,760 - P24,592 = P25,168 11. P 0 – all profit recognized in 20x5 12. P240 – (P1,200/P2,000) x P400 13. P100 - (100% of costs were fully recovered prior to 20x7 14. P10 million, the amount of sale 15 . P450 – [P1,000 – P250 = P750 – (P750 x 400/1,000)] = P450 16. P50 gain Repossessed merchandise……………………………………… 500 Deferred gross profit……………………………………………… 300 Installment Accounts receivable…………………….. Gain on repossession…………………………………… 750 50 Activity # 1 1. Compute the amount of realized gross profit for the year 20x4. 2 Compute the amount of realized gross profit for the year 20x5. 3. Compute the amount of realized gross profit for the year 20x6. Use the following information for questions 4 and 5: A company incurred the following costs and received the following collections from customers: Costs Collections 20x4. . . . . . . . . . . . . . . . . . . . . . . . . . . P120,000 P 0 20x5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20,000 80,000 20x6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000 40,000 20x7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10,000 100,000 20x8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 4. If the company used the cost recovery method of revenue recognition, the income that should be recognized in 20x6 is ___________________. 5. If the cost recovery method continues to be used through 20x7, the amount of 20x7 income that should be recognized is ____________________. Use the following information for questions 6 to 10: Johnson Enterprises uses the cost recovery method of construction accounting for all installment sales. Complete the following table: 20x4 20x5 20x6 Installment sales . . . . . . . . . . . . . . . . . . . . P 80,000 P 95,000 P ? Cost of installment sales . . . . . . . . . . . . . . .. . . . . . ? 56,050 68,250 Gross profit percentage . . . . . . . . . . . . . . . . . . . . . 38% ? 35% Cash collections: 20x4 sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,600 46,400 5,600 20x5 sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,800 ? 20x6 sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32,550 Realized Gross Profit on Installment Sales . . . . . . ? ? 16,050 6. The installment sales in 20x6: 7. The cost of installment sales in 20x4: 8. The collections in 20x6 for 20x5 sales: 9. The realized gross profit on installments sales in 20x4: 10. The realized gross profit on installments sales in 20x5: Use the following information for questions 11 to 14: Lake Power Sports sells jet skis and other powered recreational equipment. Customers pay 1/3 of the sales price of a jet ski when they initially purchase the ski, and then pay another 1/3 each year for the next two years. Because Lake has little information about collectability of these receivables, they use the cost recovery method to recognize revenue on these installment sales. In 20x4 Lake began operations and sold jet skis with a total price of P900,000 that cost Lake P450,000. Lake collected P300,000 in 20x4, P300,000 in 20x5, and P300,000 in 20x6 associated with those sales. In 20x5 Lake sold jet skis with a total price of P1,500,000 that cost Lake P900,000. Lake collected P500,000 in 20x5, P400,000 in 20x6, and P400,000 in 20x7 associated with those sales. In 20x7 Lake also repossessed P200,000 of jet skis that were sold in 20x5. Those jet skis had a fair value of P75,000 at the time they were repossessed. 11. In 20x7, Lake would record a loss on repossession of: 12. In 20x4, Lake would recognize realized gross profit of: 13. In 20x6, Lake would recognize realized gross profit of: 14. In its December 31, 20x5, balance sheet, Lake would report: a. b. c. d. Deferred gross profit of P800,000. Deferred gross profit of P650,000. Installment receivables (net of deferred) ofP700,000. Installment receivables (net of deferred) of P400,000. Use the following information for questions 15 to 18: Houser Appliances accounts for all sales of its merchandise on the installment basis. Following is the unadjusted trial balance at 12/31/x6 Cash P 45,000 Installment accounts receivable - 20x4 20,000 Installment accounts receivable - 20x5 50,000 Installment accounts receivable - 20x6 90,000 Inventory 27,400 Repossessed merchandise 4,600 Accounts payable P 37,600 Deferred gross profit - 20x4 12,000 Deferred gross profit - 20x5 26,400 Common stock 125,000 Retained earnings 10,000 Installment sales Cost of installment sales Loss on repossessions Operating expenses 120,000 78,000 3,000 13,000 P 331,000 ____ P 331,000 Additional information: • • • 20x4 gross profit rate: 25% Total cash receipts during 20x6: P118,000 Merchandise sold in 20x5 was repossessed in 20x6 and the following entry was prepared: Deferred Gross Profit—20x5.......................................... 