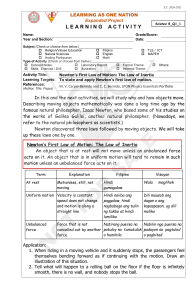

O T W O H O L O Y Y L E S I W A Step by Step Money Guide for People Who Wanna Enjoy Life NOMAD FINANCE GIRL Copyright © 2020 by Rose Nikki V. Jurado. All rights reserved. This book, or parts thereof, may not be produced in any form without permission from the publisher; exceptions are made for excerpts used in printed reviews and other media-related materials as long as proper attribution is made. The publisher and the authors make no representations or warranties with respect to the accuracy or completeness of the contents of this work and specifically disclaim all warranties. This book shall not be in any way sold and shall remain free unless the author and publisher say otherwise. The advice and strategies contained herein may not be suitable for all kinds of situations. Readers must consult with a professional where appropriate. Neither the publisher nor the author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages. Written by Rose Nikki V. Jurado All artwork by Chene Arieta Edited by Cheryl Caballes, Jeniffer Visitacion, Anne Dalusong, and Benedict Lasala Published by NFG Global www.nfgglobal.com First Edition, 2020. Acknowledgements This book will not be possible without the help, love, and support of the following people. Many thanks to my VIPs: Leo Advantage, NFG Global, Atty. Philip Jurado, Lowela Velasco, Atty. Peejay Jurado, Judge Bambi Jurado, and Sky Yaha Jurado. My pillars of strength: Mia Apilado, Rooting for Celeste, and Zeefreaks. My brains, spine, and gear: Anne Dalusong, Jen Visitacion, and Chene Arieta. My soulmate: Jhoana Cundangan. My partner and bestfriend: Marc Mancilla. Special thanks to JM Tan, Cheryl Caballes, and Benedict Lasala. Thank you to all the Nomad Finance Girls and Guys who choose to dream big every single day. Salamat din sa Deep Focus Playlist ng Spotify at sa maraming 3-in-1 na kape. Including all the names we need to thank is like counting the stars across the sky. This book is a collection of teachings shared between many ordinary people who, together, built extraordinary wisdom. May we all continue to spread light and love. Plus ultra! Table of Contents The Mission Step One: Set Your Foundation Step Two: Manage Your Money Step Three: Increase Your Income Step Four: Build Your Emergency Funds Step Five: Protect Your Money Step Six: Make Your Money Work Step Seven: Build Your Legacy How’s your financial health? A Letter for You 1 7 18 43 62 72 97 129 138 145 Para sa lahat ng tumaya sa sarili nang may halong takot. E H T N O I S S I M “Anumang sakit o pait nagiging kaakit akit depende sa Bakit.” Sir Onofre R. Pagsanghan 1 THE MISSION Many years ago, someone asked me this question… What would you do if money isn’t an issue? Being an extreme collector and a fan of comics about heroes, I simply said, “I want to be like Batman or Iron Man. I’m going to build a league of superheroes.” It’s funny how life unfolds. One day, you’ll just realize… “Wow, naabot ko na pala yung pangarap ko.” Over ten years after answering that question, I found myself asking the same thing to thousands of readers, students, and mentees. What would you do if money isn’t an issue? And those who have chosen to answer this question, dream, and take action became part of my own league of modern superheroes – change makers creating ripples of impact, day in and day out. We call ourselves NFG Global: a group of young Filipino men and women asking the most important question anyone can dare answer. What would you do if money isn’t an issue? Pero bakit? Bakit ganun na lang ka-importanteng sagutin ang tanong na ‘to? I’ve come to witness many people from all over the globe do the same thing whenever I bring this question to the table. At first, they’d say things like… 2 THE MISSION “Bibili ako ng Lamborghini!” “I will travel everyday!” “Sasampalin ko yung boss ko ng pera!” I love these sessions because we always get a good laugh. But as soon as I ask the next question, the room filled with laughter suddenly drops to a crisp, almost deafening silence: “Why?” Suddenly, the guy who wanted the Lambo didn’t even know why he wanted one. And so, we move on to the next phase of the question… They start pleading: “NFG, okay lang bang palitan ko na lang yung sagot ko?” Soon enough, their answers evolve to… “I want to be a more present mother. Gusto ko ako ang nag hahatid-sundo sa anak ko sa school.” “I want to travel the world, meet people from different cultures, and learn from them. I want to understand and build relationships that can cross boarders.” “I will quit my job and actually do what I love doing – make art.” The 'What would you do if money isn’t an issue?' question begs you to explore what’s truly important to you. It asks you to dive to the deepest pits in your heart and look for the reason why you’re working so hard in the first place… Para saan? Bakit? What is your Why? 3 THE MISSION Now, here lies the problem… Money is an issue In this society, we were taught one thing: Life is a race. Even before we were born, one spermie had to race with millions of others towards an egg to complete your unique self. At the age of five, people already start building your whole life with one seemingly innocent question: "What do you wanna be when you grow up?". In school, we had to obey and follow authorities to get good grades – grades that are based on an outdated system that tells us if we’ll eventually become good contributors to society or misfits. We raced for a diploma that should come with extra shiny medals, then we raced for job offers, afterwards, for promotions. While aiming for the top, we still have to keep in touch with our friends, somehow land into a fairy-tale relationship, serve as an organization leader, and still remain sane – at least sane enough to look like you’re living the best life ever on Instagram. In exchange for the chance to buy all the best things many, many billboard and pop up ads can offer, we offer our souls to our bosses – we say yes to them, whether they call us on a Sunday or at 3 in the morning because for some reason, all things need to get done ASAP. Eventually, you realize that only a few get to be promoted every few years, so you gotta make sure that you are the best. If you can’t be the best, at least you can 4 THE MISSION make your officemates look like crap. You step on every person you can think of because work is life and you really just have to feed your growing family, buy that car, get a bigger house, and purchase bags with brand names that get harder and harder to pronounce. You do this for the next 50 years of your life hoping for a good retirement plan that may or may not involve having your kids make money for you while they try to build their own families. If you’re one of the lucky few, you wouldn’t have to go back to work after retirement. Then, in the end, you die in a nice box that will rot anyway, and that’s it. Your life, ladies and gentlemen. That is it. …Really? It seems that from the time of our birth, we were only taught to race towards our death. You Only Live Once “YOLO” has built a notorious profile. Kadalasan, ang naiisip ng tao sa “YOLO” ay “stupid kids who don’t know how to handle their money well”. But hey, we only really live once. With the kind of system taught by our society, lemme ask you this: So far, have you ever truly lived? Survival in this world is based on a point system driven by money. The more money you make, the more successful 5 THE MISSION you are. This is simply ridiculous. With the things that we were taught, what do we have to lose in order to make more money? Just the most precious commodity of them all – time. And this is where my very own team of superheroes comes in. NFG Global Our schools taught us many things (as seen above). However, no one really taught us how to live… which is kinda weird because we only have one life to live nga, diba? Did we really just exist to work and pay our bills? Were we really just born to accumulate stuff? To impress people? To live two lives: offline and online? Mahirap baguhin ang sistemang kinasanayan na ng karamihan. But what if there is a way to still live your life to the fullest without waiting for society to change? What if, by doing so, you are changing the society? What if you can have more time for things that are more important than money? Nomad Finance Girls and Nomad Finance Guys are ordinary kids living extraordinary lives. NFGs aren’t necessarily wealthy – but they feel that they are because they have all the time in the world to focus on those that truly make life worth living: their passions and their relationships. 6 THE MISSION NFGs do not have to choose between a secured future and a fun present because we can always have both. NFGs are not just financially literate – we are also financially able. We don’t stop at learning about money – we practice what we know every single day. We are in the mission of educating as many people as we can. If you know how the money game works, then you’ll know how to make money tirelessly work for you. The financially literate Philippines What does a financially literate country look like? I I I I can can can can see see see see a dad witnessing his daughter’s first steps. a musician creating world-class music. OFWs permanently staying home. students choosing the course of their dreams. I can see people choosing their passions. I can see people choosing their families. I can see Filipinos understanding well that we only live once – and in this one chance, we have to choose what truly matters. Through this book, I can see you finally deciding to live like you only have one life. Tara! : E N O STEP R U O Y T SE N O I T A D N FOU "It doesn't matter how much you have or make. It is your feelings about money that determine your wealth." Ken Honda 8 STEP ONE: SET YOUR FOUNDATION Hair-raising or soul-stirring: I can’t really choose which is a better way to describe Steve Jobs’ immaculate 2005 commencement speech at Stanford University. “Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma - which is living with the results of other people’s thinking.” Our time is limited. We all know that. And I think that the biggest mistake we make everyday is assuming that tomorrow is guaranteed. We think about death and we see our wrinkly 70 or 80year-old selves, believing fully that we actually have that much time. Sa totoo lang, ang swerte mo kung mabigyan ka ng ganung kahabang buhay. Because the truth is we can die anytime between a few seconds from now and 50 something years from now. Since we mostly expect that we’ll always have tomorrow, we say things like… “Marami pa naman akong oras para sa pamilya ko. Next week na lang.” “Bukas ko na lang susubukan.” “Marami pa naman siguro akong chance noh?” Says who? Maybe, if we embrace the thought that we can die anytime, we will actually start to live. 9 STEP ONE: SET YOUR FOUNDATION With this in mind, shouldn’t we answer this question as early as possible? What kind of life do I want to live? A life dictated by someone else? Or a life based on my own terms? YOLO now, YOLO later People who YOLO have gained the reputation of being reckless. If you’re friends with “money gurus” online, it wouldn’t be a surprise if you find “advice” such as… “Travel ka nang travel, wala ka namang ipon.” “Kung tatanggalin mo lang ang milktea, may retirement fund ka na sana.” “Meron kang pang samgyup, pero wala kang insurance?” I wouldn’t even really call these “advice”. Sa totoo lang, I find these really annoying. However, I also understand their intentions. It is true that a lot of people do not even think twice about choosing the present over the future – reckless and unwise. Pero bakit ba lagi tayong namimili ng isa sa dalawa? Hindi ba talaga natin pwedeng makuha pareho? Why are you making me choose? I want both. I want my samgyup, my milktea, my travels, and my secured future, too! Asking me to choose one - mostly in favor for the future - is the same as asking me to live the 10 STEP ONE: SET YOUR FOUNDATION life of a robot. As much as we’re not working just to pay our bills, we are also not working just to save for our future. With the right mindset and the right money management system, we can YOLO now and YOLO later. And this is where we finally start with Step One. How do you want to feel? “Wha- wait... We’re talking about money right? Where are the numbers? The charts? Why are you asking me about ~ feelings ~ ?!?” Teka lang bes. We will get there. Remember: this is a step by step money guide for you. Step One contains the essentials that you would need in order to YOLO wisely. Step One acts as your money life’s foundation. A weak foundation sets long-term disasters, so please spend a lot of time here. Once you feel comfortable with the foundation you have built, then we can move on to Step Two. I really just asked you that question… How do you want to feel? You probably have a To-Do list. Or maybe a list of your goals for this year. How about five-year goals? Whenever I’m in front of an audience, I ask them about these things, and I always see hands up in the air. And I’d always bet that those hands would drop once I ask this one… 11 STEP ONE: SET YOUR FOUNDATION How about a list of feelings you want to feel? Instead of raised hands, I get puzzled looks – para bang sinasabi ng mga mukha nilang, “Hala. Na-scam yata ako, ah.” I totally get where you’re coming from! I felt the same way, too. But then I realized that we have this whole goal setting thing upside down. We were told a lie They had a simple formula for happiness. B + B + B = Happiness. They told us, as long as we get the babe, the boat, and the bucks, we’d be happy. And so, we ran after those things. We chased after money to buy more than what we needed. Since most people were taught in the same way, only those who have the bucks and the boat can attract the babes. Some of us did get the BBB. Sometimes. And some of us did become happy. Sometimes. Our drive to build to-do lists and chase for these achievements all day everyday come from our innate desires to feel something. What is it? Maybe, you don’t really want to be promoted. Maybe, you just want to fill in the hole left in you when your mom kept on comparing you to your high achieving cousin. Maybe, more than the promotion, you’d get more joy by 12 STEP ONE: SET YOUR FOUNDATION spending more afternoons building meaningful conversations with your mom where she’s proud of you for doing what you do best. Maybe, you’re not really all that excited about your upcoming trip. Maybe, you just want to seem adventurous too, just like everyone else you’re following on Instagram. Maybe, more than this trip, you’d get more energized by staying at home and finally finishing that art work you’ve always wanted to share. Maybe, you don’t really want to purchase that high-end bag. Maybe, you just want to get everyone’s validation that you are rich and powerful. Maybe, more than getting the bag, you’d feel more proud of yourself by wearing your favorite plain shirt and tying your hair in a messy bun as you create massive impact for the customers of the start up you’re running. What if, before building all of those to-do lists and vision boards and 5 year plans, we first get clear on how we want to feel? Find out how you want to feel then do the stuff that will make you feel that way. So, what do you really want? Run your own race I’m currently in one of Robin Sharma’s classes. One of the thoughts he shared that really stayed with me is this: “What race is worthy for you to run?” Run your own race. 13 STEP ONE: SET YOUR FOUNDATION I will translate the thought as another question for you to think about… How do you define success? You see, our brains are hardwired to join groups in order to survive. At dapat lang! Imagine, caveman ka, to protect yourself from getting eaten alive by a tiger, you have to stick with cavemen who are physically strong or who have the necessary equipment. The human brain before was equipped for basic and quick survival. Until now, even if we’re facing totally different threats, our brains still follow the same system without asking questions. Lemme ask you to do something… Describe a successful person. I mean, really describe the girl or guy in your head. Ano ang suot niya? Ano ang ginagawa niya? Where can you find this person? I wouldn’t be surprised if you imagined a guy in a nice suit or someone with a shiny car and a gigantic house. Just like our cavemen brains, we’re wired to stay in groups. If the society says that “A successful person has lots of money and stuff”, then defying this can mean getting kicked out. Who wants to get kicked out, right? So, instead of getting the hate and the ridicule, we follow 14 STEP ONE: SET YOUR FOUNDATION their words as if it’s a law. We work our butts off without even knowing why. Honestly, there’s nothing wrong with believing that success is all about money – if (and only if), you define success this way. But how do you define success? If you’re living your life based on someone else’s definition of success, then you’re just a dead man walking. If, for you, success means making money in pajamas, then go for that. If, for you, success means having a lot of free time for your children, then go for that. If, for you, success means doing something you love doing, then go for that. Define success and run that race. The Money Mountain How do you want to feel? How do you define success? What do you really want? Your answers here are the components for your money’s foundation. Building a strong base is the most crucial part in building anything. If you don’t want your money life to be wobbly, then you gotta make sure that you answer those questions as truthfully as you can. 15 STEP ONE: SET YOUR FOUNDATION Alam mo naman na hindi mo kakayaning lokohin ang sarili mo. If, one day, you finally achieved the top of the Money Mountain, we don’t want your success to be shortlived, right? It all starts here in Step One. But wait - what is the Money Mountain anyway? The Money Mountain is the step by step money guide for you. This will help you YOLO now and YOLO later. If you want to enjoy your life to the fullest and live your life your way, here’s your guide: STEP 7: BUILD YOUR LEGACY STEP 6: MAKE YOUR MONEY WORK STEP 5: PROTECT YOUR MONEY STEP 4: BUILD YOUR EMERGENCY FUNDS STEP 3: INCREASE YOUR INCOME STEP 2: MANAGE YOUR MONEY STEP 1: SET YOUR FOUNDATION The clearer you get with your foundation, the more this mountain would feel like an easy hill to climb. But really, I chose to call it a mountain exactly because mountains are hard to climb. The only way to reach the summit is to take one step followed by another, and another, and another. 16 STEP ONE: SET YOUR FOUNDATION I'm pretty privileged to be in a position where I get to work with business owners, investors, and traders newbies and veterans alike. From my view, I get to see, sort, and study those who make it from those who don't. Alam niyo kung ano yung pinagkaiba ng mga taong naabot ang goals nila sa mga hindi? Marami. Pero may iisang laging nagsa-stand out. Consistency. Even if they don't get results, successful people do what they have to do, over and over and over and over again. Madaling maging enthusiastic, lalo na sa una when we choose to say yes to new things. Mas madaling maging enthusiastic when things are convenient for us. But here lies the problem: most people think that simply saying yes would allow them to instantly achieve their goals. Hindi naman ganun yun. Those who succeed remain enthusiastic even when things aren't convenient for them. Saying yes is just Step one. Step two is doing what needs to be done. Step three is getting rejected, humiliated, even broken. But step four is standing up again and choosing to take another step. Followed by another. And another. And another. All extraordinary feats are simply many, many small and very ordinary actions done day in and day out. This is a steep mountain. You will be tempted to quit numerous times - and I am telling you, quitting will always be the 17 STEP ONE: SET YOUR FOUNDATION easiest choice. But just like winners, choose to stay gritty. Stick with it. : O W T P E ST E G A MAN Y E N O M R U O Y “Things which matter most must never be at the mercy of things which matter least.” Johann Wolfgang von Goethe 19 STEP TWO: MANAGE YOUR MONEY I can still vividly remember the day my mom helped me open my first ever bank account. I had to miss the first half of school that day since banks weren’t open on weekends and I just had to be there to open the account with her. I had no idea what it was for, pero nung pauwi na ako, binabandera ko na sa busmates ko na “Parte na 'ko ng Junior Savers Club!”. That fresh blue passbook seemed so professional. Just like most kids na nagmamadaling tumanda, it felt like a golden ticket to the world of grown ups. My mom was an extreme saver (still is) and use her being an Ilokana as an excuse to discounts and deals. Whether she’s shopping tiangge or at a big store, she would always bang discount?”