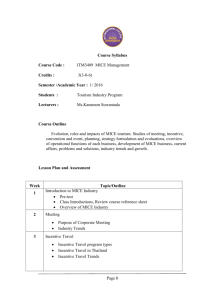

Introduction to MICE Industry

Supported by:

Compiled by:

Property and copyrighted by:

Foreword

Introduction to MICE industry

MICE, short for Meetings, Incentive Travels, Conventions, and Exhibitions, is one of the fastest

growing industries in Thailand and contributes enormously to the travel and tourism industry

which is one of the country’s most prominent sectors. After recording double-digit growth in

consecutive years, the MICE industry, in 2011, generated more than 53,000 million baht in value

for the Thai economy. It is clearly an industry that cannot be overlooked.

Thailand Convention and Exhibition Bureau (TCEB), a public organization which is a core

facilitator of Thailand’s MICE industry, has recognized an opportunity for further improvement

via enhancing the capabilities of people currently in the industry as well as those young

individuals with potential to enter the industry. It is obvious to both Thailand Convention and

Exhibition Bureau (TCEB) and private sector players in the industry that undergraduate students

are the building blocks of the future MICE industry. Reaching out to these students thus can

enhance the competitive edge of Thailand’s MICE industry ahead of the consolidation of

ASEAN member countries into the ASEAN Economic Community (AEC) in 2015.

Thailand Convention and Exhibition Bureau (TCEB), the Thailand Incentive and Convention

Association (TICA), the Thai Exhibition Association (TEA), and the Business of Creative and Event

Management Association in collaboration with Sasin Graduate Institute of Business Administration of Chulalongkorn University, Thailand’s first and only internationally accredited business

school through Sasin Management consulting (SMC), have together developed this textbook,

Introduction to MICE Industry, for undergraduate study in Thailand. SMC is a valuable

candidate to take part in increasing the industry’s competitive edge owing to its in-depth

understanding and knowledge of the MICE industry and previous collaboration with Thailand

Convention and Exhibition Bureau (TCEB) in developing a 5-year corporate strategy and an

action plan.

By reaching out to undergraduates with a solid foundation of knowledge and information, this

textbook represents one of the first comprehensive textbooks about the MICE industry and will

only strengthen Thailand’s position as a leader in Asia.

1

Acknowledgements

This book is a project funded by Thailand Convention and Exhibition Bureau (TCEB). The book

is, in many ways, the product of collaborative efforts from many individuals and organizations.

Thailand Convention and Exhibition Bureau (TCEB) would like take this opportunity to express

our greatest gratitude to the people who have been instrumental in the successful completion

of this book.

First and foremost, the president of Thailand Convention and Exhibition Bureau (TCEB)

and Ms. Nichapa Yoswee, Director of MICE Capabilities Development Department,

for their visions and beliefs in the development of the MICE industry especially through

an education for the next generation entering the industry. Thailand Convention and

Exhibition Bureau (TCEB) is also grateful to our team consisting of Ms. Nuanrumpa

Ngambanharn, Mr. Takerngsak Chaiyakarn, Ms. Arisa Anarnkaporn and Ms. Areerat

Montreepreechachi. This book would not have been possible without their immense

help and support.

Significant contributions from the MICE101 Course Board. This includes Mr. Sumate

Sudasna, President of Thailand Incentive and Convention Association (TICA);

Mr. Pravit Sribanditmongkol, President of Thai Exhibition Association (TEA);

Mr. Sermkhun Kunawong, Chairman of Business of Creative and Event Management

Association (EMA); Ms. ChooLeng Goh, Chairperson Services Development

Committee of Thailand Incentive and Convention Association (TICA) ; Mr. Panithan

Bumrasarinpai, Co-Chairperson, Services Development Committee of Thailand

Incentive and Convention Association (TICA); Ms. Kritsanee Srisatin, Services Development Committee Member of Thailand Incentive and Convention Association (TICA) ;

Ms. Prapee Buri, Vice President & Treasurer of Thai Exhibition Association (TEA);

Ms. Premporn Saisaengchan, Chaiperson-Education and Development Committee of

Thai Exhibition Association (TEA); Ms. Sumalee Noppakao, Chairperson Marketing and

Public Relations of Thai Exhibition Association (TEA); Ms. Woraporn Treesirikasem,

Committee of Business of Creative and Event Management Association (EMA);

Mr. Ittipol Sureerat, Committee of Business of Creative and Event Management

Association (EMA); and Ms. Kingnabha Amratisha, Committee of Business of Creative

and Event Management Association (EMA).

Their support and valuable comments dramatically improved the manuscript and

content of this textbook. Without them lending their collective experience and time,

this book would not have the relevance to real business that was wished for.

2

Introduction to MICE industry

Introduction to MICE industry

Special Thanks to team from Sasin Management Consulting (SMC) unit of Sasin Graduate Institute of Business Administration of Chulalongkorn University, Thailand’s first and

only internationally accredited business school. Sasin Management Consulting (SMC)

has taken part in developing this textbook through hours of researching and analyzing vast arrays of data in MICE industry then formulate them into a comprehensive

text in both languages, English and Thai.

There are many people to whom our thanks are due. Thailand Convention and Exhibition Bureau (TCEB) owns a great debt to many other who shared their experience,

gave us time to interview and reviewed this book. This project has been an incredible

learning experience for all of us.

Thailand Convention and Exhibition Bureau (TCEB)

3

Content

Chapter 1 Introduction to MICE Industry

Business Travel and Tourism

Meetings, Incentive Travels, Conventions and Exhibitions (MICE)

Economic and Social Impact

Direct Contributions

Indirect contribution

Negative Impacts

Current MICE Industry

Meetings

Incentive Travels

Conventions

Exhibitions

Factors Influencing Future MICE Industry

Economic Downturn

Technology

Sustainability and Green Meetings

Key Stakeholder Introduction

Chapter 2 Meetings

Definition

Purpose of Corporate Meetings

Goals and Objectives of Corporate Meetings

Meetings Industry Value

Industry Trends

Corporate Meeting Categories

By Objective

By Geographic Region

By Agenda

By Type of Corporation

Corporate Meetings Value in Thailand

Corporate Meetings Value Chain

Key Stakeholders in Corporate Meeting Industry

Chapter 3 Incentive Travels

Definition and Concept Clarifications

Incentive Travel Programs Types

Closed-ended Programs

Open-ended Programs

Incentive Travels Importance

Key Success Factors

Incentive Travel Industry Value

Incentive Travels in Thailand

Thailand Statistics

Top Destinations in Thailand

Incentive Travel Trends

Incentive Travel Value Chain

Key Stakeholders in Incentive Travel Industry

4

Introduction to MICE industry

8

9

10

16

22

25

29

34

35

36

42

39

37

44

46

50

54

55

56

57

59

61

62

67

68

70

Introduction to MICE industry

Chapter 4 Conventions

Terminology

Convention Industry History

Recent Conventions Trends

Convention Trends

Conventions Categorization and Measurement

Conventions in Thailand

Convention Value Chain

Key Stakeholders in Convention Industry

Chapter 5 Exhibitions

Definition

Exhibitions Purposes and Objectives

Evolvement and Significance of Exhibitions

Exhibitions in the Past

Modern Day Exhibitions

Global Exhibitions Statistics

Exhibitions Outlook

Exhibitions Categories

Exhibitions in Thailand

Exhibition Industry in Thailand

New Initiatives in the Thai Exhibition Industry

Exhibition Value Chain

Key Stakeholdersin Exhibition Industry

Chapter 6 Organizer and Attendee Decision Making Criteria

Destination Selection

Meetings and Incentive Travels Decision Criteria

Convention Organizer (PCO) Decision Criteria

Convention Attendees’ Decision Criteria

Exhibition Organizer Decision Criteria

Exhibition Attendee Decision Criteria

Service Providers Selection

Thailand MICE Brand Study by TCEB

Chapter 7 Special Events

Definition

Characteristics

Leisure Events

Personal Events

Cultural Events

Organizational Events

Special Event Component

Social and Economic Impact

Social Impact

Economic Impact

Roles and Importance ofEvent Management Companies (EMCs)