2,400 Repossessed Merchandise............................................ 4,600 Loss on Repossessions ................................................. 3,000 10,000 Installment Accounts Receivable - 20x5…….. 15. What is the gross profit rate for 20x5? 16. What is the gross profit rate for 20x6? 17. Of the total cash receipts in 20x6, how much represents collections from installment sales of: a. 20x4 b. 20x5 c. 20xx6 18. What is the total realized gross profit in 20x6? Use the following information for questions 19 to 21: Homestead Corporation incurred the following activity during its first two years of operations: 20x4 20x5 Total credit sales P 750,000 P 900,000 Installment sales* 300,000 450,000 Total cost of sales 500,000 540,000 Installment cost of sales** 165,000 270,000 Cash receipts on installment sales: 20x4 sales 75,000 105,000 20x5 sales -0120,000 *Included in total credit sales. **Included in total cost of sales. Determine the following items for both 20x4 and 20x5: 19. Gross profit realized on installment sales. 20. Total gross profit. Rubric 20 Grade Score 1.0 1.4 1.7 1.9 2.1 2.3 2.5 2.7 3.0 3.2 3.4 3.6 20 19 18 17 16 15 14 13 12 11 10 9 3.8 4..0 4.2 4.4 4.5 4.6 8 7 6 5 4 3 4.7 4.8 5.0 2 1 0 Consignment Sales SAQ # 2 Use the following information for questions 1 and 2: 1. The following summary on the books of KK Company in relation to consignment transaction from SS, Inc. appears as follows: Consignment sales, 4 watches at P1,700,000 Consignor’s costs: Shipment of 10 Rolex “Daytona” watches, P2,000,000 Freight-out, P100,000 Consignee’s charges: Cartage-in, P75,000 Commission, P340,000 Advertisement, P200,000 Advances received by the consignor amount to P500,000. 1. The amount remitted by KK Co. to SS, Inc. is: 2. The consignment profit is: 3. London Manufacturing Corp. consigned 10 refrigerators to Canada Sales Company. These refrigerators had a cost of P180,000 each. Freight on the shipment was paid by London in the amount of P120,000. Canada Sales Company submitted an account sales stating that it had sold 6 refrigerators and remitted the P1,365,000 balance due London after the following deductions from the selling price of the refrigerators: Commission (based on selling price)……………………… Marketing expenses…………………………………………….. Delivery and installation of items sold………………………. Cartage cost paid upon receipt of consignment………….. 15% P 90 60 15 The consignor’s net profit from the sale of the consigned goods was: 4. Europe Appliances consigned five electric fans, which cost P800,000 each, to Germany Marketing Co., which was to sell them for a commission of 15% of selling price. Any accounts receivable arising from the sale of the consigned goods were to be the property of Europe Appliances. Europe paid trucking costs of P200,000. Germany is to be reimbursed P170,000 for local delivery to customers. By December 31, Germany Marketing had sold three of the fans, two for cash at P1,500,000 each and one on credit at P1,800,000, of which it had collected 25% as a down payment. The cash remittance to Europe Appliance and the consignment profit are: 5. The account-sales submitted by Africa Company to Malaysia Company on its consignment transactions during the month of September follows: Sales of 7 units of P300,000 each…………… Less: Advance to consignor………………… Advertising expense…………………. Commission at 10%............................... Net proceeds remitted……………………….. P2,100,000 P1,000,000 100,000 420,000 1,520,000 P 580,000 The consignment consisted of 10 units which cost Africa P200,000 each, and on which freight outward of P60,000 was paid. The consignment profit and the cost of inventory of consigned goods are: ASAQ # 2 1. P585,000 Sales Less Charges: Cartage-in Commission Advertisement Due to Consignor Less: Advances Amount remitted 2. P290,000 Sales Less: Consignor’s charges: Cost (P2,000,000 x 4/10) Freight-out (P100,000 x 4/10) Consignee’s charges: Cartage-in (P75,0000 x 4/10) Commission Advertisement Consignment profit P1,700,000 P 75,000 340,000 _200,000 _615,000 P1,085,000 __500,000 P 585,000 P1,700,000 P 800,000 __40,000 P 30,000 340,000 _200,000 840,000 __570,000 P 290,000 3. P213,006 Sales on consignment is first determined by using an algebraic equation