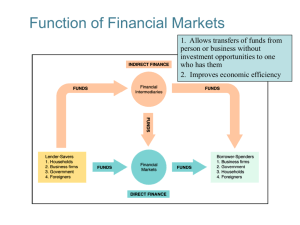

The Economics of Money, Banking, and Financial Markets Mishkin, 7th ed. Chapter 2 Overview of the Financial System Direct finance and Indirect finance Direct finance – funds are directly transferred from lenders to borrowers Indirect finance – financial intermediaries receive funds from savers and lend them to borrowers Securities are assets for the holder and liabilities for the issuer Function of Financial Markets 1. Allows transfers of funds from person or business without investment opportunities to one who has them 2. Improves economic efficiency Debt and equity markets Debt instruments – contractual obligation to pay the holder fixed payments at specified dates (e.g., mortgages, bonds, car loans, student loans) Short-term debt instruments have a maturity of less than one year Intermediate-term debt instruments have a maturity between 1 and 10 years Long-term debt instruments have a maturity of ten or more years Equity – sale of ownership share (owners are residual claimants). Owners of stock may receive dividends Primary and secondary markets Primary market = financial market in which newly issued securities are sold. Secondary market = financial market in which previously owned securities are sold. Brokers and dealers Broker – match buyers and sellers Dealers – buy and sell securities Role of secondary markets Increase liquidity of financial assets Determine security prices that help determine the price of securities in primary markets Exchanges and over-the-counter markets Exchange – buyers and sellers meet in one central location (e.g., NYSE or Chicago Board of Trade) Over-the-counter market – transactions take place in multiple locations through dealers Money and capital markets Money market – market for short-term debt instruments Capital market – market for intermediate and long-term debt and equity instruments International financial markets Foreign bond = bond issued by a foreign entity that is denominated in the currency of the country in which the bond is sold Eurobond = bond denominated in a currency other than that of the country in which the bond is sold Foreign bonds may be used to avoid exchange-rate risk Eurocurrencies – deposits denominated in a currency other than that of the country in which the bank is located London, Tokyo and other foreign stock exchanges have grown in importance Financial intermediaries Reduce transaction costs (due to economies of scale and lower information costs) Allow for differences in the desired lending and borrowing time horizons Risk sharing (asset transformation) lowers risk through diversification Asymmetric information Moral hazard The existence of a contract causes one party to alter their behavior in a manner detrimental to the other party Adverse selection Individuals who are willing to accept a financial (or other) contract are of lower “quality” than a typical individual in the population Asymmetric information: Adverse selection,and Moral hazard Adverse Selection 1. Before transaction occurs 2. Potential borrowers most likely to produce adverse outcomes are ones most likely to seek loans and be selected Moral Hazard 1. After transaction occurs 2. Hazard that borrower has incentives to engage in undesirable (immoral) activities making it more likely that won’t pay loan back Financial intermediaries reduce adverse selection and moral hazard problems, enabling them to make profits Types of financial intermediaries Depository institutions Commercial banks Savings and Loan Associations Mutual savings banks Credit unions Contractual savings institutions Life insurance companies Fire and casualty insurance companies Pension funds and government retirement funds Finance companies Mutual funds Money market mutual funds Financial Intermediaries 15 Size of Financial Intermediaries Financial market instruments Money market instruments United States treasury bills (discounted; no default risk) Negotiable bank certificates of deposit (NCD; large denominations) Commercial paper (CP; direct finance; largest instrument) Banker’s acceptances (use abroad in international trade) Repurchase agreements (repos; <2 wks; need collateral) Federal funds (overnight loan b/w banks of their deposits at Fed) Financial market instruments Capital market instruments Stocks (largest instruments) Mortgages (FNMA: Fannie Mae; GNMA: Ginnie Mae; FHLMC: Freddie Mac) Corporate bonds (convertible vs. non-convertible) US government securities (most liquid security) US government agency securities State and local government bonds (municipal bonds; interest tax free) Consumer and bank commercial loans Regulatory Agencies 19 Regulatory Agencies 20 Regulation of financial markets Two Main Reasons for Regulation (Financial sector is one of the most heavily regulated sectors of the economy) 1.Increase information to investors A. Decreases adverse selection and moral hazard problems B. SEC forces corporations to disclose information 2.Ensuring the soundness of financial intermediaries A. Prevents financial panics B. Chartering, reporting requirements, restrictions on assets and activities, deposit insurance, and anticompetitive measures Types of regulation Entry restrictions Disclosure laws (SEC) Restriction on assets and activities Deposit insurance Limits on competition Restrictions on interest rates (no longer in effect)