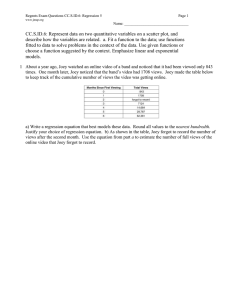

Financial Literacy Project - 1 VAC: FINANCIAL LITERACY ASSIGNMENT: CASE STUDY ON SAVINGS AND INVESTMENTS SUBMITTED BY: 1. 2. 3. 4. 5. Sriram Senthilkumar- BA Economics Hons- 0522035 Aman Dhingra- BA Economics Hons- 0522065 Divyanshi Wadhwa- BA Economics Hons- 0522004 Simone Kalsi- BA Economics Hons- 0522002 Gracy Gupta- BA Economics Hons- 0522005 SUBMITTED TO: Prof. Neha Singhal DATE OF SUBMISSION: 24.01.23 Roll No. Name 0522035 Researched the topic and helped with the analysis and observation Sriram Senthilkumar part of the project 0522004 Researched and developed Ideas to form the case study and helped Divyanshi Wadhwa frame the project 0522002 0522065 0522005 Contribution Simone Kalsi Helped structuring the project and worked in researching and creating the investment avenues required for the project Aman Dhingra Researched and helped in creating the investment avenues database Gracy Gupta Researched the topic and helped in structuring and formatting of the project CASE STUDY Introduction: Our client in this case is a young man Joey, aged 25, who is unmarried and lives with his parents in Bangalore. He is an Economics honors graduate who is now newly employed as a junior consultant at a reputed consultancy firm at a monthly pay of ₹80,000. This amount is his in-hand salary after deduction of tax and all other automated expenses such as insurance installments and EPF. Hence this amount of ₹80,000 is completely disposable. Given the condition, it can be figured out that his expenses are to provide for his family and also meet his basic needs for the future. Joey is young and can explore several avenues. His salary can be distributed into: 1. His personal expenses such as food, clothing, housing and other miscellaneous expenses related to his family. 2. Savings 3. Investment 4. Emergency funds How much of the fund each avenue needs is based on the financial goals of Joey. Given that he is independent and in his prime age, Joey may want to pursue a variety of fields including purchasing a bike or a car, rebuilding his house, going on for higher education, say MBA, save for his marriage and further family or even start his own business venture. If Joey follows the conservative approach, his prudence may channelise him to build a retirement fund or an emergency fund. 1) Personal expenses Given that Joey lives with just his parents the expenses will be quite few and limited. He needs to be careful of his investment strategy and also save upon things that are an unnecessary burden such as long or frequent vacations with friends. He should adopt a lifestyle that focuses on minimizing wasteful expenditures. 2) Savings Saving up has become a cult that most people are taught to follow. However it is important to know that the amount of money that savings can earn an individual in terms of interest is quite low. Hence investments play a dominant role after expenditures. So Joey being a young man should focus and consider investing his funds and saving a little part of his income say 10-15%. 3) Investments Joey being an upwardly mobile fellow should be investment savvy. He should consider a wide range of portfolio for his investment, keeping in mind his short term goals such as that of pursuing higher education or saving up for his marriage, or his long term goals such as rebuilding his house or building a retirement fund. This will provide a cushion and reduce the reliance on salary. It is important for Joey to explore the wide range of investment options available given that he is still young and a single income source is most likely to get him into debt. Here is a brief account of the plethora of opportunities available to young people like Joey: 1. PPF & EPF Public Provident Fund (PPF) scheme is a long-term investment option that offers an attractive rate of interest and returns on the amount invested. The interest earned and the returns are not taxable under Income Tax. The PPF has a minimum tenure of 15 years, which can be extended in blocks of 5 years. It allows a minimum investment of Rs 500 and a maximum of Rs 1.5 lakh for each financial year. Investments can be made in a lump sum or in a maximum of 12 installments. The account can be opened with just Rs 100 a month. Since PPF is backed by the Indian government, it offers guaranteed, risk-free returns as well as complete capital protection. Employee’s Provident Fund (EPF) is the main scheme under the Employees' Provident Funds and Miscellaneous Act, 1952. The employee and employer each contribute 12% of the employee's basic salary and dearness allowance towards EPF. Currently, the rate of interest on EPF deposits is 8.10% p.a. There is no requirement to make a single, lump-sum investment. Deductions are made on a monthly basis from the employee's salary and it helps in saving a huge amount of money over a long period. Our Conclusion on this Avenue: This is one of the safest avenues for investment with fixed returns and safety of capital also. One thing which we thought of bringing into picture is to not just rely on EPF if you are an Employee because in the last few years the interest rates