Event Planning

Preparing and Operating Event

Marketing the Event

Evaluating Events

74

75

78

79

85

76

89

90

94

100

101

102

104

106

109

116

119

122

128

136

137

151

153

154

155

155

159

160

164

5

Content

Chapter 8 MICE Event Management

Project Management Importance

MICE Event Management with the PMBOK Framework

1. Project Initiation

2. Project Planning

3. Project Execution

4. Project Monitoring and Control

5. Project Closing

Chapter 9 Venue Management

Venue Types

Hotels & Resorts

Convention/Exhibition Centers

Multi-purpose Facilities

Other Venues

International Venues

Venues in Thailand

Compositions of Venues Inducing Venue Selection Decision

Venue Size

Venue Location

Venue Layout

Venue Infrastructure

Transportation Access

Venue Management

Chapter 10 The MICE Industry Logistics

171

172

192

193

199

202

208

221

222

Logistics and Transportation

223

Transportation Modes

224

Air Transport

Land Transport

Water Transport

MICE Industry Logistics

Related Stakeholders in Logistics and Transportation

Chapter 11 Service Providers in MICE Industry

Key Stakeholders’ Roles and Responsibilities

Travel Management Company (TMC)

Destination Management Company (DMC)

Incentive Organization / Incentive House

Professional Convention Organizer (PCO)

Professional Exhibition Organizer (PEO)

Convention and Visitors Bureau (CVB)

Roles and responsibilities of other service providers

Supporting Governmental Organizations Roles and Responsibilities

6

170

Introduction to MICE industry

228

232

238

239

242

247

Introduction to MICE industry

Chapter 12 Standards in MICE Industry

International Organization for Standardization (ISO)

ISO 20121/BS 8901

ISO 50001: Energy Management Systems

ISO 22000: Food Safety Management System

ISO 25639: Exhibitions, Shows, Fairs and Conventions

ISO 14000: Environment Management System

National-level Standards and Guidelines

TISI 22300 MICE Security Management Standard (MSMS)

Green Meetings Guideline (TCEB)

Quality Tourism Services (QTS)

The Singapore Service STAR (STB)

European Training Certificate - Access for

All in the Tourism Sector (ETCAATS)

T-QUAL Accreditations (Australia)

Standards and Guidelines

APEX/ASTM Environmentally Sustainable Meeting Standard

GRI Sustainability Reporting Guidelines

Destination Marketing Accreditation Program (DMAP)

Certified Meeting Professionals (CMP)

Exhibition Management Degree (EMD)

Standards Guiding Sustainable Event Management

Planner Perspectives

Chapter 13 Ethics for MICE

Negative Impact

Ethics

Work Ethically

MICE Industry Code of Ethics and Code of Conduct

Preferred Attitudes working in the MICE Industry

Consumer Rights and Consumer Protection

Case Studies

References

254

255

263

267

278

279

283

286

290

7

Chapter 1

Introduction to

MICE Industry

8

Introduction to MICE industry

Business Travel and Tourism

Tourism is “the activities of persons traveling to and staying in places outside their usual environment

for not more than one consecutive year for leisure, business and other purposes” (International

Tourism: a Global Perspective).

Rob Davidson’s groundbreaking book Business Travel defines business travel and tourism as:

Business tourism is concerned with people travelling for purposes which are

related to their work. As such it represents one of the oldest forms of tourism,

man having travelled for this purpose of trade since very early times.

(Davidson, 1994)

The terms business travel and business tourism are commonly used interchangeably due to an

overlap in their definitions. Business tourism offers a broader definition of the total business-travel

experience.

On the other hand, business travel seems to include only the trip itself from one place to another, which may include only travelling to work and not tourism activities. In this textbook, business

tourism is the main term employed to convey the idea of both business travel and tourism.

Business tourism was outlined in John Swarbrooke and Susan Horner’s Business Travel and Tourism

as a broad term that encompasses different aspects:

Daily commute to work

Individual business trips

Government employee travel

Delivering goods for customers

Moving goods to market

Short-term employment migration

Off-site training courses

Incentive travel

International congresses and conferences

Local, regional and national meetings

Exhibition and trade fairs

Spending in business tourism has gained momentum over the past decade and continues to

show a potential to grow into the future. Illustrated in Figure 1-1, business tourism trends have

shown an overall growth since 2006 with a 1.5 per cent compounded annual growth rate

despite a slump in 2009 due to the financial crisis in the US.

9

Figure 1-1: Global Business Traveling Spending

950

US Billion Dollars

909

900

875

838

850

800

791

780

750

700

2006

2007

2008

2009

2010

Source : World Travel and Tourism Council

Meetings, Incentive Travels,

Conventions and Exhibitions (M-I-C-E)

The origin of meetings is traceable back to the beginning of recorded history and has ranged

from discussions about hunting plans to planning wartime defenses. Since then, its development

has mainly been possible through the establishment of trade, fraternal or religious associations

and advancements in transportation systems.

The growth in hotel & convention facilities, the emergence of professional meeting organizers

and the rise of central associations in promoting cooperation among industry players grew

hand-in-hand with the growing popularity of this industry as more and more players emerged

to meet industry needs and benefit from the opportunities it has to offer.

In the US, the rise of association activities in the early 1900s led to the creation of its first convention

bureau. Today, the MICE industry has grown to become one of most important contributors to

travel and tourism industry revenue and national GDP throughout the world.

‘MICE’ has a number of definitions varying on the source and, in fact, proves to be somewhat

problematic when examining the various ideas originating from varying sources. In the following

paragraphs, each component will be examined before providing an all-encompassing definition.

10

Introduction to MICE industry

Meetings (M-I-C-E)

A meeting is the coming together of a group of people to discuss or exchange information.

In some regions, what might be seen as a meeting may be seen as a small-scale conference

in another.

Source : Thailand Convention and Exhibition Bureau (TCEB)

The Convention Industry Council (CIC) as a collective body of professionals involved in the

meetings, conventions and exhibitions industry has developed common practices

(APEX Accepted Practices) to set standards and to promote efficiency within the industry.

In their collective glossary, the following definition is offered regarding meetings.

An event where the primary activity of the attendees is to attend educational

sessions, participate in meetings or discussions, socialize, or attend other

organized events. There is no exhibit component to this event. (Convention

Industry Council, APEX Industry Glossary)

The International Association of Professional Congress Organizers (IAPCO), an organization

representing professional organizers, meeting planners and managers of international and

national congresses, conventions and special events, has also compiled a list of terms and

definitions from within the industry.