. she would get major at a small ask, “Wala My Junior Savers Club badge and my mom’s antics built the foundations of my money life. By the time that I got into college, I had enough money saved to quit the whole get-a-diploma plan. But just like most college kids, I had too much fun. I blew up my life savings on bad investments, bad trades, bad businesses, and yes – parties I can’t even remember. In a span of just a few months, I had zero savings. I didn’t even know where my money went. It’s as if… it just magically disappeared. “Magically disappeared” – I’m pretty sure that this is how most of you guys feel. We often say, “Hala! Saan napunta 20 STEP TWO: MANAGE YOUR MONEY ang pera ko?!” But lemme be honest… You know where it went. You know how you spent it... Pero nagugulat ka pa rin! Expenses, savings, and what? When I was in nursery, my mom who haggled relentlessly with a Divisoria shop owner got me the complete Looney Tunes ring set. I was so excited about the rings that I wore them as Thanos would: one character per finger. I literally had 10 rings on and went on to learn the ABCs. One of the girls asked if she could have one. I’m not sure where I got the idea, but I simply said, “Sure, but pay me twenty petot.” Bungi ako noon. She ran to her ate, asked for money, gave me the bill, and chose Tweety Bird. “Oh no, Tweety’s my favorite. Additional ten petot for Tweety.” That day, I discovered two very important things: 1) The power of buying low and selling high, and 2) the idea of providing value and earning more from it. Trust me, back then, Tweety had a fan club of four year old kids. And we all knew that he was really male (he even had a girlfriend named Aoogah! #realfan). 21 STEP TWO: MANAGE YOUR MONEY I guess there are really just parts of our lives that remain vivid. This is one of those memories that I can remember in full color - as if it was meant to be a huge turning point in my life. I didn’t really bother using the lesson I got from that day until a few years later, but now that I’m almost 30, I look back and see how crucial that moment was. In the Philippines, you’re either a spender or a saver. And that’s all we know! We earn money and we only really have two choices: Spend it or save it. To help you picture why this is critical, I’ll share a lifechanging diagram that I picked up from Robert Kiyosaki’s book, "Cashflow Quadrant". E B Employee Businessperson S I Self-Employed Investor The Cashflow Quadrant is divided into four parts: Employee (E), Self-Employed (S), Businessperson (B), and Investor (I). The Cashflow Quadrant shows how each part deals with money and time differently. A person may fall under one, two, three, or even all parts of the quadrant. Let’s find out where you are. 22 STEP TWO: MANAGE YOUR MONEY Employee Quadrant You are an E if, of course, you are employed. But the main characteristic of an E is someone who exchanges his or her time for money. For example, if an E earns ₱25,000 net every month and works 20 days a month for 8 hours a day, then an E exchanges one hour for ₱156.25. Es get active income. This means that if an E stops working, he or she will not earn, too. Because again, to get money, Es must give their time. And that’s exactly what active income is: income you get in exchange for your time and effort (aka income you get when you act). Self-Employed Quadrant SEs are like Es but they have a little bit of control over their location. These guys usually do not run by the clock because of a boss. However, they still have clients to impress. Without clients, SEs won’t make money. Samples of SEs are freelancers who work from anywhere and have location freedom. Without clients to work with online, they won’t be able to make any money. They still exchange their time for money - but they can at least work on their laptops at the beach. Doctors and lawyers are self-employed, too. Without surgeries or cases, they won’t get paid. Just like Es, SEs get money in exchange for their time and expertise. 23 STEP TWO: MANAGE YOUR MONEY Businessperson Quadrant If a freelance writer hires other freelance writers, an accountant, and maybe an assistant, she can get more clients and pass them onto her writers. Now that she has a system that gives her money even if she’s not in the picture, the freelancer jumps from being an SE to a B. Bs are like SEs in a sense that they don’t have bosses who control or micromanage their time, location, and actions. However, unlike SEs, Bs have systems that allow them to do three significant things: 1) Produce more of their services and products within the same amount of time, 2) create more time for themselves, and 3) make money even if someone else is doing the work. Of course, Bs cannot entirely be taken out of the picture, as he or she still needs to oversee operations. Investor Quadrant While Es, SEs, and Bs work for money, Is make money work for them. Is make more money by using money. Their money isn’t simply sleeping in the bank. Every dollar goes to war through bonds, stocks, real estate, currencies, or commodities, and they work really hard while the the investor sleeps, goes on vacations, or enjoys a good time. Of course, not just because Is invest, they make money 24 STEP TWO: MANAGE YOUR MONEY instantly. Different financial markets work in different ways and contain different risks. Is must be knowledgeable not just about how the different markets work. They must also know their own investor’s profile and to understand which markets would serve them best based on this. Is earn Passive Income. This is the money that you get as time passes by, or money that you get even if you’re not doing anything. Are traders investors? Not necessarily. Trading is different from investing. In fact, I would go as far as saying that traders are SEs. If they don’t have trades, they don’t make money. Trading is about buying and selling stocks, currencies, and/or commodities within minutes, hours, days, weeks, or months. In investing, we’re looking for long-term gains and talking about holding on to a stock, a currency pair, or a commodity for years. We’ll take a closer look at these things in Step 6: Making Money Work for You. Which quadrant do you fall under? You can be in any of the quadrants. Personally, I’m in all of them. I’m an E because I’m also an employee of some companies I own. If I don’t do what I gotta do, I don’t get my pay. 25 STEP TWO: MANAGE YOUR MONEY I’m an SE because I trade the forex market. If I don’t trade, then I don’t make money from it. I’m a B because I have multiple businesses with systems that are giving me money. And I’m also an I because I have both paper and physical investments making money for me. “Who do you want to be when you grow up?” Karamihan sa atin dito sa Pilipinas, tinuruan maging E. Noong tinanong tayo ng “Anong gusto mong maging paglaki mo?”, sinabi mo bang “I want to be an investor po”? I doubt it. When we were asked that seemingly innocent question, did you ever notice that they asked “What do you want to be when you grow up” and not “Who do you want to be when you grow up”? A change in one word could spell the difference in our whole life and culture. When asked what, we tend to think about the jobs we’ll take or the positions we’ll get. “Gusto ko pong maging pulis.” “I’m going to be a doctor.” “I will be an astronaut.” But if asked who, we might have taken a longer time to answer. Kailangan kasi nating isipin kung sino yung gusto nating gayahin. “I want to be like mom who makes amazing food for us.” 26 STEP TWO: MANAGE YOUR MONEY “I want to be like dad who plays with me all the time.” “I want to be like ate who always makes me laugh!” “I want to be like kuya who makes me feel protected.” What does this have to do with managing money? Well… everything. Your money never lies In Step One, I asked you three critical questions: 1) How do you want to feel? 2) How do you define success? 3) What do you really want? If I were to summarize the essence of these questions, I will ask it in this way… What would you do if money isn’t an issue? If the base or foundation you built is strong enough, Step Two- the money management part - will be a breeze. But if you lied to yourself during Step One, then I’m telling you now: you will face serious problems. But then again, to be quite honest, your money will never allow you to lie to yourself because your money follows who you really want to be. Where your money goes is a clear reflection of your priorities. My friend who’s a single dad once called me to ask for money advice. He was in deep debt and was having a hard time trying to make ends meet, so I set up a meeting with him to see the root cause of this problem. 27 STEP TWO: MANAGE YOUR MONEY I asked him to show me a solid and detailed list of where his money goes. Fortunately, during that time, he’s been using a budgeting app. for three years that allowed me to see everything, down to the very last cent. Sabi niya, “Nag-tracker tracker pa ako, hindi naman gumagana. Wala pa rin akong naiipon na pang college ni Maxxie. Paid version pa yan, ha!”. I looked at his budget and asked him straight, “What’s your goal again?” Goal daw niyang makapag ipon para sa college tuition ng anak niya. Daw. I read his budget from top to bottom. Wala. Bottom to top. Wala pa rin. Kahit saang anggulo ko tignan, his budget doesn’t show any sign that Maxxie’s college education is in any of his top priorities. He didn’t even have life insurance to ensure that Maxxie will get to study even if something happens to him. In fact, a whopping 13% of his monthly income goes to vices and 0% to Maxxie’s college education – his “priority” daw. Now, don’t get me wrong. I did mention that this book will teach you how to prepare for the future while enjoying the present. Heck, it’s entitled “How to YOLO Wisely”. But if we’re going to do it, let’s do it right. If his priority is really Maxxie’s education, then why isn’t 28 STEP TWO: MANAGE YOUR MONEY his money reflecting this? Why is his money saying that he’s prioritizing something else? You can lie on your budget sheets. You can make yourself feel good by saying that you prioritize your family, your growth, yourself, or your goals. But your money will always follow your real priorities and your real answer to “What would you do if money isn’t an issue?”. Your money never lies. And once all is said and done, tatanungin mo nanaman… “Hala! Saan napunta ang pera ko?” Prioritize what’s real, drop what’s fake I often see posts online like… “Kung yung araw araw mong kape nilagay mo na lang sana sa insurance, edi sana milyonaryo ka na sa retirement.” “A samgyup a week keeps the millions away.” “Nakakapag-milktea araw-araw pero walang ipon? Boba pa more!” Ano kayang ginawa ng milktea sa kanila? As tackled earlier, our money follows our priorities. These priorities can be divided into two types: 1) Fake Priorities 2) Real Priorities Fake priorities are not yours. The big problem here is 29 STEP TWO: MANAGE YOUR MONEY you’re allowing other people’s thoughts, opinions, validations, and beliefs to take hold of your priorities. Just because others think that it’s trendy to wear this brand or that brand doesn’t mean you have to keep up with them… unless, of course, if you highly value their thoughts about you. If you say you want to live your life your way but buy uncomfortable designer clothes to impress people you don’t even like, then I’d say that those people are actually in control of your life. And since your money can sense that you prioritize other people’s validation, then you already know where it will go. Real priorities are yours. If designer clothes make you feel energized, creative, and inspired, then go for them! As long as you are staying true to what you really want, as long as you’re choosing this to impress yourself and not someone else, and as long as this is aligned to how you really want to feel, then by all means, go shop. Tandaan mo lang na hindi porket gusto ng iba ay kailangang magustuhan mo rin. This is what I tell my friends and clients when we fix their budget and I see a huge part of their money going to certain things like coffee, milktea, samgyup, books, travels, movies, gadgets, food, etc. Some of them buy milktea everyday just because the whole office buys milktea during breaktime and they don't want to feel left out - kahit na sukang-suka na sila sa lasa at kulay ng wintermelon. But some of them buy milktea because it makes them feel 30 STEP TWO: MANAGE YOUR MONEY relaxed and it calms them down. They even attribute their boosted energy and focus for their critical work to their milktea breaks. If I assumed that everyone’s the same and told my clients, “Wala kang pera kasi puro ka milktea” without even asking why, even if I give them a spreadsheet called The Best Budgeting System Like Ever, even if I pass them to the best financial advisor in the planet, even if I monitor their money decisions 24/7, the whole thing will still fail. Planning out your money must be customized and personalized. And we can begin by prioritizing what’s real and dropping what’s fake for you – not for your friends, not for your mom, not for your Kpop idol, but for you. Once you get this clear, we can finally move on to the Money Jar System. Bago mo pa sabihing, “Hayyy, sa wakas. Dumating din sa money management tool!” Sis, bruh, we’ve been talking about money management since the first part of this chapter. Money management starts and ends with your priorities. 31 STEP TWO: MANAGE YOUR MONEY The Money Jar System “Money will only make you more of what you already are.” T.Harv Eker The Money Jar System was first introduced by T. Harv Eker, author of the world-renowned book, “Secrets of the Millionaire Mind”. I’ve personally tried so many systems before and even used apps and spreadsheets. But they all have two things in common: they’re too restricting and they don’t work. They probably don’t work because they’re too restricting! I’m sharing the Money Jar System because it allows me to enjoy both the present and the future. And, just in case you forgot, this book is called “How to YOLO Wisely: A Step by Step Money Guide for People Who Wanna Enjoy Life.” So, how does it work? First, get your jars. Six of them. Yes, I really mean jars. As in jars. If you don’t want to use jars, you can use envelopes, wallets, boxes, yung tupperware ng mama mo (pero ibalik mo ha). Or, if it’s more convenient for you, you can use multiple bank accounts. This is what I personally do. For starters though, I would recommend using jars. During the first 60 days, we’re trying to build a new habit. And habits work better if our 5 senses can experience the habit you’re building. Using a jar would be good for this since you can see it, feel it, and hear the *kaching*. 32 STEP TWO: MANAGE YOUR MONEY Okay wait, why 60 days?! Deconstruction, confusion, installation This one was taught by Robin Sharma. It takes 60 days to build a habit. Not 21 days. 60 days! The first 20 days is all about deconstructing your old habits. During this time, hirap na hirap ka pang gawin yung new habit. Marami kang iaangal… and this is completely normal! There will be days when you’ll want to give up. The reason behind this is you still have your old belief systems installed, and it would be hard to kick them out during this phase. Just relax and do what you gotta do. Eventually, you will reach day 21 and head on to more days of confusion. Between days 21 to 40, there would be a mix of old belief systems trying to fight your new belief systems and habits. During this time, you will try bargaining with yourself. You’ll hear yourself say, “Baka pwede namang…” Don’t worry about this. This is normal. You will soon realize that you’re down to the last 20 days of your habit installation. If you’re a licensed driver, remember the time when you were just learning how to drive. Weren’t you consciously focusing on both of your hands, feet, and everything around you? Now, you can drive with one hand and eat with another. You can do this because a lot of your movements were 33 STEP TWO: MANAGE YOUR MONEY already installed. During this time, the becomes automatic. kayang hindi gawin. beliefs and your new new habit that you’re trying to form Yung para bang hindi mo na siya You’ve already let go of your old beliefs now come naturally to you. The catch here is, to make this work, you will need to provide willpower for the first 60 days. But after those 60 days, everything will be automatic for you. So, how does that work for our The Money Jar System? Whenever you receive money, split it into these six jars: Jar 1: Necessities Jar (55%) The Necessities Jar is for, well, your necessities. Necessities would include everything that is needed for your daily survival. This includes your rent, food, phone bill, medicine – mga bagay na pag hindi mo nabayaran, lagot ka o mahihirapan ka. If you’re saving up money for your emergency funds or if you’re paying for your life insurance policies, they would go to your Necessities Jar as well. Whuuut - why? In Steps 4 and 5, you will understand why both your Emergency Funds and your Life Insurance Policies are necessities, meaning they are crucial to your survival. Ideally, you should place 55% of your here. Alryyyyt, before you react… I know, I know. income 34 STEP TWO: MANAGE YOUR MONEY “Just 55%? Paano na yung credit card bills ko?” “55%?! Ang hirap niyan kung may mga anak ka na.” “55% - pwede, pero magda-diet na lang ako.” Keyword: ideally. Use this as a gauge for your current financial health. If your Necessity Jar takes too much of your current income, then you can choose from two options: Option 1, the boring and usually ineffective and quite restricting option: Cut your budget and strictly monitor every single cent until you go insane or become a spreadsheet master. Option 2, the more challenging but more effective and life changing option: Upgrade your skills, fine tune your network, find mentors, and increase your income. Wala namang tama o mali diyan, but I’m just reminding you that this book is called, How to Friggin’ YOLO (the updated version might be called this instead) – so I’m not quite sure with Option 1. Option 2 sounds fun, though. Jar 2: Financial Freedom Account (10%) Does being financially free mean earning millions? Not really. Review tayo, ah? Active Income is income that you get when you act or when you work. You get active income by working, providing the services you have promised, or trading. In this set up, you are working for money. Passive Income is income that you get as time passes by - 35 STEP TWO: MANAGE YOUR MONEY income that you get even if you don’t work. You can get passive income from your investments’ royalties, dividends, interests, and capital gains. In this set up, money is working for you. Where does financial freedom come in? You are financially free when your Passive Income becomes greater than your expenses. Kung ang gastos mo kada buwan ay ₱25,000, a consistent passive income of ₱25,000 promotes you to financial freedom. When you become financially free, this means that you’re not required to work anymore. As long as your passive income streams continue to make money for you and as long as they yield bigger profits versus your expenses, then you are financially free. The Financial Freedom Jar is your ticket to financial freedom - this is why no matter how much you’re earning, you must place 10% of your income in this jar. Imagine that this jar is your Golden Goose that will lay Golden Eggs for you every single day. As long as you take care of your Golden Goose, then you’ll be fine - even if you don’t work. In Step Six, you will learn all about the Golden Geese that you can get with your Financial Freedom Account. Jar 3: Long Term Savings (10%) Another 10% of your income will be placed into savings. I can already hear some of you… “Akala ko ba this is about YOLO-ing? Bakit ang dami kong 36 STEP TWO: MANAGE YOUR MONEY iniipon?!” Because this 10% will also be spent in the future. The money in your Long Term Savings Jar will be used to pay for the big things, like a downpayment for a house, a dream vacation, a car - anything you deem important in the coming years. Remember that a small monthly contribution to this jar can go a loooong way and can spell the difference between renting your place forever or owning one (which you can also have rented for passive income, btw). “Can I have more than one Long Term Savings Jar?” Yes, you can! Simply divide your 10% between the jars according to your priorities. Jar 4: Education Jar (10%) Learning goes beyond the four walls of your classroom. Self-made millionaires spend a good amount of money investing in books, courses, seminars, coaches, and mentors who can help them upgrade their skills and hone their craft. According to research from Thomas Crowley, over 85% of self-made millionaires can finish two or more books per month. Though there is always time for leisurely reading, these people focus on non-fiction books that cover selfimprovement, leadership, and human behavior. Personally, I use my whole education jar to get into classes, buy books, join exclusive memberships, and get access to both local and international mentors who can help me speed up my progress. 