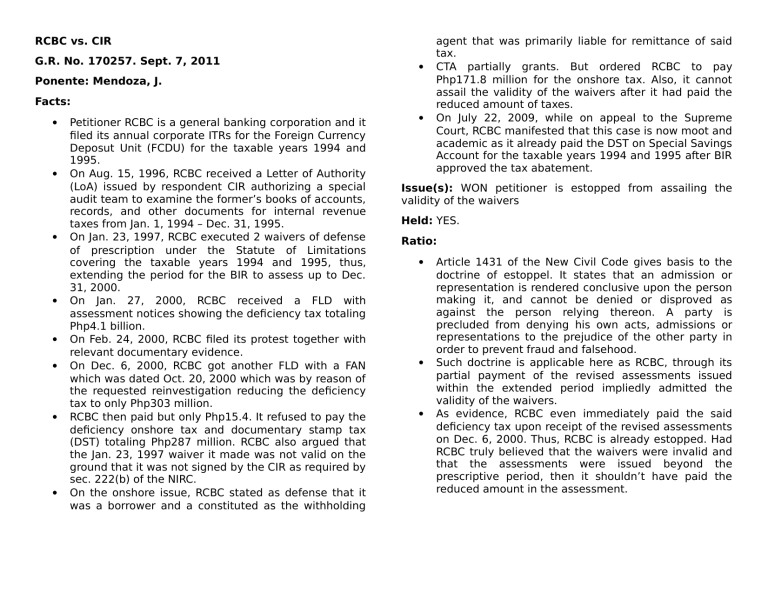

RCBC vs. CIR G.R. No. 170257. Sept. 7, 2011 Ponente: Mendoza, J. Facts: Petitioner RCBC is a general banking corporation and it filed its annual corporate ITRs for the Foreign Currency Deposut Unit (FCDU) for the taxable years 1994 and 1995. On Aug. 15, 1996, RCBC received a Letter of Authority (LoA) issued by respondent CIR authorizing a special audit team to examine the former’s books of accounts, records, and other documents for internal revenue taxes from Jan. 1, 1994 – Dec. 31, 1995. On Jan. 23, 1997, RCBC executed 2 waivers of defense of prescription under the Statute of Limitations covering the taxable years 1994 and 1995, thus, extending the period for the BIR to assess up to Dec. 31, 2000. On Jan. 27, 2000, RCBC received a FLD with assessment notices showing the deficiency tax totaling Php4.1 billion. On Feb. 24, 2000, RCBC filed its protest together with relevant documentary evidence. On Dec. 6, 2000, RCBC got another FLD with a FAN which was dated Oct. 20, 2000 which was by reason of the requested reinvestigation reducing the deficiency tax to only Php303 million. RCBC then paid but only Php15.4. It refused to pay the deficiency onshore tax and documentary stamp tax (DST) totaling Php287 million. RCBC also argued that the Jan. 23, 1997 waiver it made was not valid on the ground that it was not signed by the CIR as required by sec. 222(b) of the NIRC. On the onshore issue, RCBC stated as defense that it was a borrower and a constituted as the withholding agent that was primarily liable for remittance of said tax. CTA partially grants. But ordered RCBC to pay Php171.8 million for the onshore tax. Also, it cannot assail the validity of the waivers after it had paid the reduced amount of taxes. On July 22, 2009, while on appeal to the Supreme Court, RCBC manifested that this case is now moot and academic as it already paid the DST on Special Savings Account for the taxable years 1994 and 1995 after BIR approved the tax abatement. Issue(s): WON petitioner is estopped from assailing the validity of the waivers Held: YES. Ratio: Article 1431 of the New Civil Code gives basis to the doctrine of estoppel. It states that an admission or representation is rendered conclusive upon the person making it, and cannot be denied or disproved as against the person relying thereon. A party is precluded from denying his own acts, admissions or representations to the prejudice of the other party in order to prevent fraud and falsehood. Such doctrine is applicable here as RCBC, through its partial payment of the revised assessments issued within the extended period impliedly admitted the validity of the waivers. As evidence, RCBC even immediately paid the said deficiency tax upon receipt of the revised assessments on Dec. 6, 2000. Thus, RCBC is already estopped. Had RCBC truly believed that the waivers were invalid and that the assessments were issued beyond the prescriptive period, then it shouldn’t have paid the reduced amount in the assessment.