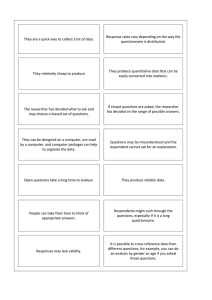

STUDENT DETAILS STUDENT NAME: BRIAN MUKUKA STUDENT ID: 2103480732 PROGRAM: MASTERS IN BUSINESS ADMINISTRATION EMAIL ADRRESS: brianmukuka12@gmail.com RESEARCH TOPIC ASSESSING CREDIT MANAGEMENT PRACTICES AND THEIR INFLUENCE ON FINANCIAL PERFORMANCE OF MICRO-FINANCIAL INSTITUTIONS. A CASE STUDY OF SELECTED MICROFINANCE INSTITUTIONS IN LUSAKA, ZAMBIA. CHAPTER ONE INTRODUCTION Overview This chapter highlights the background of the study, statement of the problem, objectives of the study, research questions, significance of the study, limitations of the study and definition of terms. Background to the study All around the world, Microfinance institutions (MFIs) have one main objective and that is to provide financial services to the poor and non-bankable population. In Africa however, this remains a difficult business. Although MFIs seem to be flourishing commercially, very few are profitable. This is because they face many challenges in their effort to deliver services effectively while making profits. The institutions are also affected by the host economy which means they are prone to suffer from political instability and weak enhancement of the rule of law (Ali, 2010). However, our focus was on the effects that credit management has on the financial performance of MFIs in Zambia. Credit is one of several factors that a firm can use to influence demand for its products. Lack of access to credit is a major obstacle to growth in Africa and this is due to the inability of many households to provide collateral when securing a loan. As with any financial institutions, lending money and not getting it back is a huge risk in this business. According to Horne and Wachowicz (2010), firms can only benefit from credit if profitability generated from sales exceeds the added cost of receivables. Profitability of MFIs across Africa is less understood and this can be linked to the unavailability of essential information (Honohan, 2011). This lack of information costs MFIs profits and profitability is vital because it aids institutions in achieving long term sustainability. Profitability is a prerequisite to a competitive micro finance industry and the cheapest source of capital, without which no firm would attract external capital (Gitman, 2017). Statement of the problem Sound credit management is a prerequisite for a financial institution’s stability and continuing profitability, while deteriorating credit quality is the most frequent cause of poor financial performance and condition in Zambia. According to Gitman (2017), “the probability of bad debts increases as credit standards are relaxed. Firms in Zambia must therefore ensure that the management of receivables is efficient and effective. Such delays on collecting cash from debtors as they fall due has serious financial problems, increased bad debts and affects customer relations. If payment is made late, then profitability is eroded and if payment is not made at all, then a total loss is incurred. On that basis, it is simply good business to put credit management at the front end by managing it strategically. As with any financial institution, the biggest risk in microfinance is lending money and not getting it back. Credit risk is a particular concern for MFIs because most micro lending is unsecured (i.e., traditional collateral is not often used to secure microloans Craig Churchill and Dan Coster (2011). The people covered are those who cannot avail credit from banks and such other financial institutions due to the lack of the ability to provide guarantee or security against the money borrowed. General Objective To assess credit management practices and their influence on financial performance of Micro-financial institutions. Specific Objectives To establish the effect that client appraisal has on the profitability of microfinance institutions. To establish the impact of credit risk control on the profitability of microfinance institutions. To ascertain the extent to which the collection policy affects the profitability of microfinance institutions. Research questions How does client appraisal affect the profitability of microfinance institutions? What is the impact of credit risk control on the profitability of Microfinance institutions? What is the effect of collection policy on the profitability of microfinance institutions? Conceptual framework Independent Variable Dependent Variable CREDIT MANAGEMENT PORTFOLIO FINANCIAL PERFORMANCE (Profitability) Client Appraisal Credit risk controls Conceptual framework Collection Policy Independent Variable Figure 1 Significance of the study Microfinance institutions play a very critical role in the provision of financial services to people living in poverty and those that cannot access credit from commercial banks. This study would go a long way in providing the following vital reference points: It would provide bank officials with information on Lending policy, how to manage their credit effectively, how they can control their credits effectively and how they can control incidence of bad debts in their institutions in order to achieve financial success. The study would definitely provide students with enough material knowledge on credit management and financial