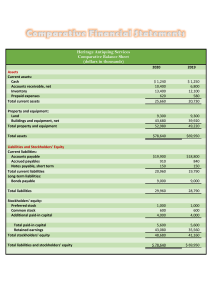

Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY Chapter 1: Accounting in Action Accounting Activities and Users Accounting: 1. Identify economic events. 2. Record financial activities (systematically and chronologically) 3. Communicate to interested users Accounting consists of 3 basic activities: 1. Identify – A company identifies the economic events relevant to its business. 2. Record – Record economic events to provide a history of its financial activities. o Recording consists of keeping a systematic, chronological diary of events, measured in dollars and cents. o Bookkeeping usually involves only the recording of economic events. It’s therefore just one part of the accounting process. 3. Communicate – A company communicates the collected information to interested users by means of accounting reports. o The most common of these reports are called financial statements. the economic events of an organization to interested users. Who Uses Accounting Data Internal Users / Managerial Accounting o Managers who plan, organize, and run a business, i.e., marketing managers, production supervisors, financial directors, and company officers. o Managerial accounting provides internal reports to help users make decisions about their companies. Examples: Financial comparisons of operating alternatives, projections of income from new sales campaigns, and forecasts of cash needs for the next year. External Users / Financial Accounting o Individuals and organizations outside of a company who want financial information about the company, i.e., Investors (owners), creditors (supplies and bankers) o Financial accounting provides economic and financial information for investors, creditors, and other external users. Examples: Taxing authorities, such as IRS, want to know whether the company applies with tax laws. Regulatory agencies, such as Who uses accounting data: Internal users – managers (managerial accounting) External users – investors and creditors (financial accounting) 1 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY the Securities and Exchange Commission or the Federal Trade Commission, want to know whether the company is operating within prescribed rules. Customers are interested in whether a company will continue to honor their product warranties and support its product lines. Labor unions want to know whether owners have the ability to pay increased wages and benefits. Generally Accepted Accounting Principles (GAAP) The accounting profession has developed standards that are generally accepted universally practiced. This common set of standards is called Generally Accepted Accounting Principles (GAAP), which indicates how to report economic events. The Securities and Exchange Commission (SEC) is the agency of the U.S. government that oversees U.S. financial markets and accounting standard-setting bodies. U.S.’s primary accounting standard-setting body is Financial Accounting Standards Board (FASB). Is FASB recognized by SEC? The FASB is recognized by the U.S. Securities and Exchange Commission as the designated accounting standard setter for public companies. The SEC relies on the FASB to develop accounting standards, which public companies must follow. Many foreign countries have adopted the accounting standards, International Financial Reporting Standards (IFRS), issued by International Accounting Standards Board (IASB). To increase comparability, 2 standard-setting bodies (IASB and FASB) have made efforts to reduce the differences between IFRS and U.S. GAAP. This process is referred to as convergence. GAAP 2 Principles: 1. Historical Cost Principle – based on the cost when you acquire the assets. 2. Fair Value Principle – based on the current market price of the assets. Measurement Principles GAAP uses one of two measurement principles: 1. Historical Cost Principle (Cost Principle) Companies record assets at their cost. This is true not only at the time the asset is purchased but also over the time the asset is held. Example: If Best Buy purchases land for $360,000, the company initially reports it in its accounting records at $360,000. But if by the end of the next 2 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY year, the fair value of the land has increased to $400,000, under historical cost principle, it continues to report the land at $360,000. 2. Fair Value Principle Assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability) Fair value information may be more useful than historical cost, for example, certain investment securities are reported at fair value because market price information is usually readily available for these types of assets. Which measurement principle to use: Selection of which principles to follow generally relates to trade-offs between relevance and faithfulness representation. o Relevance: financial information is capable of making a difference in a decision. o Faithfulness representation: the numbers and descriptions match what really existed or happened – they are factual. In general, most companies choose to use cost. Only in situations where assets are actively traded, such as investment securities, do companies apply the fair value principle extensively. Assumptions Two Main Assumptions for accounting process: 1. Monetary Unit Assumption Records events that can only be measured in money. (quantify economic events) Some relevant information is excluded. 2. Economic Entity Assumption Accounting records of an entity must be kept separate from its owner’s personal records and activities. Assumptions provide a foundation for the accounting process. Two main assumptions are: 1. Monetary Unit Assumption Definition: Requires companies to include in the accounting records only transaction data that can be expressed in money terms. This assumption enables accounting to quantify (measure) economic events. It prevents to include some relevant information in accounting records: o Health of a company’s owner o Quality of service o Morale of employees…etc. The reason is that companies cannot quantify this information in money terms although this information is important. It is vital to apply the historical cost principle. 2. Economic Entity Assumption Definition: Requires the activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities. o Owners must keep his/her personal living costs separate from the expenses of his/her business. Proprietorship – A business owned by one person. The owner is often the manager/operator of the business. The owner(proprietor) receives any profits, suffers any losses and is personally liable for all debts of the business. 