for EPF are declining and its is smarter to go with a combination of both so we can have a lump sum at the end of 15 years and another lump sum at the time of retirement which are tax free too. 2. Mutual Funds A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates. Mutual funds typically invest in a range of companies and industries. This helps to lower your risk if one company fails. The fund managers do the research for you. They select the securities and monitor the performance.Most mutual funds set a relatively low amount for initial investment ( starts from 500) and subsequent purchases. Mutual fund investors can easily redeem their shares at any time, for the current net asset value (NAV) plus any redemption fees. Mutual funds offer professional investment management and potential diversification. They also offer three ways to earn money: 1.Dividend Payments- A fund may earn income from dividends on stock or interest on bonds. The fund then pays the shareholders nearly all the income, less expenses. 2.Capital Gains Distributions- The price of the securities in a fund may increase. When a fund sells a security that has increased in price, the fund has a capital gain. At the end of the year, the fund distributes these capital gains, minus any capital losses, to investors. 3. Increased NAV- If the market value of a fund’s portfolio increases, after deducting expenses, then the value of the fund and its shares increases. The higher NAV reflects the higher value of your investment. Our Conclusion on this Avenue: Mutual funds gives our client Joey to invest in the wider market with the help of a proper expert fund manager under an Asset management company which reduces the risk of loss and also there are different kinds of Mutual Funds (Bluechip funds are the one’s who specifically invest in Tech based companies and there are many options available her) Our suggestion for Joey is to go with the Index Funds at first as this is just AMC’s trying to copy the Sensex and Nifty which means these are top companies which we are investing and over a period of time the market always goes up due to inflation which means there is a guarantee that on the long run investing in Index funds (top companies on the market) will turn out profitable and less risky. But we also suggest Joey to invest in other funds over time but just start with Index Funds as they are more reliable. 3. Fixed Deposit (FD) In a Fixed Deposit, you put a lump sum in your bank for a fixed tenure at an agreed rate of interest. At the end of the tenure, you receive the amount you have invested plus compound interest. FDs are also called term deposits. They offer greater returns on the principal invested when compared to the returns generated from a regular savings account. Depending on a consumer’s investment portfolio, the FD investment period can either be short-term or long-term. The interest rates on fixed deposits vary from one company or bank to another. Fixed deposit investments are offered by banks, post-offices, and other non-banking financial companies. In India, investors have countless options to open fixed deposit accounts. However, they must compare the interest rates, the reputation of the company, and other factors before depositing their funds. However, fixed deposit investors need to remember that they cannot withdraw money before maturity without financial repercussions. 4. Recurring Deposit (RD) Recurring Deposit or RD is an investment tool which allows people to regularly deposit money and earn returns. So, there is flexibility and ease of investing. Most RD’s range from 6 months to 10 years. On maturity of the tenure, the amount received is the lump sum plus the interest. The rate of interest of an RD is lower than FD but is higher than a savings account. You can start with as low as Rs 1000 a month and is great for meeting the short term goals. It is a risk free investment and is henceforth a very sought after source of investment, especially among the salaried professionals. Our Conclusion on this Avenue: Fixed deposit still remains as one of the popular choices for Indians to save their money but one thing which has to be noticed is that the returns from Fixed Deposits are usually higher than that of a savings account but still lower than the inflation rate. Which means though your amount earns you interest, it doesn’t earn enough interest to beat inflation or help you to improve your standard of living. It is still a great option for many who want to take less risk but Joey is just in his 25’s so he can take more risk so we don’t recommend Joey to go with Fixed deposits and Recurring Deposits. 5. Individual Stocks Stocks are shares in the ownership of a company, or investments on which a fixed amount of interest will be paid. When one invests in an individual stock, he or she is purchasing ownership. If an individual invested in shares of a public company, that individual would have a percentage of ownership in that company. Our Conclusion on this Avenue: Though it is one of the best ways to invest in Equity based on the amount of returns that we could get from the investment we would not advise anyone including Joey to invest without proper training and knowledge about the market. But still investing in bigger companies which have strong fundamentals is a good way to start in the market. 