performance. This study would provide the banking and finance public with information on banking and credit advances. It would improve understanding (literature) on credit risks associated with micro financing transactions in Zambia. This study would be of great value to scholars who would use this study as a basis for discussions on credit management and financial performance. It would also provide the scholars with empirical studies that they can use in their studies bridging gaps in credit management research in general. Scope of the Study The scope of this study is to assess credit management practices and their influence on financial performance of Micro-financial institutions. Operational definitions of concepts Client is defined in USPAP as the party (or parties) who engage an appraiser in a specific assignment. To be named as the client in a report, one must have been the party who engaged the appraiser. Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. The goal of credit risk management is to maximize a bank's riskadjusted rate of return by maintaining credit risk exposure within acceptable parameters. Profitability is the ability of a business to earn a profit. A profit is what is left of the revenue a business generates after it pays all expenses directly related to the generation of the revenue, such as producing a product, and other expenses related to the conduct of the business activities. A collection policy is the set of procedures a company uses to ensure payment of accounts receivables. Similar to the credit policy as a whole, the collection policy should be written and strictly followed. Generally, a collection policy systemizes the steps taken to recover amounts due prior to litigation. CHAPTER TWO LITERATURE REVIEW Overview This chapter offers a presentation on the concept of credit management and its effect on financial performance. The chapter is segmented into; the theoretical literature and the empirical literature. It elaborated past research perspective and also the local perspective on the subject matter. In conclusion, critique of the Literature which provided an in-depth analysis of the Literature reviewed was stated. In this chapter, the researcher concentrated on four theories that the study was based on. For the purpose of this research, the researcher will review previous research works done on the topic, by reviewing literature on the various views held by authors on credit management and financial performance in the micro finance industry. CHAPTER THREE RESEARCH METHODOLOGY Overview This chapter generally outlines the selected methods and technical aspects of the study. It covers the research design, target population, sample design, data collection instruments, data analysis, and data presentation. Research design In this research, the case study will be used to conduct the study. A case study consists of intensive observation of a single subject in a particular setting (National Research Council, 2011). The reason for using this research design is in order to get in-depth information about the problem at hand. In this case, both quantitative and qualitative methods will be applied in the collection and generation of data in order to reduce on the biases as the two complement each other. Target population A study population is a well-defined set of people or group of things, household, community, firms, or services that or which are being investigated (Noholas, 2013). This researcher will target firms of Lusaka District. The study’s target population will constitute a total of 10 registered microfinance institutions based in Lusaka, Zambia (Bayport Financial Services, Blue Financial Services, Bomach Finance, Capital Solutions, FINCA Zambia, Meanwood Finance Corporation, Microfin Africa, Nedfin Limited, Royal Microfinance and Unity Finance). It will be aimed to carry a census of the most predominant micro finance institutions operating in Zambia. Lusaka will be chosen as the area of study because all the chosen institutions have branch offices where the researcher can access them. Conveniently decisions are made partly at branch level. Sampling design Sampling refers to the process of selecting a sample such as participants from the population of interests so that the results gained by these participants can be fairly generalized to the population from which they were chosen (Noholas, 2013). In some cases, purposive random sampling will be used for this research. As the name suggests, purpose sampling will be used to select a sample for a particular purpose. Furthermore, since the precise quantitative figures of the target population may not be known, non-probability purposive sampling will be more ideal as it does not require rigorous rules and rigidity in terms of the figurative target population as strictly required in probability sampling techniques. Probability sampling aims at to achieve a homogenous sample, i.e. a sample whose units share the same or very similar traits, therefore making it a very appropriate sampling technique for this research (Noholas, 2013). The researcher will provide self-administered questionnaires to the chosen respondents, schedule for interviews and also observation in the MFIs. This will enable the researcher to collect both