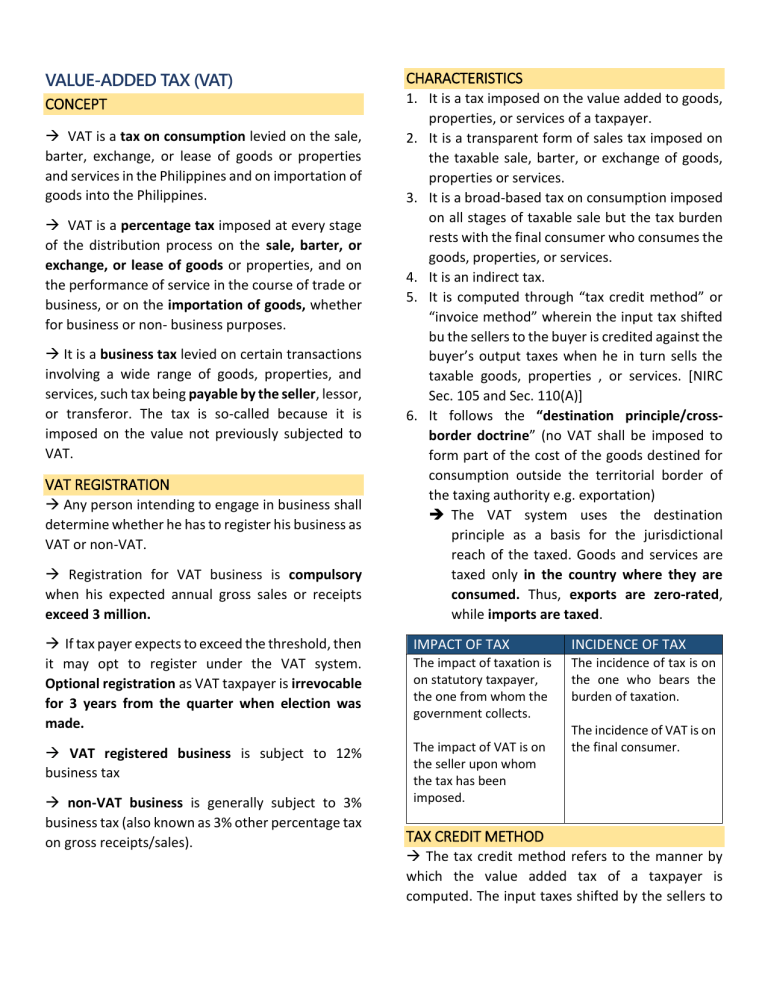

VALUE-ADDED TAX (VAT) CHARACTERISTICS CONCEPT 1. It is a tax imposed on the value added to goods, properties, or services of a taxpayer. 2. It is a transparent form of sales tax imposed on the taxable sale, barter, or exchange of goods, properties or services. 3. It is a broad-based tax on consumption imposed on all stages of taxable sale but the tax burden rests with the final consumer who consumes the goods, properties, or services. 4. It is an indirect tax. 5. It is computed through “tax credit method” or “invoice method” wherein the input tax shifted bu the sellers to the buyer is credited against the buyer’s output taxes when he in turn sells the taxable goods, properties , or services. [NIRC Sec. 105 and Sec. 110(A)] 6. It follows the “destination principle/crossborder doctrine” (no VAT shall be imposed to form part of the cost of the goods destined for consumption outside the territorial border of the taxing authority e.g. exportation) The VAT system uses the destination principle as a basis for the jurisdictional reach of the taxed. Goods and services are taxed only in the country where they are consumed. Thus, exports are zero-rated, while imports are taxed. VAT is a tax on consumption levied on the sale, barter, exchange, or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. VAT is a percentage tax imposed at every stage of the distribution process on the sale, barter, or exchange, or lease of goods or properties, and on the performance of service in the course of trade or business, or on the importation of goods, whether for business or non- business purposes. It is a business tax levied on certain transactions involving a wide range of goods, properties, and services, such tax being payable by the seller, lessor, or transferor. The tax is so-called because it is imposed on the value not previously subjected to VAT. VAT REGISTRATION Any person intending to engage in business shall determine whether he has to register his business as VAT or non-VAT. Registration for VAT business is compulsory when his expected annual gross sales or receipts exceed 3 million. If tax payer expects to exceed the threshold, then it may opt to register under the VAT system. Optional registration as VAT taxpayer is irrevocable for 3 years from the quarter when election was made. IMPACT OF TAX INCIDENCE OF TAX The impact of taxation is on statutory taxpayer, the one from whom the government collects. The incidence of tax is on the one who bears the burden of taxation. VAT registered business is subject to 12% business tax The impact of VAT is on the seller upon whom the tax has been imposed. non-VAT business is generally subject to 3% business tax (also known as 3% other percentage tax on gross receipts/sales). The incidence of VAT is on the final consumer. TAX CREDIT METHOD The tax credit method refers to the manner by which the value added tax of a taxpayer is computed. The input taxes shifted by the sellers to the buyer are credited against the buyer's output taxes when he in turn sells the taxable goods, properties or services. Under the VAT method of taxation, which is invoice-based, an entity can credit against or subtract from the VAT charged on its sales or outputs the VAT paid on its purchases, inputs and imports. If at the end of a taxable quarter the output taxes charged by a seller are equal to the input taxes passed on by the suppliers, no payment is required. It is when the output taxes exceed the input taxes that the excess has to be paid. If, however, the input taxes exceed the output taxes, the excess shall be carried over to the succeeding quarter or quarters. Should the input taxes result from zero-rated or effectively zero-rated transactions or from the acquisition of capital goods, any excess over the output taxes shall instead be refunded to the taxpayer or credited against other internal revenue taxes. BASIC FORMULA OF VAT OUTPUT VAT – INPUT VAT = VAT PAYABLE / EXCESS INPUT TAX Gross Sales Divided by Amount Net of VAT Multiply by xxx 1.12 xxx 12% VAT AMOUNT If input VAT is higher than output VAT, the excess input tax is carried over to the succeeding taxable quarter/s as tax credit. Any input tax attributable to zero-rated sales may instead be refunded or credited against other internal revenue taxes. INPUT VAT the VAT due from or paid by a VAT-registered person in the course of his trade or business on importation of goods or local purchase of goods or services, including lease or use of property, from a VAT registered person. SOURCES OF INPUT VAT 1. Purchase or importation of goods a. For sale b. For