Accounting Problems & Solutions: Payroll, Reconciliation, More

advertisement

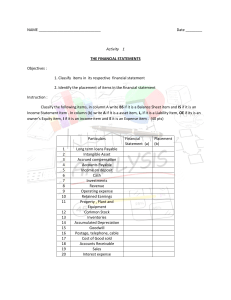

Accounts and Budget Service L-III @ethioexit Version 1 Project one- Process payroll The following data are taken from Ethiopian Road Corporation for the month of Yekatit 2005 Name of Employee Salary Allowance Overtime Remark Rahel Aseffa 2,500 900 10hr 4-weekdays (2) 4- public holidays(2.50) 2-Evening (1.25) Emebet Aseffa Dillu Teshome Abebe derje 5,000 10,000 12,500 1,000 1,200 1,400 6hr 8hr - Weekends(2) public holiday(2.5) - Additional information 1. All Employees are permanent and worked 40 hours per week 2. All Employees Allowance are tax exempted up to Br 400 3. All Employees pay one month salary to be paid monthly within a year to Abay dam Required 1. Prepared payroll sheet 2. Prepared necessary journal entries and payments of Liabilities (deductions) to the concerned body. Project Two. Process Financial Transactions and Prepare Financial The accounts in the ledger of Ethiopian Telecommunication Corporation with the unadjusted balance on June 30, at end the current year are as follows: Cash 87,500.00 Account Receivable 192,300.00 Merchandize inventory 290,500.00 Prepaid insurance 25,380.00 Store Supplies 16,500.00 Store equipment 179,000.00 Acc.Dep. of store equipment 50,600.00 Account payable 89,480.00 Salaries payable Capital stock 360,000.00 Retaining earning 162,890.00 Dividends 120,000.00 Income summary Sales 1,890,000.00 Purchase 1,220,100.00 Sales salaries expense 154,800.00 Advertising expense 49,600.00 Dep.expense of store equipment Store supplies expense Mis.selling expense 8,800.00 Office Salary expense 79,690.00 1|Page Rent expense 80,000.00 Utilities expense 32,200 Taxes expense 17,000.00 Insurance expense Mis General expense 7,200.00 Other income 7,600.00 The data needed for year ended adjustments on June 30 are as follows: Merchandise inventory on June 30 301,000.00 Insurance expired during the year 12,800.00 Store supplies inventory on June 3 4,300.00 Depreciation for the current year 38,400.00 Accrued salaries on June 30 Sales salaries 5,600.00 Office salaries 2,600.00 Required 1. Prepared adjusting entries 2. Prepared income statement and balance sheet Project Three: Bank Reconciliation 1. On May 31, 2002 Selam Company showed a balance in its cash account of Br 37,820.00 On June 2, Selam received its Bank statement for the month ended May 31, which showed an ending balance of Br 65,040.00 2. A matching of debits to the cash account on the books with deposits on the bank statement showed that the Br 9,040.00 receipts of May 31 are included in cash but not included as deposit on the bank statement. 3. An examination of checks issued and checks cleared showed three checks outstanding No 9544 Br 6,440.00 No 9545 Br 3,360.00 No 9546 Br 14,460.00 Total Br 24,260.00 4. Include with the bank statement a credit memo for Br 24,500.00 (principal of Br 24000.00 +Br 500.00 interest) for collection of note owed to selam by Ship Company. 5. Include with the bank statement is a Br 20,400.00 debit memo for an NSF check written by Kemal and deposited by Selam 6. Charges made to Selam’s account include Br 240.00 for safe deposits box rent and Br 160.00 for service charges 7. Check No 9550 for 10,160.00 to Taylor Company for the settlement of account payable recorded in the cash payments Journals as Br 18,460.00 Required: From the oboe information 1. Prepared Bank Reconciliation 2. Pass necessary journal entries Project Four Partnership Given is the balance sheet of the WXY partnership on sene 30, 2004 the date the partners decided to liquidate their partnership WXY partnership 2|Page Cash Other Asset 40,000.00 680,000.00 Total asset 720,000.00 Balance sheet April 30, 2002 Accounts payable W-Capital X-Capital Y-Capital Total liabilities and capital 380,000.00 140,000.00 100,000.00 100,000.00 720,000.00 On May 1, the non-cash asset were sold for BR 356,000.00 W,X and Y share income and losses in a 5:3:2 ratios Required: 1 prepared statement of partnership liquidation and all necessary journals entries to recorded liquidation of the partnership. Assume that any partners who had debit balances in their capital accounts after loss distributions immediately paid cash to the partnership. Project Five Taxes Ato Bekele Assefa is a shareholder in Merkato Bank Share Company. He owned 300,000.00 shares of Br 3,000.00 par value common stock in the Bank. Merkato Bank declared and paid of Br 0.20 per shares. A. How much dividend is given to Ato Bekele? B. How much is tax is to be paid to the Tax Authority? C. How much Ato Bekele will receive after tax? D. Who is liable to pay the tax to the tax Authority? Solution Project One Process Payroll Employee s no Name of Employee Basic Salary Transport Allowance over time Total income Income Tax Pension contribution Abay Dam Total Deduction Net payment 00001 Rahel 2,500.00 900.00 320.31 3,720.31 361.56 175.00 208.33 744.89 2,975.42 00002 Embet 5,000.00 1,000.00 375.00 6,375.00 928.75 350.00 