3 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY There is no legal distinction between the business as an economic unit and the owner, but the accounting records of the business activities are kept separate from the personal records and activities of the owner. Partnership – A business owned by 2 or more persons associated as partners. In most respects a partnership is like a proprietorship except that more than one owner is involved. Each partner generally has unlimited personal liability for the debts of the partnership. For accounting purposes, the partnership transactions must be kept separate from the personal activities of the partners. Corporation – A business organized as a separate legal entity under state corporate law and having ownership divided into transferable shares of stock. The stockholders enjoy limited liability. Stockholders may transfer all or part of their ownership shares to other investors at any time, meaning the corporation enjoys an unlimited life. The Accounting Equation Basic Accounting Equation Basic accounting equation: A=L+E Assets = Liabilities + Stockholders’ Equity Assets: Resources a business owns. It can provide future services or benefits to the business – the company uses it for production, sales, or services. Assets Liabilities: (creditor claim) Claims against assets. They are payable. Persons/organizations that a business owes money are creditors. When a business is liquidated, creditor claims will be paid before ownership claims by law. Liabilities appear before stockholders’ equity in the basic accounting equation because they are paid first if a business is liquidated. This accounting equation applies to all economic entities regardless of size, nature of business, or form of business organization. Assets are resources a business owns. The common characteristic of assets is the capability to provide future services or benefits. A business uses its assets to carry activities such as production and sales, which can benefit the business and result in cash inflow (receipts) For example, delivery trucks, tables, chairs, cash register, oven, tableware, cash…etc. Liabilities Liabilities are claims against assets, such as existing debts and obligations. [payable] o A restaurant purchases foods materials on credit from suppliers. These obligations are called accounts payable. o A restaurant has a note payable to First National Bank for the money borrowed to purchase the delivery truck. 4 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY o Stockholders’ Equity: (ownership claim) Stockholder equity is the residual equity after creditor claims are subtracted from assets. (match the basic accounting equation A = L + E) On balance sheet, it consists of: 1. Common stock The total amount paid in by stockholders for the shares they purchase. 2. Retained earnings Determined by 3 items: 1) Revenue Increases in assets or decreases in liabilities by selling goods or performing services. Called by various names. 2) Expenses Cost of assets consumed, or service used to generate revenue. Will decrease stockholders’ equity (a decrease in assets or an increase in liabilities) Called by various names. 3) Dividends Distribution of cash or other assets to stockholders. Dividends reduce retained earnings but not an expense. Dividends are from net income (if a business decide to distribute it to owners) A restaurant has salaries and wages payable to employees and sales and real estate taxes payable to the local government. All these persons or entities to whom the restaurant owes money are its creditors. Creditors may legally force the liquidation of a business that does not pay its debts. In that case, the law requires that creditor claims be paid before ownership claims. Stockholders’ Equity The ownership claim on a corporation’s total assets is stockholders’ equity. The assets of a business are claimed by either creditors or stockholders. To find out what belongs to stockholders, we subtract creditors’ claims (the liabilities) from the assets. The remainder is the stockholders’ claim on the assets (=stockholders’ equity). It is often referred to as residual equity. The stockholders’ equity section of a corporation’s balance sheet generally consists of (1) common stock and (2) retained earnings. 1. Common Stock (股东的股票价值/股本) o A corporation may obtain funds by selling shares of stock to investors. Common stock is the term used to describe the total amount paid in by stockholders for the shares they purchase. o In some situations, accountants use different terms to refer: Owner’s equity – one owner (i.e., sole proprietorship) Owners’ equity – multiple owners (i.e., partnerships) Stockholders’ equity – ownership in corporations o Investments by stockholders (i.e., issue stock) do not represent revenues and are excluded in determining net income. Additional investments and the initial investment have the same effect on stockholders’ equity. 2. Retained Earnings o The retained earnings section of the balance sheet is determined by three items: revenues, expenses, and dividends. 1) Revenues: Revenues are the increases in assets or decreases in liabilities resulting from the sale of goods or the performance of services in the normal course of business. Revenues usually result in an increase in an asset. Revenue may be from different sources and are called various names depending on the nature of the business, i.e., sales, fees, services, commissions, interest, dividends, royalties, and rent. 2) Expenses: Expenses are the cost of assets consumed or services used in the process of generating revenue. Expenses are decreases in stockholders’ equity that result from operating the business. 5 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY Liabilities vs. Expenses: Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties. When you don’t pay for an expense, it becomes a liability. Say for instance you can’t afford to pay cash to purchase your monthly office supplies. You decide to take out a loan to pay for these expenses, which then becomes a liability. One of the main differences between expenses and liabilities are how they’re used to track the financial health of your business. Expenses show on your income statement to offset revenue. Liabilities show up on the balance sheet and offset assets. They are in many forms and called various names depending on type of asset consumed or service used, i.e., cost of ingredients, cost of beverage, wages expense, utilizes expense, telephone expense, delivery expense, supplies expense, rent expense, interest expense and property tax expense. 