conversion into or intended to form part of a finished product for sale including packaging materials. c. For use as supplies in the course of business d. For use as materials supplies in the sale of service e. For use in the trade or business for which deduction for depreciation or amortization 2. Purchase of real properties for which a VAT has actually been paid 3. Purchase of services in which VAT has actually been paid 4. Transactions deemed sale 5. Transitional input tax – (2%) 2% of the beginning inventory of goods, materials and supplies or the actual VAT paid on such goods, materials and supplies (whichever is HIGHER) 6. Presumptive input tax – (4%) Persons or firms engaged in the processing of sardines, mackerel and milk, in manufacturing refined sugar and cooking oil and packed noodle based instant meals, shall be allowed a presumptive input tax, creditable against the output tax, equivalent to 4% of the gross value in money of their purchases of primary agricultural products which are used as inputs to their production. OUTPUT TAX the VAT due on the sale or lease of taxable goods or properties or services by any person registered or required to register under section 236 of the tax code. PERSONS LIABLE Any person who: a. in the course of his trade or business i. sells, ii. barters, iii. exchanges, iv. leases goods or properties, v. renders services b. any person who imports goods. “in the course of trade or business” means: the regular conduct or pursuit of a commercial or an economic activity, including transactions incidental thereto, by any person regardless of whether or not the person engaged therein is a non-stock, nonprofit organization irrespective of the disposition of its net income and whether or now it sells exclusively to members of their guests, or government entity. (Sec 105) the importer, whether an individual or corporation and whether or not made in the course of his trade or business, shall be liable to pay VAT. When the annual sales do not exceed 3 million: any person whose gross annual sales and/or receipts do not exceed the amount of P3,000,000, and who is not VAT registered shall pay a tax equivalent to 3% of his gross monthly sales or receipts. To be subject to 3% percentage tax, the following requisites must be satisfied: 1. The gross annual sales and/or receipts do not exceed P3,000,000 2. The taxpayer is not a VAT-registered person VAT ON SALE OF GOODS RATE: 12% VAT (beginning 1 February 2006) BASIS: Gross selling price or gross value in money of the goods or properties. WHO PAYS: paid by SELLER Goods or properties – all tangible and intangible objects which are capable of pecuniary estimation, including: 1. Real properties held primarily for sale to customers or held for lease in the ordinary course of trade or business; 2. The right or the privilege to use patent, copyright, design, or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right; 3. The right or the privilege to use in the Philippines of any industrial, commercial or scientific equipment; 4. The right or the privilege to use motion picture films, films tapes and discs; 5. Radio, television, satellite transmission and cable television time GROSS SELLING PRICE The total amount of money or its equivalent which the purchaser pays or is obligated to pay to the seller in consideration of the sale, barter or exchange of the goods or properties, excluding VAT. The excise tax, if any, on such goods or properties shall form part of the gross selling price. In this case of sale, barter or exchange of real property, gross selling price shall mean the consideration stated in the stales document of the fair market value (whichever is higher of the zonal value or the fair market value as shown in the schedule of values of the provincial and city assessors), whichever is HIGHER. REQUISITES OF THE TAXABILITY OF SALE OF GOODS OR PROPERTIES The sale of goods (tangible or intangible) must be: 1. An actual or deemed sale of goods or properties for a valuable consideration; 2. Undertaken in the course of trade or business; 3. For the use or consumption in the Philippines; and 4. Not exempt from VAT under Tax Code, special law, or international agreement SALE OF REAL PROPERTIES SUBJECT TO VAT NOT SUBJECT TO VAT On installment plan Pre-selling by real estate dealers Sale of residential lot exceeding P1,500,000 Sale of house and lot exceeding P2,000,000 (effective January 1,2021; formerly P2.5 milion) not primarily held for sale INSTALLMENT SALE OF REAL PROPERTY 1. Sale of real property by a real estate dealer 2. The initial payments of which in the year of sale do not exceed 25% of