416.67 1,695.42 4,679.58 00003 Dillu 10,000.00 1,200.00 1,250.00 12,450.00 2,717.50 700.00 833.33 4,250.83 8,199.17 00004 Abete 12,500.00 1,400.00 13,900.00 3,225.00 875.00 1,041.67 5,141.67 8,758.33 30,000.00 4,500.00 36,445.31 7,232.81 2,100.00 2,500.00 11,832.81 24,612.50 Total 1,945.31 Journal entries Salary expense -------------------------- 36,445.31 Income tax payable ----------------------------- 7,232.81 Abay Dam payable ------------------------------ 2,500.00 Pension payable ---------------------------------- 2,100.00 Salary payable ------------------------------------ 24,612.50 Pension expense = 30,000*11% ----------- 3,300.00 Pension payable -----------------------------------------3,300 When Salary is paid Salary payable -------------------------- 24,612.50 Cash in bank --------------------------------- 26,512.50 3|Page When liabilities are paid Abay Dam payable ---------------------- 2,500.00 Income tax payable --------------------- 7,232.81 Pension payable ------------------------- 5,400.00 Cash in bank ---------------------------------- 15,132.81 Project Two: Process Financial transaction and Prepare Financial Reports A) Income Summary -------------------- 290,500.00 Merchandise Inventory ------------------- 290,500.00 Merchandise Inventory ------------- 301,000.00 Income Summary --------------------------- 301,000.00 B) Insurance expense ---------------- 12,800.00 Insurance ------------------------------- 12,800.00 C) Store supplies expense -------------- 12,200.00 Store supplies ----------------------------- 12,200.00 D) Dep. Expense of store equipment ------------ 38,400.00 Acc. Dep. store equipment -------------------------- 38,400.00 E) Sales salaries expense ------------------- 5,600.00 Office salary expense ------------------- 2,600.00 Salaries payable -------------------------------------- 8,200.00 Ethiopian Telecommunication Corporation Income statement For the year ended June 30 Sales --------------------------------------------------------------------------------- 1,890,000.00 Other income --------------------------------------------------------------------------- 7,600.00 Total sales --------------------------------------------------------------------------- 1,897,600.00 Beginning inventory ---------------------------------- 290,500.00 Purchase ------------------------------------------------ 1,220,100.00 Merchandise available for sales ------------------ 1,510,600.00 Less ending inventory --------------------------------- (301,000.00) Cost of Goods sold ---------------------------------------------------------------- 1,209,600.00 Gross Profit --------------------------------------------------------------------------- 688,000.00 Sales salaries expense ---------------------------------- 160,400.00 Advertising expense ---------------------------------------- 49,600.00 Dep. Expense of store equipment ------------------------ 38,400.00 Store supplies expense -------------------------------------- 12,200.00 Mis. Selling expense ------------------------------------------ 8,800.00 Office salary expense ----------------------------------------- 82,290.00 Rent expense ----------------------------------------------------- 80,000.00 Utilities expense ------------------------------------------------- 32,200.00 Taxes expense ---------------------------------------------------- 17,000.00 Insurance expense ----------------------------------------------- 12,800.00 Mis General expense ---------------------------------------------- 7,200.00 Total ------------------------------------------------------------------------------------------------------ 500,890.00 Net income ---------------------------------------------------------------------------------------------- 187,110.00 4|Page Ethiopian Telecommunication Corporation Balance sheet June 30 Cash ------------------------------------------------------------------------------------- 87,500.00 Account receivable ----------------------------------------------------------------- 192,300.00 Merchandise inventory ------------------------------------------------------------ 301,000.00 Prepaid insurance --------------------------------------------------------------------- 12,580.00 Store supplies ---------------------------------------------------------------------------- 4,300.00 Store equipment ------------------------------------------------- 179,000.00 Acc. Dep. Of store equipment ----------------------------------(89,000.00)-------- 90,000.00 Accounts payable ------------------------------------------------------------------------------------------------- 89,480.00 Salaries payable ----------------------------------------------------------------------------------------------------- 8,200.00 Capital stock -------------------------------------------------------------------------------------------------------- 360,000.00 Retain earnings ----------------------------------------------------------------------------------------------------- 230,000.00 Total -------------------------------------------------------------------------------------------- 687,680.00687,680.00 Ending retained earning=Beginning retained earning +net income- dividend=162,890+187,110-120,000=230,000 Project Three. Bank reconciliation Selam Company Bank reconciliation May 31, 2002 Balance per bank ------------------------------------------------------------- 65,040.00 Add: deposit in transit ------------------------------------------------------- 9,040.00 Subtotal --------------------------------------------------------------------------74,080.00 Deduct: outstanding check ------------------------------------------------ (24,260.00) Adjusted balance ------------------------------------------------------------ 49,820.00 Balance per depositor ------------------------------------------------------ 37,820.00 Add: Errors ------------------------------------------ 8,300.00 Collection ------------------------------------------- 24,500.0032,800.00 Subtotal ---------------------------------------------------------------------- 70,620.00 Deduct: NSF ----------------------------------------- 20,400.00 Service charge ------------------------------------------- 400.00 20,800.00 Adjusted balance ------------------------------------------------------------- 49,820.00 A. Cash collection Cash in bank ---------------------------- 24,500.00 Accounts receivable ------------------------ 24,000.00 Interest income -------------------------------- 500.00 B. error Cash in bank ------------------------------ 8,300.00 Accounts payable -------------------------- 8,300.00 C. NSF Account receivable ---------------------- 20,400.00 Cash in bank -------------------------------------- 20,400.00 D. 5|Page Service charge ------------------------------ 400.00 Cash in bank -------------------------------------- 400.00 Project four partnerships WXY partnership Statement of partnership liquidation April 30,2005 Cash + Cash NCA Liability W-Capital X-capital + y-capital Balance ----------------------- 40,000 +680,000 380,000 +140,000+ 100,000+ 100,000 Realization division of loss 356,000 (680,000) -(162,000) (97,200) (64,800) Balance after realization 396,000.00 380,000.00 22,000) 2,800 35,200 Payment of liability (380,000.00) (380,000) Balance ----------------------------- 16,000.00 (22,000.00) 2,800.00 (35,200) Collection from W-partners 22,000 22,000 Balance 38,000.00 2,800.00 35,200 Distribution of cash to partners (38,000.00) (2,800.00) (35,200) Balancee 0 0 0 0 0 Journal entries A. Sales of Non-cash Assets Cash --------------------------------- 356,000.00 Loss on realization --------------- 324,000.00 Non-cash Assets ------------------------680,000.00 0 Distribution of loss to partners W-capital ----------------------- 162,000.00 X-Capital ------------------------ 97,200.00 Y-capital ------------------------- 64,800.00 Loss on realization --------------------- 324,000.00 Payment of liability Liability ------------------------ 380,000.00 Cash -------------------------------- 380,000.00 Collection from partners Cash ---------------------------- 22000.00 W-capital ------------------------- 22000.00 Distribution of cash X-capital ----------------------- 2,800.00 Y-capital ------------------------ 35,200.00 Cash ----------------------------------- 38,000.00 Project Five Taxes Taxes A. Dividend income = 300,000*.20 = 60,000.00 B. Tax on Dividend income = 60,000*10% = 6,000.00 C. Dividend income after tax = 60,000-6,000=54,000.00 D. Merkato bank is labile to pay the tax to tax Authority 1. Which of the following is not essentially the characteristic of taxation? 6|Page A. It is a compulsory levy B. It provides for non proportional return or benefit C. It helps in financing government activity D. It is an illegal collection 2. Assets in the statement of financial condition for in individuals reported at A. Cost B. Lower of cost or market C. Estimated Cost D. Market value 3. Taye and Tamiru are partners who share income and loss in the ratio of 2:1 who have a capital balance of Br 130000.00 and 70000.00 respectively. If sisay, with the consent of Taye, acquired one – half of Taye’s capital for Br 80000.00 for what amount would sisay capital account be credited is: A. Br 100000.00 B. Br 80000.00 C. Br 65000.00 D. Br 40000.00 4. During a period in which general price level is raising which of the following would create a purchasing power gain? A. Holding cash B. Holding a long term bonds payable C. Holding inventory D. Holding a note receivable 5. A corporation financial statement do not report cents amount. This is an example of the application of which of following concepts? A. Business entity B. Going concern C. Consistency D. Materiality 6. Types of loan granted for a period of an overnight to a maximum of fourteen days: A. Cash credited B. Money at cell C. Over draft facility D. Term loan 7. Which of the following is the possible different between a check and a bank draft? A. A draft cannot be payable to the bearer while check can be so drawn B. A check can be drawn in one stated branch while a draft drawn for any branch C. A draft may be discounted while check cannot be discounted D. A banker is not under a legal obligation to pay the money of draft while for check the bank is liable to pay the value of it 8. A petty cash fund is: A. Used to pay up to 1,000.00 birr amount B. Used to pay small payment C. It is applicable only in small enterprise D. Used to reimbursed change fund 9. A payment of cash for the purchase of merchandise would be recorded in A. Purchase journal B. Sales journal C. Cash journal 7|Page 10. 