37 STEP TWO: MANAGE YOUR MONEY You are still your most valuable asset. Remember this. Sure, there are a lot of free resources out there. But there is another crucial reason why you must invest both time and money in educating yourself: your network is your net worth. When you place money for education, you’re not just investing in yourself, you’re also investing in new relationships. Imagine being in a class with like-minded individuals who are also willing to invest both money and time for themselves... wouldn’t you want to be surrounded by these people? And when you are surrounded by these new classmates and friends who are ready to shell out cash for their own growth, plus you go through the same system and class together, wouldn’t your return on investment grow exponentially? To grow yourself and your tribe, place 10% of your income in your Education Jar. Jar 5: Play Jar (10%) It’s now time to talk about my all-time favorite jar! Use the Play Jar to buy stuff you want. Travels? Date nights? Concerts? Shopping? Go for it. As long as there’s money in your Play Jar, buy anything that your heart desires. Disciplined savers might be saying… 38 STEP TWO: MANAGE YOUR MONEY “Sayang naman. Hindi na lang ako maglalagay ng pera sa Play Jar. Ilalagay ko na lang sa emergency funds.” Nope. No, no, no. The Play Jar is the most important jar. Lemme show you why. Narinig niyo na ba ito? “YOLO ka nang YOLO, wala ka namang ipon"? How about “Puro ka travel, pero wala ka namang insurance"? Nakakabwisit. Of all the money beliefs out there, this is what I hate the most: you have to choose just one. What am I going to do with my savings if I’m already too old to experience life? Are we really just born to graduate and work just so we can pay the bills, save, and invest? Aren’t we simply living in fear and worry if all of our income would go to the future, na pagdating ng future na yun, paghahandaan naman natin ang future ng future? To tell you the truth, I was one of those fearful moneyhoarding get-ready-for-the-end-of-the-world savers. I would even look down on my friends who spent so much of their money. Not only was I stressed. Kupal pa ako. Stressed na kupal! I was so worried about losing money that I never enjoyed anything for myself. So much so that I dismissed my health and overworked just so I could increase my income, saved most of my money and said no to 39 STEP TWO: MANAGE YOUR MONEY gatherings with long-time friends, never felt fulfilled and was always burnt out, and I lost interest in things that I used to love. One day, my collective stress caught up and I blew all of my money for hospital bills. Sleepless nights on that hospital bed witnessed my breakthrough. I had to change something. Your Play Jar ensures that you get to enjoy both the present and the future. In fact, the whole jar system does this for you - it makes sure that you’re placing money for your future needs while you are enjoying your present. Never ever remove the Play Jar. If you take this out, then the whole system will fail for you. If you have doubts about the Play Jar, what you have to fix are your beliefs around money which will be tackled in Step Three. What’s the point of working so much if you’ll end up in the hospital anyway? Doesn’t make sense. Note: If you’re still in debt and you wanna prioritize paying off your credit cards, then ditch this account until you’ve cleared your debt. A good 10% of your income goes for playing. Jar 6: Give Jar (5%) Good karma. Giving back. Whatever you believe in, as long as you’re in the position to achieve financial independence, then you’re in the position to help out. 40 STEP TWO: MANAGE YOUR MONEY There’s no need to be rich in order to give. Your 5% for the Give Jar can go a long way. You can use this jar for birthday gifts, your favorite charity, special occasions, or volunteer work. There is also a deeper reason for the Give Jar… It’s to eliminate your beliefs around money scarcity. Our mindset plays a big role in our results and we will dive deep into this in the next chapter. For now, let’s talk about two opposite money beliefs: scarcity and abundance. If you’re clouded by the scarcity mindset, then you always feel like you never really have enough. You might have this mindset if... You feel like money is always tight Your first choice is to always cut back You would rather enjoy things in the future - if ever that happens You think that your money situation is always someone else’s fault You’re scared of letting go of money and would rather not give it away You believe that it’s someone else’s responsibility to give you money - a program you signed up for, your family, your job, or the government You want to hoard money because you want to feel protected You feel ashamed about your debt and your bank account You believe that in order to make more money, you have to work more ...or that you have to be born into a rich family 41 STEP TWO: MANAGE YOUR MONEY If you have an abundant mindset, then you feel like there’s always enough money going around. You’re enjoying this mindset if… You create money by providing value and answering problems Another person’s level of income doesn’t impact how much you can make You believe and know that you’re responsible for creating your money You actually love it that you’re responsible for your income streams You love money, but you understand that it’s just a tool You have a clear reason for building wealth - and it’s not just to build wealth And the reason behind building wealth is not based on someone else’s validation of your image and success You understand that money only magnifies who you already are You believe that it’s your mind that provides you peace and calmness - not money You believe that it’s easy and fun to make money The Give Jar allows you to slowly move into the abundant mindset from the scarcity mindset. For some people, giving is easy, while for others, giving 5% of their income feels like losing so much already. Allow this jar to show you where you currently are in terms of your money mindset and shift to a better place that will allow you to make even more money. Here’s the fun thing about abundance. Abundance isn’t getting a lot. You become abundant when you give a lot. 42 STEP TWO: MANAGE YOUR MONEY With an abundant money mindset, you’ll be able to give more. The more you give, the more you’d want to increase your money sources so that you can give even more. This becomes a positive upward spiral for you where you give and give and get and get. Customizing your jars The amount that you place into Money Jars can be customized depending on your current money conditions. If, for example, you want to provide 10% of your income for giving, then you can adjust your contribution for the other jars. If you want more money for playing, then, again, adjust the other jars. It’s important to remember, however, that you can modify your contribution per jar, but you cannot remove a jar. All jars play a significant role around your money beliefs – the root cause of all your money problems and money achievements. If you try computing how much can be placed into these jars with your current income, you will already get the general condition of your money life. To carry a scarcity mindset or an abundant mindset is all up to you. Remember: you are exactly where you are because of your choices. There is power in knowing that how you feel and how you react to your circumstances are all your own choices. Only by accepting this that you'll have control over your results. Why you choose certain things come from a series of deep rooted beliefs that you may have picked up from someone else or have built through personal experiences. All of these things will be the foundation of Step Three: Increasing Your Income. : E E R H T P STE E S A E R C IN E M O C N I R U O Y “The difference between winning and losing is 99% psychological.” Mark Spitz 44 STEP THREE: INCREASE YOUR INCOME 2020 marked my 11th trading year. When I started trading the forex market, I never imagined that I would be managing money for a broker and a money institution for two years as a professional trader. Never did I think that I would quit that role to build my own trading school. Never did I envision that I would be working with one of the best retail traders in the country. And never did I picture that we will be coaching over a thousand students in less than three years. Sometimes, I look back and think… “How the heck did we do that?” The human body has its limits. The human mind, however, is limitless. As a trading coach, I’m given the privilege to study our students who all come from diverse backgrounds. We have public school teachers, entrepreneurs, single mothers, college students, freelancers, and even company directors and vice presidents. All students are given the same environment, the same strategy, the same access to resources, the same everything. They even have the same trades! They trade the same commodity pair and use the same strategy, the same time frame, literally the same everything. But how come their results differ? Some students make and withdraw a lot of money. Some burn their accounts. How come? The same goes for my team of financial advisors. 45 STEP THREE: INCREASE YOUR INCOME I give them the same training, the same business plan, the same environment, and the same kind of mentorship. Some are able to get more clients. Some don’t get their desired results even after a year. Why? If the strategies, the teacher, or the money isn’t really the answer, then what is? Quite simple, really. The difference that makes the difference? You. What’s underneath your money struggles and successes? Sorry to break it to you, but this chapter will not teach you how to get a side job or how to trade money. Madali naman nang i-Google yan. Step Three: Increasing Your Income really is increasing your income. And you can’t do that by adding skills, getting more knowledge, gaining connections, buying the best tools, or starting bigger capital. about merely better with a Even with all of the best tools, mentors, and strategies on the planet, if you don’t have the right mindset, all of these things will be rendered ineffective. What we’re trying to look for is congruence: a place where your money-making skills and beliefs around money would match smoothly and beautifully. The money-making part is easy. All you gotta do is learn 46 STEP THREE: INCREASE YOUR INCOME it and practice it. But this is just half of the equation. The more important half revolves around your beliefs. For every money struggle you went through and every money success you have achieved lies a belief that allowed you to make specific decisions and take certain steps that gave you your outcome. Money is neutral Money is good and bad. Money is important and unimportant. Money is the problem and the solution. Money is what you want it to be. If you say that money is evil, then you’re right. If you say that money is good, then you’re right, too. You see, money has always been neutral. It takes no side. It means nothing. It simply acts as a transactional tool for buying and selling goods and services. There’s no meaning behind money except the meaning you give it. Money is just a tool. How you perceive it and its effect on you all come from your own beliefs around money - and these beliefs may be helpful for you, while some can be damaging not just to you, but also for the people around you. To test it out, lemme ask a few questions. Let’s pretend that you have a debt of ₱10,000 that you absolutely have to pay by payday. Your paycheck arrives 47 STEP THREE: INCREASE YOUR INCOME and you look at the amount written across it. May utang kang ₱10,000 at eto ang nakuha mo. Ano ang nararamdaman mo? Guilty? Shameful? Takot? Masaya? Excited? How about this one… Binayaran mo na nang buo yung ₱10,000. Now, you have to survive for 15 more days until you get your next paycheck. How do you feel? Guilty? Scared? Lost? Excited? Calm? Proud? There are no right or wrong answers here, only honest ones. Alright, two more… Your next paycheck finally arrived! Anong nararamdaman mo ngayong wala ka nang kailangang bayarang utang at ngayong nakapag-replenish ka na? Guilty? Ashamed? Takot? Kinakabahan? Masaya? Excited? Kalmado? I guess we’re mostly happy and excited, right? And lastly… Nalaman mo na yung batchmate mo nung college na bagsakan, kumikita nang triple ng kinita mo ngayong buwan na ‘to for only four hours of work per day. How do you feel? Guilty? Shameful? Scared? Happy? Excited? Calm? How about mad? Inspired? Competitive? Confused? 48 STEP THREE: INCREASE YOUR INCOME Bewildered? Weh? Ayaw mo ba maniwala? Scam ba? Impossible? Hulk-like? After learning about your batchmate, what are the questions and statements lingering in your head? Why? Your beliefs are always in control What will determine your financial future? Your long hours of work? Your mentors? The strategies you use? Even if you have the best ones, if your beliefs aren’t congruent with them, then they’ll all be pointless. There’s that word again - “beliefs”. What are money beliefs anyway? Your personal money beliefs will dictate how you perceive money and work. Think of your beliefs as sun glasses. If you’re wearing pink glasses, then you’ll perceive the world in pink hues. But if your friend is wearing green glasses, then she will perceive the world in green hues. If you believe that it’s hard to get money, then you’re right. You will have a hard time getting money. But if you believe that it’s a breeze to get money, then you’re also right. You will have an easy time obtaining money. Your attitude towards money and the beliefs you surround yourself with can spell the difference between living a 49 STEP THREE: INCREASE YOUR INCOME life of struggle and living a life of abundance. Now, here’s the catch: No one really knows whether your beliefs are right or wrong. Let’s imagine two 6-year-old girls in two separate rooms containing two separate television sets. Suddenly, a maala-Pinoy Big Brother Kuya sends an electrifying announcement to both rooms. “Pick up the controller and press the Power button.” Both girls follow Kuya’s orders. Kuya then says, “Whatever you’re seeing is the truth.” And just like obedient robots, these girls live their lives based on this “truth”. Now, let’s have full control over their lives. Let’s place them in the same school, the same batch, the same classroom. Gawin na rin natin silang bestfriends. They go through school together and graduate together. They’re even each other’s maid of honor! Oh, and, parehong buwan din silang manganganak. You get the point. But don’t be fooled. They did grow up in the same environment. And yes, they’re the best of friends. But they’re living totally different lives. The other one is financially struggling, juggles three jobs, and barely has time for her son. One lives in an upscale neighborhood, makes more than enough, and has so much free time for her daughter. 50 STEP THREE: INCREASE YOUR INCOME We now have two 80-year-old women in two separate rooms with two separate TV sets. Suddenly, they hear the same, familiar, thrilling voice. “Pick up the controller and press the Power button.” Both women follow Kuya’s orders. Again, he says, “Whatever you’re seeing is the truth.” One screen displays one word in big, bold letters: IMPOSSIBLE And the other displays the same word: IMPOSSIBLE Whether you believe it’s “impossible” or “I’m possible”, you’re always right. Your beliefs are always in control of your actions and your decisions - or your lack thereof. It doesn’t matter whether your beliefs are true or not. The better question is: “Is this belief helpful or is it limiting?” It’s your Reticular Activation System You probably have heard of the Law of Attraction. New Age beliefs teach the Law of Attraction as our innate human ability to attract whatever we are focusing on. The more we focus on the good stuff, the more good stuff we get. The more energy we place on the bad things, then we get more of those, too. With the power of our minds, we can materialize anything we want from thoughts to reality. For some people, learning this may be a bit hard to 51 STEP THREE: INCREASE YOUR INCOME accept, especially when you grew up in a household that acknowledges hard work as the only way to go. But the Law of Attraction is beyond wishful and positive thinking. In fact, you have your Reticular Activation System to thank for turning your “good vibes” into actuality. Your Reticular Activation System (RAS) is the part of your brain that is responsible for getting information, filtering it, and sending the filtered thoughts to the hypothalamus which mediates your behavior. What’s your favorite color? Mine is blue. When I go out to buy bed sheets like a level 99 Tita of Manila, my RAS immediately scans for blue bed sheets because I think of the color blue more often compared to other colors. It’s giving me what I want and filtering out what I don’t want. Think of your RAS as your assistant. It collects your thoughts and filters them according to what you want. Ang problema sa secretary nating ito, hindi niya alam kung ano yung good thoughts at ano yung bad thoughts. As long as you’re placing so much time and energy on a thought, your RAS will filter it as important. Once it labels a particular information as something important, then it will tell your hypothalamus “Heyyy, I’ll show this guy more of this stuff. Make sure his behavior matches them, alright?”. If your RAS filters “debt” as something important to you dahil lagi mo siyang iniisip, then it will project even more of that for you. Magiging mas hyperaware ka of debt. You go out there, and you see more reasons to go into debt. Or you will panic because you will be reminded of your debts. This leads to stress and bad behaviors. This is 52 STEP THREE: INCREASE YOUR INCOME where your downward spiral begins. In the same way, if you always think about “opportunities”, then your RAS will filter them as important. Suddenly, you see all the opportunities around you. Sasabihin mo pa, “Wow! Swerte. Iniisip ko ito kanina lang, ah?”. It’s not that those opportunities have never been there. Matagal nang andyan yan, ngayon mo lang napansin kasi ngayon lang na-filter ng RAS mo para sayo. This is why you have to be very careful with the thoughts you're feeding your RAS. What you focus on expands. I try my best to use this knowledge about RAS to my advantage. People discount the concept of luck. But actually, sincerely believing “I am a lucky person” has done wonders for me. In the context of having my RAS filter my thoughts, believing in luck has given me so many opportunities and courage. Does it matter kung totoong swerte ako o hindi? Nope. But is it helping me out? Yes - a lot! Some pages ago, I said this exact thing: “The moneymaking part is easy. All you gotta do is learn it and practice it. But this is just half of the equation. The more important half revolves around your beliefs.” Believing that the money-making part is easy is another empowering belief I’m holding onto. I’d rather make it easy than get the same amount of money with so much struggle and effort. And again - the more important half revolves around your beliefs. Whether you think it’s impossible or “I’m possible”, 53 STEP THREE: INCREASE YOUR INCOME you're right. Whether you think it’s hard or easy, you’re right. Whether you think you will struggle or not, you’re right. Your thoughts and beliefs are always right. Money is the root of all evil… or goodwill? Help? To give you a clearer view of these beliefs, let’s talk about one of the most common beliefs out there. “Money is the root of all evil.” I’m just gonna be very blunt about this… if I meet a person who believes that money is the root of all evil, I will never give that person money. Remember: money is neutral. It’s not evil nor is it good. It turns into whatever the holder of the money turns it into. If you believe that money is the root of all evil, then giving you money will only result in evil things. But if you believe that money can be used for goodwill, then money in your hands will be used for good deeds. Whatever happens to money will be because of the user. Money is just a tool, just like a knife. A knife is neutral. It’s not good nor is it bad. A knife is good in the hands of a loving mother who uses it to create delicious meals for her family. But the same knife can be bad in the hands of a murderer. 54 STEP THREE: INCREASE YOUR INCOME If “Money is the root of all evil” is one of your beliefs, lemme ask you a question… Saan mo napulot ang belief na ito? Most of the time, the beliefs we have were only passed on to us or taught to us by our own parents, schools, and society. We picked them up because we trust these people and institutions. Sometimes, we make new beliefs because of our personal experiences. The once neutral money became stained when you were scammed by someone you trust - and bam. The belief that money is the root of all evil was born. It’s not your fault. Beliefs are easy to pick up. And they’re easy to change, too. We’ll get to that. Before change takes place, we must first be aware of the things we need to change. What are the beliefs you’re currently holding onto which may be detrimental for you? Are any of these beliefs holding you back? Here are 100 beliefs about money and success. Some are limiting and some are helpful… well, it really depends on the user. Check them one by one and see if the belief rings back. If it does, simply answer this question: “Is this belief helping me live the life I want to live or is it just holding me back?” 55 STEP THREE: INCREASE YOUR INCOME 1. Money is the root of all evil. 2. The rich get richer because they are cheaters. 3. Time is more important than money. 4. I attract opportunities effortlessly. 5. Money can’t buy love but it can buy lots of good time with my loved ones. 6. If I am successful, people will hate me. 7. It’s possible for me to make more money by working less. 8. I am where I am financially because of my parents. 9. Money is more important than time. 10. The harder I work, the more money I make. 11. I am a money magnet. Anything I do makes money. 12. I attract the right people into my life. 13. My friends help me become better with money. 14. Money is energy and will appear as you really feel about it. 15. The only way to succeed is to get promoted in my 9 to 5 job. 16. I’m terrible with money. 17. I attract successful people, successful experiences, and successful connections. 18. There is always more than enough money for everyone. 19. My current money condition is the government’s fault. 20. I can enjoy the present and still have money for the future. 21. My actions match my thoughts. 22. Being born poor is a divine punishment from the gods. 23. If I have a little more than I need to get by, someone else has to go without. 24. Working hard won’t necessarily give me more money. 25. God only loves the poor. 26. Success finds me everywhere I go because I only think and feel successful thoughts about myself. 