the gross selling price. Initial payments = down payment + all payments actually or constructively received during the year of sale DEFERRED PAYMENT OF REAL PROPERTY In the case of sale of real properties on the deferred-payment basis, the initial payments in the year of sale exceed 25% of the gross selling price. The transaction shall be treated as cash sale which makes the entire selling price taxable in the month of sale. INSTALLMENT SALE1 DEFERRED PAYMENT Initial payment dos not exceed 25% of the gross selling price Taxable only on the payment actually or constructively received Initial payment exceeds 25% of the gross selling price Treated as cash sale and the entire selling price is taxable on the month of sale. Example of Installment Sale: (Assume that during the year of sale) Initial payment is P1 million (10% of the selling price) Since initial payment is less than 25%, it is installment sale. Therefore, VAT for year 1 is P1 million x 12% = P120,000 For year 2 onwards, VAT is based on future installment collections. Example of Deferred Payment: (Assume that during the year of sale) Initial payment is P3 million of P10 million (30% of the selling price) Since initial payment is more than 25%, it is deferred payment. Therefore, VAT is P10 million x 12% = P1.2 million (output VAT) P1.2 mullion output VAT is payable on the month of sale. ZERO-RATED SALE OF GOODS A zero-rated sale by a VAT-registered person is a taxable transaction for VAT purposes, but shall not result in any output tax. Input tax on purchases of goods, properties or services related to such zero-rated sale shall be available for refund. The Philippine VAT Law adheres to the “cross border doctrine” of the VAT system which means that no VAT shall be imposed to form part of the cost of goods destined for consumption outside the territorial border of the Philippine taxing authority. ZERO-RATED SALES EFFECTIVELY ZERO-RATED SALES Generally refers to the export sale of goods and supply of services. It refers to the sale of goods or supply of services to persons or entities whose exemption under special laws or international agreements to which the Philippines is a signatory effectively subjects such transactions to a zero rate: 1. Sales to enterprise duly registered and accredited with the Subic Bay Metropolitan Authority and Philippine Economic Zone Authority; 2. International agreements to which the Philippines is signatory, such as Asian Development Bank (ADB), and International Rice Research Institute (IRRI) SALES OF GOODS BY VAT-REGISTERED PERSONS SUBJECT TO ZERO PERCENT (0%) RATE 1. The sale and actual shipment of goods from the Philippines to a foreign country irrespective of any shipping arrangement that may be agreed upon which may influence or determine the transfer of ownership of the goods so exported, paid for in acceptable foreign currency or its equivalent in goods or services, and accounted for in accordance with the rules and regulations of the BSP. 2. Sale and delivery of goods to a. Registered enterprises within a separate customs territory as provided under special laws; and b. Registered enterprises within tourism enterprise zones as declared by the Tourism 3. 4. 5. 6. Infrastructure and Enterprise Zone Authority (TIEZA) subject to the provisions under Republic Act No. 9593 or The Tourism Act of 2009: Sale of raw materials or packaging materials to a nonresident buyer for delivery to a resident local export- oriented enterprise to be used in manufacturing, processing, packing or repacking in the Philippines of the said buyer's goods and paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the BSP. Sale of raw materials or packaging materials to export-oriented enterprise whose export sales exceed seventy percent (70%) of total annual production. Those considered export sales under Executive Order No. 226. otherwise known as the Omnibus Investment Code of 1987, and other special laws; and The sale of goods, supplies, equipment and fuel to persons engaged in International shipping or international air transport operations: Provided. That the goods, supplies, equipment, and fuel shall be used exclusively for international shipping or air transport operations. SERVICES PERFORMED BY VAT-REGISTERED PERSONS SUBJECT TO ZERO PERCENT (0%) RATE 1. Processing, manufacturing or repacking of goods for other persons doing business outside the Philippines, which goods are subsequently exported and paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the BSP. 2. Services (other than those mentioned in the preceding paragraph) rendered to a person engaged in business conducted outside the Philippines or to a nonresident person not engaged in business who is outside the Philippines when the services are performed and paid for in acceptable foreign currency 3. 