3) Dividends Net income represents an increase in net assets which are then available to distribute to stockholders. The distribution of cash or other assets to stockholders is called dividends. Dividends reduce retained earnings, but dividends are not an expense. A corporation first determines its revenues and expenses and then computes net income or net loss. If it has net income and decides it has no better use for that income, a corporation may decide to distribute a dividend to its owners (shareholders) o In summary, the main increases of stockholders’ equity are: Investment by stockholders Revenue by business operations Reduces in stockholders’ equity are: Expenses Dividends Analyzing Business Transactions The system of collecting and processing transaction data and communicating financial information to decision-makers is known as the accounting information system. Accounting information systems rely on a process referred to as the accounting cycle (below picture). The picture illustrates the steps companies follow each period to record transactions and eventually prepare financial statements. 6 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY Accounting Transactions Transactions are a business’s economic events recorded by accountants. External transactions: o Involve economic events between the company and some outside enterprise. o i.e., purchase equipment from a supplier, payment of monthly rent to landlord, sale of products to customers. Internal transactions: o Economic events that occur entirely within one company. o i.e., Use of cleaning supplies. Transaction Analysis Transaction 1. Investment of Cash by Stockholders. Ray and Barbara Neal start a smartphone app development company that they incorporate as Softbyte Inc. On September 1, 2020, they invest $15,000 cash in the business in exchange for $15,000 of common stock. Transaction 2. Purchase of Equipment for Cash. Softbyte Inc. purchases computer equipment for $7,000 cash. Transaction 3. Purchase of Supplies on Credit. Softbyte Inc. purchases headsets (and other computer accessories expected to last several months) for $1,600 from Mobile Solutions. Mobile Solutions agrees to allow Softbyte to pay this bill in October. This transaction is a purchase on account (a credit purchase). Transaction 4. Services Performed for Cash. Softbyte Inc. receives $1,200 cash from customers for app development services it has performed. Transaction 5. Purchase of Advertising on Credit. Softbyte Inc. receives a bill for $250 from the Daily News for advertising on its online website but postpones payment until a later date. * Retained Earnings decreases when Softbyte incurs the expense. Expenses do not have to be paid in cash at the time they are incurred. When Softbyte pays at a later date, the liability Accounts Payable will decrease and the asset Cash will decrease. The cost of advertising is an expense (rather than an asset) because Softbyte has used the benefits. Advertising Expense is included in determining net income. Transaction 6. Services Performed for Cash and Credit. Softbyte Inc. performs $3,500 of app development services for customers. The company receives cash of $1,500 from customers, and it bills the balance of $2,000 on account. Transaction 7. Payment of Expenses. Softbyte Inc. pays the following expenses in cash for September: office rent $600, salaries and wages of employees $900, and utilities $200. 7 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY Transaction 8. Payment of Accounts Payable. Softbyte Inc. pays its $250 Daily News bill in cash. (related to Transaction 5) Transaction 9. Receipt of Cash on Account. Softbyte Inc. receives $600 in cash from customers who had been billed for services (in Transaction 6). Transaction 10. Dividends. The corporation pays a dividend of $1,300 in cash to Ray and Barbara Neal, the stockholders of Softbyte Inc. 1. Each transaction must be analyzed in terms of its effect on: The three components of the basic accounting equation (assets, liabilities, and stockholders’ equity). Specific types (kinds) of items within each component (such as the asset Cash). 2. The two sides of the equation must always be equal. 3. The Common Stock and Retained Earnings columns indicate the causes of each change in the stockholders’ claim on assets. The Financial Statements Four financial statements: 1. Income statement (statement of operations, earning statement, profit and loss statement) A period of time Revenue – expenses -> net income/loss Does not include investment or dividends 2. Retained earnings statement A period of time Retained earnings are net income not paid out as dividends 3. Balance sheet A specific date Companies prepare four financial statements from the summarized accounting data: 1. An income statement presents the revenues and expenses and resulting net income or net loss for a specific period of time. The income statement reports the success or profitability of the company’s operations over a specific period of time. AKA statement of operations, earning statement, profit and loss statement. Revenue > Expenses -> net income; Revenue < Expenses -> net loss The income statement only includes revenue and expenses and does not include investment and dividend in measuring net income. 2. A retained earnings statement summarizes the changes in retained earnings for a specific period of time. 3. A balance sheet reports the assets, liabilities, and stockholders’ equity of a company at a specific date. The total assets must equal total liabilities and stockholders’ equity (A=L+E) 8 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY Assets = Liabilities Stockholders’ Equity 4. Cash flow statement A specific period Cash inflow or outflow and The balance is like a snapshot of the company’s financial condition at a specific moment in time (usually the month-end or year-end). 4. A statement of cash flows summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time. The statement of cash flows helps users determine if the company generates enough cash from operations to fund its investing activities. Income Statement: 1. Revenue with their details 2. Expenses with their details 3. get a net income/loss at the end Retained Earnings Statement: 1. Beginning retained earnings 2. Net income/loss (got from income statement) 3. Dividends paid Balance Sheet: (a specific date) 1. Assets with details 2. Liabilities and Equity Liabilities with details. Equity with common stock and retained earnings only (retained earning will be obtained from retained earnings statement) *There is no duplicated items showing on these statements. 9 Financial & Managerial Accounting, 3rd Edition, Jerry Weygandt, Paul Kimmel, Donald Kieso, WILEY 10