A meeting is a general term indicating the coming together of a number of

people in one place, to confer or carry out a particular activity. Frequency:

can be on an ad-hoc basis or according to a set pattern, as for instance annual general meetings, committee meetings … (IAPCO, Meetings Industry

Terminology)

11

A meeting, in this sense, has also been referred to as a corporate meeting with a generic

definition provided in the International Encyclopedia of Hospitality Management based

on The International Dictionary of Event Management by Goldblattb and Nelson (2001),

A corporate meeting is an officially sanctioned and required meeting for

employees of a specific corporation… often held off-site and required employees

to travel to the meeting. Expenses associated with corporate meetings are paid

by the corporation. Corporate meetings differ from association meetings in that

attendance is required. (Pizam, 2010)

Incentive Travels (M-I-C-E)

Incentive travel includes leisure trips emphasizing pleasure and excitement and may appear to

have little or no connection to business. However, when offered to employees, they become

incentive travel. Often associated with hard work, business objectives and corporate effectiveness;

however, unlike other types or reasons to travel employees on incentive travel do not need to

pay as the company will do so on their behalf.

The Society of Incentive & Travel Executives (SITE) offers one of the most cited definitions for

incentive travel:

Source : Thailand Convention and Exhibition Bureau (TCEB)

12

Introduction to MICE industry

Incentive travel is a global management tool that uses an exceptional travel

experience to motivate and/or recognize participants for increased levels of

performance in support of the organizational goal (SITE)

Incentive travel destinations and itinerary

are usually pre-determined with the

campaign itself designed specifically to

be an ‘incentive’ to perform. Clear

objectives, measurement and a

qualification process are planned and

agreed upon among those participating

and top management.

Often these trips are given as recognition

for employee effort and performance

and, as such, are considered a reward,

not an incentive. Although theoretically a distinction in definition exists between incentives and

rewards, the two terms are frequently employed interchangeably. For example, firms may use

the term ‘incentive trip’ while in reality the trip is a ‘reward.’

Conventions (M-I-C-E)

The term ‘convention’ is

frequently employed

interchangeably with other

terms such as ‘conference’ or

‘congress’. Different interpretations

given to these three terms have

blurred their definitions. In addition, while ‘conference’ may

be a preferred term in a certain

region, other regions may prefer

to use ‘convention’ or ‘congress.’ Some industry experts

define conventions as a group

of people in the same industry

but not from the same organization. There is no relationship to

the number of attendees.

13

An event where the primary activity of the attendees is to attend educational

sessions, participate in meetings/discussions, socialize, or attend other organized

events. There is a secondary exhibit (exhibition) component. (Convention Industry

Council, APEX Industry Glossary)

Exhibitions (M-I-C-E)

According to Exhibitions Liaison Council (1995), exhibitions can generally be portrayed as

“presentations of products and services to an invited audience with the object of inducing

a sale or informing the visitors”.

Exhibitions are an effective marketing tool for many firms as they offer three-dimensional product

advertising in that goods can be seen, touched and assessed. Participating in exhibitions can

boost sales and allow exhibitors to present products or services directly to the public who may

be both consumers and business owners within the same industry.

The general definition for ‘exhibition’ by The Global Association of the Exhibition Industry (UFI),

an association of trade show organizers, fairground owners, national and international associations

of the exhibition industry and its partners, states that

Source : Thailand Convention and Exhibition Bureau (TCEB)

Exhibitions are market events of a specific duration, held at intervals, at which

a large number of companies present a representative product range of one or

more industry sectors and sell it or provide information about it for the purposes

of sales promotion. Exhibitions predominantly attract the general public. (UFI)

14

Introduction to MICE industry

Business Events

‘Business event’ is another term for MICE and

has been used primarily in Australia to cover a

wide array of meanings for this industry.

Any public or private activity consisting of a minimum of 15 persons with

a common interest or vocation held in a specific venue or venues and hosted

by an organization (or organizations). This may include (but not limited to):

conferences, conventions, symposia, congresses, incentive group events,

marketing events, special celebrations, seminar, courses, public or trade shows,

product launches, exhibitions, company general meetings, corporate retreats,

study tours or training programs.

Meetings

The word meeting used in this sense does not represent the ‘M’ in ‘M-I-C-E’. ‘Meetings’ in this

sense represent a collective meaning for the MICE industry corresponding to a widely held

view among professionals that all MICE activities share a common trait, that is, they describe an

opportunity to ‘meet.’ According to the World Travel Organization (UNWTO), the International

Congress and Conferences Association (ICCA), and Meeting Professionals International (MPI),

meetings are defined as:

Activities based on the organization, promotion, sales and delivery of meetings

and events; products and services that include corporate, association and

government meetings, corporate incentives, seminars, congresses, conferences,

conventions events, exhibitions and fairs.

Keeping in mind minor definition discrepancies and although business events, meetings and

MICE are increasingly used interchangeably, in this text, the term, MICE, will be used as the core

term for this industry.

15

Economic and Social Impact

The MICE industry has grown and has become a key contributor to many economies and as

such, it is important to explore, in detail, the influence it has on both society and the economy.

Direct Contributions

Direct Revenue

The MICE industry or ‘business tourism’, is known to generate higher spending per head compared to leisure tourism. Realizing this benefit to their economy, many countries have geared

up development to support MICE industry growth and to reap the benefits as money spent

by delegates helps the economy by distributing revenue to service providers including hotels,

transportation contractors, convention & exhibition venues, event management companies

and tour agents. Furthermore, the industry guarantees employment for those working in this

sector.

Source : Thailand Convention and Exhibition Bureau (TCEB)

A full-scale research conducted in the US by the Convention Industry Council (CIC), provides a

general idea of the significant role played by the MICE industry. The findings include revenue

streams for MICE service providers and employment statuses in one of the largest MICE industries. Prior to making any estimate as to what MICE may contribute to the US economy, the

report attempted to define each term for proper data collection and results measurement.

16

Introduction to MICE industry

The Economic Significance of Meetings to the US Economy released by CIC defined the meeting industry in accordance with a previous research framework published by the United Nations

World Tourism Organization (UNWTO). Undertaken in collaboration with the International Congress

and Convention Association (ICCA), Affiliate Members Reed Travel Exhibitions and Meeting

Professionals International (MPI) Meetings, the report suggested that

… conventions, conferences, congresses, trade shows and exhibitions, incentive events,

corporate & business meetings and other meetings that meet an aforementioned

criteria. Meetings, in this context, excluded social and recreation activities, certain

educational and political activities and gatherings for sales of goods/services such as

consumer shows.

Direct spending, defined as “spending within the US economy from purchases of goods and

services attributable to the activity from each MICE trip” is the first building block in understanding

its economic significance. In 2009, with almost 1.8 million meetings taking place in the US and

an estimated 205 million participants, total spending by delegates was valued at USD 907M of

which direct sending represented over USD 263M.

According to this research, only 43% of this direct spending went to travel and tourism commodities - food & beverage and air transportation. The remainder, 57%, went to meeting-related

expenses including venue rental, meeting planning and production.

Seasonality Control and Employment

Apart from direct revenue to service providers and labor income, many observations also conclude that the MICE industry generally reduces seasonality within the overall travel and tourism

industry, as MICE volume usually occurs during the off-peak season. An ICCA statistical report

on international association meetings, by far the most useful information source for the global

convention industry, showed that international association meetings were mostly held in the low

season.

