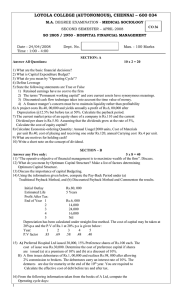

C. Only S1 is correct D. Only S1 is incorrect Multiple Choice – Theory 1. S1: The calculation of the cost of capital depends upon historical costs of funds. S2: The cost of capital for each source of funds is dependent on current market conditions and expected rates of return. A. Both statements are correct B. Both statements are incorrect C. Only S1 is correct D. Only S1 is incorrect 9. 2. S1: In determining the cost of debt, yields and prices of outstanding bonds are used. S2: The cost of debt is equal to the current bond yield on bonds of similar risk class and adjusted for the corporate tax rate. A. Both statements are correct B. Both statements are incorrect C. Only S1 is correct D. Only S1 is incorrect 3. S1: The amount of debt capital used by a corporation is not related to the availability of equity funds from retained earnings and new common stock. S2: A firm's cost of preferred stock is equal to the preferred dividend divided by market price plus the dividend growth rate (Kp= D/Po+ g). A. Both statements are correct B. Both statements are incorrect C. Only S1 is correct D. Only S1 is incorrect 10. S1: Possibly the most overlooked part of the capital budgeting process is the search for new opportunities through innovation and creative thinking. S2: Even though one project may have superior cash flows, top management may sometimes choose a project that inflates earnings instead of cash flow. A. Both statements are correct B. Both statements are incorrect C. Only S1 is correct D. Only S1 is incorrect 4. S1: The cost of new common stock is greater than the cost of outstanding common stock. S2: In determining the cost of preferred stock, the earnings on outstanding preferred stock may be used as a proxy. A. Both statements are correct B. Both statements are incorrect C. Only S1 is correct D. Only S1 is incorrect 5. Financial capital does not include: A. stock. B. bonds. C. preferred stock. D. working capital. 6. The overall weighted average cost of capital is used instead of costs for specific sources of funds because: A. use of the cost for specific sources of capital would make investment decisions inconsistent. B. a project with the highest return would always be accepted under the specific cost criteria. C. investments funded by low cost debt would have an advantage over other investments. D. use of the cost for specific sources of capital would make investment decisions inconsistent and investments funded by low cost debt would have an advantage over other investments. 7. 8. JJJ Beverages has an optimal capital structure that is 50% common equity, 40% debt, and 10% preferred stock. Debreu's pretax cost of equity is 12%. Its pretax cost of preferred equity is 7%, and its pretax cost of debt is also 7%. If the corporate tax rate is 35%, what is the weighted average cost of capital? A. between 7% and 8% B. between 8% and 9% C. between 9% and 10% D. between 10% and 12% S1; The payback method is easy to understand and places a heavy emphasis on liquidity. S2: Using the payback method can be appropriate when the time value of money is very low. A. Both statements are correct B. Both statements are incorrect S1: In most capital budgeting decisions the emphasis should be on reported earnings rather than cash flows. S2: The first administrative consideration in any capital budgeting process is collection of data A. Both statements are correct B. Both statements are incorrect C. Only S1 is correct D. Only S1 is incorrect 11. Cash flow can be said to equal A. operating income less taxes plus depreciation. B. operating income less taxes. C. operating income before depreciation and taxes plus depreciation. D. operating income after taxes minus depreciation. 12. Which of the following items is irrelevant in determining the relevant cost of acquisition in capital budgeting decisions? A. Trade in value for the old assets being replaced B. Original cost of the new assets to be acquired C. Depreciation of the new assets D. Avoidable repair expense, net of tax 13. An appropriate capital budgeting process requires that the following steps are taken in which order? a) collection of data b) reevaluation and adjustment c) evaluation and decision making d) search for and discovery of investment opportunities A. d, a, c, b B. d, a, b, c C. d, b, a, c D. b, d, a, c 14. Which is a method of ranking investment proposals that is not time-adjusted but considers the salvage value of the investment? A. Bail out period B. Payback method C. Internal rate of return method D. Accounting rate of return 15. It measures the estimated profitability of the project from the conventional accounting view. A. Bail out period B. Payback method C. Internal rate of return method D. Accounting rate of return Problem Solving 1. A company finances its operatons with 50% debt and 50% equity. It net income is P30,000,000 and it has a dividend payout ratio of 20%. Its capital budget is P40,000,000 this year. The interest rate on company’s debt is 10% and the company’s tax rate is 40%. The company’s common stock trades at P66 per share, and its curent dividend of P4 per share is expected to grow at a constat rate of 10% per year. The floatation cost of external equity, if issued is 5% of the peso amount issued. Compute for the WACC. 2. On December 1, 2021, HP Corp. is contemplating to invest into a new equipment costing P2,500,000 plus AE 313 – FINALS QUIZ 1 12092022 2 installation cost of P200,000 to replace its old equipment that has a book value of P400,000 and a remaining useful life of 4 years. The estimated useful life of the new equipment is 4 years and has a salvage value of P500,000. If the company will favor the replacement decisions, the old equipment can be sold for P150,000 but additional working capital investment must be made amounting to P400,000. However, the company must incur repair cost of P180,000 to continuously use the -> it is not avoidable since kailangan mo magincur ng cost para old equipment. Annual cash operating costs of the old magamit yung equipment. equipment is P4,000,000 while the annual cash operating cost of the new equipment is P2,400,000. At the end of the useful life, cost to remove will amount to P100,000. The company uses a tax rate of 35%, payback period is 2.5 years or less, accounting rate of return is 15%. A. Compute for the net investment. 2,747,500 B. Compute for the annual cash flow after tax. 1,197,500 3. A machine costing P8,350 yields total cash flows of P13,100 over 5 years. The following pertains to the annual cash flows using the machine: Year Net cash inflows 1 P1,750 2 2,250 3 2,850 4 3,000 5 3,250 A. Compute for the company’s payback period. B. Compute for the company’s payback reciprocal. 4. Henerhiya Co. is planning to buy a machine costing P84,000 to be depreciated on the straight line method basis over 10 years life. The related cash flow from operations, net of income taxes, is expected to be P10,000 a year for each of the first 6 years and P12,000 for the next 4 years. It was also estimated that the salvage value of the project at the end of year 1 to be P60,000 and decreases by P5,000 each year thereafter, provided further that at the end of 10 years, the machine has no salvage value. Compute the payback bailout. 3.9 5. Hanchets Inc. is considering the purchase of a new vehicle for P350,000. The firm's old vehicle has a book value of P85,000, but can only be sold for P60,000. It was being depreciated at the rate of P13,500 per year for four more years under an old depreciation method. The new vehicle will be depreciated using the 5-year using the straight line method. It is expected to save P62,000 after taxes through reduced fuel and maintenance expenses. Tabletop Ranch is in the 34% tax bracket and has a 12% cost of capital. Assume a 6 year time horizon. Compute for the accounting rate of return. 5.78%