27. I don’t deserve to have a lot of money. 28. Money brings calmness and spare time. 29. I am a slave for money. 56 STEP THREE: INCREASE YOUR INCOME 30. Success is a mindset. 31. I am comfortable asking for payment for my service. 32. Being poor is hard work. 33. It is more stressful to be poor than to be rich. 34. Everything I touch becomes successful. 35. I am learning about money everyday. 36. I can make a difference by becoming wealthy and employing many people. 37. The rich become richer because they’re good investors. I can be one too. 38. Money is my slave. It works hard for me even if I sleep. 39. I succeeded at personal development because I invest in myself first. 40. It’s impossible to make more money with less work. 41. God wants me to prosper. 42. Money only magnifies who I already am. 43. Success starts with me. I choose to be successful. 44. It’s more spiritual not to care about money. 45. Success is about having a lot of money, buying a car, and buying a house. 46. I graduated from a prestigious university. I deserve a bigger paycheck. 47. It takes a lot of money to make more money. 48. I allow myself to dream a life of abundance. 49. Money is freedom. 50. Buying a house before I turn 30 will make me feel successful. 51. There’s not enough money to go around. 52. I work on my money goals everyday. 53. Rich people get rich because they see opportunities where others see obstacles. 54. If I get paid too much, people will think I’m a fraud. 55. I honor my money-making skills. 56. I can become rich by helping other people. 57 STEP THREE: INCREASE YOUR INCOME 57. Sales people are greedy. This is why I will never enter sales. 58. He/She doesn’t deserve to have a lot of money. 59. My attitude attracts money. 60. My thoughts add value to my life. 61. I am blessed in many ways. 62. I manage my money with care and wisdom. 63. It’s not fair that those people have so much more money that I do. 64. Rich people are evil people. 65. Even in tough times, people can make money. 66. Hanging out with wealthy people teaches me a lot of important things about life. 67. I would rather have rich people’s problems. 68. I enjoy using money for pleasure and fun. 69. I am very lucky. 70. I should wait until things are perfect. 71. I deserve to be happy, wealthy, healthy, and successful. 72. Rich people are in a better position to help others. 73. I am surrounded by money-making opportunities. 74. My arms are wide open for all the abundance in the world. 75. Young millionaires probably did it by cheating. 76. I believe in myself and my ability to make money. 77. I can save for the future and still have fun in the present. 78. I give value to others and they pay me for it. 79. The only way to save a lot of money is to not have fun. 80. Being conscious about every single centavo is the right thing to do. 81. People who give things for free probably will ask for something in return. 82. I need to buy a car before I turn 30. 83. I can only achieve what I want when things are perfect. 84. There are a lot of things to learn about money outside the classroom. 85. Making money is fun. 86. I can be wealthy and modest. 58 STEP THREE: INCREASE YOUR INCOME 87. The only way out of poverty is marrying someone from a rich family. 88. I don’t deserve to have fun because I don’t have savings yet. 89. I only get what I deserve. 90. I am able to create the life I want for myself and my family. 91. To become valuable, I need to be a millionaire. 92. I have to do a lot of things you don’t like to get money. 93. The more money I have, the more time I can buy with it. 94. I do not have enough to share or give away. 95. Money can never buy happiness. 96. I always have money. 97. I feel ashamed asking for payment for my services. 98. I will never have enough. 99. This book is challenging me, but I believe I will become better because of it. 100. It’s better to be rich and healthy than poor and sick. To increase your income, install empowering beliefs Limiting beliefs don’t help, so why keep them? Beliefs are not set on stone. This in itself is a belief. If you understand that you have full control over what you believe in, then you can replace beliefs that limit you with beliefs that empower you. Some years ago, I was in a relationship with a stock trader. I was trading the forex market already during that time, so we enjoyed petty bickering on who can make more money. It was fun at first. After a few months of making more money than he does, he started cheating on me. 59 STEP THREE: INCREASE YOUR INCOME Not sure if I was slow o nagbubulagbulagan lang ako, but I only learned about all the other girls during his relationship with the third one. And guess what? They were all traders, too! I already knew why he did it. I didn’t even have to ask, but of course, I wanted to hear him tell me the reason. And he did. To put it plainly, his ego couldn’t take the fact that a girl repeatedly beat him in making money from the markets. Years after that relationship, I found myself unable to get through a trading ceiling. There was this certain price point na tuwing nandun na ako, lagi akong talo! Hindi ko maintindihan. Pinagdudahan ko na rin ang skills ko. So, I went to my mentor and showed him my account. He asked me, “Why are you sabotaging yourself?” What? Bakit ko naman gagawin yun? But then I looked at my trading history and he was right. There were clear and obvious reasons to buy, but I still tapped the sell button. Repeatedly. When I started looking deep into the root cause of my problem, I recognized the bad limiting belief from years before… “If my trading account becomes larger than my partner’s, he will cheat on me.” And even deeper: “If I go beyond my partner’s success, he will cheat on me.” 60 STEP THREE: INCREASE YOUR INCOME Aaaand deeper: “If I succeed, people will betray me.” There you go. My head wrapped its decisions around this belief that I didn’t even notice that my subconscious mind was deliberately sabotaging my potential success because I firmly believed that succeeding means betrayal. Fortunately, there is a way to replace limiting beliefs with more empowering ones. This is exactly how I saved my trading account, myself, and my relationship: Step 1: Question your old belief. Ask: “How has my current belief held me back and limited me? What were the specific instances when it stopped me from doing amazing things? How did I feel about it?” Step 2: Replace with a new belief. Ask: “What belief would empower me instead? Will this new belief be in direct conflict with my old belief? If I install this new belief, how will my life change? If my life changes because of this belief, how will I feel?” Step 3: Strengthen and automate your new belief. Ask: “How can I reinforce this new belief? What system should I implement in order to strengthen this new belief? Are there people who can help me stay accountable as I install this new belief?” You can dictate your life’s narrative. If you implement better beliefs, you get to send better thoughts to your RAS, which filters stuff you actually want and helps you take action towards them. Every decision you make changes the course of your whole life and it starts with the beliefs you choose to hold on to. 61 STEP THREE: INCREASE YOUR INCOME “Every action you take is a vote for the type of person you wish to become. No single instance will transform your beliefs, but as the votes build up, so does the evidence of your new identity.” Atomic Habits by James Clear : R U O F P E ST R U O Y D BUIL Y C N E G R EME S D N FU "Give me six hours to chop down a tree and I will spend the first four sharpening the axe." Abrahan Lincoln 63 STEP FOUR: BUILD YOUR EMERGENCY FUNDS December 31, 2019. “Bring it on, 2020!” “I’m ready for you, 2020!” “In 2020, I’m going to live like it’s my last.” Ayan, sa kakahamon natin kay 2020, look at what happened. Even before this whole COVID-19 thing happened, we were greeted by health-risk inducing ashfall from Taal. Remember that? March 15 was supposed to be an ordinary day for most of us. Just like many, I enjoyed that Sunday thinking this whole pandemic thing will be a short-lived, easy-toanswer issue. Boy, was I wrong. Malay ko bang March 15 would be the last time I would be able to step into the outside world. But my qualms and worries are nothing compared to our frontliners’ daily struggle. It’s nothing compared to those who have family members who are ill with the virus. And it’s definitely nothing compared to those who suddenly lost access to their daily income. This pandemic, ladies and gentlemen, is a health and economic emergency we didn’t see coming. Still, I’m going to pose this question here… Did we have enough time to prepare for these possibilities financially? Were we always given the choice to set aside money just in case we suddenly lose access to our income streams? 64 STEP FOUR: BUILD YOUR EMERGENCY FUNDS “Where do we get to the fun stuff?!” “When will you start teaching me how to make money, senpai?!” I have been teaching you how to make money when I first asked… “What would you do if money isn’t an issue?” But if you want to enter a war with only your boxers on, go ahead and start investing and trading without emergency funds and life insurance policies. Just in case you forgot, here’s how we described the Necessities Jar. “Necessities would include everything that is needed for your daily survival. This includes your rent, food, phone bill, medicine – mga bagay na kapag hindi mo nabayaran, lagot ka o mahihirapan ka.” Your emergency funds and life insurance policies are placed in the Necessities Jar because they are necessities - things that are needed. These are not optional wants, these are prerequisites, essentials, fundamentals, sine qua non. But why? Optimism bias Financial advisors usually talk about life’s uncertainties because those are the things we have to prepare for. 65 STEP FOUR: BUILD YOUR EMERGENCY FUNDS But when dealt with these things, what do people say? “Hindi pa naman ako mamamatay.” “Hindi naman ako siguro magkakasakit.” “Malabo naman ako mawalan ng trabaho.” This is called optimism bias. We tend to be too optimistic for our own good. We think that bad things won’t likely happen to us and assume that job loss, disabilities, illnesses, money risks, and death will only happen to other people. What are the unwise money things that people with high levels of this cognitive bias do? They believe that they’re immortal beings who are bound to get rich one way or another. What can we do if we find ourselves trapped in this bias? Well, we can use it for more positive results (just trying to be more optimistic here, people). How? When we lean towards optimism, we have a better sense of anticipation for the future and this gives us enough motivation to pursue our personal goals. To leverage on this, we can use our desired futures to make better decisions now. If you don’t want expensive uncertainties to drag you away from your goals, then it’s time to start thinking about how you can be financially prepared in any given situation. And this is exactly how you will achieve your goals - by lowering your risks as much as you can. How do you lower your risks? 66 STEP FOUR: BUILD YOUR EMERGENCY FUNDS Simply by being prepared. Who will survive? Whoever’s prepared. If you Google the word “emergency”, this is what you’d get: “a serious, unexpected, and often dangerous situation requiring immediate action." The problem with a lot of people is they think events are unexpected, when really, they must be expected already if we want to be prepared for them. Imagine mo na nagda-drive ka tapos biglang na-flat yung gulong mo. At the very least, you have a spare tire, right? Having a spare tire indicates that you already know that getting a flat tire is possible and you have come prepared just in case it happens. And now that you need it, you have something to use. All you gotta do is replace the busted one with your spare, and you’re good to go. But what if you made a totally different decision? What if, a few months before the incident, you were offered to buy a spare tire, but your all knowing, immortal, optimistic, lucky self said, “Hindi ko na kailangan niyan. Hindi naman siguro mafa-flat yung gulong ko”? And then it happens. Lo and behold, you don’t have a spare tire to use. That’s the thing with emergency funds: you have to prepare them when you don’t need the money yet, thinking that if the time does come, you have money ready to work for you at your beck and call. 67 STEP FOUR: BUILD YOUR EMERGENCY FUNDS In this world filled with uncertainties, only the prepared survives. How much is peace of mind? To know how much you’d need to complete your emergency funds, simply multiply your monthly money needs by six. If, for example, your expenses in a month ramp up to ₱20,000, plus ₱5,000 for some leeway, then you would need ₱150,000. Ideally, this ensures that you have enough money for six months just in case something happens. But really, I think the right amount of emergency funds is subjective. Remember that money is emotionally charged, so different amounts mean different things to different people. What you’re looking for when building your emergency funds is peace of mind. How much is your peace of mind? When dealing with emergencies, this doesn’t include medical bills and death - these are answered by insurance. Emergency funds can cover simple yet unpredictable events like suddenly needing a new dress for a wedding or something as big as having your house repaired because of a typhoon. If, for example, you have emergency funds of ₱150,000, this might be able to cover small medical needs which may also be reimbursed by your hospital maintenance 68 STEP FOUR: BUILD YOUR EMERGENCY FUNDS organization (HMO). But what if the emergency is beyond ₱150,000? What if you’re diagnosed with a critical illness like cancer? It would definitely cost more than your emergency funds. These events must be covered by your life insurance policy’s Critical Illness Benefit. We’ll tackle this in Step Five: Protect Your Money. What if the emergency is your death? Will ₱150,000 be enough for your family’s daily expenses? I highly doubt it. In fact, if you pass away, all of your assets, including your emergency funds and other investments won’t be passed to your beneficiaries unless they pay for the necessary taxes (oo, hanggang kamatayan nagbabayad tayo ng tax). Now, here are my hindi-kita-papatulugin questions: With these in mind, how much money would you need for your emergency funds such that having it will allow you to move forward and enjoy your present… no matter what happens? With what you have right now, what will happen to you if you face any of life’s uncertainties? With what you have right now, what will happen to your family’s money if you face any of life’s uncertainties? We tend to forget that our money decisions don’t only affect us. They all directly affect the people important to us, too. This is why you can’t just jump to the “more exciting” parts like trading and investing. 69 STEP FOUR: BUILD YOUR EMERGENCY FUNDS Remember: trying to grow and multiply your money without protecting it first is like going into war nang nakabrip o panty lang. How to open a bank account in the Philippines Since we need our emergency funds to be easily accessible, we can’t place it in assets that we have to sell. Imagine, nanganganak na si misis tapos kailangan mo pang ibenta yung stocks mo para lang magka-pera? Hello? It must be easy and liquid enough to access when the emergency arrives but hard enough to reach so that you won’t treat a payday sale as an emergency. Typically, a saving’s account in any bank would be a good place for your emergency funds. Here are some things you need to know: You can start a savings account for as low as ₱100 as maintaining balance. Annual interest rates for savings accounts are usually less than 1%. But there’s no need to fret too much about this since the purpose of the money you’ll put here is simply for your emergencies - not for money growth. You can let your money sleep while those emergencies aren’t around yet. If you use another bank’s ATM to withdraw or check your balance, you will be charged a service fee. Some banks incur penalties if your account goes below your maintaining balance. The amount varies from bank-to-bank. You can’t issue checks with a savings account. 70 STEP FOUR: BUILD YOUR EMERGENCY FUNDS Basic requirements when opening a bank account 2 Valid IDs: School ID Company ID Postal ID Passport UMID Driver’s License Two 1×1 ID (taken within 6 months) Proof of Billing: Electric bill Water bill Phone bill Tax Identification Number Initial Deposit (starting amount depends on the bank) The process 1. Select your bank of choice. Consider the following when choosing a bank: i. Initial deposit and maintaining balance ii. Interest rates iii. Do they have a lot of ATMs? Branches? iv. Do they have online banking services? v. What are the other perks if I join this bank? 2. Call the bank or check their website to see if they have other requirements on top of the basic ones 3. Compile your requirements and initial deposit 4. Check if an online application is possible. If not, visit your branch and apply there. 5. Go to your selected bank’s branch that would be convenient for you to visit (near your home or your office) 6. Fill in and sign all bank forms 7. Review the terms and conditions 71 STEP FOUR: BUILD YOUR EMERGENCY FUNDS 8. Provide all requirements and initial deposit 9. Claim your card as soon as it's ready 10. Go to the nearest ATM and change your card’s pin 11. Subscribe to online banking 12. Sometimes, subscribing to online banking will require to go to the nearest ATM to activate your online account. 13. Start saving up! Now that you have emergency funds, you have more money to protect. : E V I F STEP T C E T O R P Y E N O M R U O Y “To see the world, things dangerous to come to, to see behind walls, draw closer, to find each other, and to feel. That is the purpose of life.” The Secret Life of Walter Mitty 73 STEP FIVE: PROTECT YOUR MONEY Ironically, nothing teaches you more about life than death. For me, it was the death of a friend. We were just a few days shy from graduating high school when she passed away because of intracerebral hemorrhage. Seeing a friend you were just literally eating with yesterday inside a casket is a good enough smack in the face. I’d like to think that until the very end, she was still teaching me something valuable: “Nikki, enjoy life as much as you can.” So I decided to make tons of money to enjoy life as much as I effin’ can. A few years later, I got into the life insurance industry thinking that sales would be my golden ticket. And then I received that call. A client died. Back then, hindi ko naman iniisip that a client would actually die. Or at least, not while I was his advisor. While his death benefits were being processed, I reviewed our meeting, checked the names of his sons, and went to his wake. When I saw them, my heart broke. There they were - Kyne who just turned seven and Gino who was just three. One of the many questions in my head was, “Do they understand what’s happening?” along with “How am I 74 STEP FIVE: PROTECT YOUR MONEY even supposed to approach his wife who’s a full-time mom?”. I had no answers. I can’t remember how I did it, but I suddenly found myself talking with Suzie - a young widow. I will never forget her puzzled look when I introduced myself as her husband’s financial advisor. Natawa siya. Sabi niya, “Ang bata mo naman.” I didn’t really know what to say, so I just said, “Oo nga po, eh.” And then she started crying. That’s when it hit me. Minsan siguro talaga, mauunang makita mo yung opportunity na pagkakitaan ang isang negosyo bago mo makita kung bakit mo siya gagawin. I clearly remember this day like it was just yesterday because this was when I found out why I had to stay in the industry. This is why I do what I do. And this is why I’m still here. My client was a stranger I met on Facebook. But a short meeting with him meant that two young boys can continue studying, a widow can buy time to find work, and a whole family can live on without the financial struggles of losing their breadwinner. Suzie gave me a hug and said, “Mahal na mahal niya talaga kami, noh?”. Without even realizing it, I became an instrument of someone's unconditional love for his family. 75 STEP FIVE: PROTECT YOUR MONEY What are you really protecting? If building your emergency funds is about preparing for unseen events that may cost you money, then protecting your income is about gathering all the necessary gear and armor to make sure you survive the war. The money game is not all rainbows and butterflies. It can get bloody and violent. And those who enter this world without the necessary protection get trampled by uncertainties. Sa totoo naman din kasi, hindi naman na talaga uncertainty ang critical illness, disability, at death. Ayaw lang nating isipin na pwede silang mangyare sa atin. Remember optimism bias? Let me show you what you’re really protecting. Let’s create a fictional character and call him Benben. Benben is an extreme saver (who also happens to be a talented musician). His parents taught him to make every cent count and to save as much as he can, so by the young age of 22, he was able to save up ₱200,000. Wooot, good job, Benben! Every month, he can set aside at least ₱3,500 of his income for savings. Benben decided to place his monthly savings in the bank instead of paying for an insurance policy. Naisip niya, “Sayang naman kasi yung ₱3,500. Iipunin ko na lang! Bata pa naman ako at hindi ko kailangan ng insurance.” 