The exhibition industry’s global association (UFI) a well-accepted association who represents

and provides support to the exhibition industry, another MICE industry component, also

concluded the same in that “exhibitions combat seasonality as they are generally held in

low … seasons.”

17

In 2010, of 9,030 recorded meetings, over 30% of all global international association meetings

were held from April to June with another influx in September easing off until November

representing another 38% of the meetings held that year.

Considering seasonality in the MICE sector, service providers, especially those who can

accommodate both leisure travel programs as well as MICE events, will be able to manage

their revenue streams. Resource planning will also be easier as they can plan according to a

balanced year-round demand for both leisure and business trips.

The benefit also moves downstream to suppliers who can plan to have inventories available

during the low season as well. Continuous demand for service providers within the MICE industry

can simplify resource planning and lead to the creation and support of permanent positions

throughout the year rather than just adding part-time jobs during the high season.

Indirect contribution

Indirect contributions are intangible and include foreign direct investment, partnership

opportunities, innovation and technological advancements and knowledge dissemination.

Striving for economic development, effective modernization and employment creation,

emerging countries are attempting to attract more foreign direct investment (FDI) by

liberalizing investment policies and tax schemes related to core industrial sectors along with

improving logistics, supporting infrastructure and expanding human resource capability.

Once an investment turns into products and services ready to be promoted and marketed,

hosting exhibitions is one medium that can channel products and services to potential buyers

on a regional and global scale.

Attending conventions can also expand the partnership pool for delegates who usually come

from the same industry. Ultimately, MICE, or in particular conventions and exhibitions, are a

means to generate sales, to increase profitability, to build long-term partnerships, to form

strategic alliances or to increase foreign direct investment.

Survey results of business travelers conducted by the World Travel and Tourism Council (WTTC) was

published in Business tourism: a catalyst for economic performance. This survey distinguished

different purposes for business travel including work on client sites, internal company meetings,

supplier or partner meetings, sales or marketing meetings, external conferences & conventions,

external trade shows & exhibitions and incentive travel.

18

Introduction to MICE industry

The WTTC survey concluded

that important benefits from

business travel include an ability

to increase sales & profit, develop

partnerships and enhance

innovation. From responses

provided by business travelers

surveyed, approximately 50%

stated that face-to-face meetings

convert into sales. Moreover, on

average, 15% of their annual

sales depended on trade shows

Source : Thailand Convention and Exhibition Bureau (TCEB)

and exhibitions.

Realizing that relationships are important to company performance, business travelers seek

opportunities to create and retain business partnerships through attendance at conventions

and exhibitions. According to the WTTC survey, 72% of global business travelers found conferences

and conventions have a ‘significant’ or ‘high’ impact in developing partnerships.

Well over half of the respondents also indicated that meetings with partners was ‘very’ or ‘extremely’

important in expanding or investing in new markets and managing company supply chains.

Furthermore, 64% of those participating in trade shows believed it had a ‘significant’ impact on

building partnerships, professional development and career development.

Countries attempting to promote the MICE industry must strive to develop or at least encourage

necessary development to keep national technological offerings on par with global standards.

Trends and needs must be thoroughly identified to promote direct development where most

needed. Technological trends within the industry, such as social media, virtual events and

Wi-Fi coverage need to be incorporated into plans. MICE service providers must improve their

services to meet what MICE travelers are seeking. In short, they must improve their effectiveness

through innovation and technology to tap into this ever-changing market.

MICE events have proven to be very useful in bringing new ideas, knowledge and insights to a

country, service providers and attendees. The MICE industry has become a channel for information

or knowledge to spread wider and faster, especially in this era of globalization. Local providers

get to learn new and innovative approaches in handling MICE events. In turn, because of an

increased exposure to foreign service-providers not only can they increase business opportunities

they can also enjoy a chance to share and exchange ideas.

19

Likewise, convention or exhibition attendees can create new business partnerships and increase

their industry knowledge and professional development through meeting with other delegates,

buyers or sellers. Moreover, convention themes, often based on concerns or latest innovations

within a particular industry, are useful in enhancing the capability of a community to provide a

solution for an issue being faced.

The MICE industry can influence local business climate, which in turn, can directly influence the

strategic direction of an industry. Moreover, growth in the industry can also help to improve local

business in procurement and manufacturing standards. Once policy is established to support

the local MICE industry, infrastructure development will eventually follow including additional

venue investment, sophisticated and cheaper logistics systems and tax incentives.

Apart from the benefits mentioned above, the MICE industry also provides exposure to local

ways of doing things, and creates

cultural understanding of the host’s

domestic culture.

Negative Impact

Although there are numerous

benefits associated with the industry,

its negative impact on the

environment must also be considered.

Pollution and greenhouse gas

emissions trail after every delegate

and the products shipped to meeting

Source : Thailand Convention and Exhibition Bureau (TCEB)

venues or exhibition halls. Hotels and

meeting facilities are often forced to leave behind piles of waste consisting of plastic, paper,

food, drink related waste, toiletries, along with unwanted or unused promotional giveaways.

In response to an enhanced awareness of environmental conservation, many countries have

started to offer niche tourism programs, ecotourism, both as traditional leisure tourism programs

or as a supplement to MICE programs. Defined as “a program that provides a first-hand active

experience of a place, ecotourism provides an educational experience that can help to develops

visitor understanding and appreciation of the place visited and promotes appropriate behavior

and a conservation ethic”, employing various strategies to minimize negative impact and maximize

local economic returns.” (Bottril & Pearce, 1993; Scace, 1995)

20

Introduction to MICE industry

Within the MICE industry, a number of convention bureaus, corporations and MICE service

providers have started to take action in creating a new industrial norm with ‘green or sustainable’

meetings becoming a major change in terms of practices. According to the Convention Industry

Council (CIC), a collective body of firms associated with the meetings, conventions, exhibitions

and events industry, green or sustainable meetings is when

Sustainability takes a triple bottom line approach that seeks to balance the

social, environmental and economic concerns against business needs

Many organizations have taken a stand in raising awareness among MICE travelers, setting the

standard for hosting MICE events together with educating service providers. For instance, the

Convention Industry Council (CIC) set standards and minimum best practices for each type of

service providers in the industry.

The Green Meeting Industry Council (GMIC), another important source of knowledge and expertise

in sustainable meetings, aims to educate, promote and standardize practices associated with

sustainable meetings. Other major organizations including Meeting Professionals International

(MPI) and International Association of Convention and Visitors Bureaus (IACVB) are also dedicating

their resources to stress the importance of sustainable meetings.

Current MICE Industry

This section provides a global overview of the MICE industry and provides an overview of where

the industry is in terms of value and volume.

Meetings (M-I-C-E)

The International Association of Professional Congress Organizers (IAPCO) conducted research

based on their 110 members to measure volume and trends in the corporate meeting industry.

The findings, limited to corporate meetings organized by its members, mainly took place in

Europe. In 2010, IAPCO members organized 3,454 corporate meetings both domestically and

internationally and in 2009, 3,140 meetings.

21

Incentive Travel (M-I-C-E)

The Market for Incentive Travel, Motivational Meetings and Special Events published by the

Incentive Research Foundation offers some insight into the size of the industry. In 2006, the market

for incentive travel spending was valued at USD 13.4B. Most executives acknowledged the

importance of incentive travel seeing benefits in terms of increased efficiency or an improved

bottom line.