6. Bonds A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond is a debt security, similar to an I.O.U., between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. 7. Debentures: A debenture is a type of debt instrument that is backed by the creditworthiness and reputation of the issuer. It is commonly used by corporations and governments to raise capital. They pay interest and are redeemable at a fixed date. Debentures are advantageous for companies since they carry lower interest rates and longer repayment dates as compared to other types of loans and debt instruments. So, investors can avail regular interest payments, convertible debentures can be converted to equity shares after a specified period, making them more appealing to investors and in the event of a corporation's bankruptcy, the debenture is paid before common stock shareholders. However, there is a risk involved as they are not secured by collateral. Our Conclusion on this Avenue: There are various bonds both private and government bonds which Joey could invest (Green Bonds for example) but there is an upfront cost which is big at times but there is assured returns most of the times and the returns are also decent though not as high as individual stocks. Debentures are also a good option and there are different types of debentures which could be chosen based on our needs and goals. 8. Gold Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. Gold investment can be done in many forms like buying jewelry, coins, bars, gold exchange-traded funds, Gold funds, sovereign gold bond schemes, etc. Though there are times when markets see a fall in the prices of gold, usually it doesn't last for long and always makes a strong upturn. Our Conclusion on this Avenue: Gold is a stable investment option for Joey to balance the risk factor because in the long run Gold is something which always gives back some form of returns which is guaranteed (in the short run it is pretty volatile). We advise Joey to invest in Electronic Gold to avoid the wastage costs and other costs associated with buying physical gold, to diversify the portfolio and manage risk better in the long run. 9. Crypto: Cryptocurrency is a digital money that is secured by blockchain technology. It can vary from buying the cryptocurrency to investing in the crypto funds and companies. The currencies can be brought through the dealers or brokers. Investment in crypto is very risky as it is highly volatile and there is a risk of market fluctuation and the crypto going illegal. So, only after all the terms and conditions are carefully read, the market studied and your own pocket considered, should the decision be made. There is an upside to crypto as there is a great return that can be earned but it is not with certainty. Some cryptocurrencies are Bitcoin, Litecoin, Ethereum etc. 10. NFT’s: NFT’s or Non Fungible Tokens are unique tokens having distinct characteristics and therefore cant be interchanged, exchanged or replaced. NFT’s are a great option for investing as they create tokenized asset value and hence when objects like artwork are tokenized it limits the ownership to the artist and avoids duplication. It offers more liquidity to investors and there is a potential for development and growth. Our Conclusion on this Avenue: These are unregulated and highly risky investment avenues and we would advise Joey to not invest in it right away (especially in crypto) and only experiment after he has gotten good amount which he is fine with losing just in case if the worst happens because these are high risk and have no factors to analyze their behavior in the market. 11. Real Estate: Real estate can be a very strong investment option and there is a promise of good return especially in the long run when the property appreciates and it can be sold at a profit. It offers a steady source of income and liquidity. There is also an option of leveraging the investment. Along with this, real estate enjoys tax benefits. Our Conclusion on this Avenue: Real Estate is a very tricky investment but a worthwhile one for the long term. Though the market is volatile at times, it still remains a great investment for people who are ready with a lump sum amount to invest in it. It offers a steady source of income later on in the form of rent and because there are tax exemptions this is also one great investment opportunity for Joey to exploit once he is in his 35’s and there is a significant amount at his disposal to invest in real estate. 