76 STEP FIVE: PROTECT YOUR MONEY I’m not going to write an elaborate story about how Benben suddenly started feeling physical pains and I’ll just get straight to the point: At age 35, he was diagnosed with lung cancer. Alright, now, let’s deal with money. Benben’s savings at age 22: ₱200,000 Benben’s savings from 23rd year to 35th year (₱3,500 x 144 months) = ₱504,000 Benben’s total savings = ₱704,000 If his lung cancer costs ₱2,000,000, what will happen to Benben’s financial life? Three things: 1. He will lose ₱704,000 in savings 2. He will lose all the 12 years that he spent saving that money 3. He will dive ₱1,296,000 into debt Sucks right? Let’s be honest here – we all know that fictional Benben who has ₱200,000 in savings by age 22 and can strictly save ₱3,500 per month for 12 years is nearly god-like in terms of saving discipline in the Philippines, diba? Paano ka? But before we even get to your money life, hindi pa tayo tapos kay Benben. Kawawang bata. May sakit na nga, may utang pang ₱1,296,000. Where will he get this? Benben has already ticked off Step 1 of the What To Do When You Get Critically Ill And Don’t Have Life Insurance Guide: use up all his savings. 77 STEP FIVE: PROTECT YOUR MONEY What’s next? Step 2: Check if your immediate family members have savings and then use their money as well. Step 3: If Steps 1 and 2 still won’t cut it, umutang sa mga kamaganak at mga kaibigan. Step 4: Kung hindi pa rin, ibenta ang mga ariarian katulad ng kotse, bahay, at alahas. Step 5: At kung hindi pa rin kakasya ang pera kahit nagawa na ang Steps 1 to 4, mag bukas ng Go Fund Me account at humingi ng donations sa Facebook. Sounds harsh, but this is the truth. At minsan, para gumalaw ka, kailangan mo munang makita yung masakit na katotohanan. This is what we’re trying to protect. When 2020 started, I ran financial wellness workshops where we taught this whole thing. I already expected na katulad ng maraming financial wellness workshops namin, when we get to this part, merong iiyak. That day in January, true enough, a workshop attendee started crying. I asked her if she’s fine. Ang sabi niya, “Eto po kasi yung pinagdadaanan namin ngayon. Nagpapa-chemo si papa at nakapag benta na kami ng kotse.” I approached her and asked her how she’s feeling. At the back of my head, inisip ko that she’d probably affirm her sadness. To my surprise, she said something else. 78 STEP FIVE: PROTECT YOUR MONEY “Galit ako.” Hala. “Gusto kong gumaling si papa, pero sana naghanda sila.” Money can never replace your relationships or buy back lost time. But these giant money-eating uncertainties can be beaten if we choose to prepare for them. This book is called “How to YOLO Wisely” - and to live the best life possible, let’s suit up and wear our trustee armor with pride and confidence, knowing fully well that no matter what happens to us, we have a solid and strong money defense. We need to protect your money so that you won’t lose all the time you used making money just to pay for your hospital bills. We need to protect your money so that you won’t pass the financial burden to your family if ever something happens to you. We need to protect your money so that you don’t have to watch your family and friends ask for donations online. Two inevitable things in life: death and taxes The bad guys in this story aren’t just critical illnesses. There’s one inevitable money villian, too. Death. When we think of death, we think of our old wrinkly selves. And that’s totally okay. Who doesn’t want to live until they’re 80? 79 STEP FIVE: PROTECT YOUR MONEY But the truth is, death can come as early as now. Or later. Or tomorrow. Or next year. We don’t really know. The only thing we know about death is it will happen someday, and someday can be today. With no guarantee that we’ll have many days with our loved ones, how much money would you want to leave behind if ever something happens to you? Of course, the answer to this question depends on the kind of family that you have now, your set up, and the type of life you want to give them after your death. Let’s say that you’re a mom who wants to make sure that her kid gets to finish college, no matter what. If we peg your death benefit (the money you’ll leave behind) at ₱5,000,000, how will you be able to save up for ₱5,000,000 with your current income? How much should you set aside every month for ₱5,000,000? What if you haven’t reached your first million yet, but you were suddenly taken out of the picture, how will your child be able to finish college? This isn’t half of the problem yet. It’s time to drop a bomb that not everyone knows about… Hanggang kamatayan, nagbabayad pa rin tayo ng tax. Alam mo ba na pag namatay ka, hindi pa makukuha ng beneficiary mo ang pamana mo? This includes your savings, paper assets, properties - anything you have left behind. Republic Act No. 10963 says that your beneficiaries must 80 STEP FIVE: PROTECT YOUR MONEY pay 6% of the net estate determined at the time of death decedent composed of all properties, real or personal, tangible or intangible less allowable deductions. If, for example, you left behind ₱10,000,000, your beneficiaries will have to pay ₱600,000 in order to get your ₱10,000,000. Some heirs may be able to pay for this, sure. But what if yours can't? How to deal with these money villains? In the Philippines, we have three heroes for money villains such as critical illnesses, death, and taxes after death. All of these fall under the Necessity Jar, which means that I am not noting these down so that you can choose from them, because you should have them all. Here’s a quick recap of the non-negotiables so that you can YOLO wisely: 1. Emergency funds that amount to at least 6 months of your monthly expenses or to the amount that would guarantee your peace of mind 2. Philippine Health Insurance Corporation (PhilHealth) benefits 3. Health Maintenance Organization (HMO) benefits 4. At least one life insurance policy You’re probably familiar with the mandatory PhilHealth. Once you get employed, you become a member of PhilHealth and your payment is taken from your monthly salary. 81 STEP FIVE: PROTECT YOUR MONEY PhilHealth helps you pay for a portion of your hospital room fees, covers maternity benefits, and gives free inpatient services if you go to government hospitals. You don’t have to worry about age limits when it comes to PhilHealth - anyone can have one for ₱1,500 to ₱6,000 annually. Ang mura noh? Kasi maliit lang din yung coverage, and this is why a lot of people opt for another healthcare provider. But then again, just like what I said, these are not options. These are necessities. Get PhilHealth if you don’t have one yet, then add an HMO. Narinig niyo na ba itong commercial na ito? “Sa panahon ngayon, bawal magkasakit.” Bakit? Because getting sick is expensive. HMOs work like PhilHealth, but give you better coverage in exchange for higher monthly payments. Some employers provide HMO upon regularization. Some offer it for free, some reduce it from your salary, and some don’t provide them at all. You have to check what your company offers so that you can strategize from there. If your company provides HMO, what happens to your account if you resign or transfer to another company? It’s still best if you get this on your own so that you don’t have to be dependent on your company’s benefits. Different HMO companies partner with various hospitals 82 STEP FIVE: PROTECT YOUR MONEY and clinics. Check if your preferred hospital is in the list of the HMO’s network. If it is, then you go there for your check ups, lab tests, and emergency visits and everything will be paid by your HMO card. But of course, your HMO benefits depend on your monthly payments, too. Alright, so now we have PhilHealth to cover some basic things plus HMO to cover more expensive hospital stuff. Why would you need life insurance on top of these? What you specifically need for life insurance is its Critical Illness Benefit, which is just one of the many benefits you’ll get with a life insurance policy. This works on a reimbursement system, so you will need cash or credit card to pay your bills until you get your critical illness benefit claim from your life insurance company. As its name suggests, life insurance policies cover the expensive stuff that some HMOs cannot, like cancer, major organ transplant, coma, Parkinson’s disease, etc. Eh eto naman talaga yung kakain at uubos ng ipon mo at ipon ng pamilya mo, kaya we gotta be prepared for these as well. PhilHealth, HMOs, Critical Illness Benefits all work together as one network and you can’t miss one of these as these are essentials and necessities. But before we even start hoarding, ang tanong... Insurable ka ba? All my mentees learn about everything written in this book first hand. Best part is I get to show them the ropes 83 STEP FIVE: PROTECT YOUR MONEY in person so that they can YOLO wisely. One of them was a 21-year-old girl who was fresh from college and helped her mom run their own carinderia. After learning from my teachings, this girl was so proud of being able to budget some money for her first life insurance policy. The team guided her throughout her application, sent the requirements, and waited for the results. Just a few days later, I received the bad news... Her life insurance policy was declined. How does life insurance work anyway? Think of it as making a bet with the company that says, “Bibigyan kita ng ₱5,000 kada buwan for 10 years, pero pag namatay ako within 10 years siguraduhin mong bibigyan mo yung pamilya ko ng ₱3,000,000. And if ever I get critically ill within those 10 years, bibigyan mo rin ako ng ₱1,000,000. Deal?” If you think about it, to get millions in benefits, you only need to pay a total of ₱600,000. So, paanong hindi malulugi ang life insurance company dito? The life insurance business is a risk pooling business. In order to make sure that the company doesn’t collapse, the first part of the application process goes through a strict underwriting process to ensure that the applicant is far from getting ill or dying. What does this mean? 84 STEP FIVE: PROTECT YOUR MONEY It means that not everyone has the privilege to make a bet with the life insurance company. You can be all giddy and say, “Kailangan ko lang mag bayad ng ₱5,000 a month tapos may ₱3,000,000 na yung pamilya ko at may sigurado pa akong ₱1,000,000 kung magkasakit ako. Wow!”, pero paano kung sabihin ng kumpanya na, “Ayoko nga”? And they can say this. Why? They’re more likely to take the bet if you’re young and healthy because that makes you less risky. : b m o b h t Tru e f i l y u b t d You can’ e e n u o y n e h w e c n e b t ’ insura n o w u o y e s u a . e r o it bec m y n a e n o t e g e h t able to t a t i t e g t s u m ed e You n t ’ n o d u o y n e h u o y time w t a h t g in p o h , t e y it . r e v e t i d e e n t ’ n o w Let’s go back to my mentee. She’s 21, fit and healthy. Bakit siya na decline? Some policy applications would require medical check ups. She went through one and the underwriting officers found out that she has hyperthyroidism. The Medical Information Bureau (MIB) is an agency that reports to all life insurance companies. Think of this as a blacklist that helps life insurance companies protect themselves against fraud. This blacklist contains the names of people who were declined by life insurance companies and the reasons why. So, if my mentee was declined by one company and if she decides to apply to another one, the second company will see her name in the MIB database and will decline her as well. 85 STEP FIVE: PROTECT YOUR MONEY What will happen to my mentee? Well, that’s exactly what she was asking me. "Ano na po ang gagawin ko?" "Paano po kung magkasakit ako nang mas malala?" "Paano po pag matanda na sila papa at ako na ang breadwinner?" These questions were hard to answer. Imagine mo, papasok ka sa gera, tapos wala kang proteksyon. Ganun ang pakiramdam ng mga uninsurable. A lot of people run from financial advisors and decline life insurance policies without knowing that the older they get, the more uninsurable they become. Other than being uninsurable even at a young age, what are some of the common things about life insurance that most people don’t know about? “You’re an educator, not a salesman” I always tell my mentees: “If people fully understand how life insurance works, it’s impossible for them to say no. The reason they say no is because they have misunderstandings about it. And it is our duty as financial advisors to educate them well.” I’ve looked at money from various perspectives already: as a buyer, a retail trader, an institutional trader, a broker, a businessperson, a salesperson, a coach, a mentee, a mentor, and an educator. And I completely understand why a lot of people run away from financial advisors. 86 STEP FIVE: PROTECT YOUR MONEY There are two kinds of financial advisors: salesmen and educators. Both earn in the same way - through commissions from each financial policy sold. So, what’s the difference? Salesmen earn by selling products. Educators earn by providing value and solutions to existing problems. “Hindi ba pareho lang yun?!” Nope. There is a massive difference. When you have a salesman in front of you, it feels like the product is being shoved to your face. You’ll know and feel it – this is about him and not you. If you’re with an educator, you are learning something valuable. Your once narrow view becomes broader, and you get that “Aha!” moment. Buying from a salesman feels heavy and off. When you pay for your policies, it feels like a burden. Some months later, gusto mo na tumigil sa pagbabayad. Buying from an educator feels light. You feel like it was entirely your decision. When you pay for your policies, you feel happy and kilig because you understand where your money will go. You can hear your future self and your family thanking you. Buying from an educator makes you beam with pride and say, “I’m doing this because I love myself and my family.” NFG Global Financial Advisors are educators. I have four books in line and the one you’re reading is the first one. When I decided to write this book, I asked the 87 STEP FIVE: PROTECT YOUR MONEY help of the whole team. Ang tanong ko: “Ipapamigay ba natin ito nang libre o ibebenta natin?” It was an easy choice. If you’re already at this point of the book, I’m confident that this thought already passed through your mind: “Bakit ito libre?!” Because this is our mission. To educate as many people as we can. To help people live their lives to the fullest by being financially literate, protected, and able. Kaya isa isahin na natin... what are the misconceptions about protecting your money? common “Hindi ko pa kailangan ng life insurance kasi bata pa ako. Still healthy!” As you age, expensive. your insurance policy becomes more Well, okay, not more expensive because you get to decide how much you’ll pay every month or every year. But what happens is, for the same amount of money, your benefits decrease. Ibig sabihin ba nun, pag bumili ka ngayon at ₱2,500 per month, next year mas mahal na babayaran mo? Hindi. Pag bumili ka ngayon ng ₱2,500 at 10 years to pay siya, sampung taon siyang ₱2,500 per month. 88 STEP FIVE: PROTECT YOUR MONEY But if you don’t buy this year and you decide to buy next year, you can still pay ₱2,500 per month but with less benefits. Why? As mentioned earlier, the life insurance business is a risk pooling business. If you’re younger, you’re less risky as a client. I don’t think I have to explain what happened to my young and healthy mentee who became uninsurable, right? In fact, the younger you are, the better it is for you to get a policy. Benefits are bigger / Your premiums (payments) are more affordable. Higher chance for you to get insured. Remember that not everyone is insurable! You have more time to grow your money. Your life insurance is not all about death and critical illnesses. A part of your payments go to investments too. “Eh para sa patay patay lang yan.” The younger you are, the more time you have to grow your money. The guaranteed death benefits and guaranteed medical benefits are just some of the benefits of a life insurance policy. A part of your payments also go to investments. This can be placed in the bond market, stock market, and other markets (we’ll deal with these markets in the next chapter). 89 STEP FIVE: PROTECT YOUR MONEY As such, there is a chance for you to withdraw your cash value (money that has grown) after a few years. This money can be used for your retirement or for your child’s education or for your vacation – anything, really. As long as you don’t withdraw 100% of your cash value, your guaranteed benefits (death and medical) remain intact. Sweet, right? Just remember that this cash value or this money growth part is not guaranteed. “Bakit ako maglalagay ng pera diyan kung hindi pala guaranteed yung money growth?” Yung paglalagyan ng pera mo are the same markets that you invest in if you go directly to a bank or a fund manager. It’s the same stock market, it’s the same bond market, it’s the same commodity market. All investment vehicles like stocks, currencies, commodities, bonds, art, real estate - literally all of them - are not guaranteed. This is why when you invest, the first thing you have to think of is your investor profile. Are you the type who can manage high risk investments or should we place your money in less risky funds that will result in slower growth? “Wala akong pera para diyan. Dagdag gastos lang yan.” Money Jars! 90 STEP FIVE: PROTECT YOUR MONEY Protecting your money is Step Five. The Money Jars is in Step Two: Managing Your Money. Sa Step Two pa lang, alam mo na kung bakit wala kang pera, not just for this, but for anything else. Remember din diba, your money never lies. It will go to your priorities. Sana ngayon mas naiintindihan na natin kung bakit napaka importante ng Step One: Building Your Foundation and Step Two: Managing Your Money. Sa bagay, this book is called “How To YOLO: A Step by Step Money Guide for People Who Wanna Enjoy Life”. “May insurance akong nakukuha from my company.” That’s good! Now, check what your benefits are. Most likely, the insurance you have with your company is a group life insurance deal. Baka magulat ka, maliit lang pala ang coverage. Here are some things you have to find out if you’re receiving insurance benefits from your company: Who is paying for this? How much? How much will my family get if I pass away? Will I get anything if I get critically ill? What will happen if I resign? Will I get retirement benefits from this insurance policy? If I were to get retirement benefits, does it mean that I have to stay with my company until I retire? Am I willing to do this? 91 STEP FIVE: PROTECT YOUR MONEY Am I happy with the benefits that I will get with this policy? Who has control over this policy? Me or the company? Should I get a separate policy that I can fully control? “I trade the stock market. I don’t need that.” Okay, eh kumikita ka ba? Yung hindi chamba strategy ha. Can you confidently say that your trading profits can pay for uncertainties? And can you do it consistently? If your trading skills can, congratulations! Now, how will you pass it on? Some people pass their assets to their families before they die just to learn na hindi pa pala sila kukunin ni Lord. This might work for some, but not for everyone. Your savings, properties, and even paper assets such as stock market trades and shares remain frozen until your family members pay for the necessary taxes after your death. The only asset that won’t be frozen if you pass away which they can use to pay for taxes and unfreeze all of your assets? Your guaranteed death benefits from life insurance policies. “Meron na 'kong life insurance.” Congratulations! Alam mo ba na mas marami pang car insurance sa Pilipinas kesa life insurance? You’re one of the few 92 STEP FIVE: PROTECT YOUR MONEY people who value themselves and their families more than their cars. It’s great to know that you have a policy already. Now, let’s find out if your policies are already enough for your needs. We made a free calculator that you can use to check if you need more policies or if your current ones are enough. What do you have to do? Collect all of your life insurance policies or log into your online portals. Go to www.nfgglobal.com/policyreview Fill it up according to the amounts stated in your life insurance policies The usage of this calculator is totally free. If you need assistance, you can also sign up for a free consultation so that an NFG Global Financial Advisor can assist you. Sign up here: www.nfgglobal.com/freeconsultation “Sus, gusto mo lang akong pagkakitaan eh.” Gusto mo rin ba mag trabaho nang libre o mag negosyo nang lugi? That would be stupid, right? If as a financial advisor, I am providing value and solutions for your financial problems, then I will really be paid for it through commissions and referrals. But of course, I would rather choose to be an educator who is paid well and referred often than a salesman who 93 STEP FIVE: PROTECT YOUR MONEY is paid as much. And this is also why I love what I’m doing and why I help and teach the financial advisors in my team! I always tell them: “Kung hindi ka kumikita, ibig sabihin wala kang natutulungan.” This business model allows everyone to win. As a financial advisor, our wealth and success is a prime indicator that we have helped so many individuals and families. YOLO with life insurance I love travelling. And when I travel, I don’t like restricting myself because of my budget. I want to see everything there is to see and I enjoy it as much as I possibly can. Kasi nga, YOLO! One of my favorite travels happened in July 2019, our second time to UAE. I hopped into a helicopter with my boyfriend and business partner, Marc, to get a better view of Dubai. Dubai from the sky is something else! After our heli tour, we enjoyed Moroccan Tea to rest for a 7-course meal scheduled at Al Muntaha, Burj Al Arab. Burj Al Arab is one of the tallest hotels in the world. It stands on a private curving bridge on an artificial island. Pumasok kami nang hindi alam kung ano ang ieexpect aside from extreme luxury and impeccable service. Upon stepping into the elevator, naalala ko kung paanong hinanap ko lang dati ito sa Pinterest. I grabbed a photo of a girl enjoying dinner here, printed it, placed it on my dream board, and turned it into a plan. 94 STEP FIVE: PROTECT YOUR MONEY A few years, a lot of sweat and tears, and some failures later, we were finally able to book a table. In the earlier chapters, we talked about the Money Jars. And I’ve already shared why the Play Jar is so important. If we break down how much we spent that day, the saver in me would slap me in the face. ➡ VIP Heli Tour ₱18,000 per person Burj Al Arab 7 Course Dinner ₱35,000 per person ➡ Aside from the Money Jars, I’ll share a little secret that allows me to enjoy life to the fullest, no matter how crazy these costs can get. Kasi nga, baka nakakalimutan natin… this book is called “How to YOLO Wisely”. So, what’s the secret? Life insurance policies. While life insurance is meant for the future, life insurance is the best tool to acquire the enjoyment of the present. Okay, so I’m currently 28 and I have eight life insurance policies. Let’s break some of them down... Some policies are meant for critical illnesses. Ibig sabihin nito, kung maospital man ako dahil sa cancer, heart attack, major burns, and/or other critical stuff, I have at least ₱10,000,000 to get from all of my policies. Cancer costs a lot! At least I don’t have to pull out money from my savings and investments just to pay for hospital bills. 