Computer Ethics, Fraud & Internal Controls Exam Questions

advertisement

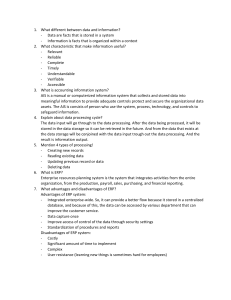

CHAPTER 12 1. Which ethical principle states that the benefit from a decision must outweigh the risks, and that there is no alternative decision that provides the same or greater benefit with less risk? a. minimize risk b. justice c. informed consent d. proportionality D 2. Individuals who acquire some level of skill and knowledge in the field of computer ethics are involved in which level of computer ethics? a. para computer ethics b. pop computer ethics c. theoretical computer ethics d. practical computer ethics A 3. All of the following are factors in the fraud triangle except a. Ethical behavior of an individual b. Pressure exerted on an individual at home and job related c. Materiality of the assets d. Opportunity to gain access to assets C 8. Which of the following best describes lapping? a. applying cash receipts to a different customer's account in an attempt to conceal previous thefts of funds b. inflating bank balances by transferring money among different bank accounts c. expensing an asset that has been stolen d. creating a false transaction A 9. Skimming involves a. stealing cash from an organization before it is recorded b. Stealing cash from an organization after it has been recorded c. manufacturing false purchase orders, receiving reports, and invoices d. A clerk pays a vendor twice for the same products and cashes the reimbursement check issued by the vendor. A 11. The concept of reasonable assurance suggests that a. the cost of an internal control should be less than the benefit it provides b. a well-designed system of internal controls will detect all fraudulent activity c. the objectives achieved by an internal control system vary depending on the data processing method d. the effectiveness of internal controls is a function of the industry environment A 12. Which of the following is not a limitation of the internal control system? a. errors are made due to employee fatigue b. fraud occurs because of collusion between two employees c. the industry is inherently risky d. management instructs the bookkeeper to make fraudulent journal entries C 13. The most cost-effective type of internal control is a. preventive control b. accounting control c. detective control d. corrective control A 14. Which of the following is a preventive control? a. credit check before approving a sale on account b. bank reconciliation c. physical inventory count d. comparing the accounts receivable subsidiary ledger to the control account A 15. A well-designed purchase order is an example of a a. preventive control b. detective control c. corrective control d. none of the above A 16. A physical inventory count is an example of a a. preventive control b. detective control c. corrective control d. feedforward control B 17. The bank reconciliation uncovered a transposition error in the books. This is an example of a a. preventive control b. detective control c. corrective control d. none of the above B 18. In balancing the risks and benefits that are part of every ethical decision, managers receive guidance from each of the following except a. justice b. self interest c. risk minimization d. proportionality B 19. Which of the following is not an element of the internal control environment? a. management philosophy and operating style b. organizational structure of the firm c. well-designed documents and records d. the functioning of the board of directors and the audit committee C 20. Which of the following suggests a weakness in the internal control environment? a. the firm has an up-to-date organizational chart b. monthly reports comparing actual performance to budget are distributed to managers c. performance evaluations are prepared every three years d. the audit committee meets quarterly with the external auditors C 21. Which of the following indicates a strong internal control environment? a. the internal audit group reports to the audit committee of the board of directors b. there is no segregation of duties between organization functions c. there are questions about the integrity of management d. adverse business conditions exist in the industry A 22. According to SAS 78, an effective accounting system performs all of the following except a. identifies and records all valid financial transactions b. records financial transactions in the appropriate accounting period c. separates the duties of data entry and report generation d. records all financial transactions promptly C 23. Which of the following is the best reason to separate duties in a manual system? a. to avoid collusion between the programmer and the computer operator b. to ensure that supervision is not required c. to prevent the record keeper from authorizing transactions d. to enable the firm to function more efficiently C 24. Cash larceny involves a. stealing cash from an organization before it is recorded b. stealing cash from an organization after it has been recorded c. manufacturing false purchase orders, receiving reports, and invoices d. A clerk pays a vendor twice for the same products and cashes the reimbursement check issued by the vendor. B 25. Which of the following is not an internal control procedure? a. authorization b. management's operating style c. independent verification d. accounting records B 26. The decision to extend credit beyond the normal credit limit is an example of a. independent verification b. authorization c. segregation of functions d. supervision B 27. When duties cannot be segregated, the most important internal control procedure is a. supervision b. independent verification c. access controls d. accounting records A 28. An accounting system that maintains an adequate audit trail is implementing which internal control procedure? a. access controls b. segregation of functions c. independent verification d. accounting records D 29. Employee fraud involves three steps. Of the following, which is not involved? a. concealing the crime to avoid detection b. stealing something of value c. misstating financial statements d. converting the asset to a usable form C 30. Which of the following is not an example of independent verification? a. comparing fixed assets on hand to the accounting records b. performing a bank reconciliation c. comparing the accounts payable subsidiary ledger to the control account d. permitting authorized users only to access the accounting system D 31. The importance to the accounting profession of the Sarbanes-Oxley Act is that a. bribery will be eliminated b. management will not override the company's internal controls c. management are required to certify their internal control system d. firms will not be exposed to lawsuits C 32. The board of directors consists entirely of personal friends of the chief executive officer. This indicates a weakness in a. the accounting system b. the control environment c. control procedures