primary and secondary data. Primary data will be collected using semi structured questionnaires. On the other hand, secondary data will be collected from articles, books, newspapers, the internet, magazines and financial reports from the institutions. Sample size determination The study will target specific respondents from these institutions and these will be: credit managers, finance managers, and credit officers in the MFIs in Lusaka. A total of 100 respondents will be used. Data collection methods Data will be collected using a structured interview schedule and questionnaire specifically designed for this study. The other Data about the respondents will be obtained from the selected sources. Data will be collected using both primary and secondary data collection techniques. Primary data will be gathered basically through structured questionnaires and interviews. The researcher will use a combination of structured questionnaires and interviews. The main instrument of data collection will be the questionnaire. Secondary data on the other hand will be gathered through review of available relevant materials such as print and electronic media; other dissertations will be; books, articles on NGP, and related reports. Data analysis Thematic analysis and descriptive statistical analysis will be used to analyze data. Thematic analysis involves the classification of words and phrases that emerge from interviews and related to the same content into major themes (Bryman, 2018). The idea behind this is to allow the actual prevailing pattern, themes and phrases of the research findings to emerge from the data. Additionally, data obtained from questionnaires will be manually coded, synthesized and quantified into percentages, using SPSS and presented in form of tables of frequency and percentages as descriptive statistics in Microsoft word. Triangulation Triangulation refers to the use of multiple methods or data sources in qualitative research to develop a comprehensive understanding of phenomena (Patton, 2019). Triangulation also has been viewed as a qualitative research strategy to test validity through the convergence of information from different sources. Denzin (1978) and Patton (1999) identified four types of triangulation: (a) method triangulation, (b) investigator triangulation, (c) theory triangulation, and (d) data source triangulation. This research will present the four types of triangulation followed by a discussion of the use of focus groups (FGs) and in-depth individual (IDI) interviews as an example of data source triangulation in qualitative inquiry. Limitations of the Study The respondents approached will be reluctant in giving information fearing that the information sought would be used to intimidate them or print a negative image about them or their Micro Finance Institution. Some respondents might turn down the request to fill questionnaires. The study will handle the problem by carrying an introduction letter from the University and assuring them that the information they give would be treated confidentially and it would be used purely for academic purposes. Employees operate on tight schedules; respondents will not be able to complete the questionnaire in good time and this overstretched the data collection period. To mitigate this limitation, the study will make use of network to persuade targeted respondents to fill up and return the questionnaires. The researcher also will encounter problems in eliciting information from the respondents as some of the information required will be subject to areas of feelings, emotions, attitudes and perceptions, which cannot be accurately quantified and/or verified objectively. This might lead to lack of response due to the veil of confidentiality surrounding the Micro Finance institutions. The researcher will encourage the respondents to participate without holding back the information they might be having as the research instruments will not bear their names. Ethical considerations Ethics are important in research in order to protect people who participate in the research from psychological and physical harm. Therefore, a researcher has to take into account various ethical considerations in order to protect participants and respect their personal integrity. An introductory letter will be used; consent forms will be supplied to the respondents; anonymity will be applied and data collected will be kept confidential and purely used for academic purposes. In view of the above, the researcher will take into account ethical considerations when conducting the research and the following issues will be taken into account to adhere to ethics. Confidentiality-All respondents will be assured that the information collected from them would be used strictly for academic purposes and held in the strictest confidentiality. Anonymity-The respondent’s names will not not collected and their private and personal details will not disclosed to the readers of the research report. Informed Consent-A letter of introduction will be provided to the targeted respondents explaining why the research is important and why it is important for them to participate in it and respondents will be given an option to either participate in the research or to opt out. THE END THANK YOU