About 85% of management surveyed perceived incentive travel as an investment rather than a

cost with an annual budget set aside for incentive travel averaging USD 164,000 per company

surveyed. Moreover, three-quarters of the companies surveyed, reported an involvement in

incentive travel in the USD 100,000 to USD 500,000 range.

Driving our Future: the top 11 incentive trends for 2011 published by IRF mentioned that confidence

in incentive travel remains intact, as many studies have stressed its power to drive employee

engagement and promote company performance; yet fragile since it can crumble as soon as

the market is hit by negative news.

Many who are optimistic about the market believe corporations will adapt to budget constraints

and will eventually work incentive plans around existing funding. In addition, as Corporate

Social Responsibility (CSR) is becoming widely accepted and added as an element to many

incentive programs, travelers expect more in terms of unique experiences and a reduction in

lavishness and therefore, to some extent, help to stretch incentive budgets.

Conventions (M-I-C-E)

Data concerning conventions is published annually by the International Congress and Conventions

Association (ICCA) and the Union of International Association (UIA). While assumptions and

methodology in collecting data vary across organizations, data collected by ICCA best illustrates

the current state of the convention industry.

It is important to point out that ICCA data takes into account international meetings segmented

into corporate or association meetings. International corporate meetings consist of internal

and/or external meetings. On the other hand, association meetings, sometimes called conventions,

include international governmental association meetings and international non-governmental

meetings (association meetings). ICCA data collection criteria are meetings that occur on a

regular basis, attract a minimum of 50 participants and rotate between at least three countries.

It can be seen that the international association meetings industry has enjoyed an upward

22

Introduction to MICE industry

trend (approximately 3% compounded annually) even though it faced a severe drop in 2009

due to the economic downturn in the US.

Figure 1-3 highlights the fact that the majority, albeit a small one, of major association meetings

Figure 1-2: International Association Meetings (2006-2010)

9200

9,120

9000

8,715

8800

8,586

8600

8400

8200

8,294

8,094

8000

7800

7600

7400

2007

2006

2008

2009

2010

Year

Source : ICCA Statistical Report 2006-2010

Figure 1-3: International Association Meetings by Continent (2010)

North America

11%

Other

16%

Europe

54%

Asia

19%

Source : ICCA Statistical Report 2006-2010

23

are held in Europe, which represents 54% of the total number of association meetings held globally in 2010. Asia ranked second with 19% followed by Oceania, Latin America and Africa.

Exhibitions (M-I-C-E)

Within the exhibition industry, the best-known and most reliable information source is the Global

Association of the Exhibition Industry (UFI), an association of trade show organizers, fairground

owners, national and international associations of the exhibition industry and its partners. UFI

published statistical data offers an insight into the global supply in this industry. Note that UFI

cross checks with press, media, members, national association and key operators within each

country to verify data validity.

Figure 1-4: Global Share of Exhibition Space (Million square meters)

35

30

31.2

27.6

25

20

15

10

5

0

2006

North America

2010

Europe

Source : UFI Global exhibition industry statistics

Others include Oceania, Middle East, Africa and Latin America

24

Introduction to MICE industry

Asia

Other

Growth in global exhibition space has been quite significant, expanding from 27.6 to 31.2 million

square meters. By exhibition space, UFI refers to “the amount of gross exhibition space in the

venue regularly marketed and rented/licensed /used for exhibitions, trade fairs or consumer/

public shows.” This research was completed before the end of 2010, therefore; the 2010 figure is

an estimated value.

Europe held the largest share of exhibition space available growing from 14.3 million square

meters in 2006 to approximately 16.2 in 2010. In contrast, Asia, which had only 3.9 million square

meters in 2006, had grown to around 4.6 million in 2010. Net exhibition space in Asia experienced

a compound annual growth rate of 20% compared to 13% in Europe thereby pointing out the

significant increase in supply within Asia, a promising sign of what Asia can offer in the future.

Factors Influencing Future MICE Industry

Economic Downturn

During the past few years, both the US and EU economies have been experiencing a persistent

global economic slowdown that has had a direct impact on every facet of the corporate world

and associations.

Spending on scheduled meetings is now used to its fullest benefit through negotiations for the

best deal combinations, by avoiding costly amenities and by offering less lavish meetings.

International association meetingshave also seen a slump in terms meeting numbers since the

economic downturn started in 2008. Incentive travelers are also willing to undergo local

experiences rather than partake in extravagant programs. In short, costs have become a

leading priority when organizing MICE events.

Corporate and association meetings have started to rotate around the same region reflecting

a demand for more short-hauls trips. Association meeting attendees are now seeking enhanced

educational and informative content with less interruption from non-necessities. Future Watch

2011 survey by MPI pointed out an emerging trend in which corporate meetings will be held in

the same country or if truly necessary, the same continent.

Return on investment (ROI), measuring benefit against meeting cost, is now required for most

meetings. However, as no standardized method has been accepted, efforts are underway

to standardize ROI calculation for each meeting type. This overriding concern about ROI has

become prevalent leading to the elimination of unnecessary activities when planning meetings

and cost reduction for both planners and attendees. Increasingly meetings must have a direct

bearing on company performance or meet specified association purposes.

25

Technology

Video Conferences and Virtual Events

As budgets become tighter, incorporating technology that allow for video conferencing and

virtual meetings are increasingly seen as a cost effective option when holding MICE events.

In an effort to cut costs, but maintain a personal feel, the industry is experiencing a rapid

growth in hybrid meetings (combination of traditional face-to-face meetings and video

conferences). The MIA Pathfinder Report conducted in 2010 noted that there had been a slight

increase in video-conferencing usage and that just over 50% of the survey respondents stated

that they planned to invest in this technology.

Meetings and conventions that do not require being present at a physical location are easy to

imagine, but possibilities also stretch to trade shows and exhibitions as ‘virtual events’. In virtual

events, attendees can interact with sponsors through real time chats similar to being in

exhibition halls and serve as a substitute for recession-prone exhibitors and attendees.

The growth in e-commerce and advancements in payment security for internet-transactions

ensures that virtual events can generate sales safely and conveniently thus increasing their

popularity. Virtual events can also improve data collection and customer relationship management. As everything is undertaken online, exhibitors can track and monitor attendee interests,

content downloaded and level of engagement to the exhibition to cater marketing efforts to

different types of buyers. With virtual exhibitions, exhibitors can attract a larger pool and variety

of attendees since they do not require a physical presence at a location, increasingly perceived as a huge selling point for ‘virtual’ exhibitions.

Source : Thailand Convention and Exhibition Bureau (TCEB)

26

Introduction to MICE industry

The report, The Practicalities of Virtual Events presents an overview by Marketing Profs, ON24

and Trendline Interactive, two main players among marketing experts, web-based service

providers and marketing consulting. The survey shows that in 2010-2011, half of the 187 surveyed

attendees planned to attend a virtual trade show, in other words, virtual exhibitions have

gained momentum over the past few years.

However, some business travelers still believe that video conferences cannot completely

replace face-to-face meetings. Although video conferences add values in the sense that they

expand meeting options, many continue to believe that face-to-face is still better in creating ,

building and retaining relationships.