95 STEP FIVE: PROTECT YOUR MONEY All policies have guaranteed death benefits that will go to my parents just in case something happens to me. Some of my policies are partly made of investments in bonds and equities (the stock market). Though money growth in these investments is not guaranteed - just like in any other investment vehicle - there is still a chance for me to get money when I grow old. No need for me to expect my future children to pay me back for putting a roof over their heads for 18+ years, right? So, how do these life insurance policies play a role in the present if they’re all about the future? One of my policies cost ₱3,500 per month. This ₱3,500 per month provides a guaranteed death benefit for my family, a critical illness benefit for me, and a part of it is invested in the stock market. Sa halagang ₱3,500 per month: Siguradong may maiiwan ako sa pamilya ko kung may mangyari man sa akin (guaranteed) May makukuhanan ako ng pera just in case maospital ako (guaranteed) May chance na lumago yung pera ko para sa retirement (not guaranteed) If I save ₱3,500 every month for 30 years, that will only give me ₱1,260,000. Sa guaranteed benefits alone, lugi nako ng milyon milyon sa pagsave ng ₱3,500 compared to getting a life insurance policy. And this is just one of my eight policies. So ano nga bakit nga yan makakatulong sa present, aber?! 96 STEP FIVE: PROTECT YOUR MONEY Well you see, if I’m already prepared for the future, why would I be worried about spending my money in the present? Using the Money Jar System, I already automatically place money in my life insurance policies (because it’s a necessity) which allows me to ensure my future. Kung sigurado na yung future ko, bakit pa ako mag aalala? YOLO na! Remember: We were not born just to pay the bills and invest and prepare for the future. Are you really living? Or are you simply worrying? Anyone who isn’t prepared for the future with emergency funds and life insurance policies will definitely worry and will essentially live life without a solid financial plan. Kung mag yo-YOLO ka nang wala ka pang emergency funds o life insurance, hindi yan YOLOing wisely. Safeguard your future so that you can enjoy the present all you want. Every time I pay for my policies, I get this certain kind of kilig dahil alam kong I did something for my future self. And because that’s all set, all the money I have left can be used to enjoy the only life I have now. With wise financial planning, proper money management, the right money-making skills, and a good set of friends, you’ll be able to check items off your bucket list one by one - with no limits. Because hey, the only limit that we really have is having only one life to live. : X I S P E T S R U O Y E K A M K R O W Y E N O M “Time you enjoy wasting is not wasted time.” Marthe Troly-Curtin 98 STEP SIX: MAKE YOUR MONEY WORK An attendee of one of my webinars once asked me, “What’s an achievement you’re really proud of?” I’ll let you imagine and feel my answer to this question: Imagine waking up, not to an alarm clock but because of birds chirping. Sounds cheesy and cliche, but I swear, it happens in real life and not just in Disney movies. Then, you get one whole hour for yourself. You use this to meditate, to list down 10 things you’re grateful for, and to read a short but powerful excerpt from any book to jumpstart your day. After that, you do your morning stuff, take a bath, brush your teeth, eat breakfast, and enjoy a hot cup of coffee. Maybe you’ll work, maybe you won’t. But if you decide to dive into your calendar, you beam with pride and say: “I chose to have these activities here.” “No one forced me to place anything I don’t want to have in my day.” “Everything here is an opportunity for me to achieve my best self and my goals.” “This is the life I created and chose for myself. These are mine.” Then you do whatever you gotta do. Pwedeng napakahaba ng To-Do list mo sa araw na ito. Pwedeng napagod ka. Pwedeng nagpuyat. Other days aren’t as packed. For some of them, you just read a good book, enjoy playing games, or watch anime. 99 STEP SIX: MAKE YOUR MONEY WORK However your day looks like, what’s guaranteed about it is you built it yourself. No need to drag your feet, heart, mind, and soul to do something you don’t want to do. You go to bed satisfied, thankful, and proud. Before sleeping, you say, “I’m excited for tomorrow. Thank you, Universe.” An achievement I’m proud of: I never feel busy. Everyday, I look at my calendar and the list of things I gotta do and I flare with excitement. If I don’t want to do this or that, it’s not on my calendar. This, for me, is freedom. “Busy with the ugliness of the expensive success, We forget the easiness of free beauty Lying sad right around the corner, Only an instant removed, Unnoticed and squandered.” ― Dejan Stojanovic How much is your time worth? Our forex trading students in Leo Advantage come from vast backgrounds. We have public school teachers, basketball coaches, make-up artists, and even surgeons. I’m in charge of one-on-one review sessions with the students. During this time, I get to take a closer look at their personal money life, money EQ, beliefs around money, and money habits. This way, I get to know why they do certain things and make specific decisions when 100 STEP SIX: MAKE YOUR MONEY WORK they trade. During a session with a surgeon, walang pasikot sikot, diretso na lang niyang sinabe sa aking: “Nikki. Ang dami kong kinikitang pera as a doctor. This has always been my dream. But I’m tired.” I asked him, “What exactly do you want to happen?” He said, “I can tell you what I don’t want anymore. I don’t want to grow old and realize that I suddenly have two teenagers who won’t even hug me anymore.” This isn’t the first time I’ve encountered students making lots of money as doctors, lawyers, pilots, or executives. “Nagulat ako, puti na pala buhok ni daddy. Hindi ko manlang napansin.” “Suddenly, I’m 40. Walang problema doon. The problem is I feel like I’m 60.” “I always feel like I’m already too late because I never have time for what I really want.” What are they really looking for? They’ve got the money, right? What else do they want? Obviously, something more important than money. They don’t just want time. They want time for their families. Time for their relationships. Time for their passions. Time for what’s truly important. You can have all the money in the world, but if you don’t even have the luxury of time for the people and reasons why you’re working so hard in the first place, then it just doesn’t make sense. 101 STEP SIX: MAKE YOUR MONEY WORK It all starts with awareness. When you realize that time is more valuable than money, then you’re already wealthier. A piso saved is a piso lent By now, I hope you understand why there’s no point in being busy with being busy and that being busy on the wrong things is just, well, miserable. Having a big paycheck sounds sweet until you realize that you don’t even have time to spend it all. Ano ang magagawa natin? What if we really have to work? Hello, we have bills to pay, right? Hindi naman lahat tayo pinanganak sa mayamang pamilya. Anong gagawin natin? To answer these questions, I will give you a question. Do you ever wonder how banks make money? This is one of the differences between people who have both time and money and those who only have money: those who have both earn interest, and those who only have money pay interest. When you place your money in the bank, it’s not really safely sleeping in a metal box. Your money is being lent to someone else. YOURY MONE BANK WHAT THEY GIVE IN RETURN WHAT TH EY DO WITH YO UR MON EY 102 STEP SIX: MAKE YOUR MONEY WORK Kunwari, dahil sinunod mo yung mga natutunan mo sa librong ito, you were able to build your emergency funds amounting to ₱500,000. You decided to place your emergency funds in a savings account that gives you 1% annual interest. While you’re out there doing your thing, your money is working hard for someone else. The bank lent your money to fund someone’s house loan, credit card, or car loan. Other than the usual banking fees, your bank already earned so much more from the interests they got with loaning your emergency funds. And what do you get in return for letting them play with your money? 1%. What’s your risk appetite? Pwede kang magalit diyan at maasar at sabihing “Ang daya! Ang daya ng banko!” or you can say “Ayoko na. I’m going to quit and be a trader.” Pero babasagin ko lang for a bit ang trip mo because here’s a fundamental truth… Trading and investing is not for everyone. At the very least, it’s not for people who don’t understand themselves. We’re finally in this part where we start talking about making money work for us. I hope you already have all your protective gear because we’re about to enter a bloody war. Before we step into the battlefield, we gotta know your 103 STEP SIX: MAKE YOUR MONEY WORK risk appetite. Trading and investing is a double edged sword. We often just look at the gains, and we forget that placing your money in the financial markets involves the risk of losing it all, too. “Wooow, totoo ba, I can earn that much from the forex market?!” “Yung kaibigan ko, nag stocks lang, naka pag resign na!” “Pag gumaling ako magbasa ng charts, yayaman ako.” Lahat yan narinig ko na with matching sparkly eyes pa, na onti na lang luluwa na ng barya. But the same people end up looking for another job because they have failed to manage their risk appetite. Not only did they lose money - they ended up poorer than they were before they started. Knowing your risk appetite is basically knowing how much risk you can handle. If you really think about it, there’s no formula for this. Napaka subjective, because for you to know your risk appetite, you have to understand your Money EQ, not your Money IQ. People mistake knowledge, skill, chart reading, strategies, indicators, news finding, and even connections as the key to making lots of money from the markets. They focus too much on Money IQ. Though these are important, they’re just a small part of the equation. Even if you’re a skilled trader or investor, your emotional attachments around money can be proven detrimental to your investing and trading decisions - especially if you don’t have a clear grasp around the reasons why you carry 104 STEP SIX: MAKE YOUR MONEY WORK specific emotions around money. Naranasan mo na bang ma-stress dahil marami kang utang? Mawalan ng tulog dahil negative yung trade mo? Kabahan kasi hindi pa dumadating yung sweldo? Eh yung tumalon sa saya dahil naka pulot ka ng ₱500? Kiligin sa bonus? Ma-excite sa dividends? Money is emotionally charged. Unless we understand why we feel certain things about money, we’ll keep on making bad decisions around our investments. You might be comfortable going through the market’s highest peaks and lowest valleys. Or uncertainties can make you lose sleep. The reason behind your decisions around money are not logical - they’re always emotional. So, how will you know more about your risk appetite? Learning more about your Money EQ is honestly a long, loooong game. In fact, you will learn some of the essential things about yourself when you’re already in the war. But now, we can simply ask three questions which can help you determine your risk appetite. Question #1: Magkano ang kaya mo mawala bago ka bumalik sa pancit canton for breakfast, lunch, at dinner? How much money are you willing to lose? How much investment risk can you stomach? 105 STEP SIX: MAKE YOUR MONEY WORK Magkano yung pera na sa wallet mo na pag naiwan mo sa jeep, hindi mo na hahabulin? At pag nawala mo ito, ilang gabi kang hindi makakatulog? Money growth calls for a certain amount of emotional tolerance for risk. Markets fluctuate. If you stare at charts or if you find it stressful seeing your investments go up and down, you might do things that may be harmful for your portfolio. Those with low risk tolerance will pull out their money at the slightest market fluctuation. And those who are too aggressive will inject more money whenever possible. Question #2: Ano ba ang gusto kong mangyare sa pera ko? Malamang sasabihin mo, “Duh, gusto kong kumita. Anuba ghorl.” Of course. That’s everyone’s goal. But why? Why do you want to achieve this? You’d be surprised that it’s common to see someone saying “Gusto ko kumita in a wise and strategic manner”, pero yung investment decisions parang naglalaro lang sa casino. It’s important to set your investment goals because this will also determine the markets we can play in. Some goals won’t really require you to join speculative markets that give high rewards but also dabble in extremely high risks. And some goals can only be achievable if we place your money in markets that 106 STEP SIX: MAKE YOUR MONEY WORK provide more reward and more risk. Question #3: Gaano katagal natin ito lalaruin? Pakiestimate nga, mars. Here, we’re dealing with your investment timeframe. Actually, there are two factors that come into play when dealing with this question: 1. Ilang taon ka na ba? 2. How long will you let your money work for you? Yes, in investing, your age matters… a lot. People often think that investing is only for the rich. Well, I believe that investing is for the young. If you’re young, you have time by your side. Even if you don’t have a big capital, and even if you start with small money, you still get the luxury of growing your money through compound interest – interest earning on interest earning on interest. And you can only do this if you give it enough time to grow. Age also matters because older people tend to be more risk averse because they know that they have less time to recover possible losses. Knowing these, hindi mo talaga pwedeng pag handaan ang retirement nang bigla bigla lang. You can’t just decide to start saving up or investing for retirement five years before you actually retire. If you want to know how much you’ll get every month during your retirement years with whatever you’re doing 107 STEP SIX: MAKE YOUR MONEY WORK now, you can find out for free by using this calculator: www.nfgglobal.com/retirement Goodluck! The money war zone “Making your money work for you” or “Making money while you sleep” is such a common money advice that it’s almost cliché. Financial freedom is not having to work on things you don’t have and want to do because your passive income covers your expenses. Passive income is income that you get even if you’re not working. The formula looks like this: Financial Freedom = Passive Income > Expenses Whenever people learn about this, they just jump right to it! But the truth about passive income is it only becomes passive after some enormous active work. To build your Golden Goose that will lay your Golden Eggs for you, you first have to be able to give any of these three things: 1. Money called capital which you can put upfront, knowing well that there are risks involved and that it may take time before your money grows. You can attain passive income by placing money in various financial markets. 2. Massive energy and effort, knowing that you only have to do this once and it eventually can give you passive money through sales. An example would be writing a book - it will take time and effort to write one, but you can sell it later on and earn from it even as you enjoy 108 STEP SIX: MAKE YOUR MONEY WORK life. 3. Lots of time in which you upgrade your skills and also lose money and effort knowing that if you become good at it, you’ll make income. Notice that I only said income and not passive income, because I want to put trading here. And as I’ve said earlier, trading is not a passive skill. If you don’t trade, you don’t get or lose money. Pwede kang mamili sa tatlong ito or you can have all of them. I personally have all three: Money: I have money in savings, money markets, time deposits, variable life insurance, bonds, index funds, long term stocks, real estate, collectibles, and commodities. Effort: As Unit Manager, if my financial advisors financially succeed, I make money as well through override commissions. Skills: It took me 5 years of learning, practicing, and failing before forex trading became my top money maker and beat my profits from all my businesses. Now, with only less than five minutes per day, I get to make money from the forex market. Unless you have so much capital that can be placed in money markets, you still have to do some work. And trust me, it will not happen overnight! Slow is always fast When people learn about this whole passive income thing, nakikita ko na yung kinang sa kanilang mga mata… and then I get scared. 109 STEP SIX: MAKE YOUR MONEY WORK Paano ba naman, resignation letter. bigla na silang nagda-draft ng I’ve seen too many people get caught up in this money war that they get frustrated and become cynical when they learn a fundamental truth: the slow game is the fast game. Warren Bezos, second simple. Buffett is the world’s most prolific investor. Jeff CEO of Amazon once asked him: “You’re the richest guy in the world and your strategy is so Why doesn’t everyone copy you?” Warren Buffett simply said, “Because nobody wants to get rich slowly.” The number one account, portfolio, business, and even adulting killer? Pagmamadali. Skills are practiced and honed overtime. The same goes for building a business, writing a book, or making anything worthwhile. Ikaw ba, magpapa opera ka ba sa medical student? I don’t think so. If we want to consistently make money from the markets, if we want to be profitable traders, if we want to successfully make money as investors or businesspeople, we gotta take a step back and look at the bigger picture. Most people are too zoomed in and don’t see the importance of all the losses and failures anymore. If you just zoom out a bit, makikita mo na sa simula pa lang na parte pala yung losses sa buong plano - kung may plano 110 STEP SIX: MAKE YOUR MONEY WORK ka. 3%, 5%, 10% a month from the financial markets done consistently for 5 years will yield bigger results than tsyambahang 100%, 500%, 1000% in one week. Being slow but consistent is the key. Slow is always fast. Welcome to the financial markets There are many options available in the Philippines (and there are a lot of scams too). Here, we will talk about your financial market options which are readily available through banks and some companies. DISCLAIMER: These are just summaries of some of the financial markets in the Philippines. I did not include every single option (there are too many) and every single detail. The options available here are the popular choices that are readily available through banks and companies. I have no intention of promoting any company (whether a bank, a life insurance company, or any institution that may provide and sell these instruments). You can easily obtain the list of top performing companies and fund managers online if you are interested in joining any of these markets. Remember, paulit ulit ulit ulit ulit: Before you get into any of these markets, you must be financially, mentally, emotionally, and psychologically prepared and equipped. Before deciding to invest in any of these markets, carefully consider your investment objectives, level of experience, and risk appetite. Some of these markets may not be suitable for you. 111 STEP SIX: MAKE YOUR MONEY WORK No investment advice or strategies will be given in this chapter. If you want to learn more about your personal financial health and a market you want to get into, please contact a licensed and professional financial advisor. Schools that focus on specific markets also exist. But those who sign up for the www.nfgglobal.com newsletter will get additional information and learning resources about these financial markets. The general rule of thumb in the financial markets is the higher the possible reward, the higher the risk involved. Alright, we’ll start from least risky to most risky. Checking Account and Savings Account A Savings Account is a bank deposit