4. 5. 6. 7. and accounted for in accordance with the rules and regulations of the BSP. Services rendered to persons or entities whose exemption under Special laws or international agreements to which the Philippines is a signatory effectively subjects the supply of such services to 0% rate. Services rendered to persons engaged exclusively in international shipping or air transport operations, including leases of property for use thereof; Provided, that these services shall be exclusively for international shipping or air transport operations. Services performed by subcontractors and/or contractors in processing, converting, or manufacturing goods for an enterprise whose export sales exceed 70% of the total annual production. Transport of passengers and cargo by domestic air or sea vessels from the Philippines to a foreign country. Sale of power or fuel generated through renewable sources of energy such as but not limited to, biomass, solar, wind, hydropower, geothermal and steam, ocean energy, and other emerging sources using technologies such as fuel cells and hydrogen fuels. The sale of power or fuel is the one being subject to 0% and not the sale of services related to the maintenance or operation of the plants generating said power. TRANSACTIONS DEEMED SALE Before considering whether the transaction is deemed sale. It must first be determined whether the sale was in the ordinary course of trade or business. Even if the transaction was "deemed sale," if it was not done in the ordinary course of trade or business, still the transaction is not subject to VAT. In a transaction deemed sale, the input VAT was already claimed by the seller as credit against output VAT. However, since there is no actual sale, no output VAT is actually charged to the customers. As a result, the state will be deprived of its right to collect the output VAT. To avoid the situation where a VAT-registered person avail of input VAT without being liable for corresponding output VAT, certain transactions shall be considered sales even in the absence of actual sale. In transaction deemed sale, the seller is also the buyer, and no valuable consideration is thus paid. For transactions 'deemed sale, the output tax shall be based on the market value of the goods deemed sold as of the time of the occurrence of the transactions enumerated. 1. Transfer, use or consumption not in the course of business of goods or properties originally intended for sale or for use in the course of business (e.g. when a VATregistered person withdraws goods from his business for his personal use) 2. Distribution or transfer to: Shareholders or investors as share in the profits of the VAT-registered persons; or Creditors in payment of debt. 3. Consignment of goods if actual sale is not made within 60 days following the date such goods were consigned; Consigned goods returned by the consignee within the 60-day period are not deemed sold. 4. Retirement from or cessation of business, with respect to inventories of taxable goods existing as of such retirement or cessation. VAT ON IMPORTATION OF GOODS VAT is imposed on goods brought into the Philippines, whether for use in business or not. The VAT on importation shall be paid by the importer prior to the release of such goods from customs custody. The importer is any person who brings goods into the Philippines, whether or not made in the course of trade or business. It includes non-exempt persons or entities who acquire tax-free imported goods from exempt persons, entities or agencies. The 12% VAT is based on: 1. The total value used by the Bureau of Customs in determining tariff and customs duties, plus customs duties, excise taxes, if any, and other charges, prior to the release of goods from customs custody: or, 2. In case the valuation used by the BOC in computing customs duties is based on volume or quantity of the imported goods, the landed cost shall be the basis for computing VAT. Landed cost consists of the invoice amount, customs duties, freight, insurance and other charges. If the goods imported are subject to excise tax, the excise tax shall form part of the tax base. TRANSFER OF GOODS BY TAX-EXEMPT PERSONS As a rule, all importations are subject to VAT. However, importations by tax-exempt persons are not subject to VAT. Tax-exempt persons pertain to those who enjoy exemption from VAT due to special laws or international agreements to which the Philippines is a signatory. If importer