as shown below: Let X = Sales .15X = Commission Equation (from the Account Sales format): Sales – (Commission + Expenses) = Remittance X - (.15X + P165 ) = P1,365,000 .85X = P1,365,165 X = P1,606,076 The consignment profit can now be computed as follows: Sales P1,606,076 Cost and expenses: Cost of goods (6 x P180,000) P1,080,000 Freight-out (6/10 x P120,000) 72,000 Commission (15% x P1,606,076) 240,911 Marketing expenses 90 Delivery and installation 60 Cartage cost (6/10 x 15) __ 9 _1,393,070 Consignment Profit P 213,006 4. P2,560,000 is the amount to be remitted as determined from the following Account Sales: Sales: Cash (2 x P1,500,000) P3,000,000 Credit Sales (1,800,000 x 25%) __450,000 P3,450,000 Less: Consignee’s charges Commission (15% x P4,800,000) P 720,000 Delivery expense __170,000 __890,000 Remittance P2,560,000 The consignment profit is P1,390,0000 determined as follows: Sales: Cash (2 x P1,500,000) P3,000,000 Credit Sales (1 x 1,800,000) _1,800,000 P4,800,000 Cost and expenses: Cost of goods (3 x P800,000) P2,400,000 Trucking cost (3/5 x P200,000) 120,000 Commission (15% x P4,800,000) 720,000 Delivery expenses ___170,000 _3,410,000 Consignment profit P1,390,000 5. P348,000 is computed as follows: Sales Cost and expenses: Cost of goods (7 x P200,000) Freight-out (7/10 x P60,000) Advertising Commission (10% x P2,100,000) Consignment Profit P618 is determined as follows: Cost of goods (3 x P200,000) Freight –out (3/10 x P600,000) Cost of inventory on consignment P2,100,000 P1,400,000 42,000 100,000 __210,000 _1,752,000 P 348,000 P600,000 __18,000 P618,000 Activity 2 1. On May 15, 20x7, Japan Sales Company received a shipment of merchandise with a selling price of P15,000 from China Company. The consignment agreement provided for a sale of merchandise on credit with terms of 2/10, n/30. The commission of 15% was to be based on the accounts receivable collected by the consignee. Cash discounts taken by customers, expenses applicable to goods on consignment and any cash advanced to the consignor were deductible from the remittance by the consignee. Japan Sales Company advanced P6,000 to China Company upon receipt of the shipment. Expenses of P80,000 was paid by Japan. By June, 20x7, 70% of the shipment had been sold, and 80% of the resulting accounts receivable had been collected, all within the discount period. Remittance of the amount due was made June 30, 20x7. The consigned goods cost China Company P10,000 and freight charges of P120,000 had been paid to ship it to Japan sales Company. The cash remitted by Japan Sales Company and the cost of inventory on consignment are: 2. On May 1, the Thailand products Company ships five (5) of its appliances to the Korea Company on consignment. Each unit is to be sold at P250,000 payable P50,000 in the month of purchase and P10,000 per month thereafter. The consignee is to be entitled to 20% of all amounts collected on consignment sales. Korea Company sells 3 appliances in May and 1 in June. Regular monthly collections are made by the consignee, and appropriate cash remittances are made to the consignor at the end of each month. The cost of the appliances shipped by the consignor was P155,000 per unit. The consignor paid shipping costs to the consignee totaling P50,000. The cash remittance to consignor and the consignment profit are: 3. On June 1, Taiwan Sales Co. shipped 25 radio sets to India Store on consignment, sets to be sold at an advertised price of P200,000. The cost of each set to the consignor was P100,000. The cost of shipment paid by the consignor was P75,000. Commission is to be 25% of sales price. During the month, two sets were returned. On June 30, India Store reported sales of 8 sets and expenses incurred of P80,000; and remitted the net proceeds due. The profit on consignment and cost of inventory on consignment are: 4. The account sales submitted by a consignee to Barbie Company for the month of February, 20x7 is shown below: Sales of 6 units of P400,000 each……………… Less: Advance to consignor……………………… Advertising expense………………………. Commission ………………………………... Net proceeds remitted………………………….. P2,400,000 P1,000,000 150,000 480,000 1,630,000 P770,000 Barbie Company realized a net income of P426,000 in February out of the consignment, which consisted of ten (10) units and on which freight out of P240,000 was paid upon shipment to the consignee. The cost of goods sold on the consignment amounted to: 5. Anton Corporation delivered 150,000 bath water heaters