account that acts as a safe piggy bank for your money. As you store your money in a Savings Account, you earn interest overtime. A Checking Account is just like a Savings Account, but this allows you to issue checks. This is also known as “Current Account”. Unlike Savings Accounts, Checking Accounts don’t have withdrawal limits and don’t incur interest. SAVINGS Pros A safe place to keep your money Emergency funds Easy withdrawals ₱500,000 is insured by the government Initial deposit is affordable Money earns interest Can be linked to e-wallets or online services Cons Limited withdrawals amount Transactions fees CHECKING Unlimited number of transactions High limits for transactions Checks are safer to carry Perfect for recurring bills Comes with a passbook & debit card Can be used as a proof of payment Convenient for making large payments Helps with establishing credit score Not for money growth (no interest) Higher initial deposit 112 STEP SIX: MAKE YOUR MONEY WORK Major commercial banks offer both Savings and Checking Accounts. It’s good to have both in order to manage your money well. As discussed earlier, you need to have an emergency fund and a Savings Account will be perfect for that. For recurring payments, however, a Checking Account would be the better option. Time Deposits A Time Deposit account is another safe option for conservative investors. If you’re looking for anything that provides higher interest rates compared to a Savings Account, this might be for you. Basically, what happens is your savings become illiquid meaning hindi mo siya mawi-withdraw for a certain period of time. This allows the bank to play with your money without withdrawals. In return, the bank will give you a higher interest rate. If you will place money in time deposits, this must be money that you won’t be using during that period. You cannot place your emergency funds here, kasi duh, paano pag nagka emergency at hindi ka maka-withdraw? Here are some perks: Better returns compared to a saving’s account You can choose its maturity period: 30, 60, 90, 180 days, 1 year, or longer Up to ₱500,000 is also insured 113 STEP SIX: MAKE YOUR MONEY WORK Helps you with your money discipline since you won’t be able to withdraw and spend it Unit Investment Trust Fund and Mutual Funds If you want to get into buying stocks of top Philippine corporations, you can do this by opening a Unit Investment Trust Fund (UITF). A UITF is a pool of money invested by the public. The goal of this fund is, of course, to build maximum returns. This fund is managed by trust entities through banks and the money in it is provided by multiple investors with similar investment goals. Another thing that you have to know about UITFs is they’re “open-ended”. Open-ended, hindi open-minded. Ibig sabihin, if you place your money here, you can get your money back any time as well. Fund managers can invest the pooled funds into stocks and bonds and investors earn through dividends, stock price increase, or interest. Some of you might be thinking, “Hindi ba ganito rin ang mutual funds?” Yes, mutual funds and UITFs operate in the same way but there are still differences that you should consider. A mutual fund also grows money through a managed fund with pooled money from multiple investors. Just like UITFs, the pooled money is used to buy and sell securities (collective term for stocks and bonds). 114 STEP SIX: MAKE YOUR MONEY WORK Okay, so anong pinagkaiba nila? Their difference lies on the way they are managed. FACTORS MUTUAL FUND UITF Who offers Investment companies Bank Who sells SEC licensed advisors Bank employees What you buy Shares of mutual fund Units of participation Pricing Net Assets Value per Share (NAVPS) Net Asset Value per Unit (NAVPU) Who regulates Securities & exchange Commission Bangko Sentral ng Pilipinas Which law governs managed funds Republic Act 262- Investment Company Act of the Philippines Republic Act 8791- General Banking Law Tax Non-taxable Withholding tax UITFs and Mutual Funds can invest in stock funds, bond funds, balanced funds, and money market funds. Stock Funds are invested in stocks (duh). These are best for aggressive investors who are okay with placing their money in a volatile market. The risk involved in investing in this fund is high. Despite the risks, a lot of people are attracted to this fund because the potential returns are also high. Fund managers can invest pooled funds in individual stocks or in indices. If you put your money in Index Funds, you’re betting on the top companies of a country. For the US, it’s SP500. For Japan it’s Nikkei225. For the Philippines, we’re talking about PSEI’s top 30 blue chip companies. Bond Funds are invested in bonds (again, duh). These are the stuff for conservative investors who want to make sure their capital remains safe. But of course, low risk comes with low rewards. Walang problema. Kung ang goal 115 STEP SIX: MAKE YOUR MONEY WORK ng investor is to earn some passive income without losing his or her capital, this is a good option. Balanced Funds provide a mix of bonds and stocks and are great for those who want to experience the potentials of the stock market but also want to have the safety and security provided by bonds. Para ito sa mga dalawa ang puso. Money Market Funds are best for conservative investors who want to invest their money in short-term debts. Low risk and low potential returns… but safe. Variable Life Insurance Life insurance policies do not only provide death and medical benefits. Variable Life Insurance (also known as Unit Linked Funds or VULs) give you guaranteed death benefits and non-guaranteed investment benefits. Think of VULs as your 3-in-1 package: you get to invest in Stock Funds, Bond Funds, Balanced Funds, or Money Market Funds and you also get the guaranteed death and medical benefits. Dalawang tanong ang pwedeng lumalabas ngayon: 1. “Eh kung ganito pala ang VUL, bakit pa ako mag mumutual funds o UITF?” 2. “Bakit hindi na lang ako mag invest sa stocks directly?” Because it still depends on your current financial conditions, skills, level of risk appetite, and financial goals. Para mas madali: 116 STEP SIX: MAKE YOUR MONEY WORK If it’s important for you to be protected with the guaranteed benefits, go for a VUL. If you want to make money from the growth of the Philippine company and don’t have the necessary skills to manage your own funds yet, then choose a mutual fund or a UITF. If you have the interest, time, effort, commitment, money, and the right risk profile, then investing in stocks directly may be a good option for you. Stocks Whenever I talk about stocks, I always feel that I have to explain the difference between investing and trading. Both of these provide opportunities to earn money from highly liquid markets, but they do this in very different ways. Traders buy and sell stocks, currencies, and commodities within minutes, hours, days, or weeks. They focus on short term factors. The main question a trader needs to answer is “In which direction will this stock move?”. Investors have a longer game plan compared to traders. These guys think in terms of years and hold stocks, currencies, or commodities through the market’s volatility. Sabi nga nila, ang traders pa shota shota lang pero ang investors, pangkasalan na. Kidding aside, you must know whether you want to trade or if you want to invest. Para rin hindi tayo yung traders na naglalagay ng “Investor at PSEi” as jobs sa Facebook profiles natin. 117 STEP SIX: MAKE YOUR MONEY WORK We’ll head back to trading later when we start talking about market speculation. So, what are stocks? A stock represents what you own in a company. If you have more stock shares, you own more of that company. Essentially, when that company you invested in makes more money, you make more money, too, because the value of your shares go up. A company’s growth multiplied by the amount of shares you have = Kaching kaching! Pero basag trip muna ako ha… Kung ganoon siya paakyat, ganoon din siya pababa. If the value of your stock goes down, then so does your money. Other than capital appreciation, you also earn money through dividends. Some corporations you invest in may issue dividends to shareholders. These represent your earnings. These dividends can be given as cash or as additional shares of stocks. If we’re going to round up investing in stocks in easy steps, it will look like this: 1. Choose your broker. As I said earlier, I will not provide specific companies. Check for online brokers who have a history of easy deposits and withdrawals. Alternatively, you can get a licensed broker or salesman who will help you go through the process. 118 STEP SIX: MAKE YOUR MONEY WORK 2. Open your stock market brokerage account online. You can start for as low as ₱1,000. 3. Fund your account. This can be done via online banking. 4. Place your orders online. If you have a stockbroker, call him to place the order for you. 5. Track your investments. Alam kong by reading this, ang dami nang HOW questions. How do I choose a broker? How do I choose which companies to buy? How would I know if it’s a good time to buy? How would I know if I can exit already? How to withdraw money? How do I track investments? How do I study these companies? May mas malupit akong tanong: Kung tanong mo yan lahat, bakit ka nag bukas ng account? I’ve been very clear from the very start - though this sounds interesting, you should never get into any of these markets without knowing the risks, preparing your funds, studying how it works, building a strategy, and customizing your whole plan based on your risk profile and investment goals. Oo, marami kang matututunan if you just jump right away. But let’s not lose so much money and let’s not risk our sanity by getting into the stock market unarmed. Real Estate If you have the capital to buy a property and the operational money to build it up and manage it, then real 119 STEP SIX: MAKE YOUR MONEY WORK estate may be for you. This is a dream for most because unlike the stock market, real estate is tangible. You buy it and you see it, feel it, and even smell it. There are various ways to earn from the real estate market. One of these ways is called flipping. Flipping involves 3 steps: buy, renovate, and sell. What you’re doing here essentially is buying low and selling high. But of course, in order to renovate it so that you can sell it for a better price, you will need capital. Other than flipping, there are also rentals (like apartments), lease contracts (like gas stations), ancillary profits (like vendo machines), and community listings (like Airbnbs). Sometimes, investors treat raw land like stocks which they buy and hold. When you do this, what you’re really investing is in the location of the property. If you believe that the property rests on a future hot spot for development, then you can buy it while it’s still affordable and wait for its value to go up as its surroundings get developed. Speculation (Trading) Speculation is primarily trading high liquid, high volume, and high risk markets in exchange for high returns. This is a double edged sword. If you can make ₱100,000 in a snap, you can also lose ₱100,000 in a snap. 120 STEP SIX: MAKE YOUR MONEY WORK The most commonly traded markets are the stock market (stocks) and the forex market (currencies and commodities). There are many differences between the stock market and the forex market but here are the major ones: Trading Hours The stock market is open like a 9 to 5 job. Kung may trabaho ka at nag tetrade ka during work, idaan na lang sa Alt+Tab kasi malamang, pag uwi mo, sarado na ang market at hindi ka na makakapag trade. The forex market is open from Monday 5:00 am to Saturday 5:00 am. This means that you can trade at 2pm or 10pm or 8am. Whatever fits your schedule. Liquidity and Volume Liquidity deals with the amount of money circulating around the markets. Mas maraming players, mas maraming pera. Mas maraming pera, mas malakas na volatility. Mas malakas na volatility, mas maraming galaw. Mas maraming galaw, mas maraming opportunities for day traders to make money. This also allows traders to enter and exit at prices that they really want. If the market isn’t moving, then you can’t make money. The largest stock market is the New York Stock Exchange (NYSE) which plays with around 200B USD a day. However, this is nothing compared to the forex market with an estimated volume of 5.7T USD a day. This means that in terms of opportunities to make money 121 STEP SIX: MAKE YOUR MONEY WORK I have an obvious bias for the forex market because 1) I am a forex trading coach and co-own Leo Advantage, and 2) my main source of income still comes from the forex market. So, in this part, I will talk more about… dundundunduuun… The Forex Market I’ve been in the forex market for 11 years. Within those years, I worked as an institutional trader, a forex trainer for a Singapore-based broker, and a trading strategist for an Australian-based forex school. After these experiences, I eventually opened my own forex trading school with another CEO - my former competitor and now my business partner and life partner (yiheee), MMM. His pick up line was: “Dapat kasi pag nag jowa ka, forex trader din.” Gumana naman. Anyway, what is forex trading? You probably know someone who knows someone who knows someone who made it big by trading the forex market. Now, you wanna dip your toes into this whole forex trading thing. We're all looking for other ways of generating income other than sitting inside a cubicle, pretending to work, and waiting for the clock to strike 5. In this journey of trying to make money from the forex market, we were somehow brought to believe that this market will generate unlimited sums of money all from the comfort of your sweet, sweet bed. Sounds good, right? 122 STEP SIX: MAKE YOUR MONEY WORK But what is the forex market, really? Being a forex trader is just like being a doctor, a lawyer, or an engineer – you don't become one overnight. Learning how to become a competent and profitable forex trader takes months and even years of experience, patience, and discipline. Forex stands for "foreign exchange". Some people simply call it "FX". The forex market is where we exchange one currency (like the US Dollars, Great Britain Pound, and the Japanese Yen) and commodities (like Gold, Oil, and Paladium) with one another. That’s it. “Wait - what?” Alright, let's slow it down a bit. Have you ever travelled to another country before? If you had 100 US Dollars and you're travelling to Japan, you wouldn't be able to buy anything using your dollar bills. The first thing you'd have to do is have your US Dollars changed into Japanese Yen.Changing 100 USD to JPY would mean that you have 10,614.50 JPY. Now, you can definitely start shopping in Akihabara. Here's the real deal: when you turned your USD to JPY, did you actually lose your USD? Newp. 123 STEP SIX: MAKE YOUR MONEY WORK You still have your 100 USD! It just turned into 10,614.50 JPY. Think of it as Peter Parker just becoming Spiderman or the other way around. The same value, different "costume." You might have used the forex market before without even knowing it. Go you! Other than buying ridiculously cute things from Japan, the forex market also helps businesses that ship stuff from one country to another. If I’m going to buy something from China and I’m from UK, it would be better if talk money in terms of one currency so that they’re all on the same page. What are we actually trading in the forex market? And how does it work? The obvious answer: Money. But you can also trade commodities like Gold, Oil, and Palladium. Oh, and indices too! We have GER30, Nikkei 225, and SP500 among many others. Forex can be a bit confusing for most because you’re not really buying anything. In stocks, when you buy 100 shares of a company, you literally own 100 shares of a company. It’s so literal that you can even use these shares as collateral when you take a loan. It’s all yours and you can do whatever you wanna do it — you can keep it or sell it, much like how you can keep or sell your laptop, your playstation, or your books. Remember, we’re talking about the foreign exchange market. We are simply exchanging one currency into 124 STEP SIX: MAKE YOUR MONEY WORK another — not owning anything. The forex market always operates in pairs like GBP/JPY, XAU/USD, and EUR/USD. Think of the slashes as “versus”. If GBP is doing better than JPY, then we will buy GBP. If we buy GBP, we are automatically selling JPY. This happens simultaneously. If we’d rather take JPY than GBP because JPY is doing better than GBP, then we will sell GBP. Doing so will buy JPY at the same time. Confusing? Just think about the first currency in the pair (called the Base). In GBP/JPY, the base is GBP. If GBP is good, buy it. If GBP is bad, sell it. So, how will you know if a pair must be bought or sold? Well, that’s where your strategies come in. But just like what I said earlier, we have to do this wisely. The forex market is one of the most rewarding of them all. And what does this mean? It’s also one of the riskiest. How will you lower your risk? By creating your money foundation, building your emergency funds, protecting your money, getting mentors, studying, practicing, and accepting that you can lose 100% of your capital. 125 STEP SIX: MAKE YOUR MONEY WORK Investment Risk Quiz I hope that by now, you understand why knowing your investment profile is a fundamental factor before you enter the markets. Given what you already know about the markets, you can get a clearer view about your own investment profile. To get to know yourself more, take this quiz consisting of 13 questions. There’s only one rule: be honest. 1. How would people around you describe you as a risk taker? a. b. c. d. Gambler yan! Will do research then will take risk. Very cautious... Anong risk risk?! Doon lang sa safe! 2. May napanood ka sa TV na mas masaya kesa sa Game KNB?. It’s a money game that asks you this question: Which would you take? a. b. c. d. ₱50,000 in cash A 50% chance at winning ₱200,000 A 25% chance at winning ₱500,000 A 5% chance at winning ₱5,000,000 3. You have finally completed saving up for your dream vacation! But two weeks before your flight, you got fired! What will you do? a. b. c. d. Cancel. Malas. Downgrade to a more modest vacation. Chill lang, baks. Tuloy pa rin. Sus, extend pa the vacation noh. Wala na pa lang work, eh. Watanays! 126 STEP SIX: MAKE YOUR MONEY WORK 4. You magically got $20,000 to invest. What will you do? a. Deposit the money in a bank. At the most, invest in time deposit account. b. Invest in bonds. c. Invest it in long term stocks. 5. How comfortable are you in trading the stock or forex market? a. Huhu ayoko nga! Nakakatakot mamsh. b. Hmmm, keri naman. c. Suuuus #mastertrader kaya ako. 6. What comes to mind when you think of the word “risk”? a. b. c. d. Loss Uncertainty Opportunity Wooot taralets! Gusto ko yaaaan! 7. Experts are saying that prices of assets such as stocks, currencies, and gold will increase in value while bonds may fall. But you also know that bonds are relatively safe. Most of your money are in high interest bonds. What will you do? a. Keep the bonds. b. Let go of the bonds, put half of the money in the bank, and the other half in currencies. c. Let go of the bonds and place everything in currencies. d. Let go of the bonds, place everything in currencies, and borrow money to get more currencies. 127 STEP SIX: MAKE YOUR MONEY WORK 8. Given the best and worst case returns of the four investment choices below, which would you prefer? a. b. c. d. ₱10,000 gain best case; ₱0 gain/loss worst case ₱40,000 gain best case; ₱10,000 loss worst case ₱130,000 gain best case; ₱40,000 loss worst case ₱240,000 gain best case; ₱120,000 loss worst case 9. In addition to whatever you own, you have been given ₱50,000. You are now asked to choose between: a. A sure gain of ₱25,000 b. A 50% chance to gain ₱50,000 and 50% chance to gain nothing 10. In addition to whatever you own, you have been given ₱100,000. You are now asked to choose between: a. A sure loss of ₱25,00 b. A 50% chance to lose ₱50,000 and a 50% chance to lose nothing 11. A generous tita left you an inheritance of ₱10,000,000, stipulating in the will that you invest all the money in one of the following choices. Ano ang pipiliin mo? a. b. c. d. A savings account A mutual fund that owns stocks and bonds Long term real estate Commodities like gold, silver, and oil 12. If you had to invest P1,000,000, which of the following investment choices would you find most appealing? 