is tax-exempt, the subsequent purchasers, transferees or recipients of such imported goods shall be considered as importers who shall be liable for the tax on importation. The tax due on such importation shall constitute a lien on the goods superior to all charges or liens on the goods, irrespective of the possessor thereof. SALE OR EXCHANGE OF SERVICE Sale or exchange of service means the performance of all kinds of services in the Philippines for others for a fee, remuneration or consideration. "Service" has been defined as "the art of doing something useful for a person or company for a fee" or "useful labor" or work rendered or to be rendered to another for a fee. The tax base is gross receipts derived from the sale or exchange of services. SALES OF SERVICE IN THE COURSE OF BUSINESS INCLUDES SERVICES PERFORMED BY: 1. Construction and service contractors 2. Stock, real estate, commercial, customs and immigration brokers 3. Lessors of property, whether personal or real 4. Transmission of electricity by electric cooperatives 5. Persons engaged in warehousing services 6. Lessors or distributors of cinematographic films 7. Persons engaged in milling, processing, manufacturing or repacking goods for others 8. Proprietors, operators, or keepers of hotels, motels, rest houses, pension houses, inns, resorts, theaters, and movie houses 9. Proprietors or operators of restaurants, refreshment parlors, cafes and other eating places, including clubs and caterers 10. Dealers in securities 11. Lending investors 12. Transportation contractors on their transport of goods or cargoes, including persons who transport goods or cargoes for hire and other domestic common carriers by land relative to their transport of goods or cargoes 13. Common carriers by air and sea relative to their transport of passengers, goods or cargoes from one place in the Philippines to another place in the Philippines 14. Sales of electricity by generation, transmission, and/or distribution companies, including electric cooperatives 15. Franchise grantees of electric utilities, telephone and telegraph, radio and/or television broadcasting and all other franchise grantees, except franchise grantees of radio and/or television broadcasting whose annual gross receipts of the preceding year do not exceed P10,000,000, and franchise grantees of gas and water utilities 16. Non-life insurance companies (except their crop insurances), including surety, fidelity, indemnity and bonding companies; and 17. Similar services regardless of whether or not the performance thereof calls for the exercise or use of the physical or mental faculties. COMMON CARRIER COMMON CARRIER TRANSPORTI NG By land Persons By sea Goods or Cargo Whether person or goods/car go KIND OF CARRIER Domestic Domestic Domestic Internatio nal By air Domestic TAX LIABILITY 3% percentage tax 12% VAT 3% percentage tax, doing business in the PH Zero rated VAT – International trip 12% VAT Domestic flight Zero rated VAT – International trip SALE OR EXCHANGE OF SERVICES SHALL LIKEWISE INCLUDE: 1. The lease or the use of or the right or privilege to use any copyright, patent, design or model, plan secret formula or process, goodwill, trademark, trade brand or other like property or right. 2. The lease of the use of, or the right to use of any industrial, commercial or scientific equipment. 3. The supply of scientific, technical, industrial or commercial knowledge or information. 4. The supply of any assistance that is ancillary and subsidiary to and is furnished as a means of enabling the application or enjoyment of any such property, or right as is mentioned in number (2) or any such knowledge or information as is mentioned in number (3); 5. The supply of services by a nonresident person or his employee in connection with the use of property or rights belonging to, or the installation or operation of any brand, machinery or other apparatus purchased from such nonresident person. 6. The supply of technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme. 7. The lease of motion picture films, films, tapes and discs. 