Social Media, Mobile and Tablets’ Apps

Use of social media has become so commonly used in marketing for almost every type of products and services that it cannot be overlooked as it remains one of many underlying factors

that has shifted behavior and challenged traditional marketing campaigns. Blogs, Facebook,

LinkedIn and Twitter are on top of any list of social networks being used to create exposure,

increase levels of engagement from attendees both before and after the event and as a medium for communication.

IMEX 2011 in Frankfurt, the worldwide exhibition for meetings and incentive travel organizers,

conducted a survey of agencies, corporate and associations. The survey revealed that professional

usage of Facebook and Twitter had risen 60% and 27% from 2010 to over 71% and 41% in 2011,

respectively.

In addition, many exhibitors believe social media usage has grown and can increase levels of

penetration with prospective attendees. Research from FastFurture presented in Convention

2020 Seminar at IMEX in Frankfurt 2011 stated that 62% of event organizers see the need to

extend the use of social media around events.

Popularity in the use of smart phones and tablets has led to the need to support mobile applications.

Organizers can employ mobile apps as a way to provide and update information for delegates

and other exhibitors. It also increases the level of engagement and eases data exchange

among delegates and organizers as it has the ability to provide on-the-spot data.

27

Internet Access

Internet access within meetings facilities is among the top requirements for delegates attending MICE

events. Research from FastFurture presented in 2011 also pointed out that 73% of the exhibitors

and delegates surveyed strongly agreed that meeting facilities should provide free access to

Wi-Fi service and considered one of the main criteria in venue selection.

Sustainability and Green Meetings

Persistent global warming concerns

and potential environmental impact

caused by hosting MICE events has

intensified during the past decade,

raising an awareness of the need

to promote sustainability among

those involved. Sustainable meetings

balance three objectives: delegate

needs, profit generation and avoiding

environmental damage.

In line with these concerns, is the

fact that cost is now a primary factor

Source : Thailand Convention and Exhibition Bureau (TCEB)

influencing the decision of whether

to hold meetings or exhibitions and as such, most companies and associations are turning to

green meetings to save budget. Furthermore, green meetings promote corporate social

responsibility (CSR). Increasingly delegates see themselves connecting to society in a

sustainable and meaningful manner, according to President and CEO of Orlando/Orange

County Convention & Visitors Bureau.

Apart from organizing sustainable events, upcoming plans in building new environmental

friendly meeting facilities through solar cell technology, innovative designs and other state-ofthe-art technologies will ultimately reduce carbon footprints. For existing facilities, planners

and venue owners are moving toward using green products, recycling initiatives and providing

other green services.

Research from FastFuture at Convention 2020 and Hotel 2020 Seminar in Copenhagen 2011

showed that out of 606 survey respondents, 83% ‘strongly agreed’ or ‘agreed’ environmental

considerations play a major role in the choice of a business or leisure hotel. Most hotels, therefore, stress their ability to provide a variety of ‘green’ services that align with MICE delegate

needs.

28

Introduction to MICE industry

Key Stakeholder Introduction

Similar to any industry, the MICE industry has both a demand and supply side. The need for

meetings or incentive programs for employees derive from corporate needs. Associations need

to fix schedules to hold conferences on a timely basis and require outsourcing or external

service providers in orchestrating events. Service providers on the supply side include

Professional Exhibition Organizers (PEO), Professional Convention Organizer (PCO) and

Destination Management Companies (DMC).

Convention and Visitors Bureau (CVB) within a country are one of the most important organizations

that facilitate and coordinate with MICE organizers to provide smooth service. In addition, they

also promote the country and attract more MICE events.

Convention and Visitors Bureaus (CVB)

As the MICE industry grows, every country faces intense competition from both mature and potential emerging markets. The Creation of a Convention and Visitors Bureau (CVB) has become

a priority for countries that seek to promote their MICE industry and usually act as a central

body to facilitate growth. Generally, a CVB has four main purposes:

1. To encourage groups to hold MICE events in their region or country

2. To assist groups with preparations; to give advice, to solicit the support of service

providers and to liaise between local service providers and MICE visitors

3. To be a hub for information and to stand ready to provide it whenever needed

4. To market the country or region it represents

CVB play as an intermediary between MICE visitors or organizers and qualified local providers.

A CVB’s role is to represent its territory by investing in marketing efforts to support the MICE

industry it represents. However, different CVB may play different roles depending on the

authority it has been given.

In Thailand, the Thailand Convention and Exhibition Bureau (TCEB) was founded as a public

organization in 2004 and has been the sole body representing the MICE industry in Thailand.

According to TCEB, its roles consists of

29

To set policies and standards for Thailand’s MICE industry

To promote and publicize Thailand’s MICE industry

To represent Thailand in submitting proposals/bid to host events

To act as a hub for information and services, including professional consultations

regarding domestic and international MICE business

To support and arrange professional seminars and training to develop the professional

skills of MICE personnel in Thailand

To set standards for services and certify qualifications of Thai MICE operators

To act as a coordinating center for MICE events in Thailand

To develop projects to inspire the MICE industry in Thailand under the sponsorship of the

Royal Thai Government

To support organizations involved in Thailand’s MICE industry

To carry out missions that will help TCEB to achieve its major roles and objectives

Associations

Associations are usually not-for-profit organizations and can be formed at a national, regional,

or even international level. Association can be segmented into two broad categories: trade

or professional. Their purpose is to provide services for their members and to the community at

large. Once an association schedules a conference, related work is often delegated to specialized

service providers called Professional Convention Organizer (PCO). Association conferences

tend to follow a predetermined rotation schedule and have a much longer lead-time when

compared to corporate meetings.

Corporations

Corporations are organizations established to generate profit and provide financial return to

their owners. Corporate meetings come in many types and forms but the main purpose is to

communicate with employees or clients. Lead-time to organize meetings is often much shorter

than association meetings. Normally, companies do not invest in an event or conference

management division, but solicit this expertise from external service providers e.g. event

organizers or destination management companies (DMC).

Professional Convention Organizers (PCO)

A Professional Convention Organizer (PCO) specializes in planning and managing congresses

and conferences for associations that would like to hold a conference but do not wish to undertake

the bulk of the work. Typical PCO roles include:

30

Introduction to MICE industry

Selecting and booking venues

Managing delegate accommodation

Marketing the event

Designing programs

Designing promotional materials

Handling administration

Planning catering

Coordinating technical aspects

Preparing budgets

Recording expenses

The requirement of each association will determine the PCO role for any given conference and

as such, will not be the same with every conference.

Incentive Houses

Incentive houses usually coordinate with corporations in shaping incentive programs that can

help a company reach its goals. Incentive travel programs are invariably quite specific in terms

of size and program details that must be specifically provided. Usually, corporate buyers contact an incentive house in the same region and if the program requires travelling outside the

country, they may hire a Destination Management Company (DMC) to manage the program

at the destination.

Incentive house roles include identifying program goals and objectives and later plan and to

organize the program. Commonly, incentive travel requires a very specific set of outcomes,

motivating employees to enhance company performance; therefore, it is also an incentive

house role to find a method to track the success rate in a program.