11. 12. 13. 14. 15. 16. 17. 18. D. Purchase discount journal The controlling account in the general ledger that summarize the debits and credits to the individual customers in the subsidiary ledger in entitled: A. Account payable B. Account receivable C. Sales D. Purchase The balance in unearned rent at the end of period represents: A. An asset B. A liability C. Revenue D. An expense The salary expense account has a credit balance of 10,000.00 on hamle 1, the beginning of the fiscal year, after reversing entries have been posted but before any transaction has occurred. The balance represents A. An asset B. A liability C. Revenue D. An expense What is the maturity value of 90-day, 12% for 100,000.00? A. 88,000.00 B. 100,000.00 C. 103,000.00 D. 112,000.00 At the end of the fiscal year before account are adjusted, account receivable has a balance of Br 400,000.00 and allowance for doubtful accounts has a credit balance 5,000.00. if the estimated of uncollectable determine by against receivable is 17,000.00, the current portion to be made for uncollectable accounts will be A. 5,000.00 B. 12,000.00 C. 17,000.00 D. 400,000.00 Post –closing trail balance may include which of the following account A. Sales B. Salary expense C. Account receivable D. Interest expense A credit may signify A. An increase in asset account B. A decrease in asset account C. A decrease in liability account D. A decrease in a capital account The payment of cash for your client for the settlement of purchase on account would be recorded by A. Debit for cash and credit for account receivable B. Debit for account receivable and credit for cash C. Debit for account payable and credit for cash D. Debit for cash and credit for account payable The properties owned by a business enterprise are: A. Capital 8|Page B. Owner’s equity C. Assets D. liability 19. in a business transaction the first occurrence can be recorded in the book of account is A. journal B. ledger C. payment journal D. receipt journal 20. Goods and documents are exempted in accordance with legislative, organizational guideline and procedures plus It needs bank permits based on national bank directives, commercial banks policies. This is refers to: A. To have principal registration certificate B. Regarding to import and export activities C. Regarding to declaration of tax D. It emphasis the internal control of a company 21. Assume that you have 5,000.00 euro in your hand. What is the equivalent amount of it in USD if the exchange for a dollar is Birr 18 and for euro is Birr 24? A. 6,666.67 USD B. 5,833.33 USD C. 5,000.00 USD D. 120,000.00USD Section B matching type questions Column A ------------ 1. Mutual Agency -------------2. Indirect tax -------------3. Batch -------------4. Ledger -------------5. Credit card -------------6. Cash -------------7. L/C ( Letter of Credit) -------- ----8. Credit memo -------------9. SWOT Analysis -------------10. Maintain quality documentation -------------11. Supervision -------------12. System control -------------13. Check/CPO/ --------------14. Accrued revenue --------------15. Term loan 1 2 3 4 Column B A. Used to keep accurate data records B. Account Receivable C. Payment instrument D. Used to improve business performance E. Granted for fixed period of time F. Small team G. Helps to protect from fraud/corruption/ H. Secondary book I. Needs the involvement of issuing and advisory banks J. Most liquid asset K. Group of journal L. Sales tax M. Partnership N. Corporation O. The customer is to be credited P. Plant asset Q. Liability account R. VISA Multiple choice D- it is an illegal collection A-Cost C-Br 65,000.00 C-holding inventory 9|Page 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 D-Materiality B-Money at cell A-A draft cannot be payable to the bearer while check can be so drawn B-used to pay small payment C-cash journal B-Account receivable B- A liability D- An expense C-103,000.00 B-12,000.00 C-Account receivable B-A decrease in asset account C-Debit for Account payable and credit for cash C-Asset A-journal B-regarding to import and export activities A-6666.67 USD Matching M-partnership L-sales tax K-group of journal H-secondary book R-Visa J-most liquid asset I-needs the involvement of issuing and advisory banks O-the customer is to be credited D-used to improve business performance A-used to keep accurate data records F-small team G-Helps to protect from fraud/corruption C-payment instrument B-Account Receivable E-Granted for fixed period of time 10 | P a g e