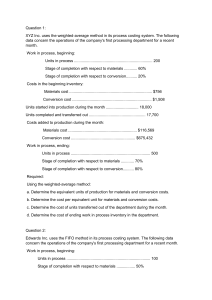

Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Week 6 & &: Unit Learning Outcomes (ULO): At the end of the unit, you are expected to a. Compute for the product cost using process costing system by preparing cost of production report considering the effect of beginning work in process inventory using FIFO and Average method of computing the product under process costing system. b. Apply the appropriate methods for costing joint and by products. Big Picture in Focus: ULOa. Compute for the product cost using process costing system by preparing cost of production report considering the effect of beginning work in process inventory using FIFO and Average method of computing the product under process costing system; Metalanguage For you to demonstrate ULOa, you will need operational understanding of the terms enumerated below. FIFO Method is the method of first in, first out consideration Average Method is the method of computing cost and units in average format and not consider the concept of which is first in and which is first out. Essential Knowledge To perform the aforesaid big picture (unit learning outcomes), you need to fully understand the following essential knowledge laid down in the succeeding pages. Please note that you are not limited to exclusively refer to these resources. Thus, you are expected to utilize other books, research articles and other resources that are available in the university’s library e.g. ebrary, search.proquest.com etc., and even online tutorial websites. METHODS OF COSTING IN PROCESS COSTING SYSTEM FIFO METHOD The method that assumes the flow of production that the units first placed in the process is presumed to be the completed first and those that are first completed are those first transferred out. Under this method, the work in process beginning will require a separate computation of equivalent unit of production and the units started, completed and transferred is will also have separate computations of equivalent units of production. Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 The equivalent unit of production of this period shall consist only of those that completed this period and the completed last period is recorded last period. Example if the product is 70% completed last period. The 70% is recorded as work done last period so, how many percentage do we need to complete the product? Yes, 30% then the 30% completion is recorded as work done this period. The unit cost are computed by current period product cost divided by the equivalent units of current work done. The cost of goods transferred out is computed as the sum of the following: a. The cost in beginning work in process inventory b. The current period cost to complete beginning inventory, computed by the equivalent unit of production of the beginning work in process multiplied by the current period unit cost c. The cost to start and complete units, calculated by number of units multiplied by the current cost computed The cost of work in process ending is computed by multiplying the equivalent units of production by the current product cost per unit. AVERAGE METHOD The method the merges all the departmental costs by elements of the beginning work in process and cost incurred for the period an getting the average units cost by dividing the total cost by elements tot equivalent units of production. Under this method, the computation of equivalent units of production from the beginning work in process is ignored and the total units completed and transferred are considered to be 100% completed. The equivalent unit of production of this period does not consider or ignore the work done last month in computing equivalent unit of production. The unit cost are computed as follows cost of the beginning work in process added to the current period product cost divided by the sum of equivalent units of production of the beginning work in process and the equivalent units of the current work done. The cost of goods transferred out and the cost of work in process ending is computed as follows: total units transferred multiply by the weighted average unit cost. The cost of work in process, ending is equal to the equivalent units of production multiplied by the weighted average unit cost. Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 COMPUTATION OF EQUIVALENT UNITS OF PRODUCTION The following information pertains to Brill John Corporation for its May 2020 production. Units in process, beg, 60% completed 10,000 Units Started 40,000 Units Completed 35,000 Units in process, End, 90% completed 15,000 Materials are added at the beginning of the process Solution: FIFO Materials Quantity Schedule Units in process, beg Unit Started Total Units in Process, beg Units Completed Units in Process, end Actual 10,000 40,000 50,000 10,000 25,000 15,000 50,000 WD EP 100% 100% 25,000 15,000 40,000 Actual 10,000 40,000 50,000 35,000 15,000 50,000 WD EP 100% 100% 35,000 15,000 50,000 Conversion Cost WD EP 40% 100% 90% 4,000 25,000 13,500 42,500 Solution: Average Materials Quantity Schedule Units in process, beg Unit Started Total Units Completed Units in Process, end Conversion Cost WD EP 100% 90% 35,000 13,500 48,500 Illustration for Preparation of Cost of Production Report The following information pertains to Brill John Corporation for its June 2020 production. Finishing department and the previous department is Molding Department Units in process, beg, 60% completed 5,000 Units Started 30,000 Units Completed 30,000 Units in process, End, 90% completed 5,000 Materials are added at the beginning of the process Costs Cost from preceding department Materials Labor and Overhead(Conversion cost) Beg 85,000 21,000 38,000 450,000 360,000 425,250 Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Solution for FIFO Method Brill John Corporation Cost of Production Report For the month of June 2020 (Finishing Department) Materials Quantity Schedule Units in process, beg Unit Started Total Units in Process, beg Units Completed Units in Process, end Actual 5,000 30,000 35,000 5,000 25,000 5,000 35,000 Conversion Cost WD EP WD EP 100% 100% 25,000 5,000 30,000 Cost Charge to the department In Process, beg 144,000 Cost from Preceding department 450,000 Cost added in the department Materials 360,000 Conversion cost 425,250 Total cost to be accounted for 1,379,250 Cost accounted for as follows: Completed and transferred From IP, beginning Cost last month 144,000 Cost added this month: Materials Conversion cost 27,000 27,000 This month completed and transferred 40% 100% 90% 2,000 25,000 4,500 31,500 15.00 12.00 13.50 40.50 171,000 1,012,500 1,183,500 In Process, end Cost from preceding department Materials Conversion Costs Total cost as accounted for 75,000 60,000 60,750 195,750 1,379,250 Journal entries: Work in process – Finishing Department 450,000 Work in Process – Molding Department 450,000 Work in Process – Finishing Department Materials Payroll/Factory Overhead Applied 360,000 425,250 785,250 Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Finished Goods 1,183,500 Work in process – Forming Department 1,183,500 Solution for Average Brill John Corporation Cost of Production Report For the month of June 2020 (Finishing Department) Materials Quantity Schedule Units in process, beg Unit Started Total Units Completed Units in Process, end Actual 5,000 30,000 35,000 30,000 5,000 35,000 WD EP 100% 100% 30,000 5,000 35,000 Conversion Cost WD EP 100% 90% 30,000 4,500 34,500 Cost Charge to the department Cost from Preceding department (85,000+450,000) 535,000 15.28571429 Cost added in the department Materials (21,000+360,000) 381,000 10.88571429 Conversion cost (38,000+425,250) 463,250 13.42753623 Total cost to be accounted for 1,379,250 39.59896481 Cost accounted for as follows: Completed and transferred (30,000*39.59896481) In Process, end Cost from preceding department (5,000*15.28571429) Materials (5,000*10.88571429) Conversion Costs (4,500*13.42753623) Total cost as accounted for 1,187,969 76,429 54,429 60,423 191,281 1,379,250 Journal entries: Work in process – Finishing Department 450,000 Work in Process – Molding Department Work in Process – Finishing Department Materials Payroll/Factory Overhead Applied 450,000 785,250 Finished Goods 1,187,969 Work in process – Forming Department 360,000 425,250 1,187,969 Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Let’s Check! I. Questions: 1. What is FIFO costing? ________________________________________________________ ________________________________________________________ ________________________________________________________ 2. What is Weighted Average costing? ________________________________________________________ ________________________________________________________ ________________________________________________________ 3. What are distinguishing characteristics of FIFO and Weighted average costing? ________________________________________________________ ________________________________________________________ ________________________________________________________ II. True or False 1. To calculate weighted-average equivalent production you do not need to know the number of units in the beginning inventory. 2. Equivalent production calculated using FIFO is higher than equivalent production calculated using weighted average. 3. If a company has no inventories, the weighted-average approach and the FIFO approach will result in the same income. 4. Although weighted average and FIFO may give different values for inventory, the resulting income will always be the same. 5. When the beginning work in process inventory is zero, the peso amounts assigned to units transferred out under FIFO and weighted-average method is equal. III. Multiple choice 1. Which of the following is NOT relevant in determining weighted-average unit cost in process costing? a. Cost of beginning inventory. b. Equivalent unit production in beginning inventory. c. Equivalent unit production in ending inventory. d. Units completed. 