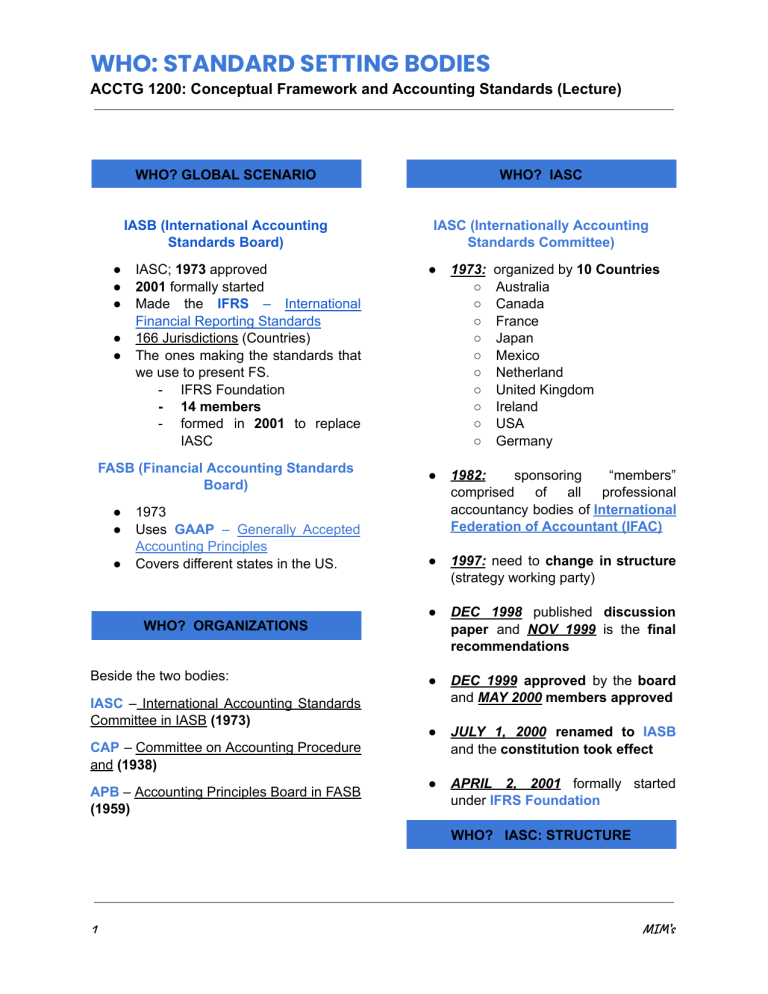

WHO: STANDARD SETTING BODIES ACCTG 1200: Conceptual Framework and Accounting Standards (Lecture) ● ● ● ● ● WHO? GLOBAL SCENARIO WHO? IASC IASB (International Accounting Standards Board) IASC (Internationally Accounting Standards Committee) IASC; 1973 approved 2001 formally started Made the IFRS – International Financial Reporting Standards 166 Jurisdictions (Countries) The ones making the standards that we use to present FS. - IFRS Foundation - 14 members - formed in 2001 to replace IASC FASB (Financial Accounting Standards Board) ● ● ● 1973 Uses GAAP – Generally Accepted Accounting Principles Covers different states in the US. WHO? ORGANIZATIONS Beside the two bodies: IASC – International Accounting Standards Committee in IASB (1973) ● 1973: ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ● 1982: sponsoring “members” comprised of all professional accountancy bodies of International Federation of Accountant (IFAC) ● 1997: need to change in structure (strategy working party) ● DEC 1998 published discussion paper and NOV 1999 is the final recommendations ● DEC 1999 approved by the board and MAY 2000 members approved ● JULY 1, 2000 renamed to IASB and the constitution took effect ● APRIL 2, 2001 formally started under IFRS Foundation CAP – Committee on Accounting Procedure and (1938) APB – Accounting Principles Board in FASB (1959) organized by 10 Countries Australia Canada France Japan Mexico Netherland United Kingdom Ireland USA Germany WHO? IASC: STRUCTURE 1 MIM’s WHO: STANDARD SETTING BODIES ACCTG 1200: Conceptual Framework and Accounting Standards (Lecture) ● As of 2018, 144 jurisdictions require the use of IFRS for all or most publicly listed companies and further 12 jurisdictions permit its use. Globally comparable accounting standards promote transparency, accountability, and efficiency in financial markets around the world. IASC BOARD ● ● ● ● ● ● ● ● The standard setting board of the IASC. 13 country members and up to 3 additional organizational members (part time and voluntary basis) Each member was represented by 2 representatives and 1 technical advisor Observe Members – (representative of IOSCO, FASB, and the European Commission) participated in debate but not in voting Consultative Group – advisory body Standing Interpretations Committee (SIC) – developed and invited public comment on interpretations, subject to final approval Advisory Council – oversight body Steering Committees – expert task forces for individual agenda projects Who are required/permitted to follow? FIRMS COVERED International Board (IASB) ● ● ● 2 Accounting Standards IFRS – permitted but not required, for use by at least some domestic publicly accountable entities, including listed companies and financial institutions Foreign securities issuers are required or permitted by IFRS SME may choose full IFRS. Financial Accounting Standards Board (FASB) ● Public and private companies and not for profit organizations Governed by FASB, only public traded companies are required to comply with GAAP because they are created with investors in mind. There are no separate private company standards and the new efforts are aimed to augment existing principles rather than creating separate standards for private companies. ● WHERE? GLOBAL SCENARIO IASB ● ● Cannon Street 17 years Canary Wharf London, UK FASB ● ● Norwalk Connecticut US WHY? GLOBAL SCENARIO IASB MIM’s WHO: STANDARD SETTING BODIES ACCTG 1200: Conceptual Framework and Accounting Standards (Lecture) ● To develop, in the public interest, a single set of high quality (relevant and faithful representation), understandable, enforceable, and globally accepted financial reporting standards based upon clearly articulated principles. FASB ● Develops and issues financial accounting standards through a transparent and inclusive process intended to promote financial reporting that provides useful information to investors and others who use financial reports. IASB Objectives ● ● ● IFRS Principles Based ○ Subjective ○ Judgement ○ Flexibility ○ Restrict Standardization FASB ● ● GAAP Rules Based ○ Prescriptive ○ TICK BOX approach ○ Must Adhere ○ Promotes Standardization PRINCIPLES-BASED VS. RULES-BASED STANDARDS Difficulties associated with rules-based: Globally accepted accounting standards: ● ● ● Providing high quality, transparent, comparable information for users. Common language for financial reporting. Transparency and integrity. Consistent application of standards. ● ● ● IASB-FASB CONVERGENCE ● October 2002 Agreement – the Norwalk KEY TAKEAWAYS - IASB vs FASB - IFRS vs GAAP Principles Based vs Rules Based ● Bright-line tests lead to inconsistencies in the application and a lack of comparability. Tend to be seen as an act of compliance as opposed to a means of communicating information. Complexity does not allow for effective understanding and application of the underlying accounting principle. Can be circumvented and can override the intent of the standard. WHAT? PRINCIPLES: RULES IASB 3 MIM’s