Fundamental Accounting Principles, 17th Canadian Edition Volume 1, 17e Kermit Larson, Heidi Dieckmann, John Harris

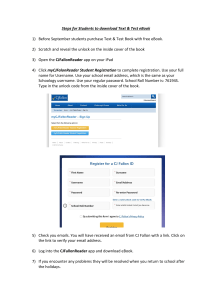

advertisement