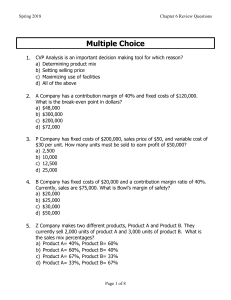

The following costs related to Wintertime Company for a relevant range of up to 20,000 units annually: Variable Costs: Direct materials Direct labor Manufacturing Overhead Selling and administrative Fixed Costs: Manufacturing overhead Selling and Administrative $2.50 0.75 1.25 1.50 $10,000 5,000 The selling price per unit of product is $15.00. At a sales volume of 15,000 units, what is the total profit for Wintertime Company? Select one: A. $225,000 B. $120,000 C. $130,000 D. $150,000 Salvador Company sells two products, as follows: Product Y Product Z Selling Price per Unit Variable Expense per Unit $300 $150 700 300 Fixed expenses total $500,000 annually. The expected sales mix in units is 60% for Product Y and 40% for Product Z. How much is Salvador Company's expected break-even sales in dollars? Select one: A. $920,000 B. $414,000 C. $555,882 D. $900,000 Which of the following would be classified as a fixed selling and administrative cost? Select one: A. Sales Commissions B. Depreciation on office equipment C. Depreciation on factory equipment D. Wages of production supervisor Sales mix refers to Select one: A. the portion of unit variable costs that are consumed by each product. B. the absolute portion of total variable costs consumed by each product. C. the relative portion of unit or dollar sales that are derived from each product. D. none of the above. The following information is available for Redwood Corporation for a sales volume of 500 stereo speakers for the past month: Sales Less: Variable expenses Contribution margin Less: Fixed expenses Net operating income Total $112,500 40,000 $ 72,500 $ 17,500 $ 55,000 Per Unit $225 80 $145 If sales increase by $51,750, net income will increase by what amount? Select one: A. $22,000 B. $20,000 C. $30,000 D. $33,350 Adam Company sells one product at a price of $50 per unit. Variable expenses are 40 percent of sales, and fixed expenses are $50,000. The sales dollars level required to break even are: Select one: A. $41,667 B. $83,333 C. $ 2,500 D. $10,000 In a cost-volume profit graph Select one: A. the total revenue line is plotted above the total cost line. B. the slope of the total revenues line is the contribution margin per unit. C. the total costs line normally begins at zero. D. the slope of the total cost line is dependent on the variable cost per unit. Peak Company sells three different products that are similar, but are differentiated by various product features. Budgeted sales by product and in total for the coming year are shown below: Percentage of total sales Sales Less: Variable costs Contribution margin Less: Fixed expenses Net operating income Standard 48% $120,000 36,000 $ 84,000 Product Deluxe 20% $50,000 40,000 $10,000 Premium 32% $80,000 44,000 $36,000 Total 100% $250,000 120,000 $130,000 $117,000 $ 13,000 The break-even point in sales dollars for Peak Company is: Select one: A. $449,231 B. $500,000 C. $225,000 D. $250,000 The contribution margin ratio is Select one: A. the percentage difference between sales and cost of goods sold. B. the portion (or percent) of revenues available for covering fixed costs and providing a profit. C. the difference between price and variable cost per unit. D. the percentage difference between total revenues and total costs. Which of the following is an assumption used in cost-volume-profit analysis? Select one: A. All costs are classified as fixed or variable. B. The total cost function is linear. C. The total revenue function is linear. D. All of the above.