8. The lease or the use of or the right to use radio, television, satellite transmission and cable television time. LEASE OF PROPERTIES The lease of properties shall be subject to VAT irrespective of the place where the contract of lease or licensing agreement was executed, if the property is leased or used in the Philippines. There shall be levied, assessed and collected, a VAT equivalent to 12% of gross receipts derived from the sale or exchange of services, including the use or lease of properties. Gross receipts refer to the total amount of money or its equivalent representing the contract price, compensation, service fee, rental or royalty, including the amount charged for materials supplied with the services and deposits applied as payments for services rendered and advance payments actually or constructively received during the taxable period for the services performed or to be performed for another person, excluding VAT. VAT-EXEMPT TRANSACTIONS VAT-exempt transactions refer to the sale of goods or properties and/or services and the use or lease of properties that is not subject to VAT (output tax) and the seller is not allowed any tax credit of VAT (input tax) on purchases. The seller shall not bill any output tax to his customers since transaction is not subject to VAT. Any person whose sales or receipts are EXEMPT from VAT or who is not VATregistered person, shall pay a tax of 3% of his monthly gross sales or receipt. ZERO-RATED VAT-EXEMPT Transaction is taxable for VAT purposes but Transaction is subject to VAT NOT shall not result to output tax Input tax on the purchases of goods, properties or services, related to the zerorated sale shall be available as tax credit or refund Input tax on the VATexempt sale is not allowed as tax credit VAT-EXEMPT TRANSACTIONS 1. Sale or importation of agricultural and marine food products must be in their original state (even if they have undergone simple process of preparation or preservation for the market such as freezing, drying, salting, broiling, smoking, stripping, etc. including those using advance technological means of packaging such as shrink wrapping in plastics, vacuum packing, tetra-pack etc.) NOT EXEMPT /VATABLE IF: it undergoes many processes (ex. marinated products) sale of pet animals/ zoo animals (not for human consumption / livestock animals) 2. Sale or importation of fertilizers, seed, seedlings and fingerlings it should be consumed by poultry or livestock NOT EXEMPT/ VATABLE IF: specialty feeds for race horses, zoo animals, or animals considered as pets (not a livestock) 3. Importation of personal and household effects imported goods must be for personal use belonging to residents of the PH returning from abroad and non-resident citizens coming to resettle in the PH; provided that such goods are exempt from custom duties under the Tariff and Customs Code of the Philippines NOT EXEMPT/ VATABLE IF: imported goods are made available for sale 4. Importation of professional instruments instruments must be for personal use and not to be sold or bartered in the country 5. Services subject to Percentage Tax under Title V of the Tax Code i. Sale or lease of goods or properties or the performance of services of non-VAT registered persons, other than the transactions mentioned in paragraphs (A) to (AA) of the Tax Code, the gross annual sales and/or receipts of which does not exceed the amount of three million pesos P3,000,000. ii. Services rendered by international air/shipping carriers iii. Services rendered by franchise grantees of radio and/or television broadcasting whose annual gross receipts of the preceding year do not exceed ten million pesos P10,000,000, and by franchise grantees of gas and water utilities iv. Services rendered by overseas dispatch, message or conversation originating from the Philippines v. Services rendered by any person, company, or corporation (except purely cooperative companies or associations) doing life insurance business of any sort in the Philippines. vi. Services rendered by fire, marine, or miscellaneous insurance agents of foreign insurance companies. vii. Services of proprietors, lessees or operator of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, Jai-Alai and race tracks, viii. Receipts on sale, barter or exchange of shares of stock listed and traded through the local stock exchange or through initial public offering. 6. Services by agricultural contract growers and milling milling for others (palay into rice, corns into grits, sugar cane into raw sugar) Agricultural contract growers – persons producing for others poultry, livestock or other agricultural and marine food products in their original state. Toll Processing/ Toll Dressing EXEMPT: if performed as packaged service (yung nagkatay is also the owner/grower) VATABLE: if separate contractor 7. Medical, dental, hospital and veterinary services EXCEPT those rendered by professionals EXEMPT: Laboratory services of Outpatient Medical expenses part of the hospital bill (medicines, professional fee) of in-patients or confined patients VATABLE: If the hospital or clinic operates a pharmacy or drugstore, the sale of drugs and medicine, doctor’s fee of OUTPATIENTS 8. Educational services rendered by private educational institutions must be duly accredited by DepED, CHED, TESDA, and those rendered by government educational institutions. VATABLE: tuition fees to review centers, inservice trainings not accredited by mentioned above. 