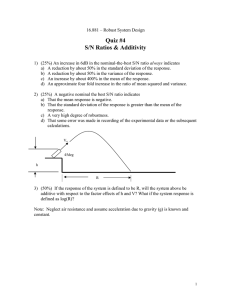

FINM2003 Investments Tutorial 5 Solution Question 1 The following are estimates for the two stocks. Stock Expected return E(r) Beta β Firm-specific standard deviation σe A 13% 0.8 30% B 18% 1.2 40% The market index has a standard deviation σM = 22% and the risk free rate rf = 8% (a) What are the standard deviations of stocks A and B? (b) Suppose that we were to construct a portfolio with proportions: Asset wi Stock A 30% Stock B 45% Risk free asset 25% Compute the expected return, standard deviation, beta, and firm-specific standard deviation of the portfolio. Answer (a) The variance of a stock 2 σi2 = βi2 σM + σe2i Therefore, the standard deviation q 2 βA2 σM + σe2A √ = 0.82 × 0.222 + 0.32 σA = = 34.78% 1 q 2 σB = βB2 σM + σe2B √ = 1.22 × 0.222 + 0.42 = 47.93% (b) For the portfolio The expected return is simply the weighted average expected returns E(rP ) = wA E(rA ) + wB E(rB ) + wf rf = 0.3 × 13% + 0.45 × 18% + 0.25 × 8% = 14% We solve the portfolio’s standard deviation in several steps βP = wA βA + wB βB + wf βf = 0.3 × 0.8 + 0.45 × 1.2 + 0.25 × 0 = 0.78 σe2P = N X 2 2 2 2 wi2 σe2i = wA σeA + wB σeB + wf2 σe2f i=1 = 0.32 × 30%2 + 0.452 × 40%2 + 0.252 × 02 = 0.0405 Then the portfolio’s standard deviation q 2 βP2 σM + σe2P √ = 0.782 × 0.222 + 0.0405 σP = = 26.45% 2 Question 2 Consider the following two regression lines for stocks A and B in the following figure. Assume two figures use the same scale. B A (a) Which stock has higher alpha? (b) Which stock has higher systematic (market) risk? (c) Which stock has higher firm-specific risk? (d) Which stock has higher R2 ? (e) Which stock has higher correlation with the market? Answer (a) Alpha is the intercept of the SCL. Stock A has a higher alpha than stock B. 2 (b) Systematic risk (βi2 σM ) is quantified by β, which is the slope of the SCL. Stock B has a higher slope than stock A, and therefore stock B has a higher β and higher systematic risk. (c) Firm-specific risk is measured by the deviations of observations (sum of squares of residuals σe2 ) from the fitted SCL. The observations of stock A are much worse fitted than stock B, and therefore stock A has higher firm-specific risk than stock B. 3 (d) Recall the definition of R2 R2 = Systematic risk β 2σ2 = 2 2i M 2 Total risk βi σM + σei Stock B has higher systematic risk but lower firm-specific risk, so stock B has higher R2 than stock A. (e) The correlation coefficient is defined as ρi,M = √ R2 . As stock B has a higher R2 , it also has a higher correlation with the market. Question 3 Consider the two (excess return) index model regression results for A and B: Stock Estimated index model R2 Residual standard deviation A 1% + 1.2[E(rM ) − rf ] 0.576 10.3% B −2% + 0.8[E(rM ) − rf ] 0.436 9.1% (a) Which stock has higher firm-specific risk? (b) Which stock has higher market risk? (c) For which stock does market movement explain a greater fraction of return variations? Answer (a) Residual standard deviation from regression of index model is the same as the firm-specific standard deviation σe . As σeA = 10.3% > σeB = 9.1%, stock A has higher firm-specific risk. (b) As βeA = 1.2 > βeB = 0.8, stock A has higher market risk. 2 2 (c) As RA = 0.576 > RB = 0.436, market movement explains a greater fraction of return variations for stock A than stock B. 4 Question 4 The estimated index models for stock A and B are as follows rA − rf = 3% + 0.7(rM − rf ) + eA rB − rf = −2% + 1.2(rM − rf ) + eB 2 2 With R-squared RA = 0.2, RB = 0.12 Assume the standard deviation of market index σM = 20% (a) What is the standard deviation of each stock? (b) Break down the variance of each stock into its systematic and firm-specific component (please keep the variance form and no need to take square root.) Answer (a) The variance and R2 of a stock are defined as 2 σi2 = βi2 σM + σe2i R2 = 2 2 βi2 σM βi2 σM = 2 βi2 σM + σe2i σi2 Therefore σi = q r σi2 = 2 βi2 σM βi σM = √ 2 R R2 The standard deviation of each stock is then βA σM 0.7 × 0.2 = 31.31% σA = p 2 = √ 0.2 RA βB σM 1.2 × 0.2 σB = p 2 = √ = 69.28% 0.12 RB 5 (b) Break down the variance of each stock 2 Systematic variance of stock A = βA2 σM = 0.72 × 0.22 = 1.96% 2 Systematic variance of stock B = βB2 σM = 1.22 × 0.22 = 5.76% 2 Firm-specific variance of stock A = σe2A = σA2 − βA2 σM = 31.31%2 − 0.72 × 0.22 = 7.84% 2 Firm-specific variance of stock B = σe2B = σB2 − βB2 σM = 69.28%2 − 1.22 × 0.22 = 42.24% 6