Synertech-Dosagen Case Study: Pharma Plant Acquisition

advertisement

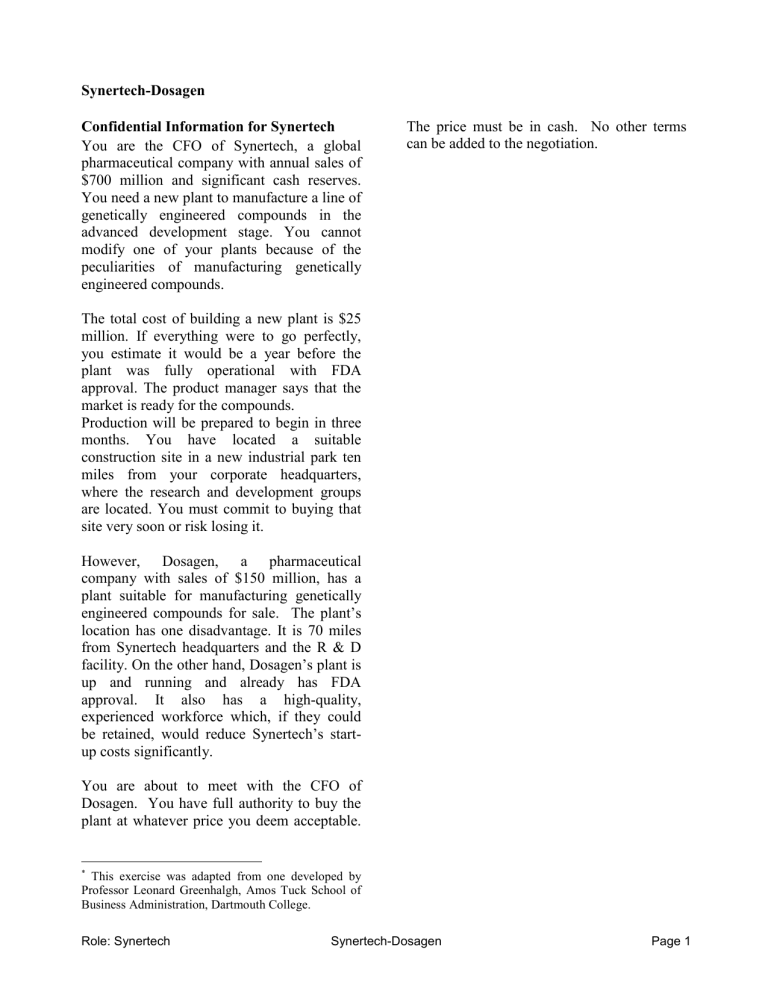

Synertech-Dosagen Confidential Information for Synertech You are the CFO of Synertech, a global pharmaceutical company with annual sales of $700 million and significant cash reserves. You need a new plant to manufacture a line of genetically engineered compounds in the advanced development stage. You cannot modify one of your plants because of the peculiarities of manufacturing genetically engineered compounds. The price must be in cash. No other terms can be added to the negotiation. The total cost of building a new plant is $25 million. If everything were to go perfectly, you estimate it would be a year before the plant was fully operational with FDA approval. The product manager says that the market is ready for the compounds. Production will be prepared to begin in three months. You have located a suitable construction site in a new industrial park ten miles from your corporate headquarters, where the research and development groups are located. You must commit to buying that site very soon or risk losing it. However, Dosagen, a pharmaceutical company with sales of $150 million, has a plant suitable for manufacturing genetically engineered compounds for sale. The plant’s location has one disadvantage. It is 70 miles from Synertech headquarters and the R & D facility. On the other hand, Dosagen’s plant is up and running and already has FDA approval. It also has a high-quality, experienced workforce which, if they could be retained, would reduce Synertech’s startup costs significantly. You are about to meet with the CFO of Dosagen. You have full authority to buy the plant at whatever price you deem acceptable. * This exercise was adapted from one developed by Professor Leonard Greenhalgh, Amos Tuck School of Business Administration, Dartmouth College. Role: Synertech Synertech-Dosagen Page 1 General Information The Dosagen plant is in an area with many start-up biotechnology companies. There is an experienced biotech workforce in this area. Given the project nature of much of the work, this workforce is mobile between companies. Dosagen purchased this plant from Biotech, a diversified chemical company, three years ago for $15 million. Biotech was at the time in bankruptcy and needed cash badly, so this Role: Synertech purchase price may not be a good indicator of market value at that time. Two years ago, the Dosagen plant was appraised at $19 million. The local real estate market has declined 5% since then. However, the Dosagen plant is unique, and general real estate trends may not apply. Although newer, a plant like the Dosagen plant sold for $26 million nine months ago. Synertech-Dosagen Page 2