Destination Management Companies (DMC)

According the Society of Incentive and Travel Executives (SITE),

“A DMC is a local service organization that provide consulting services,

creative events and exemplary management of logistics based on an in-depth

knowledge of the destination and the needs of the incentive and motivation

markets”

Since DMCs have very thorough knowledge of the destination and sometimes even rare access

to exotic and new locations within a country, which is why DMCs often work closely with incentive

houses from abroad in arranging meetings and incentive programs.

31

Professional Exhibition Organizer (PEO)

A Professional Exhibition Organizer (PEO) usually handles every aspect of hosting an exhibition.

Once they have accepted the task, they will be responsible for recruiting exhibitors and attracting

attendees, in other words, they need to promote exhibitions to a qualified public. A PEO is also

required to handle agreement contracts between exhibitors and sponsoring organizations if

they exist.

Another major role is to plan,

coordinate and manage exhibitions,

which may also include selecting

proper subcontractors and other

service providers to delegate the

tasks needed in organizing it. A PEO

will usually need to subcontract a

number of services for instance,

exhibit material handling, storage,

installation, maintenance and

dismantling displays, design and

constructions of displays, functional

Source : Thailand Convention and Exhibition Bureau (TCEB)

furniture within exhibition halls and

logistics.

Venues

Venues are now one of the most important factors influencing the decision to host a MICE

event and include conference hotels, conference centers and exhibition halls. MICE visitor

requirements dictate the facilities needed in any venue making important for venues to meet

visitor needs and to keep up with trends.

Hotels are now very active in the MICE industry. Firstly, they can provide the accommodation

for the meetings and incentive travels segment. Secondly, meeting and conference rooms are

now found in most hotels fully equipped to provide convenience and meet visitor needs.

Conference centers or conference hotels are the new players within the convention industry as

they can provide five-star hotel rooms together with spacious conference rooms and supplementary

facilities traditional hotels may not be able to provide.

32

Introduction to MICE industry

Other Supporting Organizations

Supporting organizations refer to

both national and international

organizations whose roles directly or

indirectly support the MICE industry.

In Thailand, many private

associations directly support the

local MICE industry such as Thailand

Incentive and Convention

Association (TICA), Thai Exhibition

Association (TEA), Thai Hotels

Associations (THA), and Event

Management Association (EMA).

These associations bring together

Source : Thailand Convention and Exhibition Bureau (TCEB)

related MICE industry service providers

to enhance collaboration and to set standards within the industry. They also aim to create

knowledge and share expertise and to align a unified strategic direction to promote the

domestic MICE industry effectively.

Apart from domestic associations, the MICE industry is also influenced by public authorities

such as The Tourism Authority of Thailand (TAT), the Board of Investment (BOI), the Department

of International Trade Promotion (DITP), the Revenue Department, the Airports of Thailand (AOT)

and the Port Authority.

Other international organizations or associations have been formed to support and assist

stakeholders within the worldwide MICE industry.

International Association of Congress Centers (AIPC)

Destination Marketing Association International (DMAI)

International Association of Professional Congress Organizers (IAPCO)

International Congress and Convention Association (ICCA)

Meeting Professionals International (MPI)

The Global Association of the Exhibition Industry (UFI)

Society of Incentive Travel Executives (SITE)

Green Meetings Industry Council (GMIC)

Their roles range from lobbying and representation, establishing codes of practice within the

industry and setting compatible standards for service providers to follow. Moreover, some of

these associations support human resource development by organizing training programs and

education courses.

A final area of interest is government conferences and the ways they differ from association

conventions and conferences and while they are not a major sector internationally, they are

very important in Thailand.

33

Chapter 2

Meetings

34

Introduction to MICE industry

Source : Thailand Convention and Exhibition Bureau (TCEB)

Definition

Meetings can be categorized as corporate, government or associations. In this chapter,

‘meetings’ only refers to corporate meetings as government and association meetings will be

discussed in chapter 4.

The first industry in the acronym MICE is meetings or, in this case, corporate meetings. Even

though it may be easy to visualize the concept of corporate meetings, the complexity lies in

the way this particular word can be defined and employed.

According to the International Dictionary of Event Management by Goldblatt & Nelson (2001),

and accepted by the International Special Event Society (ISES), meetings are defined as:

An assembly of individuals gathered to discuss items of mutual interest or

engage in professional development through learning activities.

From the definition above, it would appear meetings could come in many formats or forms

aligning with the definition by the International Association of Congress Organizers (IAPCO):

A general term indicates a coming together of a number of people in one

place to confer or carry out a particular activity. Frequency can be on an ad

hoc basis or according to a set pattern, as for instance annual general

meetings, committee meetings…

35

Both of these definitions could suggest that the term ‘meetings’ could be interpreted or seen

to be any association meeting, convention, congress or conference. However, the scope of

this chapter will be limited to corporate meetings defined in the International Encyclopedia of

Hospitality Management as,

…an officially sanctioned and required meeting for employees of a specific

corporation. Corporate meetings are often held off site of the corporate

location and required employees to travel to the meeting. Expenses associated

with the meeting such as, transportation, meals, and hotel accommodations

are paid for by the corporation…

Corporate meetings are the coming together of two or more individuals from ‘the same

organization’ but may come from different departments, branches or countries. Sometimes it

can be a local meeting, which may or may not involve overnight spending. In addition,

corporate meetings must be for attendees with a shared purpose, at a specified time & venue

and at company’s expense.

Purpose of Corporate Meetings

Corporate meetings are inevitable as some, for example, annual shareholder meetings by

public companies are required by law; while some are held for other purposes including press

conferences, product launches and new business plan announcements.

Goals and Objectives of Corporate Meetings

The two terms ‘goals’ and

‘objectives’, although

commonly used side-by-side,

are different in their underlying

definitions. ‘Goals’ are

long-term targets set by a

company. An example of

corporate meeting goals could

be for employees to bring

back what was discussed and

learned at a meeting to boost

sales and to become a market

Source : Thailand Convention and Exhibition Bureau (TCEB)

36

Introduction to MICE industry

leader.

On the other hand, ‘objectives’ are often seen as short-term targets set for each activity.

Corporate meeting objectives could be for employees to gain more understanding about the

direction the company is taking or an opportunity for employees across branches or countries

to meet, interact and discuss matters or issues.

Additional objectives for corporate meetings may include the need to:

Announce new initiatives

Create discussion opportunities

Build teams

Share knowledge

Increase efficiency

Corporate Meeting Categories

The criteria used to group the vast array of meetings organized is based on employing four

main characteristics: objective, geographic region, agenda and company type.

Source: Thailand Convention and Exhibition Bureau (TCEB)

By Objective

Seminar: This format involves professional trainers, primarily lecturing about a topic intended

for attendees to gain more knowledge and/or skills about the topic presented.

Workshop: Similar to workshops, this format creates a learning-by-doing atmosphere through

experiments, discussion and interaction among the attendees.

Brainstorming: Conducted with employees within the same or cross-department, the goal is

to find solutions for issues or to create new initiatives. Typical brainstorming sessions do not allow

attendees to discuss opinions at the time. However, after the session, recorded ideas and

suggestions will be evaluated and chosen as appropriate.

37

Panel Forum: This type of meeting includes professionals and experts who discuss particular

topics in an exchange of ideas intended to open new perspectives related to topics selected.

By Geographic Region

International Corporate: Attendees come from the same corporation on different continents

or countries of more than one continent. This type of meetings is usually organized by

multinational companies with branches around the globe.

