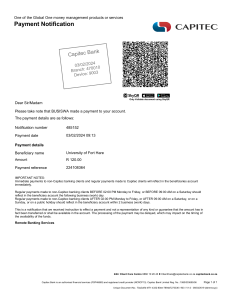

SBUSISO CELE Number / Tax invoice number 006 Date 21 May 2023 Account Num. 51042544358 Branch Code 632005 Customer VAT Registration Number Not Provided 1 PARK LANE WIERDA VALLEY SANDTON 2196 Internet Banking : Notice of Payment Dear Mr S CELE Confirmation of Payment:ELSABE DE LA REY Please be advised that Mr D Beemt has made a payment to your account as indicated below. Payment date: 21/05/23 Payment made by: S CELE Payment made to: ELSABE DE LA REY Beneficiary banking institute ABSA BANK Beneficiary account number: 9217160535 Bank account type: Cheque Bank branch code: 470010 The amount of: 6 000.00 Payment method: EFT PAYMENT/SAME DAY CLEARANCE Reference on beneficiary statement: PAYMENT/PRF1705232075 Please inform us should you wish to query an entry in this statement. Should we not hear from you, we will assume that you have received the statement and that it is correct. We subscribe to the Code of Banking Practice of the Banking Association of South Africa and, for unresolved disputes, support resolution through the Ombudsman for Banking Services. This document serves as a Tax Invoice for the purposes of the Value-Added Tax Act 89 of 1991. Please refer to www.tymebank.co.za for details about the TymeBank terms and conditions. ● Payment made on weekdays before 15:30 will be credited to the receiving bank account by midnight of the same day payments made on weekdays after 15:30 will be credited by midnight the following day. ● Payments made on Saturday, Sunday or public holiday will be credited to the account by midnight of the 1st following weekday If ● Immediate access of funds is subject to an hour's delay for 1st and 2nd payments to new beneficiaries/once-off payments. ● you need more information or assistance, please call Bank on 0866 85 95 05 or 27 (11) 772 8970 (International calls). Please inform us should you wish to query an entry in this statement. Should we not hear from you, we will assume that you have received the statement and that it is correct. We subscribe to the Code of Banking Practice of the Banking Association of South Africa and, for unresolved disputes, support resolution through the Ombudsman for Banking Services. This document serves as a Tax Invoice for the purposes of the Value-Added Tax Act 89 of 1991. Please refer to www.tymebank.co.za for details about the TymeBank terms and conditions.