12. Insurance: Insurance is the safety cover that provides financial security in times of uncertainty. For example, Life insurance refers to a service that one purchases with the motive to guard themselves or their family against any unfortunate events like loss of life, property, or health. In case of any unforeseen event, the nominee gets the assured benefits. It is a way to secure your and your family’s future. How an insurance works is, you buy a policy and make regular payments, known as premiums, to the insurer. If you make a claim your insurer will pay out for the loss that is covered under the policy. If you don’t make a claim, you won’t get your money back, instead it is pooled with the premiums of other policyholders who have taken out insurance with the same insurance company. If you make a claim, the money comes from the pool of policyholders’ premiums. Our Conclusion on this Avenue: Insurance doesn’t come under investment avenues but it is still an investment for the long run which we do to have medical cover incase of an emergency. After thorough research we have decided that there are only 2 plans which everyone needs and the other plans are literally unnecessary (property insurance exempted). These two are Term Life Insurance, and Health insurance. We also suggest Joey only to take a term life insurance so if something happens to him and he passes away his dependants can have some financial support and the other plan is a Health insurance which covers pre and post hospitalization also and which also allows to add family members on the plan (never depend only on the company’s insurance alone) Observation: We have seen what Joey's personal life circumstances are and also have got a brief idea as to what are his personal financial goals for the short term and long term. In addition to that we have also seen all the possible avenues which he could channelise his income into a productive use (Save and Invest or even Prioritizing Expenses). One thing which we as a team have understood in the whole research process is that finance is a whole world in itself and how one uses finance to his benefit is totally subjective to each and every individual that is why we have not brought in any generalized theory as a conclusion rather we will be looking into what kind of solution Joey should take to attain financial freedom. This means that every individual has to understand the nuances of finance and later formulate their own strategies and plans to attain financial freedom according to their risk and comfort level based on their circumstances and goals ahead. Analysis and Solution: Joey belongs to the vast majority of the upper middle class and which means we can observe a pattern in which he would spend his income which is more or less how everyone belonging to this income group spends their money. If you can closely observe the diagram below which we have made we can see Joey receives his salary as his income (EPF deducted) and first he has to meet the expenses and then it if he is to go attain all his goals (like buying a car and house and all the other stuff right away) he will have EMI’s to pay and Interest to be paid for the loan taken and whatever’s remaining would be a meager amount which he tries to save it in a RD to have more security (while most people just have it in their bank). This is a vicious cycle which he will put himself for which he will have to work continuously to meet this expenses and liability till he is in his late 40’s and then there is no savings at the end to have his dream vacation or an opportunity to live life in his own terms, because he has almost lived half his life not in his own terms and breaking pattern now would be very hard. On the other hand let’s take Chandler’s way of living into account (Chandler is a millionaire entrepreneur). Chandlers owns his business which brings him the income and the income is then channelised to assets which will earn him money passively and by now he has already invested a lot over the past 20 years that the passive income from the assets are higher than the income from his main business. Now the income he receives from business is further used for investment in assets and the income he receives from the assets he spends it to pay his taxes and liabilities and then has a huge chunk to spend on anything. He lives life on his own terms. Joey’s goal is also to attain this state but it can not happen overnight we need a proper plan with which we will have to approach this so Joey gradually moves out of the current cycle to a better one and eventually one like Chandler’s. But how do we do that ? 1. 30/20/50 Rule Our suggestion for Joey is to take 30% of his income and use it to buy assets for the long term which he would not touch for the next 20 years. And use 20 % of his income to create emergency funds and savings (insurance premium, PPF etc..). Finally Joey can use 50 % of his income on anything he wants. He can also use the same 30/20/50 rule on the left out 50% income to channelise more into savings if his expenses are that low. The 30/20/50 Rule is something practical for most people but to implement it we need a proper system in placer otherwise it would be very hard to follow it religiously over a period of time and we might fall back to old ways which we don’t want Joe’s to face, so we are setting up a small bank set up for him to make it simple 2. The Triple Account Strategy We know Joey has an account given by the company in which his salary gets credited so apart from that we are creating two more bank accounts for Joey firstly. Joey has to enable an