Regional Corporate: Employees from one company within the same region or continent.

Typically, this type of meeting is held by a multinational company with branches in a number of

countries in the same region.

National Offshore: Employees from one company held in a country outside where the

company resides. For instance, employees of a consumer products manufacturing company

in Thailand attend a corporate meeting held in Australia.

Local corporate meetings: Closely related to a national offshore meeting, attendees are from

the same company based in one country although it might be held in a different town,

province or state than where the company is located, though in the same country. For instance,

a company located in Bangkok decides to hold its corporate meeting in of Phuket.

By Agenda

Executive/Management Meeting: Attendees from a management team and usually refers

to top executives. The purpose is usually to set company’s overall strategies or direction.

Shareholders Meeting: This type of meeting somewhat deviates from definition of Meetings

above. Attendees for this type of meeting do not necessary have to be employees or members

of the management team, they can be individuals that hold shares in the company.

The agenda of this meeting is to announce company performance and profitability and/or

to seek for consensus from shareholders on certain management issues. Although this type of

meetings can be domestic meetings, it can involve spending overnight

New Product Introduction Meeting: As the name suggests, the main purpose is to announce

a new product launch with attendees usually company employees, clients and the press.

Department Meeting: Meetings conducted among employees of the same department.

For instance, a sales department meeting at which the agenda is to set sales goal for the

upcoming fiscal year or to discuss and initiate new sales strategies.

38

Introduction to MICE industry

By Type of Corporation

Corporate Meeting: A private company meeting regardless of where it is located or the agenda.

Governmental Organization Meeting: Held by a governmental organization, for example a Thai

government organization holding a meeting in any part of Thailand or a governmental organization from abroad holding a meeting in Thailand. More on this in Chapter 4.

Industry Trends

Shifting Roles in Destination Management Companies (DMCs)

Corporate meetings, especially

those that require travel to

different countries are not usually

organized in-house. This is often

due to the various difficulties

encountered in a planning

process that has to deal with

many stakeholders in different

countries in terms of accommodation reservations, meeting

room preparation, plane

ticketing, travel insurance

arrangements, activity planning

and content design. Increasingly

companies outsource planning and organizing corporate meetings to external planners called

Destination Management Companies (DMCs) who specialize in the destinations they represent.

As more corporate meetings tend to be combined with incentive travel, companies are

increasingly looking for a one-stop service. SITE Global is one of the most renowned associations

representing meetings, incentives and events was created to maximize business results through

motivational tools. It periodically publishes its SITE Index, an up-to-date snapshot of the incentive

travel industry in which it was stated that DMCs are expanding their roles to provide one-stop

services so that companies no longer contact incentive houses, planners or agencies prior to

coming to DMCs. However, it goes on to state that even though companies are seeking a one-stop

service, many DMCs are not willing to increase their roles which may be due to proficiency

concerns in some aspects associated with organizing meetings.

39

Technology, Cost Savings and Green Meetings

With ongoing economic concerns, consumer confidence has declined leading to a decrease

in the bottom line for many companies, in turn, forcing many to tackle this decline in profitability

by cutting unnecessary costs of which budgets allocated to corporate meetings, especially

ones held abroad, are among the first to go. In a search for other cost-effective alternatives,

companies are employing tools such as web conferencing, VDO conferencing and virtual

meetings to compliment corporate meetings since they have proven to be effective options

that, at the same time, incur less cost.

Apart from adopting technology to avoid excessive cost in corporate meetings, energy

conservation is another trend in the industry. Fast Future Survey by Talwar (2011) surveyed 606

professionals in the industry from seven continents and concluded that sustainability and green

initiatives will continue to be another important factor employed by clients when choosing

meeting destinations and venues.

Figure 2-2: Sustainability and Green intiatives Importance

Unit : Percent

50

45

40

39

43

Green & Sustainability

35

30

25

20

15

15

10

5

0

2

Strongly agree

Agree

Disagree

Strongly disagree

Source : Fast Future Survey, Rohit Talwa (2011)

Companies are now looking towards technology such as Telepresence, developed by Cisco,

for cross-border corporate meetings with adoption sometimes employed as an initiative to

promote corporate social responsibility (CSR) in that the company has organized cost-effective

and environmentally friendly meetings.

40

Introduction to MICE industry

Figure 2-3 presents a graphic representation of TeliaSonera who used Telepresence in 464

meetings to save 500,000 Euros in traveling expenses, 40 months travel time spent on travel and

reduced their carbon footprint by 16,900 kilograms.

Figure 2-3: Reduction in CO2 Emissions by TeliaSonera

Unit : Percent

100

90

80

70

60

50

40

30

20

10

0

CO2 Reduction of TeliaSonera

after the implementation of

green meetings

76% Co2

Reduction

2001

2009

Source : TeliaSonera Company

The shift in demand for green or environmentally friendly meetings has also increased the demand

for facilities or meeting venues that can accommodate such needs, for example, venues that

pursue energy reduction and effective waste management. Taking into account the state of

the global economy and concerns over global warming, many professionals believe the industry

is headed in a direction that involves intensive use of technology and greener initiatives to save

corporate meeting costs, which will, in turn force organizers to shift their offerings in parallel with

changing corporate demands.

Increasingly, companies focus on CSR initiatives, which means they would prefer to choose venues

or locations that align with their CSR values or initiatives. In turn, this has led to many venues

adapting current practices and adopting others to respond to this industry trend and to serve

the needs of their clients.

41

Venue Finder

Venue finders are companies or independent sales representatives who maintain databases of

venues worldwide they have researched and present ideal venues based on specific needs.

They can then book venues and earn revenue based on commissions. HelmsBiscoe Associates

is a global leader in Meeting Procurement and helps to streamline the process needed when

delivering events for companies anywhere in the world. In addition, through their purchasing

power and industry relationships, venue finders can offer clients better availability and pricing.

A final concern in the industry is that many client companies are cutting unnecessary costs due

to the global economy and its slow improvement with corporate meetings previously held at

venues at distant destinations increasingly moved to nearer locations. This will lead to substantial

cost reduction in airfare, accommodation and other related expenses, which can be perceived

as both an upside and downside to Thailand’s corporate meeting industry and the MICE industry

as a whole. The downside is that this trend will obviously translate into reduced MICE travelers

from Europe and North America. On the other hand, it will increase the potential for Thailand to

capture new emerging markets nearby such as China and its Asian neighbors.

Meetings Industry Value

The United Nations World Tourism Organization (UNWTO), Meeting Professionals International

(MPI), the Convention Industry Council (CIC), PricewaterhouseCoopers LLP (PwC), and the US

Travel Association, provide corporate meeting data.

Table 2-1: The US MICE Industry Value 2009

Meeting Type

Number of

Meetings

Number of

Attendees

Share of

attendees

number

Corporate Meetings

1,266,200

107,187,000

52%

Conventions/conferences/congresses

269,800

51,104,000

25%

Exhibitions

10,700

24,800,000

12%

Incentive Travels

66,000

8,154,000

4%

Other Meetings

178,100

13,479,000

7%

Total

1,790,800

204,724,000

100%

Source : The economic significance of meetings to the U.S. economy study by United Nations World Tourism Organization (UNWTO),

Meeting Professionals International (MPI), the Convention Industry Council (CIC), PricewaterhouseCoopers LLP (PwC), and the US

Travel Association

42