128 STEP SIX: MAKE YOUR MONEY WORK a. 60% in low-risk investments 30% in mediumriskinvestments 10% in high-risk investments b. 30% in low-risk investments 40% in medium-risk investments 30% in high-risk investments c. 10% in low-risk investments 40% in medium-risk investments 50% in high-risk investments 13. Your childhood friend is building a start-up. Based on his pitch, if you invest money for his start-up, you can potentially earn 300%. If it’s a bust, you can lose your whole investment. How much will you invest? a. b. c. d. Nothing One month’s salary Three month’s salary Six month’s salary Scoring System 1. a=4; b=3; c=2; d=1 2. a=1; b=2; c=3; d=4 3. a=1; b=2; c=3; d=4 4. a=1; b=2; c=3 5. a=1; b=2; c=3 6. a=1; b=2; c=3; d=4 7. a=1; b=2; c=3; d=4 8. a=1; b=2; c=3; d=4 9. a=1; b=3 10. a=1; b=3 11. a=1; b=2; c=3; d=4 12. a=1; b=2; c=3 13. a=1; b=2; c=3; d=4 18 19 23 29 33 or below = Low risk tolerance (conservative investor) to 22 = Average risk tolerance to 28 = Moderate risk tolerance to 32 = Above-average risk tolerance and above = High risk tolerance (aggressive investor) : N E V E S P E T S R U O Y D L BUI Y C A LEG “Legacy is not leaving something for people. It’s leaving something in people.” Peter Strople 130 STEP SEVEN: BUILD YOUR LEGACY I come from a family of lawyers. It’s in my blood and even my surname — Jurado. It’s so maala-teleserye that not becoming a lawyer is kind of a big deal, especially when your brother is a genius in lawyer-ing. I grew up thinking I would be called “Atty. Jurado” one day, just like all the other Atty. Jurados in the family. I had to become one. Or else. One day, I realized that I wanted to become a pianist. Then a filmmaker. Then a writer. Then a businessperson. Ayun, hindi ko na pinangarap maging abogada ulit. My dad eventually gave up. Until now though, my titos and titas say, “Kung naging abogada ka, isa ka sa pinakamagaling natin!” or “Kung nag-law ka edi abogada ka na sana ngayon noh?” I always thought that because I didn’t take up law, my dad loved me less or that he was disinterested in anything that I did just because I’m not a lawyer like him, like my kuya, like my sister-in-law, and like everyone else in the family. I had this weird belief that I had to make a lot of money by the age of 28 just because my kuya became a lawyer at this age. Sabe ko pa noon, “I’ll prove them all wrong, then I’ll be happy.” And I did. I never became a lawyer but I did make money. Did I prove them wrong? Yes. Was I happy? Hmmm… I spent a lot of years focusing on goals that would prove to everyone that I was someone, that I didn’t need to become a lawyer to get their attention or to build money. 131 STEP SEVEN: BUILD YOUR LEGACY Often, we think our life is ours, pero hindi pala. Our goals belong to someone whose validation we’re craving for. Nabubuhay pala tayo para sa iba. In some cases, we wanna achieve something just so we can get approval from someone. Usually, these people are our own parents. “I just want my dad to say that he’s proud of me.” “If I hear my mom tell me that she loves me, I’d be happy.” “Papatunayan ko sa kanila na kaya ko lahat ito mag isa.” “I’ll prove you wrong.” Familiar? When we say and do these things, we’re not really trying to achieve anything for ourselves. We’re just chasing goals for someone else. In the end, you may have proven them wrong. Pero kaninong oras at buhay ang nasayang? Yung iyo lang. It was only last year when I stopped doing things just to prove my dad wrong. I was surprised to witness our relationship blossom. I became more open to him and vice versa. We talk and go on father-daughter dates more often, and he easily tells me that he’s proud of what I’ve done for myself. Minsan nga, naiisip kong baka hinihintay lang pala niya akong gawin ang mga bagay para sa sarili ko at hindi para sa kaniya. Whose goals are you chasing? Whose life are you living? Are they really yours? 132 STEP SEVEN: BUILD YOUR LEGACY A letter from the past Written December 27, 2018 Received December 27, 2019 Dear Nikki, Exactly a year ago, you learned a valuable lesson: hindi nasasagot ng pera ang lahat. But first, magpakatotoo tayo. Money can buy you happiness. Temporary happiness. Unless, of course, if you bought a dog. But don't buy dogs. Adopt instead! Alam mo naman kung papaanong naayos ng pera ang iba sa mga problema mo. It is a booster for nearly all areas of your life. Keywords: nearly and temporary. Noong 2018, you asked yourself: "Eto na lang ba talaga yun?" What are we really living for? Is it just to work, save, pay bills, and invest? Why? Why has money become the driving force of our lives? There has got to be more to life than chasing things that only provide temporary pleasure. This 2019, don't just get out of the rat race. Find and destroy the maze itself. Acquire wisdom. Go out there. The people you will meet have collected golden nuggets that will light your path. 133 STEP SEVEN: BUILD YOUR LEGACY Travel the world, find your why, write, inspire as many people as you can, talk with strangers, and I mean really, reaaally talk with strangers, learn from ates and kuyas, cry with new friends, paint, take a gazillion photos, talk about what you're thankful for, talk about your pains, share whatever you can, give, give, give, chase sunsets, tell your parents you love them (everyday), dream bigger dreams, fight for what you believe in, love fiercely, laugh at trolls, laugh with trolls, eat whatever you want on the menu, buy one-way tickets, and please please please... Live intentionally. Ask and face bigger questions. Ask why. Do not allow other people to define who you are and who you can be. Your downfall starts when you try to prove yourself to others. Above all, be kind - especially when it's difficult to share your light. Those who walk with dark clouds need your kindness and love the most. 2019's gunbe great. Excited for your (mis)adventures, Your younger (and hopefully chubbier) self. What would you do if money isn’t an issue? Babalik at babalik tayo dito. Knowing your values and priorities, managing your money, increasing your income, building emergency funds, protecting your money from uncertainties, and making your money grow will give you the mindset, attitude, tools, and money you’d need to buy the most important 134 STEP SEVEN: BUILD YOUR LEGACY commodity in the world... Time. When we think about money and our money goals, ang unang naiisip agad ng tao ay “making millions”. Well, not just millions. But “making kajillionzzz”. So so so much money. But when we really think about it and if we sit down and do the math, you only need a bit in order to live a life of freedom. Whatever your answer is to “What will you do if money isn’t an issue?” will be your legacy. Legacy. What is it, really? And do we really need to build one? When I first started watching all these inspirational speakers, they kept on talking about legacy. And somehow, once you get into the endless motivational loop and surround yourself with the right people, you’ll start thinking about your own legacy, too. Kadalasan, when we think about legacy, we think about death. At least, eto yung naiisip ko dati. Before, I thought legacy was having your name used as the name of a great hall, or having your story passed on like a legend, or having your own Wikipedia page, or getting your own statue after death. We think that leaving a legacy is about being 135 STEP SEVEN: BUILD YOUR LEGACY remembered or being the star, the root and cause of it all, the person to look up to, many generations later. Is building a legacy really about creating your life after death? One ordinary day in 1888, a successful man read his own obituary. It was supposed to be his brother’s, but the editor of the newspaper confused the two and placed his name instead. In bold, striking letters, the published headline said, “THE MERCHANT OF DEATH IS DEAD”. This obituary proceeded to describe a man who made lots of money by providing tools for people to kill one another. This event is believed to be the turning point of this man’s life. He left his fortune and lived a life where he awarded those whose work most benefited humanity. He died eighty years later. This is the true story of Alfred Nobel - inventor of the dynamite and founder of the Nobel Prize. We want to find meaning in our lives even if we know that death is inevitable. And this is exactly why we YOLO - we don’t want to be on our deathbeds thinking… “Sayang.” “Sana pala…” “Kung ginawa ko lang…” We don’t want to appreciate the only life we have when we’re about to lose it -- that is, if we’re even given the 136 STEP SEVEN: BUILD YOUR LEGACY gift and luxury of reflecting about life on a bed rather than realizing that we are going to die in a few seconds because of an accident. “Don’t be afraid of death; be afraid of an unlived life. You don’t have to live forever; you just have to live.” -Natalie Babbitt You don’t have to be an Alfred Nobel, a Steve Jobs, a Jose Rizal, a Mother Theresa, or a Nelson Mandela. You don’t have to die taking a bullet for someone else, write a best selling novel, or build an empire to build a legacy. I have learned that building a legacy is really about creating the kind of impact you give every person you meet along the way. My 3rd year high school Chemistry teacher taught the subject using vivid stories, our household helper for ten years created the best pork adobo recipe in the world, my grade 2 homeroom teacher looked me in the eye and said, “Ang galing-galing mong magsulat!”, a student and friend from Dubai sent me a heartfelt 10-page letter that prompted me to write this book, and a stranger I once talked with in a UV Express introduced me to lifechanging authors John Maxwell and Robin Sharma. These are the legacies left behind by ordinary people. But their impact on me will always live on - through this book, through the other books I will write, through the businesses I have and will build, through the people I employ, and through the students and mentees we take in. This is what building a legacy is all about. Sometimes, it’s not our names written in history books. But how many names are behind the famous ones? How many people have touched their lives for them to be able 137 STEP SEVEN: BUILD YOUR LEGACY to leave such incredible marks? Sometimes, we’re just the guys behind the curtains and not the people under the limelight. And it doesn’t matter. What matters is still this: what kind of impact do you have on other people? What kind of legacy will you leave behind? To build your legacy, all you gotta do is live. Actually live. Live your life your way. Live it according to your personal values. Live it in your own terms. Live intentionally. Ikaw, what will you do if money isn’t an issue? S ’ W HO R U O Y L A I C N FINA ? H T L A E H 139 HOW’S YOUR FINANCIAL HEALTH? Find out how you’re doing financially with this quick and fun quiz. All you gotta do is be as honest as possible. The results of this quiz will determine whether you need to tweak some things in your financial life or if you’re doing okay. Let’s start! How much of your income goes to your expenses? a. b. c. d. Less than 50% 51% to 70% 70% to 100% More than 100% If ever you lose your source of income today, do you have at least 6 months of savings to live as you usually would? a. b. c. d. Yes, at least 6 months. No, but my savings can last me 3 months. No savings. I need to find a job ASAP! May utang pa nga. Do you have enough savings to pay for emergencies? a. Yes, I am confident that my savings are enough to pay for emergencies. b. I have savings, but I am not yet confident that they are enough to pay for emergencies. c. I don’t have savings. But I can sell some of my valuables to pay for emergencies. d. Uutang ako. Bahala na si Batman. Do you place your savings somewhere safe and may yield better returns? 140 HOW’S YOUR FINANCIAL HEALTH? a. Yes, my savings are in the form of different assets such as investments, life insurance policies, stocks, etc. b. Yes, I have a bank account for my savings. c. I place my savings in an envelope or a box. d. Not applicable. Ang kulit nito. Wala nga akong savings, eh. How much of your income goes to necessities? a. b. c. d. Less than 20% 21% to 55% 55%-99% 100% tapos may utang pa Are you currently saving up for any passive income stream? a. b. c. d. I already have passive income. Yes, around 10% of my money. Yes, minsan. Basta may extra. Ano nga po ulit yung Passive Income? Have you invested time and/or money on learning new money making skills? a. Yes! I have spent both time and money learning more about money making skills. b. I spent some time learning about money or upgrading my skills… basta dapat libre! c. I am willing to learn more about money. Willing lang. Wala pa akong ginagawa about it, though. d. Lol hi my name is Patrick Star. Do you have a system for your money that allows you to enjoy the present while still saving for the future? 141 HOW’S YOUR FINANCIAL HEALTH? a. Yes! My system has something like the Play Jar and the Golden Goose Jar. Plus I have an emergency fund and life insurance policies. b. Yes! My system both has something like the Play Jar and the Golden Goose Jar. c. I have the Play Jar… but no savings. Yikes! d. Please repeat the question. Do you save and/or invest a part of your income for any medical plan? a. Yes, I have both health insurance (HMO) to cover the little things and life insurance (with Critical Illness Benefit) to cover the big things. b. I have a life insurance policy with Critical Illness Benefit. c. I have an HMO from my company. d. Please pray for me. If ever you suddenly lose your source of income because of a pandemic, will your family be financially okay? a. Yes, I am not the breadwinner. b. Yes, I have enough money back ups for at least 6 months to cover the whole family. c. No, I need to borrow money. d. Halp. Plz. If ever you are diagnosed with a critical illness costing ₱3,000,000, do you have life insurance policies that can pay for your treatment? a. Yes, my life insurance policy has a Critical Illness Benefit that can fully pay for my medical bills if ever I get any critical illness like cancer. b. Kinda… my life insurance policy has a Critical Illness 142 HOW’S YOUR FINANCIAL HEALTH? Benefit, but it’s not enough to pay for the whole thing. c. No, but I have family members who have savings that can pay for it. d. No, but my family members can ask for donations, borrow money, or sell our material possessions to pay for it. If you retire at age 65, will your monthly retirement money be enough? You can use our free calculator to check how much you will get every month: www.nfgglobal.com/retirement a. Yes, I have assets that I can easily liquidate and use to achieve my ideal monthly retirement budget. b. I’ll be fine with less than ₱10,000 per month during retirement… c. I will borrow money from my children when I retire. d. Retirement? Hindi na uso yan. Magtatrabaho ako hanggang mamatay. Do you know that you can be uninsurable? And that each birthday, it becomes more expensive for you to buy a life insurance policy if you don’t have one yet? a. Yes, that’s why I got mine early. b. I know that I can be uninsurable. c. I know that it becomes more expensive every year that I don’t get it. d. Wooopppssss… never knew. Will your children/siblings be able to finish their schooling if you pass away today? a. I’m not the breadwinner yet. But I will make sure that I will give my family the gift of a life insurance 143 HOW’S YOUR FINANCIAL HEALTH? policy when the time comes. b. Yes, my existing policie’s Death Benefit will be enough for their schooling. c. I only have savings and some assets… but they’ll get frozen when I die right? d. Aalagaan na lang sila ng relatives ko. Have you prepared your emergency funds, fixed your debt, studied well, and protected your money before investing? a. Yes! Because this is the best way to protect myself from risks. b. At least yung emergency funds and life insurance, meron na. c. Emergency funds lang po. d. Sugod mga martyr! Trade and invest tayo like a gambler, woohooo! Have you tried dipping your toes in any of the available financial markets in the Philippines? a. Yes, I have emergency funds, life insurance policies that come with investments, other separate investments, and I trade on the side, too. b. Yes, I have emergency funds, life insurance, and separate investments. c. Yes, I have investments managed by a professional and licensed fund manager. d. Wala pa nga akong emergency funds. :( So, how’s your financial health? To know your score, simply add them up accordingly: 144 HOW’S YOUR FINANCIAL HEALTH? A = 5 points B = 3 points C = 1 point D = None Bonus! Set up a free one-on-one consultation with an NFG Global financial advisor here: nfgglobal.com/freeconsultation and get 5 additional points! Results: 80+ This is great! Inspire as many people as you can! 60-79 You are missing essential things. Please set a consultation with us. 0-59 GhOrL, you need our help. A R E T LET U O Y FOR 146 STEP SEVEN: BUILD YOUR LEGACY Congratulations! You have been accepted to be part of the NFG mission. Devouring this book from page to page would have equipped you with the necessary questions needed to become superheroes of today. Yes, questions. I believe that asking bigger questions is more important than getting bigger answers. “Courage doesn’t happen when you have all the answers. It happens when you are ready to face the questions you have been avoiding your whole life.” ― Shannon L. Alder If the questions you were asking before getting this book were “What can I buy when I make more money?” or “How do I become rich quickly?”, I hope they have evolved into questions that are richer and fuller – questions with answers that are hard to find; answers that require one whole journey across the world. When I decided to write this book, my team asked me, “What kind of reaction do you want to get?” Sabi ko sa kanila, “Gusto kong magulat at magtaka sila kung bakit libre ito.” I hope that’s exactly how you feel now. If, after reading, you have a lot of what ifs and should haves, then please know that you are not alone in this journey. There is a divine reason why you acquired this right here, right now. Keep faith that one day soon, you will find out why. May you use that small, flickering light inside of you and build it into something remarkable, 147 STEP SEVEN: BUILD YOUR LEGACY something that lights another’s darkness. Ang nais ko ay maging ilaw ka para sa iba. It’s never too late. Just start. In Latin, the word “passion” means “to suffer”. Yet, when we think about passion, we jump into the things we like doing. Maybe, instead of asking “What am I passionate about?”, it’s better to ask “What am I willing to suffer for?”. What are you willing to suffer for? What are you willing to do even when it’s inconvenient for you? “Passion” is funny. Because as much as it can mean “to suffer”, the word structure itself can also look like this: “Pass-I-On”. How can I pass myself to you? And if I do share myself to others, what kind of impact will I create in your life? What kind of legacy will I leave behind? To tell you honestly, this was written in one week. Writing a book this packed in a few days is easy. But acquiring all the wisdom that has just been passed to you took years of suffering and faith. This is exactly why it was so easy to make. Some parts of it were simple to obtain on my own. But some had to be given to me by giants: ordinary people who touched many, many lives. Some of them are still with us and are still leading our mission in various parts of the globe. Others have lived on to their next life - and I can only hope to meet their new versions very soon. I’m sure, however, that their will and drive to help as many 148 STEP SEVEN: BUILD YOUR LEGACY people as they can have been passed on to their mentees, including myself. I want us all to evolve and grow with this book. I am planning to make multiple editions and to have them printed so that you can pass them on as gifts. Until then, I hope this digital copy provides the same light for everyone. May you use the knowledge and skills and questions you have now to touch as many lives as possible. As an NFG, you are a hero. As the legendary creator Stan Lee would put it… Excelsior! Thankful in all ways always, 149 STEP SEVEN: BUILD YOUR LEGACY Nomad Finance Girl “What would you do if money isn’t an issue?” When Nikki was asked this question many years ago, the Ironman fanatic’s answer was “Build a team of superheroes.” At the age of 28, Nikki Jurado - known online as Nomad Finance Girl - has built a following of more than 80,000 readers and has created and managed more than 8 businesses. Beyond being an entrepreneur and a forex trader, she sees herself as an educator, writer, and philosopher who helps people have more time for things that are more important than money by understanding the complex world of personal finance and currency and commodity trading in the easiest way possible. What’s next after this book? “I think it’s more important for us to ask big questions than to find big answers. I’m already writing a book about this.” Still so young and eager, NFG has no plans of slowing down anytime soon. 150 The Leo Advantage is a currency and commodity trading training community co-owned by NFG. They teach individuals from all kinds of backgrounds the necessary skills for becoming a profitable trader without the use of indicators, economics, and with only five minutes of work per day. Ultimately, the core of a Lion trader is to focus on the easy and obvious trades so that we can spend time on things that are more important than money - our passions and our relationships. Join Leo Advantage classes: www.theleoadvantage.com www.fb.com/leoadvantage NFG Global is a unit of licensed financial advisors from Pru Life UK who help individuals and families enjoy both the present and the future through financial education. NFG Global provides customized financial plans to aid individuals if ever life’s emergencies come their way getting diagnosed with a critical illness, disability, and untimely death. They also provide assistance for retirement and estate taxes. Join the team: www.nfgglobal.com/joinus Get a free consultation: www.nfgglobal.com/freeconsultation Learn more: www.nfgglobal.com 151 Written by Nomad Finance Girl NOMAD FINANCE GIRL Rose Nikki V. Jurado Official Accounts: Facebook: Nomad Finance Girl Instagram: @hellonfg For partnerships and inquiries: hello@nfgglobal.com 152 Designed by Chinvest CHINVEST Chene Arieta Official Accounts: Facebook: Chinvest Instagram: @chinvest For partnerships and inquiries: chinvestinyourself@gmail.com 153 If you find anything useful in this book and would like to share it with your friends online, please tag Nomad Finance Girl on Facebook and @hellonfg on Instagram. Parts of this book may be shared with proper citation to the book author and publisher. May you live intentionally.