on consignment basis to Dave Company. These water heaters cost P900,000 each, and they are advertised to sell at P1,500,000 each. The consignee is to be allowed a commission of 15% of the selling price. The consignment agreement also stated that the consignor would draw a sight draft on the consigned for 60% of the cost of the water heaters. The advance shall be recovered periodically by the consignee through monthly deductions, in proportion to the number of units sold, from the remittances which accompany the monthly account sales. All expenses of the consignee are to be deducted monthly as incurred. The consignee rendered an account sale at the end of the first month showing, among other things, the following information. Advertising……………………… Delivery expense…………………………………………………….. Commission…………………………………………………… P 2,250,000 1,125,000 3,375,000 The amount remitted by Dave Co. and the consignment profit of Anton Corp. are: 6. On January 1, 20x7, Dreicy Electrical Shop received from Kim Trading 300 pieces of bread toasters. Dreicy was to sell these on consignment at 50% above cost for a 15% commission on the sales price. After selling 200 pieces, Dreicy had the remaining unsold units repaired for some electrical defects for which P2,000 was spent. Kim subsequently increased the selling price of the remaining units to P33,000. On January 31, Dreicy remitted P6,498,000 to Kim after deducting 15% commission, P85,000 for delivery expenses and P200,000 for the repair of the defective units. The consigned goods cost Kim Trading P20,000 per unit, and P900,000 was paid to ship them to Dreicy Electrical Shop. All expenses in connection with the consignment are reimbursable to the consignee. The consignment profit and the cost of inventory on consignment are: 7. Dorothy Trading Corporation consigns merchandise to Cerise, Inc. of Quezon City. In 20x4 shipments to the consignee amounted to 4,000 and in 20x5 6,210 units. Unit cost and sales price per unit have been uniformly applied at P4 and P9, respectively. The consignor considers all shipments as sales and credits the consignee’s account for remittances made. The consignee remits for the units as soon as they are sold, and the remittances for 20x5 amounted to P58,590. The inventory on consignment as of December 31, 20x5 was 1,200 units. The inventory on consignment as of December 31, 20x4 was: 8. The Mang Cha-a Publishing ships 8-volume sets of encyclopedia to book dealers on consignment. The sets are to be sold at an advertised price of P99. The cost per set is P50. Consignees are allowed a commission of 30% of the sales price, and are to be reimbursed for freight relating to the consigned goods. On December 3, 20x7, 100 sets were sent to JCo Bookstore on consignment. The consignor paid packing charges of P170 for the shipment. The shipping cost paid by the consignor was P400, and the consignee paid P60 for freight on the sets received. 60 sets were sold in December for cash. Remittance of the amount owed to the consignor was made on December 31, 20x7. Both the consignor and the consignee take physical inventories, and they adjust and close their books at year-end. How much is the consignor’s net profit on the consignment? 9. On January 10, 20x7, Karen Mfg. Corporation consigned 10 units of washing machines costing P3,600 each to Kulin Marketing Corporation. Kulin paid P2,400 for freight on the shipment. On January 31, Karen submitted a liquidation report which shoed sales of 6 units and accompanied by a remittance for P27,300 after a 15% commission on the sales price and the following deductions: Cartage paid upon receipt of consigned goods……………… Advertising expense…………………………………………… Delivery and installation of goods sold………………………… The consignor’s profit from sales of consigned goods is: P 300 1,800 1,200 10. Gail, Inc. consigned 10 one-horse power air-condition units to Faye Trading and paid P2,000 freight-out. The consignee is allowed a commission of 10% on sales. Faye Trading submitted an account sale on its sales in December, 20x7 as follows: Sales, 6 units including 12.5% gross profit……………………........ Less: Advance to consignor Selling expenses…………………………………………........... Installation and delivery……………………… Commission, 10% of sales……………………………………... Net Remittance……………………………………… P72,000 P10,000 800 1,200 7,200 19,200 P52,800 How much is the consignment profit (loss) of Aircon, Inc.? Rubric 10 points Grade 1.0 1.4 1.9 2.5 3 3.4 3.8 4.0 4.5 4.8 5.0 10 9 8 7 6 5 4 3 2 1 0 Score