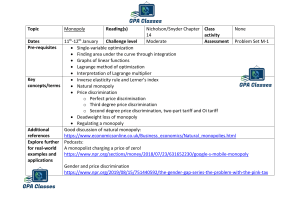

Price discrimination in Monopoly Price discrimination is the practice of charging a different price to different groups of people for the same good or service. There are three types of price discrimination – first-degree, second-degree, and third-degree price discrimination. First degree First-degree price discrimination, alternatively known as perfect price discrimination, occurs when a firm charges a different price for every unit consumed. The firm is able to charge the maximum possible price for each unit which enables the firm to capture all available consumer surplus for itself. In practice, first-degree discrimination is rare as a consumer’s maximum willingness to pay is difficult to determine. Second degree Second-degree price discrimination means charging a different price for different quantities, such as quantity discounts for bulk purchases. Cheaper after 10 minutes phone calls become. Electricity is more expensive for the first number of units. For a higher quantity of electricity consumed the marginal cost is lower. Loyalty cards reward frequent buyers with discounts on future products. Third degree Third-degree price discrimination means charging a different price to different consumer groups. For example, the higher price at peak times on trains is a form of third degree price discrimination, because generally, a different group of consumers (usually commuters) use trains at peak times, than off-peak times. Similarly, adults, students and children pay different prices to see the same film at a cinema. It costs the cinema the same to show the film, but the consumers have been divided into groups based on age. It is commonly seen in the entertainment industry. 1 If the profit from separating the sub-markets is greater than for combining the sub-markets, then the rational profit maximizing monopolist will price discriminate 3 Conditions necessary for price discrimination 1. Separate markets. The firm must be able to separate markets and prevent resale. E.g. stopping an adults using a child’s ticket. Prevent business travelers from buying discount tickets. 2. Different elasticities of demand. Different consumer groups must have elasticities of demand. E.g. students with low income will be more price elastic and sensitive to price. Business travellers will have more inelastic demand. 3. Low admin costs. It must be relatively cheap to separate markets and implement price discrimination. Advantages of price discrimination 1. Firms will be able to increase revenue. Price discrimination will enable some firms to stay in business who otherwise would have made a loss. For example price discrimination is important for train companies who offer different prices for peak and off-peak. Without price discrimination, they may go out of business or be unable to provide off-peak services. 2. Increased investment. These increased revenues can be used for research and development which benefit consumers 3. Lower prices for some. Some consumers will benefit from lower fares. For example, old people benefit from lower train companies; old people are more likely to be poor. Also, customers willing to spend time in researching ‘special offers’ and travelling at awkward times will be rewarded with lower prices. 4. Manages demand. Airlines can use price discrimination to encourage people to travel at unpopular times (early in the morning) This helps avoid over-crowding and helps to spread out demand. 2 Disadvantages of Price Discrimination 1. Higher prices for some. Under price discrimination, some consumers will end up paying higher prices (e.g. people who have to travel at busy times). These higher prices are likely to be allocatively inefficient because P > MC. 2. Decline in consumer surplus. Price discrimination enables a transfer of money from consumers to firms – contributing to increased inequality. 3. Potentially unfair. Those who pay higher prices may not be the poorest. For example, adults paying full price could be unemployed, senior citizens can be very well off. 4. Administration costs. There will be administration costs in separating the markets, which could lead to higher prices. 5. Predatory pricing. Profits from price discrimination could be used to finance predatory pricing. Natural monopoly A natural monopoly occurs when the most efficient number of firms in the industry is one. A natural monopoly will typically have very high fixed costs meaning that it is impractical to have more than one firm producing the good. An example of a natural monopoly is tap water, Gas network, Electricity grid and Railway infrastructure.For a natural monopoly the long-run average cost curve (LRAC) falls because of continuous economies of scale that are available and therefore achieve productive efficiency. MOHIMANUR RAHMAN [RIFAT SIR] Senior A Level Economics Teacher Profits Cell: 01717465428 In order to maximise profits the natural monopolist would charge P and produce Q quantity, and make super-normal profits, area PCZB. 3 Measures to control monopoly: 1. Price control: This is one of the main ways in which the government has regulated the privatised monopolies. A maximum price can be set at a level where it is equal to the firm’s marginal cost. It will result in allocative efficiency and lower prices for consumers. 2 Breaking up the monopoly: The firm can be forced to sell off parts of the business to create competing firms, leading to lower prices and profits. 3 De-regulation: – There are legal restrictions on competition in some markets, which governments can remove to break the power of a monopoly. Air travel in Europe has also been de-regulated (the so called ‘open skies’ policy) enabling new competitors to fly on routes previously reserved for national ‘flag carriers’ such as BA and Air France. 4 Performance and quality targets: Govt. could set performance and quality targets, with financial penalties if they are not achieved. Train companies are set targets for punctuality. Water companies have to meet minimum quality standards for water. Electricity suppliers have to meet time limits for restoring power 5 Profit controls - The government can regulate monopolies by limiting the amount of profit they are allowed to make. A maximum rate of profit can be set equal to what the regulator thinks a firm would earn in a competitive market. 4