auto transfer in his salary account to transfer 50% of the salary to the other bank account (new one) from which he will spend all the amount. And he should also enable auto transfer of 30% of his income going to the other account (second new one) from where he will do all trading activities for which he will also enable a demat account. The salary account will be the one from which he will be paying the premium from insurances and also the SPI for PPF (Public Provident Fund) which can also be automated. By following this we can make sure that the insurance premium and short term savings is regular without Joey’s interaction so that reduces the friction in initiating the action and also having a separate account to meet the expense will make it easier to track the expenses and analyze them. The other investment account helps Joey to make investment choices from the fixed amount without any possibility of shortage or mixup of funds. This makes the whole process streamlined and less interactional. If Joey wants to hold a credit card he can only hold one from the savings bank that to with a limit of 30 % of the amount in the savings bank only so by this we can also make sure that he doesn’t get into the credit card trap and pay high interest for it but at the same time use it in a limited range and repay it to maintain a decent CIBIL score also. Working with Numbers: As we know Joey earns 80,000 (After EPF deduction). Applying the strategies we just used we know 50% of 80,000 is 40,000 and 30% of 80,000 is 24,000 and 20% of 80,000 is 16,000. Now we know the amount he spends on each avenue. With this information about how much the split is for each category and also taking into consideration his age we can chart out how investing along our plan can turn fruitful for Joey and help him attain his goal of financial freedom. We are taking a conservative approach over this analysis that is assuming he only invests the fixed amount over his lifetime (but in reality the investment can go up even further as his assets rise and it starts giving income too). Let’s say if he on average we get a 7% returns from investments in PPF and EPF and other short term investments and emergency funds (In reality we almost get close to same, ranges around 7 to 8 %) Age Amount Invested Interest Earned Total 25 ₹960,000.00 ₹223,467.00 ₹1,183,467.00 30 ₹1,920,000.00 ₹1,026,651.00 ₹2,946,651.00 35 ₹2,880,000.00 ₹2,693,522.00 ₹5,573,522.00 40 ₹3,840,000.00 ₹5,647,155.00 ₹9,487,155.00 45 ₹4,800,000.00 ₹10,517,865.00 ₹15,317,865.00 50 ₹5,760,000.00 ₹18,244,723.00 ₹24,004,723.00 55 ₹6,720,000.00 ₹30,226,801.00 ₹36,946,801.00 From the table above we can see how his investments grow each 5 years and how the concept of compounding multiplies the investment over a period of time with continuous investment and patience. We can easily observe that right when he turns 40 he would be earning more returns than the principle he would have put in by then and from then on it's only scaling upward. A sixty lakh investment would turn into 3.5 crores which is a good sum to plan for retirement. But this is just the 20% savings and emergency fund part, let's see how the actual investment (the 30% part) turns out after 30 years with the same principles of compounding applied to it also. So if we look at the table given below we can see a similar behavior as it was in the previous investment chart. The only difference is that the investment here is a bit higher and also because this investment consists of individual stocks, mutual funds, bonds, gold, cryptocurrency etc.. there are possibilities of higher returns over time which we keep at 10% constant (conservative approach again. It could be much higher). Here just an investment of 1 crore leaves him with around 9 crore at the end of 30 years which is a very good amount to actually settle down for the later part of the life without having to depend on anyone financially. Age Amount Invested Interest Earned Total 25 ₹1,410,000.00 ₹433,977.00 ₹1,843,977.00 30 ₹2,880,000.00 ₹2,077,248.00 ₹4,957,248.00 35 ₹4,320,000.00 ₹5,710,182.00 ₹10,030,182.00 40 ₹5,760,000.00 ₹12,616,726.00 ₹18,376,726.00 45 ₹7,200,000.00 ₹24,909,368.00 ₹32,109,368.00 50 ₹8,600,000.00 ₹46,063,808.00 ₹54,663,808.00 55 ₹10,080,000.00 ₹81,798,641.00 ₹91,878,641.00 We have been telling about how the assumptions we took are conservative and there are possibilities for more returns over time. It is because there could be promotion which will increase Joey’s income and as Joey invests in assets there are returns which are also income which Joey might reinvest and not just that. Conclusion: The final conclusion and the solution for the case study is to properly follow the suggestions regarding investing and savings to attain financial stability. We have not done a deep research on each aspect, rather we wanted to keep it simple and at the same time we have not gone with unrealistic expectations, hence our plan and strategies are simple and actionable for the client. The overall aim is fulfilled which is not to earn as much as possible and retire soon rather to live life on his own terms, that is to have financial freedom.