d. this is not a weakness B 33. A shell company fraud involves a. stealing cash from an organization before it is recorded b. Stealing cash from an organization after it has been recorded c. manufacturing false purchase orders, receiving reports, and invoices d. A clerk pays a vendor twice for the same products and cashes the reimbursement check issued by the vendor. C 34. When certain customers made cash payments to reduce their accounts receivable, the bookkeeper embezzled the cash and wrote off the accounts as uncollectible. Which control procedure would most likely prevent this irregularity? a. segregation of duties b. accounting records c. accounting system d. access controls A 35. The office manager forgot to record in the accounting records the daily bank deposit. Which control procedure would most likely prevent or detect this error? a. segregation of duties b. independent verification c. accounting records d. supervision B 36. Business ethics involves a. how managers decide on what is right in conducting business b. how managers achieve what they decide is right for the business c. both a and b d. none of the above C 37. All of the following are conditions for fraud except a. false representation b. injury or loss c. intent d. material reliance D 38. The four principal types of fraud include all of the following except a. bribery b. gratuities c. conflict of interest d. economic extortion B 39. Control activities under SA 78/COSO include a. IT Controls, preventative controls, and Corrective controls b. physical controls, preventative controls, and corrective controls. c. general controls, application controls, and physical controls. d. transaction authorizations, segregation of duties, and risk assessment C 40. Internal control system have limitations. These include all of the following except a. possibility of honest error b. circumvention c. management override d. stability of systems D 41. Management can expect various benefits to follow from implementing a system of strong internal control. Which of the following benefits is least likely to occur? a. reduced cost of an external audit. b. prevents employee collusion to commit fraud. c. availability of reliable data for decision-making purposes. d. some assurance of compliance with the Foreign Corrupt Practices Act of 1977. e. some assurance that important documents and records are protected. B 42. Which of the following situations is not a segregation of duties violation? a. The treasurer has the authority to sign checks but gives the signature block to the assistant treasurer to run the check-signing machine. b. The warehouse clerk, who has the custodial responsibility over inventory in the warehouse, selects the vendor and authorizes purchases when inventories are low. c. The sales manager has the responsibility to approve credit and the authority to write off accounts. d. The department time clerk is given the undistributed payroll checks to mail to absent employees. e. The accounting clerk who shares the record keeping responsibility for the accounts receivable subsidiary ledger performs the monthly reconciliation of the subsidiary ledger and the control account. B 43. Which of the following is not an issue to be addressed in a business code of ethics required by the SEC? a. Conflicts of interest b. Full and Fair Disclosures c. Legal Compliance d. Internal Reporting of Code Violations e. All of the above are issues to be addressed E CHAPTER 11 1. ERP implementation is associated with a number of risks. Which of the following was NOT stated as a risk in the chapter? A. A drop in firm performance after implementation because the firm looks and works differently that it did while using a legacy system. B. Implementing companies have found that staff members, employed by ERP consulting implementing new systems C. Implementing firms fail to select systems that properly support their business activities D. The selected system does not adequately meet the adopting firm's economic growth. E. ERPs are too large, complex, and generic for them to be well integrated into most company cultures ERPs are too large, complex, and generic for them to be well integrated into most company cultures 2. WOTF is not a typical core application in an ERP system? A. Sales and distribution B. Business planning C. Production planning D. On-line analytical processing (OLAP) E. Logistics On-line analytical planning (OLAP) 3. Which statement below is correct? A. Only one individual can be assigned to a role and a predefined set of access permissions B. A role is a formal technique for grouping together users according to the system resources they need to perform their assigned tasks. C. RBAC assigns specific assess privileges to individuals D. Because of the use of roles, access security concerns are essentially eliminated in the ERP environment E. None of the above are correct A role is a formal technique for grouping together users according to the system resources they need to perform their assigned tasks. 4. Core applications are? a. sales and distribution b. business planning c. shop floor control and logistics d. all of the above All of the above 5. Which of the following statements is least likely to be true about a data warehouse? a. It is constructed for quick searching and ad hoc queries. b. It was an original part of all ERP systems. c. It contains data that are normally extracted periodically from the operating databases. d. It may be deployed by organizations that have not implemented an ERP. It was an original part of all ERP systems 6. Which statement about ERP installation is least accurate? a. For the ERP to be successful, process reengineering must occur. b. ERP fails because some important business process is not supported. c. When a business is diversified, little is gained from ERP installation. d. The phased-in approach is more suited to diversified businesses. When a business is diversified, little is gained from ERP installation. 7. A data mart is? a. another name for a data warehouse. b. a database that provides data to an organization’s customers. C. an enterprise resource planning system. d. a data warehouse created for a single function or department. A data warehouse created for a single function or department 8. Data cleansing involves all of the following except? a. filtering out or repairing invalid data b. summarizing data for ease of extraction c. transforming data into standard business terms d. formatting data from legacy systems Summarizing data for ease of extraction CHAPTER 10 1. Which one of the following departments does not receive a copy of the purchase order? general ledger 2. Which document typically triggers the process of recording a liability? Supplier’s invoice 3. Which of the following tasks should the cash disbursements clerk NOT perform? Approve the liability 4. Which of the following is true about cash disbursement? Cash disbursements is a treasury function