2. Which company is most likely to use process costing? a. A manufacturer of nuclear reactors. c. A construction contractor. b. A cannery. d. A textbook publisher. Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 3. The numerator of weighted-average unit cost calculations is a. current period cost. b. cost of beginning inventory. c. cost of goods sold. d. current period cost plus cost of beginning inventory. 4. Which item is NOT relevant in determining FIFO unit cost? a. Cost of beginning inventory. b. Equivalent unit production in beginning inventory. c. Equivalent unit production in ending inventory. d. Units completed. 5. The FIFO method of calculating equivalent production and unit costs a. is less likely to be accurate than the weighted-average method. b. is more useful for control purposes than the weighted-average method. c. cannot be used unless a company also uses standard costing. d. eliminates the need to calculate separate equivalent-production numbers for each element of manufacturing cost. 6. Falgoma Corporation completed 10,000 units, had beginning inventory of 2,500 units 40% complete, and ending inventory of 1,000 units 20% complete. Weighted-average EUP was a. 9,200. b. 10,000. c. 10,200. d. 11,000. 7. Dwendwey Company had a beginning inventory of 3,000 units 35% complete, and an ending inventory of 2,500 units 20% complete. If 17,500 units were completed and transferred, under FIFO costing what is the EUP is conversion cost a. 17,500. b. 16,950. c. 16,050. d. 15,050. 8. Cheating Corporation has a weighted-average EUP of conversion cost 30,000 units. Beginning inventory was 4,000 units 40% complete; ending inventory was 5,000 units 60% complete. The number of units completed for the period is a. 27,000. b. 29,000. c. 30,000. d. 31,000. 9. Susasa Inc. had P 3,000 cost of beginning work in process and incurred an additional for the period P 28,500 during the period. If weighted-average EUP was 10,000 units, unit cost would be a. P 2.85. b. P 3.15. c. P 9.50. d. P 3.00. 10. Woods Run has a weighted-average EUP of 49,750 units. Beginning inventory of 4,500 units was 60% complete; the ending inventory of 4,800 units was 60% complete. Conversion costs in beginning inventory were P 1,960; conversion costs added during the period were P 40,825. Conversion costs per unit are a. P 0.82. b. P 0.86. c. P 0.70. d. P 1.00. Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Let’s Analyze! Senikel Company uses FIFO process costing. Data are as follows: Beginning inventory 40% complete 5,000 units Units completed during period 100,000 units Ending inventory 70% complete 9,000 units The cost of the beginning inventory was P 2,900 and current period production costs were P 166,880. Required: a. Compute equivalent production. b. Compute the unit cost. c. Compute the cost of the ending inventory of work in process. d. Compute the cost of goods completed and transferred to finished goods inventory. In a Nutshell The following data are available for 2020 for Hunter Y Field, Inc., which uses weighted-average process costing. Beginning inventory (30% complete) Units transferred in during 2020 Units completed during 2020 Ending inventory (60% complete) Lost-normal (discovered at the end) 4,000 units 56,000 units 55,000 units 4,500 units 500 units Materials are added at the beginning of the process Costs of inventory at beginning of 2020 Cost from preceding department P 6,600 Materials 12,000 Conversion Cost 6,750 Production costs incurred during 2020 Cost from preceding department P 660,000 Materials 405,000 Conversion Cost 458,850 Required: a. Prepare Cost of Production Report for 2020. b. Compute equivalent production fo-33r 2020. b. Compute the unit cost for 2020 to the nearest cent. c. Compute the cost of the ending inventory of work in process. d. Compute the cost of goods completed and transferred to finished goods. Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Q&A List Do you have any question for clarification? Questions/Issues 1. 2. 3. 4. 5. Answers Keywords index FIFO Costing Work in Process Beginning Weighted Average Costing Self-Help: You can also refer to the sources below to help you further understand the lesson. You can also refer to the sources below to help you further understand the lesson: De Leon, N. D., De Leon, E. D. and De Leon, G. Jr. M. (2019). Cost accounting and control. Manila: GIC Enterprise & Co., Inc. Garrison, R.H., & Noreen, E.W. (2003). Managerial accounting (10th ed.). McGrawHill Company, Inc. Cabrera, E. B. (2014). Management accounting: concepts and application. Manila: GIC Enterprise & Co., Inc. Department of Accounting Education Mabini Street, Tagum City Davao del Norte Telefax: (084) 655-9591, Local 116 Big Picture in Focus: ULOb. Apply the appropriate methods for costing joint and by products. Metalanguage For you to demonstrate ULOb, you will need operational understanding of the terms enumerated below. • Joint products – are individual. Products each with significant sales values