9. Services rendered by individuals pursuant to an employer-employee relationship must be duly accredited by DepED, CHED, TESDA, and those rendered by government educational institutions. 10. Services rendered by regional or area headquarters established in the Philippines by multinational corporations that do not earn or derive income from the Philippines 11. Transactions which are exempt under international agreements to which the Philippines is a signatory or under special laws except those granted under PD No. 529 PEZA- Philippine Economic Zone Authority – already paying special 5% tax on gross income, thus, VAT EXEMPT 12. Sale by Agricultural Cooperatives Agricultural To Cooperatives members/ investors Own EXEMPT products Other than EXEMPT own products which are not agricultural To nonmembers EXEMPT VATABLE 13. Gross receipts from lending activities Lending and For For nonmultipurpose members members activities From lending EXEMPT EXEMPT activities From non- VATABLE VATABLE lending activities 14. Sales by non-agricultural, non-electric and noncredit cooperatives Contribution For For nonper members members members 15,000 and EXEMPT EXEMPT below 15,000 above VATABLE VATABLE 15. Export sales by persons who are not VATregistered 16. Sale of real properties Sale not in the ordinary course of trade or business In general VAT EXEMPT Sale of residential lot by a real estate dealer Selling price is less than P1.5 million VAT EXEMPT Selling price is more than P1.5 million VATABLE Sale of residential house and other residential dwellings by a real estate dealer Selling price is less than P2 million VAT EXEMPT Selling price is more than P2 million VATABLE Sale of residential lot or residential house and lot by a non-dealer Used in business (incidental VATABLE transaction) Not used in business (regardless of 6% capital amount) gains tax Sale of real property classified as low-cost housing In general VAT EXEMPT Sale of real property for socialized housing In general VAT EXEMPT 17. Lease of real properties RULES ON LEASE OF RESIDENTIAL UNITS Monthly rental per unit Tax Treatment P15,000 and below per unit Aggregate annual gross YES VAT EXEMPT & receipts of lessor exceed P3 NO NOT subject to 3% Percentage million? tax Above P15,000 Aggregate annual gross YES 12% VAT receipts of lessor exceed P3 NO VAT EXEMPT & million? but subject to 3% Percentage tax Lessor has several residential units P15,000 and below monthly YES rental per unit, regardless of aggregate annual gross receipts Above P15,000 and monthly YES rental per unit BUT aggregate annual gross receipts from said units do NOT exceed P3 million Above P15,000 monthly rental YES per unit AND aggregate annual gross receipts from said units exceed P3 million Above P15,000 per unit & YES above P3 million VAT threshold VAT EXEMPT & NOT subject to 3% Percentage tax VAT EXEMPT & but subject to 3% Percentage tax 12% VAT 12% VAT 18. Sale, importation, printing or publication of books and any newspaper, magazine review or bulletin at regular intervals NOT EXEMPT/ VATABLE if: Publication of paid advertisements (brochure) E-books, E-journals 19. Transport of passengers by international carriers subject to common carriers tax Ex. Air asia, Malaysian company doing business in the PH (VAT EXEMPT) 20. Sale, importation or lease of passenger or cargo vessels and aircraft for domestic or international transport operations 21. Transportation of fuel, goods and supplies by persons engaged in international shipping or air transport operations. 22. Service of bank, nonbank financial intermediaries performing quasi-banking function subject to percentage tax Example of intermediaries performing quasi banking function: Palawan express, LBC, Cebuana 23. Sale to senior citizens and PWD 24. Transfer of property pursuant to Section 4 (c) (2) 25. Association dues, membership fees, and other assessment collected on a purely reimbursement basis of Home Owner’s Association 26. Sale of gold to BSP 27. Sale or importation of prescription drugs and medicines for Diabetes, high cholesterol and hypertension, beginning January 1, 2020 Cancer, mental illness, tuberculosis and kidney diseases, beginning January 1, 2023 Note: Provided that the DOH shall issue a list of approved drugs and medicines for this purpose within sixty (60) days from the effectivity of this Act.