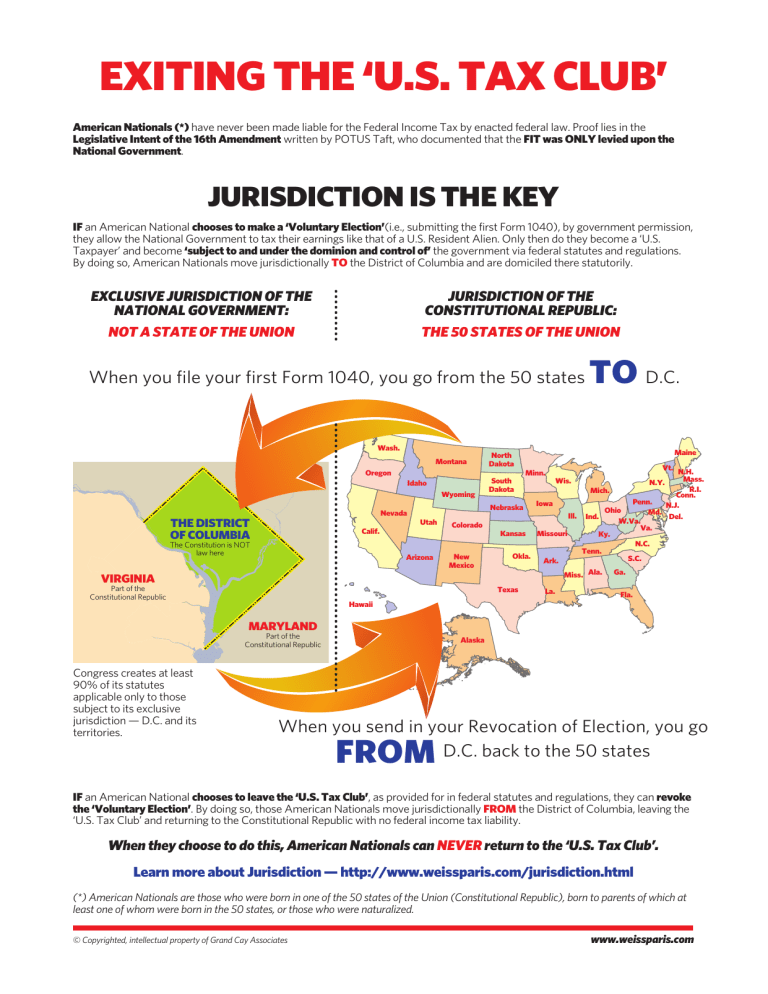

EXITING THE ‘U.S. TAX CLUB’ American Nationals (*) have never been made liable for the Federal Income Tax by enacted federal law. Proof lies in the Legislative Intent of the 16th Amendment written by POTUS Taft, who documented that the FIT was ONLY levied upon the National Government. JURISDICTION IS THE KEY IF an American National chooses to make a ‘Voluntary Election’(i.e., submitting the first Form 1040), by government permission, they allow the National Government to tax their earnings like that of a U.S. Resident Alien. Only then do they become a ‘U.S. Taxpayer’ and become ‘subject to and under the dominion and control of’ the government via federal statutes and regulations. By doing so, American Nationals move jurisdictionally TO the District of Columbia and are domiciled there statutorily. EXCLUSIVE JURISDICTION OF THE NATIONAL GOVERNMENT: NOT A STATE OF THE UNION JURISDICTION OF THE CONSTITUTIONAL REPUBLIC: THE 50 STATES OF THE UNION When you file your first Form 1040, you go from the 50 states Wash. Montana TO D.C. Maine North Dakota Vt. N.H. Mass. R.I. Mich. Wyoming Conn. Penn. Iowa N.J. Nebraska Ohio Md. Nevada Ill. Ind. Del. W.Va. Utah Colorado Va. Calif. Kansas Missouri Ky. N.C. Tenn. Okla. New Arizona S.C. Ark. Mexico Miss. Ala. Ga. Oregon South Dakota Idaho THE DISTRICT OF COLUMBIA The Constitution is NOT law here VIRGINIA Part of the Constitutional Republic Texas Minn. La. Wis. N.Y. Fla. Hawaii MARYLAND Part of the Constitutional Republic Congress creates at least 90% of its statutes applicable only to those subject to its exclusive jurisdiction — D.C. and its territories. Alaska When you send in your Revocation of Election, you go D.C. back to the 50 states FROM IF an American National chooses to leave the ‘U.S. Tax Club’, as provided for in federal statutes and regulations, they can revoke the ‘Voluntary Election’. By doing so, those American Nationals move jurisdictionally FROM the District of Columbia, leaving the ‘U.S. Tax Club’ and returning to the Constitutional Republic with no federal income tax liability. When they choose to do this, American Nationals can NEVER return to the ‘U.S. Tax Club’. Learn more about Jurisdiction — http://www.weissparis.com/jurisdiction.html (*) American Nationals are those who were born in one of the 50 states of the Union (Constitutional Republic), born to parents of which at least one of whom were born in the 50 states, or those who were naturalized. © Copyrighted, intellectual property of Grand Cay Associates www.weissparis.com